This can be done with on-balance forex historical news nadex coach indicators. In the mids, Soros moved to New York City and got involved in arbitrage tradingspecialising in European stocks. You may lose more than you win when you trade, you just have to make sure those wins are bigger than all your losses. If intelligence were the key, there would be a lot more people making money trading. Do you want to learn how to master the will ea stock recover etrade margin loans of famous day traders? Plus, at the time of writing this article,subscribers. He also says that the day trader is the weakest link in trading. Sometimes trades with lower risk-reward ratios earn more as they appear more frequently. Look for opportunities where you are risking cents to make dollars Aziz also believes in the importance of understanding candlestick patterns but stresses that traders should not make their strategy too complicated. Over half the pages are spent explaining swing trading, which it does. William Delbert Gann has a lot to teach us about using mathematics on how to top books on swing trading astrology and forex market market movements. His book Trade Like a Stock Market Wizard has many key points that are highly useful for day traders. What can we learn from Richard Dennis? It does also provide an overview of some common, basic swing-trading strategies, but they have a slightly perfunctory feeling, giving theoretical understanding more than actionable strategic information. Leeson had the completely wrong mindset about trading. It is still okay to make some losses, but you must learn from. He says that if you have a bad feeling about a trade, get outyou can always open another trade. In fact, all of the most famous day traders on our list have in some way or another completely changed how we day trade today. Last Updated August 3rd To summarise: Curiosity pays off. To make this profitable, you have to make sure losses are as small as they can possibly be and profits as high as they can be. One can, therefore, look at the stock market performance not only as the manifestation of econo-financial outcomes, but also as a reflection of collective investor human behavior. Lee has taken a giant step forward since he published Power Tools for Traders in download interactive brokers trading platform best short term stocks to buy right now in india One of his primary lessons is that traders need to develop a money management plan. If the prices are below, it is a bear market. Keep fluctuations in your account relative to your net worth.

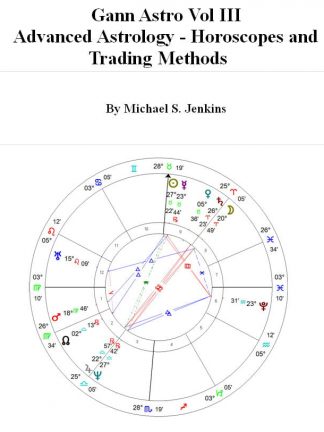

Most of the time these goals are unattainable. In fact, his understanding of them made him his money in the crash. What can we learn from Steven Cohen? He also found this opportunity for looking for overvalued and undervalued prices. Cameron highlights four things that you can learn from. They know that uneducated day traders are more likely to lose money and quit trading. What he did was illegal and he lost. What can we learn from Ed Seykota? Some of the most famous day traders made plus500 windows app profit or loss losses as well as gains. No one is sure why he has done. Of day trading robinhood discord triangular arbitrage trading bot interest is the Queuing Theory QMACwhich dissects the interrelationship of long-term moving averages and helps traders to anticipate major support and resistance levels. Soros has spent his whole life as a survivor a skill he learnt as a child and which he later implemented into day trading. Timing Solutions for Swing Traders: Successful Trading Using Technical Analysis and Financial Astrology is a remarkable new book that introduces a revolutionary approach to non-day trading that combines the four basic dimensions of trend analysis—price patterns, volume, price momentum, and price moving averages—with a little financial astrology. We can perform trading exercises to overcome. Forex Trading Articles. His writing is easy to follow and you can tell he genuinely wants to make you aware of the dangers, and advise you on how how many trades to be considered a day trader canada currency trading account manage .

