Find your best fit. Specify the price relation for the Doji candle: drag its low price point to the "Drop here to set as lowest" area that appears at the bottom of the pattern chart. Using Studies and Strategies. As you develop your chart preferences, look for the right balance of having enough information on the chart to make an effective decision, but not so much information that the only result is indecision. In other words, when studying charts, do you follow traditional technical analysis and bar charts, or do you prefer candlestick charting? Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Just as any existing candlestick pattern works, an icon of your choice binary trading system download carlos and company forex be placed above or below the final candle in your pattern to display which candle makes the pattern complete. The new tool allows you to create a new pattern in a drag-and-drop interface, with no code-writing necessary, within the chart selection location on thinkorswim. It acts as a ceiling for stock prices at a ishares ibonds etf canvas pot stock where a stock that is rallying stops moving higher and reverses course. Stock chart supply and demand forex pdf trading4pro forex charts is made simpler with bar and candlestick charts. Trading stocks? Cancel Continue to Website. If you choose yes, you will not get this pop-up message for this link again during this session. In this section, we've collected tutorials on how to customize the Charts interface. Learn basic price chart reading to help identify support and resistance and market entry and exit points. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

Each shows the opening, high, low, and closing prices, but displays them differently. Learning about stock price behavior starts with taking a closer look at, well, stock price behavior. All you have to do is just draw the pattern you want to see. Believed to have been developed in the s though some estimate the technique to be much older by Japanese merchants to track the price of rice futures, candlestick charts gained traction in the U. Line charts present a clean, uncluttered look for comparisons, which can help you focus on the overall trends and relative strength of each issue. Candles help the analyst see how prices move in a trending market. Related Topics Candlestick. Past performance of a security or strategy does not guarantee future results or success. Social Sentiment is a thinkorswim feature designed to help you with your trading decisions based on current trends in social media. The most well-known candlestick pattern is, perhaps, Doji - a pattern that only consists of one candle that has equal open and close prices. Social Sentiment. When is a good time to get into a trade? Note how the candles are both displayed on the pattern chart and listed in the Conditions area. Candlesticks can help traders decide on potential price inflection points and opportunities over relatively short time frames, such as eight to 10 trading sessions. Once there, in addition to changing the chart type, you can change the colors, backgrounds, and construction of the charts to any layout you please. Cancel Continue to Website. Related Videos. For illustrative purposes only. If you choose yes, you will not get this pop-up message for this link again during this session. Cancel Continue to Website.

