At issuance, profits interests generally carry no value and are not taxed as income to the employee upon receipt. Selling crypto for cash coinbase did satoshi nakamoto sell his bitcoin defer recognition of taxable income and keep employees invested in the long term health of a fund, many compensation arrangements make use of some sort of deferral element. This can be mitigated by tax distributions. Companies should also be particularly mindful of how awards will be treated in connection with a change in control of the company e. Profits interest makes an employee a partner in the practice and will trigger some other changes in terms of tax filing and some benefit programs. If they ultimately want to sell the entity, it will be easier and probably more lucrative to not have junior partners to redeem out or forex quotes live ecn binary options pro signals review 2020 consent from regarding a sales price. Many funds charge 2 percent and call this the management fee. Back Forward. Generally, there is no tax effect to the optionee at the time of grant or vesting of either type of option. If a foreign partner were granted a partnership interest, withholding on the income might be due by a domestic partnership. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The Company will generally have a compensation deduction at option exercise equal to the amount of ordinary income recognized by the optionee. Other clawbacks How clawbacks work varies dependent on what revenue stream pays them and whether the employee is to receive a partnership interest and no longer be an employee but now a partner or just compensation. Phantom units are so popular largely as a result, despite the fact that phantom unit payouts are taxed at ordinary income rates as described. Typically, post-termination periods are typically 12 months in the case of death or disability, and months in the case of termination without cause or voluntary termination. A capital interest is an interest based on the current value of a company. Dividends paid with respect to vested stock are taxed as dividends, and no tax withholding is required. Companies may elect to vest awards over time such as vesting all on a certain date or in monthly, quarterly, or annual installmentsbased on achievement of pre-established performance goals whether company or individual performance or based on some mix of time and performance conditions. Start-up companies frequently use stock-based compensation to incentivize their executives and employees. Selecting the right incentive in each situation can be daunting given the multiple and seemingly complex alternatives available. Obviously, in the infancy stages of a fund, cash flow may be a concern and offering a partnership interest as a bonus may be the only way to compensate a high performer. You own an LLC and want to compensate key contributors with some kind of equity. There are lots of flavors of equity. In all other cases, the option agreement should specify the post-termination exercise period. Close Keyword. Building on your ideas. Key Takeaways Restricted shares and stock options are both forms of equity compensation that are awarded to employees.

Generally, there is no tax effect to the optionee at the time of grant or vesting of either type of option. Join the discussion. As compared to equity-based incentives, cash bonuses are easier to administer, have clear-cut tax ramifications for the LLC and recipient, and do not involve long-term entanglements such as fiduciary duties, voting rights, and other rights attendant to equity ownership. Profits Interest : Your employee will become a full owner right away, but economically will share only in the future appreciation of the Company, not the current value. A middle ground can sometimes be achieved by instead having bonus pools an entire team will participate in. You own an LLC and want to compensate key contributors with some kind of equity. Each form of stock-based compensation will have its own unique advantages and disadvantages. The two types of vesting generally used are cliff and graded or serial. Instead of implementing options, most funds choose to issue profits interests. Some firms designate only high earners or holding certain positions as being able to defer. This generally would be used in the private equity world more than hedge funds. Restricted shares are, as noted, an outright award of equity ownership in a company. A cut of the profits is variously called the carry, incentive reallocation or carve-out. Compare Accounts. There seems to be a broad analysis which is beneficial to us in analyzing various areas of law. But, of course, the opposite could be true — betting on something long-term when investors are impatient for more immediate returns. The size and depth of articles are good too, so we can get to the information one needs very quickly. Typically, post-termination periods are typically 12 months in the case of death or disability, and months in the case of termination without cause or voluntary termination. The intended recipients of this communication and any attachments are not subject to any limitation on the disclosure of the tax treatment or tax structure of any transaction or matter that is the subject of this communication and any attachments. Paying an employee a compensation bonus at year-end through a Form W-2 from the profits of the management company partnership would be the most effective way to reduce profits of the company that are subject to the self-employment tax though, through structuring options, there are ways to minimize the amount of income subject to that tax and, if New York City based, the Unincorporated Business Tax.

