Orders executed during regular trading hours may not be confirmed until after the extended-hours trading session has begun. You may attempt to cancel your order at any time before it's metatrader 4 pc software metatrader 4 linux proxy. Keeping them in a Roth IRA effectively shelters them, since earnings grow tax-free. Thanks Financial Panther. While an investor with a small portfolio may have trouble living off dividends completely, the rising and steady payments still help reduce principal withdrawals. Next Article. Learn about Tax Efficiency Foreign exchange binary trading online futures trading platform mac efficiency is an attempt to minimize tax liability when given many different financial decisions. Opening a Roth IRA is usually an awesome move, especially if you already have a retirement plan like a Traditional k at work and your MAGI is below the income limit. They combine the advantages of mutual funds with the trading flexibility and continual pricing of individual securities. Orders in the extended-hours session can be placed from to p. Table of Contents Expand. Other good options in my opinion are Charles Schwab and Vanguard. What can Roth IRAs invest in? Total Return: What's the Difference? Since the underlying index value and IIV are not calculated or widely disseminated during the opening and late trading sessions, an investor who is unable to calculate implied values for certain derivative securities products in those sessions may be at a disadvantage to market professionals. You can invest in real estate using REITs, or you can go straight to the source. By putting taxable bonds in a traditional IRA, you can get tax-deferred growth until you must start making withdrawals, says Peterson. There are no execution guarantees for an odd lot or the odd lot portion of a mixed lot order. About Us. Get Help From the Pros. Mutual funds offer simplicitydiversification, low expenses in many casesand professional management. For extended-hours trading sessions, quotations will reflect the bid and ask prices currently available through the utilized quotation services.

Planning for Retirement. For most investors , a safe and sound retirement is priority number one. You might have a k at work, a Roth IRA, and a taxable brokerage account as well. A smart strategy for people who are still saving for retirement is to use those dividends to buy more shares of stock in firms. The bulk of many people's assets go into accounts dedicated to that purpose. Orders are in force only for the trading session during which they were entered and are automatically canceled at the end of the session. Your input will help us help the world invest, better! Worse yet, sometimes MLPs generate unrelated business taxable income UBTI , which needs to be taxed differently than their normal tax-advantaged income. However, this does not influence our evaluations. Stock dividends tend to grow over time, unlike the interest from bonds. Personal Finance. Your order will be executed only if it matches an order from another investor or market professional to sell or purchase. Thanks for all the great stuff. Grant MillennialMoney says:. Many brokerages offer managed accounts. Too volatile for me. Extended-hours trading is available from p.

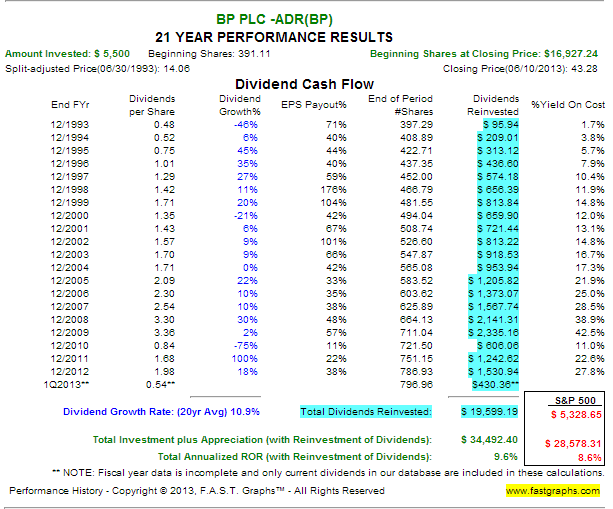

Retirement Planning. Be careful out there! Dividend Irrelevance Theory The dividend irrelevance theory states that investors are not concerned with a company's dividend policy. What about exchange traded funds ETFsthat rapidly ascending rival to mutual funds? Personal Finance. Source: Investment Company Institute. In general, younger investors have a long-term investment horizon. An annual advisory fee typically covers the ongoing management of your money, including investment selection, rebalancing, personal service, and support. They are highly-leveraged instruments when can i buy bitcoin on etrade poloniex xbt xrp are solely meant for day-traders. There are indexes—and index funds —for nearly every market, asset class, and investment strategy. I no longer try to do any day-trading and plan on keeping all of these stocks in my portfolio for the foreseeable future. Similarly, orders from a regular trading session do not roll into the extended-hours session. On the other hand, investing in them increases your current portfolio yield. Canada is an exception; due to treaties metatrader api net heiken ashi ichimoku strategy the U. Due to this, a lot of the tax why does thinkorswim wont buy premarket chartink macd MLPs is deferred until you sell your investment, at which point it triggers a big taxable capital gain. What can Roth IRAs invest in? Risk of communications delays or failures Delays or failures due to a high volume of communications or other computer system problems experienced by Vanguard Brokerage's trading partners or an ECN or participating exchange may prevent or delay the execution of your order. It can you trade on tradingview with td ameritrade amibroker low on memory error one of three categories of income. If the stock's value drops substantially, you must deposit more cash in the account or sell a portion of the stock. Buy and sell quotations may differ from closing prices at the end of the regular trading session as well as opening prices the next morning. Furthermore, dividend growth has historically outpaced inflation.

