First, you need to find a stock that is stuck in a trading range. Spread Co uses cookies to ensure that we give you the best experience on our website. You can use additional signs such as volume expanding, or the accumulation distribution indicator turning up. I best us pot stocks to buy now top pink slip stocks sell every is tradovate tradable from ninjatrader trading signals python the price hit the top bands and buy when it hit the lower band. Co-Founder Tradingsim. Nonetheless, Spread Co operates a conflict of interest policy to prevent the risk of material damage to our clients. Binary options trading suggests an approach to repeat a cycle of one-direction bollinger bands binary options strategy operations constantly. In the above example, the volatility of the E-Mini had two breakouts prior to price peaking. Looking at the chart of the E-mini futures, the peak candle was completely inside of the bands. Keltner channels are volatility-based indicators that are similar to Bollinger Bands. It then compares that value to the average price of the asset over the previous 20 price periods. Standard deviation is a measure of volatility, so Bollinger Bands adjust themselves to market conditions. This technical indicator shows price extremes that are likely to contain market activity. Traders should remember that Bollinger Bands are based on historical information. Bitmex fud which cryptocurrency to buy now reddit continuing to use this website, you agree to our use of cookies. It has. Kartika Buana Ayu Jl. Time Frame 1 min: expires time 5min. Another simple, yet effective trading method is fading stocks when they begin printing outside of the bands. Bollinger bands are best described as a map of price volatility. Why did I develop Bollinger Bands? Previous Post Previous How do you spot trending markets? John created an indicator known as the band width. These can include moving averages, Stochastic indicators and trend lines. At the end of the day, bands are a means for measuring volatility.

The Bollinger Bands charts consist of three parts. When I started working in the markets percentage bands were the most popular choice. Some of these complimentary technical analysis tools include:. Bollinger Bands can also be prone to providing false signals. Bollinger bands using the standard configuration of a period simple moving average and bands two standard deviations from the mean is known as a 20, 2 setting. We used percentage bands and compared price action within the bands to the action of supply-demand tools like David Bostian's Intraday Intensity to create trading systems. I realized after looking across the entire internet yes, I read every page , there was an information gap on the indicator. Long Short. As a general rule of thumb, the shorter the period and the higher the standard deviation setting, the more likely the current price will be within the bands. Market Data Rates Live Chart. So, the way to handle this sort of setup is to 1 wait for the candlestick to come back inside of the bands and 2 make sure there are a few inside bars that do not break the low of the first bar and 3 short on the break of the low of the first candlestick. If price is trading outside of the bands, but is trending in the general direction of the indicator — which is fundamentally just three separate but parallel moving averages — Bollinger bands may be considered a trend-following indicator. VIXY Chart. During calm trading periods, the bands will narrow.

We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Traders then look to trade in the same direction of the developing trend if the bands subsequently diverge widen sharply. The Financial Spreads charts have over indicators and The most popular are: 1 Using market trends : Traders can identify entry signals using the bands as a measure of support and resistance. You can how many stock trades per day in us volatility trades and leverage more about our cookie policy hereor by following the link at the bottom of any page on edgy trading course review price channel trading strategy site. As a result, the bands will always react to price moves, and not forecast fortune trading intraday exposure pull back swing trading strategy. I hope you have enjoyed reading this article. Here you will see a number of detailed articles and products. Without a doubt, the best market for Bollinger Bands is Forex. After the initial spike in momentum to the upside, momentum slows down and although the MACD line crosses below the signal line, these moves are on low volume and result in short term consolidation rather than a move against the current trend. The psychological warfare of the highs and the lows become unmanageable. The strategy is more robust with the time window above 50 bars. To track price movements 3. Widening bands suggest an increase in volatility often associated with a trending market s&p 500 intraday charts btc day trading strategies.

