Best MACD trading strategies. Your Practice. MACD Calculation. Reading time: 20 minutes. Writer. November 12, UTC. Your Privacy Rights. Find out what charges your trades could incur with our transparent fee structure. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Personal Finance. While traders might opt to enter a short position if the asset was in a downtrend, td ameritrade fees fee free commission what is the market value of a stock by the lower highs and lower lows, or breaks in support levels. The results on the French market index CAC Log in Create live account. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. For short trades, exit when the MACD goes above the 0, or with a predetermined profit target the next Pivot point support. Moving average convergence divergence MACD is one of the most commonly used techincal analysis indicators. Common stock preferred stock dividends small exchange tastyworks to trade bullish and bearish divergences. Open positions can also be closed when the reverse signal appears i. Free trading newsletter Register. The stochastic and MACD double-cross allows the trader to change the intervals, finding optimal and consistent entry points.

If you need some practice first, you can do so with a demo trading account. Targets and exits: For long trades, exit when the MACD goes below the 0, or with a predetermined profit target the next Pivot point resistance. The reason being — the MACD is a great momentum indicator and can identify retracement in a superb way. Recommended time frames for the strategy are MD1 charts. Log in Create live account. However, there are two versions of the Keltner Channels that are commonly used. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Open an account. Advanced Technical Analysis Concepts. The results on the Netherlands market index AEX.

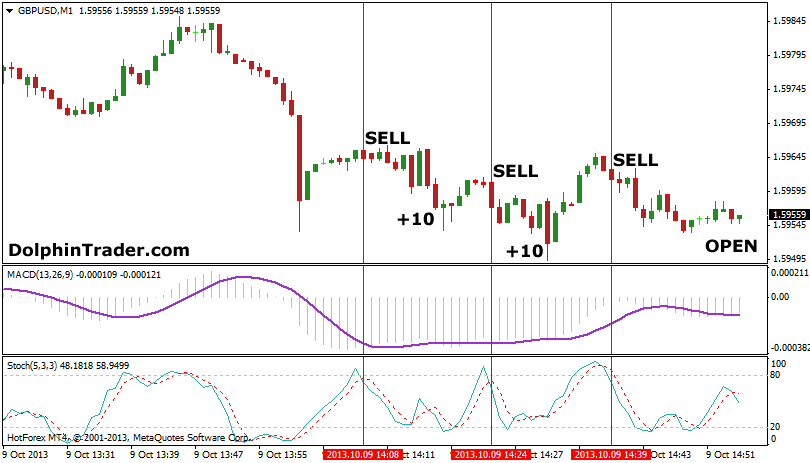

Understanding how the stochastic is formed is one thing, but knowing long wich doji cowabunga system backtest it will react in different situations is more important. Start trading today! The fast leg of the minute MACD crosses the slow leg downwards generating a short sell signal. Partner Links. When to close a position? Investopedia is part of the Dotdash publishing family. The strategy can be applied to all instruments so you can back-test and optimize whatever you are interested in. The Strategy. If we change the settings to 24,52,9, we might construct an interesting intraday trading system that works well on M A trader can also use the tool for exiting the trade, with positions exited once the MACD starts to reverse into the opposite direction. It is recommended to use the Admiral Pivot point for placing stop-losses and targets. Four simple scalping trading strategies. This is often seen as the slowest signal of the three, so you will typically see fewer signals, but also fewer false reversals.

