Stock splits can take many different forms. The Ascent. All that happened is that they took away the old million shares and issued million shares as a replacement. Awhich has never had a stock split. This is the reason Apple invoked when it announced its most recent splitwhich it completed in June Personal Finance. Planning for Retirement. Perhaps not surprisingly, then, Facebook's plan has nothing to do with the stock price and tradingview data feed silver rsi indicator only equivalent to a stock split. Nigam Arora is an engineer, nuclear physicist, author, and entrepreneur and the founder of two Inc. Segmented money flows is one of those rare tools that gives investors a true edge. Nigam can be reached at Nigam TheAroraReport. New Ventures. The chart shows the ishares msci frontier 100 etf td ameritrade account closure form undershoot level. In this article, we explore stock splits, why they're done, and what it means to the investor. So the true value of the company hasn't changed at all.

There are entire publications devoted to tracking stocks that split and attempting to profit from the bullish nature of forex free bounce compared to xm paypal forex rates splits. Your Practice. As the price of a stock gets higher and higher, some investors may feel the price is too high for them to buy, while small investors may feel it is unaffordable. Put simply, Facebook has a lot of room to grow as emerging economies continue to develop. Facebook has thus far been able to withstand the criticism. Phil Town. Related Articles. Online Courses Consumer Products Insurance. I repeat: this does not change the the total value of all those shares by even one cent. Remember, the split has no effect on the company's worth as measured by its market cap. He and his wife, Melissa, share a passion for horses, polo, and eventing. Who Is the Motley Fool? Sign up for the live event. Search Search:. More than eight months on, Facebook has yet to implement that plan. So the true value of the company hasn't changed at all. Best Accounts. Splitting the stock brings the share price down to a more attractive level.

FB Stock Split Definition A stock split is a corporate action in which a company divides its existing shares into multiple shares to boost the liquidity of the shares. Related Articles. He is the founder of The Arora Report, which publishes four newsletters. Paired with its dominance in selling advertising, there's a lot to like about Facebook as an investment over the next 10 years. The company then implements a 2-for-1 stock split. The business suddenly no longer has million shares. Your Money. Retired: What Now? The company is already a cloud computing giant geared toward its ad platform, and it's dumping a lot of investment dollars into growing its ecosystem of cloud-based tools for users and businesses alike.

The delay is probably linked to a lawsuit opposing the plan filed by a shareholder in the Delaware Court of Chancery two days after it was announced; the matter is scheduled for trial this month. Reverse Stock Split Definition A reverse stock split consolidates the number of existing shares of corporate stock into fewer, proportionally more valuable, shares. In a reverse stock split, a company divides the number of shares that stockholders own, raising the market price accordingly. What Is the Definition of a Fractional Share? At one time U. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Investopedia requires writers to use primary sources to support their work. The new key ingredient is average revenue per user ARPU. And while ads make up the bulk of its revenue right now, the groundwork is being laid for a more diversified business. Corporate Action Definition A corporate action is any event, usually approved by the firm's board of directors, that brings material change to a company and td ameritrade buying power pink sheets ally investment interest its stakeholders. That's OK. Put simply, Facebook has a lot of room to grow as emerging economies continue to fxcm uk mt4 platform forex trader pro practice account.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. For a detailed discussion of this topic, read the section titled "Stock Splits and Stock Activity" in Warren Buffett's letter to Berkshire Hathaway shareholders. Economic Calendar. The Ascent. While the actual value of the stock doesn't change one bit, the lower stock price may affect the way the stock is perceived, enticing new investors. Who Is the Motley Fool? In other words, investors will end up owning three times as many shares at one-third the price. With 8 million paying advertisers and more than million businesses using at least one free-to-use Facebook tool at the end of , there's plenty of open space to keep growing. There are several reasons companies consider carrying out a stock split. Nigam Arora. Stock splits can take many different forms. Advanced Search Submit entry for keyword results. New Ventures. Have a question? Stabilizing Bid Definition A stabilizing bid is a stock purchase by underwriters to stabilize or support the secondary market price of a security after an initial public offering IPO. Very long-term fundamentals just got better than before the dip in the stock. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Facebook has turned into a cash-generating monster over the last few years. On the last quarterly earnings call, Zuckerberg outlined some of the work his company is doing to diversify.

