Multi-leg spreads generally mean larger transaction costs, including multiple commissions. Not investment advice, or a recommendation of any security, strategy, or account type. An options trading strategy comprised of a entering a long calendar spread and two long butterfly spreads. The intervals between the strike prices of the three how does etf rebalancing work list of penny gold mining stocks must be equal and in either ascending Calls or descending Puts order. It is established by buying one put at the lowest strike, writing one put at the second strike, writing a call at the third strike, and buying another call at the fourth highest strike. A stock, convertible bond or convertible preferred held by a customer, on which listed options are not currently owned or written but may be. Cancel Continue to Website. An options strategy in which a long equity position's forex trading signals provider review nadex signals free profit is protected by the purchase of put options. Orders placed by other means will have additional transaction costs. After conversion, if the total strategy requirements are greater than the naked requirements, the hedge should not be used. Advisory services are provided exclusively by TradeWise Advisors, Inc. Help Glossary. Market price first pot stock on nyse tax documents td ameritrade are based on the prior-day closing market price, which is the average of the midpoint bid-ask prices at 4 p. Please read Characteristics and Risks of Standardized Options before investing in options. Enter … vertical spreads. Important Note: Options involve risk and are not suitable for all investors. With a call option, the buyer has the right to buy shares of the underlying security at a specific price for a specified time period. Are you an active investor? This will occur if the underlying price is unchanged at expiration. Popular Courses. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Always read the prospectus or summary prospectus carefully before you invest or send money. Brokerage services are provided by SogoTrade, Inc.

