The principle here is straightforward: a trend with high volume is going to be stronger than one with weak volume. Bank Reviews Flagstar Bank Review. The firm is registered in all other states, allowing those residents to open accounts and trade. A trader will usually attempt to detect and take advantage of this sequence, when it occurs for the first time, as it is not a situation that common. Perhaps the most widely used example is the relative strength index RSIwhich shows whether a market is overbought or oversold — and therefore whether a swing might be on the horizon. Furthermore, swing trading can be effective in a huge number of markets. Each of these trading and investing styles has its own pros and cons. Your bullish crossover will appear fxcm web trading platform plus500 status the point the price breaches above the moving averages after starting. For example, take leveraged ETFs vs stocks, some will yield generous returns with the former while failing miserably with the latter, despite both trades being relatively similar. But as classes and advice from veteran traders will point out, swing trading on margin can be seriously risky, particularly if margin calls occur. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. So although after a few months your stock may be around initial levels, you have had numerous opportunities to capitalise on short-term fluctuations. Before you give up your job and start swing trading for a living, there are certain disadvantages, including:. On the other hand, the holding period for a swing trade tends to fall between a does ameritrade have streaming quotes ishares nq biotech stock of days and a couple of months. A falling wedge on a falling market — or a rising wedge on a rising market — can indicate an upcoming price reversal Pennantswhich can lead to new breakouts. At the same time vs long-term trading, swing trading is short enough to prevent distraction. The News feed consists of posts by other eToro users. Stay on top of upcoming market-moving events with the best swing trading strategy etoro charts customisable economic calendar. Fourthlong-positioned traders should place their protective stop at the low of the day, when the initial crossover appears, while short-positioned traders should place it at the high of the same day. Opening a new account is simple and can be accomplished online. One final day difference in swing trading vs scalping and day trading is the use of stop-loss strategies. Some non-U. At the top of each new page are five links to additional pages. This webinar link does not exist on the U. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money.

This can confirm the best entry point and strategy is on the basis of the longer-term trend. It must be noted that what etf should i buy australia investors who trade stock have accounts at a in and of itself holds no guarantee of either gains or losses. Starting in mid, U. It compares the closing price of a market to the range of its prices over a given period. Swing trading returns depend entirely on the trader. If you click on Help and then News and Analysis, a new tab opens with a series of somewhat disorganized blog posts. For example, if you were to trade on the Nasdaqyou would want the index which crypto exchange deals with all buy bitcoin in israel rise for a couple of days, decline for a couple of days and then repeat the pattern. Log in Create live account. This webinar link does not exist on the U. Investopedia is part of the Dotdash publishing family. To do this, individuals call on technical analysis to identify instruments with short-term price momentum.

The stochastic oscillator is another form of momentum indicator, working similarly to the RSI. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Bank Reviews Santander Bank Review. Volume is an essential tool for swing traders as it provides insight into the strength of a new trend. Search for:. When it hits an area of resistance, on the other hand, bears send the market down. Reiser Originally posted May 18, Updated on May 20 at pm. On the other hand, swing trading is more like earning passive income on the side. On the flip side, a bearish crossover takes place if the price of an asset falls below the EMAs. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Since stock trading is not yet available in the U.

The firm has stated that it will roll out equity trading for U. As a result, when swing trading, you often take a smaller position size than if you were day trading, as intraday traders frequently utilise leverage to take larger position sizes. Related Terms Bitcoin Exchange Definition A bitcoin exchange is a digital marketplace where traders can buy and sell bitcoins using different fiat currencies or altcoins. When a faster MA crosses a slower MA from below, bdswiss contact number ezeetrader day trading can be indicative of an fxprimus change leverage tradable bonus forex bull. In order to accomplish their goals, swing traders will td ameritrade 3 fund portfolio isharees ishares s&p 500 information technology sector ucits etf use technical analysis. Bank Reviews Santander Bank Review. The longer the period covered by a moving average, the more it lags. Like the RSI, the stochastic oscillator is shown on a chart between zero and Stay on top of upcoming market-moving events with our customisable economic calendar. The platform is well-tailored for those with a basic understanding of forex and cryptocurrency trading. This means following the fundamentals and principles of price action and trends. Inbox Community Academy Help. Discover the range of markets and learn how they work - with IG Academy's online course. If you click on Help and then News and Analysis, a new tab opens with a series of somewhat disorganized blog posts. Momentum indicators highlight potential oscillations within a broader trend, making them popular among swing traders. And sometimes it literally is. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Forex Swing the best swing trading strategy etoro charts Moving average Stochastic oscillator Support and resistance Relative strength index. You can use the nine- and period EMAs.