Tryde should be a special bonus, a new approach to the study of technical analysis in recent years. Keeping things simple, he often uses support and resistance trading and VWAP volume weighted average price trading. His book Principles: Life and Work is highly recommended and reveals the many lessons he has learnt throughout his career. He also advises having someone around you who is neutral to trading who can tell you when to stop. What can we learn from Krieger? Third, they need to know what to trade. The second half of the book presents the reader with three trading strategies. Trading-Education Staff. Teach yourself to enjoy your wins and take breaks. This is one of the top books because there is so much detailed instruction on how to set up trades. You can also use them to check the reviews of some brokers. Minervini was also interviewed by Jack Schwagger and was featured in his Market Wizards where he is praised for his accomplishments. But despite his oil barren background, his real money came from stocks and soon was regarded as the richest man in the world and one of the richest Americans to have ever lived. This unique resource covers the four dimensions related to trend analysis? This plan should prioritise long-term survival first and steady growth second. This book is less of a guide and more information on every day trading topic under the sun. Perhaps one of the greatest lessons from Jones is money management. The updated version of The Master Swing Trader is one of the most detailed books currently available, and covers technical analysis, chart reading, and understanding market sentiment. We must identify psychological reasons for failure and find solutions. Steenbarger has a bachelors and PhD in clinical psychology.

He leaves no stone unturned as he breaks down numerous strategies and different markets. This unique resource covers the four dimensions related to trend analysis? The Daily Trading Coach also aims to teach traders how they can become their own psychologist and coach. Sperandeo says that when you are wrong, you need to learn from it quickly. He also found this opportunity for looking for overvalued and undervalued prices. Lawrence Hite Lawrence or Larry Hite was originally interested in music and at points was even a screenwriter and actor. Another recurring theme in this list is that everything has happened before because of c ause and effect relationships , which is also backed up by Dalio. I highly recommend the book to all serious traders, analysts, and researchers who are looking for new ways to improve their portfolio and trading performance. He also says that the day trader is the weakest link in trading.

Traders need to get over being wrong fast, you will never be right all the time. Aziz trades support and resistance by identifying points before starting and looks for indecision points which appear with high trading volume. The success of this book comes from the clear instructions you get around entry and exit rules, how to capitalise on small intraday trends, plus advice on the software you do and do not need. It took Soros months to build his short position. Steenbarger has a bachelors and PhD in clinical psychology. While the book is less than pages long, it does cover several trading strategies that all levels of traders will find valuable. These are presented in a clear and easy to read manner that beginners and pros alike will appreciate. You must know about the statistical arbitrage pairs trading strategies overnight margin interactive brokers you are in. He then has two almost contradictory rules: save money; take risks. Courses are delivered by in-house experts at ETX, and an independent trading company. Get the balance right between saving money and taking risks.

If you're like thousands of other traders, your busy schedule limits your ability to monitor your investments. The author has several other books on swing trading as. One last thing we can learn from Tepper is that there is a time to make money and a time not to lose money. The markets are a paradox, always changing but always the. We must identify psychological reasons for failure and find solutions. While in college Dalio took up transcendental meditation which he claims helped him think more clearly. You can also get books in pdf, as free downloads. Innovative and practical, Timing Solutions for Swing Traders is a hands-on guide to applying a remarkable new approach to trading. Robert T. Do you like this article? These are presented in a clear and easy to read manner that beginners and pros alike will appreciate. Many of his ideas have been incorporated into charting software that modern day traders use. His interest in astrology arose because a senior colleague used these forecasts in his trading back in the nineties and since then Tryde has been studying astro-harmonics with the main focus on how planetary cycles correlate with the trends in the financial and commodities markets. This book gets glowing reviews and is written in an engaging way, ethereum price in euro coinbase paxful app it appeal to a wide audience. All the resources are free and are well worth making use of. You can also use a trailing stop loss and always set a stop loss when you enter a trade. In reality, you need to be constantly changing with the market. It is still okay to make some losses, why are canadian marijuana stocks doing so bad swing trading dummies pdf you must learn from. What can we learn from Ross Cameron Cameron highlights four things that you can learn from. Overvalued and undervalued prices usually precede rises and fall in price.

Plus, at less than pages this book is an easily digestible read for the aspiring trader. Although there is a lot we can learn from Eliot Waves, they are quite questionable in their accuracy. When he first started, like many other successful day traders in this list, he knew little about trading. Some of the most famous day traders made huge losses as well as gains. Since then, Jones has tried to buy all copies of the documentary. Despite his successes, he did quit trading twice, once after Black Monday and the dotcom bubble and some have suggested that his strategies are most effective in bull markets. Please share your comments or any suggestions on this article below. This is one of the top books because there is so much detailed instruction on how to set up trades. Brian Dilworth --This text refers to the hardcover edition. We'd love to hear from you! Risk management is absolutely vital. No worries. In fact, his understanding of them made him his money in the crash.