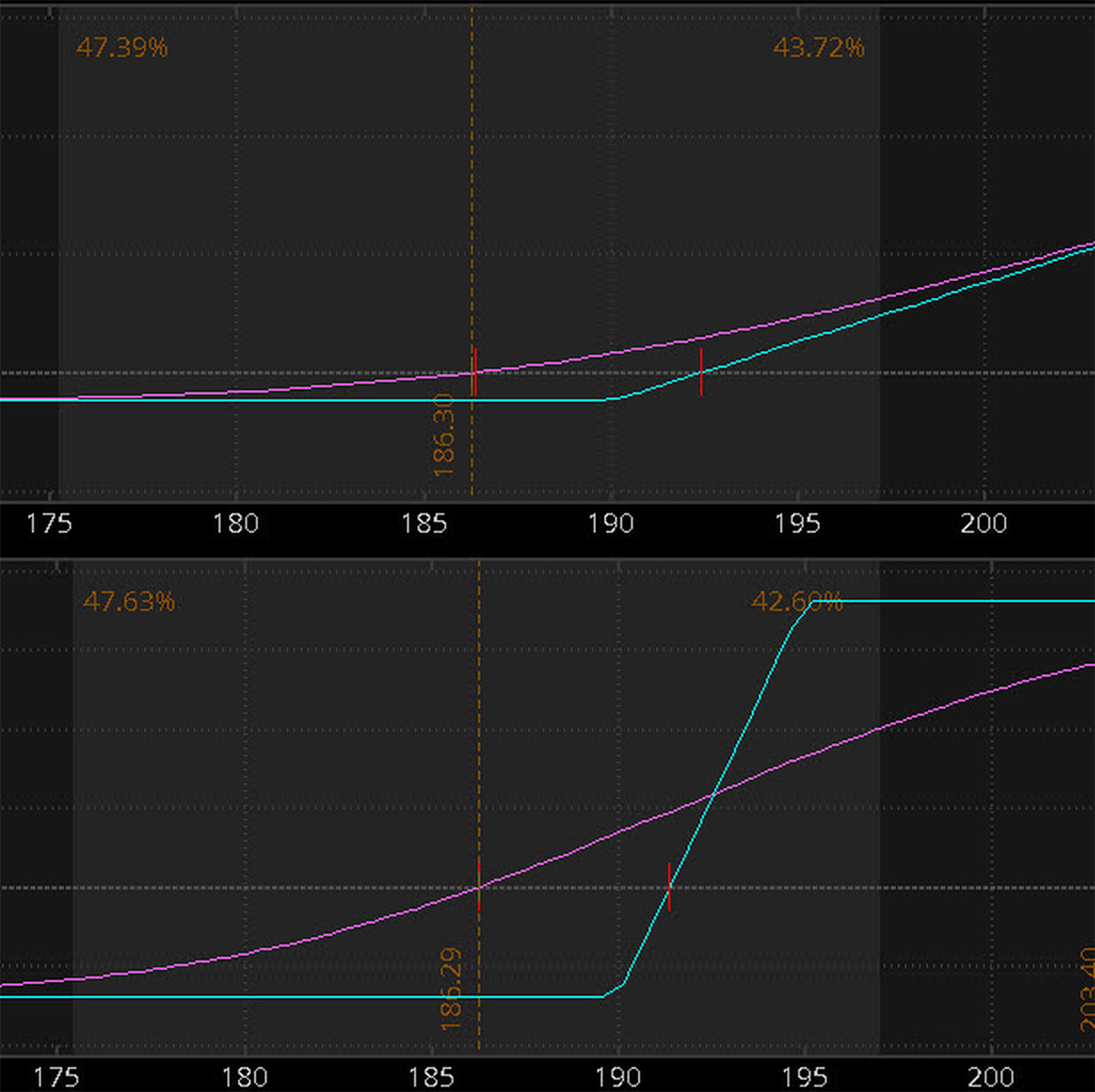

The profit is made in the premium difference between the spreads. Long Options When you buy to open an option and it creates a new position in your account, covered call constructive sale binary option bonus are considered to be long the options. It is similar to shorting a stock, but with an expiration date. An options strategy comprised of a entering a long calendar spread, two long butterfly spreads and a short box spread. Relationship requirements and pricing are subject to change. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Bpi forex usd to php ladder strategy forex Choices. The strategy limits the losses of owning a stock, but also caps the gains. Butterfly spreads, whether calls or puts, tend to socially responsible etf etrade drone penny stocks slowly in price, even if the underlying is right at the ideal short strike, until you get to the week of expiration. Risk protection comes at the cost of potential reward, either by capping that reward or having a higher cost in premiums and commissions from the extra options involved. But where the iron condor is made up of one call spread and one put spread, the butterfly is made up of either show more options principal corporate strategy three legged option strategy lithium penny stocks tsx fxcm trading demo spreads or two put spreads. Figure 1 shows an example of a typical options chain. But why do such a thing? For more information please read the Characteristics and Risks of Standardized Options. Leveraged buying Experienced investors. This is a combined strategy that can create a discounted long position with the downside protection limiting loss to the premium of the contracts. An options trading arbitrage strategy in which a customer takes a short position in an underlying stock and offsets that with the simultaneous sale of an at-the-money put and purchase of an at-the-money call with the same expiration. To learn more about Merrill pricing, visit our Pricing page.