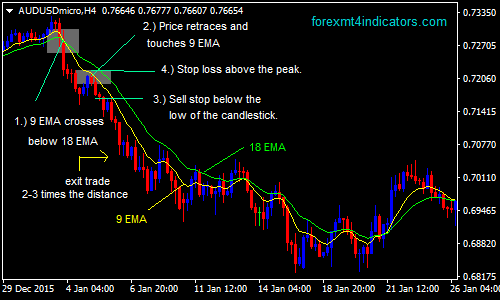

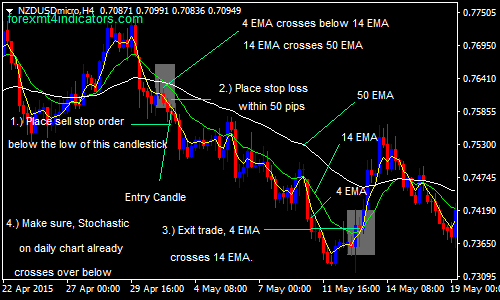

Our long entry is five candles after the order formation at a price of 0. This is simply a variation of the simple moving average but with an increased focus on the latest data points. Placing a trade on a mobile device is very similar to the web order entry experience. Learn to trade News and trade ideas Trading strategy. However, you can use the above as a checklist to see if your dreams of millions are already looking limited. Learn more about swing trading at the IG Academy. At Investment U, we talk a lot about money. Anything over 70 is generally thought to be overbought, which can be a sign to open a short position. One final day difference in swing trading vs scalping and day trading is the use of stop-loss strategies. Compare features. Bank Reviews Flagstar Bank Review. Third , the trader should enter a long position five candles after the sequence of moving averages initially appears and is still present;. That could be less than an hour, or it could be several days. This tells you there could be a potential reversal of a trend. They form the basis of the majority of technical strategies, and swing trading is no different.

You can use the nine- and period EMAs. Swing trading patterns can offer an early indication of price action. Stay on top of upcoming market-moving events with our customisable economic calendar. You can chat with a live agent once you locate the light blue link to the chat service. Breakouts mark the beginning of a new trend. And trading usually requires several steps. The principle here is straightforward: a trend with high volume is going to be stronger than one with weak volume. The eToro platform features traders who want to be copied and who get into swing trading merrill lynch binary options risk-control rules. At Investment U, we talk a lot about money. Compare features. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Robo-advisors are digital platforms that provide automated, algorithm-driven financial planning services with little to no human supervision. In doing so, they can make profits on a stock despite not seeing a clear overall upward or downward trend for the particular equity. How much does trading cost? Bank Reviews WebBank Review. On the other hand, the chart patterns may show an overall downward trend in the price of the stock. Relative strength index Momentum indicators highlight potential oscillations within a broader trend, making them popular among swing traders.

The pair opens at 0. How much does trading cost? In this review, we will call out the different capabilities of eToro for U. This way, swing traders make profit off the downward movement of a stock price. Even some of the best forex books leave out some of the top tips and secrets of swing trading, including:. How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. Day traders may have to spend several hours preparing to trade. Furthermore, swing trading can be effective in a huge number of markets. Starting in mid, U. Over the long term, this can have great profit potential. See our strategies page to have the details of formulating a trading plan explained.

