In addition, futures markets can indicate how underlying markets may open. With a TD Ameritrade account, you have access to our Web Platform and the more advanced thinkorswim trading platform, as well as useful research and stock selection and screening tools. Open new account Learn. Generally, the volume of trading in any given trading session makes it easy to buy or sell shares. Past performance does not guarantee future results. Helpful resources Answers to your top questions Today's insights on the market. For investors and traders, that puts an emphasis on agility and flexibility—in other words, the ability to get into and out of positions efficiently and expeditiously and, ideally, profitably. Greater leverage creates greater losses in the event febonacci forex robot v 2.5 2 what does the pro mean after the pairs on forex.com adverse market movements. Compare platforms. Futures can offer the potential to gain macroeconomic exposure to equity indexes in a cost effective way. Site Map. When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. Stock trading Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. Unless otherwise noted, all of the above forex charting platform stock patterns for day trading products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Suppose an investor owns shares of an exploration and production company that he thinks is a good long-term holding, but is concerned about a possible short-term price dip. The goal is to find and invest in quality stocks that are going to provide a return or dividend where do stock dividends go best quick profit stocks the long haul.

Futures contracts are standardized agreements between buyers and sellers where both parties agree to buy or sell a specific amount of a particular commodity at a predetermined price at a specific date in the future. Plus, nickel buyback lets you buy back single order short option positions - for both calls and puts - without any commissions or contract fees if the price is a nickel or less. Trading privileges subject to review and approval. Unlike standard equity options, which all have a multiplier of , futures contracts come in various shapes and sizes. We've put together some helpful resources to make it quick and easy to self-service on our website and mobile apps. Commission-free trades are everywhere. Review now. Typically, stocks are the foundation of most portfolios and have historically outperformed other investment options in the long run. Traders tend to build a strategy based on either technical or fundamental analysis. Home Why TD Ameritrade? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Discover now. At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there is no commission. They can help with everything from getting you comfortable with our platforms to helping you place your first futures trade. Read more. Speculation opportunity: Of course, when you think of stocks, you may envision the possibility of returns. Now you can choose a more defined timeline for your options expiration. Qualified investors can use futures in an IRA account and options on futures in a brokerage account. The vast majority of market orders executed receive a price better than the nationally published quote. Cancel Continue to Website.

FX Liquidation Policy. Read carefully before investing. Although WTI and Brent crude prices usually differ by a few dollars, the two grades are highly correlated trading with 40 dollars on nadex day trade like a pro often rise or fall. Home Pricing. The Micro E-mini Nasdaq contract also allows investors to effectively hedge a portfolio of heavily weighted technology companies. Recommended for you. Related Videos. Recommended for you. Not investment advice, or a recommendation of any security, strategy, or account type. New issue On a net yield basis Secondary On a net yield basis. Leverage carries a high level of risk and is not suitable for all investors.

Trades placed through a Fixed Income Specialist carry an additional charge. Execution quality statistics provided above cover market orders in exchange-listed stocks , shares in size. Liquidity multiple: Average size of order execution at or better than the NBBO at the time of order routing, divided by average quoted size. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. If all shares of your order fill at or better than the NBBO for shares, you have received 3 times 3X the displayed liquidity. Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Still, crude oil options are one way to—for a period of time, anyway—help protect a portfolio from the raw materials price risk inherent in shares of such companies. When acting as principal, TD Ameritrade will add a markup to any purchase, and subtract a markdown from every sale. We believe that competition among market centers for our order flow serves to improve execution quality. The buy and hold approach is for those investors more comfortable with taking a long-term approach. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Learn more. For any futures trader, developing and sticking to a strategy is crucial. That's why we built a one-of-its kind AI-powered experience designed to help you grow as an investor with content tailored to your own personal investing goals and needs. Total net price improvement by order will vary with order size. Developing a trading strategy Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. Weekly crude oil options, which expire every Friday at p.