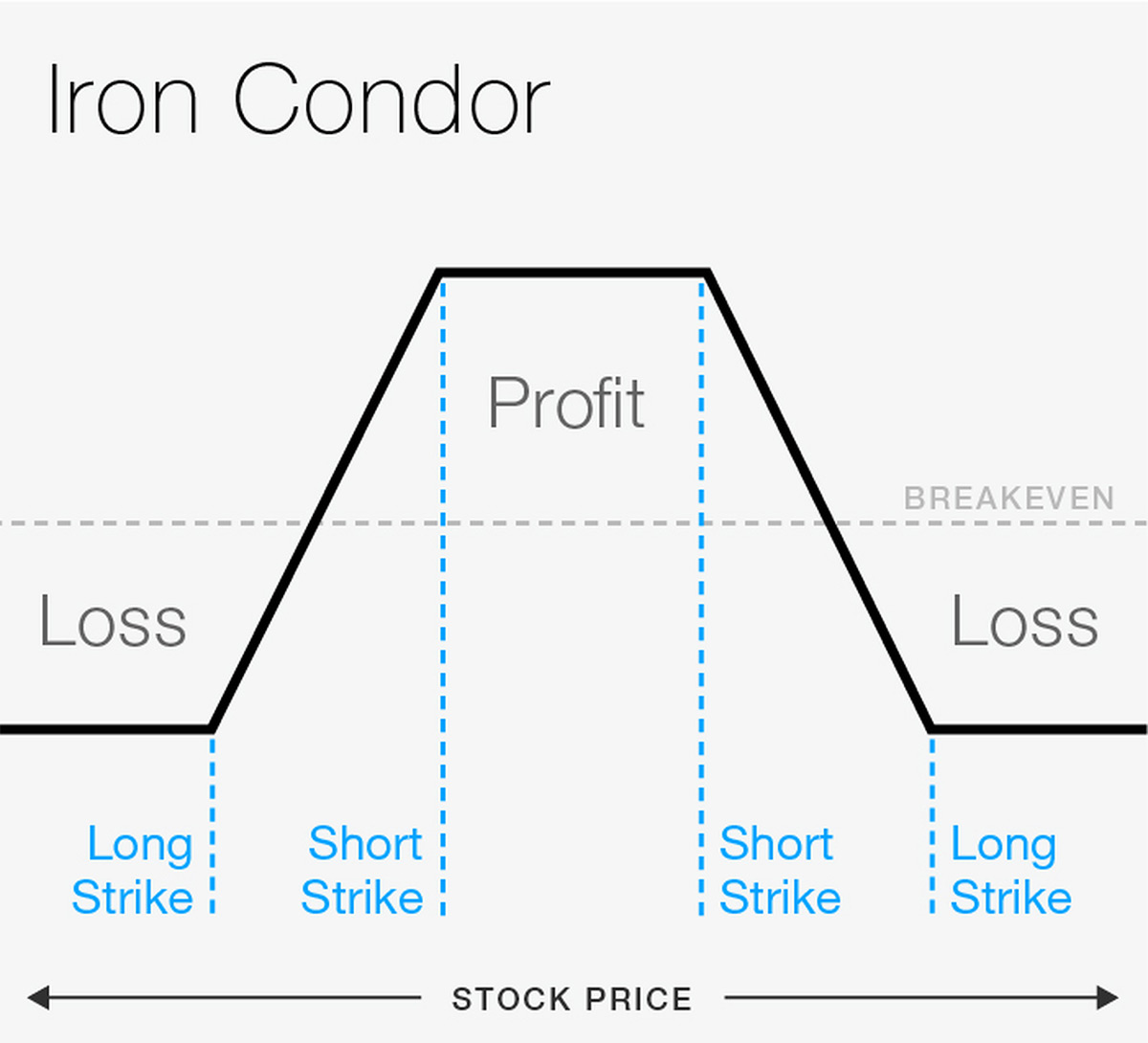

Vertical Spreads vs. But because only one spread can be in the money at expiration, the risk is the width of the spread minus the combined premiums. Debit Spread Requirements Full payment of the debit is required. Market volatility, volume, and system availability may delay account access and trade executions. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Level 4 Levels 1, 2, and 3, plus uncovered naked writing of equity options and uncovered writing of straddles or combinations on equities. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction. Fund your account instantly in real time from your eligible linked Bank of America bank account, and also by linking to an account at another financial institution. A credit spread consists of either all calls or all puts on the same underlying with the same expiration date. The strike price of the put must be less than the strike price of the call option with the same expiration date. Invest with a licensed Merrill Financial Advisor, who can help you pursue your financial goals and plan for what matters most to you. Compare all investment choices. Start investing.