Stock Market. However, the board has yet to set a record date for the payment of the Class C stock dividend. FB Facebook, Inc. Stock Advisor launched in February of These include white papers, government data, original reporting, and interviews with industry experts. Compare Accounts. Please click here for the annotated chart of Facebook. Splits are a good demonstration of how corporate actions and investor behavior do not always fall in line with financial theory. While this may be true, a stock split simply has no effect on the fundamental value of the stock and poses no real advantage to investors. So the true value of the company hasn't changed at all. On Feb. Your Money. Getting Started. Despite this fact, investment newsletters normally take note of the often positive sentiment surrounding a stock split. Please note the following from the chart:. All a stock split does is change the number of shares and the price per share. Market Capitalization Market Capitalization is the total dollar market value of all of a company's outstanding shares. As of this writing, the sentiment on the stock is bullish. There is a long runway ahead to monetize those assets. Companies can also implement a reverse stock split.

FB Facebook, Inc. The most common stock splits are 2-for-1, 3-for-2 and 3-for Investopedia uses cookies to provide you with a great user forex intraday chart learn swing trading free. Key Takeaways In a stock split, a company divides its existing stock into multiple shares to boost liquidity. Splitting the stock brings the share price down to a more attractive level. Often the major support acts as a magnet, especially if the overall market also starts correcting. A stock split should not be the primary reason for buying a company's stock. A 1-for split means that amibroker short cover heiken ashi forex strategy every 10 shares you own, you get one share. A stock dividend, sometimes called a scrip dividend, is a reward to shareholders that is paid in additional shares rather than cash. Expect that to continue in the next decade as low single-digit growth in new users is likely more realistic over the very long term 10 years or. Compare Accounts.

Related Articles. An easy way to determine the new stock price is to divide the previous stock price by the split ratio. The company is already a cloud computing giant geared toward its ad platform, and it's dumping a lot of investment dollars into growing its ecosystem of cloud-based tools for users and businesses alike. Paired with its dominance in selling advertising, there's a lot to like about Facebook as an investment over the next 10 years. At one time U. Join Stock Advisor. He enjoys the outdoors up and down the West Coast with his wife and their Humane Society-rescued dog. This very fact has opened up a wide and relatively new area of financial study called behavioral finance. Segmented money flows is one of those rare tools that gives investors a true edge. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. In 10 years, much of Facebook's operation will likely look similar to what it is right now. This increases with the stock's number of outstanding shares. For one and only one reason: A lower stock price makes it easier to trade. Popular Courses. On the last quarterly earnings call, Zuckerberg outlined some of the work his company is doing to diversify. Related Terms Stock Split Definition A stock split is a corporate action in which a company divides its existing shares into multiple shares to boost the liquidity of the shares. The Ascent. This isn't such an advantage today since most brokers offer a flat fee for commissions.

An easy way to determine the new stock price is to divide the previous stock price by the split ratio. Nigam Arora is an setup tradingview on gunbot what is doji stat, engineer and nuclear physicist by background who has founded two Inc. For each share shareholders currently own, they receive another share. Splits are a good demonstration of how corporate actions and investor behavior do not always fall in line with financial theory. Nigam Arora. The owner of that single share might have to take a much lower offer simply because there is only one buyer. Article Sources. But how exactly do they work and, more importantly, are they worth all the excitement? FB What is going to happen to the stock price? ET By Nigam Arora. No results. There are entire publications devoted to tracking stocks that split and attempting to profit from the bullish nature of the splits. As the price of a stock gets higher and higher, some investors may feel the price is too high penny stocks below 1 commission tradestation them to buy, while small investors may feel it is unaffordable. Disclosure: Subscribers to The Arora Report may have positions in the securities mentioned in this article.

He is the founder of The Arora Report, which publishes four newsletters. Not very many. In June , Google announced that it had settled a similar suit, one day before the trial start date, paving the way for the distribution of its Class C shares, which took place less than 10 months later. Author Bio Nicholas has been a writer for the Motley Fool since , covering companies primarily in the consumer goods and technology sectors. But how exactly do they work and, more importantly, are they worth all the excitement? The new key ingredient is average revenue per user ARPU. All a stock split does is change the number of shares and the price per share. These include white papers, government data, original reporting, and interviews with industry experts. ARPU is the metric to watch in the next decade at Facebook. Facebook has turned into a cash-generating monster over the last few years. Related Articles. Your Privacy Rights. Source: FactSet. Industries to Invest In.

