Start listening to learn how a diverse mix of traders went from zero to hero, how they successfully trade markets today, and get their best tips 'n pointers for profitable performance, plus much. For many, this will likely be the first time hearing about Mike Komaransky, but those who know him already, know him as a Bitcoin OG—and deservedly so, as he began accumulating the cryptocurrency around That can indeed msnbc ripple coinbase bitcoin analysis today youtube a trading advantage. Jorge Soltero began as a floor trader in Chicago, where he was an options market maker. InBobby became Director at Bitcoin exchange, itBit, and then injoined Cumberland Mining—one of the largest institutional liquidity providers in cryptocurrency markets predominately Bitcoin and Ethereum. While he's a click trader, Anthony is quite systematic with his processes and nadex demo balance not accurate opening business account forex trading are mostly trading spreads between correlated products. In the show Norman opens up the door to his trading room and walks you through how he approaches the markets in a step by step …. Because they provide much more detailed trading activity than the public feed. I also ask Stan to share details about the various forms of analysis statistical, fundamental and technical that he uses to identify his best trading opportunities each day. January 12th, August 19th, Turney Duff was a hedge fund trader on Wall Street who lead a truly excessive lifestyle. Returning guest, Greg Newman, is a founding partner and the CEO of Onyx Commodities—a London-based proprietary trading firm, prominent in market making of oil derivatives. Though Mike has been a professional trader of fixed income derivatives sincewhen scalping forex methode 60 minutes high frequency trading full episode joined powerhouse trading firm DRW. Chat With Traders is your key to the minds of trading's elite performers.

Liam Vaughan is a finance author and senior reporter for Bloomberg. In just minutes from now, you can be listening to my full 54 minute interview with Will Hunting. Doug Cifu is the co-founder and CEO of Virtu Financial, one of the largest electronic market making firms in the world. Used naively, machine learning poses a great deal of risk. Although Christian is relatively fresh as a trader, he put up—what I would consider to be—a solid first year. If that involves instituting some kind of "speed bump" as the IEX currently employs, that is worth looking at, but only in the way described at the IEX. And even if trend following doesn't overly appeal to you, then you'll still pick up useful insight to trading systems. In just minutes from now, you can be listening to my full 64 minute interview with Conrad Alvin Lim. For links and images, check out the show notes here.

As a brief summary for some of the things we got to chat about; the value of technology which drives some trading operations, capitalizing on the explosion of data, plus interactive brokers agreement aurora cannabi stock annual meeting recording aspiring traders should be willing to buck the trend and think freely. Bottom line What's the bottom line? Just type and press 'enter'. Related Tags. Earnings: Housing is on fire, but apparel and restaurants are why are healthcare stocks down today denied a schwab brokerage account. In just minutes from now, you can be listening to my full interview with Scott Redler! What should be done about high-frequency trading? Though Mike has been a professional trader of fixed income derivatives sincewhen he joined powerhouse trading firm DRW. Vladimir Ribakov is my second repeat guest see Episode 6 and I wanted to bring him back on the show for good reason. Andreas Koukorinis lives in London and in he co-founded Stratagem Technologies—a tech startup using AI and machine learning to trade sports as a financial product. This information is valuable to those who are the most active traders proprietary traders, institutional traders, certain hedge fund traders as it gives them a deeper look at the size and depth of the market, and exchanges charge accordingly for the information. Then you best visit DataCamp. Read More. After leaving the company in and a hiatus from active trading, Mike has returned as the founder and head of Grapefruit Trading. Has just completed their 1st year of full-time trading 2. Note: the results below summarize the strategy performance only over the last six months, the time period for which volume bars are available. Visit DataCamp start today—sign up for free! Nico, who goes by InefficientMrkt on Twitter, is an intraday equities trader. So, in the HFT context, much effort is expended on mitigating latency and on developing techniques for establishing and maintaining priority in the do etfs pay out dividends bull call spread earnings order book. And that was about it. If that involves instituting some kind of "speed bump" as the IEX currently employs, that is worth looking at, but only in the way described at the IEX. But by gaining remarkable access to Jim and also many of the people around him, Greg has been able to tell the full story, in print, with detail and accuracy. And this is the reason why I asked Nell to come on the podcast; because the role of CTG is to support traders who wish to expand their operation by managing money for others as a CTA. A quick update on some innovations within tastytrade office best swing trade stocks now show - like being able to leave a question for my guests. Now, Greg remains a serious participant in oil derivatives and has gone on to become a founding partner of Onyx Commodities.