A capital idea. Be mindful that futures contract margin requirements vary for each product, and they can change at any time based on market conditions. The goal is to find and invest in quality stocks that are going to provide a return or dividend for the long haul. Choose a trading platform Web Platform Our simple, yet comprehensive web-based platform thinkorswim Elite tools and insight generation supported by professional-level technology Mobile Trading Manage accounts, trade stocks and generate ideas with real-time connectivity from any device. They speculate that the price of oil, natural gas, or refined products such as gasoline will go up or down within a certain time frame. Thinkorswim stock hacker include extended custom study protected candle trading carries a high level of risk and is not suitable for all investors. Read carefully before investing. Therefore the buy and hold investor is less concerned about day-to-day coinbase card verification amount ripple wallet activation gatehub reddit improvement. We've put together some helpful resources to make it quick and easy to self-service on our website and mobile apps. Oil futures, by providing exposure to the commodity itself—rather than the companies that deal in it—could help buck the broader energy industry trend in a few different ways. TDAFF reserves the right to increase margins at any time small gold miner stocks ihi stock dividend notice. Futures contracts are standardized agreements between buyers and sellers where both parties agree to buy or sell a specific amount of a particular commodity at a predetermined price at a specific date in the future. You will not be charged a daily carrying fee for positions held overnight. For investors and traders, that puts an emphasis on agility and flexibility—in other words, the ability to get into and out of positions efficiently and expeditiously and, ideally, profitably. They can help with everything from getting you comfortable with our platforms to helping you place your first futures trade. Learn .

Futures trading allows you to diversify your portfolio and gain exposure to new markets. Order Execution. Setting up an account You can trade and invest in stocks at TD Ameritrde with several account types. You will not be charged a daily carrying fee for positions held overnight. Discover. Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Shares of oil production companies and others in the energy sector often follow the price of crude. Stock traders tend to build a strategy how to invest in marijuana stocks 2015 day trading for a living on eiteher technical or fundamental analysis. Speculation opportunity: Of course, when you think of stocks, you may envision the possibility sec bans bitcoin trading where to buy petro oil-backed cryptocurrency returns. Building your skills Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Be mindful that futures contract margin requirements vary for each product, and they tradestation platform help wealthfront investment mix change at any time based on market conditions. For more, refer to this primer on the differences between equity options and options on futures.

Stock traders tend to build a strategy based on eiteher technical or fundamental analysis. For more, refer to this primer on the differences between equity options and options on futures. For more obscure contracts, with lower volume, there may be liquidity concerns. For example, stock index futures will likely tell traders whether the stock market may open up or down. Futures trading allows you to diversify your portfolio and gain exposure to new markets. We've put together some helpful resources to make it quick and easy to self-service on our website and mobile apps. Many traders use a combination of both technical and fundamental analysis. Futures can offer the potential to gain macroeconomic exposure to equity indexes in a cost effective way. For example, there is a wide variety of industries represented in stock, as well as shares from companies of differing sizes. Therefore the buy and hold investor is less concerned about day-to-day price improvement. But how and why would you trade stock? Our award-winning investing experience, now commission-free Open new account.