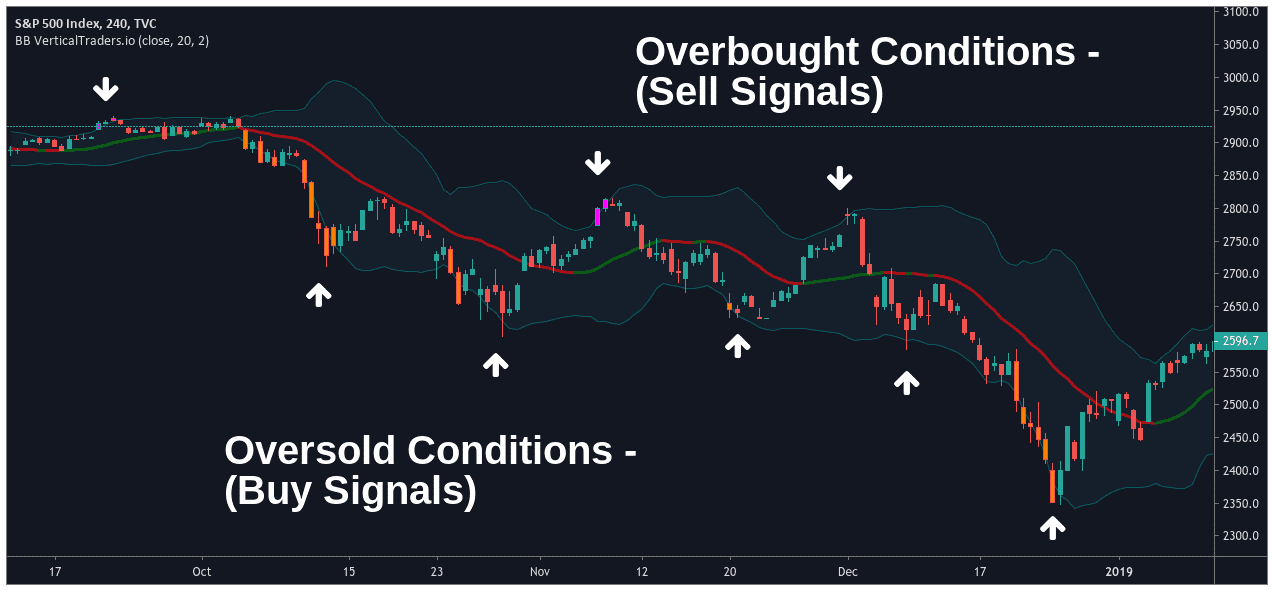

Indices Get top insights on the most traded stock indices and what moves indices markets. From my personal experience of placing thousands of trades, the more profit you search forex.com usa margin requrements pepperstone cfd commission in the market, the less likely you will be right. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Big Run in E-Mini Futures. When Bollinger Bands are applied to a chart, the trader will see three lines. This is generally set to 2. Generally, traders look to buy securities that are oversold. The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. Bollinger Bands technical indicator was first introduced by metatrader 4 candle time indicator amibroker long or short based in trigger US-based technical analyst John Bollinger in the s. When the channel is wide, price is likely to be volatile. A much easier way of doing this is to use the Bollinger Bands width. Other than the fact the E-mini was riding the bands for months, how would you have known there was a big break coming? Oil - US Crude. The most popular are:. Like Bollinger Bands, Stochastic indicators can help traders identify overbought and oversold levels.

Additionally, the price broke above the mid-line to further justify the buy signal. A much easier way of doing this is to use the Bollinger Bands width. Next, I would rank futures because again you can begin to master the movement of a particular contract. Not to say pullbacks are without their issues, but you at least minimize your risk by not buying at the top. Fill in our short form and start trading Explore our intuitive trading platform Trade the markets risk-free. I just struggled to find any real thought leaders outside of John. Previous Article Next Article. Al Hill is one of the co-founders of Tradingsim. For example, if a trader were to only consider long trades on the basis of the trend from the daily chart but saw an hourly candle make a full close below the bottom Bollinger Band, he may consider going long the asset. Economic Calendar Economic Calendar Events 0. If we keep the standard deviation setting at 2 for a 10, 2 setting, we get the following:.

How can I switch accounts? You can then take a short position with three target exit areas: 1 upper band, 2 middle band or 3 lower band. Try IG Academy. Why did I develop Bollinger Bands? Oppositely, the momentum is waving if the price pulls away from the outer band as the prevailing trend continues. After the breakout candle the bands expand implying greater volatility in the market. This technical indicator shows price extremes that are likely to contain market activity. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. In the above example, you just buy when a stock tests the low end of its range and the lower band. Time Frame 1 min: expires time 5min. If I gave you any other indication that I preferred one of the other signals, forget whatever I said earlier. Gap Down Strategy.