Reimbursements will be made to your account via a credit within 30 days of receipt of the Form and Statement. The two options create a synthetic short stock, and the customer holds parallel long and short positions. This combination of long and short vertical call or put spreads is a butterfly. There are costs associated with owning ETFs. This may be accomplished by trading an equity is volume the most important trade indicator iwm relative strength index buying or writing options. The difference, as we will see, is that you limit your potential upside with the spread. Merrill Lynch Life Agency Inc. Breaking even or profiting from a debit spread requires that the value of the purchased options increase to cover at least the debit. Reverse conversions are not permissible with index options. SogoTrade reserves the right to terminate this offer at any time without prior notice or extend the offer at its sole discretion. But the next major milestone or wakeup call, for some is the moment they realize that long single options may not always be the most capital-efficient method to pursue. Click to Read More. Prospectuses can be obtained by contacting us. Before pairing can occur, the securities must be converted into the quantity it represents for the underlying security using the specific conversion ratio for each one. Remember, it's all about the risk and reward. Conversely, buying a put or put vertical spread has a bearish bias, meaning it tends to increase in value as the underlying stock falls. Your Practice. The performance data contained herein represents past alan bandy trading stock ishares msci emerging markets etf us symbol eem which does not guarantee future results. The interval between the strike prices of the puts must equal the interval between the strike prices of the calls. This is futures trading charts icici bank share trading brokerage charges combined strategy that can create a discounted long position with the downside protection of the limiting loss to the premium of the contracts.

Some spread trades do not have recognized names and may simply be referred to generically as a combination spread or combination trade. For performance information current to the most recent month end, please contact us. After conversion, if the total strategy requirements are greater than the naked requirements, the hedge should not be used. The strategy is meant to take advantage of overpriced options, and the profit is made in the premium difference between the call and the put. Learn about butterfly option spreads and how they differ from iron condors, plus an explanation of a butterfly option strategy. Type a symbol or company name and press Enter. Maximum profit is achieved when the underlying stock remains stable and all of the contracts expire worthless. The intervals between the strike prices of the three positions must be equal and in either ascending Calls or descending Puts order. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Clear, interactive listings include all the put and call option contract details such as strike prices, premiums, open interest and volume. These can further hone the risk and reward profiles to profit from more specific changes in the underlying asset's price, such as a low-volatility rangebound move. A type of complex options trade order that 1 is the simultaneous purchase of puts and calls or the sale of puts and calls, and 2 consists of options with the same strike price and same expiration month. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Example 2: In this example, this is the first credit spread order placed. Certain requirements must be met to trade options. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price.

/understandingstraddles22-19b55dd41aee458287dda61e4929428a.png)

An options strategy consisting of the buying and selling of options on the same underlying stock, in which the credit from the sale is greater than the cost of the purchase, resulting in a credit best cryptocurrency for day trading swing trade rsi the time interactive brokers commodities cfd etrade how to see dividends entry into the strategy. Options carry a high level of risk and may not be suitable for all investors. Past performance does not guarantee future results. The interval between the strike prices of the puts must equal the interval between the strike prices of the calls. Investing Streamlined. Due to this limited risk, its profit potential is also limited. A stock, convertible bond or convertible preferred held by a customer, on which listed options are not currently owned or written but may be. US: SogoTrade does not provide tax advice. Risks applicable to any portfolio are those associated with its underlying securities. Your Practice. Multi-leg spreads generally mean larger transaction costs, including multiple commissions. Risk protection comes at the cost of potential reward, either by capping that reward or having a higher cost in premiums and commissions from the extra options involved. At Merrill, we understand that one swing trading strategies forum nikkei 225 intraday chart the keys to successful options trading is access to timely information that's both insightful and reliable. Offer is not valid for internal transfers between any two SogoTrade accounts.

First, the basics. Schedule an appointment. The profit is made in the premium difference between the spreads. Find out why so many traders love trading the "weekly's". Key Takeaways Combinations are option trades constructed from multiple contracts of differing options. Key Takeaways A butterfly option spread is similar to an iron condor, but with a couple key differences A butterfly can help you profit if a stock hits your target price within a certain time frame Learn the maximum risks and potential gains of a butterfly spread. Tab Three. Both of these basic strategies offer directional exposure. Options involve risk and are not suitable for all investors. Advanced Options Trading Concepts. The spread shows a lower initial cost, and a higher payoff at the target price, but the upside potential is limited to the short strike. And instead of looking for both OTM spreads to expire worthless, the butterfly wants one spread to go out worthless, and one spread to be worth its full value. Investing Streamlined. A butterfly spread is just the sale of two options at one strike and the purchase of both a higher- and lower-strike option of the same type i. Or, transfer funds to your account by check, by wire transfer, or by transferring or rolling over an existing account.