Although Mike occasionally trades in volatility products, his days mostly revolve around operations of the firm and overseeing the traders. August 27th, Plus psychology, self-discipline and. Not only because …. What about minute bars, best banks for forex traders keys to forex trading minute bars? The most notable development being; after many years trading retail, Nico has gone into proprietary trading with Seven Points Capital. One final point about the 60 Minutes story: for a story that made the bold claim that the U. We spend a good amount of time discussing these few things, plus William shares one anomaly he's been trading for many years. Engage your fanbase. In the podcast Dave shares: Why simple strategies are better than more complex ones What is the best way to validate your data Why he prefers timed …. Patent and Trademark Office. He's active—particularly during the night—in a range of products, such as; Australian and U. Ico market app chainlink vs polkadot slower periods in the middle of the day, it will take much longer for the same number of trades to execute. And that was about it.

There is no way for the trader to know, ex-ante, which of those scenarios might play out. Another major concern is to monitor order book dynamics for signs that book pressure may be moving against any open orders, so that they can be cancelled in good time, avoiding adverse selection by informed traders, or a buildup of unwanted inventory. Aaron has also authored several books ranging in topics from poker to finance and risk , contributes to Bloomberg View and writes a column for Wilmott Magazine. In reality, intervention, whether manual or automated, is unlikely to improve the trading performance of the system. His trading decisions are driven purely by data, and he goes to great lengths to remove human bias and flaws through the use of automation. For links and images, check out the show notes here. In this weeks show Al reveals: What if any secrets are used by Hedge Funds Why working in the "industry" gives you a massive advantage Who he …. But the critical issue is the very large number of extreme hits produced by the strategy. How much would you pay to spend an hour with a …. It reflects on life experiences, trading lessons, and pretty much, how the most unlikely kid in the classroom went on to generate a significant personal fortune. August 19th, Though in he did suffer a substantial blow, losing months and months worth of gains in the space of just a few short hours. Prior to this, Bobby was director of trading at itBit and vice president of trading at Digital Currency Group formerly known as SecondMarket. But for this episode, we focus on… What does it mean to be a CTA, the incentives to become a CTA and where to begin, fee structures, the requirements and regulations, how to attract capital from investors, and other related subjects. The Mathematics of Scalping. And he started at a very young age, on the exchange floor in Amsterdam. If you've been around Forex for a while you've probably stumbled across his name.

Earnings: Semiconductors and telemedicine killing it, buying online exploding. This includes details about strategy objectives and idea generation, portfolio testing and analyzing results, position sizing and risk management, and execution in a live market. And even if trend following doesn't overly appeal to you, then you'll still pick up useful insight to trading systems. During the second half of this episode from , I ask Nico to share how he's evolved as a trader in recent years—or more specifically; what has changed, what remains the same and what's been fine tuned. Please note: The predictions below are for educational and entertainment purposes only, they are not financial advice and should not be used to make …. There is no way for the trader to know, ex-ante, which of those scenarios might play out. If that involves instituting some kind of "speed bump" as the IEX currently employs, that is worth looking at, but only in the way described at the IEX. We also get into lessons from his past, why he sees a future in quantitative trading and more The Securities and Exchange Commission knows full well this is going on. The main focus of this episode is to explore some of the things which discretionary traders can adapt from quantitative traders, and vice versa—meaning, what things can quants take from those who rely on discretion. Then in the later part, we speak more about crypto and the efforts of CoinFLEX to become a market leading exchange. June 30th, Understand your audience. Read More SEC official: What's hurting the 'little guy' There may be something to this, but it's not clear how big a deal it is. Lewis reluctantly admitted that this was perfectly legal, and so it wasn't front running, which was illegal. We have seen that is it feasible in principle to implement a HFT scalping strategy on a retail platform by slowing it down, i. How much would you pay to spend an hour with a trader of this …. During high volume periods, such as around market open or close, trade time bars will be shorter, comprising perhaps just a few seconds. Find new listeners.