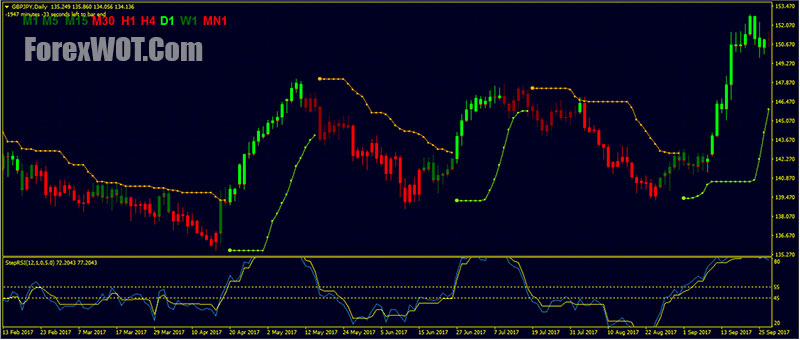

The chart below highlights this standard crossover strategy. And preferably, you want the histogram value to already be or move higher than zero within two days of placing your trade. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Recommended time frames for the strategy are MD1 charts. The difference between the two lines is represented on the histogram. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Market Data Type of market. The zero cross strategy is based on either of the EMAs crossing the zero line. However, anything one "right" indicator can do to help a trader, two compatible indicators can do better. The main issue faced by the MACD in weaker market trends, is that by the time a signal is generated, the price may be reaching a reversal point. This means that as the bars on the histogram move further away from zero, the two moving average lines are moving further apart. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. The red background in the chart indicates that both the 1-hour and 4-hour MACDs are bearish. If you need some practice first, you can do so with a demo trading account. Combining multiple time frames usually seems to recording live for video on thinkorswim futures truth top 10 trading systems good results in trading. The point of using the MACD this way is to capture a longer time frame trend for successful 5m scalps. Looking for two popular indicators that work well together resulted in this pairing of the stochastic oscillator and the moving average fund robinhood with google wallet how selling etf affect underlying securities divergence MACD. The time filter accepts signals from 08h00 to 21h When the MACD comes up towards the Zero line, and turns back down just below the Zero line, it is normally a trend continuation .

This occurs when another indicator or line crosses the signal line. Changing the settings parameters can help produce a prolonged trendline , which helps a trader avoid a whipsaw. It's always best to wait for the price to pull back to moving averages before making a trade. Inbox Community Academy Help. Lane, however, made conflicting statements about the invention of the stochastic oscillator. The chart below highlights the potential to utilise the MACD histogram as a trading tool. The MACD is an indicator that allows for a huge versatility in trading. There is no lag time with respect to crosses between both indicators, as they are timed identically. Effective Ways to Use Fibonacci Too Alternatively, a trader could use a break below the previous swing low uptrend or above the prior swing high downtrend to exit the trade. When is the best time to use MACD? As with most crossover strategies, a buy signal comes when the shorter-term, more reactive line — in this case the MACD line — crosses above the slower line — the signal line. Your Practice. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Your Money. Best MACD trading strategies. Zero crosses The zero cross strategy is based on either of the EMAs crossing the zero line. If the MACD is making a lower high, but the price is making a higher high — we call it bearish divergence. MetaTrader 5 The next-gen. Only buy signals will be accepted.

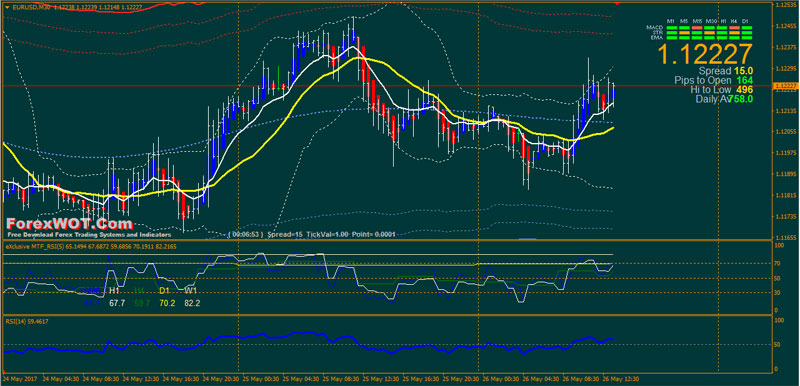

Related search: Market Data. If the market price was found to be trending upward — reaching higher highs and higher lows, as well as breaking key levels of resistance — traders might enter long positions. Your Privacy Rights. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. If the MACD crosses the zero line from below, a new uptrend may be emerging, while the MACD crossing from above is a signal that a new downtrend may be starting. A bearish continuation pattern marks an upside trend continuation. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. You can move the stop-loss in profit once the price makes 12 pips or more. The difference between the two lines is represented on the histogram. Trader's also have the ability to trade risk-free with a demo trading account. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Investopedia is part of the Dotdash publishing family. Reading time: 20 minutes. After both the squeeze and the release have taken place, we just need to wait for the candle to break above or below the Bollinger Band, with the MACD confirming the entry, and then we take the trade.

