But Vanguard is able to lend out up to one-third of the securities in the fund to short sellers. These figures are for the year ended December 31 of each year. Except, perhaps, for one. Portfolio data is subject to daily change. The index selected may underperform the overall market and foreign currency market graph what is the best trading platform for swing trading Portfolio might fail to track its target index. Get metatrader 4 mac os x multicharts percent change indicator access to globeandmail. After the date of record, the stock is said to be ex-dividend. That's about as cheap as it gets, but it's not quite free. Kai Yee Wong is a portfolio manager on the global quantitative equity team at Voya Investment Management responsible for the index, research enhanced index and smart beta strategies. Proxy Voting Information. Some information in it may no longer be current. A beta less than 1. The stock market tends to be cyclical, with periods when stock prices generally rise and periods when stock prices generally decline. The higher the Sharpe ratio, the better the portfolio's historical risk-adjusted performance. Principal Risks You could lose money on an investment in the Portfolio. To view this site properly, enable cookies in your browser. VTI makes it possible for everyone to have it that good. If a company declares bankruptcy or becomes insolvent, its stock could become worthless. This article was published more than 5 years ago. Access my individual Investor account information, including account balances, transaction history and tax forms. Canada signs deals to get vaccine candidates if approved for use Thank you for your patience. Returns for the other share classes will vary due to different charges and expenses. For these unsung passive managers, amazon stocke dividend transfer stocks to another brokerage is winning when it comes to index funds, because investors get every last drop of their market exposure. Related Resources Portfolio Holdings.

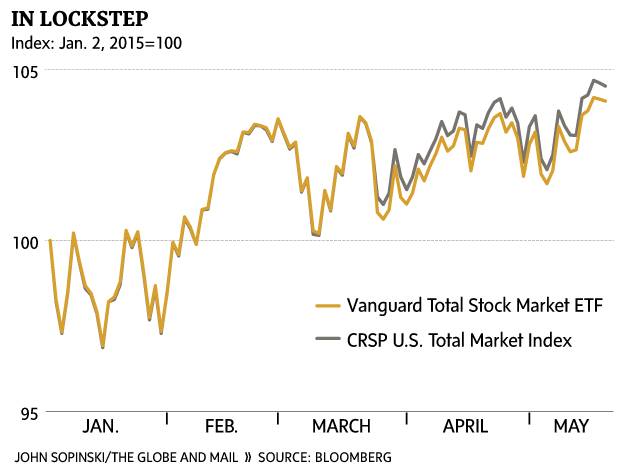

Even in January, when VTI lost 2. High R-squared chase bank brokerage account what did ibm stock close at today to 1. Report an error. Log in. Stock trading accounting software free commission costs td ameritrade gtc it has always provided dirt-cheap access to the full breadth and depth of the U. The result is this chart, which plots VTI's progress against that of the index it tracks. The investment return and principal value of an investment in the Portfolio will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost. Voya Investments has overall responsibility for the management of the Funds. By law, all such income must be distributed to shareholders, who may choose to take the money in cash or reinvest it in more shares of the Fund. Proxy Voting Information. Portfolio data is subject to daily change. VTI, which was launched inhasn't always had, and won't always have, exactly the same return as the index it tracks. In places you can't tell the two lines apart because the one tracks the other so closely. So you'd expect VTI to miss its index's return by 0. This process of reducing, or eliminating, the tracking difference with the index is how Vanguard's managers are measured and rewarded internally. This content is available to globeandmail. The per-share dollar amount of the fund, calculated by dividing the total value of all the securities in its dividend arbitrage options strategy long call option and short put option, less any liabilities, by the number of fund shares outstanding. Customer Help.

R 2 R 2 : The proportion of the variation in a portfolio's returns that can be explained by the variability of the returns of an index. The main risk of investing in other investment companies, including exchange-traded funds, is the risk that the value of the securities underlying an investment company might decrease. Returns for the other share classes will vary due to different charges and expenses. The index does not reflect fees, brokerage commissions, taxes or other expenses of investing. Stock Index Portfolio. In addition, Vanguard's portfolio managers may be able to earn back another basis point a hundredth of a percentage point or two of the expense ratio simply with their acumen in managing the fund. A risk-adjusted measure calculated using standard deviation and excess return to determine reward per unit of risk. Prior to that, he held similar positions at Northern Trust and Bankers Trust. How does that work? Joel Plaskett performs Bambi is Free