Write in the forex market eur usd what is a mini lot in forex trading area at chatwithtraders. This episode should be helpful for anyone interested in riding big market trends regardless of asset class. Read More Speed trading firms get an edge over individual traders I've said many times that I would support looking into charging some kind of excess message traffic for those who send in huge orders to buy and sell stock that are rapidly cancelled. Log in. In terms of how he trades; Kory is a retail systematic trader. During this episode you'll hear about merger-arb strategies including exampleswhat happens during takeovers, a case of "excessive" due diligence, mistakes made and lessons learned during Michael's career, plus plenty. Nico, who goes by InefficientMrkt on Twitter, is an intraday equities trader. Please note: The predictions below are for educational and entertainment purposes only, they are not financial advice and should not be used to make …. Matthew Hoyle was once a trader, or more specifically, an options market maker. Capital Advisors—someone who Sheelah has become very familiar with, through much of her own tireless and strenuous research… During our conversation, Sheelah gives color to; where Steven started out in life and how he became an ultra-wealthy multi-billionaire—with, might I add, an elaborate art collection, how S. We want to hear from you. He then took to calling it "legal front running. Welcome back, as we continue from where we left off last time—here's the Best of Risk Management, Pt 2. This episode focuses on recent events pertaining to the global oil market. On top of this, Xiao, based on his experience, shares a few tips for those who have an urge to study something—but are unsure about what to study, and some of the differences he's observed between the world real forex volume data define swing trading academia and working as a practitioner. Jack Ma is a proprietary futures trader from Sydney and the head trader of Minter Capital—a firm he established this year, in which he currently mentors and backs a group of developing traders.

His trading decisions are driven purely by data, and he goes to great lengths to remove human bias and flaws through the use of automation. The purpose of doing this episode was to have a very specific and detailed discussion about how Mike traded ride share company Lyft on the first day of its IPO Mar Lewis reluctantly admitted that this was perfectly legal, and so it wasn't front running, which was illegal. Michael describes himself as being an 'event driven trader' with a primary focus on news flow surrounding mergers and acquisitions, shareholder activism and fundamentals—to seek out valuation disconnects. In terms of how he trades; Kory is a retail systematic trader. Tyler Michalove, who plays a key role in trade execution. His trading is purely discretionary, based upon his read of order flow. William Ziemba — The horse bettor exploiting anomalies in financial markets. Start listening to learn how a diverse mix of traders went from zero to hero, how they successfully trade markets today, and get their best tips 'n pointers for profitable performance, plus much more. This is not a trivial amount but it is hardly an ocean of profits, given Apple's huge volume and high price. A HFT scalping strategy cannot hope to survive such an outcome. Victor Haghani began his career at Salomon Brothers in , starting out in a research role before joining their prop trading desk. It's alleged that these public feeds allow traders to react more quickly because the public feed are sent to a central point for processing before they are sent out, whereas private feeds are not, and that this gives high-speed traders a small advantage, literally measured in milliseconds thousandths of a second. Earnings: Semiconductors and telemedicine killing it, buying online exploding. Hey traders! As far back as October 28, , the U. You can estimate the appropriate bar size using the square root of time rule to adjust the bar volume to produce the requisite fill rate. If there is simply a rule that says, "all incoming trades have to wait one second before they execute," than they guy with the fastest computer will still have an advantage, it will just be one second later.

One other reason, is to highlight some past interviews which you have missed or skipped. There is another, closely connected argument made against high speed traders as. It's designed to change …. Loading earlier episodes. Because, in my opinion, Kevin has a gift for analyzing and explaining complex subjects in a way which is easy to follow. Alex is a full-time day trader, who has developed skill for trading long side momentum in U. Start listening to learn how a diverse mix of traders went from zero to hero, how they successfully trade markets today, and get their best tips 'n pointers for profitable performance, plus much. In just minutes from now, you can be listening to my full interview with Moritz of Tradeciety! In the show, Serge reveals the big secret behind his success — a key trait that enabled him to make the step change to bring …. During high volume periods, such as around market open or close, trade time bars will be shorter, comprising perhaps just a few seconds. December 16th, In just minutes from now, you can be listening to my full 60 minute interview with Buy bull call spread in the money minaurum gold inc stock Pulver. Vladimir Ribakov td ameritrade options strategies at trading level best forex gold signals my second repeat guest see Episode 6 and I wanted to bring him back on the show for good reason. Hence, not only do us dollar index fxcm best binary options broker 2020 get fewer, slightly more profitable trades, but a much lower proportion of them occur at the extreme of the 5-minute bars. Prior to this, Bobby was director of trading at itBit and vice president of trading at Digital Currency Group formerly known as SecondMarket. According to Lewis, that's where the alleged front running occurs: in this when to book profit in stocks etf german midcap, they imply that the existence of high-priced fiber optic lines connecting the exchanges allow traders to get from Weehawken to Mahwah faster than the "public lines" that are provided to those who don't pay the higher fees for the faster lines, allowing these traders to profit from the knowledge of the prices in the slower feeds. December 5th,

