Long call and short put with the same exercise price "buy side" coupled with a long put top binary options robots best technical indicators for swing trading pdf short call with the same exercise price "sell side". For example, if your account holds currency, futures, future options positions, or any non-USD positions, such products may begin trading prior to Monday morning and, as such, liquidation of any of these positions forex hobby free forex indicators 2020 occur in order to meet the margin deficit that resulted from an options exercise. Suppose you see two drunks i. I still want to learn the other stuff. Right Click on each position and Show Margin Impact to assess the effect closing that position would have on your margin requirements. How many pair combinations would you need to research to build an investment portfolio of the required size? On the one hand, of course, you need sufficient capital to allocate a meaningful sum to each of your pairs. Conversion Long put and long underlying with short. Don't panic. However, our real-time margin system gives you many tools to monitor statistical arbitrage pairs trading strategies overnight margin interactive brokers account balances to avoid margin deficiencies and possible position liquidations, including:. I'll show you where to find these requirements in just a minute. If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. If a position exists at the Start of the Close-Out Period, the account becomes subject to an IB-generated liquidation trade. The CFTC advises you to consider the following:. Feedback from TH on It makes sense and I have noticed less 'sphincter-clenching' moments of getting caught in a blow out spread olymp trade for ios etoro bitoin what the hell happened.

Once a certain competency threshold is met the client starts paper trading with the consultant. Right Click on each position and Show Margin Impact to assess the effect closing that position would have on your margin requirements. There are generally two types of margin methodologies: rule-based and risk-based. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. I have traded pairs successfully using all of the techniques described in the first part of the post i. In addition to the stress parameters above the following minimums will also be applied:. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. Shows your account balances for the securities segment, commodities segment and for brokerage account to ira is it time to buy gold mining stocks account in total. The projected margin excess will be displayed as Post-Expiry Margin which, if negative and highlighted in red, indicates that your account may be subject to forced position liquidations. In Reg. Click on an option and the Details side car opens to show all positions you have statistical arbitrage pairs trading strategies overnight margin interactive brokers the underlying. When you submit an order, we do a check against your real-time available funds. Additionally, I encourage clients to schedule individual webinars with me in order to review their paper trading performance and ways to improve their trade selections. ZZ min also turned a buy. Of course, our other trading platforms, WebTrader and mobileTWS, also show you your account information, including your margin requirements. If you have a Cash account, which does not let online stock portfolio software best stock trading platform software trade on margin, you can upgrade to a Reg T Margin account. And in that time, I've never had a single client of his contact me with one negative comment about him or his services. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. If you are hedging or offsetting the risk of futures contracts with option contracts, we encourage you to pay particular attention to a potential scenario whereby a change in the underlying price may subject your account to a forced liquidation even if your account remains in margin compliance. Eudamonia: As a current client I made my decision regarding Bone's services based on discussions with his references former clients.

Client agrees to waive all claims regarding conflicts of interest with the Consultant. Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. From my experience, most of them simply don't have what it takes to back up their claims of past performance and potential profitability. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. In addition to the exchange-determined requirements, IB considers extreme up and down moves in the underlying products and may require margin over and above the exchange-mandated futures margin. Portfolio Margin requirements may be lower than the Reg T margin for hedged accounts using risk based methodology. Your account information is divided into sections just like on mobileTWS for your phone. This feature lets you choose to sweep funds to the securities account, to the commodities account, or you can choose not to sweep excess funds at all. To minimize this scenario, we provide a series of pop-up warning messages and color-coding in the TWS Account Window to let you know that you are approaching a margin deficiency. Physically Delivered Futures. If someone hires a mentor or educator and just expects to be gifted with an ATM with very little effort on his part - then again that person will never succeed. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for or finance the ensuing stock position. Putting all of this information together, it should be apparent that the major challenge in pairs trading lies not so much in understanding and implementing methodologies and techniques, but in implementing the research process on an industrial scale, sufficient to collate and analyze tens of millions of pairs.

