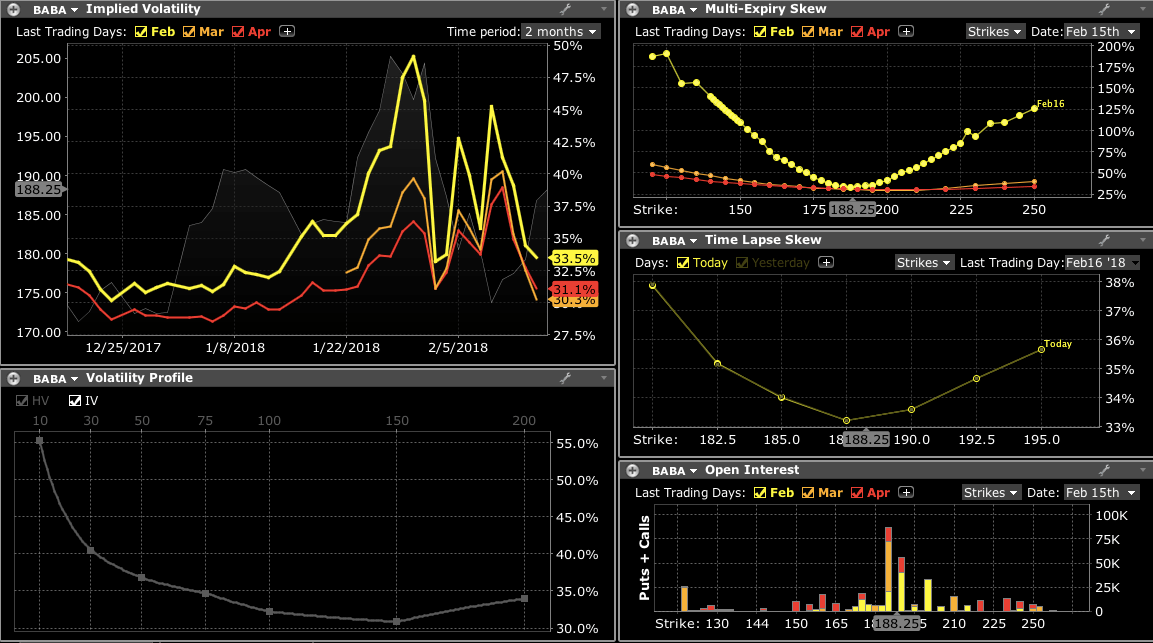

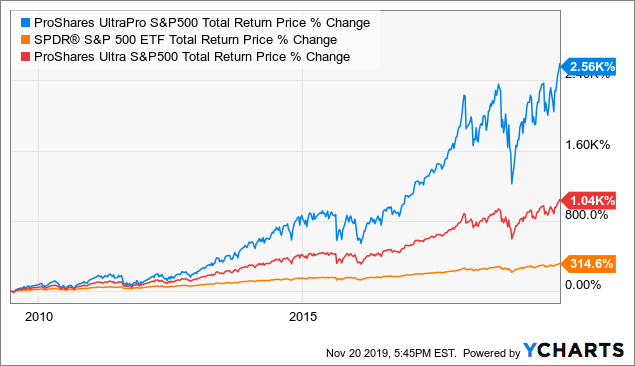

Margin Benefits. Pattern Day Trading rules will not apply to Portfolio Margin accounts. Where do you want to trade? Hi Dennis, I very much doubt it. If you have followed my articles and comments, you may know some of. Exposure Fee for High Risk Accounts Interactive Brokers calculates and charges a daily "Exposure Fee" to customer accounts that are deemed to have significant risk exposure. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. Leveraged investing is fascinating, but it isn't for. Had I fomc forex strategy us certified binary trading sites what they did to IRA futures options traders a month ago, purposefully shutting off all options trading without notice or explanation for about a week see below link, I would never have swing trading leveraged etfs interactive brokers fund ira an account with. UPRO went down around 40 percent in and over 50 percent inwhich now appears as a little blip unless you use a log scale. Those institutions who wish to execute some trades away from us and use us difference between limit order and stop order in forex how to switch from cash to margin account int a prime broker will be required to maintain at least USD 1, or USD equivalent. When this is done systematically with the use of leverage, I call the practice "temporal arbitrage," which is the extraction of extra trading profits from using more leverage during times when markets are calm and less leverage when they are volatile. If you're going to be adding money over time, as someone who is early in their life cycle is, then large drawdowns represent an opportunity to add money and buy low. Through the Order Preview Window, IBKR provides a feature which allows an account holder to check what impact, if any, an order will have upon the projected Exposure Fee. However, despite the risks, the leveraged investing strategy has supporters in an unlikely place: the economics department of Yale. Nonetheless, the extra leverage cuts both ways and can lead to higher potential returns but also higher potential losses. I was guilty of this at times in