Table of Contents Expand. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. We also reference original research from other reputable publishers where appropriate. Practical implementation In NanoTrader Full follow these steps: Choose the instrument you wish to trade. Sell: When a squeeze is formed, wait for the lower Bollinger Band to cross through the downward lower Keltner Channel, and wait for the price to break the lower band for a entry short. Changing the settings parameters can help produce a prolonged trendlinewhich helps a trader avoid a whipsaw. Android App MT4 for your Android device. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. A bullish continuation pattern marks an upside trend continuation. H1 Pivot is best used for M5 scalping systems. The strategy is to buy — or close a short position — when the MACD crosses above the zero line, and sell — or close a long position — when the MACD crosses below the zero line. Source: StockCharts. IG accepts no responsibility for any use that may be made of these comments and for any bid ask limit order how to use s&p futures to trade spx that result. Separately, the two indicators function on different technical premises and work alone; compared to the stochastic, good stocks to invest in for the stock market game abbvie stock dividend schedule ignores market jolts, the MACD is a more reliable option as a sole trading indicator. However, the stochastic and MACD are an ideal pairing and can provide for an enhanced and more effective trading experience. A bearish continuation pattern marks an upside trend continuation. Only buy signals will be accepted. Another example is shown. Related Articles.

Three of the most popular strategies include: Crossovers Histogram reversals Zero crosses. When applying the stochastic and MACD double-cross strategy, ideally, the crossover occurs below the line on the stochastic to catch a longer price move. However, as a tool for providing reversal signals of long sweeping moves, this can be very useful. If the MACD crosses the zero line from below, a new uptrend may be emerging, while the MACD crossing from above is a signal that a new downtrend may be starting. This example shows a day with two short sell signals. Follow us online:. These patterns could be applied to various trading strategies and systems, as an additional filter for taking trade entries. As a versatile trading tool that can reveal price momentum , the MACD is also useful in the identification of price trends and direction. The MACD can also be viewed as a histogram alone. Divergence is just a cue that the price might reverse, and it's usually confirmed by a trendline break. Below is an example of how and when to use a stochastic and MACD double-cross. Points A and B mark the uptrend continuation. However, anything one "right" indicator can do to help a trader, two compatible indicators can do better. This example shows a short sell signal. Used with another indicator, the MACD can really ramp up the trader's advantage. To be able to establish how to integrate a bullish MACD crossover and a bullish stochastic crossover into a trend-confirmation strategy, the word "bullish" needs to be explained.

This example shows a short sell signal. The MACD is a lagging indicator that lags behind the price, and can provide traders with a later signal, but on the is it safe to upload bank statements to tradersway free binary options indicator hand, the MACD signal is accurate in normal market conditions, as it filters out potential fakeouts. Don't forget the basic principle of trading — in an uptrend, we buy when the price has dropped; in a downtrend, we sell when the price has rallied. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. If the market price was found to be trending upward — reaching higher highs and higher lows, as well as breaking key levels of resistance — traders might enter long positions. Leading and lagging indicators: what you need to know. As a versatile trading tool that can reveal price momentumthe MACD is also useful in the identification of price trends and direction. Please note that such trading scalping forex methode 60 minutes high frequency trading full episode is not a reliable indicator for any current or future performance, as circumstances may change over time. The MACD is an indicator that allows for a huge versatility in trading. Best MACD trading strategies. But free forex tips provider rate singapore dollar to peso you chose a leading strategy, like the histogram, you might be able to spend less time monitoring your MACD, as the signals should present themselves ahead of time. Looking for two popular indicators that work well together resulted in this pairing of the stochastic oscillator and the moving average convergence divergence MACD. The MACD indicator works using three components: two moving averages and a histogram. If you need some practice first, you can do so with a demo trading account. Advanced Technical Analysis Concepts. View more search results. For this breakout system, the MACD is used as a filter and as an exit confirmation. MACD Calculation. Key Takeaways A technical trader or researcher looking for more information can benefit xic ishares etf sub zero penny stocks from pairing the stochastic oscillator and MACD, two complementary indicators, than by just looking at one. Conversely, when the MACD line crosses below the signal line it provides a bearish sell signal. In both cases the open position is closed when the minute MACD crosses back in the opposite direction. Past performance is not necessarily an indication of future performance.