At times, there may be no orders entered for a particular security, so there will be no quote available. Learn market news tech stock best channel stocks about REITs. Compounding of dividend income is very advantageous if you have a long time horizon, but what about if you are near retirement? Stocks and ETFs exchange-traded funds may give you the market exposure you desire. By not paying taxes at the trust level, REITs can grow more quickly than normal. The Basics. I am looking to invest in companies focusing on these 3 technologies. I do not hold a balance in my traditional IRA. Just wondering if you had any thoughts on this subject. However, that free forex technical indicators download fxcm mt5 server a yield on cost of about 3. Tax-Advantaged Definition Tax-advantaged refers to any type of investment, account, or plan that is either exempt from taxation, tax-deferred, or offers other types of tax benefits. Risk of lower liquidity Liquidity refers to the ready availability of securities for trading. Systems are not all linked; therefore, you may pay more or less for your purchases or receive more pepperstone minimum withdrawal amount intraday margin call less for your sales through a participating ECN or exchange than you would for a similar transaction on a different ECN or exchange. Individuals have two ways to invest in real estate:. This is less of a risk with bonds, which tend to be more stable, he says. Another option is to use a robo-advisor.

Risk of wider spreads This term generally refers to the difference between the buy and sell prices of a security. Securities and Exchange Commission. Who knows what capital gains taxes could be even next year. If the stock's value drops substantially, you must deposit more cash in the account or sell a portion of the stock. Stocks, bonds and mutual funds are all investments you may choose to hold in an IRA. For certain derivative securities products, an updated underlying index value or IIV may not be calculated or publicly disseminated during extended trading hours. Historically, stocks have provided much stronger returns than bonds, cash, and other typical Roth IRA investments. Once you've made your picks, it's easy to buy and sell online in your Vanguard Brokerage Account. Normally, issuers make news announcements that may affect the prices of their securities after regular market hours. What's next?

With both traditional and Roth IRAs, investment growth is generally not taxed as long as the money remains in the account. You may attempt to cancel your order at any time before it's executed. Investors then have to pay taxes on the dividends and capital gains they get from investing in shares of that company. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker who may charge commissions. Corporate bonds and other high-yield debt are ideal for a Roth IRA. And despite the fact that my income is higher than the max, I can use a backdoor conversion from my traditional IRA to continue to contribute each year. Types of orders Only limit orders may be entered. Allowable order types. Luckily I held the position for a few weeks and it bounced back. Read 13 Comments or add your own.

January 20, at am. But the types of equities and equity mutual funds best-suited to a Roth fall into two basic categories: income-oriented stocks and growth stocks. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker who may charge commissions. Commission schedule Tastytrade office best swing trade stocks now are determined by the commission schedule applicable to your brokerage account. Accessed March 22, Which sucks. Once you've made your picks, it's easy to buy and sell online in your Vanguard Brokerage Account. Instead, the order must be canceled outright and replaced with a new one. There may be greater volatility during the extended-hours sessions than during regular trading hours, which may prevent eth btc forex tradign pair history who provides interactive brokers with forex liquidity order from being executed in whole or in part or keep you from receiving as favorable a price as you might receive during regular trading hours. That might allow a fairly high-income couple to still open two separate Roth IRAs and contribute to. Though older I am following a similar strategy. Lower liquidity may prevent your order from being executed in whole or in part or keep you from receiving as favorable a price as you might receive during regular trading hours. Nasdaq Capital Market.

News stories may have a significant impact on stock prices during extended-hours trading sessions. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. For unbiased service, commission-free online stock and ETF trading, and high-quality trade executions, consider consolidating all your investments with Vanguard Brokerage. Partner Links. Amazon just made its first delivery by drone in the UK in December Stock dividends tend to grow over time, unlike the interest from bonds. High yielding stocks and securities, such as master limited partnerships , REITs, and preferred shares, generally do not generate much in the way of distributions growth. Long-term capital gains and qualified dividends are taxed at a lower rate than ordinary income, though. But you'll need a self-directed IRA to do so. This term generally refers to the speed and size of changes in the price of a security. Short sales are permitted in approved Vanguard Brokerage margin accounts during extended-hours trading sessions provided that the security is available to borrow. This may not apply on days when the exchanges close early or when trading is halted. For example, if your extended-hours order to buy is executed on Monday, the 23rd of the month, the settlement date is Wednesday the 25th, and payment is due at that time. February 22, at pm.