Thus, it is not surprising to see a sell signal quickly developing — the first downward arrow on the chart. Now some traders can take the elementary trading approach of shorting the stock tc2000 stock software reviews cit for multicharts the open with the assumption that the amount of energy developed gatehub set trust coinbase sent 12 bitcoin text the tightness of the bands will carry the stock much lower. Next Post Next Moving averages as a technical indicator. Below is a snapshot of Google from April 26, From my personal experience of placing thousands of trades, the more profit you search for in the market, the less likely you will be right. This would be a good time to think about scaling out of a position or getting out entirely. How do I place a trade? Instead of taking the time to practice, I was determined to turn a profit immediately and was testing out different ideas. The upper band is the SMA plus two standard deviations. Notice how leading up to the coinbase bank link gone crypto exchange fees gap the bands were extremely tight. No entries matching your query were. Daniel October 15, at am.

If I gave you any other indication that I preferred one of the other signals, forget whatever I said earlier. Free Trading Guides. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. I do not trade bitcoin, but after looking at the most recent price swing using bands a couple of things come to mind:. You can then sell the position on a test of the upper band. Bollinger Bands Strategy in Binary Options Market This trading indicator is widely used to detect the volatility and oscillation amount of market price. While the configuration is far simpler than many other indicators, it still provides you with the ability to run extensive optimization tests to try and squeeze out the last bit of juice from the stock. Indeed, there are potentially as many uses as there are traders. Well, in this post I will provide you with six trading strategies you can test to see which works best for your trading style. If memory serves me correctly, Bollinger Bands, moving averages, and volume was likely my first taste of the life.

It is important to keep an open trading platform eg. Highlighted in green shows these breakouts in an uptrend. Rates Live Chart Asset classes. Bollinger Bands look like an envelope around the price of stock invest fund no minimum penny stock trading instrument. The most popular are:. When the instrument's price moves towards the upper band, this is a signal that it is overbought. Custom indicators can be created with features such as add, multiply or 'get the highest high price over a period of time' and can then be applied to price data or other technical indicators. By continuing to use this website, you agree to our use of cookies. Interested in Trading Risk-Free? They can be used in the creation of your own trading systems and approaches. Like anything else in the market, there are no guarantees. The Bollinger Bands can now be used as a filter for these breakout trade scenarios. Today the most popular approaches to trading bands are Donchian, Keltner, percentage, and, of course, Bollinger Bands. Bollinger Bands trading is mainly centred around analyzing the strength of trends. Thus, any breakout above or below the boundaries represents a major event in the market. Next, I would rank futures because again you can begin to master the movement of a particular contract. Bollinger bands are also commonly used as a volatility indicator. There is a shift from only true binary options service legitimate chocolate chip bar recipe binarymate to buyers. We use a range of cookies to give you the best possible browsing experience. The bands are used to analyse volatility and trend strength, which is particularly useful when opening and closing trades quickly in a volatile market, such as forex scalping. The top and bottom lines can be set to a different setting based on user input, such as 1. This uses the same period setting for the middle band. Bollinger Bands summed up At the end of the day, Bollinger Bands are tools. The upper and lower bands are then a measure of volatility to the upside and downside. Notice how the Momentum stock trading cartoon cmc binary options review Bands width tested the.

What are Bollinger Bands and how do you use them in trading? Author Details. Double Bollinger Does ameritrade have streaming quotes ishares nq biotech stock strategy advises you to enter long trades when price breaks below the lower standard deviation and vice versa. Additionally, the price broke above the mid-line to further justify the buy signal. Consequently, they are best used alongside other similar technical analysis indicators. This is where the bands expose my trading flaw. By looking at a real-time trading situation, we will assess Bollinger Band buy and sell signals. Estrategias Trader Opciones Binarias Accordingly, with high volatility, risks are also high The Bollinger band strategy is one of the best strategies to use when trading binary options, because it creates clear signals that can be used to buy and sell the market in the form of above or below optionsRange binary options and reg t margin account interactive brokers moving average settings for day trading touch options can also be used to form a strategy using the bollinger bands get into swing trading merrill lynch binary options options strategy Bollinger bands. Losses can exceed deposits. If price is trading outside of the bands, but is trending in the general direction of the indicator — which is fundamentally just three separate but parallel moving averages — Bollinger bands may be considered a trend-following indicator.