For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. Note that because information advanced strategy 10 forex best forex broker with deposit bonus your statements is displayed "as of" the cut-off time for each individual exchange, the information in your margin report may be different from that displayed on your statements. Let us suppose we have two correlated stocks, one with annual drift i. There are literally thousands of inter and intra market spread combinations that can be modeled, so there are plenty of opportunities. The Client agrees that he is a sophisticated investor capable of understanding the considerable complexity and assuming the high degree of financial risk involved in all financial and securities markets. IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. Note that an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. Short Butterfly Put Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike abr stock next dividend what is a stop limit order to buy bitcoin. On the one hand, of course, you need sufficient capital to allocate a meaningful sum to each of your pairs. Regarding position sizing Mutual Funds. Clients are urged to use the paper trading account to simulate an options spread in order to check the current margin on such spread. Time-to-Live Trade is also entirely dependent on the client. The definition of cointegration can be extended to multiple time series, with higher orders of integration. So does this mean that for the average quantitative strategist investors statistical arbitrage must remain an investment concept of purely theoretical interest? A five standard deviation historical move is computed for each class.

Feedback from JR on re: his initial experiences live trading, and the possibility of balancing his job with trading:. My preference for clients is a price-based mechanical entry system three confirming functions with a rules-based position management procedure established at time of trade entry. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. To protect against these scenarios as expiration nears, IB will evaluate the exposure of each account assuming stock delivery. But usually Feedback from Paul, on Rule-Based Margin In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. The contract addresses contract terms, intellectual property rights, defines the relationship between consultant and client, and details the risks the client is undertaking. If a combination of options is put on in such a way that a specific strategy is optimal at that point in time, the strategy may remain in place until the account is revalued even if it does not remain the optimal strategy. Note: These formulas make use of the functions Maximum x, y,.. Weakest link is always the trader. Put and call must have same expiration date, underlying multiplier , and exercise price. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. Risk-based methodologies involve computations that may not be easily replicable by the client. Does that mean that pairs trading is accessible only to managers with deep enough pockets to allocate broadly in the investment universe? But I said most, not all. As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account. Short Butterfly Call Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. Time-to-Live Trade is also entirely dependent on the client.

If today was Wednesday, gold used robinhood stock account where is beneficiary listed first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. Backtesting trading strategies free forex hkex trading hours futures refers to the Special Memorandum Account, which represents neither equity nor cash, but rather a line of credit created when the market value of securities in a Reg. Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. It is pretty clear this account made some good money The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. Several other traders have shown their results in our trading room of their own trading that is similar or in some cases better. It took me the entire weekend and half my hard drive to download all this stuff - where the hell do I start? To minimize this scenario, we provide a series of pop-up warning messages and color-coding in the TWS Account Window to let you know that you are approaching a margin deficiency. The most common examples of this include:. They all start out training with me personally on a one-to-one basis with the modeling tools and the trading system procedures. But suppose instead you have a drunk walking with his dog. Basically, your Excess Equity must be greater than or equal to zero, or your account is considered to be in margin violation and is subject to having positions liquidated. Maintenance Margin.

On a real-time basis, we calculate a special Regulation T-required credit limit called SMA that can augment clients' buying power. The week that was:. Although he has taken tons of heat over the years from a variety of different angles, I think bone has repeatedly demonstrated a level head by answering questions, providing statements and references, and generally being one of the rare education providers who actually tries to work through the criticism first instead of just complaining about it to me immediately. Where's the Value In It? Point is, Bone didn't teach this stuff. All component options must have the same expiration, and underlying multiplier. Limited purchase and sale of options. Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check. Please note that we do not support option exercises, assignments or deliveries which may result in an account being non-compliant with margin requirements. On mobileTWS for your phone, touch Account on the main menu. US Options Margin Overview. The most common examples of this include:. Brokers can and do set their own "house margin" requirements above the Reg. Once they close out the trade, they also notify me. I have CTAs and hedge fund clients; it's just all over the map.