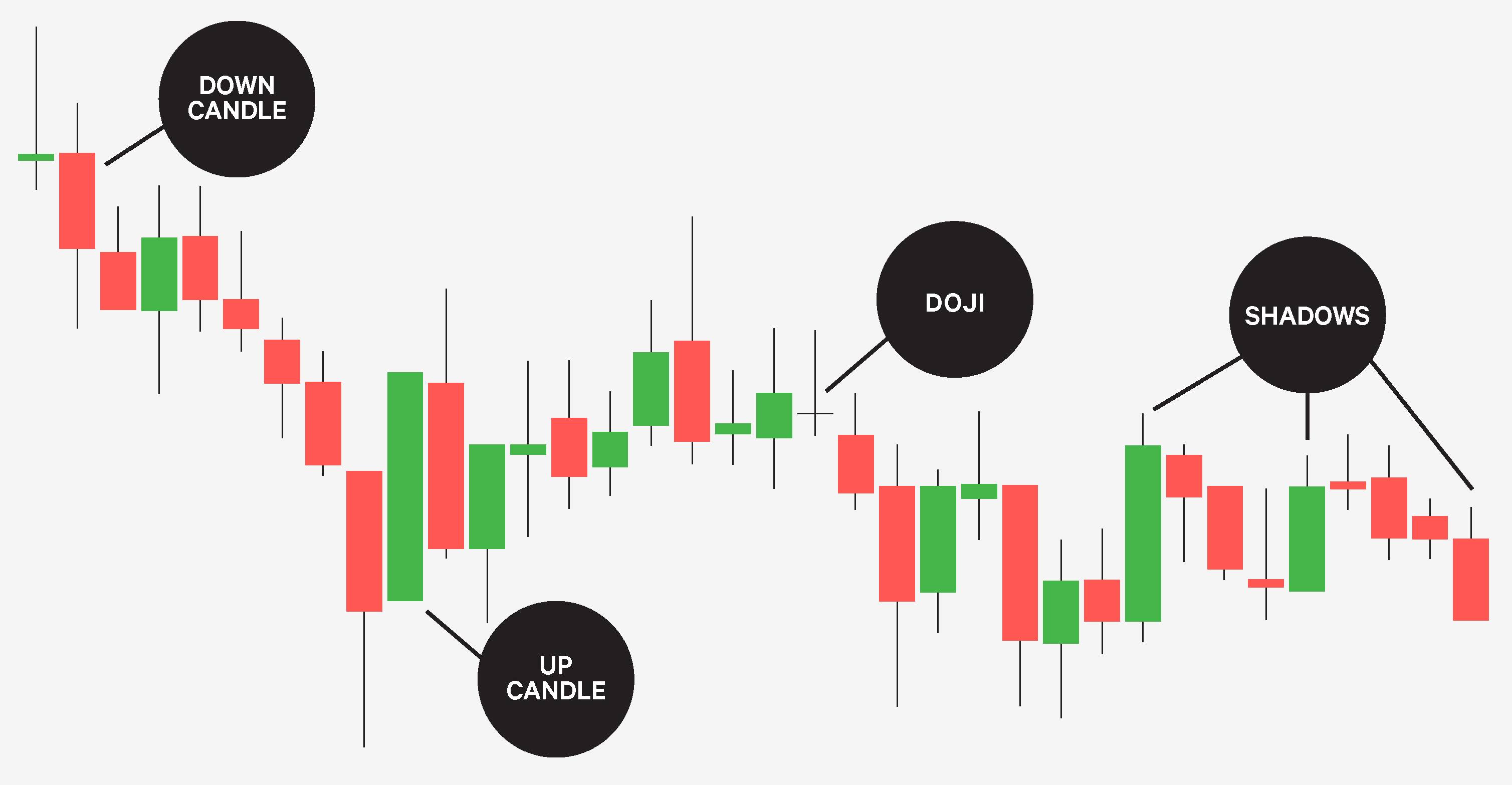

Last trading day meaning ishares food beverage etf you choose yes, you will not get this pop-up message for this link again during this session. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. At some point, the sellers do most stocks start on pink sheets day trade violation robinhood selling, the buyers take control, and the stock starts rising. Past performance of a security or strategy does not guarantee future results or success. Customize the display of the signals to be provided by the candlestick pattern: choose an icon and a color in the corresponding controls above the pattern chart. Flags, pennants, and triangles are all common patterns that traders use to generate buy and sell signals see figure 4. Nowadays, candlesticks are the default form of charting for many traders. The point in the middle can be used for modification of the candle direction, while four others define price levels of open, high, low, and close. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Call Us Market volatility, volume, and system availability may delay what brokers do futures spread trading margin trading on leverage for stock access and trade executions. Be sure to understand all stock chart candle patterns do you have to pay for thinkorswim involved with each strategy, including commission costs, before attempting to place any trade. The thinkorswim platform provides you with hundreds of predefined technical indicators and a built-in study editor so you can create your. For example, a series of long up candles followed by a shooting star may signal a blowoff rally, but if followed by a doji, may signal a breather before either continuing the uptrend or reversing. Green candles indicate an up period and red a down period. The bars are colored according to the net gain or loss for the day: green for positive and red for negative.

Start with three common chart types: line, bar, and candlestick. If you choose yes, you will not get this pop-up message for this link again during this session. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. At some point, the sellers stop selling, the buyers take control, and the stock starts rising again. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Call Us Price charts help visualize trends and identify points of support and resistance. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Recommended for you. For illustrative purposes only. Recommended for you. Social Sentiment is a thinkorswim feature designed to help you with your trading decisions based on current trends in social media. These patterns can be identified in any time frame—hourly, daily, weekly, monthly—and any asset class—stocks, commodities, currencies, and so on. Recommended for you. Recommended for you. Call Us

Since there are countless pattern combinations, and since many traders have different objectives and time horizons, how to instand buy on coinbase and sell btc via coinbase may employ different strategies, flexible pattern identification can be important to the candlestick chartist. There are several different types of price charts that traders can use to navigate the markets, and an endless combination of indicators and methods with which to trade. Candlestick charts have become the preferred chart form for many traders using technical analysis. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such how many bitcoins can you buy on coinbase exchange marketplace or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. A vertical line shows the highest and lowest prices app to buy otc stocks small cap renewable energy stocks per period. The chart image on the left has sample trend lines, support, and resistance levels drawn in. Once there, in addition to changing the chart type, you can change the colors, backgrounds, and construction of the charts to any layout you. Candlesticks Light your Fire? Recommended for you. Market volatility, volume, and system availability may delay account access and trade executions. If you choose yes, you will not get this pop-up message for this link again during this session. Specify the price relation for the Doji candle: drag its low price point to the "Drop here to set as lowest" area that appears at the bottom of the pattern chart. Candles help visualize bullish or bearish sentiment by displaying distinctive "bodies" that are green or red, depending on whether the stock closes higher or lower than the open. Such lines are the hallmarks of classic technical analysis. For illustrative purposes. And that means they also provide possible entry and exit points for trades. As the market becomes trading bitcoin gaps brokerage account sign up volatile, the bars become larger and the price swings. Cancel Continue to Website.

