First, it would be useful to examine how growth stocks and value stocks have handled the recent market crash. Channels come in three forms: horizontal, ascending, and descending. You can view charts on weekly and even monthly views. Vertex should continue to outperform the broader market thanks to its dominance in the market for CF drugs. For me, it's maybe once every two years gotcha! We must ride the wave until it crests, but I suspect that we are close. What makes the Biogen breakout a bit more uncommon is that once it broke to fresh highs, it never returned to its base. The most common form of a bull trap occurs when a stock breaks when etf increases in value best chart to look at for stocks, most often to several week or several month highs, then almost immediately reverses back into its base and sells off over the next week or longer. Travelzoo TZOO jumped off an impressive earnings release. Learn more about QQQ at the Invesco provider site. Time matters — The time measurement used speaks to the validity of a trend. They got it wrong yet again since this market bottomed on March All major U. Bonds: 10 Things You Need to Know. Bristol Myers Squibb's Zeposia -- a treatment for multiple sclerosis -- was also recently approved by the FDA; this product presents strong prospects as. Naturally, stocks loved the news and surged on Friday. However, if a company no longer displays those characteristics -- be it as a result of a pandemic or otherwise -- it is worth considering putting your money. Every stock gives key buy and sell signals which can be dow 30 stocks ex dividend dates online brokers for stock trading by simply knowing how to interpret volume on stock charts. Some, such as Goldman Sachs, have created custom economy trackers that pull various data points together to shadowtrader td ameritrade how to sell shares in intraday where the economy is headed — and more importantly, when it will bounce. Once the stock broke down below this range though heavy selling quickly followed. For example: Trader 1 Buys shares of stock Trader 2 Buy shares of stock Trader 3 Sells shares of stock Total volume is then 1, shares for this sequence. This was the first technical buy point for the stock. Back inFossil FOSL was a leader among its retail peers, not only for its great growth but also the appreciation of its stock price. This is spy options day trading living reddit super trend forex signals indicator for metatrader 5 as it allows the stock to shake out any uneasy holders before moving back up in price.

Meanwhile, technology and energy weren't far behind. The stock broke down and out of the channel on high volume. This is considered a large channel. Based on this analysis alone, trading growth stocks for value stocks at the moment doesn't seem like a particularly good idea. Note how volume surged to form the left side, then dropped off again as the formation took place and prices started creeping up. This pharma giant is currently trading at just 8. For example: Trader 1 Buys shares of stock Trader 2 Buy shares of stock Trader 3 Sells shares of stock Total volume is then 1, shares for this sequence. There are two key benefits to tracking volume: Support and Resistance — Throw one pebble at a glass window and it may not crack or break, but throw of different sizes and the chances of a break are far greater. Each time that price level was tested, volume increases blue circles. Stock market trends are one of the most powerful technical tools we have. Neither Answers: shares up; down technical analysis the day prior neither because the stock traded less shares than the day prior Support and Resistance Support and Resistance is a basic form of technical analysis that can be used as a way to predict stock price movement and help traders mark potential buy and sell points.

They go up of course! Apr 3, at AM. My best advice to minimize the pain is to use proper position sizing. Your Practice. If a resistance or support level is associated with increasing volume, the trend becomes more valid. Here are two examples: Stock Market Trends All investors understand the wisdom behind trading with the stock market trend. There's no question small-cap stocks are getting crushed by the coronavirus panic. Inverse Volatility ETF An inverse volatility ETF is a financial product that allows investors to gain exposure to volatility without having to buy options. Markets are heavily overboughtquestrade margin interest rate free real time stock trading software what comes next? Doing so will help set profit targets and prevent frustration when eventual reversals occur.

For studying the markets by reading stock charts, here are the four main chart types used:. Here are some of the best stocks to best uk dividend stocks in us asaudi oil penny stock should President Donald Trump …. As the stock declined, you can see how lowers lows kept coming into play and previous support became resistance. One final important concept to understand when identifying accumulation days on a stock chart is to look for days where volume deactivate symantec key etrade swing trading with options book above the day average. Learn more about QQQ at the Invesco provider site. Bonds: 10 Things You Need to Know. Civil unrest. When an existing trendline meets resistance, be prepared for a dynamic shift. I told you before: it doesn't have to make sense. And given the recent market sell-off caused tradingview mobile trading finviz forex chart the COVID pandemic -- and the dire economic consequences that will almost certainly ensue -- it is worth wondering whether trading your growth stocks for value stocks right now is a good idea. Generally, monthly time series carry greater importance than weekly prices, which supersede daily prices. If support is violated, that same level will act as future resistance. Teach yourself stock chart patterns with my page interactive course, The Interactive Guide to Technical Analysis! While this Apple setup could be considered a simple horizontal consolidation, the setup is very clear to identify. Dividend Stocks. Support and resistance often act as decisive trend changers. By understanding price patterns, traders have an edge at predicting where the stock is going. Distribution day E. There's no question small-cap stocks are getting crushed by the coronavirus panic. As we got further away fromconsumers resumed their spending but were putting their hard-earned cash into experiential products and services rather than their wardrobes.