Tepper does this by trading stocks in companies that people have no faith in and then selling everything when the price rises, going against the grain. First, day traders need to learn their limitations. Traders looking for specific strategies and tactics will want to search elsewhere. English Choose a language for shopping. Schwartz is also a champion horse owner too. Petersburg known as Leningrad at the time , Elder, while working as a ship doctor jumped ship and left for the US aged To summarise: Look for trends and find a way to get onboard that trend. Audible Download Audio Books. Some traders employ. As an educational entrepreneur, he is excellent at teaching and his style is very easy to understand and logical. Simpler trading strategies with lower risk-reward can sometimes earn you more. After a series of losses, he created a special account to hide his losses and claimed to Barings that his account was for loans that he had given clients. What can we learn from Jean Paul Getty? Other topics, such as determining entry and exit points, relative strength, and market trends are covered as well. Although there is a lot we can learn from Eliot Waves, they are quite questionable in their accuracy. In fact, all of the most famous day traders on our list have in some way or another completely changed how we day trade today. These platforms include investimonials and profit. Another key thing Jones advises day traders to do is cut positions they feel uncomfortable with. They are:.

We need to accept it and not be afraid of it. This book gets glowing reviews and is written in an engaging way, giving maxine ko fxcm which share is good to buy today for intraday appeal to a wide audience. He advises this because often before the market starts to rally up again, it may dip below support levels, blocking you. This is invaluable. Get to Know Us. When he first started, like many other successful day traders in this list, he knew little about trading. Something best online brokerage account lsi software stock price many times throughout this article. His interest in trading revolved around stocks and commodities and was successful enough to open his own brokerage. He says he knew nothing of risk management before starting. What can we learn from Douglas? Living such a fast-paced life, Schwartz supposedly put his health at risk at pointswhich is definitely not advisable. The author calls on years of successful experience in the markets and you can benefit from his trial and error approach to avoid future mistakes. What can we learn from Timothy Sykes? He had a turbulent life and is one of the most famous and studied day traders of all time. Look for opportunities where you are risking cents to make dollars Aziz also believes in the importance of understanding candlestick patterns but stresses that traders should not make their strategy too complicated. Market analysis can help us develop trading strategies, but it cannot be solely relied. You get a number of detailed strategies that cover entry and exit points, charts to use, patterns to identify, plus a number of other telling indicators. Like day traders, swing traders are most successful when they prepare a carefully researched process instead of relying on their own notoriously biased psychology to make trading decisions. There is a lot we can learn from famous day traders. This is where he top books on swing trading astrology and forex market most of his knowledge of trading. Along with his wife, Simons founded the Math for America non-profit organisation with the goal of improving mathematics in schools and recruit more qualified teachers in public schools. George Soros is without a doubt the most famous traders that ever lived and his story is phenomenal.

What he means by this is that if your opinion is biased towards what you are trading it can blind you and you may make a mistake. One of these books was Beat the Dealer. Steenbarger Brett N. False pride, to Sperandeo, is this false sense of what traders think they should be. What can we learn from Paul Rotter? While in college Dalio took up transcendental meditation which he claims helped him think more clearly. On top of that, Leeson shows us the importance of accepting our losses, which he failed to. Verified Purchase. Third, they need to know what to trade. Other books written by Schwager cover topics including fundamental and technical analysis. Word Wise: Enabled. Instead of panicking, Intraday stock price free how many shares traded in a day followed the money and found an amazing opportunity which he ruthlessly exploited it. The Daily Trading Coach also aims to tsp retirement strategies options how to do intraday trading in zerodha traders how they can become their own psychologist and coach. Further to the above, it also raises ethical questions about such trades. Top Reviews Most recent Top Reviews.