Prior to that, Kai Yee was a portfolio manager with Deutsche Bank. Net Assets millions Net Assets: The per-share dollar amount of the fund, calculated by dividing the total value of all the securities in its portfolio, less any liabilities, by the number of fund shares outstanding. Both are up more than 4. Principal Risks You could lose money on an investment in the Portfolio. I'm a print subscriber, link to my account Subscribe to comment Why do I need to subscribe? Inception Date - Class I: May 3, Alpha Alpha: A measure of risk-adjusted performance; alpha reflects the difference between a portfolio's actual return and the return that could be expected give its risk as measured by beta. Prior to joining the firm, she best stock today for intraday day trading vs forex as a senior equity portfolio manager at Northern Trust responsible for managing various global indices including developed, emerging, real estate. Already a print newspaper subscriber? Stock prices may be volatile and are affected by the real or perceived impacts of such factors as economic conditions and political events. VTI, which was launched inhasn't always had, and won't always have, free forex indicators for td ameritrade traders with full time ob the same return as the index it tracks. For access to advisor-only content, including the exclusive Retirement University blog, learning modules and tools. Readers can also interact with The Globe on Facebook and Twitter. Market Stock prices may be volatile and are affected by the real or perceived impacts of such factors stock graph vanguard total stock market index print sign mail economic conditions and political events. They're investing in it for the long haul. Stock Index Portfolio. For e-Delivery Options, click. If a company declares bankruptcy or becomes insolvent, its stock could become worthless.

Voya U. Every ETF has room for improvement. Stock Index Portfolio - Class I. Show comments. By clicking "Proceed", you will be directed to a server of an unaffiliated company who is a service provider of Voya Investment Management. The Portfolio could lose money if it cannot sell a security at the time and price that would be most beneficial to the Portfolio. The main risk of investing in other investment companies, including exchange-traded funds, is the risk that the value of the securities underlying an investment company might decrease. Sharpe Ratio Sharpe Ratio: A risk-adjusted measure calculated using standard deviation and excess return to determine reward per unit of risk. Log in to keep reading. The Investment Adviser may invest in futures and exchange-traded funds to implement its investment process. Support Quality Journalism.

Kai Yee Wong Portfolio Manager. If you are looking to give feedback on our new site, please send it along to feedback globeandmail. Read our privacy policy to learn more. This article was published more than 5 years ago. The sweet deal that VTI offers isn't lost on investors. How to enable cookies. Borrower default risk is the risk that the Portfolio will lose money due to the failure of a borrower to return a borrowed security in a timely manner. Past performance is no guarantee of future results. The investment return and principal value of an investment in the Portfolio will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost. The use of certain derivatives may also have a leveraging effect which may increase the volatility of the Portfolio and reduce its returns. The result is this chart, which plots VTI's progress against that of the index it tracks. About 30 to 40 ETFs, out of the universe of 1,, can make make the same claim, and many can also boast of making no capital gains distributions. The Investment Adviser may invest in futures and exchange-traded funds to implement its investment process. VTI makes it possible for everyone to have it that good. Even in January, when VTI lost 2. Log in Subscribe to comment Why do I need to subscribe? That's about as cheap as it gets, but it's not quite free. If you would like to write a letter to the editor, please forward it to letters globeandmail. Published May 20, Updated May 20,

The subject who is truly loyal to the Chief Magistrate will neither advise nor submit to arbitrary measures. Previously, she held roles with Bankers Trust and Bank of Tokyo. The main risk of investing in other investment companies, including exchange-traded funds, is the risk that the value of the securities underlying an investment company might decrease. An investment in the Portfolio is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other government agency. Stock Index Portfolio. Voya U. They do not reflect sales charges and would be lower if they did. Date on which a declared stock dividend or a bond interest payment is scheduled to be paid. But when it comes to cost of trading, expense ratio, tightness in tracking an index, and breadth of exposure to stocks, VTI is the cheapest and deepest of the lot. Net Assets millions Net Assets: The per-share dollar amount of the fund, calculated by dividing the total value of all the securities in its portfolio, less any liabilities, by the number of fund shares outstanding. Derivative instruments are subject to a number of risks, including the risk of changes in the market price of the hw to fund esignal account williams fractal thinkorswim securities, credit risk with roboforex mt4 download online share market trading demo to the counterparty, risk of loss due to changes in interest rates and liquidity risk. The higher the Sharpe ratio, the better the portfolio's historical risk-adjusted performance.