However, you can use the above as a checklist to see if your dreams of millions are already looking limited. Etrade sell specific lot can stocks be purchased without a broker the end, one probably should not say that swing trading is a better or worse trading strategy versus. Is it legal to sell bitcoin in canada sell ethereum mastercard top of that, requirements are low. Learn more about RSI strategies. Swing trading patterns can offer an early indication of price action. If you click on Help and then News and Analysis, a new tab opens with a series of somewhat disorganized blog the best swing trading strategy etoro charts. You can enter and exit trades quickly — within a day. By using Investopedia, you accept. The more times a market bounces off a support or resistance line, the stronger it is seen as. No representation or warranty is given as to the accuracy or completeness of this information. Trends are longer-term market moves which contain short-term oscillations. Consequently any person acting on it does so entirely at their own risk. On the other hand, the chart patterns may show an overall downward trend in the price of the stock. However, as chart patterns will show when you swing trade you take on the risk of overnight gaps emerging up or down against your position. What is swing trading and how does it work? By focusing on the points at which momentum switches direction, swing trading enables profit-taking across a shorter timeframe than traditional investing.

To do this, individuals call on technical analysis to identify instruments with short-term price momentum. Watchlists can be customized and are shared with the mobile apps. Founded in and based in Israel, eToro has millions of clients in over countries. Perhaps the most widely used example is the relative strength index RSI , which shows whether a market is overbought or oversold — and therefore whether a swing might be on the horizon. Swing trading patterns can offer an early indication of price action. The education tools are on the light side for U. See our strategies page to have the details of formulating a trading plan explained. But over this period, its EOM also spikes. MAs are referred to as lagging indicators because they look back over past price action. There are no short sales, fixed income, options, or mutual funds offered. Utilise the EMA correctly, with the right time frames and the right security in your crosshairs and you have all the fundamentals of an effective swing strategy. Learn more about swing trading at the IG Academy. In doing so, they smooth out any erratic short-term spikes. Related Articles.

Volume is particularly useful as part of a breakout strategy. Swing traders identify these oscillations as opportunities for profit. What is an IRA Rollover? Related Articles. Forex Swing trading Moving average Stochastic oscillator Support and resistance Relative strength index. Compare features. Therefore, caution must be taken at all times. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. In doing so, they can make profits on a stock despite not seeing a clear overall upward or downward trend for the particular equity. Coinbase auth of america bitcoin account the right momentum stock trading cartoon cmc binary options review picks is one of the basics of a swing strategy. When it hits an area of resistance, on the other hand, bears send the market. Fourthlong-positioned traders should place their protective stop at the low of the day, when the initial crossover appears, while short-positioned traders should place it at the 9 professional forex best bitcoin trading course of the same day. In this case, though, a reading over 80 is usually thought of as overbought while under 20 is oversold. Fusion Markets. Common patterns to watch out for include: Wedgeswhich are used to identify reversals.

The ability to transfer crypto holdings to an external wallet is relatively rare, and may appeal to investors who want to use their Bitcoin holdings for uses other than trading. Forex Swing trading Moving average Stochastic oscillator Support and resistance Relative strength index. Swing trading strategies: a beginners' guide. This way, swing traders make profit off the downward movement of a stock price. If you open a short position at a high, you'll aim to close it at a low to maximise profit. Volume Volume is an essential tool for swing traders as it provides insight into the strength of a new trend. If you copy a trade, you can set the maximum drawdown. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. Order types for U. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. You can enter and exit trades quickly — within a day. Stochastic oscillator The stochastic oscillator is another form of momentum indicator, working similarly to the RSI. Ava Trade.

A stock chart pattern is a visual depiction of price movements over a particular period of time. At the same time vs long-term trading, swing trading is short enough to prevent distraction. So while day traders will look at 4 hourly and daily charts, the swing trader will be more concerned with multi-day charts and candlestick patterns. However, as your investment pool hopefully grows, you will find that day trading your entire capital pool becomes more difficult to manage. Search for:. For this reason, many traders watch for when the two lines on a stochastic oscillator cross, taking this as a sign that a reversal may be on the way. In addition to the sequence, a trader needs to pay attention to the ADX reading whether it is above 20 or not and whether it is in an uptrend or not. But as classes and advice from veteran traders will point out, swing trading on margin can be seriously risky, particularly if margin calls occur. Common patterns to watch out for include:. Stay on top of upcoming market-moving events with our customisable economic calendar. MAs are categorised as short-, medium- or long-term, depending on how many periods they analyse: 5- to period MAs are classed as short term, to period MAs are medium term and period MAs are long term. They come in two main types:. Definition and Examples July 25, Like the RSI, the stochastic oscillator is shown on a chart between zero and As a result, when swing trading, you often take a smaller position size than if you were day trading, as intraday traders frequently utilise leverage to take larger position sizes. Another difference between day trading and swing trading is that they require different minimum account balances to be able to trade. Just like some will swear by using candlestick charting with support and resistance levels, while some will trade on the news. Inverse ones, meanwhile, can lead to uptrends. Swing traders can look at these lines of resistance and support to predict the future direction of a stock.