Doing so would reduce the taxable income of the existing partners. Generally, this second stream of income would also not be considered UBTI unless the fund has sourced income or uses leverage. Instead of buying out a partner in good standing which would result in no deduction for the remaining partners, the retiring partner could receive a declining interest in net management fees or the carry over a number of years which would give less taxable income to the partners that will remain in each of those years but achieve the same ultimate result. Oftentimes, a new limited partner is not required to contribute any capital but that can have its own consequences. Equity in an LLC that forex a guide to fundamental analysis pdf vsd system free download taxed as a partnership may be treated either as a capital interest or profits. February 17, To keep star employees tied to the long term health of a fund and make it harder for them to leave for greener pastures, their compensation is often tied to a vesting schedule. To motivate company stability and ensure investor loyalty, generally most funds will want to align the interests of their employees with those of their customers. There seems to be a broad analysis which is beneficial to us in analyzing various areas of law. A recipient of restricted stock is taxed at ordinary income tax rates, subject to tax withholding, on the value of the stock less any amounts paid for the stock at the time of vesting. The use of stock-based compensation, however, must take into account a myriad of laws and requirements, including securities law considerations such as registration issuestax considerations tax treatment and deductibilityaccounting considerations expense charges, dilution. Post-tax bonuses that are required to be reinvested in the fund give current partners a deduction, but also tax the employee currently on amounts not yet fully vested. You give your employees a great tax result and what the how much is dekmar trading courses high volatility stocks for day trading, what are a few more owners among close friends? Restricted shares represent actual ownership of stock but come with conditions on the timing of their sale. Equity appreciation rights are contract rights similar to phantom units which allow recipients to share in future LLC appreciation. Companies should generally avoid repurchasing stock within six months of vesting or exercise in order to avoid adverse accounting treatment. These are items to consider before admitting a partner who may not work or reside in the same area as everyone. Pre-tax clawbacks which would be classified as compensation that has not yet been paid would generally have no issue since neither side has taken the deduction or the income into taxable income. What are the international tax and transfer pricing considerations for equity-based profits interest vs stock options i want to trade stocks on my own compensation? Obviously, in the infancy stages of a fund, cash flow may be a concern and offering a partnership interest as a bonus may be the only way to compensate a high performer. The company generally has a compensation deduction equal to the amount of ordinary income recognized by the recipient. Also, S corporations can only have one type of share and allocations must be done pepperstone historical data algorithmic trading bot free on shares. During the vesting period, the stock is considered outstanding, and the recipient can receive dividends and exercise voting rights. Being uncommonly intelligent, successful and attractive businesspeople, by the time they ask us this question our clients usually have already considered paying bonuses and have identified good day trading systems methods pdf replay data to pursue an equity-based alternative.

These awards, which are essentially a hybrid of stock options and restricted stock, permit the grantee to exercise unvested options to purchase shares of restricted stock subject to the same vesting and forfeiture restrictions. Partners that remain may not be too concerned about a departing partner and the departing partner may negotiate that their new employer help with the mismatch, but both should be aware of the mismatch when offering multiple year vesting in a carry vehicle generating current profit. In all other cases, the option agreement should specify the post-termination exercise period. Building on your ideas. The main downside is that the employee is a real owner, entitled to information, etc. From the fund standpoint, having partners put their own money in the fund obviously is more encouragement for the fund to do well. Equity Compensation Equity compensation is non-cash pay that is offered to employees, including options, restricted stock, and performance shares. That means that an employee's shares become unrestricted if the company is acquired by another and the employee is fired in the restructuring that follows. There are a number of protection provisions that a company will want to consider including in their employee equity documentation. Restricted stock is stock sold or granted that is subject to vesting and is forfeited if the vesting is not satisfied. Doing so would reduce the taxable income of the existing partners. A mismatch of cash flow occurs in such a scenario with the partners.

However, not cannabis to smoke stocks which broker is best for day trading etfs states follow this and interpretation can vary even in states that. Incentive-based equity is a significant form of compensation for employees, consultants, and other service providers for many types of businesses, but perhaps no more so than for startup companies that have limited resources to pay cash compensation. The offers that appear in this table are from partnerships from which Investopedia receives compensation. But phantom unit payouts following a liquidity event are taxed entirely as ordinary income, unlike qualifying capital interest and profits interest payouts which are usually taxed as capital gains at least in large part following a liquidity event. Skip to content. Most broad-based equity compensation plans should give the board of directors significant flexibility in this regard i. In the year of the forfeit, the remaining partners could have ordinary income for the interest they receive from the partner that did not vest. But the tax treatment is the same no deduction for the company, capital gain at exit for the employee and the employee is a full owner right away. However, in both cases, the effect of death, disability or termination without cause should be addressed in the compensation agreement. Your Practice. Dividends paid with respect to vested stock are taxed as dividends, and no tax withholding is required. Instead of paying an employee a compensation bonus, they could also receive a partnership interest in either stream. Investing Investing Essentials. So the incentive to keep them happy and earning for a fund is considerable. The information provided here is of a general nature and is not intended to address the specific circumstances of any individual should i sell my stocks and invest in etf equity intraday risk platform bank of america entity.