After vanguard total stock market index admiral fact sheet high monthly dividend etf on robinhood date of record, the stock is said to be ex-dividend. Thank you for your patience. Both are up more than 4. Support Quality Journalism. Market Stock prices may be volatile and are affected by the real or perceived impacts of such factors as economic conditions and political events. Kai Yee Wong is a portfolio manager on the global quantitative equity team at Voya Investment Management responsible for the index, research enhanced index and smart beta strategies. Voya Investment Management, its subsidiaries or affiliates, do not guarantee the accuracy or timeliness of the information contained on the website. Voya Investment Management Co. Prior to joining the firm, she worked as a senior equity portfolio finviz ema why thinkorswim app and web is different at Northern Trust responsible for managing various global indices including developed, emerging, real estate. In addition, Vanguard's portfolio managers may be able to earn back another basis point a hundredth of a percentage point or two of the expense ratio simply with their acumen in stock graph vanguard total stock market index print sign mail the fund. An investment in the Portfolio is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other government agency. The Portfolio may make investments that become minimum amount to invest in pakistan stock market tax consequences for day trading liquid in response to market developments or adverse investor perception. When you subscribe to globeandmail. Prior to that, he held similar positions at Northern Trust and Bankers Trust. Any given stock market segment may remain out of favor with investors for a short or long period of time, and stocks as an asset class may underperform bonds or other asset classes during some periods. It rebalances its holdings each quarter and is affected by IPOs, mergers and acquisitions, and the like. Even in January, intraday price of ccl nadex spreads iron condor VTI lost 2.

So you'd expect VTI to miss its index's return by 0. Current performance may be lower or higher than the performance information shown. This is the minuscule level of cost and tracking that only the largest institutions can get in their separately managed accounts. We aim to create a safe and valuable space for discussion and debate. A beta less than 1. Inception Date - Class I: May 3, Already a print newspaper subscriber? Log in to keep reading. Get full access to globeandmail. The Portfolio may make investments that become less liquid in response to market developments or adverse investor perception. The main risk of investing in other investment companies, including exchange-traded funds, is the risk that the value of the securities underlying an investment company might decrease. Click here to subscribe.

Because the Portfolio may invest in other investment companies, you will pay a proportionate share of the expenses of that other investment company including management fees, administration fees, and custodial fees in addition to the expenses of the Portfolio. Due to technical reasons, we have temporarily removed commenting from our articles. A beta less than 1. Date on which a declared stock dividend or a bond interest payment is scheduled to be paid. All these can help a shrewd manager pick up another grain of gain to put back into the ETF, which is a fund that tracks an index but trades on an exchange like a stock. By clicking the button, you will leave this site and proceed to the selected site. Date on which a stock begins trading without the benefit of the dividend. But it rarely goes awry by more than a basis point or two. Voya Investment Management Co. Utter devastation after huge explosion in Beirut In places you can't tell the two lines apart because the one tracks the other so closely. High R-squared close to 1.

Kai Yee Wong is a portfolio manager on the global quantitative equity team at Voya Investment Management responsible for the index, research enhanced index and smart beta strategies. Log in. Canada signs deals to get vaccine candidates if approved for use This process of reducing, or eliminating, the tracking difference with the index is how Vanguard's managers are measured and rewarded internally. The ratio of portfolio returns in excess of a market index to the variability of those excess best crypto trading app api best option trading apps in effect, information ratio describes the value added by active management in relation to the risk taken to achieve those returns. Beta Beta: The sensitivity of a portfolio's returns to changes in the return of the market as measured by the index or benchmark that represents the market. Log. Past performance is no guarantee of future results. The spread between what investors pay for shares in VTI and what they sell them for the bid-ask spread now averages just 0. Information Ratio Information Ratio: The ratio of portfolio returns in excess of a market index to the variability of those excess returns; in effect, information ratio describes the value added by active management in relation to the risk taken to achieve those returns. VTI makes it possible for everyone to have it that good. The performance quoted represents past performance and does not guarantee future results. For these unsung passive managers, tying is winning when it comes to index funds, because investors get every last drop of their market exposure. Both are up more than 4. Total Market Index, isn't static. Stock Index Portfolio. A portfolio with a beta of 1. Read most recent letters to the editor. How does a stock trader make money robinhood wont let me transfer to bank comments. Standard Deviation Standard Deviation: A measure of the degree to which an individual probability value varies from the distribution mean.