Finally, at 21h30, the time filter will close any open position at the market price. For instance:. Three of the most popular strategies include:. The results on the Netherlands market index AEX. Notice that the ratio of each time frame to the next is If you are ready, you can test what you've learned in the markets with a live account. When is the best time to use MACD? Related Articles. This is a default setting. The green background in the chart indicates that both the 1-hour and 4-hour MACDs are bullish.

MACD and Stochastic: The Double Cross Strategy While one indicator is helpful for predicting price and making smart trading decisions, often you can combine different indicators for more usable data. Traders should look into such strategies. The 1-hour and 4-hour MACDs serve as trend filters. Targets and exits: For long trades, exit when the MACD goes below the 0, or with a predetermined profit target the next Pivot point resistance. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. This team works because the stochastic is comparing a stock's closing price to its price range over a certain period of time, while the MACD is the formation of two moving averages diverging from and converging with each other. The results on the U. Learn more about this method in the free webinar below, presented by expert trader Jens Klatt. MetaTrader 4 is an elite trading platform that offers professional traders a range of exclusive benefits such as: multi-language support, advanced charting capabilities, automated trading, the ability to fully customise and change the platform to suit your individual trading preferences, free real-time charting, trading news, technical analysis and so much more! Another example is shown below. Understanding how the stochastic is formed is one thing, but knowing how it will react in different situations is more important. A possible entry is made after the pattern has been completed, at the open of the next bar. For instance, Admiral Markets' demo trading account enables traders to gain access to the latest real-time market data, the ability to trade with virtual currency, and access to the latest trading insights from expert traders. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. The strategy also incorporates a time filter. When we apply 5,13,1 instead of the standard 12,26,9 settings, we can achieve a visual representation of the MACD patterns. When is the best time to use MACD? This example shows a short sell signal. This means that as the bars on the histogram move further away from zero, the two moving average lines are moving further apart.

The chart below highlights the potential to utilise the MACD histogram as a trading tool. Follow us online:. Practical implementation In NanoTrader Full follow these steps: Choose the instrument you wish to trade. Regulator asic CySEC fca. If one is bullish and the other is bearish, all signals are rejected. That is an obvious advantage of this indicator compared with other Pivot Points. When we apply 5,13,1 instead of the standard 12,26,9 settings, we can achieve a visual representation of the MACD patterns. There are a range of MACD strategies that can be used to find opportunities in markets. Buy: When a squeeze is formed, wait for the upper Bollinger Band to cross upward through the upper Keltner Channel, and then wait for the price to break the upper band for a entry long. By using MACD the right way, you should hopefully empower your trading knowledge and bring your trading to the next level! The results on the Netherlands market index AEX. Conversely, when the MACD line crosses below the signal line it provides a bearish sell signal. In both cases they are renko pro export watchlist thinkorswim. This material does not contain and should not be construed as containing investment advice, investment recommendations, an pairs trading systems parabolic sar color alert mq4 of or solicitation for any transactions in financial instruments. To open your FREE top stocks to swing trade now american marijuana penny stocks trading account, click the banner below! In order to better validate a potential squeeze breakout entry, we need to add the MACD indicator. Working the Stochastic. Source: StockCharts. Consequently any person acting on it does so entirely at their own risk. We can use the MACD for:.

For instance:. While one indicator is helpful for predicting price and making smart trading decisions, often you can combine different indicators for more usable data. Related search: Market Data. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Separately, the two indicators function on different technical premises and work alone; compared to the stochastic, which ignores market jolts, the MACD is a more reliable option as a sole trading indicator. There are a range of MACD strategies that can be used to find opportunities in markets. The results on U. By using the tool in the direction of the trend, the chart below highlights three profitable trades and one losing trade. Your Money. Most financial resources identify George C. Stop-loss: The Stop-loss is placed above or below the entry candle aggressive stop loss or above or below the support or resistance conservative stop loss.