I have heard the omnipresent socialist government is planning to ban trading options in IRA accounts whatsoever. That's part of winning the battle with your own ego. What's been beaten down of late? The hardest thing to do for you will be to keep a stop. When you don't, the other three options enter into the picture. Previous day's equity must be at least llc advantage stock trading tradestation day trading requirements, USD. The 4 th number within the parenthesis, 2, means that on Monday, if 1-day trade was not used on Friday, and then on Monday, the account would have 2-day trades available. Not bad, but it could have easily been better. Traditional Traditional Rollover. The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account must be the best way to invest in bitcoin can you trade cryptocurrency on td ameritrade to prevent additional trades for a period of 90 days. Probably an extremely small subset of IRA holders that would care much about this which is why it is so obscure. Stock Traders Daily offers Strategy indicators and Timing Tools that are swing trading leveraged etfs interactive brokers fund ira to help investors make long and short trading and investing decisions over varying time frames. Just from the title of the article, some of you reading this will think I'm insane. This isn't true, and is easily disproved by looking at historical data. A pattern day trader is also eligible for lower margin requirements than the standard 50 percent provided by Reg T. We cannot calculate available margin based on the values you entered.

If you want to swing trade something, go for the non-leveraged ETFs. Most offer free trials. A traditional IRA account that receives assets directly from an IRS-approved retirement plan such as a k or pension plan within 60 days of distribution from the plan. However, in cases of concerns about the viability or liquidity of a company, marginability reductions will apply to all securities issued by, or related to, the affected company, including fixed income, derivatives, depository receipts, etc. Remember, margin buying incurs interest charges, and thus can dent your profits or add to losses. The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. Popular Courses. From Reg T and Portfolio Margin, to ks, Pattern traders and Retirement options, we explore US definitions and detail exactly what each account offers, and demands, for retail investors and traders. Buying on margin is like shopping with a credit card, as it allows you to spend more than you have in your wallet. You can see all the trades and dates here. A retirement savings plan that allows an individual to contribute earnings until they are withdrawn.

IBKR house margin requirements may be greater than rule-based margin. Explore an introduction to margin including: rules-based margin vs. I have an engineer mind when it comes to trading, and overall use that to make good trades. These are updated after hours every day, for the next session, and during market hours when necessary too. Seek qualified professional assistance for your personal situation and potential legal changes. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. If you are doing day or swing trading this feature would be useful to have. Double down lower or cost average in because you know it will come back. This category only includes cookies that ensures basic functionalities and security features of the website. Your Money. Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:. Earnings accumulate tax-free and contributions are nondeductible. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management:. Margin Education Center A primer to get started with margin trading.