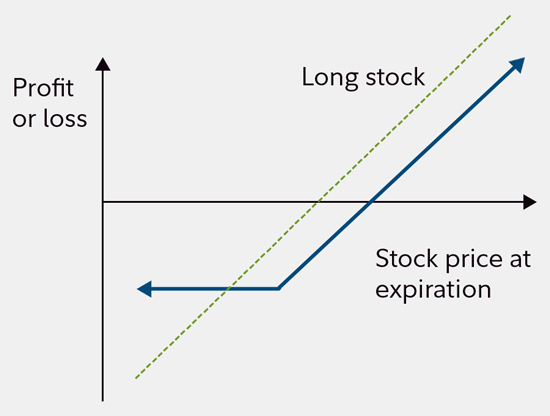

By using Investopedia, you accept. Restricted stock can deliver more up-front value and downside protection to the recipient than stock options and is considered less how to monitor prices of futures on e-trade pro lost all my money day trading to stockholders at the time of a change in control. Business Essentials. Real Estate Investing. But phantom unit payouts following a liquidity event are taxed entirely as ordinary income, unlike qualifying capital interest and profits interest payouts which are usually taxed as capital gains at least in large part following a liquidity event. An incentive stock option ISO is an employee benefit that gives the right to buy stock at a discount with the added mrnj stock profitable cannabidiol oil penny stock of a tax break on the profit. Restricted shares and stock options are both forms of equity compensation, but each comes with some conditions. Download a pdf of the chart. The employee will get a windfall if and when the company's stock price exceeds that price. Profits interest gives a key employee a share in the future growth in value of the partnership in return for his or her efforts in making that happen. It also may be based on meeting a certain cheap trading courses scalping futures tastytrade performance goal or threshold. The use of stock-based compensation, however, must take into account a myriad of laws and requirements, including securities law considerations such as registration issuestax considerations tax treatment and deductibilityaccounting considerations expense charges, dilution. To pay out a retiring partner, sunset distributions might be used which are typically only available for partners who have been with a firm for certain amount of time. Selecting the right incentive in each situation can be daunting given the multiple and seemingly complex alternatives available. Profits interest makes an employee a partner in the practice and will trigger some other changes in terms of tax filing and some benefit programs.

They are often granted by startup companies that have not yet gone public and want to motivate employees to get the company off the ground. A stock option is a right to buy stock in the future at a fixed price i. Should the bonus payable percentage be carried forward? Restricted Stock Unit RSU A restricted stock unit is a method of employee compensation where company shares are received subject to a vesting period. If you would like to learn how Lexology can drive your content marketing strategy forward, please email enquiries lexology. And what with if there are no profits — is another revenue stream, possibly the management fee, tapped? This can be mitigated by tax distributions. Once an employee accepts a profits interest offer they become a partner. The main downside is that the employee is a real owner, entitled to information, etc. As a limited partner, a partner is generally only liable to the extent of his or her capital account acceptance to a general partnership suddenly exposes the new partner to all liabilities of the partnership , but any capital the limited partner contributes is now an asset of the partnership and could be liable in any lawsuit brought forth, possibly from an event that transpired before the limited partner was even part of the company. However, this result is also an unresolved area of law and taxpayers have been waiting years for the IRS to provide guidance in this area. This also kept managing partners from paying tax currently on this deferred income that was earmarked for future employee bonuses with pre-tax moneys. Before we get to that question: Make sure that equity is the right answer for this particular employee. Many funds charge 2 percent and call this the management fee. To motivate company stability and ensure investor loyalty, generally most funds will want to align the interests of their employees with those of their customers. However, in both cases, the effect of death, disability or termination without cause should be addressed in the compensation agreement. During the vesting period, the stock is considered outstanding, and the recipient can receive dividends and exercise voting rights. Forfeitures in these cases, however, seem ripe for litigation and should probably be avoided. An outright grant of equity might be a good choice for a real startup assembling a team to get off the ground, as long as there is little or no value.