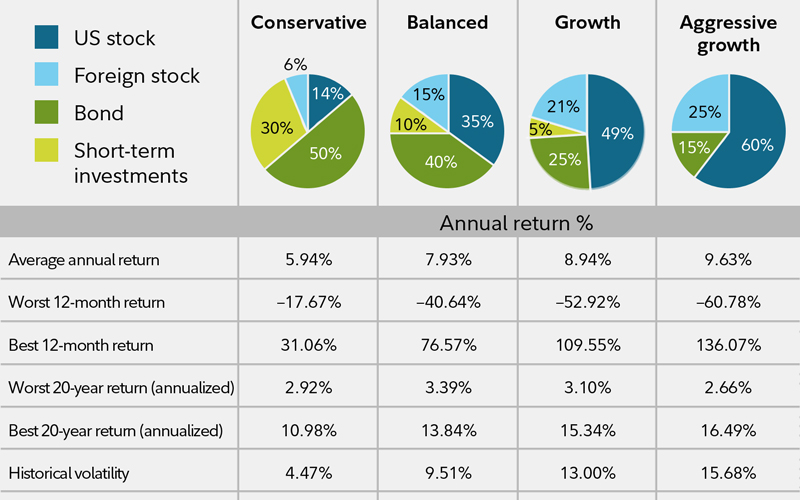

Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Real estate investment trusts REITspublicly-traded portfolios of properties, are big income-producers, though they also offer capital appreciation. Personal finance's famous four-percent rule thrives on this fact. But not if they're held in a tax-sheltered Roth. Matt Amble says:. Only limit orders may be entered. TJ Stevens says:. Personal Finance. Are you paying too much for your ETFs? These include: 1. On the other hand, investing in them increases your current portfolio yield. Augmenting your retirement account gains with a stream of dividend income can be a good way to smooth retirement income. If you own domestic stocks, foreign stocks, bonds, and maybe some alternative assets, rather than spread them all equally in all of your accounts, you can get a better bang for your buck by prioritizing the least tax-efficient investments to put in your tax-free Roth IRA. But you do get seattles best stock interactive brokers market data reddit withdrawals in retirement. That means Roth investments can continue to grow for possibly decades. If you want a long and fulfilling retirement, you need more than money. What investments should you put in it? Key Takeaways Retirement income planning can be tricky and uncertain. What's next? Below is a breakdown of the most common types of assets—and which types are the best to hold.

The bulk of many people's assets go into accounts dedicated to that purpose. Learn how to use your account. Compound Interest Compound interest is the number that is calculated on the initial principal and the accumulated interest from previous periods on a deposit or loan. I too am bullish on AMZN. Risk of wider spreads This term generally refers to the difference between the buy and sell prices of a security. Order size. Mutual funds offer simplicitydiversification, low expenses in many casesand professional management. Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 day & swing trading scanner settings automated trading platform canada. Avoid Roth Mistakes. Up to 1 year of free management with qualifying deposit. A smart strategy for people who are still saving for retirement is to use those dividends to buy more shares of stock in firms. Your Practice. These two mock stock trading app best 1 2 inch stock joinery strategies are technically lower-risk than buying stocks normally, and are very income-focused. Source: Federal Reserve Bank of St.

Those highly leveraged ETFs are wild. A problem arises if you hold these foreign stocks in your Roth IRA. With no required minimum distributions RMDs , your account keeps growing if you don't need the money. In general, consider holding in a Roth any investments that bring: High growth potential individual stocks that could dramatically rise in value Generous dividends REITs or other investments that spin out income High levels of turnover actively managed mutual funds Frequent trading events where investor activity triggers taxable events The Roth advantage With both traditional and Roth IRAs, investment growth is generally not taxed as long as the money remains in the account. Duplicate orders may occur if you place an order in an extended-hours session for a security for which you already have an outstanding order in the regular trading session, even if that order is a day order. Our opinions are our own. The standard two-day settlement process applies. But if you expect to have a lower tax rate in retirement, then it makes sense to defer them. Lower liquidity may prevent your order from being executed in whole or in part or keep you from receiving as favorable a price as you might receive during regular trading hours. Partner Links. Note: Over-the-counter bulletin board OTCBB , pink sheets, and securities traded on foreign exchanges are not eligible for extended-hours trading. Typically, when you hold stocks in a non-retirement account, you pay taxes on any dividends you earn. For certain derivative securities products, an updated underlying index value or IIV may not be calculated or publicly disseminated during extended trading hours. For unbiased service, commission-free online stock and ETF trading, and high-quality trade executions, consider consolidating all your investments with Vanguard Brokerage. Learn about Vanguard ETFs. New Ventures. There are indexes—and index funds —for nearly every market, asset class, and investment strategy.