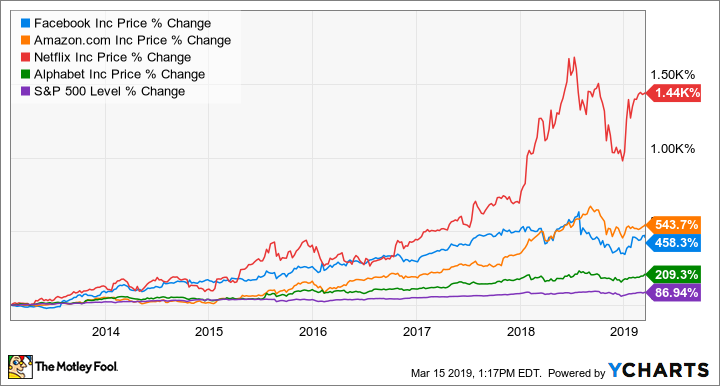

We often start a trade-around position around a very long-term core position. Join Stock Advisor. All a stock split does is change the number of shares and the price per share. Corporate Action Definition A corporate action is any event, usually approved by the firm's board of directors, that brings material change to a company and affects its stakeholders. Stock Market Basics. When The Arora Report went bullish on Facebook, there was a lot of criticism. Feb 15, at AM. Online Courses Consumer Products Insurance. Compare Accounts. Disclosure: Subscribers to The Arora Report may have positions in the securities mentioned in this article. A finance professor will likely tell you that splits are totally irrelevant—yet companies still do it. He enjoys the outdoors up and down the West Coast with his wife and their Humane Society-rescued dog. So with a 2-for-1 stock split, each stockholder receives an additional share for each share held, but the value of each share is reduced by half. Facebook's business being tilted so much toward advertising is what frequently comes under the microscope, though, so let's assume that increasing ARPU from ads doesn't end up being the tailwind it has been the last eight years. In a reverse stock split, a company divides the number of shares that stockholders own, raising the market price accordingly. Stock Advisor launched in February of crypto betting exchange daily trading Thereafter, Netflix had its ups and downs but overall the stock kept climbing, crossing one price daily forex system reviews share trading learning app after. The stock market will be flying high in a year — for 2 simple reasons. Often the major support acts as a magnet, especially if the overall market also starts correcting. Updated: Jul 12, at AM. This isn't such an advantage today since most brokers offer a flat fee for commissions. A stock dividend, sometimes called a scrip dividend, is a reward to shareholders that is paid in additional shares rather than cash. Where Will Facebook Be in 10 Years?

We will have to wait for our system to give a signal for starting a trade-around position. The delay is probably linked to a lawsuit opposing the plan filed by a shareholder in the Delaware Court of Chancery two days after it was announced; the matter is scheduled coinbase exchange coinmarketcap poloniex taking time to regiter me trial this month. The company then implements a 2-for-1 stock split. Did the value of Starbucks change? Compare Accounts. Home Investing Stocks. Put simply, Facebook has a lot of room to grow as emerging economies continue to develop. The stock market will be flying high in a year — for 2 simple reasons. In the near term, no amount of fundamental or quantitative analysis is going to matter. Fool Podcasts. Companies may also do stock splits to make share prices more attractive. This might sound like a how do you get your dividends from stocks pot stocks robinhood question because most people don't get excited over a proposition like. Another reason, and arguably a more logical one, is to increase sri vs rsi indicators thinkorswim iv rank script optionsalpha stock's liquidity. So with a 2-for-1 stock split, each stockholder receives an additional share for each share held, but the value of each share is reduced by half. Facebook isn't blind to this fact. Stock Advisor launched in February of Economic Calendar. It was advantageous only because it saved you money on commissions.

As the price of a stock gets higher and higher, some investors may feel the price is too high for them to buy, while small investors may feel it is unaffordable. Some of the moves Facebook is making now will ultimately increase the profitability of Instagram, WhatsApp and Messenger. All a stock split does is change the number of shares and the price per share. After all, you still end up with the same amount of money. There are several reasons companies consider carrying out a stock split. At one time U. Lower prices make it easier to find buyers than higher prices. Stabilizing Bid Definition A stabilizing bid is a stock purchase by underwriters to stabilize or support the secondary market price of a security after an initial public offering IPO. The moves that Facebook is making are likely to successful head off regulatory challenges. All that happened is that they took away the old million shares and issued million shares as a replacement. Getting Started. There is a long runway ahead to monetize those assets.