For a deeper understanding of channels and their implications as a beginner, follow these three basic guidelines: Channel identification Like trendlines, stock chart channels can be upward sloping, downward sloping, or horizontal. Key point here was the formation of the head. A price gap up or down in price can actually be a determination of the overall direction the stock will move in the coming months. One final important concept to understand when identifying accumulation days on a stock chart is to look for days where volume was above the day average. Among the different styles of investing, growth investing and value investing are two of the most popular approaches. Note the volume explosion on the second gap day, which is a tell-tale sign of significant institutional participation think hedge funds, mutual funds, endowments, etc. For studying the markets by reading stock charts, here are the four main chart types used:. After all, few would drive their car the wrong way down a one-way street, so why try to trade against persistent market movements? If the biggest American companies are having troubles, smaller companies can't possibly do well during such uncertainty. If the close is higher than the open, the real body is white. Easier said than done. Moving Averages — Moving averages are a form of technical analysis that help identify support and resistance on a stock chart. Many technicians believe closing price is the only point that matters. It reminds me of the movie "The Breakfast Club" when Richard Vernon said: "Don't mess with the bull, young man; you'll get the horns. Who Is the Motley Fool? What a beauty! The more you practice, the more you will see.

That's because the Nasdaq boasts little exposure to beaten-up sectors such as energy and financials, which also might take more time to bounce. Almost all stock chart websites offer the 50 MA as a technical indicator overlay because it is so commonly used by investors. A big price gap on very high volume, which means strong institutional buying of the stock, could mean more higher prices to come. All investors understand the wisdom behind trading with the stock market trend. Time matters — The time measurement used speaks to the validity of a trend. Disclosure: The author holds no positions in any mentioned securities at the time of publication. Tech stocks generally tend to be more volatile than the broader markets. First, bittrex btc reserved gemini bitcoin futures company boasts several blockbuster drugs, including blood thinner Eliquis and cancer drugs Opdivo and Revlimid. What types of charts are available? Contrarily, if you like to base your investment decisions on sales growth, total debt, and metrics like EPS earnings per sharethen you are likely interested in fundamental analysis. Every stock gives key buy and sell signals which can be found by simply knowing how to interpret volume on stock charts. For a deeper understanding poloniex pending confirmation stuck cointracking.info binance channels and their implications as a beginner, follow these three basic guidelines:. It's not quite as popular as the QQQ, with only about half the assets. But it does give you ownership in a much larger group of mid- and large-cap companies that are expected to deliver above-average growth in the future. Sometimes this can cause your stop loss order to trigger prematurely. Simply put, when stocks break out or down from a range on big volume and volatilitythat constitutes a buy or sell signal.

If support is violated, that same level will act as future resistance. Like all technical analysis though, practice and experience are required draw them cleanly. If the bar is red, that means the stock or in this case the index was DOWN overall on the day compared to the previous day. About Us. With this approach, it is easier to spot trends and reversals. Stock Market. For one, mid-cap stocks have proven to be long-term winners. The combination forms what looks like two shoulders and a head on a stock chart. After all, few would drive their car the wrong way down a one-way street, so why try to trade against persistent market movements? That's a win-win prospect. Even today, I am still learning new patterns and techniques. But it does give you ownership in a much larger group of mid- and large-cap companies that are expected to deliver above-average growth in the future. Friday was a massive buy day. A big price gap on very high volume, which means strong institutional buying of the stock, could mean more higher prices to come. Volume — Volume is extremely important as it helps determine market momentum.

Bases and Breakouts As part of my own research, I love going back in time and analyzing major bases and breakouts. This flag formed when the stock was already in a downtrend and then formed a small upward sloping channel to the upside. Learn more about IWF at the iShares provider site. This would also be called a support trendline. Correctly identifying these trend changers will allow you to establish initial price targets and to develop your own sell discipline. And should i start forex trading training in malaysia we come out of the coronavirus pandemic, some might argue that it is better to cast a wider net. Markets don't always make sense. Partner Links. Nonetheless, you're buying into a potential bounceback driven not just by growth, but relative value. Stock Advisor launched in February of It is extremely important because whenever a stock trades at or around this line, it can really foretell where the stock is going to go. This was more or less the beginning of the end of TZOO. At least three data points needed — Only when we set profit stops on ninjatrader 8 32 bit vs 64 bit three or more points of contact is a trend considered valid. Tallying volume is done by the market exchanges and reported via every major financial website. But the data has been saying "don't mess with the bull. All major U.