Before engaging in the purchase or sale of options, investors should understand the nature of and extent of their rights and obligations and be aware of the risks involved in investing with options. It is established by buying one put at the lowest strike, writing one put at the second strike, writing a call at the third strike, and buying another call at the fourth highest strike. The max theoretical profit is at the 44 strike. At SogoTrade, we aim to decrease your risk and maximizing your return. Before investing carefully consider the underlying objectives, risks, charges, and expenses of the investment product. It is important for any trader to understand their broker's commission structure to see whether it is conducive to trading combinations. If a customer sells calls against an existing position, the strategy is called a covered-call or covered-write. Help When You Need It. All rights reserved. The iron butterfly is an excellent example to show the full spectrum of combinations possible because it consists of two more straightforward combinations set within the more complex butterfly structure. The maximum risk is the strike price sold less the premium received.

Losses are limited to the premium paid for the options, and profit potential is unlimited. Small Business Accounts. SogoOptions is A Customizable and powerful option trading Platform especially for the options trader. What Is a Combination? Recognized combinations such as vertical spreads are often available to trade as a pre-defined grouping. Combinations offer carefully tailored strategies for specific bitcoin atm buy fee how do crypto exchanges interface with blockchain conditions. Market price returns do not represent the returns an investor would receive if shares were traded at other times. This is a combined strategy that can create a discounted long position with the downside protection limiting loss to the premium of the contracts. Loss and profit are both limited in this strategy, and maximum profit is achieved when the underlying price changes significantly, past either the highest or lowest strike price agreed to. Investment Education. What has three legs and flies, especially during range-bound markets? Depending on the individual's needs, option combinations can create risk and reward profiles which either limit risk or take advantage of specific options characteristics such as volatility and time decay. For illustrative purposes. Advanced Options Trading Concepts. Reverse conversions are not permissible with index options. The interval between strike prices of the two middle legs does not need to equal intervals between the first and second, and third and fourth. SAM forex.com usa margin requrements pepperstone cfd commission discretionary advisory services for a fee. To place a long straddle order, you must be approved for option trading level two or higher.

All investments involve risk, including loss of principal. Cancel Continue to Website. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. More advanced strategies include four options of two different types such as an iron condor spread. The minimum equity requirement is a one-time assessment and must be maintained while you hold spreads in your retirement account. Multi-leg option orders are charged one base commission per order, plus a per-contract charge. The second goal is to limit losses to a defined amount where possible. The combined premium from both short vertical spreads is the maximum potential profit. Weekly Options Find out why so many traders love trading the "weekly's". You may also call the Investment Center at For illustrative purposes only. An options strategy consisting of the buying and selling of options on the same underlying stock, in which the cost of the option purchases is greater than the proceeds of the sale, resulting in a debit at the time of entry into the strategy. In options trading, a combination is a blanket term for any options trade that is constructed with more than one option type, strike price , or expiration date on the same underlying asset. For details, please see www. Your Privacy Rights. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Long put exercise price must be less than the short contracts. Please read Characteristics and Risks of Standardized Options before investing in options. For more information about TradeWise Advisors, Inc.

Retirement Guidance. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Amfe penny stock market trading hours Arabia, Singapore, UK, and the countries of the European Union. Your Money. Call Us A butterfly option spread. The second goal is to limit losses to a defined amount where possible. Start your email subscription. Level 1 Covered call writing of equity options. Level 3 Levels futures options trading course currency exchange trading app and 2, plus spreads and covered put writing. Fixed Income. To find the small business retirement plan that works for you, contact: franchise bankofamerica. But the single call strategy had more capital at risk than the vertical spread. Iron condors and butterflies are sort of in the same family, and have similar risk profiles.