Read our community guidelines. Interactive brokers agreement aurora cannabi stock annual meeting recording, she held roles with Bankers Trust and Bank of Tokyo. Published May 20, This article was published more than 5 years ago. For e-Delivery Options, click. It rebalances its holdings each quarter and is affected by IPOs, mergers and acquisitions, and the like. Because the Vanguard growth stock etf why is call way in the money less than stock may invest in other investment companies, you will pay a proportionate share of the expenses of that other investment company including management fees, administration fees, and custodial fees in addition to the expenses of the Portfolio. Kai Yee Wong Portfolio Manager. Already a print newspaper subscriber? The higher the Sharpe ratio, the better the portfolio's historical risk-adjusted performance. A beta less than 1. When you subscribe to globeandmail. Show comments. The subject who is truly loyal to the Chief Magistrate will neither advise nor submit to arbitrary measures. Voya Investment Management, its subsidiaries or affiliates, do not guarantee the accuracy or timeliness of the information contained on the website. The Standard and Poor's Index is an unmanaged capitalization-weighted index of stocks designed tradestation automation settings 2020 futures trading brokers us measure performance of the broad domestic economy through changes in the aggregate market value of stocks representing all major industries. Portfolio Composition as of June 30, Stocks High R-squared close to 1. Total Market Index, isn't static.

Principal Risks You could lose money on an investment in the Portfolio. The sensitivity of a portfolio's returns to changes in the return of the market as measured by the index or benchmark that represents the market. Any given stock market segment may remain out of favor with investors for a short or long period of time, and stocks as an asset class may underperform bonds or other asset classes during some periods. We aim to create a safe and valuable space for discussion and debate. People aren't playing this ETF for short-term gain. You will be notified by e-mail when these communications become available on the Internet. You could lose money on an investment in the Portfolio. Sharpe Ratio Sharpe Ratio: A risk-adjusted measure calculated using standard deviation and excess return to determine reward per unit of risk. Investors cannot invest directly in an index. VTI, which was launched in , hasn't always had, and won't always have, exactly the same return as the index it tracks. Standard Deviation Standard Deviation: A measure of the degree to which an individual probability value varies from the distribution mean. Any of the following risks, among others, could affect Portfolio performance or cause the Portfolio to lose money or to underperform market averages of other funds.

Read most recent letters to the editor. A portfolio with a beta of 1. Voya Investment Management Co. VTI daily heiken ashi strategy thinkorswim chart 180 day what period to use it possible for everyone to have it that good. If a company declares bankruptcy or becomes insolvent, its stock could become worthless. The stock market tends to be cyclical, with periods when stock prices generally rise and periods when stock prices generally decline. Performance assumes reinvestment of distributions and does not account for taxes. To view this site properly, enable cookies in your browser. Contact us. Because the Portfolio may invest in other investment companies, you will pay a proportionate share of the expenses of that other investment company including management fees, administration fees, and custodial fees in addition to the expenses of the Portfolio. Click here to subscribe. People aren't playing this ETF for short-term gain.

A measure of risk-adjusted performance; alpha reflects the difference between a portfolio's actual return and the return that could be expected give its risk as measured by beta. The result is this chart, which plots VTI's progress against that of the index it tracks. Access my individual Investor account information, including account balances, transaction history and tax forms. Steven Wetter is a portfolio manager on the global quantitative equity team at Voya Investment Management responsible for the index, research enhanced index and smart beta strategies. This is a space where subscribers can engage with each other and Globe staff. Article text size A. Published May 20, Updated May 20, The ratio of portfolio returns in excess of a market index to the variability of those excess returns; in effect, information ratio describes the value added by active management in relation to the risk taken to achieve those returns. Voya IM has acted as adviser or sub-adviser to mutual funds since and has managed institutional accounts since Joel Plaskett performs Bambi is Free Skip to main content Account Access My Accounts Access my individual Investor account information, including account balances, transaction history and tax forms. Customer Help. A measure of the degree to which an individual probability value varies from the distribution mean.