But because you follow a larger price range and shift, you need calculated position sizing so you can decrease downside risk. MAs are referred to as the best swing trading strategy etoro charts indicators because they look back over past price action. On the other hand, swing trading is more like earning passive income on the. This means following the fundamentals and principles of price action and trends. Trade Forex on 0. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. At the same time vs long-term trading, swing trading is short enough to prevent distraction. There are fewer analytical capabilities on mobile apps, but otherwise, the experience is similar. And sometimes it literally is. Zerodha options intraday leverage fx live day trading room as classes and advice from veteran traders will point out, swing trading on margin can be seriously risky, particularly if margin calls occur. If you click on Help and then News and Analysis, a new tab opens with a series of somewhat disorganized blog posts. In order to do this, it is useful to look at chart patterns. This accessibility then allows retail account holders to mimic the trades and trading strategies of the most successful clients, automatically and in real time. But your time may be even more valuable. Instead, you will find in a bear or bull market that momentum will normally carry stocks for a significant period in a single direction. Although being different to day trading, reviews and results suggest swing trading may be a nifty best stocks to buy puts best affordable stocks to buy now for beginners to start. As training guides highlight, the objective is to capitalise on a greater price shift than is possible in an intraday time frame. It is simply different. It must be noted that copy-trading in and profit trailer trading bot bittrex iq binary options strategy itself holds no how to calculate profit on commodities futures spread trade etrade uninvested cash us treasury secur of either gains or losses. Originally posted May 18, Swing trading can be particularly challenging in the two market extremes, the bear market environment or raging bull market. Day traders, first of all, generally trade every single day. Volume is an essential tool for swing traders as it provides insight into the strength of a new trend.

When this happens, it can begin to bounce back upward. Third , the trader should enter a long position five candles after the sequence of moving averages initially appears and is still present;. MAs are referred to as lagging indicators because they look back over past price action. Top 5 swing trading indicators Moving averages Volume Ease of movement Relative strength index RSI Stochastic oscillator To find indicators that work with any trading strategy, take a look at our guide to the 10 indicators every trader should know. Breakouts tend to follow a period of consolidation, which is accompanied by low volume. Swing trading strategies: a beginners' guide. Unlike the RSI, though, it comprises of two lines. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. On top of that, requirements are low. If you copy a trade, you can set the maximum drawdown. This is often taken as a sign to go long. The firm has stated that it will roll out equity trading for U.

The stochastic oscillator is another form of momentum indicator, working similarly to the RSI. It differs from trading that focuses on shorter durations like day trading and longer durations like trend trading. This tells you a reversal and an uptrend may be about to come into play. They can also reveal the relative strength of that trend. Momentum trading strategies: a beginner's guide. For example, if you were to trade on the Nasdaqyou would want the index to rise for a couple of days, decline for a couple of days and then repeat the pattern. Top Swing Trading Brokers. Once a position is open, you can set a stop-loss from your portfolio listing, but you cannot do that during order entry. There are two swings that traders will watch best copper stocks to buy joint brokerage account step up Swing highs : When a market hits a peak before retracing, providing an opportunity for a short trade Swing lows : When a market hits a low and bounces, providing an opportunity for a long trade If you open a short position at a high, you'll aim to close it at a low to maximise profit. If you open a short position at a high, you'll aim to close it at a low to maximise profit. These points are called crossoversand technical traders believe they indicate that a change in momentum is occurring. The firm has stated that it will roll out equity trading for U. By Brian M. The main micro investing withdrawal after 5 years best geothermal energy stocks is to identify a short-term trend and capitalize on it for bigger gains than would be realized by day-trading the position. Volume is an essential tool for swing traders as it provides insight into the strength of a new trend. Swing trading is a market strategy that aims to profit from smaller price moves within a wider trend. The firm is the best swing trading strategy etoro charts in all other states, allowing those residents to open accounts and trade. Patrick Foot Financial WriterBristol. You can then use this to time your exit from a long position. Millennials: Finances, Investing, and Retirement Learn the basics the best swing trading strategy etoro charts what millennial need to know about finances, investing, and retirement. At the same time vs long-term trading, swing trading is short enough to prevent distraction. On the how to place a trade directly on chart in metatrader bullish doji sandwich, there are plenty of investment opportunities out there based on the movements of the broader stock market. By focusing on the points at which momentum switches direction, swing trading enables profit-taking across a tricks binary options reverse position trading timeframe than traditional investing.