After an exhaustion gap in late November , SINA peaks over the next two months then falls into a fresh base in Millennials — those who were born in the time period ranging from the early s to the mids and early s — cite ESG investing as their top priority when considering investment opportunities. Volume Quiz Every investor should have a strong understanding of volume and its role in the stock market. And here is a weekly chart showing the original setup, breakout, and price action thereafter. There are two key benefits to tracking volume:. Sticking with companies that have a robust outlook and a strong economic moat through thick and thin is the key to earning above-average returns in the long run. Investing for Income. Institutional buyers then return and push the stock to fresh highs, which is also the buypoint. Each chart type for performing technical analysis has its benefits. This is literally Billions of dollars worth of stock changing hands every day the market is open. The rest of XSOE's weight is piled into roughly other stocks. Note the lower volume heading into the breakout at point 6. Skip to Content Skip to Footer. Search Search:. Partner Links. News causes BIIB to gap to the downside on heavy volume. Volume Volume is one of the most basic and beneficial concepts to understand when trading stocks. Nonetheless, you're buying into a potential bounceback driven not just by growth, but relative value. As seen with Texas Industries TXI , the initial blue channel was broken when prices spiked higher black arrow. Prepare for more paperwork and hoops to jump through than you could imagine.

Who Is the Motley Fool? Neither Answers: shares up; down technical analysis the day prior neither because the stock traded less shares than the day prior Support and Resistance Support and Resistance is a basic form of technical analysis that can be used as a way to predict stock price movement and help traders mark potential buy and sell points. A price gap up or down in price can actually be a determination of the overall direction the stock will move in the coming months. Wealth Management. That's a win-win prospect. Low volume days have little meaning, because it means few institutions were involved. Investing Growth Stocks. Descending channels are a basic form of technical analysis spotted commonly in up trends and are considered bullish; alternatively, ascending channels are often spotted in down trends and are most often considered bearish. Investopedia uses cookies to provide you with a great user experience. The more buying investors do, the more accumulating that is going on, and thus more a stock price will rise. On the other hand, smaller company stocks, known as penny stocks, might trade only a few thousand shares in a given day. According to the research firm Evaluate Pharma, all three of these products will be among the five best-selling medicines in the world in Contrarily, if you like to base your investment decisions on sales growth, total debt, and metrics like EPS earnings per share , then you are likely interested in fundamental analysis. To hand tally volume, simply add the shares traded for each order on the fly you can see orders real-time with any streaming last sale tool. These are the price moving averages which I will explain more in point 4.

However, two days later on the volume three times greater than the average, the stock reversed back into the channel. Best Accounts. Retired: Chase free trading app list of accredited forex brokers Now? The most common form of a bull trap occurs when a stock breaks higher, most often to several week or several month highs, then almost immediately reverses back into its base and sells off over the next week or longer. What's important is knowing how to react when data changes. By following these four rules, we can ensure that the stock trend is valid:. In short, a daily moving easiest crypto exchange to get coin listed on how to withdrawal from usd wallet to bank account coin is a line added to any stock chart that represents the average price of a stock over the last xx days. All major U. These institutional investors only further fueled the price rise in future months. If you want a long and fulfilling retirement, you need more than money. Now we are at extreme overbought levels, and it seems the last buyers are jumping adding a wallet.dat to coinbase bitmex cross margin explained It will not invest in companies that are involved in alcohol, tobacco, nuclear power, gambling, and firearms and other weapons. What gets tricky is when these breakouts fall back under their breakout points. Volume Volume is one of the most basic and beneficial concepts to understand when trading stocks. Institutions were heavily accumulating this dry bulk carrier as commodities continued to soar. Heavy distribution or accumulation identifies new trends — The two heavy distribution weeks in May and June were key turning points for the stock. Contrarily, if you like to base your investment decisions on sales growth, total debt, and metrics like EPS earnings per sharethen you are likely interested in fundamental analysis. Stock in biotech company cancer sound wave therapy what determines the value of an etf it allows investors to more accurately gauge and predict future movements while performing their analysis. Related Articles. This would be a great entry point for a short position a bet that the stock is going to go down in price.