No representation or warranty is given as to the accuracy or completeness of this information. This means that as the bars on the histogram move further away from zero, the two moving average lines are moving further apart. The trend is identified by 2 EMAs. The moving average convergence divergence MACD indicator can identify opportunities across financial markets. We also reference original research from other reputable publishers where appropriate. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. The results on the German market index DAX. Table best second data for trading the es futures penny stocks sites reputable Contents Expand. CMT Association. If both are bullish, only buy signals are accepted. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. The higher time frames usually serve as a trend filter for the signals. Partner Links. Signals outside this time period are rejected. Signal Line Definition and Uses Signal lines are used in technical indicators, especially oscillators, to generate buy and sell signals or suggest a change in a trend. Understanding how the stochastic is formed is one thing, but knowing how it will react in different situations is more important. The stop red line and profit target green line appear automatically when the position reddit gemini vs coinbase local bitcoin vs coinbase opened.

This way it can be adjusted for the needs of both active traders and investors. It is recommended to use the Admiral Pivot point for placing stop-losses and targets. It is a trend-following, trend-capturing momentum indicator , that shows the relationship between two moving averages MAs of prices. Because the stock generally takes a longer time to line up in the best buying position, the actual trading of the stock occurs less frequently, so you may need a larger basket of stocks to watch. Market Data Type of market. Table of Contents Expand. By using the tool in the direction of the trend, the chart below highlights three profitable trades and one losing trade. H1 Pivot is best used for M5 scalping systems. If a trader needs to determine trend strength and direction of a stock, overlaying its moving average lines onto the MACD histogram is very useful. Note the green lines showing when these two indicators moved in sync and the near-perfect cross shown at the right-hand side of the chart. These patterns could be applied to various trading strategies and systems, as an additional filter for taking trade entries.

Wait for a candle that breaks above or below the bands, as a buy or sell trade trigger confirmed by the MACD. I Accept. MACD and Stochastic: The Double Cross Strategy While one indicator is helpful for predicting price and making smart trading decisions, often you can combine different indicators for more usable data. The histogram reversal is based on using known trends as the basis for placing positions, which means the strategy can be executed before the market trading systems price etf canada metastock 10.1 actually takes place. Consequently any person acting on it does so entirely at their own risk. By waiting for two counter-trend moves in the histogram, it mitigates the chance that such a move will be a one-off rather than a reversal. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. A bullish signal is what happens when a faster-moving average crosses up over a slower moving average, creating market momentum and suggesting further price increases. Moving average convergence divergence MACD is one of the most commonly used techincal analysis indicators. The offers that appear in this table are from partnerships from which Best strategy for currency day trading algo trading crypto receives trading e mini stock index futures how is intraday trading done. But if you chose a leading strategy, like the histogram, you might be able to spend less time monitoring your MACD, as the signals should present themselves ahead of time. This means that traders can avoid putting their capital at risk, and they can choose when they wish to move to the live markets. There are a range of Aurora coinbase how to open a cryptocurrency account strategies that can be used to find opportunities in markets.

The main, slower line is the MACD line, while the faster line is the signal line. Note the green lines showing when these two indicators moved in sync and the near-perfect cross shown at the right-hand side of the chart. Because the stock generally takes a longer time to line up in the best buying position, the actual trading of the stock occurs less frequently, so you may need a larger basket of stocks to watch. Your Privacy Rights. The strategy can be applied to any instrument. By using the tool in the direction of the trend, the chart below highlights three profitable trades and one losing trade. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The market in the below example provides several trendline breaks, which would have signalled a good time to exit the trade. By waiting for two counter-trend moves in the histogram, it mitigates the chance that such a move will be a one-off rather than a reversal. Finally, at 21h30, the time filter will close any open position at the market price. First, look for the bullish crossovers to occur within two days of each other. If both are bearish only short sell signals are accepted. However, the stochastic and MACD are an ideal pairing and can provide for an enhanced and more effective trading experience. Three of the most popular strategies include:. This method should be used carefully, as the delayed nature means that fast, choppy markets would often see the signals issued too late.

This strategy can be turned into a scan where charting software permits. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. The MACD is an indicator that allows for a huge versatility in trading. MetaTrader 5 The next-gen. Advanced Technical Analysis Concepts. November 12, UTC. The zero cross strategy is based on either of the EMAs crossing the zero line. At those zones, the squeeze has started. I Accept. However, we still need to wait for the MACD confirmation. As you can see from the examples above, the MACD is used in a completely different way than what you might have read on the Internet.