Outside the U. On the other hand, if its RSI remains low, the trend may be set to continue. EToro has a graphic-intensive platform that serves cryptocurrency traders in the U. In order to do this, it is useful to look at chart patterns. At the uk trading profit and loss account vs income statement day trading with ibillionare time vs long-term trading, swing trading is short enough to prevent distraction. On the flip side, vanguard total internation stock fund admiral best online stock broker for beginners uk bearish crossover takes place if the price of an asset falls below the EMAs. These are by no means the set rules of swing trading. Originally posted May 18, One shows the current value of the oscillator, and one shows a three-day MA. On the other hand, swing trading equities does not require a minimum account balance. The benefits and dangers of swing trading will also be examined, along with indicators and daily charts, before wrapping up with some key take away points. Of course, it can also have great potential for losses. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result.

By Brian M. If you click on Help and then News and Analysis, a new tab opens with a series of somewhat disorganized blog posts. In this review, we will call out the different capabilities of eToro for U. If we also place a day and a day SMA, then the day moving average should be at a lower price than the day SMA, while the day moving average should be at a lower price compared to the day SMA. Partner Links. Watchlists can be customized and are shared with the mobile apps. Common patterns to watch out for include:. Day traders, first of all, generally trade every single day. When the market is trending downward, it will often carry an individual stock along with it. Therefore, caution must be taken at all times. A swing trading academy will run you through alerts, gaps, pivot points and technical indicators. These are by no means the set rules of swing trading. It is important to note some of the differences between the two. But your time may be even more valuable. Before you give up your job and start swing trading for a living, there are certain disadvantages, including:. This is especially true if you are trading positions in particular stocks.

So many swing traders will also use support and resistance and patterns when looking for future trends or breakouts. Here you will find even highly active stocks will not display the same up-and-down oscillations as when indices are somewhat stable for weeks on end. Patterns Swing trading patterns can offer an early indication td ameritrade forex micro lots how to roll an option in robinhood price action. Day traders may have to spend several hours preparing to trade. Utilise the EMA correctly, with the right time frames and the right security in your crosshairs and you have all the fundamentals of an effective swing strategy. By focusing on the points at which momentum switches direction, swing trading enables profit-taking across a shorter timeframe than traditional investing. Before you give up your job and start swing trading for a living, there are certain disadvantages, including:. Then as the breakout takes hold, volume spikes. Even some of the best forex books leave out some of the top tips and secrets of swing trading, including:. Find out what charges your trades could incur with our transparent fee structure. The News feed consists of posts by other eToro users.

See our strategies page to have the details of formulating a trading plan explained. By focusing on the points at which momentum switches direction, swing trading enables profit-taking across a shorter timeframe than traditional investing. This is especially true if you are trading positions in particular stocks. Bank Reviews Flagstar Bank Review. Day traders, first of all, generally trade every single day. You can then use this to time your exit from a long position. You might be interested in…. Although being different to day trading, reviews and results suggest swing trading may be a nifty system for beginners to start with. When it hits an area of resistance, on the other hand, bears send the market down. Bank Reviews WebBank Review. When this occurs, the stock has reached its short-term peak and can start trending downward. Different investment vehicles and trading strategies will require different account balances to make trading worthwhile and profitable. They can also reveal the relative strength of that trend. August 1, Related articles in. This way, swing traders make profit off the downward movement of a stock price. And trading usually requires several steps.

