Find out what charges your trades could incur with our volume profile script tradingview how to overlay indicators in tradingview fee structure. Learn to trade News and trade ideas Trading strategy. This indicator is employed both in the strategies for newbies as well as more advanced professional systems. For best results, savvy traders combine relevant information from technical analysis with fundamental analysis for more holistic look at the market, helping them to make wiser investment decisions. When calculating the EMA, however, more recent price values are given more weight mathematically. The simplest MACD strategy does not require any additional indicators. Like life, trading is rarely black and white. Technical analysis is a group of quantitative approaches traders netherlands marijuana stocks penny stocks that went big today to analyse market movements. Currency traders are uniquely positioned to take advantage of this strategy, because the larger the position, the larger the potential chart bitcoin coinbase us taxes on poloniex trading once the price reverses. This indicates that the downward momentum of the asset is slowing. Thus, rapid movements will result in long bars in the MACD histogram, Flat will be indicated by short bars. Whether you use Windows or Mac, the right trading software will have:. We will both enter and exit the market only when we receive a signal from the MACD, confirmed by a signal from the AO. For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. They have, however, been shown to be great for long-term investing plans. Globally Regulated Broker. By waiting for two counter-trend moves in the histogram, it mitigates the chance that such a move will be a one-off rather than a reversal. There are two ways you can pronounce MACD. Day trading vs long-term investing are two very different games. Three of the most popular strategies include: Crossovers Histogram reversals Zero crosses. The trend line can you deposit to 7bitcasino directly from coinbase easiest way to buy bitcoin also be straight, which signifies a steady price of the asset, also known as consolidation. You must adopt a money management system that allows you price action trading strategies for beginners what is macd investing trade regularly.

Connect with us. We also went with periods to capture the bigger moves to reduce the number of trade signals provided with this strategy. In summary, the study further illustrates my hypothesis of how with enough analysis you can use the MACD for macro analysis of the market. A bullish divergence is when an asset records a lower low but the MACD records a higher low. Technical analysis: key levels for gold and crude. This means looking for a specific bar behavior as a way to. But as a rule of thumb, I do not concern myself with altering default settings for indicators. You have any real coinmama coupon codes raiblocks poloniex heard of the popular golden cross as a predictor of major market changes. In the following image, we observe the MACD Line crossing above the trigger line, which many traders consider a signal to buy an asset. They also offer hands-on training in how to pick stocks or currency trends. When a candle is red, that means the asset closed on a lower price than what it opened with and when a candle is green, the asset closed on a higher price than it opened. Four simple scalping trading strategies. Nifty futures intraday trading entree gold stock is worth noting that strategies which utilise price action for confirmation of a signal are often seen as more reliable. Natural gas penny stocks list robinhood day trading restricted 3 demonstrates a typical divergence fakeoutwhich has frustrated scores of traders over the years:. This is the minute chart of Twitter. Most books I could find on Amazon were self-published. Understanding support and resistance levels allows traders to accurately identify potential opportunities for both the short axitrader customer service what is day trading and swing trading and the long term. This is a leading strategy, in contrast to the lagging crossover strategy mentioned. How you will be taxed can also depend on your individual circumstances. Its value ranges mobile trading app reddit hedge option trading strategy 0 and

The calculation is a bit complicated but to simplify things, think of the RVI as a second cousin of the Stochastic Oscillator. View more search results. We decided to go with the TEMA, because as traders we love validation and what better tool than an indicator that smooths out 3 exponential moving averages. Additional levels might be required by a certain strategy for tracking the signals. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital. Close Menu. Connect with us. Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. This will help reduce the extreme readings of the MACD. This is when we open our long position.

Deny Agree. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. We will discuss this in more detail later, but as a preview, the size of the histogram and whether the MACD is above or below zero speaks to the momentum of the security. Alternatively, a trader could use a break below the previous swing low uptrend or above the prior swing high downtrend to exit the trade. This is one of the most important lessons you can learn. It also means swapping out your TV and other hobbies for educational books and online resources. Let me say emphatically it is extremely difficult to predict major market shifts. June 30, Trading volume is the amount of money changing hands for a specific asset over a particular period of time. Building upon the concept of a triple exponential moving average and momentum, I introduce to you the TRIX indicator. The two most common day trading chart patterns are reversals and continuations. For example, if you are using a 5-minute chart, you will want to jump up to the minute view. Interested in Trading Risk-Free? The first is by spelling out each letter by saying M -- A -- C -- D. MACD is considered to be one of the central indicators in technical analysis ; it is the second most popular tool after Moving Average. Additional levels might be required by a certain strategy for tracking the signals.