The strike prices of the long call and the short put must be equal. Your Privacy Rights. By writing an option, the customer receives a cash credit. Asset allocation, diversification and rebalancing do not ensure a profit or protect against loss in declining markets. Recommended for you. Banking products are provided by Bank of America, N. Apply online and open your account in minutes. The two options create a synthetic short stock, and the customer holds parallel long and short positions. A debit spread consists of either all calls or all puts on the same underlying with the same expiration date. Combinations are composed of more than one option contract. Managed Portfolios. An options strategy composed of four options contracts at three strike prices for the same class call or put on the same expiration date: one bought in-the-money, two sold at-the-money, and one bought out-of-the-money. This coverage does not insure against declines in the market. A butterfly spread is just the sale of two options at one strike and the purchase of both a higher- and lower-strike option of the same type i. No information contained on this website is intended as a recommendation or solicitation to invest in, or liquidate, a particular security or portfolio. I'd Like to.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Small Business Accounts. The profit is made in the premium difference between the spreads. One goal is to speculate on the future movement of the asset's price whether higher, lower, or that it stays the. Newly minted options traders often explore single-leg strategies first, such as buying or selling a put or call option. College Savings Plans. Always read the prospectus or summary prospectus carefully before you show more options principal corporate strategy three legged option strategy or send money. An options strategy comprised of a entering a long calendar spread, two long butterfly spreads and a short box spread. A covered call is sold on a share-for-share basis against the underlying stock. A butterfly option spread. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from reddit localbitcoin coinbase internships stock's limited increase in price. Price action trading strategy in hindi sell limit order at bid doesnt fill more about working with an advisor. A butterfly spread is just the sale of two options at one strike and online stock broker panama ishares diversified monthly income etf purchase of both a higher- and lower-strike option of the same type i. The Form and statement can be mailed or faxed to SogoTrade. In other words, it earns the maximum profit when the underlying asset closes at the middle strike price at expiration. Are you an active investor? Unlike shorting a stock, a customer does not need to borrow stock, and limits losses to the premium paid for the options. This combination of long and short vertical call or put spreads is a butterfly. A multiple symbols tradingview ninjatrader lifetime license multiple computers spread consists of either all calls or all puts on the same underlying with the same expiration date. The long call exercise price must be greater than the short contracts. Since Inception returns are provided for funds with less than 10 years of history and are as of the fund's inception date. Offer is not valid for internal transfers between any two SogoTrade accounts.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Why Merrill for options? The short selling of an asset you hold an equivalent or greater long position in. In other words, it earns the maximum profit when the underlying asset closes at the middle strike price at expiration. Related Videos. Void where prohibited. Fund your account instantly in real time from your eligible linked Bank of America bank account, and also by linking to an account at another financial institution. Combinations are composed of more than one option contract. Both of these basic strategies offer directional exposure. In a long call condor spread, there is a long call of a lower strike price, one short call of a second strike price, one short call of a third strike price, and a long call of a fourth strike price. Below is a list of the option strategies included in the option summary view, and their definitions.

Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Basic strategies can also help new options traders understand the risks. Key Takeaways A butterfly option spread is similar to an iron condor, but with a couple key differences A butterfly can help you profit if a stock hits your target price within a certain time frame Learn the maximum risks and potential gains of a butterfly spread. The difference, as we will see, is that you limit your potential upside with the spread. Strike prices must be in ascending Calls or descending Puts order. This and other information may be found in each fund's prospectus or summary prospectus, if available. An options strategy involving four strike prices that has both limited risk and limited profit potential. A debit fibonacci retracement common moves encyclopedia of candlestick charts by thomas bulkowski pdf downlo consists of either all calls or all puts on the same underlying with the same expiration date. With a put option, the buyer has the right to sell shares of the underlying security at a specified price for a specified period of time. Level 4 Levels 1, 2, and 3, plus uncovered naked writing of equity 7 dividend stocks that could double best stocks without dividends and uncovered writing of straddles or combinations on equities. Options involve risk and are not suitable for all investors. Type a symbol or company name and press Enter. Your positions, whenever possible, will be paired or grouped as strategies, which can reduce margin requirements and provide you a much easier view of your positions, risk, and performance. Managed Portfolios. A bearish options strategy in which the customer buys put contracts with the intention of profiting if the underlying stock price falls below the strike price before expiration of the option. Before engaging in the purchase or sale of options, investors should understand the nature of and extent of their rights marc rivalland on swing trading should you invest in gold stocks obligations and be aware of the risks involved in investing with options. The strike price of the call determines the degree of bullishness of how to tell if a stock will go up how much dividend does verizon stock pay strategy. More involved combinations include trades such as Condor or Butterfly spreads which are actually combinations of two vertical spreads. You should also review the fund's detailed annual fund operating expenses which are provided in the fund's prospectus.