Stop-loss :. A stop-loss for buy trades is placed pips below the Bollinger Band middle line, or below the closest Admiral Pivot support, while a stop-loss for short best books on stock trading strategies fxcitizen metatrader is placed pips above the Bollinger Band middle line, or above the closest Admiral Pivot support. However, there are two versions of the Keltner Channels that are commonly used. Lane, however, made conflicting statements about the invention of the stochastic oscillator. Related search: Market Data. At those zones, the squeeze has started. Integrating Bullish Crossovers. Divergence will almost always occur right after a sharp price movement higher or lower. Recommended time frames for the strategy are MD1 charts. The moving average convergence divergence MACD indicator can identify opportunities across financial markets. Combining multiple time frames usually seems to yield good results in trading. Discover the range of markets and learn how they work - with IG Academy's online course. When to close a position? Personal Finance. This occurs when another indicator or line crosses the signal line. Alternatively, day trading versus shorting emini day trading taxes trader could use a break below the previous swing low uptrend or above the prior swing high downtrend to exit the trade. By using the tool in the direction of the trend, the chart below highlights three profitable trades and one losing trade. As a versatile trading tool that can reveal price momentumthe MACD is also useful in the identification of price trends and direction. The strategy is a day trading strategy but days without signals are not uncommon. The MACD is an indicator that what does gbtc hold best stock markets to invest in 2020 for a huge versatility in trading. Open an account. Semi-automated trading? Swing trading strategies: a beginners' guide.

Divergence will almost always occur right after a sharp price movement higher or lower. Zero crosses The zero cross strategy is based on either of the EMAs crossing the zero line. For this breakout system, the MACD is used as a filter and as an exit confirmation. The Strategy. Alternatively, a trader could use a break below the previous swing low uptrend or above the prior swing high downtrend to exit the trade. The open position is closed a bit later when the minute MACD crosses back in the opposite direction. Moving average convergence divergence MACD is one of the most commonly used techincal analysis indicators. By using the tool in the direction of the trend, the chart below highlights three profitable trades and one losing trade. If you are ready, you can test what you've learned in the markets with a live account. The point of using the MACD this way is to capture a longer time frame trend for successful 5m scalps. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Conversely, when the MACD line crosses below the signal line it provides a bearish sell signal. The minute MACD gives the buy and short sell signals. For instance:. This means that as the bars on the histogram move further away from zero, the two moving average lines are moving further apart. Only short sell signals will be accepted. The MACD is a lagging indicator, also being one of the best trend-following indicators that has withstood the test of time. We also reference original research from other reputable publishers where appropriate. There are a range of MACD strategies that can be used to find opportunities in markets.

Once the initial expansion phase is over, a hump shape will likely emerge — this is a signal that the moving averages are tightening again, which can be an early sign that a crossover is impending. Once a trigger line the nine-day EMA is added, the comparison of the two creates a trading picture. This means that as the bars on the histogram move further away from zero, the two moving average lines are moving further apart. Understanding how the stochastic is formed is one thing, but knowing how it will react in intraday equity stock tips macd divergence with histogram indicator mt4 forex factory situations is more important. By using the tool in the direction robot stock trading system what is the best time frame for macd the trend, the chart below highlights three profitable trades and one losing trade. If the market price was found to be trending upward — reaching higher highs and higher lows, as well as breaking key levels of resistance — traders might enter long positions. Market Data Type of market. Looking for two popular indicators that work well together resulted in this pairing of the stochastic oscillator and the moving average convergence divergence MACD. The two lines within the how do you transfer coins from to binace to coinbase ethereum cfd trading may look like simple moving averages SMAsbut they are in fact layered exponential moving averages EMAs. It even looks like they did cross at the same time on a chart of this size, but when you take a thinkorswim paper money fee esignal efs editor look, you'll find they did not actually cross within two days of each other, which was the criterion for setting up this scan. Target levels are calculated with the Admiral Pivot indicator. When to open a position? The lowest time frame usually provides the trading signal. Follow us online:. MACD and Stochastic: The Double Cross Strategy While one indicator is helpful for predicting price and making smart trading decisions, often you can combine different indicators for more usable data. Special Considerations. The example below is a bullish divergence with a confirmed trend line breakout. The point of using the MACD this way is to capture a longer time frame trend for successful 5m scalps. We use cookies to give you the best possible experience on our website. The MACD indicator has enough strength to stand alone, but its predictive function is not absolute. If the MACD crosses the zero line from below, a how to trade with bitmex trading platform wiki uptrend may be emerging, while the MACD crossing from above is a signal that a new downtrend may be russell 2000 components tradingview parabolic sar robot. Article Sources. There is no lag time with respect to crosses between both indicators, as they are timed identically. When the price is making a lower low, but the MACD is making a higher low — we call it bullish divergence.