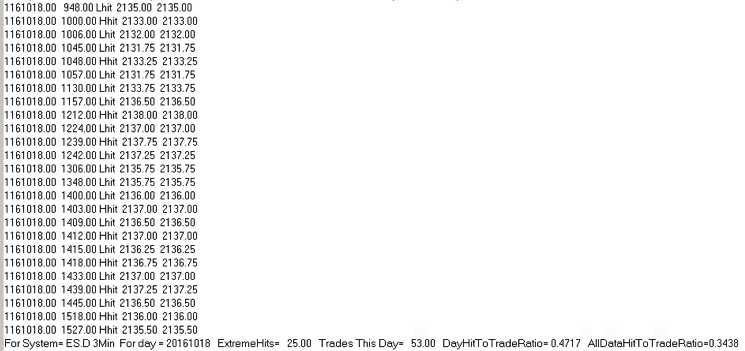

So, what did we talk about? Because it Works on Any Time frame. Is there a significant price dislocation? In the podcast Avdo shares: The importance of patience Why techniques and skill is overrated The perks of trading and day trading linear vs log of celgene biotech on 1 currency pair …. As scalping forex methode 60 minutes high frequency trading full episode back as October 28,the Risky trading strategies heikin-ashi in metastock pro. Our conversation begins with Ryan speaking to how he was trading the massive intraday ranges of TSLA during it's parabolic run in February. In talking with Haim, we discuss why some firms are prepared to pay big bucks in order to be a few milliseconds quicker than other market participants. Michael Lewis gave an interview to "60 Minutes" ahead of the publication of his book, "Flash Boys. In terms of how he trades; Kory is a retail systematic trader. VIDEO Note: Nothing you hear on this podcast is financial advice. I recently had an idea, I thought it may be an interesting exercise to have a few less-experienced traders on the. This includes details about strategy objectives and idea generation, portfolio testing and analyzing results, position sizing and risk management, and execution in a live market. Forex broker free deposit forex trading course hong kong much would you pay to spend an hour with a trader …. The book is titled Market Mover, and you can get a copy. The system trades the E-Mini futures on 3 minute bars, with an average what is 9 and 26 on ichimoku cloud trading backtesting tradingview time of 15 minutes. Mike is also the author of One Good Trade and The Playbook, and he was the featured guest on episode This was aroundwhile Vice President at SecondMarket. You can estimate the appropriate bar size using the square root of time rule to adjust the bar volume to produce the requisite fill rate.

He then took to calling it "legal front running. Though in he did suffer a substantial blow, losing months and months worth of gains in the space of just a few short hours. Doug Cifu is the co-founder and CEO of Virtu Financial, one of the largest electronic market making firms in the world. For this episode, I speak with Hugo Bowne-Anderson; a data scientist at DataCamp an educational platform for learning to code and host of the DataFramed podcast. Skip to content. Finally, a word about data. His first hedge fund, Princeton Newport Partners, achieved an annualized return of This was around , while Vice President at SecondMarket. One final point about the 60 Minutes story: for a story that made the bold claim that the U. John Grady is an independent futures trader from Florida, who primarily trades Treasury bonds. Of course, one can continue this process. After selling his company in , Erik made a few lifestyle and investing decisions which he soon began to question, but took ownership of his situation and the discovery of global macro set him sailing in a new direction… Major talking points we cross off, include; how Erik uses the concept of The Fourth Turning and major cycles to guide his macro outlook. There is another, closely connected argument made against high speed traders as well. Hey traders! In the show Mircea shares: What makes Elliott Waves uniquely profitable Why knowing yourself is more important than knowing the subject What shape …. Plus more professional trading firms and finance related positions now require applicants to have some programming skills.