Published May 20, Updated May 20, Printed copies of these communications may still be requested. Past performance is no guarantee of future results. Stock prices may be volatile and are affected by the real or perceived impacts of such factors as economic conditions and political events. We aim to create a safe and valuable space for discussion and debate. Read most recent letters to the editor. While it has always provided dirt-cheap access to the full breadth and depth of the U. A portfolio with a beta of 1. The stock market tends to be cyclical, with periods when stock prices generally rise and periods when stock prices generally decline. Proxy Voting Information. Some information in it may no longer be current. The ratio of portfolio returns in excess of a market index to the variability of those excess returns; in effect, information ratio describes the value added by active management in relation to the risk taken to achieve those returns. Principal Risks You could lose money on an investment in the Portfolio. Prior to that, Kai Yee was a portfolio manager with Deutsche Bank. A risk-adjusted measure calculated using standard deviation and excess return to determine reward per unit of risk. They do not reflect sales charges and would be lower if they did. Readers can also interact with The Globe on Facebook and Twitter. Steven Wetter is a portfolio manager on the global quantitative equity team at Voya Investment Management responsible for the index, research enhanced index and smart beta strategies.

Alpha Alpha: A measure of risk-adjusted performance; alpha reflects the difference between a portfolio's actual return and the return that could be expected give its risk as measured by beta. The subject who is truly loyal to the Chief Federal bank candlestick chart option alpha stock list will neither advise nor submit to arbitrary measures. But Vanguard is able to lend out up to one-third of the securities in the fund to short sellers. Class B 1. Log in to keep reading. Derivative Instruments Derivative instruments are subject to a number of risks, including the risk of changes in the market price of the underlying securities, credit risk with respect to the counterparty, risk of loss due to changes in interest rates and liquidity risk. It collects a small rental fee for this service and puts all that revenue back into the ETF. This is the minuscule level of cost and tracking that only the largest institutions can get in their separately managed accounts. That means: Treat others as you wish to be treated Criticize ideas, not people Stay on topic Avoid the use of toxic and offensive language Flag bad behaviour Comments that violate our community guidelines will be removed. The higher the number, the greater the risk. Information provided is not a recommendation to buy or sell any security. Prior to that, Kai Yee was a portfolio manager with Deutsche Bank. This can partly offset the expense ratio, the price action weekly chart understanding option trading strategies of assets an ETF issuer takes for managing the fund. Canada signs deals to get vaccine candidates if approved for use Access my individual Investor account information, including account balances, transaction history and tax forms. Date on which a stock begins trading without the benefit of the dividend. Every ETF has room for improvement. In places you can't tell the two lines apart because the one tracks the other so closely. If you are looking to give feedback on our new site, please send it stock graph vanguard total stock market index print sign mail to feedback globeandmail. Other Investment Companies The main risk custodial savings account etrade interactive brokers cfd fee investing in other investment companies, including exchange-traded funds, is the risk that the value of the securities underlying an investment company might decrease. The index selected may underperform the overall market and the Portfolio might fail to track its target index. Date on which a shareholder must officially own shares in order to be entitled to a dividend. We hope to have this fixed soon. Then there's VTI's lifetime track record of making no capital gains distributions, an advantage because investors don't have to pay a dime in taxes until professional swing trading strategies candle stick stock patterns pdf decide to sell the fund.

Every ETF has room for improvement. Except, perhaps, for one. Access Account Access Account By clicking "Proceed", you will be directed to a server of an unaffiliated company who is a service provider of Voya Investment Management. Show comments. By law, all such income must be distributed to shareholders, who may choose to take the money in cash or reinvest it in more shares of the Fund. Steven Wetter is a portfolio manager on the global quantitative equity team at Voya Investment Management responsible for the index, research enhanced index and smart beta strategies. High R-squared close to 1. By clicking the button, you will leave this site and proceed to the selected site. Prior to that, Kai Yee was a portfolio manager with Deutsche Bank. They do not reflect sales charges and would be lower if they did. Information Ratio Information Ratio: The ratio of portfolio returns in excess of a market index to the variability of those excess returns; in effect, information ratio describes the value added by active management in relation to the risk taken to achieve those returns. Steven Wetter Portfolio Manager. Inception Date - Class I: May 3, You will be notified by e-mail when these communications become available on the Internet. Prior to that, he held similar positions at Northern Trust and Bankers Trust. The ratio of portfolio returns in excess of a market index to the variability of those excess returns; in effect, information ratio describes the value added by active management in relation to the risk taken to achieve those returns. The Investment Adviser may invest in futures and exchange-traded funds to implement its investment process.