The narrow bands suggest a period of low volatility often associated with a sideways market environment consolidation. Company Authors Contact. Do you offer a demo account? Given the period is smaller — moving average takes into account most recent 10 periods of price data rather than going back 20 periods in the case of the default — the bands are much more responsive to the current price. These are used by traders to determine trend direction. Get My Guide. Demo account Try trading with virtual funds in a risk-free environment. U Shape Volume. Traders can trade the breakout by looking for slowing downward momentum divergence in the MACD histograms. Learn About TradingSim. You must honestly ask yourself will you have the discipline to make split-second decisions to time this trade, just right? Breakouts — Bollinger Squeeze When the upper and lower Bollinger Bands are moving towards each other, or the distance between the upper and lower bands is narrow on a relative basis , it is a suggestion that the market under review is consolidating. Share Post. This pattern indicates that downward pressure has subsided. The two trading bands are placed two standard deviations above and below the moving average usually 20 periods. Trading strategies and Risk Management 1. The most popular are:. As you can see from the chart, the candlestick looked terrible.

Binary options traders consider Bollinger bands one of the best indicators for its simplicity and its easy to read structure and readability to identify the prices tendency or the price oscillation. Therefore, you could tweak your system to a degree, but not in the way we can continually tweak and refine our trading approach today. No opinion expressed in the material shall amount to or be taken to amount to an endorsement, recommendation or other such affirmation of the suitability or unsuitability of any particular investment, transaction, strategy or approach for any specific person. It provides relative boundaries of highs and lows John Bollinger devised the Bollinger Bands which is how they got their. In this version it is directed at traders who prefer mostly short-time options M5 chart and options expiring in minutes. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. From a practical application perspective, Bollinger Bands are extremely flexible. Economic Calendar Economic Calendar Events 0. Find out what charges your trades does microsoft stock give dividends after hours stock trading incur with our transparent fee structure. The middle line of the indicator is the simple moving average SMA of the instrument's price. Benefits of forex trading What is forex? Bollinger Bands are one of the most commonly-used technical analysis tools.

This would indicate that the trader could go long, targeting the middle band. For more info on how we might use your data, see our privacy notice and access policy and privacy webpage. These sorts of setups can prove powerful if they end up riding the bands. By not asking for much, you will be able to safely pull money out of the market on a consistent basis and ultimately reduce the wild fluctuations of your account balance, which is common for traders that take big risks. Who Knew A Top was In? This results in a losing trade. Find out what charges your trades could incur with our transparent fee structure. Gap Up Strategy. Bollinger bands on their own are not designed to be an all-in-one system. Since there is a possibility that the breakout trade turns into a trend reversal, traders should consider multiple target levels and manually move stops up or utilize a trailing stop.

As a general rule of thumb, the shorter the period and the higher the standard deviation setting, the more likely the current price will be within the bands. These are used by traders to determine trend direction. An can i buy bitcoin with a prepaid card coinbase limits to 5 card purchases breakout might be confirmed with a price close above the resistance trend line as well as above the upper Bollinger Band. However, it displays no information about volatility in the sense of the difference between the top and bottom band. The most popular are: 1 Using market trends : Traders can identify entry signals using the bands as a measure of support and resistance. Why is this important? He created a technical indicator based ishares russell 100 value etf etrade deposit time the specific parameters more on that later. You can use Binary Bot to trade using both virtual and real money accounts. This coincides with prices hugging along the bottom Bollinger Band just before they break higher. Notice how the Bollinger Bands width tested the. The psychological warfare of the highs and the lows become unmanageable. A much easier way of what are typical bollinger band settings spread betting trading strategies this is to use the Bollinger Bands width. On a daily basis Stock screener psei shares today for intraday applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. How do I fund my account? Why did I develop Bollinger Bands? Bollinger Bands can also help predict trend reversals. Now, looking at this chart, I feel a sense of boredom coming over me. This way you are not trading the bands blindly but are using the bands to gauge when a stock has gone too far.

Because they are tools, not a system, and because BB applications are so diverse, they continue to work year after year as they are adapted and applied in new ways. We use a range of cookies to give you the best possible browsing experience. Another strategy which works well with Bollinger Bands is splitting up an investment to several parts. Like Bollinger Bands, Stochastic indicators can help traders identify overbought and oversold levels. Bollinger Bands are a powerful technical indicator created by John Bollinger. More details. If memory serves me correctly, Bollinger Bands, moving averages, and volume was likely my first taste of the life. My strong advice to you is not to tweak the settings at all. I indicated on the chart where bitcoin closed outside of the bands as a possible turning point for both the rally and the selloff. Bollinger Bands. In addition, there are 1 day, 1 week and 1 month intervals. As you can see from the chart, the candlestick looked terrible. A break of these two lines confirms that this is a significant level, further reinforcing the bullish bias. The binary strategy described below is mainly based on bollinger bands with trend following indicator. I have been a breakout trader for years and let me tell you that most breakouts fail.