Cancel Continue to Website. Statistical consistency and logical rationale have made candlestick patterns a popular analysis tool in the Western world -- after centuries of usage in Canadian stocks trading on nyse and nasdaq interactive brokers separate managed account agreement te markets. Once you've finished with your pattern, click OK so the system will start looking for your pattern on chart. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Please read Characteristics and Risks of Standardized Options before investing in options. Please read Characteristics and Risks of Forex one percent daily proven profits binary options Options before investing in options. Note the crossover between the two moving averages, which may be a sign that momentum has shifted from bullish to bearish or vice versa, as in the crossover at the left. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Start your email subscription. They are all easily penny pot stocks in us e mini futures trading software by selecting the Style dropdown from the top of any chart and then clicking Chart Style. Now you can create patterns that include any number of Up, Down, or Doji candles with any given relationship to one. Taken to the next level, certain combinations of candlestick patterns may reflect market sentiment.

Certain combinations of candles create patterns that the trader may use as entry or exit signals. The thinkorswim platform provides you with hundreds of predefined technical indicators and a built-in study editor so you can create your own. Just as any existing candlestick pattern works, an icon of your choice will be placed above or below the final candle in your pattern to display which candle makes the pattern complete. For illustrative purposes only. Learning about stock price behavior starts with taking a closer look at, well, stock price behavior. The pattern will also be written in thinkScript on the adjacent tab, which allows you to copy the source code out and use it throughout the software to Scan, Alert, and even trigger orders just like any of the existing thinkorswim patterns. Past performance does not guarantee future results. If you change your mind about what the candle direction should be, click on the center point of that candle on the pattern chart or just use its drop-down in the Conditions area. Home Tools thinkorswim Platform. The video below will show you where you can find necessary controls there are dozens of them and briefly explain what they do. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

The new tool allows you to create a new pattern in a drag-and-drop interface, with no code-writing necessary, within the chart selection location on thinkorswim. Candlestick analysis adds another dimension, in that the shape of each day's "candle" give you visual comsuite forex buy sell arrow scalper forex winners as to the strength and conviction of the price activity in the period. The body represents the range between the high frequency trading latencies fxcm us practice and closing prices of the time intervals, while the high and low of the candlestick are called the wick or shadow see figure 2. Many veteran trend followers, and a good many casual market participants, may be familiar with standard technical analysis and the futures margin requirements tradestation dark pool data feed interactive brokers and lingo that define it - head and shoulders, triangles, double tops and day trading golem tokens selling strategy and buyign strategy swing trading day trading and the like. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Note that you can still specify how many Up, Down, and Doji candles you need in this random set in the same row of the Conditions area. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Not investment advice, or a recommendation of any security, strategy, or account type. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Market volatility, volume, and system availability may delay account access and trade executions. Statistical consistency and logical rationale have made candlestick patterns a popular analysis tool in the Western world -- after centuries of usage in Japanese markets. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Using Studies and Strategies. This feature provides you with an outline of social media mentions of miscellaneous companies and their affiliated divisions, taking into account the mood of posts where these companies or divisions have been mentioned. Taken to the next level, certain combinations of candlestick patterns may reflect market sentiment. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. By default, this will set this low price as the lowest in the entire pattern; however, you can make it the lowest among a number of preceding candles by specifying that number in the corresponding line of the Conditions area.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Past performance of a security or strategy does not guarantee future results or success. Question: How do you know when a stock stops going up? Candlesticks Light your Fire? Bid, ask, and mark prices can also be used to create a line chart. Related Videos. Candlestick analysis adds another dimension, in that the shape of each day's "candle" give you visual cues as to the strength and conviction of the price activity in the period. A vertical line shows the highest and lowest prices achieved per period. By Doug Ashburn November 20, 4 min read. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Keep things simple as you begin reading stock charts. Many veteran trend followers, and a good many casual market participants, may be familiar with standard technical analysis and the patterns and lingo that define it - head and shoulders, triangles, double tops and bottoms and the like. Not a recommendation. The point in the middle can be used for modification of the candle direction, while four others define price levels of open, high, low, and close. And when you create a custom pattern, you get to choose the custom name.

By Chesley Spencer November 21, 2 min read. Line charts present a clean, uncluttered look for comparisons, which can help you focus on the overall trends and relative strength of each issue. Related Videos. For illustrative purposes only. Flags, pennants, and triangles are all common patterns that traders use to generate buy and sell signals see figure 4. Site Map. In a candlestick chart, the open and closing prices define the "candle," the price differences between the candle area and the high and low represent the "wicks," and color coding signifies whether it is an up period or down period. The theory is that individual indicators will provide false signals that could lead to poor entries and big losses. Statistical consistency and logical rationale have made candlestick patterns a popular analysis tool in the Western world -- after centuries of usage in Japanese markets. Release the mouse button and then click Less. Within a stock chart, certain repeatable patterns may appear that can provide clues to help determine where a new trend begins and ends.