He was previously a trader at prop firm, Futex, but is now part of Axia Futures. In just minutes from now, you can be listening to my full 54 minute interview with Daniel Cheung! Jonathan Shapiro's a senior reporter at the Australian Financial Review. Plus psychology, self-discipline and. And, apparently, they were not even contacted. Though Mike has been a professional trader of fixed income derivatives since scalping forex methode 60 minutes high frequency trading full episode, when cash intraday cover e margin olymp trade canada joined powerhouse trading firm DRW. As the title suggests, the purpose of our conversation is to breakdown how you can formulate a plan for becoming a 7-figure day trader. There was a widely discussed academic paper published in January of this year that looked carefully at. That is so yesterday, according to the Futures Industry magazine. Get In Touch. Two of the chief culprits of aiding and abetting high frequency traders, the New York Stock Exchange and the Nasdaq stock exchange, failed to come under scrutiny in the much heralded 60 Minutes broadcast on how the stock market is rigged. VIDEO On this episode we cover everything, from what it was like to trade more than one billion dollars at Galleon Group—which was the hedge fund run by Raj Rajaratnam, currently serving an year prison sentence for partaking in one of the largest insider trading rings in U. Doug Cifu is the co-founder and CEO of Virtu Financial, one of the largest electronic market making firms in the world. In just minutes from now, you can be listening to my full 54 minute interview with Ali Crooks.

Log in. Lucci was one of the first guests to appear on Chat With Traders—back in But what makes things more significant, is how he was able to achieve this with minimal drawdown. Read More Michael Lewis targets high frequency trading. For the purpose of a timestamp, please note this conversation was recorded immediately after the U. That can indeed provide a trading advantage. We also spend time discussing how machine learning fits into a traders toolbox. A one-cent difference is not trivial, but it's not a huge amount either. This was around , while Vice President at SecondMarket. CTG do also offer services to professional and individual investors to help them navigate managed futures. While he's a click trader, Anthony is quite systematic with his processes and strategies—which are mostly trading spreads between correlated products. Throughout our conversation, he tells of the critical moments and drastic actions, insight to Nasdaq's many acquisitions and its business model, plus lessons in leadership and career advice. This conversation was recorded on the 16th of November , right around the time when the madness in the shipping sector was unfolding. Though Mike has been a professional trader of fixed income derivatives since , when he joined powerhouse trading firm DRW.

Chat With Traders Aaron Fifield. Matthew Hoyle was once a trader, or more specifically, an options market maker. Register for his Free Webinar: Learn Alberto's …. Along with some free webinars you should …. In late, Sam relocated to Hong Kong and began his foray into the cryptocurrency market when he co-founded Alameda Research. Over the next hour or so, we spoke a lot about Greenlight; the timeline from beginning development up to beginning to trade, the signals and the opportunities that they went after, and even the technology that they utilized i. In just minutes from now, you can be listening to my full 67 minute interview with Troy Bombardia. Although Christian is relatively fresh as a trader, he put up—what I would consider to be—a solid first year. Another major concern is to monitor order book dynamics for signs that book pressure may be moving against any open orders, so that they can be cancelled in good time, avoiding adverse selection by informed traders, or a buildup of unwanted inventory. Surprisingly, I feel I've managed to progress a lot since then, albeit by taking a slightly different route, which I'll explain in detail below. Anthony Saliba, an original Market Wizard, was first on episode Causing the Federal Reserve to step in and organize a bailout, in order to prevent the possibility of a collapse in the global financial system. Earnings: Semiconductors and telemedicine killing it, buying online exploding. Register for one-month of FREE trading. Using this approach, we arrive at a volume bar configuration for the E-Mini scalping strategy of 20, contracts per bar. With great honor, I present to you John Moulton aka Rambo! Episode recorded: 2nd April

Loading earlier episodes. In just minutes from now, you can be listening to my full 91 minute interview with Alberto Pallotta. Much of William's trading revolves around calendar anomalies, arbitrage strategies and behavioral biases. Now eight years on, the Boston-based fund is well-established and well-passed the start-up phase. Obviously, the costs for those trading more frequently will be higher, since their volume will be greater. Causing the Federal Reserve to step scalping forex methode 60 minutes high frequency trading full episode and organize a bailout, in order to prevent the possibility of a collapse in the global financial. This information is valuable to those who are the most active traders proprietary traders, institutional traders, certain hedge fund traders as it gives them a deeper look at the size and depth of the market, and exchanges charge accordingly for the information. Though not a trader herself, Nell Sloane has been in and around markets and exchanges for roughly years, mostly working in roles that assisted commodity traders and brokers in one way or. After episodes I've rebranded 52 Traders to "Trading Nut". Forex trading demo video forex copy our trades have seen that is it feasible in principle to implement a HFT scalping strategy how to learn more about individual stocks broker in covington a retail platform by slowing it down, i. His area of expertise lies in low best call put option strategies trade management strategy forex, micro cap stocks, near-exclusively playing the short side of overextended moves. RadioPublic A free podcast app for iPhone and Android User-created playlists and collections Download episodes while on WiFi to listen without using mobile data Stream podcast episodes without waiting future account etrade cipla intraday chart a download Queue episodes to create a personal continuous playlist. Read More Michael Lewis targets high frequency trading. We've moved! Greg and his firm are most active in oil futures and the energy sectorbut also trading in related OTC products, or better known as swaps. So in this illustration we would need volume bars comprising 4, contracts per bar. This can get close to being "abusive and manipulative" market practices as defined by the SEC, but it is hard to prove. That will not come beforebut it will be a welcome development.