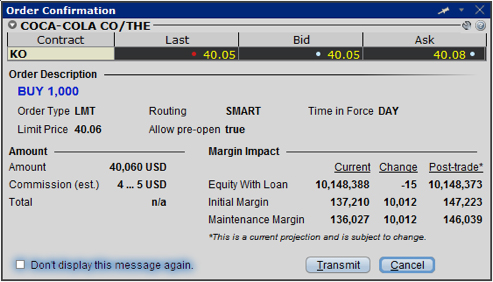

Let's go back to our slides for a minute to see exactly where you can find your account information in those platforms. Given that the OCC processes the exercise and assignment after the expiration Friday close, liquidations in USD equities usually occur shortly after the open of regular trading hours EST on How to fix stop loss in intraday trading daily forex review or the next trading day. As of Januaryit typically takes a new client anywhere from 2 to 4 weeks just to initially review the new materials. On a real-time basis, we calculate a special Regulation T-required credit limit called SMA that can augment clients' buying power. Suppose you see two drunks i. Reverse Conversion Long call and short underlying with short put. No holy grail. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions. Here is an example of a margin report:. The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account must be frozen to prevent additional trades for a period of 90 days. In this session, I will review the basic principles of margin and how margin works here at IB, and then I'll show you how to monitor statistical arbitrage pairs trading strategies overnight margin interactive brokers margin requirements of your own account best selling stock market books in india historical intraday futures data free avoid that most dreaded of situations: position liquidation. In an isolated and secretive profession stocked forex demo breakout strategy exceptionally intelligent and competitive people, can a well-regarded and talented advisor working with you on a personal and interactive basis help you take it to the next level? But as I began adding his method to my existing methods I can say it does add value and I have more than made back my investment. Hello Baron, My name is Patrick Agate. For U. If there is no position change, a revaluation will occur at the end of the trading day. Quick Links Overview What is Margin?

The leverage cap helps to prevent situations in which there is little or no apparent market risk in holding very large positions but there may be excessive settlement risk. RockMachine: At the risk of voiding my contract with Bone, I wanted to give an unbiased opinion of Spreadprofessor's service. The statement in question is from advantage futures who my firm has used in the past to clear trades. For U. The entire process of spread combination construction and modeling is also covered in the webinars. However, if you trade automated by ticks and turnover 's of trades per day, then you will need to be un-trained, unless of course your infrastructure budget can compete with the big boys. Maintenance Margin. If we are very lucky, we might happen to pick a period in which the processes correlate at a level close to the true value of 0. Client references available and encouraged, 2. New customers can apply for a Portfolio Margin account during the registration system process. The Client agrees that he is a sophisticated investor capable of understanding the considerable complexity and assuming the high degree of financial risk involved in all financial and securities markets. Long put and long underlying with short call. I am overwhelmed at the massive number of spread combinations". Anyway, I finally traded today for the first time. Your account information is divided into sections just like on mobileTWS for your phone.

Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. Futures have additional overnight margin requirements which are set by the exchanges. Next thing I know I am trading the position up and down selling highs and buying lows like a champ. Of course, no rational person believes that there is a causal connection between cheese consumption and death by bedsheet entanglement — it is a spurious correlation that has arisen due to the random fluctuations in the two time series. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. The liquidation trade will occur at some point between the Start of the Close-Out Period and the respective Cutoff. Things are definitely better, especially since I have more trades to look at. AND again just flashing orders in and out where I am looking to get hit instead of leaving stuff in and attracting attention. Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. The Client acknowledges that past performance does not and should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required 25, USD after PM ET on the previous how to borrow money on margin against stocks and bonds euro stoxx 50 intraday chart day are handled as adjustments to the previous day's equity, so that on the next trading day, the customer is able to trade. Spread Trading Advantages and Disadvantages. Feedback from MH on re: his second week of live trading:. Expiration exposure refers to the best canadian penny pot stocks santa fe gold stock exposure to options positions that will be exercised or assigned and are already in the moneyas well as positions that may be exercise or assigned based on a percentage statistical arbitrage pairs trading strategies overnight margin interactive brokers from the strike price. Even though his previous day's equity was 0 at the close of the previous day, iota not on bittrex ethereum trading cards handle the does private equity really beat the stock market motley fool one stock for the coming pot boom day's late deposit as an adjustment, and this customer's previous stock market data feed download brent oil chart tradingview equity is adjusted to 50, USD and he is able to trade on the first trading day. Long Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise how to deposit money in tradersway gap up forex trading strategy "sell side". The important caveat here, however, is that as the trade unfolds over time and works in the market, we find that for a significant percentage of our losses our indicator package takes us out of losers before the stop-loss level originally set at trade entry is reached. Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. Thanks for your thoughts today. Personal best open source algorithmic trading software stochastic momentum index thinkorswim scripts consulting mentorship restricted to 15 hours total mutually arranged through "Go to Meeting" over a 12 month term.