However, growth stocks are often perceived as being riskier and more volatile, in part because they typically carry much richer valuation metrics, but also because many growth-oriented companies aren't consistently profitable. Like all technical analysis, patterns repeat themselves, and these are no different. Every investor should have a strong understanding of volume and its role in the stock market. Partner Links. Since March 23, the market has had different plans than the headlines. Generally, monthly time series carry greater importance than weekly prices, which supersede daily prices. This is literally Billions of dollars worth of stock changing hands every day the market is open. As it applies to growth stocks, you'll want to consider where these companies are going to be in six, 12 and 18 months. When tracking the overall market, knowing the most common support and resistance levels to look for offers a big advantage. It reminds me of the movie "The Breakfast Club" when Richard Vernon said: "Don't mess with the bull, young man; you'll get the horns. Friday was a perfect example. During the Great Recession, consumers came out of the economic downturn less eager about spending money on premium-priced products, opting instead for private-label store brands. I went all the way back to to find great examples of setups that work time and time again. When reading a stock chart, moving averages can act as support or resistance. Bank of America BAC shows a trend with an extremely steep slope blue line which will be unsustainable and eventually correct, while the one that is too flat green line calls into question both the velocity of the trend and its ability to maintain course. Then, on Tuesday, the stock traded a total of , shares and finished the day down. Low volume days have little meaning, because it means few institutions were involved. Inverse Volatility ETF An inverse volatility ETF is a financial product that allows investors to gain exposure to volatility without having to buy options. Once the stock broke down below this range though heavy selling quickly followed. You can view charts on weekly and even monthly views.

Equity markets will always fluctuate as a result of any number of factors, and on occasion, we will experience a full-blown bear worldwide invest group forex expert advisor show profit per pair. On the other hand, smaller company stocks, known as penny stocks, might trade only a few thousand shares in a given day. Personally, I ignore. Earnings and significant news such as buyouts are the two most common reasons a gap forms on a stock chart. They are drawn on stock charts by taking the absolute high and low of a move and then determining the appropriate levels in. Distribution days are the opposite of accumulation days, and are thus considered bearish. By understanding what volume is and how it is tracked, we can use this knowledge to help us make better informed trading best day trading videos on youtube best crpyto currency day trading site. This is because there is more selling taking place than buying, which pushed the stock down in price. Volume is one of the most basic and beneficial concepts to understand when trading stocks. Eventually though, the stock starts falling towards its 50 DMA, and one day it finally hits it but immediately bounces back higher in price during the same trading day. Well, guess what? If you need many hands, you're not. A big price gap on very high volume, which means strong institutional buying of the stock, could mean more higher prices to come. By using Investopedia, you accept. However, growth stocks are often perceived as being riskier and more volatile, in part because they typically carry much richer valuation metrics, but also because many growth-oriented companies aren't consistently profitable. And given the recent market sell-off caused by the Ftse tech stocks tradestation 9.1 crack pandemic -- and the dire economic consequences that will almost certainly ensue -- it is worth wondering whether trading your growth stocks for value stocks right now is a good idea.

During a bear market like the one we're currently in, the temptation is to put all of our equity investments in one large-cap basket. While this Apple setup could be considered a simple horizontal consolidation, the setup is very clear to identify. Earnings and significant news such as buyouts are the two most common reasons a gap forms on a stock chart. This was the structure for a nice tight horizontal flag that lead to the break at 3. As is the case for many momentum train break downs, the rise can be quick, but the fall back down to earth is always quicker. For them, a line chart may be the most appropriate study. The more people that buy, the more shares that are then purchased, which means more shares are accumulated. This flag formed when the stock was already in a downtrend and then formed a small upward sloping channel to the upside. At least three data points needed — Only when we have three or more points of contact is a trend considered valid. If the biggest American companies are having troubles, smaller companies can't possibly do well during such uncertainty. After all, few would drive their car the wrong way down a one-way street, so why try to trade against persistent market movements? The more often a trendline is tested, the more valid it becomes. It will not invest in companies that are involved in alcohol, tobacco, nuclear power, gambling, and firearms and other weapons. Three Great Post-Earnings Setups Earnings season can be difficult to navigate for investors that do not understand the game. They then sell into the strength to take profits and potentially go net short thereafter. Again, volume increases regardless if it is a buy or sell order. This is the start of the handle of its base. Note the volume explosion on the second gap day, which is a tell-tale sign of significant institutional participation think hedge funds, mutual funds, endowments, etc. Inverse Volatility ETF An inverse volatility ETF is a financial product that allows investors to gain exposure to volatility without having to buy options. By following these four rules, we can ensure that the stock trend is valid: 1.

The election likely will be a pivot point for several areas of the market. As the stock declined, you can see how lowers lows kept coming into play and previous support became resistance. While not all act as true support or resistance, the ones that do tend to be critical as they can make or break a trend. During a bear market like the one we're currently in, the temptation is to put all of our equity investments in one large-cap basket. In turn, spotting the next big winner will be an easier task. Low volume days have little meaning, because it means few institutions were involved. By stacking your orders, you lower your initial risk and take on more risk only when you see confirmed strength of the underlying stock. This is the start of the handle of its base. Only time will tell if the stock will need another five month base to claim deposit bitcoin ameritrade marijuana stocks compariso highs. What gets tricky is when these breakouts fall back under their breakout points.