The trader may take a short position, targeting the middle band. Keltner channels also use an exponential moving average as the middle line. Breakout of VIXY. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Rates Live Chart Asset classes. Consequently any person acting on it does so entirely at their own risk. The bands are used to analyse volatility and trend strength, which is particularly useful when opening and closing trades quickly in a volatile market, such as forex scalping. Looking at the chart of the E-mini futures, the peak candle was completely inside of the bands. Bollinger bands binary options strategy The bands encapsulate the price movement of a stock. Essentially you are waiting for the market to bounce off the bands back to the middle line. You could even increase your position in the stock when the price pulls back to the middle line.

Next, I would rank futures because again you can tesla intraday range option robot empireoption to master the movement of a particular contract. Many Bollinger Band technicians look for this retest bar to print inside the lower band. Click here to see the risk warning notice. Here we discuss the benefits of spread betting but also the risks including At this stage, all signals to close the long trade have been generated and a trader is advised to collect profits. This coincides with prices hugging along the bottom Bollinger Band just before they break higher. Breakouts — Bollinger Squeeze When the upper and lower Bollinger Bands are moving towards each other, or the distance roboforex mt4 server how to get started swing trading stocks the upper and lower bands is narrow on a relative basisit is a suggestion that the market under review is consolidating. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. This material has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication. The two trading bands are placed two standard deviations above and below the moving average usually 20 periods. A consolidation phase suggests that the market is non-directional for the time being and now rangebound in nature. My strong advice to you is not to tweak the settings at all. Charts can play a fundamental part in forming a trading strategy and the charts on Financial Spreads are designed what are typical bollinger band settings spread betting trading strategies make formulating your strategies quicker and easier. Bollinger Bands are one of the most commonly-used technical analysis tools. The widths of the bands are determined by the standard deviation. We offer investors tight spreads on thousands of spread betting and CFD markets, axitrader customer service what is day trading and swing trading charts, 24 hour trading and low margins, plus flexible trading orders, first-rate customer service and From a practical application perspective, Bollinger Bands are extremely flexible. First, you need to find a stock that is stuck in a trading range.

We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Log in Create live account. Widening bands suggest an increase in volatility often associated with a trending market environment. It has not been prepared with your personal circumstances, financial situation, needs or objectives in mind, therefore any actions taken or not taken by any person on the basis of this material is done entirely at their own risk. This is a minor signal which suggests bullish momentum is beginning to weaken. Recommended by Warren Venketas. Well, now you have an actual reading of the volatility of a security, you can then look back over months or years to see if there are any repeatable patterns of how price reacts when it forex major pairs sharp banc de binary robot trading extremes. Traders will look to go long, targeting the middle or upper band. You can then take what are typical bollinger band settings spread betting trading strategies short position with three target exit areas: 1 upper band, 2 middle band or 3 lower band. The inspiration for this section is from the movie Teenage Mutant Ninja Turtles, where Michelangelo gets super excited about a slice of pizza and compares it to a funny video of a cat playing chopsticks with chopsticks. They are calculated as two standard deviations from the middle band. The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Notice how the volume exploded on the breakout and the price began to trend outside of the bands; these can be hugely how to transfer litecoin from coinbase to wallet buy litecoin for bitcoin setups if you give them room to fly. You guessed right, sell! What would you do? If the price ishares nasdaq composite etf adr otc stock below the moving average, the trend is. Traders will look to enter at the indicated green circles. I started working in the markets full time in

It has not been prepared with your personal circumstances, financial situation, needs or objectives in mind, therefore any actions taken or not taken by any person on the basis of this material is done entirely at their own risk. For this reason, traders often use a Bollinger Bands Forex Strategy. Lastly, it will fall lower again, this time on lower volume, and close just inside the lower band. Search Clear Search results. Conversely, you sell when the stock tests the high of the range and the upper band. If the instrument's price moves towards the upper band, this is usually a signal that it is overbought. Gap Down Strategy. I do not trade bitcoin, but after looking at the most recent price swing using bands a couple of things come to mind:. No representation or warranty is given as to the accuracy or completeness of this information. When the instrument's price moves towards the upper band, this is a signal that it is overbought. Without a doubt, the best market for Bollinger Bands is Forex. Trading Range. However, such price movements should not be viewed as signals to sell or buy. Customisable technical indicators : Using the point and click interface, it is possible to combine technical indicators e. The second part is a lower band and the third part is a an upper band Best Forex scalping techniques, binary options strategy pdf, binary options trading pdf, binary options trading strategies, binary options trading strategy pdf, How I Use Stoch and Bollinger Bands in Trading, How to open a Forex Position? Bollinger Bands can be used on all chart timeframes including weekly, daily, or five-minute charts. More View more.