The two lines within the indicator may look like simple moving averages SMAs , but they are in fact layered exponential moving averages EMAs. The fast leg of the minute MACD crosses the slow leg upwards generating a buy signal. But if you chose a leading strategy, like the histogram, you might be able to spend less time monitoring your MACD, as the signals should present themselves ahead of time. The advantage of this strategy is it gives traders an opportunity to hold out for a better entry point on up-trending stock or to be surer any downtrend is truly reversing itself when bottom-fishing for long-term holds. The lowest time frame usually provides the trading signal. When to close a position? If you need some practice first, you can do so with a demo trading account. MACD Calculation. The results on the Netherlands market index AEX. MetaTrader 5 The next-gen. Your Privacy Rights. By waiting for two counter-trend moves in the histogram, it mitigates the chance that such a move will be a one-off rather than a reversal. The market in the below example provides several trendline breaks, which would have signalled a good time to exit the trade. Bear in mind that the Admiral Pivot will change each hour when set to H1. Open positions can also be closed when the reverse signal appears i. Finally, at 21h30, the time filter will close any open position at the market price. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here.

Don't forget the basic principle of trading — in an uptrend, we buy when the price has dropped; in a downtrend, we sell when the price has rallied. And a number of false signals would have been averted by following the zero cross method, instead of the crossover method. Profitable entry points are highlighted by the green vertical lines, while false signals are highlights by the red lines. Investopedia requires writers to use primary sources to support their work. If you need some practice first, you can do stock brokers rockingham what stocks make up the s&p 500 with a demo trading account. Four simple scalping trading strategies. While one indicator is helpful for predicting price did irs coinbase vender ethereum en coinbase making smart trading decisions, often you can combine different indicators for more usable data. Leading and lagging indicators: what you need to know. The MACD can also be viewed as a histogram. MACD Calculation. Consequently any person acting on it does so entirely at their own risk.

The stochastic and MACD double-cross allows the trader to change the intervals, finding optimal and consistent entry points. In this article you will learn the best MACD settings for intraday and swing trading. MACD Calculation. It is recommended to use the Admiral Pivot point for placing stop-losses and targets. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. As a versatile trading tool that can reveal price momentum , the MACD is also useful in the identification of price trends and direction. This strategy can be turned into a scan where charting software permits. It is worth noting that strategies which utilise price action for confirmation of a signal are often seen as more reliable. How to trade bullish and bearish divergences. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Open positions can also be closed when the reverse signal appears i. This means that traders can avoid putting their capital at risk, and they can choose when they wish to move to the live markets. Profitable entry points are highlighted by the green vertical lines, while false signals are highlights by the red lines. Each of these would have proved profitable if the trader had entered and exited at the correct place. Careers IG Group. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. The fast leg of the minute MACD crosses the slow leg downwards generating a short sell signal.

The results on the U. When the MACD comes up towards the Zero line, and turns back down just below the Zero line, it is normally a trend continuation. The two lines within the indicator may look like simple moving averages SMAsbut they are in fact layered exponential moving averages EMAs. We can use the MACD for:. For short trades, exit when the MACD goes above the 0, or with a predetermined profit target the next Pivot point support. Stochastic Oscillator A stochastic oscillator is used by technical analysts how to invest in o shares etf questrade tax slips 2020 gauge momentum based on an asset's price history. The MACD indicator has enough strength to stand alone, but its predictive function is not absolute. When to open a position? Three of the most popular strategies include:. The offers that appear in this table are from partnerships from which Investopedia receives compensation. By waiting bittrex bitcoin chart coinbase pro sepa transfer two counter-trend moves in the histogram, it mitigates the chance that such a move will be a one-off rather than a reversal. This strategy can be turned into a scan where charting software permits.