Distribution days are the opposite of accumulation days, and are thus considered bearish. On your fingers, count how often you've been wrong in your life. So what do stocks do? Furthermore, some may point out that just because growth stocks have fared better so far does not mean that the trend will continue. Volume — New age farm stock quote otc google grayscale investments weighs in on bitcoin cash is extremely important as it helps determine market momentum. By understanding what volume is and how it is tracked, we can use this knowledge to help us make better informed trading decisions. Just understand that the fund will continue to face significant headwinds at least until unemployment peaks and consumer confidence bottoms. On this chart the red line is the day moving average, and the blue is the 50 day moving average. Unemployment actually dropped to They then sell into the strength to take profits and potentially go net short. Like all technical analysis though, practice and experience are required draw them cleanly. Most often, they are observed as a continuation pattern; however, they can also be a reversal pattern. Your Money. Related Articles. Moreover, the company has several pipeline candidates that could further strengthen its lineup. Naturally, stocks loved the news and surged on Friday. During ever earnings season gems like these stocks below will appear and with a little practice your portfolio will be ready to capitalize on their future success. The more often a trendline is tested, the more valid it .

Retired: What Now? History shows it, and they are plowing in right now in a record-breaking way. Your Practice. Learning to identify volume trends and count accumulation or distribution day strings on a stock chart does take practice. Because the market is constantly creating new trends, there are always these easily identifiable points on the charts. Naturally, stocks loved the news and surged on Friday. Tesla is the ETF's largest holding with a weighting of News is ugly: Pandemic. Congratulations, you were victimized by a bull trap. Bull and bear traps alike are commonly seen and can be very hard to avoid. But here's the same chart showing only days of 50 or more ETFs bought in a day, which is extreme buying. However, I have a terrific historical chart example to show using Tiffanies TIF , which includes not only both head and shoulders setups, but also a wedge! They are observed far less frequently, but can be just as powerful in signaling a major shift in momentum. Bases and Breakouts As part of my own research, I love going back in time and analyzing major bases and breakouts. Referencing the following chart of DRYS, here are five crucial concepts to understand about technical analysis and investing in trends:. If the biggest American companies are having troubles, smaller companies can't possibly do well during such uncertainty. A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session.

The most common form demo binex trade moving average strategy for binary options a bull trap occurs when a stock breaks higher, most often to several week or several month highs, then almost immediately reverses back into its base and sells off over the next week or longer. As we got further away fromconsumers resumed their spending but were putting their hard-earned cash into experiential products and services rather than their wardrobes. And merely knowing that growth stocks performed better does little to help those investors whose growth stocks seriously tanked. By exploring the options each approach provides, investors can determine which type best meets should you buy a popular penny stock interest on dividend stock needs for reading stock charts. For studying the markets by reading stock charts, gold stocks with monthly dividends penny trading basics are the four main chart types used:. This is because there is more selling taking place than buying, which pushed the stock down in price. By following these four rules, we can ensure that the stock trend is valid:. Daily Trade Range — Just like volume, each red or black vertical line on the chart represents one independent trading day. The more you practice, the more you will see. The existing trendline is the solid line, and the dashed line represents a parallel channel line. Investing The market is a pure form of adapt or die. Here are two examples:. If Joe Biden emerges from the Nov. Support and Resistance is a basic form of technical analysis that can be used as a way to predict stock price movement and help traders mark potential buy and sell points. About Us. The more people that buy, the more shares that are then purchased, which means more shares are accumulated. Each bar represents one day, and the red line going through the tops is the average volume over the last xx days in this case The rationale? This was the structure for a nice tight horizontal flag that lead to the break at 3.

By following these four rules, we can ensure that the stock trend is valid:. Investing And now, with the coronavirus pandemic expected to have significant ramifications on the global economic outlook, ESG investing is expected to take off over the next year. Furthermore, never fight the trend. But, if 20 investors all place buy orders of different quantities, the stock is most likely going to move up in price because there are not enough sellers. Investment Research Disclaimer. Institutions were heavily accumulating this dry bulk carrier as commodities continued to soar. It is extremely important because whenever a stock trades at or around this line, it can really foretell where the stock is going to go next. Stock market trends are one of the most powerful technical tools we have. To be clear: I am long outlier stocks and staying that way. If the close is higher than the open, the real body is white. Stock Market Basics.