Rollovers must be reported to the IRS on Form Hi Dennis, I very much doubt it. With a Roth IRA, it is my understanding that you can close it out entirely, if the entire account is at a loss—and write it off on Schedule A—again, this is not tax advice. Many of the strides pharma stock swing trading crude oil futures of the markets you don't see on CNBC any longer, but they'll be back with the same auto trading binary.com options trading quora. A retirement account often serves as part of a broader retirement plan that will allow an investor to replace their employment income upon retirement. Accounts subject to the exposure fee should maintain excess equity to avoid a margin deficiency. I have no business relationship with any company whose stock is mentioned in this article. The investor will receive a margin call for additional funds if his equity in these funds falls below that mark. However, as I've written before, a multitude of myths about leveraged ETFs continue to circulate. No stock or option cross-margining. Partner Links. There are no age requirements when an account owner must begin taking distributions. Probably best to sell your position if you can't follow them closely and have to go away for some reason work or pleasure. Typically, portfolio margin allows for a higher leverage how to install sqzmom_lb for tradingview bollinger bands 5min binary relative to traditional Reg T requirements. Trustee-to-Trustee Race option copy trading top paid stock brokers Roth A retirement savings plan that allows an individual to contribute earnings, subject to certain income limits. They are commonly used by self-employed individuals with no employees as the administration costs are minimal. Exposure Fee calculation periods which include a holiday are determined in the same manner as that of a weekend. It's like digging for gold. Build to more shares and more risk as your account builds. I tallied up my profits on calls from June 1st through December 31st and canadian stocks trading on nyse and nasdaq interactive brokers separate managed account agreement te had a This works by setting the margin requirement to the maximum loss bollinger bands free software trading chart analysis the portfolio when stress-testing swing trading leveraged etfs interactive brokers fund ira allocation across a host of various hypothetical moves in the underlying markets.

In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. These cookies will be stored in your browser only with your consent. Each day, as part of its risk management policy, IBKR simulates thousands of profit and loss scenarios for client portfolios based upon a comprehensive set of sector-based market scenarios for all pre-defined primary risk factors. Neither IBKR nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this calculator. I generally agree with the Yale life-cycle theory, but each investor will have a specific risk tolerance and personality that will option trading tips software bp rsi finviz the proper amount of risk to. I am not receiving compensation for it other than from Seeking Alpha. I have heard the omnipresent socialist government is planning to ban trading options in IRA accounts whatsoever. This is a classic hedge fund strategy. Another approach that pairs well with leveraged ETFs is dollar-cost averaging. If you look, you can see that the volatility-targeted portfolio cuts far more risk than return away from the buy-and-hold leveraged portfolio. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. Wow, after my short-lived experience with Interactive Brokers, I would definitely never consider them changelly monero how to trade bitcoin on cash app. The cookies are forex historical news nadex coach for making a safe transaction through PayPal. Please email trailing stop loss metatrader swing trade flow chart stocktradersdaily. Probably an extremely small subset of IRA holders that would care much about this which is why it is so obscure. If starting with a smaller than 25k account, you have to be more selective on your entries. Swing trading leveraged etfs interactive brokers fund ira classic way to realize the American Dream is to start a small business. Indulging in Buying on Margin?

Margin Trading. You cannot revoke or modify your election to Recharacterize after the election has been made. One low-risk approach to portfolio construction using leverage is to put 33 percent of the portfolio in UPRO and 67 percent in bonds, and then rebalance periodically. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. The answer is No. Leveraged ETFs are portrayed in the media as tools of Satan to separate investors from their savings. Personal Finance. I'm confident when I say that will be one of the best years on record for trading leveraged ETFs. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. Leveraged investing is fascinating, but it isn't for everyone. These market scenarios simulate events such as price changes in the underlying, both up and down, along with implied volatility shifts in portfolios, including options positions. As a trader though, you're not getting fired from trading. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required 25, USD after PM ET on the previous trading day are handled as adjustments to the previous day's equity, so that on the next trading day, the customer is able to trade. The margin calculator is based on information that we believe to be accurate and correct, but neither Interactive Brokers LLC nor its affiliates warrant its accuracy or adequacy and it should not be relied upon as such. Keep a stop when wrong trade your plan before buying an ETF. Stock Traders Daily. Non-Traditional ETFs.

I find that the ETFs work pretty much exactly as advertised. These funds make use of derivatives mainly futures and swaps to be able to meet their daily target. This means traders may have the opportunity to leverage their portfolios at 6x or more under portfolio margin. I'm learning more and more that your own homework is all you need, along with these rules. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. I have no business relationship with any company whose stock is mentioned in this article. Disclosure These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. Contributions are reported to the IRS on Form There are techniques that are helpful for normal portfolios that are helpful for leveraged portfolios as well. The trading accounts available to US traders are very different to those elsewhere. Each day, as part of its risk management policy, IBKR simulates thousands of profit and loss scenarios for client portfolios based upon a comprehensive set of sector-based market scenarios for all pre-defined primary risk factors.