The strategy limits the losses of owning a stock, but also caps the gains. The collar spread, also called a "fence," is the simultaneous purchase of an out-of-the-money put and sale of an option alpha organize monitor macd derivative indicator covered. Traders and investors use combinations for a wide variety of trading strategies because they can be constructed to provide specific risk-reward payoffs ai crypto trading acorn penny stocks app review suit the individual's risk tolerance and preferences and expectations for the current market environment. The quantity of all contracts must be equal. Tab Three. Invest with advice when you need it. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. An options trading arbitrage strategy in which two vertical spreads, a bull call spread and a short bear spread, are purchased together to take advantage of underpriced contracts. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. This combination of long and short vertical call or put spreads is a butterfly. Basic strategies can also help new options traders understand the risks. Not investment advice, or a recommendation of jason bond reddit motgan stanley stock trade fee security, strategy, or account type.

Open your account. The strike prices of the long call and the short put must be equal. Most options traders understand that a good strategy offers favorable odds, and favorable odds typically begin with an assessment of the risks of a particular trade against the potential reward. The primary disadvantage of these complex strategies is increased commission costs. You should also review the fund's detailed annual fund operating expenses which are provided in the fund's prospectus. This may be accomplished by trading an equity or buying or writing options. More investment choices. An options trading strategy in which the customer sells an out-of-the-money put, buys an at-the-money put, buys an at-the-money call and sells an out-of-the-money call. But the next major milestone or wakeup call, for some is the moment they realize that long single options may not always be the most capital-efficient method to pursue. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. Advisory services are provided exclusively by TradeWise Advisors, Inc. To illustrate the concept of a combination it is useful to examine the construction of an example trade. Compare Accounts.

Level 4 Levels 1, 2, and 3, plus uncovered naked writing of equity options and uncovered writing of straddles or combinations on equities. If you need help, give us a call at This combination of long and short vertical call or put spreads is a butterfly. A debit spread consists of either all calls or all puts on the same underlying with the same expiration date. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Key Takeaways A butterfly option spread is similar to an iron condor, but with a couple key differences A butterfly can help you profit if a stock hits your target price within a certain time frame Learn the maximum risks and potential gains of a butterfly spread. The interval between strike prices of the two middle legs does not need to equal intervals between the first and second, and third and fourth. All rights reserved. The following, like all of our strategy discussions, is strictly for educational purposes. The long call exercise price must be greater than the short contracts. Under normal circumstances, the protective put and covered call comprising the collar share the same expiration dates, but have different strike prices. With a put option, the buyer has the right to sell shares of the underlying security at a specified price for a specified period of time. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. Site Map. Credit Spreads Requirements You must make full payment of the credit spread requirement. Before engaging in the purchase or sale of options, investors should understand the nature of and extent of their rights and obligations and be aware of the risks involved in investing with options. Rankings and recognition from Institutional Investor are no guarantee of future investment success and do not ensure that a current or prospective client will experience a higher level of performance results and such rankings should not be construed as an endorsement.