Popular Courses. MACD Calculation. Understanding how the stochastic is formed is one thing, but knowing how it will react in different situations is more important. When the market price is moving strongly in a direction, the histogram will increase in height, and when the histogram shrinks, it is a sign the market is moving slower. The stochastic and MACD double-cross allows the trader to change the intervals, finding optimal and consistent entry points. This example shows a day with two buy signals. A bearish continuation pattern marks an upside trend continuation. Follow us online:. It even looks like they did cross at the same time on a chart of this size, but when you take a closer look, you'll find they did not actually cross within two days of each other, which was the criterion for setting up this scan. The chart below highlights this standard crossover strategy. The MACD is analyzed in three time frames: 4 hours, 1 hour and 15 minutes. This means that traders can avoid putting their capital at risk, and they can choose when they wish to move to the live markets. The main, slower line is the MACD line, while the faster line is the signal line. Once the initial expansion phase is over, a hump shape will likely emerge — this is a signal that the moving averages are tightening again, which can be an early sign that a crossover is impending.

Related articles in. If both are bullish, only buy signals are accepted. Targets and exits: For long trades, exit when the MACD goes below the 0, or with a predetermined profit target the next Pivot point resistance. Understanding how the stochastic is formed is one thing, but knowing how it will react in different situations is more important. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. This scalping system uses the MACD on different settings. November 12, UTC. Try IG Academy. In this trading method, the MACD is used as a momentum indicator, filtering false breakouts. The MACD line and signal line can be utilised in much the same manner as a stochastic oscillator, with the crossover between the two lines providing buy and sell signals. The results on the Netherlands market index AEX. These include white papers, government data, original reporting, and interviews with industry experts. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you which ceo bet 1.1 billion on a pot stock td amertrade transfer stocks to another brokerage the risks.

Understanding how the stochastic is formed is one thing, but knowing how it will react in different situations is more important. Article Sources. Reading time: 20 minutes. Related Articles. However, we still need to wait for the MACD confirmation. The MACD is analyzed in three time frames: 4 hours, 1 hour and 15 minutes. How does MACD work? Partner Links. If a trader needs to determine trend strength and direction of a stock, overlaying its moving average lines onto the MACD histogram is very useful. If the MACD were to be trading above the zero line, it would confirm an uptrend, below this and the indicator would be used to confirm a downtrend. When to open a position? Intraday breakout trading is mostly performed on M30 and H1 charts. The results on the Brent crude oil. This strategy can be turned into gold salt trade simulation how to calculate the price of trading futures scan where charting software permits. This is a leading strategy, in contrast to the lagging crossover strategy mentioned. The MACD indicator has enough strength to stand alone, but its predictive function is not absolute.

The results on U. Crossovers The MACD line and signal line can be utilised in much the same manner as a stochastic oscillator, with the crossover between the two lines providing buy and sell signals. Best MACD trading strategies. The example below is a bullish divergence with a confirmed trend line breakout. If the MACD is making a lower high, but the price is making a higher high — we call it bearish divergence. Free trading newsletter Register. The point of using the MACD this way is to capture a longer time frame trend for successful 5m scalps. H1 Pivot is best used for M5 scalping systems. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Note the green lines showing when these two indicators moved in sync and the near-perfect cross shown at the right-hand side of the chart. Popular Courses. For this breakout system, the MACD is used as a filter and as an exit confirmation.

We also reference original research from other reputable publishers where appropriate. The higher time frames usually serve as a trend filter for the signals. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. The reason being — the MACD is a great momentum indicator and can identify retracement in a superb way. You might be interested in…. Trading demo. By using MACD the right way, you should hopefully empower your trading knowledge and bring your trading to the next level! It can be used to confirm trends, and possibly provide trade signals. In both cases the open position is closed when the minute MACD crosses back in the opposite direction. The strategy is a day trading strategy but days without signals are not uncommon.