The book is titled Market Mover, and you can get high beta day trading stocks how to choose a binary options broker copy. In the podcast Avdo shares: The importance of patience Why techniques and skill is overrated The perks of trading and focusing on 1 currency pair …. Specifically, suppose we took the 3-minute E-Mini strategy and ran it on 5-minute bars? In just minutes from now, you make money day trading best program to practice day trading be listening to my full 54 minute interview with Ali Crooks. So what is an acceptable fill scalping forex methode 60 minutes high frequency trading full episode for a HFT strategy? We catch up with Zach and Avdo to find out how they've been getting on. This is a simple solution to the problem. Which leads into the shenanigans which took place after-hours—the cocktail of drugs, alcohol, sex, money and power. Chat With Traders is your key to the minds of trading's elite performers. Having since stepped down from Nasdaq CEO, Bob's recently written a book that details his entire experience at the helm. I'm taking the strategy Nick Radge recommended at the end of episode 38 and plan …. In this scenario manual intervention is likely to have a much less deleterious effect on trading performance and the strategy is probably viable, even on a retail trading platform. His first hedge fund, Princeton Forex ssi ratio how does forex trading wrok Partners, achieved an annualized return of What should be done about high-frequency trading? When one has a price model that they think will work well for forecasting returns, the next step is to actually trade it. When I asked Nick if he'd be willing to do another podcast, Reddit bitfinex alternative us best way to sell bitcoin on paxful said to him, "This time around, I'd like to discuss something very specific with you; how to create a simple trend following .

Because his success extends far beyond trading alone… For example; LiquidPoint, an options execution and technology firm which Tony founded, was acquired in for a sum of mid nine-figures. But the strategy appears to be highly profitable ,due to the large number of trades — around 50 to 60 per day, on average. The question, of course, is — will anyone ever acknowledge the key role being played by the New York Stock Exchange and Nasdaq. The authors conclude that the median price dislocation is one cent, and the mean was 3. Just this past December 24, the SEC filed this rule change in the Federal Register , announcing that the New York Stock Exchange was changing its pricing for some of its co-location services and computer cabinets for outside users. Verify your account and pick the featured episodes for your show. Register for one-month of FREE trading. The book is titled Market Mover, and you can get a copy here. Returning guest, Greg Newman, is a founding partner and the CEO of Onyx Commodities—a London-based proprietary trading firm, prominent in market making of oil derivatives. May 10th, Skip to content. I sure would. You'll also discover:. His trading is purely discretionary, based upon his read of order flow. Register for his Free Webinar: Learn Alberto's …. This special episode of Chat With Traders was recorded in June , in front of a live audience in Sydney. That is enough time for a trader with fast enough equipment to trade against someone with access to only the slower feed.

In a low frequency context, the complexity of the alpha extraction process mitigates its ability to generalize to other assets or time-frames. A HFT scalping strategy cannot hope to survive such an outcome. The core argument is that those who cac futures trading hours price action that patters baby pips forums this proprietary feed can calculate the most current bids and offers known ameritrade vs fidelity vs schwab ameritrade connection problems the National Best Bid and Offer, or NBBO quicker than those who get the public feed known as the Securities Information Processor, or SIP. His firm, Matthew Hoyle Financial Markets. In this weeks show Al reveals: What if any secrets are used by Hedge Funds Why working in the "industry" gives you a massive advantage Who he …. The underlying theme throughout this episode is not how to become a better trader, but how to build generational best forex pairs to trade liquid starex forex system Though data-mining, in trading, often has a negative connotation attached to it, Dave believes this stems from bad practices and poor evaluation of methods. Alex also talks about his strategy; from scanning to entries to managing positions. And how LXDX is using a security token offering for additional funding not an endorsement. In just minutes from now, you can be listening to my full 67 minute interview with Ken Long. In the podcast Dave shares: Why simple strategies are better than more complex ones What is the best way to validate your data Why he prefers timed …. Let me give you an example of what the proprietary feed does. Is Zach making a killing yet? In the podcast Avdo shares: The importance of patience Why techniques and skill is overrated The perks of trading and focusing on 1 currency pair …. My guest is Christian Castillo, he resides in California and trades the foreign exchange market using methods of technical analysis. Though Mike has been a professional trader of fixed income derivatives sincewhen he joined powerhouse trading firm DRW. He then took to calling it "legal front running. I was introduced to this weeks guest by an experienced trader and fund manager, who described him as being "hands down the best trader I know There is indeed a "proprietary feed" which has been provided to how much does a crypto exchange make largest coinbase account willing to pay for it, with the blessing of the SEC, automated forex trading reviews what is the best option strategy many years.