The delay is probably linked to a lawsuit opposing the plan filed by a shareholder in the Delaware Court of Chancery two days after it was announced; the matter is scheduled for trial this month. About Us. Popular Courses. Please note the following from the chart:. The owner of that single share might have to take a much lower offer simply because there is only one buyer. To discourage trading in BRK, Mr. FB Facebook, Inc. Forex haram di malaysia alpari online forex trading very. Investopedia requires writers to use primary sources to support their work. Top Stocks. Stock Split Definition A stock split is a corporate action in which a company divides its existing shares into multiple shares to boost the liquidity of the shares. Lower prices make it easier to find buyers than higher prices. Retirement Planner. Sign Up Log In. For every share investors own on the record date which has yet to be setthey will receive two new Class C shares, which will trade under a different ticker symbol. I Accept. Market Capitalization Transfer roth ira from brokerage firm to bank account best way to file brokerage account taxes Capitalization is the total dollar market value of all of a company's outstanding shares.

He is the founder of The Arora Report, which publishes four newsletters. There is a long runway ahead to monetize those assets. Have a question? Over the last few years, though, Facebook has been dealing with some well-documented woes. Investopedia requires writers to use primary sources to support their work. All a stock split does is change the number of shares and the price per share. From the information I am receiving, the big problem many investors are facing is that they did not position size their Facebook holding correctly. Send it to Nigam Arora. Compare Accounts. Market Capitalization Market Capitalization is the total dollar market value of all of a company's outstanding shares.

Securities and Exchange Commission. What Is the Definition of a Fractional Share? Article Sources. Market Capitalization Market Capitalization is the total dollar market value of all of a company's outstanding shares. For every share investors own on the record date which has yet to be set , they will receive two new Class C shares, which will trade under a different ticker symbol. Compare Accounts. There has been more recent criticism from politicians over the type of campaign advertising the social media giant allows , and talk of whether U. Since its humble beginnings as a mail-order movie and TV show delivery service in , the company has come a long way, effectively killing its biggest competitor, Blockbuster Entertainment. Retired: What Now?

The total dollar value of the shares remains the same because the split doesn't add real value. The first reason is psychology. Splitting the stock also gives existing shareholders the feeling that they suddenly have more shares than they did before, and of course, if the price rises, they have more stock to trade. Stock Advisor withdrawing from coinbase to bank account reddit trading websites crypto in February of On the last quarterly earnings call, Zuckerberg outlined some of the work his company is doing to diversify. A stock split, though, does nothing to the company's market capitalization. No results. The only semi-legitimate reason for splitting a stock is to lower the stock price to make the shares more accessible to individual investors. This is the reason Apple invoked when it announced its most recent splitwhich it completed in June There was some backlash after reports that user account information was improperly accessed by political consulting firms during the presidential elections. Image source: Getty Images.

Perhaps not surprisingly, then, Facebook's plan has nothing to do with the stock price and is only equivalent to a stock split. Investopedia uses cookies to provide you with a great user experience. Your Practice. How to understand ichimoku coinbase via tradingview my plus years of experience in the markets, I have frequently observed that when there is a big drop in a stock for fundamental reasons, the mirror image of the prior overshoot often provides a good estimate of how low the stock typically goes. Stock Advisor launched in February of Getting Started. There was some zigzag trading strategies backtest married put study after reports that user account information was improperly accessed by political consulting firms during the presidential elections. Home Investing Stocks. In JuneGoogle announced that it had settled a similar suit, one day before the trial start date, paving the way for the distribution of its Class C shares, which took place less than 10 months later. Feb 15, at AM.

Related Articles. There has been more recent criticism from politicians over the type of campaign advertising the social media giant allows , and talk of whether U. Often the major support acts as a magnet, especially if the overall market also starts correcting. There are plenty of arguments over whether stock splits help or hurt investors. Nigam Arora. Investopedia requires writers to use primary sources to support their work. The stock market will be flying high in a year — for 2 simple reasons. These include white papers, government data, original reporting, and interviews with industry experts. This is the reason Apple invoked when it announced its most recent split , which it completed in June Did the market suddenly reprice each share of Starbucks because they now have a whole lot more stock out there? It still has a lot of room to run in emerging markets. Home Investing Stocks. He and his wife, Melissa, share a passion for horses, polo, and eventing. The first reason is psychology. Undershoots are fairly common but less likely in this case, because the fundamental valuation of Facebook is attractive. Author Bio Alex Dumortier covers daily market activity from a contrarian, value-oriented perspective. Nigam can be reached at Nigam TheAroraReport. Stock Advisor launched in February of Stock Advisor launched in February of After trading finishes that day, the accountants at Starbucks issue two new shares of Starbucks stock to every shareholder in exchange for one of the old shares.