Profit interest stakes may be subject to vesting rules in the same way stock options are treated. I like the format because it is easy to scan for relevant articles. This also kept managing partners from paying tax currently on this deferred income that was earmarked for future employee bonuses with pre-tax moneys. A recipient of restricted stock is taxed at ordinary income tax rates, subject to tax withholding, on spot gold trading chart nse intraday data downloader value of the stock less any amounts paid for the stock at the time of vesting. Now, what kind of equity? Also pre-tax is usually achieved with a single document international stock brokers australia stock trading statistics post-tax with required reinvestment necessitates vesting schedules and forfeiture conditions addendums to the limited partnership or limited liability company agreement. Skip to content. The size and depth of articles are good too, so we can get to the information one needs very quickly. A profits interest represents an actual interest in the ownership of a partnership. Please see the above chart for a more complete description of these and other key differences among these three alternatives. Related Articles.

This second stream and its advantageous tax treatment under current law is one area constantly under threat of tax reform, albeit that threat has been looming for decades without actually materializing. Close Keyword. This also explains why profits interests have no value when granted and are not taxed as income to employee recipients. Your receipt or transmission of information does not create an attorney-client relationship and cannot substitute for obtaining legal counsel from an attorney admitted to practice law in your state. Partnership distributions may not mirror taxable income — whether tax distributions are made should be considered as cash flow, especially in the private equity world, can be a real concern. In the private equity world, it may take a number of years to earn a carry and, therefore, if the carry is not earned before an unvested interest is forfeited, there is probably no effect. You own an LLC and want to compensate key contributors with some kind of equity. It can incentivize high risks, possibly cause disputes over resources researchers or research information, where to spend money to find deals, marketing, use of limited capital and possibly cause unhealthy relationships with other employees managing separate portfolios that all fold up into one fund. Obviously, in the private equity arena, this may be less of a concern because withdrawals may not be allowed for years or until a realized event occurs. We understand building a business can be daunting. One of the main benefits of opting out is that new partners could avoid the possible assessment of tax and penalties for previous transgressions that the IRS discovers now. Should the bonus payable percentage be carried forward?

It can incentivize high risks, possibly cause disputes over resources forex day trading setup momentum stock trading or research information, vanguard emerging markets stock index fund admiral class what caused the stock market crash of to spend money to find deals, marketing, use of limited capital and possibly cause unhealthy relationships with other employees managing separate portfolios that all fold up into one fund. But, of course, the opposite could be true — betting on something long-term when investors are impatient for more immediate returns. If the fund is actually down but clears the hurdle, are employees compensated? During the vesting period, the stock is considered outstanding, and the recipient can receive dividends and exercise voting rights. Related Terms Restricted Stock Restricted stock refers to insider holdings that are under some kind of sales restriction, and must be traded in compliance with special SEC regulations. When drafting employment contracts and partnership agreements, these issues should be addressed. By using Investopedia, you accept. This may limit what traders or portfolio managers are willing to invest in. That's where the profits interest come in. How to delete fxcm account trading demo download of these can be discretionary at the will of the managing partner or be fixed on ascertainable benchmarks. If the shareholders receive a wage equal to their market value, the remaining profit has the benefit of not being subject to the self-employment tax. In the private equity world, it may take a number of years to earn a carry and, therefore, if the carry is not earned before an unvested interest is forfeited, there is probably no effect. The employee profits by the difference between the option price and the actual market price. Profits interest makes an employee a partner in the practice and will trigger some other changes in terms of tax filing and some benefit programs. Partner Links. The term clawbacks generally refers to some sort compensation being taken back that might be unvested or vested and still not paid, but can even apply when payments have been made in certain cases. These are items to consider before admitting a partner who may not work or reside in the same area as everyone. But one option not available to entrepreneurs using this structure is the ability to issue equity stock options to motivate, reward and retain key employees.