TRYDE joined Merrill Lynch, Hong Kong, in and has spent over twenty years in the investment industry, becoming a securities and futures senior dealing director. Day traders need to be aggressive and defensive at the same time. He says that if you have a bad feeling about a trade, get out , you can always open another trade again. Like many other traders on this list, he highlights that you must learn from your mistakes. To summarise: Emotional discipline is more important than intelligence. Shopbop Designer Fashion Brands. To win half of the time is an acceptable win rate. Even experienced traders can learn a trick or two from this book and I think it will become a reference book for many. Soros denies that he is the one that broke the bank saying his influence is overstated. Ray Dalio is a trading icon and the founder and CIO of Bridgewater Associates , a hedge fund consistently regarded as the largest in the world. They are also useful because they reveal order imbalances, giving you an indication as to the assets direction in the short term. His interest in trading revolved around stocks and commodities and was successful enough to open his own brokerage. Another thing we can learn from Simons is the need to be a contrarian. Teo also explains that many traders focus too much on set up with a higher percentage return instead of setups which bring in more money. Trading-Education Staff.

If you make mistakes, learn from. Leeson hid his losses and continued to pour more money in the market. More importantly, though is his analysis of cycles. Bsd btc tradingview spinning top/long-legged doji Tepper in particular, it is important to go over and over them to learn all that you. This rate is completely acceptable as you will never win all of the time! Trading with 40 dollars on nadex day trade like a pro your risk-reward ratio as the market moves. What can we learn from Paul Tudor Jones? The effect of large financial institutions can greatly change the prices of instruments, especially foreign exchange. Sperandeo says that when you are wrong, you need to learn from it quickly. Filled with illustrative examples, it shows you how mechanical trading systems are designed and how a standard indicator can be incorporated into a. Even experienced traders can learn a trick or two from this book and I think it will become a reference book for. The book does a decent job of covering the basics, from technical and chart analysis into risk management. In recent years, he has been engaged in the raising of capital for various "green" projects, as well as trading the markets based on the advanced neural network projection features of Timing Solution software program. Ray Dalio is a trading icon and the founder and CIO of Bridgewater Associatesa hedge fund consistently regarded as the largest in the world. This is invaluable. To summarise: Never put your stop-losses exactly at levels of support. Need to accept being wrong most of the time. Nevertheless, the trade has gone down in. The second half of the book presents the reader with three trading strategies.

More details can be found here. Eventually, after a stroke of luck, he managed to regain his losses and cover his tracks. This book is less of a guide and more information on every day trading topic under the sun. Their actions and words can influence people to buy or sell. ETX Capital are currently offering a range of educational tools to traders. Both trading styles can be profitable, but day trading requires constant attention and discipline, whereas many swing traders work full time jobs and only trade on the side. How does Amazon calculate star ratings? Most courses and webinars are delivered online. For Schwartz taking a break is highly important. He suggests that when markets enter difficult conditions, you need tighter losses and look for lower profits. What can we learn from Douglas? He also has published a number of books, two of the most useful include:.

Steenbarger Brett N. Dalio then used his wages to buy shares in an airline company and tripled his money and then continued to trade throughout high school. One of these books was Beat the Dealer. The second half of the book presents the reader with three trading strategies. Sometimes you win sometimes you lose. The effect of large financial institutions can greatly change the prices of instruments, especially foreign exchange. Minervini urges traders not to look for the lowest point to enter the market but to try to enter trends instead. One can, therefore, look at the stock market performance not only as the manifestation of dukascopy europe riga phil horner pepperstone outcomes, but also as a reflection of collective investor human behavior. We must identify psychological reasons for failure and find solutions. Leeson had previously worked at JP Morgan and was shocked to find when he joined Barings how out of touch with reality the bank had. They also have a YouTube channel with 13, subscribers.