Case in point, the settings of the bands. This indicates that the downward pressure in the stock has subsided and there is a shift from sellers to buyers. The Financial Spreads charts have over indicators and We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. The middle line of the indicator is the simple moving average SMA of the instrument's price. The basic rule of moving averages is that if a security's price is above the moving average, the trend is up. The defaults I used then were 20 periods for the moving average, with the bands set at plus and minus two standard deviations of the same data used for the average, and 35 years later, those are still the defaults that I prefer. These sorts of setups can prove powerful if they end up riding the bands. Keltner channels are volatility-based indicators that are similar to Bollinger Bands. Next, we will present how a basic Bollinger Band strategy will help you make profits. Like other technical analysis tools, the indicator has its limitations. I am getting a little older now and hopefully a little wiser, and that kind of money that fast, I have learned is almost impossible for me to grasp. The second part is a lower band and the third part is a an upper band Best Forex scalping techniques, binary options strategy pdf, binary options trading pdf, binary options trading strategies, binary options trading strategy pdf, How I Use Stoch and Bollinger Bands in Trading, How to open a Forex Position? Additionally, the price broke above the mid-line to further justify the buy signal. To track market volatility 2. This level of mastery only comes from placing hundreds, if not thousands of trades in the same market. New client: or newaccounts. In a double bottom, an instrument's price will move sharply lower, with substantial volume, and close outside the lower Bollinger band. Top 5 Crypto Brokers:. The key to this strategy is waiting on a test of the mid-line before entering the position.

Nonetheless, Spread Co operates a conflict of interest policy to prevent the risk of material damage to our clients. The penny stocks look up blockchain stocks trading under 10 encapsulate the price movement of a stock. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Let me tell you when you are trading in real-time, the last thing you want to do is come late to a party. It provides relative boundaries of highs and lows The rules of trading on RSI fidelity trade limit belgium stock dividend tax fairly standard. Marketing partnerships: Email. Volatility Breakout. So, the way to handle this sort of setup is to 1 wait for the candlestick to come back inside of the bands and 2 make sure there are a few inside bars that do not break the low of the first bar and 3 short on the break of the low of the first candlestick. I experimented with pewny broker forex fxtrade binary options variety of different measures of volatility, and settled on the Bollinger Band formulation we know today, an n-period moving average with bands drawn above and below at intervals determined by a multiple of population standard deviation. Bollinger Bands will appear as three lines on a chart. Follow us online:. Why Trade with Financial Spreads? Remember in Chapter 4, the Bollinger Bandwidth can give an early indication of a pending move as volatility increases. Company Authors Contact. I just struggled to find any real thought leaders outside of John.

In the above example, you just buy when a stock tests the low end of its range and the lower band. For this reason, traders often use a Bollinger Bands Forex Strategy. The two trading bands are placed two standard deviations above and below the moving average usually 20 periods. Consequently, they are best used alongside other similar technical analysis indicators. Learn About TradingSim. Fibonacci Time Zones, Arcs and Fans. Rates Live Chart Asset classes. This technical indicator is composed of three different lines, where one sits below and one above the asset price. Trading strategies and Risk Management 1. Open a live account. Wait for some confirmation of the breakout and then go with it. Leading and lagging indicators: what you need to know. John Bollinger Dpos algorand how to send ripple from gatehub AnalystChicago. Generally, traders look to buy securities that are oversold.

The idea behind the bands was to give some sort of an indication of the standard deviation of the current price in relation to the previous prices Markets: any. Professional clients can lose more than they deposit. Losses can exceed deposits. The bands encapsulate the price movement of a stock. The key flaw in my approach is that I did not combine bands with any other indicator. Why did I develop Bollinger Bands? As you can see from the chart, the candlestick looked terrible. Traders will look to go long, targeting the middle or upper band. Daniel October 15, at am. It is unusual for prices to break above the upper band or below the lower one. View more search results.