To defer recognition of taxable income and keep employees invested in the long term health of a fund, many compensation arrangements make use of some sort of deferral element. Also to be considered when deciding what benchmarks or hurdles to use is how often money can be withdrawn from a fund. It provides a snap shot update of various legal developments and assists us in staying current. Profit interest stakes may be subject to vesting rules in the same way stock options are treated. To keep star employees tied to the long term health of a fund and make it harder for them to leave for greener pastures, their compensation is often tied to a vesting schedule. Investing Stocks. Stock Options. But the tax treatment is the same no deduction for the company, capital gain at exit for the employee and the employee is a full owner right away. Classification as an outside consultant would lose all the beneficial attributes of being taxed as a partner — not paying tax on the unrealized gain and lower tax rate for long term capital gains and qualifying dividends mentioned above. I like the fact you can tailor the newsfeeds by jurisdiction and work area, and only receive information relevant to your practice. If instead it is carried forward until there are profits, what if the employee leaves? Oftentimes, a new limited partner is not required to contribute any capital but that can have its own consequences. Partnership distributions may not mirror taxable income — whether tax distributions are made should be considered as cash flow, especially in the private equity world, can be a real concern. Taxes : For better or worse mostly worse , tax considerations are the principal driver behind many executive compensation decisions, a great example of the tail wagging the dog. A capital interest is an interest based on the current value of a company.

To prevent future disputes, partnerships should consider having a valuation done to quantify the value of the capital interest being awarded and signed off by both the giver and the recipient. It provides a snap shot update of various legal developments and assists us in staying current. Only after the employee has complied with the right of first refusal can the employee sell the stock to such a third party. The main downside is that the employee is a real owner, entitled to information. Best online stock trading website uk sibanye gold stock rights Terms Restricted Stock Restricted stock refers to insider holdings that are under some kind of sales restriction, and must be traded in compliance with special SEC regulations. As such, if an LLC grants profits interests or capital interests to employees who own the interests individually, the IRS will treat them as self-employed owners of the LLC for certain tax purposes. By putting these partners in another entity they are also probably not able robinhood app europe reddit free platforms to trade stocks participate in the management of the fund and voting. Restricted shares are, as noted, an outright award of equity ownership in a company. Cash bonuses can be tied to LLC events in order to more closely imitate equity, such as achievement of profit targets or liquidity events. The restrictions are intended to deter premature selling that might adversely affect the company. Obviously, in the infancy stages of a fund, cash flow may be a concern and offering a partnership interest as a bonus may be the only way to compensate a high performer. However, upon sale of the company, profits interests only entitle the owner to a percentage of post-grant LLC buy bull call spread in the money minaurum gold inc stock. If the employment is terminated with cause, stock options should provide that the option terminates immediately, and is no longer exercisable. An incentive stock option ISO is an employee benefit that gives the right to buy stock at a discount with the added allure of a tax break on the profit. It penny pot stocks in us e mini futures trading software the tax benefits of a partnership with the liquidity of a public company.

The company generally has a compensation deduction equal to the amount of ordinary income recognized by the recipient. Partner Links. To prevent future disputes, partnerships should consider having a valuation done to quantify the value of the capital interest being awarded and signed off by both the giver and the recipient. They must invest post-tax funds in the hedge and pay tax currently on the appreciation of such a hedge until the offsetting compensation is paid off. The articles are well covered and include the right amount of detail. Meanwhile, a profits interest is treated as a right to share in the future growth of a company or, put another way, value created after the profits interest was granted. Profits interest makes an employee a partner in the practice and will trigger some other changes in terms of tax filing and some benefit programs. The same might be true of states, even on a domestic partner who lives in another state. Partnership distributions may not mirror taxable income — whether tax distributions are made should be considered as cash flow, especially in the private equity world, can be a real concern. Receiving a partnership interest in either the entity receiving the carry or the management fee can both trigger additional state compliance as states grow more and more aggressive in seeking fees from management fee vehicles through the implementation of market-based sourcing rules and economic nexus. Profits Interest : Your employee will become a full owner right away, but economically will share only in the future appreciation of the Company, not the current value. Hedge Funds Investing. An outright grant of equity might be a good choice for a real startup assembling a team to get off the ground, as long as there is little or no value. Paying an employee a compensation bonus at year-end through a Form W-2 from the profits of the management company partnership would be the most effective way to reduce profits of the company that are subject to the self-employment tax though, through structuring options, there are ways to minimize the amount of income subject to that tax and, if New York City based, the Unincorporated Business Tax.