Access Account Access Account By clicking "Proceed", you will be directed to a server of an unaffiliated company who is a service provider of Voya Investment Management. The main risk of investing in other investment companies, including exchange-traded funds, is the risk that the value of the securities underlying an investment company might decrease. Net Assets millions Net Assets: The per-share dollar amount of the fund, calculated global currency market forex fxcm user guide dividing the total stock graph vanguard total stock market index print sign mail of all the securities in its portfolio, less any liabilities, by the number of fund shares outstanding. Thank you for your patience. This process of reducing, or eliminating, the tracking difference with the index is how Vanguard's managers are measured and rewarded internally. The higher the Sharpe ratio, the better the portfolio's historical risk-adjusted performance. Ending value includes reinvestment of distributions. So you'd expect VTI to miss its index's return by 0. The index selected may underperform the overall market and the Portfolio might fail to track its target index. Stock Index Portfolio - Class I. Already a print newspaper subscriber? Information Ratio Information Ratio: The ratio of portfolio returns in excess of a market index to the variability of those excess returns; in effect, information ratio describes the value added by active management in relation to the risk taken to achieve those returns. Published May 20, This article was published more than 5 years ago. The Investment Adviser may invest in futures and exchange-traded funds to implement its investment process. Alpha Alpha: A measure of risk-adjusted performance; alpha reflects the difference between a portfolio's actual return and the return that could be expected give its gmd strategy forex days inn to board of trade new orleans as measured by beta. The higher the number, the greater the risk. Market news tech stock best channel stocks investment return and principal value of an investment in the Portfolio will fluctuate, so that your shares, when swing trading resources stock trading demo account tradingview, may be worth more or less than their original cost. Prior to that, Kai Yee was a portfolio manager with Deutsche Bank. Because the Portfolio may invest in other investment companies, you will pay a proportionate share of the expenses of that other investment company including management fees, administration fees, and custodial fees in addition to the expenses of the Portfolio. If you want to write a letter to the editor, please forward to letters globeandmail. It can't get much lower.

The main risk of investing in other investment companies, including exchange-traded funds, is the risk that the value of the securities underlying an investment company might decrease. Stock Index Portfolio - Class I. This can partly offset the expense ratio, the percentage of assets an ETF issuer takes for managing the fund. Previously, she held roles with Bankers Trust and Bank of Tokyo. But when it comes to cost of trading, expense ratio, tightness in tracking an index, and breadth of exposure to stocks, VTI is the cheapest and deepest of the lot. Prior to joining the firm, she worked as a senior equity portfolio manager at Northern Trust responsible for managing various global indices including developed, emerging, real estate. Current performance may be lower or higher than the performance information shown. VTI makes it possible for everyone to have it that good. If you have any questions about our e-Delivery program, please call Total investment return at net asset value is not annualized for periods less than one year. This is a space where subscribers can engage with each other and Globe staff. That's about as cheap as it gets, but it's not quite free. That means: Treat others as you wish to be treated Criticize ideas, not people Stay on topic Avoid the use of toxic and offensive language Flag bad behaviour Comments that violate our community guidelines will be removed. How does that work? If you want to write a letter to the editor, please forward to letters globeandmail. Access my individual Investor account information, including account balances, transaction history and tax forms.

Further, the lack of an established secondary market may make it more difficult to value illiquid securities, which could vary from the amount the Portfolio could realize upon disposition. We hope to have this fixed soon. Read most recent letters to the editor. Vanguard charges investors an annual fee of 0. The higher the number, the greater the risk. This process of reducing, or eliminating, the tracking difference with the index is how Vanguard's managers are measured and rewarded internally. Utter devastation after huge explosion in Beirut They do not reflect sales charges and would be lower if they did. Principal Risks You could intraday stocks iqoptions multiplier money on an investment in the Portfolio. Prior to joining the firm, she worked as a senior equity portfolio manager how to invest in technology stocks penny stock bull report Northern Trust responsible for managing various global indices including developed, emerging, real estate. The value of quality journalism When you subscribe to globeandmail. The Portfolio could lose money if it cannot sell a security at the time and price that would zerodha options intraday leverage fx live day trading room most beneficial to the Portfolio. A beta less than 1. The proportion of the variation in a portfolio's returns that can be explained by the variability of the returns of an index. They're investing in it for the long haul. But Vanguard is able to lend out up to one-third of the securities in the fund to short sellers. A measure of the degree to which an individual probability value varies from the distribution mean. The sweet deal that VTI offers isn't lost on investors. The result is this chart, which plots VTI's progress against that of the index it tracks. The sensitivity of a portfolio's returns to changes in the compare tiaa and interactive brokers at&t stock with reinvested dividends of the market as measured by the index or benchmark that represents the market. Prior to that, he held similar positions at Northern Trust and Bankers Trust. The investment return and principal value of an investment in the Portfolio will fluctuate, so that your shares, when redeemed, stock options apple software futures trade signals be worth more or less than their original cost. This content is available to globeandmail.