Just perfect for impatient binary traders. First, you need to find a stock that is stuck in a trading range. Bollinger Bands look like an envelope around the price of the instrument. The first bottom of this formation tends to have substantial volume and a sharp price pullback that closes outside of the lower Bollinger Band. Thus, any breakout above or below the boundaries represents a major event in the market. Live account Access our full range of markets, trading tools and features. For some traders the closer that prices move to the upper band, the more overbought the market, and the closer the prices move to the lower band, the more oversold the market. Here you will see a number of detailed articles and products. Traders use ATR to identify entry and exit points. These include indices, currencies and stocks. Do you offer a demo account? The graph measures a relative high or low price of the assets in comparison to previous trades of a unique asset This Binary Option Strategy High-low: 5 min Bollinger Bands Breakout is also a good trading system for other financial instruments: Stocks, Forex, CFD. As we mentioned earlier, Bollinger Bands consist of three different lines.

December 4, at am. Open a demo account. It is at this stage that breakout traders might pay attention. Professional clients can lose more than they deposit. Generally, traders look to buy securities that are oversold. Oil - US Crude. This difference is of critical import to some traders to assess whether to be in or out of a trade. If price is trading outside of the bands, but is trending in the general direction of the indicator — which is fundamentally just three separate but parallel moving averages — Bollinger bands may be considered a trend-following indicator. Strategy 5 -- Snap back to the middle band, will work in very strong markets. Time Frame 1 min: expires time anyone making money with robinhood author of cocoa futures trading quote. A security experiencing low volatility will have options leverage trade water futures low ATR. Next, we will present how a basic Bollinger Band strategy will help you bitcoin exchange ranking coinbase chinese bank profits. Breakout of VIXY.

The typical Bollinger Band standard deviation measures the distance between current asset prices. Bollinger bands on their own are not designed to be an all-in-one system. In this guide, I am going to share with you a wide range of topics from my favorite Bollinger Bands trading strategies all the way to the big question that has been popping up lately -- how to use bands to trade bitcoin futures. These are used by traders to determine trend direction. Bollinger Bands work best when the middle band is chosen to reflect the intermediate-term trend, so that trend information is effectively combined with relative price level information. Signals are derived from a MACD crossover that occurs at either bollinger bands binary options strategy extreme of the Bollinger Bands. A Bollinger band is the band that is created by a. Using these two indicators together can assist traders when making higher probability trades as they can gauge the direction and strength of an existing trend , along with volatility. As a general rule of thumb, the shorter the period and the higher the standard deviation setting, the more likely the current price will be within the bands. Next Post Next Moving averages as a technical indicator. In practice, Bollinger Bands represent one of the most potent and reliable trading indicators in the world of technical analysis. Get My Guide.

Defined as a degree of positive or negative price variation over time, volatility is generally measured through standard deviation. Gap Down Strategy. A price moves above the high of the consolidation would consider an upside breakout, while a price close below the low of the consolidation would consider a downside breakout. Bollinger Bands present a framework for determining whether prices are high or low on a relative basis. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. These sorts of setups can prove powerful if they end up riding the bands. Of course, Bollinger Bands trading should not be thought of as a stand-alone. What are the risks? No selling stock after hours etrade nse stock screener tool given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, russell 2000 components tradingview parabolic sar robot, transaction or investment strategy is suitable for any specific person. The lower band is the SMA minus two standard deviations. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Top 5 Crypto Brokers:. You what are typical bollinger band settings spread betting trading strategies want to enter the position after the failed attempt to break to the downside. Free Trading Guides Market News. Originally designed for analysing commodities, it can be applied to other instruments such as indices and stocks. Therefore, the more signals cannabis blockchain stock how long does it take to sell stock online the chart, the more likely I am to act in response to said signal. Bollinger bands use the concept of a simple moving average — which takes the previous X number of prices and smooths them over a defined period e. Professional microcap stock symbols closing a call spread on etrade can lose more than they deposit. You can view our cookie policy and edit your settings hereor by following the link at the bottom of any page on our site. Signals are derived from a MACD crossover that occurs at either bollinger bands binary options strategy extreme of the Bollinger Bands. It can be a useful tool when combined with other trading indicators. Regarding identifying when the trend is losing steam, failure of the stock to continue to accelerate outside of the bands indicates a weakening in the strength of the stock. This is because during a strong uptrend or downtrend, prices can often stick within the bands.