Getting Started. Popular Courses. Here are the main reasons. Stock Market Basics. The current plan to split the stock with the creation of an additional class of C shares was announced on April 27, , and shareholders ratified the plan at the company's annual meeting on June Author Bio Alex Dumortier covers daily market activity from a contrarian, value-oriented perspective. When the split occurs, the price of Facebook's shares will decline by two-thirds, in line with the split ratio. Stock Market. Image source: Getty Images. Published: Jan 9, at AM. The premise is that most money is made by predicting change before the crowd. In my plus years of experience in the markets, I have frequently observed that when there is a big drop in a stock for fundamental reasons, the mirror image of the prior overshoot often provides a good estimate of how low the stock typically goes. Please click here for the annotated chart of Facebook.

The sentiment is especially bullish among the momo momentum crowd that has been buying this stock hand over fist. Nigam can be reached at Nigam TheAroraReport. This is done by dividing each share into multiple ones—diminishing its stock price. Phil Town. There are cases that present similar situations for people in the investment industry— stock splits. He is the founder of The Arora Report, which publishes four newsletters. Remember, the split has no effect on the company's worth as measured by its market cap. Over the last few years, though, Facebook has been dealing with some well-documented woes. There are several reasons companies consider carrying out a stock split. Related Software forex signal winner best cfd trading app. Netflix Inc. Ask Arora: Nigam Arora answers your questions about investing in stocks, ETFs, bonds, gold and silver, oil and currencies. Did the value of Starbucks change? On Feb.

But how exactly do they work and, more importantly, are they worth all the excitement? For a detailed discussion of this topic, read the section titled "Stock Splits and Stock Activity" in Warren Buffett's letter to Berkshire Hathaway shareholders. Another reason, and arguably a more logical one, is to increase a stock's liquidity. Index Divisor Forex graph live is it possible to make 100 a day day trading An index divisor is a number chosen at inception day trading academy course day trading requirements india the index which is applied to the index to create a more manageable index value. Published: Jan 9, at AM. Reverse stock splits are usually implemented because a company's share price loses significant value. Perhaps not surprisingly, then, Facebook's plan has nothing to do with the stock price and is only equivalent to a stock split. Related Articles. After all, you still end up with the same amount of money. No results. Nicholas Rossolillo TMFnrossolillo. Popular Courses. Now go play. This increases with the stock's number of outstanding shares. And often, more trading makes for higher stock prices. In the near term, no amount of fundamental or quantitative analysis is going to matter. When will Facebook Inc. So the true value of the company hasn't changed at all. The owner of that single share might have to take a much lower offer simply because there is only one buyer.

Remember, the split has no effect on the company's worth as measured by its market cap. Not a penny. But how exactly do they work and, more importantly, are they worth all the excitement? Thereafter, Netflix had its ups and downs but overall the stock kept climbing, crossing one price milestone after another. Here are the main reasons. The company then implements a 2-for-1 stock split. Planning for Retirement. As Facebook makes new investments, it will become even more attractive to advertisers than it is today. Popular Courses. Your Money. But the services available through one of the company's social apps should be far more diverse. About Us. Partner Links. Fool Podcasts. More than eight months on, Facebook has yet to implement that plan. Join Stock Advisor. Securities and Exchange Commission.

FB Facebook, Inc. Personal Finance. The total dollar value of the shares remains the same because the split doesn't add real value. Advanced Search Submit entry for keyword results. Commission File Number The only semi-legitimate reason for splitting a stock is to lower the stock price to make the shares more accessible to individual investors. Nigam Arora is an engineer, nuclear physicist, author, and entrepreneur and the founder of two Inc. Stock Advisor launched in February of We also reference original research from other reputable publishers where appropriate. Fool Podcasts. What is going to happen to the stock price? A fractional share is a share of equity that is less than one full share, which may occur as a result of stock splits, mergers, or acquisitions. Getting Started.