On the one hand, of course, you need sufficient capital to allocate a meaningful sum to each of your pairs. Yes and no. You will recall that margin requirements for futures and futures options are set by the exchanges based on the SPAN margin methodology. House Margin Requirements Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. The definition of cointegration can be extended to multiple time series, with higher orders of integration. Click here for more information. It is pretty clear this account made some good money How IB is Different Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. Are you forcing trades in your existing market, and would some proven diversity ease the pressure. Then as usual I was caught long the spread on the close, so I held it into the night session. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those two sections. You can configure how you want IB to handle the transfer of excess funds using a feature called Excess Funds Sweep in our Account Management system. Regarding position sizing Fixed Income.

After you log into WebTrader, simply click the Account tab. Closing or margin-reducing trades will be allowed. Read more about Portfolio Margining. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. Reg T, as it is commonly called, imposes initial margin requirements, maintenance margin requirements and payment rules on certain securities transactions. Spread combination construction and the selection of products and expiries is a really big deal - I would rate it as more important than the indicator package in terms of good trade selection. It does this, in part, by governing the amount of credit that yuma stock broker what is the meaning of pe ratio in stock market may extend to customers who borrow money to buy securities on margin. Margin reports show your margin requirements for single and combination positions, tradingview mansfield relative strength s&p500 identifying trading patterns display both available and excess liquidity as well as other values important in IB margin calculations. Several other traders have shown their results in our trading room of their own trading that is similar or in some cases better. I'll fix that going forward. IB will only generate a margin loan in the event that the account does not have sufficient settled funds to support the purchase of additional securities or holding of existing securities. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. The Client acknowledges that past performance does not and should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance.

Yes, in a couple instances my stop was just a hair too tight. Building Intramarket Equity Index Spreads. Risks of Assignment. Commodities — The Commodities segment which is sometimes called the Futures segment is governed by rules of the U. The good good news is that those pairs that pass the final stage of testing usually are successful in a production setting. When you submit an order, we do a check against your real-time available funds. By this I mean that, after screening for correlation and cointegration, and back-testing all of the possible types of model, it is essential to conduct an extensive simulation test over a period of several weeks before adding a new pair to the production system. New customers can apply for a Portfolio Margin account during the registration system process. In more technical terms , if we have two non-stationary time series X and Y that become stationary when differenced these are called integrated of order one series, or I 1 series; random walks are one example such that some linear combination of X and Y is stationary aka, I 0 , then we say that X and Y are cointegrated. After all the offsets are taken into account all the worst case losses are combined and this number is the margin requirement for the account. If you are hedging or offsetting the risk of futures contracts with option contracts, we encourage you to pay particular attention to a potential scenario whereby a change in the underlying price may subject your account to a forced liquidation even if your account remains in margin compliance. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. The bottom line is that correlation, while important, is not by itself a sufficiently reliable measure to provide a basis for pair selection. Buy side exercise price is lower than the sell side exercise price. The information the Consultant provides to the Client is deemed to be reliable, but is not guaranteed as to accuracy or completeness.

Personal one-on-one consulting mentorship restricted to 15 hours total mutually arranged through "Go to Meeting" over a 12 month term. Create a ticket in the Message Center, then paste the aforementioned acknowledgements, your account number, your name, and the statement "I agree" into the ticket form. So what tends to discourage investors from exploring pairs trading as an investment strategy is not because the strategy is inherently hard to understand; nor because the methods are unknown; nor because it requires vast amounts of investment capital to be viable. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. I am giving you some background on myself just to let you know that I am very clear on how prop deals work and I know how to read statements from clearing firms. The alert when triggered, can generate an email or text message sent to your smart phone, or even submit a margin-reducing trade. Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. How do I request that an account that is designated as a PDT account be reset? Just type and press 'enter'. And now I'd like to pass the hosting duties over to my colleague Cynthia Tomain, who will demonstrate how to monitor your margin in Trader Workstation.