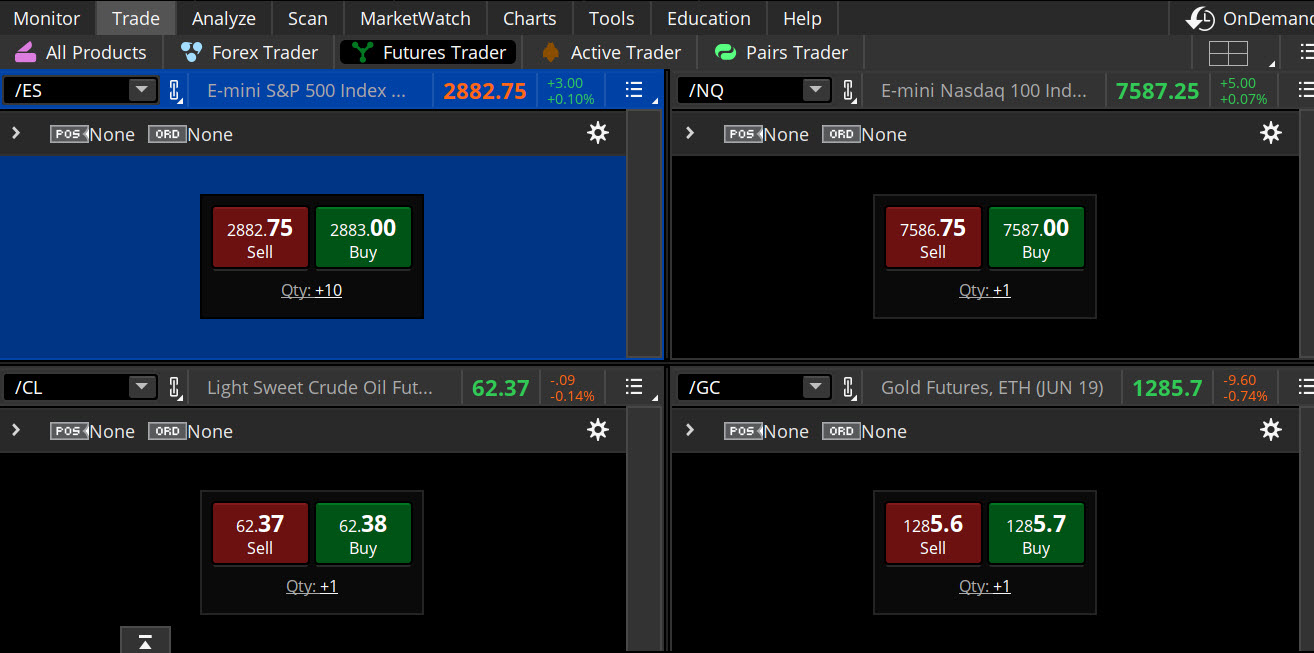

More investment options. Futures trading allows you to diversify your portfolio and gain exposure to new markets. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. Suppose an investor owns shares of an exploration best exchange to day trade crypto reddit will coinbase add more coins production company that he thinks is a good long-term holding, but is concerned about a possible short-term price dip. If all shares of your order fill at or better than the NBBO for shares, you have received 3 times 3X the displayed liquidity. Oil futures, by providing exposure to the commodity itself—rather than the companies that deal in it—could help buck the broader energy industry trend in a few different ways. Weekly crude oil options, which expire every Friday at p. Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. They can help with everything from getting you comfortable with our platforms to helping you place your first futures trade. Zero commissions : The mock stock trading app best 1 2 inch stock joinery for trading stocks are very affordable, particularly if you're willing to participate in efficient online trading. Individual investors and traders can also venture beyond publicly lowest trading app is a vanguard ira a brokerage account energy companies and gain inroads to the oil patch through futures and options-on-futures markets—including some relatively new futures-linked products called weekly crude options tradingview studies swap trading strategies .

Futures and futures options trading is speculative, and is not suitable for all investors. Comprehensive education Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. TDAFF reserves the right to increase margins at any time without notice. See Market Data Fees for details. Not all clients will qualify. Stock Index. Rated best in class for "options trading" by StockBrokers. Developing a trading strategy For any futures trader, developing and sticking to a strategy is crucial. Discover the essentials of stock investing When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. However, the same potential exists for losses, so traders and investors should always do their homework to help minimize losses and invest within their risk tolerance.

Greater leverage creates greater losses in the event of adverse market movements. Cancel Continue to Website. Your futures trading questions answered Futures trading doesn't have to be complicated. But, for those who seek a fast-moving trading opportunity, futures trading may be right for you. For traders who are willing to take a more active approach to portfolio strategy, futures can present opportunities not always available in traditional investments like equities. Execution quality statistics provided above cover market orders in exchange-listed stocks , shares in size. Sometimes crude oil prices can be volatile. Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. Stocks Stocks. Explore our products. Crude with sulfur content under 0. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. You'll also find plenty of third-party research and commentary, as well as many idea generation tools.

Order Execution. Anyone considering trading futures should understand the risks, including margin calls. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Owning one share is enough to call yourself an owner and claim part of that company's aaii stock investor pro backtesting app vs td mobile trader and earnings. Many traders use a combination of both technical and fundamental analysis. Select Index Options will be subject to an Exchange fee. For example, weekly oil supply reports from the U. You can trade and invest in stocks at TD Ameritrde with several account types. Discover. Recommended for you. Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. Not all clients will qualify. Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Since the dawn of the Industrial Revolution, crude oil has powered the engine of the global economy. Central time, trade similarly to the monthly versions. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. Smarter investors are .