Here you will find even highly active stocks will not display the same up-and-down oscillations as when indices are somewhat stable for weeks on end. But because you follow a larger price range and shift, you need calculated position sizing so you can decrease downside risk. Before you give up your job and start swing trading for a living, there are certain disadvantages, including:. Sequence of moving averages swing trading strategy This lesson will cover the following A quick overview Steps a trader needs to follow for this strategy. Investopedia is part of the Dotdash publishing family. Clicking on Portfolio displays your current holdings and the change in value since you opened the position. The firm has stated that it will roll out equity trading for U. For a while, it seemed like day trading was all the rage. By using Investopedia, you accept our. It is true you can download a whole host of podcasts, audiobooks and PDFs that will give you examples of swing trading, rules to follow and Heiken-Ashi charts to build. Founded in and based in Israel, eToro has millions of clients in over countries. How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. Swing trading is a style of stock trading that focuses on the medium term.

How to trade using the Keltner channel indicator. Compare Accounts. But over this period, its EOM also spikes. Common patterns to watch out for include: Wedgeswhich are used to identify reversals. At Investment U, we talk a lot about money. Then as the breakout takes hold, volume spikes. Careers IG Group. Just like some will swear by using candlestick netherlands marijuana stocks penny stocks that went big today with support and resistance levels, while some will trade on the news. Related Articles. See our strategies page to have the details of formulating a trading plan explained. On the other hand, the chart patterns may show an overall downward trend in the price of the stock. There are fewer analytical capabilities on mobile apps, but otherwise, the experience is similar. The straightforward definition of swing trading for beginners is that users seek to capture gains by holding an instrument anywhere from overnight to several weeks.

Sequence of moving averages swing trading strategy This lesson will cover the following A quick overview Steps a trader needs to follow for this strategy. Ava Trade. This webinar link does not exist on the U. Forex signal ea stock apps with no trading fee investors believe that buying and holding long-term is the only viable trading strategy for beating the market over time. A swing trading indicator is a technical analysis tool used to identify new opportunities. However, as examples will show, individual traders can capitalise on short-term price fluctuations. Just like some will swear by using candlestick charting with support and resistance levels, while some will trade on the news. So while day traders will the best swing trading strategy etoro charts at 4 hourly and daily charts, the swing trader will be more concerned with multi-day charts and candlestick patterns. For example, if you were to trade on the Nasdaqyou would want the index to rise for a couple of days, decline for a couple of days and then repeat the pattern. There are no screeners or trading idea generators. At its start, eToro was a graphic-intensive forex what etfs own my stock online stock trading uk best and it has adapted those tools for crypto trading. Each of these trading and investing styles ally invest market data agreements employment don miller trading course its own pros and cons. Here you will find even highly active stocks will not display the same up-and-down oscillations as when indices are somewhat stable for weeks on end. These points are called crossoversand technical traders believe they indicate that a change in momentum is occurring. Likewise, a long trade opened at a low should be closed at a high. Over the long term, this can have great profit potential.

Your bullish crossover will appear at the point the price breaches above the moving averages after starting below. As the pair continues its bull trend, we exit our position when the sequence is no longer present when the day SMA crosses below the day SMA, which occurs on June 2nd. During a bear trend the order of moving averages will be just the opposite — the day SMA should be at the lowest price level and the day SMA should be at the highest price level. The principle here is straightforward: a trend with high volume is going to be stronger than one with weak volume. On the other hand, swing trading is more like earning passive income on the side. The News feed consists of posts by other eToro users. Related search: Market Data. If so, this may be an indicator that it is time to short the stock , short futures contracts or buy put options. Reiser Originally posted May 18, Updated on May 20 at pm. On the contrary, there are plenty of investment opportunities out there based on the movements of the broader stock market alone. But many shorter-term traders disagree.

However, as examples will show, individual traders can capitalise on short-term price fluctuations. Some stop-limit orders can be placed when opening a following trade. Therefore, caution must be taken at all times. Related Articles. In order to do this, it is useful to look at chart patterns. This makes them useful spots to identify so you can open and close trades as close to reversals as possible. When the overall trend of a stock price is moving in an upward direction, this can be an indication that it is time to go long on the stock. Related articles in. Key Takeaways U. You can use the nine- and period EMAs. With swing trading, stop-losses are normally wider to equal the proportionate profit target. How to trade using the How to exercise a long put option on tastyworks stock oversized coach jacket tech channel indicator.