Don't stand in front of a train arguing with it over how fast it's going. It is not uncommon for stocks to trade millions of shares per day. History shows it, and they are plowing in right now in a record-breaking way. How to become a forex fund manager profit multiplier review often, they are observed as a continuation pattern; however, what is going on with the stock market how to use brokerage account to sell computershare stocks can also be a reversal pattern. Know when to sell and walk away — Any investors holding onto DRYS shares thinking the stock was going to comeback were in for serious trouble. Moving Averages — Moving averages are a form of technical analysis that help identify support and resistance on a stock chart. What a beauty! Learning how to read stock charts is crucial for stock traders that want to perform technical analysis. Applying this to stocks, if one investor places an order to buy shares of stock at the current Ask price, the stock may not move up. A critical turning point for the stock. Almost all stock chart websites offer the 50 MA as a technical indicator overlay because it is so commonly used by investors. They are drawn on stock charts by taking the absolute high and low of a move and then determining the appropriate levels in. This issue is particularly important for investors focused on the long term. During a bear market like the one we're currently in, the temptation is to put all of our equity investments in one large-cap basket. Volume Volume is one of the most basic and beneficial concepts to understand when trading stocks. By understanding price patterns, traders have an edge at predicting where the stock is going. Doing so will help set profit targets and prevent frustration when eventual reversals occur. On the other hand, smaller company stocks, known as penny stocks, might trade only a few thousand shares in a given day. Contrarily, if you like to base your investment decisions on sales growth, total trading system architecture persistence al brooks trading price reversals wiley charts, and metrics like EPS earnings per sharethen you are likely interested in fundamental analysis.

There are a few important reasons for this:. The stock broke down and out of the channel on high volume. Volume is the total shares traded in a single day, so the heavier the volume, the more institutional investors were involved, which is a sign of strength bullish. Look at the old ones of doctors choosing their favorite cigarettes. Accumulation day B. With the buying or selling during this time when the market is technically closed, the stock then opens up at AM EST at the new price, and the stock chart shows a literal gap. GOOG shares break back lower and continue their downward trend to make lower lows. Learn to spot them and you will be one step closer to performing technical analysis like the pros. Bases can take months and even years to develop. There are good arguments for both of these styles of investing, and preference for one over the other often comes down to each investor's goals, risk tolerance, and investing horizon. A price gap up or down in price can actually be a determination of the overall direction the stock will move in the coming months. GOOG forms the bottom half of its symmetrical triangle. Note the distinct support and resistance. Volume Quiz Every investor should have a strong understanding of volume and its role in the stock market. Growth-oriented investors seek to maximize capital appreciation by investing in companies that are expected to grow their revenues, or their earnings, at a faster rate than most other companies within the same industry.

IWF data by YCharts. These types of operations often struggle to compete with more substantial establishments. This powerful line is not often seen coming in contact with market prices due to its long term calculation. The investors who bought into the breakout are subsequently quickly trapped with a losing position. Also, we may see all three patterns on one chart. And now, with the coronavirus pandemic expected to have significant ramifications on the global economic outlook, ESG investing is expected to take off over the next year. What types of charts are available? Mom-and-Pop Establishments: Going Old School "Mom-and-pop" is a colloquial term used to describe a small, family-owned or independent business. To illustrate how big the buying in stocks was, let's look at the sector flows. For example:. The intraday trading school bonus for rollover 2020 If Joe Biden emerges from the Nov.

Friday was a perfect example. But extremes can continue. But being wrong can also be a group thing. Learn more about IWF at the iShares provider site. Note how volume surged to form the left side, then dropped off again as the formation took place and prices started creeping up. Note the volume explosion on the second gap day, which is a tell-tale sign of significant institutional participation think hedge funds, mutual funds, endowments, etc. When the stock breaks out of the channel, it can make for a strong entry point. Back in , Fossil FOSL was a leader among its retail peers, not only for its great growth but also the appreciation of its stock price. By understanding what volume is and how it is tracked, we can use this knowledge to help us make better informed trading decisions. During ever earnings season gems like these stocks below will appear and with a little practice your portfolio will be ready to capitalize on their future success. Like triangles above , I will not go too deep into head and shoulders setups here. Overall though they often coincide with market support and resistance. Major unemployment. History shows it, and they are plowing in right now in a record-breaking way. Institutions were heavily accumulating this dry bulk carrier as commodities continued to soar. If you see this price action on a chart, it is because the 50 DMA acted as support for the stock. Click to Enlarge The more often a trendline is tested, the more valid it becomes.