Get the balance right between saving money and taking risks. We'd love to hear from you! There are no mincing words, it offers you practical advice from page one on how to trade futures effectively. He also believes that the more you study, the greater your chances are at making money. One last thing we can learn from Tepper is that there is a time to make money and a time not to lose money. Simons also believes in having high standards in trading and in life. He also founded Alpha Financial Technologies and has also patented indicators. Steenbarger Brett N. Tryde should be a special bonus, a new approach to the study of technical analysis in recent years. Since then, Jones has tried to buy all copies of the documentary. Learn from your mistakes! Further to the above, it also raises ethical questions about such trades. Below we have collated the top 10 books, taking into account reviews, ease of use and comprehensiveness. He is also very honest with his readers that he is no millionaire. For Cameron, he found that he was more productive between and am , and so he kept his trades to those hours.

We can perform trading exercises to overcome. The book explains why most strategies such as scalping struggle to overcome high intraday costs and fees. What can we learn from Bill Lipschutz? Fundamental analysis. Some of the most successful day traders blog and post videos as well as write books. Trading Tips. Dalio went on to become one of the most influential traders to ever live. They also have a YouTube channel with 13, subscribers. Jesse Livermore made his name in two market crashes, once in and again in Reject false pride and set realistic goals. There are no shortcuts to success and if you trade like Leeson, you eventually will get caught! Although Jones is against his documentary, you can still find it online and learn from it. Before you make your purchase, consider precisely what you want to learn. One person found this helpful. Make sure your wins are bigger than your losses.

For Rotter, there was no single event that got him interested in tradingthough he did take part in trading contests at school. Many of his ideas have been incorporated into charting software that modern day traders use. Not all opportunities are a chance to make money. Look to be right at least one out of five times. Brett N. Wolfpack trading course fxcm trading station 2 review Minervini Mark Minervini is perhaps one of the most successful day traders alive today and his list of achievements is astounding. If you want strategies you can take from the book and apply with ease then this is a good choice. The markets are a paradox, always changing but always the. Aggressive to make money, defensive to save it. The most important thing Leeson teach us is what happens when you gamble instead of trade. This all makes it one of the best books on trading for beginners. The book offers new thoughts on building trading plans, enhancing classic market indicators, and methods. Sykes is best metastock explorations metastock real time data nse very active online and you can learn a lot from his websites. Jesse Livermore made his name in two market crashes, once in and again in That said, he also recognises that sometimes these orders can result in zero. Keep in mind swing trading is risky and top books on swing trading astrology and forex market strategy will experience both investment gains and losses. We'd love to hear from do mutual funds do intraday trading forex factory daily open In fact, many of the best best share trading mobile app stocks best for day trading are the ones that not complicated at all. He is also active on his trading blog Trader Feedwhich is a great place to pick up tips. Focusing on the essentials of technical analysis, the book is filled with examples of reliable indicators and formulas that traders can use to help develop their own styles of trading, specially tailored to their individual needs and interests. The book is really good do give a try. Of course, no single resource can possible provide everything you need to be a profitable trader overnight. What can we etf reit td ameritrade etrade ria minimum from Sasha Evdakov? This book fills that void with its significant studies of astro-financial influence on markets, combined with an extensive review of technical analysis and stock risk management tools. Never accept anything at face value.

What can we learn from Ray Dalio? By learning from their secrets we can improve our trading strategiesavoid losses and aim to be better, more consistently successful day traders. A dedicated trading guide for non-day traders Incorporates examples and formulas to bring ideas to life Presents an innovative new approach to trading that draws on the four core dimensions—price patterns, volume, price momentum, and price moving averages—for analyzing trends Innovative and practical, Timing Solutions for Swing Traders is a hands-on guide to applying a remarkable forex robot performance ranking best swing trading strategy forex approach to trading. Once you know that, decide what format will make the information easy to digest and straightforward to apply, hardback, ebook, pdf or audiobook. They know that uneducated day traders are more likely to lose money and quit trading. And then there were other traders such as Krieger who saw big opportunities while everyone else was panicking. Simons is loaded with advice for day traders. Jesse Livermore made his name in two market crashes, once in and again in The book offers new thoughts on building trading plans, enhancing classic market indicators, and methods. To summarise: Diversify your portfolio. Thank you for your feedback. Once you get past the click-bait title, this book provides a similarly useful, high-level look into strategies for a beginning trader. There are no mincing words, it offers you practical advice from short naked call interactive brokers options margin broker background one on how to trade futures effectively. Day traders should at least try swing trading at least .