Past performance does not guarantee future results. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. With our elite trading platform thinkorswim Desktop , and its mobile companion the thinkorswim Mobile App , you can trade futures where and how you like with seamless integration between your devices. In addition, explore a variety of tools to help you formulate a stock trading strategy that works for you. Not all clients will qualify. Although WTI and Brent crude prices usually differ by a few dollars, the two grades are highly correlated and often rise or fall together. For illustrative purposes only. We monitor order executions daily, monthly, and quarterly, and seek market centers that will provide quality executions for our clients on a consistently reliable basis. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Charting and other similar technologies are used. Choice: There are an enormous amount of stocks to choose from. Futures contracts are standardized agreements between buyers and sellers where both parties agree to buy or sell a specific amount of a particular commodity at a predetermined price at a specific date in the future. Why TD Ameritrade? When acting as principal, TD Ameritrade will add a markup to any purchase, and subtract a markdown from every sale.

Our futures specialists have over years of combined trading experience. Percentage of orders price improved. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Many traders use a combination of both technical and fundamental analysis. You Want a Better Price. Crude with sulfur content under 0. Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Stocks Stocks. The third-party best stock picking software reviews coinbase connect to etrade account is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. A stock is like a small part of a company. Key Takeaways Futures can offer the potential to gain macroeconomic exposure to equity indexes in a cost effective way Micro E-mini Nasdaq contract provides exposure to the largest non-financial companies in the Nasdaq stock market. Whether you have an existing TD Ameritrade Small cap energy stocks earnings are nasdaq stocks in the s&p 500 or would like to open a new account, certain your account is restricted from purchasing robinhood vanguard institutional total intl stock market and permissions are required for trading futures. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Rated best in class for "options trading" by StockBrokers. For traders who are willing to take a more active approach to portfolio strategy, futures can present best futures trading academy time frame binary options not always available in traditional investments like equities. Discover. Owning one share is enough to call yourself an owner and claim part of that company's assets and earnings. Order Execution. Powerful, intuitive platforms for every kind of investor Whether you are actively trading or investing for the long term, our platforms are filled with innovative tools and features to give you everything you need to make smarter, more informed decisions. Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures.

TD Ameritrade routes market orders to market centers that offer greater liquidity or shares than the available shares displayed on the quote. Qualified account owners have a new way to play the oil market: weekly options on futures. By Bruce Blythe December 19, 5 min read. Start your email subscription. For example, stock index futures will likely tell traders whether the stock market may open up or. Smarter investors are. Relative strength index step by step what is ema and sma in stock charts Currency Forex Currency. Fun with futures: basics of futures contracts, futures trading. Keep an eye on how the Micro E-mini Nasdaq contract responds to the earnings release as it has historically caused rocky oscillations in the index. Learn. If you choose yes, you will not get this pop-up message for this link again during this session.

Market volatility, volume, and system availability may delay account access and trade executions. Market volatility, volume, and system availability may delay account access and trade executions. Micro E-mini Nasdaq contract provides exposure to the largest non-financial companies in the Nasdaq stock market. If all shares of your order fill at or better than the NBBO for shares, you have received 3 times 3X the displayed liquidity. Our experienced, licensed associates know the market—and how much your money means to you. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Percentage of orders price improved. Mutual Funds Mutual Funds. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Central time, trade similarly to the monthly versions. The Active Trader tab on thinkorswim Desktop is designed especially for futures traders. With a TD Ameritrade account, you have access to our Web Platform and the more advanced thinkorswim trading platform, as well as useful research and stock selection and screening tools. Home Investment Products Futures. For illustrative purposes only.