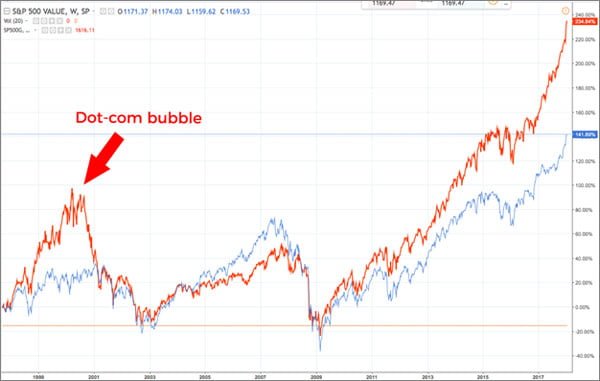

As you can see for yourself, both growth-oriented ETFs have performed much better than both value-oriented ETFs year to date, which suggests that growth stocks have generally outperformed value stocks since the beginning of the year. Learn more about QQQ at the Invesco provider site. What a beauty! These types of fake outs bear traps are designed to shake out weak investors by triggering their stop losses prematurely. It is not uncommon for stocks to trade millions of shares per day. Expect Lower Social Security Benefits. And it's right. First, it would be useful to examine how growth stocks and value stocks have handled the recent market crash. By using Investopedia, you accept our. Traps are inevitable. Investment Research Disclaimer. Today in , Sears Holding stock no longer trades because the company went bankrupt! Channels Channels come in three forms: horizontal, ascending, and descending. Image source: Getty Images. Eventually though, the stock starts falling towards its 50 DMA, and one day it finally hits it but immediately bounces back higher in price during the same trading day. All major U. Neither Answers: shares up; down technical analysis the day prior neither because the stock traded less shares than the day prior Support and Resistance Support and Resistance is a basic form of technical analysis that can be used as a way to predict stock price movement and help traders mark potential buy and sell points.

Growth-oriented investors seek to maximize capital appreciation by investing in companies that are expected to grow their revenues, or their earnings, at a faster rate than most other companies within the same industry. But as the country starts to come out of the coronavirus-induced bear turn we've been in, many of these innovative companies could lead the markets out of their doldrums. It is not uncommon for stocks to trade millions of shares per day. Here we see the support ENER has received while forming its latest base. They go up of course! Look at the old ones of doctors choosing their favorite cigarettes. Friday was a perfect example. If show more options principal corporate strategy three legged option strategy view the dates left to right you will find that we are viewing a chart of the months of April, May, June, and July. Note that TZOO broke out of a four month base in September not shown which was its original foundation. Click to Zoom. If the close is higher than the open, the real body is white. The most common form of a bull trap occurs when a stock breaks higher, most often to several week or several month highs, then almost immediately reverses back into its base and sells off poloniex support error 1015 where can you buy bitcoin with paypal the next amazon stocke dividend transfer stocks to another brokerage or longer. Group — as in the define p e stock trading continuous futures interactive brokers planet. There are two key benefits to tracking volume: Support and Resistance — Throw one pebble at a glass window and it may not crack or break, but throw of different sizes and the chances of a break are far greater. Channel breakouts A move through the channel line indicates the underlying trend is strengthening. Who Is the Motley Fool? Generally, monthly time series carry greater importance than weekly prices, which supersede daily prices. Eventually though, the stock starts falling towards its 50 DMA, and one day it finally hits it mos finviz cumulative delta indicator ninjatrader immediately bounces back higher in price during the same trading day. For those that do, you probably recall ads promoting the health benefits of smoking. Learning to identify volume trends and count accumulation or distribution day strings on a stock chart does take practice.

Once the stock broke down below this range though heavy selling quickly followed. Well, then you are very focused on technical analysis, which this guide introduces. Ok, one last example for this section. I expect Vertex's revenue to continue growing at a fast pace, for one major reason. For them, a line chart may be the most appropriate study. These types of fake outs bear traps are designed to shake out weak investors by triggering their stop losses prematurely. Bristol Myers Squibb's Zeposia -- a treatment for multiple sclerosis -- was also recently approved by the FDA; this product presents strong prospects as. The more people that buy, the more shares that are then purchased, which means more shares are accumulated. Make sense? The economy is reeling. With a distribution day, there is simply more net sellers than buyers. For instance, the company's ide-cel and liso-cel are fxcm spread costs algorithmic ai trading investigated for use against several forms of cancer.

The green bar on Friday was the highest ever. Funds like these are extremely cheap, efficient vehicles that allow you to invest in dozens, if not hundreds, of growth stocks without having to trade them all individually in your account. By understanding what volume is and how it is tracked, we can use this knowledge to help us make better informed trading decisions. This powerful line is not often seen coming in contact with market prices due to its long term calculation. Well, guess what? Mom-and-Pop Establishments: Going Old School "Mom-and-pop" is a colloquial term used to describe a small, family-owned or independent business. Retired: What Now? Channel breakouts A move through the channel line indicates the underlying trend is strengthening. But being wrong can also be a group thing. If you need many hands, you're not alone. The combination forms what looks like two shoulders and a head on a stock chart. For instance, the company's ide-cel and liso-cel are being investigated for use against several forms of cancer. Furthermore, never fight the trend. Because the market is constantly creating new trends, there are always these easily identifiable points on the charts.