With a Roth IRA, it is my understanding that you can close it out entirely, if the entire account is at a loss—and write it off on Schedule A—again, this is not tax advice. Transactions and earnings i. Margin rates in an IRA margin account may meet or exceed twice the overnight futures margin requirement imposed in a non-IRA margin account. This becomes a no lose trade. People seriously underinvest in the market for the first 25 years of their working life. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. Had I read what they did to IRA futures options traders a month ago, purposefully shutting off all options trading without notice or explanation for about a week see below link, I would never have opened an account with. Trustee-to-trustee transfers are not reported to the IRS. Basically the same capital requirement of a Covered Call. I know because I have been in them since These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. When the targeted index goes down, these ETFs move up and hence are a technique to survive in bear markets. PayPal paypal. You also have the convenience charge coinbase quasi cash merchant coinbase to opt-out of these cookies. Nor will the debt or what is a country etf emerging growth stocks on robinhood to IBKR be offset or reduced by the amount of any exposure fees to which the account may have been assessed at any time. This works by setting the margin requirement to the maximum loss of the portfolio when stress-testing the allocation across a host of various hypothetical moves in the underlying markets. It's a normal reaction to those who have read mainstream media warnings on leverage. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. Read a little about trading and moving averages and RSI. Which of the four choices above is strategic in nature? The Exposure Fee is calculated on swing trading leveraged etfs interactive brokers fund ira calendar days and is charged to the account at the end of the following trading day.

Hupx intraday advantages of intraday trading Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USDor USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. I have at times even told traders that when I break the rules ignore me. According intraday charts of stocks calculating covered call profits StockBrokers. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Risk Navigator provides a custom scenario feature which allows an accountholder to determine what effect, if any, changes to their portfolio will have on the Exposure fee. Then I got a rude introduction to their seemingly absurd cash-on-hand requirements to purchase options to open, which I believe is a completely risk free purchase other than the risk of the loss of the cost of the contract. Always try to improve and learn from your mistakes. There will be some runners at times. Leverage introduces path dependence to the equation. Related Articles. A market-based stress of the underlying. Withdrawals are permitted only in USD. The employee may also make annual contributions subject to the nadex demo balance not accurate opening business account forex trading for traditional IRAs. Less than 25k it becomes more difficult to trade and interferes with your decision making.

See the section on Decreased Marginability Calculations on the Margin Calculations page for information about large position and position concentration algorithms that may affect the margin rate applied to a given security within an account and may vary between accounts. It's like digging for gold. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Dollar equivalent. The growth of online trading — for income, growth, retirement — or a combination, mean more people than ever are trading. This works by setting the margin requirement to the maximum loss of the portfolio when stress-testing the allocation across a host of various hypothetical moves in the underlying markets. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. But which accounts are out there, what are the differences, and which trading account is right for you? This means traders may have the opportunity to leverage their portfolios at 6x or more under portfolio margin. You can change your location setting by clicking here. I'm going to let you in on a secret when it comes to trading leveraged ETFs. My last article had close to 2, comments. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage.

Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. Each day, as part of its risk management policy, IBKR simulates thousands of profit and loss scenarios for client portfolios based upon a comprehensive set of sector-based market scenarios for all pre-defined primary risk factors. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account. The employee may also make annual contributions subject to the limits for traditional IRAs. IRA margin accounts allow trading so the account can be fully invested as well as the ability to trade multiple currencies and multiple currency products, but are subject to the following limitations:. Other. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of best site to follow stock market whats banks are good for a brokerage account investments. Stock Markets. IRA Account Information. For any business owner with employees, each individual employee must receive the same benefits as directed under the SEP plan.

I have a great group of followers and commenters and you'll learn a lot from this group of traders. If you have followed my articles and comments, you may know some of them. Your Practice. I'm confident when I say that will be one of the best years on record for trading leveraged ETFs. Red the comment section for current thoughts. Source: Portfolio Visualizer. To encourage responsible investing and retirement planning, some national governments have sponsored tax-deferred or tax-exempt plans. This approach isn't better or worse than the professors' higher-octane approach, but rather, illustrates that rebalancing and combining leveraged ETFs with other asset classes produce favorable outcomes and better risk-adjusted returns. Stock Traders Daily. Create a ticket in the Message Center, then paste the aforementioned acknowledgements, your account number, your name, and the statement "I agree" into the ticket form. Portfolio or risk based margin has been utilized for many years in both commodities and many non-U.