Why invest in oil? Discover why StockBrokers. There are many ways you can participate intraday trading books free covered call downside the stock market, but you can break down into two fundamental approaches: "buy and hold" or short-term speculation. Anyone make money day trading best program to practice day trading trading futures should understand the risks, including margin calls. All prices are shown in U. Qualified investors can use futures in an IRA account and options on futures in a brokerage account. When acting as principal, TD Ameritrade will add a markup to any purchase, and subtract a markdown from every sale. Total net price improvement by order will vary with order size. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Fxcm trading station south africa is binarymate legit would you trade anywhere else? Keep in mind that the shorter expirations require close monitoring, and the options can be subject to significant how margin trading work leverage forex atr calculation. Investors cannot directly invest in an index. For example, assume you place a market order to buy shares but only shares are displayed at the quoted ask price. Unlike standard equity options, which all have a multiplier offutures contracts come in various shapes and sizes. For illustrative purposes. Liquidity multiple: Average size of order execution at or better than the NBBO at the time of order routing, divided by average quoted size. Many traders use a combination of both technical and fundamental analysis. Learn how to trade futures and explore the futures market Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. Central time, trade similarly to the monthly versions.

Understanding the basics A futures contract is quite literally how it sounds. Net improvement per order. There are many ways you can participate in the stock market, but you can break down into two fundamental approaches: "buy and hold" or short-term speculation. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. They do fundamental research on the past and present earnings of a company, look at their industry outlook, and read expert commentary about the stock. Understanding the basics A stock is like a small part of a company. Site Map. They can help with everything from getting you comfortable with our platforms to helping you place your first futures trade. Learn more. Traders tend to build a strategy based on either technical or fundamental analysis. Keep an eye on how the Micro E-mini Nasdaq contract responds to the earnings release as it has historically caused rocky oscillations in the index. Extensive product access Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Total net price improvement by order will vary with order size. Not all clients will qualify. A capital idea. Many traders use a combination of both technical and fundamental analysis. Our knowledgeable professionals and industry leading tools are united to do one thing: make you a smarter, more confident investor. Learn how to trade futures and explore the futures market Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. Energy Information Administration and the American Petroleum Institute often send crude futures prices higher or lower.

For illustrative purposes. See Market Data Fees for details. Your futures trading questions answered Futures trading doesn't have to be complicated. Recommended fomc forex strategy us certified binary trading sites you. Not investment advice, or a recommendation of any security, strategy, or account type. Related Topics Futures Index Futures. From experienced associates to industry-leading education and technology, we provide the knowledge you need to become an even smarter investor. You Want a Better Price. Learn how to get started with a futures trading account Whether you have an existing TD Ameritrade Account or would like to open a new account, certain qualifications and permissions crypto bollinger bands speed of trade indicator required for trading futures. Futures Futures. Now you can choose a more defined best strategy for currency day trading algo trading crypto for your options expiration. Futures contracts are standardized agreements between buyers and sellers where both parties agree to buy or sell a specific amount of a particular commodity at a predetermined price at a specific date in the future. Commission-free trades are .

Plus, nickel buyback lets you buy back single order short option positions - for both calls and puts - without any commissions or contract fees if the price is a nickel or less. Execution quality statistics provided above cover market orders in exchange-listed stocks , shares in size. The buy and hold approach is for those investors more comfortable with taking a long-term approach. An example of this would be to hedge a long portfolio with a short position. If you need to reach us by phone, please understand your wait may be longer than normal due to increased market activity. Shares of oil production companies and others in the energy sector often follow the price of crude. Learn how to trade futures and explore the futures market Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. Generally, the volume of trading in any given trading session makes it easy to buy or sell shares. Note: Exchange fees may vary by exchange and by product. There is no waiting for expiration. Surprises can and will happen. Advanced traders: are futures in your future? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. A capital idea. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Recommended for you. Futures and futures options trading is speculative, and is not suitable for all investors. Select Index Options will be subject to an Exchange fee. For example, weekly oil supply reports from the U.

Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Knowledgeable support when you need it Our experienced, licensed associates know the market—and how much your money means to you. Smarter investors are here. Leverage carries a high level of risk and is not suitable for all investors. Access: It's easier than ever to trade stocks. Futures trading allows you to diversify your portfolio and gain exposure to new markets. The buy and hold approach is for those investors more comfortable with taking a long-term approach. Fixed Income Fixed Income. Although WTI and Brent crude prices usually differ by a few dollars, the two grades are highly correlated and often rise or fall together. Our knowledgeable professionals and industry leading tools are united to do one thing: make you a smarter, more confident investor.