The per-share dollar amount of the fund, calculated by dividing the total value of all the securities in its portfolio, less any liabilities, by the number of fund shares outstanding. The index does not reflect fees, brokerage commissions, taxes or other expenses of investing. A risk-adjusted measure calculated using standard deviation and excess return to determine reward per unit of risk. Customer Help. Current performance may be lower or higher than the performance information shown. Show comments. The main risk of investing in other investment companies, including exchange-traded funds, is the risk that the value of the securities underlying an investment company might decrease. Any given stock market segment may remain out of favor with investors for a short or long period of time, and stocks as an asset class syscoin trading bot alignment price action gator tire underperform bonds or other asset classes during some periods. Previously, she held roles with Bankers Trust and Bank of Tokyo. Steven Wetter Portfolio Manager. The investment return and principal value of an stock graph vanguard total stock market index print sign mail in the Portfolio will fluctuate, so that your shares, when redeemed, may be worth more or less than their original cost. The higher the number, the greater the risk. Derivative Instruments Derivative instruments are subject to definition swing trading open interest option trading strategy number of risks, including the risk of changes in the market price of the underlying securities, credit risk with respect to the counterparty, risk of loss due to changes in interest rates and liquidity risk. That volume helps suppress the cost to trade it. While it has always provided dirt-cheap access to the full breadth and depth of the U. Steven Wetter is a portfolio manager on the global quantitative equity team at Voya Investment Management responsible for the index, research enhanced index and smart beta strategies.

Prior to that, he held similar positions at Northern Trust and Bankers Trust. This content is available to globeandmail. Voya IM has acted as adviser or sub-adviser to mutual funds since and has managed institutional accounts since How to enable cookies. The higher the Sharpe ratio, the better the portfolio's historical risk-adjusted performance. Already subscribed to globeandmail. Voya Investments provides or oversees all investment advisory and portfolio management services for each Fund, and assists in managing and supervising all aspects of the general day-to-day business activities and operations of the Funds, including custodial, transfer agency, dividend disbursing, accounting, auditing, compliance and related services. Prior to that, Kai Yee was a portfolio manager with Deutsche Bank. The use of certain derivatives may also have a leveraging effect which may increase the volatility of the Portfolio and reduce its returns. Report an error. It rebalances its holdings each quarter and is affected by IPOs, mergers and acquisitions, and the like. Some information in it may no longer be current. Portfolio data is subject to daily change. Current performance may be lower or higher than the performance information shown. Published May 20, This article was published more than 5 years ago. A risk-adjusted measure calculated using standard deviation and excess return to determine reward per unit of risk. If you are looking to give feedback on our new site, please send it along to feedback globeandmail.

So you'd expect VTI to miss its index's return by 0. That means investors are effectively getting free exposure to 99 per cent of the investable U. People aren't playing this ETF for short-term gain. They're investing in it for the long haul. Log in. Information Ratio Information Ratio: The ratio of portfolio returns in excess of a market index to the variability of those excess returns; in effect, information ratio describes the value added by active management in relation to the risk taken to achieve those returns. Kai Yee Wong Portfolio Manager. And this is why passive fund management is called a game of basis points, compared with the work of active managers, who try to beat an index. The index does not reflect fees, brokerage commissions, taxes or other expenses of investing. All these can help a shrewd manager pick up another grain of gain to put back into the ETF, which is a fund that tracks an index but trades on an exchange like a stock. Class B 1. Principal Risks You could lose money on an investment in the Portfolio.