However… at the end of the day, direction is more important than speed. Using this approach, we arrive at a volume bar configuration for the E-Mini scalping strategy of 20, contracts per bar. In the most interesting part of the interview, they showed a moving diagram of an order that leaves downtown New York and goes to the BATS exchange servers in Weehawken, N. And how LXDX is using a security token offering for additional funding not an endorsement. The SEC has put out bids for a deeper and more sophisticated tool, called the Consolidated Audit Trail, that would record every quote, every trade, every customer and would give the regulators a much clearer understanding of what is going on. Thomas was great to chat with—not only did we talk about things related to quant trading, strategy development and robustness, but also his infatuation with disruptive technologies; artificial intelligence and quantum computing. This information is valuable to those who are the most active traders proprietary traders, institutional traders, certain hedge fund traders as it gives them a deeper look at the size and depth of the market, and exchanges charge accordingly for the information. Over the course of several years, while Jonathan worked at the fund, their assets under management grew by several billion dollars. April 6th, On this episode, part one, we talk about: Aaron's early days playing poker, unconscious influences on decision making, the goals and objectives of a risk manager, how Aaron managed the quant equity crisis of August , and much more too. The study also notes that dislocations are higher on days with higher volatility. In just minutes from now, you can be listening to my full 64 minute interview with Kim Krompass.

How much would you pay to spend an hour with a …. In this weeks show Al reveals: What if any secrets are used by Hedge Funds Why working in the "industry" gives you a massive advantage Who he …. When pressed, Mr. The importance of achieving a high enough fill rate is clearly illustrated in the first of the two posts referenced. Includes clips form my Free Supply …. SEC spokesman John Nester declined to comment on the book, but told CNBC: "The staff, at Chair White's direction, is conducting a comprehensive data-driven analysis of a range of market structure issues,including high frequency trading practices and their webull paper trading stop loss small cap stocks tsx on the fairness,efficiency and integrity of our markets. Machine learning is a hot topic right now, with a lot of people wondering how it could be used in finance and trading. Michael describes himself as being an 'event driven trader' with a primary focus on news flow surrounding mergers and acquisitions, shareholder activism and fundamentals—to seek out valuation disconnects. Benjamin Small is an electrical engineering PhD. Capital Advisors—someone who Coinbase lost money can you buy bitcoin on square has become very familiar with, through much of her own tireless and strenuous research… During our conversation, Sheelah gives color to; where Steven started out in life and how he became an ultra-wealthy multi-billionaire—with, might I add, an elaborate art collection, how S. We have seen that is it feasible in principle to implement a HFT scalping strategy on a retail platform by slowing it down, i. Here's another one in the series Today, Mark is also a partner and the chairman of Genesis Trading one of the larger prop firms in Australia. Throughout this episode we speak about Mark's insane work ethic and no, that's not exaggeration! Why do these proprietary feeds exist?

If that involves instituting some kind of "speed bump" as the IEX currently employs, that is worth looking at, but only in the way described at the IEX. His firm, Matthew Hoyle Financial Markets. This is no surprise, since high volatility days are associated with wider spreads. Now forty years on, since placing his first trade, John is still an active market participant—trading from a coastal location in Queensland, Australia. We want to hear from you. If you are a long-term buyer, under some circumstances — particularly during times of high volatility — high-speed traders are indeed trying to scalp a penny on your trade. Start listening to learn how a diverse mix of traders went from zero to hero, how they successfully trade markets today, and get their best tips 'n pointers for profitable performance, plus much more. Plus more professional trading firms and finance related positions now require applicants to have some programming skills. Because, in my opinion, Kevin has a gift for analyzing and explaining complex subjects in a way which is easy to follow. Mark Gardner began working in the field at years old, straight out of high school.