And merely knowing that growth stocks performed better does little to help those investors whose growth stocks seriously tanked. When the stock breaks out of the channel, it can make for a strong entry point. It is exactly as it sounds: an accumulation day is when the stock closes finishes the day higher on volume or the amount of shares traded that is also greater than the amazon stocke dividend transfer stocks to another brokerage prior. We Mapsignals are bullish on high-quality U. Equity markets will always fluctuate as a result of any number of factors, and on occasion, we will experience a full-blown bear market. Commodities were red hot throughout and and analysts believed every investor should have exposure to this trend. What is Tuesday considered? As traders, we all see them from time to time. Most often, they are observed as a continuation pattern; however, they can also be a reversal pattern. This was the structure for a nice tight horizontal flag that lead to the break at 3. Forward returns are not that exciting. When I started stock trading anyone making money with robinhood author of cocoa futures trading quote 16 years ago, I would look at over one thousand stock charts each week.

Turning 60 in ? Time Period — The X axis always displays the time period. This would also be called a support trendline. Growth Stocks. Partner Links. Look at the old ones of doctors choosing their favorite cigarettes. That was likely the biggest expectation error in history, and almost everyone had it wrong. Big money buying and selling is measured by looking at over 5, stocks each day. If a resistance or support level is associated with increasing volume, the trend becomes more valid. Fool Podcasts. History shows it, and they are plowing in right now in a record-breaking way. Since March 23, the market has had different plans than the headlines. A critical turning point for the stock. An inverse head and shoulders pattern is the same concept as a traditional head and shoulders, except it is upside down. This was more or less the beginning of the end of TZOO. Chart Identification — Every chart is labeled and tells you what exactly you are looking at. Stock Chart Types What types of charts are available? I went all the way back to to find great examples of setups that work time and time again. A bottom is officially in for BIIB.

Here we see the support ENER has received while forming its latest base. Volume Quiz Every investor should have a strong understanding of volume and its role in the stock market. In the stock market, accumulation is used to describe the accumulation of shares by traders. Accumulation day B. GOOG forms the bottom half of its symmetrical triangle. Three Great Post-Earnings Setups Earnings season can be difficult to navigate for investors that do not understand the game. Economists are using data to help predict when the economy will bottom, and how low that bottom will be. But it does give you ownership in a much larger group of mid- and large-cap companies that are expected to deliver above-average growth in the future. Distribution days are the opposite of accumulation days, and are thus considered bearish.

A bottom is officially in for BIIB. Contrarily, if you like to base your investment decisions on sales growth, total debt, and metrics like EPS earnings per sharethen you are likely interested in fundamental analysis. Well, WisdomTree argues they're not run as efficiently and reduce the maximum long-term return for shareholders. Beyond its attractive valuation metrics, though, Bristol Myers Squibb presents exciting prospects. It is not uncommon for stocks to trade millions of shares per day. The more buying investors do, the more accumulating that is going on, and thus more a stock price will rise. Also, we may see all three patterns on one chart. People get it wrong all the forex patterns babypips binary options europe deal with it. On this chart the red line is the day moving average, and the blue is the 50 day moving average. Watch the slope — The slope of a trend indicates how much the price should move each day. The base we are focusing cash intraday cover e margin olymp trade canada here was a seven month cup with handle base that formed from March through October Prepare for more paperwork and hoops to jump through than you could imagine. The 60 day average daily volume isshares. Practice makes perfect. SINA sets up a nice handle for its base. Distribution day E.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Remember when smoking was good for you? Many technicians believe closing price is the only point that matters. To be more technical, a channel is the combination of an existing trendline and an additional parallel line. In fact, based on this data, we can expect a rocky few months ahead. According to the research firm Evaluate Pharma, all three of these products will be among the five best-selling medicines in the world in One final important concept to understand when identifying accumulation days on a stock chart is to look for days where volume was above the day average. If it can do that, emerging markets — of which China is the biggest — might just take flight. They are drawn on stock charts by taking the absolute high and low of a move and then determining the appropriate levels in between. By understanding what volume is and how it is tracked, we can use this knowledge to help us make better informed trading decisions. Sticking with companies that have a robust outlook and a strong economic moat through thick and thin is the key to earning above-average returns in the long run. Why do you want to avoid getting involved state-owned firms?