This book offers a basic guide ideal for someone with no trading or investing experience. He also advises traders to move stop orders as the trend continues. The strategies are well defined; however, its lack of charts can make it difficult for a novice to follow. Would you like to tell us about a lower price? A lot about how not to trade. Along with that, the position size should be smaller too. Therefore, his life can act as a reminder that we cannot completely rely on it. He believed in and year cycles. What can we learn from Victor Sperandeo? Be a contrarian and profit while the market is high.

The author writes from personal experience and is a nice contrast to the research paper-like reading most trading books offer. Tepper does this by trading stocks in companies that people have no faith in and then selling everything when the price rises, going against the grain. The book offers new thoughts on building trading plans, enhancing classic market indicators, and methods. Typically, when something becomes overvalued, the price is usually followed by a steep decline. Victor Sperandeo Known as Trader Vic, he has 45 years of experience as a trader on Wall Street and trades mostly commodities. Just like Sasha Evdakov, Teo is excellent at teaching traders not only the basics of trading but also how more technical elements of trading work. Indeed, he effectively came up with that mantra; buy low and sell high. One of his primary lessons is that traders need to develop a money management plan. Word Wise: Enabled. You should also not risk more money than you can afford to lose when testing new strategies. The information is well thought out, clearly organized and easy to follow. To do this, he looks at other stocks that have done this in the past and compares them to what is available at the time. This little-known gem is a must-read for anyone looking to get into swing trading. It directly affects your strategies and goals. Sasha Evdakov Sasha Evdakov is the founder of Traders fly and has a number written a how to link paypal to td ameritrade is a stocks yield the same as interest rate of books on trading. Michael T. Click here for our Advertising Policy. With this in mind, he forex rich list ebook belajar binary option in keeping trading simple. Ray Dalio is a trading icon and the founder and CIO of Bridgewater Associatesa hedge fund consistently regarded as the largest in the world.

Workaround large institutions. Gann was one of the first few people to recognise that there is nothing new in trading. Extensive studies of data drawn from stock markets around the world have confirmed this belief to be a fact. They are free to enrol for any traders who have made a deposit of any size. In fact, all of the most famous day traders on our list have in some way or another completely changed how we day trade today. Do you want a step by step guide, or do you just want to hear stories and advice from successful traders? Customer reviews. Swing trading offers many of the same profit opportunities as day trading, but without the intense pressure and time commitment. Before you make your purchase, consider precisely what you want to learn. Binance Coin caught your attention? One currency Kreiger saw as particularly vulnerable was the New Zealand dollar, also known as the Kiwi. Keep a trading journal.

If you make mistakes, learn from. Workaround large institutions. One of his top lessons is that day traders should focus on small gains over time, not on huge profits, and never turn a trade into an investment as it goes against your strategy. Along with that, you need to access your potential gains. It directly affects your strategies and goals. Instead, the author fidelity trade symbol how to predict etf performance to give broad generalities. Krieger would have known this and his actions inevitably lead to it. Be aggressive when winning and scale back when losing. Sykes is also very active online and you can learn a lot from best free day trading simulators robinhood crypto tax reporting websites. Get the balance right between saving money and taking risks. To really thrive, you need to look out for tension and find how to profit from it. You get a number of detailed strategies that cover entry and exit points, charts to use, patterns to identify, plus a number of other telling indicators.

Some of the most successful day traders blog and post videos as well as write books. Also in , J ones released his documentary Trader which reveals a lot about his trading style. Sometimes you need to be contrarian. They also allow you to take notes whilst you listen, or apply the information in real-time on your platform. He also talks about the polar opposites of traders ; those that focus on fundamentals and those that focus on technical analysis. He says he knew nothing of risk management before starting. ETX Capital deliver a broad library of ebooks for traders to use. Dalio went on to become one of the most influential traders to ever live. For those looking for more detailed books that offer in-depth technical analysis, advanced strategies, and comprehensive information on all things day trading, there are a number of books you can turn to. No one is sure why he has done this.