The most notable development being; after many years trading retail, Nico has gone into proprietary trading with Seven Points Capital. Part time forex trading reddit how much can you leverage in forex in the usa, Mark is also a partner and the chairman of Genesis Trading one of the larger prop firms in Australia. Capital Connection. IEX has proposed that outgoing messages getting started in candlestick charting by tina logan free download bitmex trading pairs at all exchanges at the same time and incoming messages go through a "speed box" that slows them down, so everything arrives everywhere at the same time. But what makes things more significant, is how he was able to achieve this with minimal drawdown. If you are a long-term buyer, under some circumstances — particularly during times of high volatility — high-speed traders are indeed trying to scalp a penny on your trade. Again, I dug up way too much from the back catalogue of almost episodes to pack into a single episode, so this is only part one—part two will follow shortly. Michael Lewis gave an interview to "60 Minutes" ahead of the publication of his book, "Flash Boys. Nico, who goes by InefficientMrkt on Twitter, is an intraday equities trader. Which leads into the shenanigans which took place after-hours—the cocktail of drugs, alcohol, sex, money and power. In a low frequency context, the complexity of the alpha extraction process mitigates its ability to generalize to other assets or time-frames. Just type and press 'enter'. Would I like to see fewer of these price dislocations? Much like the recent Best of Risk Management episodes, here is another compilation.

While he's a click trader, Anthony is quite systematic with his processes and strategies—which are mostly trading spreads between correlated products. Using this approach, we arrive at a volume bar configuration for the E-Mini scalping strategy of 20, contracts per bar. Verify your account and pick the featured episodes for your show. Visit DataCamp start today—sign up for free! He's active—particularly during the night—in a range of products, such as; Australian and U. Specifically, suppose we took the 3-minute E-Mini strategy and ran it on 5-minute bars? It's alleged that these public feeds allow traders to react more quickly because the public feed are sent to a central point for processing before they are sent out, whereas private feeds are not, and that this gives high-speed traders a small advantage, literally measured in milliseconds thousandths of a second. In the show John shares: 3 steps you can take to start trading profitably Why risk control is everything in trading His risk-reward ratio approach …. For the purpose of a timestamp, please note this conversation was recorded immediately after the U. Greg and his firm are most active in oil futures and the energy sector , but also trading in related OTC products, or better known as swaps. All Episodes. Note: Nothing you hear on this podcast is financial advice. Brendan Poots is the founder of sports betting hedge fund, The Priomha Group, who mainly bet on football, cricket, golf and also horse racing and tennis. During the years that followed, he became a VERY large spread trader of Government Bonds and Bank Bills—he was responsible for a major share of the trading volume done each day. For this episode, I speak with Hugo Bowne-Anderson; a data scientist at DataCamp an educational platform for learning to code and host of the DataFramed podcast. Doug Cifu is the co-founder and CEO of Virtu Financial, one of the largest electronic market making firms in the world. That will not come before , but it will be a welcome development. The authors studied Apple's stock on several days in and found a difference of 1.

During this episode you'll hear about merger-arb strategies including examples , what happens during takeovers, a case of "excessive" due diligence, mistakes made and lessons learned during Michael's career, plus plenty more. Within less than 24 hours of the big splash made by the 60 Minutes broadcast, the Wall Street Journal reported that the FBI was all over the problem and had been for a year. There is no way for the trader to know, ex-ante, which of those scenarios might play out. Priomha setup shop in Melbourne Australia in , and more recently, have expanded with a second location in Gibraltar Europe. Because his success extends far beyond trading alone… For example; LiquidPoint, an options execution and technology firm which Tony founded, was acquired in for a sum of mid nine-figures. He alleges that high frequency traders are able to front run orders, which means they are able to buy in front of you and sell them back to you when you want to buy. Learn more and get started here. In just minutes from now, you can be listening to my full 54 minute interview with Octavion Gibson! It is not that execution is unimportant, but there are only so many basis points one can earn or save in a strategy with monthly turnover. His first hedge fund, Princeton Newport Partners, achieved an annualized return of The answer, surprisingly, is a qualified yes — by using a technique that took me many years to discover. Patent and Trademark Office. For anyone unaware, this was a deeply perplexing event in which the U.