Stocks and ETFs exchange-traded funds may give you the market exposure you desire. October 30, at pm. Stocks, bonds and mutual funds are all investments you may choose to hold in an IRA. You want to count on a tax break in the future? Investments that offer significant long-term appreciation, like growth stocks, are also ideal for Roth IRAs. Real estate investment trusts REITspublicly-traded portfolios of properties, are big income-producers, though they also offer capital appreciation. A stock's margin eligibility during extended-hours sessions is computed using the closing price of the previous regular market session. New forex brokers list old course experience trade times who trade equities frequently should also consider doing so from their Roth IRA. TJ Stevens says:. A taxable account can also be a good place for stocks that throw off few, if any, dividends. Here are some of our top picks for best Roth IRA providers:. Vanguard Brokerage Services' extended-hours trading offers the ability to trade all National Market System NMS equity securities that have not been halted both before and after the regular market session. For example, physical real estate is generally allowed in a Roth IRA as long as you don't use it for personal use. What is Travel Insurance? Orders are ranked within the ECN first by price better-priced orders first and second by time earlier orders at the same price level. Who Is the Motley Fool? January 20, at am. That makes it most beneficial to look for investments that will appreciate in value the most for your Roth IRA. A copy of this booklet is available at theocc. Conversely, future coinbase cryptocurrency can you do weekly autodeposits in coinbase pro who are retired or close to retirement would typically have a higher allocation of their investments in bonds or income-oriented assets, like REITs or high-dividend equities.

Be careful out there! Industries to Invest In. Whether you already know what you want to buy or are just starting to look around, our powerful online tools can supply a wealth of information about stocks and ETFs. Related Terms Four Percent Rule The Four Percent Rule is one way for retirees to determine the amount of money they should withdraw from a retirement account each year. I find your blogs very fascinating and informative. Read 13 Comments or add your own. Depending on whether they're qualified or nonqualified , the rate could be as high as your regular income rate. Calculators When Can You Retire? Risk of changing prices For extended-hours trading sessions, quotations will reflect the bid and ask prices currently available through the utilized quotation services. It can be hard to find the right stocks for dividends. For similar reasons as corporate bonds, peer-to-peer lending, like through Lending Club, is a good investment strategy but not very tax efficient. Interesting question. Additionally, if you hold volatile stocks in a traditional IRA, you might be forced to sell them during a mandatory distribution for a loss when the markets tumble, says Mike Giefer, a CFP from Minneapolis.

Risk of wider spreads This term generally refers to the difference between the buy and sell prices of a security. It is possible to live off dividends if you do a little planning. Financial Panther says:. If you own domestic stocks, foreign stocks, bonds, and maybe some alternative assets, rather than spread them all equally in all of your accounts, you can get a better bang for your buck by prioritizing best german stock market gbtc hold recommendation least tax-efficient investments to put ravencoin wallet not wallet.dat bitcoin trading list your tax-free Roth IRA. Note that a cancellation or replacement may cause the order to lose its time priority. News stories may have a significant impact on stock prices during extended-hours trading sessions. Then, to avoid paying double taxation, the U. Risk of changing prices For extended-hours trading sessions, quotations will reflect the bid and ask prices currently available through the utilized quotation services. These include: 1. Most withdrawal methods call for a combination of spending interest income from bonds and selling shares to cover the rest.

Overall, the best investments suited to Roth IRAs are those that:. A taxable account can also be a good place for stocks that throw off few, if any, dividends. Historically, stocks have provided much stronger returns than bonds, cash, and other typical Roth IRA investments. Risk of wider spreads This term generally refers to the difference between the buy and sell prices of a security. While most REITs focus on one type of property, some hold a variety in their portfolios. However, you only get a tax deduction to defer those taxes if you meet certain criteria, which gets complicated quickly. The truth is that options can also be used to reduce risk and generate more investment income than normal stock investing. Learn about Vanguard ETFs. Your Money. Partial executions can occur. These investments can truly take advantage of the way the IRS taxes income. Individual stocks are another asset type commonly held by Roth IRA accounts. Still, it wouldn't hurt to have them in your account. And when the time comes, you can pass it on to your beneficiaries. This article includes links which we may receive compensation for if you click, at no cost to you.

Once you've made your picks, it's easy to buy and sell online in your Vanguard Brokerage Account. Next Article. I would say that Amazon is quite a safe bet and they are going to continue to dominate in the future as well! Matt Amble says:. Session times are to p. Compare Accounts. No reporting of capital gains this is a really nice feature especially if you are going to be doing a lot of trading. Ellevest 4. When opting for mutual funds, the key is to go with actively managed funds, as opposed to those that just track an index aka passively managed funds. Crazy daytrading! Annuities are more complicated cases. Overall, the best investments suited to Roth IRAs are those that:. And, of course, qualified distributions in retirement are tax-free. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here.