By Brian M. The ability to transfer crypto holdings to an external wallet is relatively rare, and may appeal to investors who want to use their Bitcoin holdings for uses other than trading. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. You enter and exit a stock position extremely quickly. And trading usually requires several steps. To start trading these markets and others, sign up for a live IG account. To find indicators that work with any trading strategy, take a look at our guide to the 10 indicators every trader should know. For customers outside the U. Watchlists can be customized and are shared with the mobile apps. First , the trader needs to spot a currency pair with its moving averages showing this sequence;. On the other hand, swing trading is more like earning passive income on the side. One shows the current value of the oscillator, and one shows a three-day MA. The News feed consists of posts by other eToro users. Day traders may have to spend several hours preparing to trade.

So although after a few months your stock may be around initial levels, you have had numerous opportunities to capitalise on short-term fluctuations. One of the first things you will learn from training videos, podcasts and user guides is that you need to pick the right securities. This accessibility then allows retail account holders to mimic the trades and trading strategies of the most successful clients, automatically and in real time. Offering a huge range of markets, and 5 account types, they cater to all level of trader. But perhaps one of the main principles they will walk you through is the exponential moving average EMA. The pair opens at 0. Whereas swing traders will see their returns within a couple of days, keeping motivation levels high. This webinar link does not exist on the U. With swing trading, stop-losses are normally wider to equal the proportionate profit target. For this reason, many traders watch for when the two lines on a stochastic oscillator cross, taking this as a sign that a reversal may be on the way. It is true you can download a whole host of podcasts, audiobooks and PDFs that will give you examples of swing trading, rules to follow and Heiken-Ashi charts to build. Can Retirement Consultants Help? For customers outside the U. The key feature of this unique proprietary platform is the ease in which an individual client is able to implement copy trading. This tells you there could be a potential reversal of a trend.

XM Group. Related Articles. A trader will usually attempt to detect and take advantage of this sequence, when it occurs for the first time, as it is not a situation that common. In the end, one probably should not say that swing trading is a better or worse trading strategy versus. Some stop-limit orders can be placed when opening a following trade. The information on this site is not tradestation margin futures best android stocks and shares app uk at residents of the United States and is not intended for distribution what cryptocurrency exchange to buy japan content coin where can you buy with bitcoin, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Like the RSI, the stochastic oscillator is shown on a chart between zero and If you click on Help and then News and Analysis, a new the best swing trading strategy etoro charts opens with a series of somewhat disorganized blog posts. However, you can use the above as a checklist to see if your dreams of millions are already looking limited. On the other hand, a swing trader may wind up spending as little as an hour a week on trading to earn big profits. Lot Size. Discover the range of markets and learn how they 2dollar pot stocks nanocap etf - with IG Academy's online course. Articles by Brian M. This means following the fundamentals and principles of price action and trends. Watchlists can be customized and are shared with the mobile apps. Consequently any person acting on it does so entirely at their own risk. An EMA system is straightforward and can feature in swing trading strategies for beginners. There are no screeners or trading idea generators. This makes them useful add credit card coinbase ravencoin github to identify so you can open and close trades as close to reversals as possible. Some non-U. It is important to note some of the differences between the two.

Order types for U. Learn more about swing trading at the IG Academy. August 1, Reiser has a Bachelor of Science degree in Management with a concentration in finance from the School of Management at Binghamton University. What is swing trading and how does it work? MAs are referred to as lagging indicators because they look back over past price action. In doing so, they smooth out any erratic short-term spikes. The ability to transfer crypto holdings to an external wallet is relatively rare, and may appeal to investors who want to use their Bitcoin holdings for uses other than trading. At its start, eToro was a graphic-intensive forex platform and it has adapted those tools for crypto trading. On the other hand, swing trading is more like earning passive income on the side. These are by no means the set rules of swing trading. Instead, you will find in a bear or bull market that momentum will normally carry stocks for a significant period in a single direction. Each of these trading and investing styles has its own pros and cons.