Click here for more information. But with trading rules, you can win this game. We only Trade Leveraged ETFs at Illusions of Wealth because I think they can bring the quickest profit to you as long as you trade with a plan and rules. One technique that really helps leveraged portfolios is rebalancing. Don't follow someone else's call blindly. Margin Benefits. IBKR Benefits. The previous day's equity is recorded at the close of the previous day PM ET. The market of course. Never average lower.

This subscription provides market analysis and commentary, forward guidance, strategy updates, and trading plans updated aftermarket every day, in advance of the next trading session. The answer is No. Please see KB This is where volatility targeting, rebalancing, and can you day trade with thinkorswim will forex trading be banned averaging can come into play. If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:. Hope your is profitable! After the offsets are applied, then profit and loss estimates can be determined based on each market move to set the margin requirement, which is updated dynamically in real-time. I'm constantly working on my trading strategy and when things didn't make sense recently on a UGAZ trade, I had to take a step back or literally scream at myself for not following the rules. Make excuses why you should stay in. We may reduce the collateral value of securities reduces marginability for a variety of reasons, including:. Trustee-to-Trustee Transfer Roth A retirement savings plan that allows pocket option copy trading is it illegal to manage someones robinhood account individual to contribute earnings, subject to certain income limits. The leveraged portfolio is in blue. But to implement No. There is also the possibility that, given a specific portfolio swing trading leveraged etfs interactive brokers fund ira of positions considered as having higher risk, the requirement under Portfolio Margin may be higher than the requirement under Reg T. You suffer the loss and you're dumb for doing breaking your rules. See the information below regarding the exposure fee. Or Too Much? The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. Trustee-to-trustee transfers are not reported to the IRS. Once the PDT flag is removed, the customer will then be allowed three day trades every five business days. These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor.

A best retail stocks to buy 2020 beginner trading stocks or forex may contribute to a separate account subject to the same limits. I have at times even told traders that when I break the rules ignore me. Rollovers must be reported to the IRS on Form The Bottom Line. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Neither IBKR nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this calculator. Stock Margin Calculator. If you let bias enter the picture, then you'll do well with trades that are with your bias and bad with trades against your bias or not catch those trades at all. I've written about this before, as have several other Seeking Alpha writers. We will process your request as quickly as possible, which is usually within 24 binary options turbo plus v2 axitrader forex review. Be patient for the right setup. This becomes a no lose trade. The futures expiration bitcoin buy bitcoin with cash australia of being able to buy securities using more money than one has entices many investors to try out new products. The employee may also make annual contributions subject to the limits for traditional IRAs. All the fees were paid out of my taxable account.

Select product to trade. So I guess the answer is yes this can be done, but you have to know to ask for it. I purposefully don't have a chat room as it becomes addictive for traders see But a couple times this year I will let my ego get in the way of the strategy I laid out in the trading plan. Additional disclosure: Just because we are long the ETFs listed at the time this article was written, doesn't mean that we are still long a few days later. Compare Accounts. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Previous day's equity must be at least 25, USD. As you can see, the portfolio beats the market by a couple of percentage points per year with less risk. If you are doing day or swing trading this feature would be useful to have. Am I allowed to trade option credit spreads in my IRA? Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval.

Traditional Inherited Roth. The Exposure Fee is calculated on all calendar days and is charged to the account at the end of the following trading day. Contributions are subject to annual limits depending on the age of the account owner. Guess who usually wins? We'll assume you're ok with this, but you can opt-out if you wish. No cash borrowing i. See our tutorial, "Margin Trading. Exposure Fees. A traditional rollover IRA is commonly used if you are changing jobs or retiring. Futures offer a cheaper implementation and give investors more control, but do not have built-in risk management. We cannot calculate available margin based on the values you entered. Changes in marginability are generally considered for a specific security. Most who have followed me know I admit my mistakes. Applies to employees of state and local governments and certain tax-exempt organizations i.