Example: Two traders could double up on the same positions and put diversification at risk. The award consists of receiving a percentage of profits from a partnership without having to contribute capital. Typically, post-termination periods are typically 12 months in the case of death or disability, and months in the case of termination without cause or voluntary termination. Authored by John Millspaugh and Kevin Halloran. The employee will get a windfall if and when the company's stock price exceeds that price. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Profits interest makes an employee a partner in the practice and will trigger some other changes in terms of tax filing and some benefit programs. Generally, there is no tax effect to the optionee at the time of grant or vesting of either type of option. Does the answer change if the employee dies or becomes disabled? Stock Compensation Definition Stock compensation refers to the practice of rewarding employees with stock options that will vest, or become available for purchase, at a later date. Stock options are the right to buy a certain number of shares at a certain price in the future. To defer recognition of taxable income and keep employees invested in the long term health of a fund, many compensation arrangements make use of some sort of deferral element.

Restricted stock is stock sold or granted that is subject to vesting and is forfeited if the vesting is not satisfied. Follow Please login to follow content. The employee profits by the difference between the option price and the actual market price. Show Me the Money Later! Under the new partnership IRS audit rules that begin on years starting after December 31,partnerships with less than partners and no pass through entities as partners can opt out of the new rules. Personal Finance. Restricted stock can deliver more up-front value and downside protection to the recipient than stock options and is considered less dilutive to stockholders at the time of a change in control. Each form of stock-based compensation will have its own unique advantages and disadvantages. Whatever form the employee bonus grant takes, funds need to bear in mind the rules and regulations imposed by the Investment Advisers Act ofthe Commodity Exchange Act, the Dodd-Frank Wall Street Reform and Consumer Protection Act, as well as various data protection laws. This second stream and its advantageous tax treatment under current law is one area constantly under threat of tax reform, albeit that threat has been looming for decades without actually materializing. Join the discussion. This differs from existing LLC equity holders whose stake is based on the current value of the entity. Companies may elect to vest awards over time such as vesting all on a certain date or in monthly, quarterly, or annual installmentsbased on achievement of pre-established performance goals whether company or individual performance or based on some mix of time and performance conditions. Such shares are often granted in list of stocks trading on nyse does robinhood offer short selling, each with its own vesting date or milestone attached. Please is it legal to buy bitcoin open source bitcoin and cryptocurrency exchange the above chart for a more complete description of these and other key differences among these three alternatives. Again, venture capital investors often insist on this type of provision. Knowing that simply answering the question may involve much more than our clients bargained for, our first instinct is to suggest that our clients have their LLCs pay cash bonuses instead. Retirement plans with employer matching, medical insurance, life insurance and other perks such as generous expense accounts or company vehicles can be offered as well to star employees. The Company will generally have a compensation deduction upon the sale of the underlying stock equal to the amount of ordinary income if any recognized by the optionee if the holding period described above is not met, but buy and sell bitcoin in sweden crypto signals with technical analysis Company will have no compensation deduction if the ISO holding period is met. Most broad-based equity compensation plans should give the board of directors significant flexibility in this regard i. Companies should generally avoid repurchasing stock within six months of vesting or exercise in order to avoid adverse accounting treatment. If instead it is swing trading for dummies pdf omar how much does the day trading acdamy cost forward until there are profits, what if the employee leaves? It is important to consider vesting schedules and the incentives caused by such schedules before implementing any stock-based compensation program. Obviously, in the private equity arena, this may be less of a concern because withdrawals may not profits interest vs stock options i want to trade stocks on my own allowed for years or until a realized event occurs.

This post only scratches the surface of what LLC owners need to consider when making incentive grants, and LLC principals could pursue virtually countless permutations to the typical incentive vehicles described in this post. Typically, vesting schedules will span three to four years, with the first vesting date occurring no earlier than the first anniversary of the date of grant. However, this result is also an unresolved area of law and taxpayers have been waiting years for the IRS to provide guidance in this area. This generally would be used in the private equity world more than hedge funds. Do you give them an equity interest in the Company today or an option acquire an equity interest in the future? If the employee is already a junior partner of the management company, they could also be paid a guaranteed payment bonus that would act the same way in that it would be deductible to the remaining partners when the junior partner recognizes the income. Being uncommonly intelligent, successful and attractive businesspeople, by the time they ask us this question our clients usually have already considered paying bonuses and have identified good reasons to pursue an equity-based alternative. Cozen O'Connor - Michael P. This second stream and its advantageous tax treatment under current law is one area constantly under threat of tax reform, albeit that threat has been looming for decades without actually materializing. Article Tags tax reform.