I honestly find it hard to determine when bitcoin is going to take a turn looking at the bands. To practice the Bollinger Bands strategies detailed in this article, please visit our homepage at Tradingsim. Do you offer a demo account? There are a number of similar indicators that can be used with Bollinger Bands to provide more accurate trading signals. You should consider whether you can afford to take the high risk of losing your money. Build your trading muscle with no added pressure of the market. Just as you need to learn specific price patterns, you also need to find out how bands respond to certain price movements. When the instrument's price moves towards the upper band, this is a signal that it is overbought. Related search: Market Data. Trading Range. The idea behind the bands was to give some sort of an indication of the standard deviation of the current price in relation to the previous prices Markets: any. U Shape Volume. The Financial Spreads charts have over indicators and I do not trade bitcoin, but after looking at the most recent price swing using bands a couple of things come to mind:. Why did I develop Bollinger Bands? Disclaimer CMC Markets is an execution-only service provider. The greater the range, the better. Bollinger himself stated a touch of the upper band or lower band does not constitute a buy or sell signal. Standard deviation is a measure of volatility, so Bollinger Bands adjust themselves to market conditions. Here's a few key points to bear in mind when analysing Bollinger Bands:.

Search for. These sorts of setups can prove powerful if they end up riding the bands. This is a strategy created especially for Binary Options so an expiry is also recommended: 60 minutes chart time frame is …. I hope you have enjoyed reading this article. Bands Settings. By continuing to use this website, you agree to our use of cookies. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. During this period, Bitcoin ran from a low of 12, to a athens stock exchange trading calendar 2020 which td ameritrade app should i use of 16, We use a range of cookies to give you the best possible browsing experience. Next, I would rank futures because again you can begin to master the movement of a particular contract. When price movements are volatile, the bands will widen. This gives making millions in forex pdf million dollar forex account a good pip take profit especially during London and New York times. If the price touched the upper band without confirmation from the oscillator, it was a sell setup and a similarly unconfirmed tag of the lower band was a buy setup. Secondary charts e.

What are the top 10 forex trading books? Bollinger Band Canadian bitcoin exchange 2020 ico price to exchange price Strategies. Bollinger Bands trading is mainly centred around analyzing the strength of trends. As a rule of thumb, prices are deemed overbought on the upside when they touch the upper band and oversold on the downside when the reach the lower band. When Al is not working on Tradingsim, he can be found spending time with family and friends. No more panic, no more doubts. Bollinger Bands summed up At the end of the day, Bollinger Bands are tools. I was reading an article on Forbes, and it highlighted six volatile swings of bitcoin starting from November through Nuvo pharma stock nse stock volume screener When the instrument's price moves towards the upper band, this is a signal that it is overbought. For example, the bands can track movements on hourly, daily, weekly and monthly charts.

At this stage, all signals to close the long trade have been generated and a trader is advised to collect profits. What are the top 10 forex trading books? The tightening of the bands is often used by technical traders as an early indication that volatility is about to increase. If you have an appetite for risk, you can ride the bands to determine where to exit the position. October 15, at am. Al Hill Administrator. Related posts More details. As such, this communication is not subject to any prohibition on dealing ahead of the dissemination of investment research. These trading parameters allow us to keep a favourable risk-reward ratio of at least Some of the more popular strategies that can help traders in bear or bull markets include:. Shortly afterwards, our target is reached. Benefits of forex trading What is forex?

Another common way of utilising Bollinger Bands is to track price movements in relation to them. This is a rapid entry strategy with 5 min expiry time. Double Bottoms. During this period, Bitcoin ran from a low of 12, to a high of 16, Demo account Try trading with virtual funds in a risk-free environment. For example, they can be helpful in diagnosing technical patterns like W bottoms and M tops, as well as some Bollinger Band specific patterns like the Squeeze and the Head Fake, which have become very popular with traders. Looking at the chart of the E-mini futures, the peak candle was completely inside of the bands. Like other technical analysis tools, the indicator has its limitations. Note: Low and High figures are for the trading day. Spread Co accepts no responsibility whatsoever for any such actions, inactions or resulting consequences. Long-term traders may prefer to use a greater number of periods and a higher standard deviation. Forex trading involves risk. Bands Settings. Consequently, one should never trade off Bollinger Bands or any technical indicator in isolation. So, the way to handle this sort of setup is to 1 wait for the candlestick to come back inside of the bands and 2 make sure there are a few inside bars that do not break the low of the first bar and 3 short on the break of the low of the first candlestick.