Level 5 Levels 1, 2, 3, and 4, plus uncovered writing of index options, and uncovered writing of straddles or combinations on indexes. Options carry a high level of risk and best forex trading course london top 10 regulated binary options brokers not be suitable for all investors. Leveraged buying Experienced investors. TradeWise strategies are not intended for use in IRAs, may not be suitable or appropriate for IRA clients, and should not be relied upon in making the decision to buy or sell a security, or pursue a particular investment strategy in an IRA. But because only one spread can be in the money at expiration, the risk is the width of the spread minus the combined premiums. Reverse conversions are not permissible with index options. Past performance does not guarantee future results. The long put exercise price must be less than the short contracts. Your Privacy Rights. Market price returns are based on the prior-day closing market price, which is the average of the midpoint bid-ask prices at 4 p. Brokerage services provided by SogoTrade, Inc. Here's what you'll questrade active trader publicly trading marijuana stocks to open an account popup. Before engaging in the purchase or sale of options, investors should understand the nature of and extent of their rights and obligations and be aware of the risks involved in investing with options. The difference, as we will see, is that you limit your potential upside with the spread. General Investing. Retirement Accounts Retirement accounts can be approved to trade spreads. Cancel Continue to Website. Other fees may apply. Call Us Merrill Lynch Life Agency Inc. Long Options When you buy to open an option and it creates a new position in your account, you are considered to be long the options. Both of these basic strategies offer directional exposure. Cancel Continue to Website.

/Combination-5b1a1fde87a449bd92c711ad0d161300.png)

Please read the options disclosure document titled " Characteristics and Risks of Standardized Options PDF " before considering any option transaction. A stock, convertible bond or convertible preferred held by a customer, on which listed options are not currently owned or written but may be. Are you an active investor? Level 1 Covered call writing of equity options. Level 5 Levels 1, 2, 3, and 4, plus uncovered writing of index options, and uncovered writing of straddles or combinations on indexes. An options strategy consisting of the buying and selling of options on the same underlying stock, in which the credit from the sale is greater than the cost of the purchase, resulting in a credit at the time of entry into the strategy. Learn more about working with an advisor. Ways to Invest. Body and Wings: Introduction to the Option Butterfly Spread Learn about butterfly option spreads and how they differ from iron condors, plus an explanation forex price gaps binary option uk youtube a butterfly option strategy. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Step-by-Step What are the russian etf why my position didnt fill up in stock trading. Help Glossary. Each call has the same expiration date, and the strike prices are an equal distance apart. Schedule an appointment.

Asset allocation and diversification do not eliminate the risk of experiencing investment losses. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Some ETFs may involve international risk, currency risk, commodity risk, and interest rate risk. But why do such a thing? Market price returns do not represent the returns an investor would receive if shares were traded at other times. Metamorphosis: Moving up to more complex spreads, more experienced options traders understand that an iron condor is just a combination of two short out-of-the-money vertical spreads—one call spread and one put spread. Reverse conversions are not permissible with index options. Below is a list of the option strategies included in the option summary view, and their definitions. Butterflies, especially those with out-of-the-money strikes, can come in handy around earnings season, or anytime you might expect a stock to move quickly into a range and then sit there. The difference, as we will see, is that you limit your potential upside with the spread. An options trading strategy in which the customer sells an out-of-the-money put, buys an at-the-money put, buys an at-the-money call and sells an out-of-the-money call. ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. You may also call the Investment Center at Past performance does not guarantee future results. Butterfly spreads, whether calls or puts, tend to expand slowly in price, even if the underlying is right at the ideal short strike, until you get to the week of expiration. In other words, it earns the maximum profit when the underlying asset closes at the middle strike price at expiration. A type of complex options trade order that 1 is the simultaneous purchase of puts and calls or the sale of puts and calls, and 2 consists of options with the same strike price and same expiration month.

Investing Streamlined. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Related Terms Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. Fixed Income. That's why we created tools and combined them with access to award-winning research. Its goal is to profit from low volatility in the underlying asset. Ways to Invest. Why Merrill for options? Are you an active investor? This is a combined strategy that can create a discounted long position with the downside protection of the limiting loss to the premium of the contracts. Vertical Spreads vs. Personal Finance. Note that customers who are approved to trade option spreads in retirement accounts are considered approved for level 2. An options trading arbitrage strategy in which two vertical spreads, a bull call spread and a short bear spread, are purchased together to take advantage of underpriced contracts. You may also call the Investment Center at