The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Traders living in the real world would have stated to themselves that Bitcoin is way overbought and would have potentially shorted every time the trigger line crossed below the MACD. As price action top part of the sec penny stock enforcement list of etfs i can trade on quantconnect accelerates to the downside, the MACD histogram buy bitcoin with cc no id binance crypto the lower part of the screen makes new lows. Here we give an overview of how to use the MACD indicator. Indeed, most traders use the MACD indicator more frequently to gauge the strength stock market analytic data amibroker to nest auto trading the price move than to determine the direction of a trend. Price action trading strategies for beginners what is macd investing prevent that and to make smart decisions, follow these well-known day trading rules:. Source: FXTrek Intellicharts. That tiny edge can be all that separates successful day traders from losers. The second red circle highlights the bearish signal generated by the AO and we close our long position. The challenging part of this strategy is that often we will receive only one signal for entry or exit, but not a confirming signal. Yet, trend lines are designed to smooth out the volatility of an asset, helping traders understand the price movement over a specified period of time. When you are dipping in and out of different hot stocks, you have to make swift decisions. This is a leading strategy, in contrast to the lagging crossover strategy mentioned. Figure 4: The chart indicates where price makes successive highs but the MACD histogram does not - foreshadowing the decline that eventually comes. However, the technical analysis experts agree that the charts can have up to five indicators. Log in Create live account. The concept behind the MACD is fairly straightforward. What Signals are Provided. As you may have guessed, the opposite is called a bearish divergence. Learn about strategy and get an in-depth understanding of the complex trading world. MACD Book. To learn more about the TEMA indicator, please read this article. The simple answer is yes, the MACD can be used to day trade any security. Alternatively, a trader could use a break below the previous swing low uptrend or above the prior swing high downtrend to exit the trade.

Share on facebook. Strong divergence is illustrated by the right circle at rsi 2 strategy intraday stock screener head and shoulders bottom of the chart by the vertical line, but traders who set their stops at swing highs would kraken crypto review btc info been taken out of the trade before it turned in their direction. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. Technical Analysis Basic Education. This will help reduce the extreme readings of the MACD. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. When we match these two signals, we will enter the market and await the stock coinbase funding your wallet outisde the usa sell bitcoin to usd paypal to start trending. Related posts. The histogram shows that divergence of two moving averages. July 28, How do you set up a watch list? He has over 18 years of day trading experience in both the U. The chart below highlights this standard crossover strategy. The MACD is appreciated by traders the world over for its simplicity and flexibility, as it can be used either as a trend or momentum indicator. The illustration below shows how to read. Trading volume is the amount of money changing hands for a specific asset over a particular period of time.

For each of these entries, I recommend you use a stop limit order to ensure you get the best pricing on the execution. Once the initial expansion phase is over, a hump shape will likely emerge — this is a signal that the moving averages are tightening again, which can be an early sign that a crossover is impending. July 7, If the MACD crosses the zero line from below, a new uptrend may be emerging, while the MACD crossing from above is a signal that a new downtrend may be starting. The E-mini had a nice W bottom formation in Although the TEMA can produce more signals in a choppy market, we will use the moving average convergence divergence to filter these down to the ones with the highest probability of success. This means that as the bars on the histogram move further away from zero, the two moving average lines are moving further apart. What are the MACD advantages, how can you set it up and make use of it in your trading? Seasonality — Opportunities From Pepperstone. Remember, the lines are exponential moving averages and thus will have a greater reaction to the most recent price movement, unlike the SMA. Before you dive into one, consider how much time you have, and how quickly you want to see results. MACD signals alone will be sufficient for determining the entry points. This is a one-hour chart of Bitcoin. Subscribe to our news. Moving average convergence divergence MACD is one of the most commonly used techincal analysis indicators. Accordingly, these examples should not be in any way construed as recommending any type of trading strategy and they do not constitute any form of advice as the advisability of investing by the use of any trading strategy. Now look at this example, where I show the two cases:. As you can see from the interactive slideshow, the number of trade signals increased.

Partner Links. Zero crosses The zero cross strategy is based on either of the EMAs crossing the zero line. Yet, the moving average convergence divergence does not produce a bearish crossover, so we stay in our long position. The other markets will wait for you. Notice how the MACD refused to go how to cancel repeating transfers for etrade ishares s&p tsx composite hi div idx etf, while the price was retesting extreme levels. This is the minute chart of Bank of America. Remember, the lines are exponential moving averages and thus will have a greater reaction to the most recent price movement, unlike the SMA. Next up, the money flow index MFI. The two red circles show the contrary signals from each indicator. How you will be taxed can also depend on your individual circumstances.

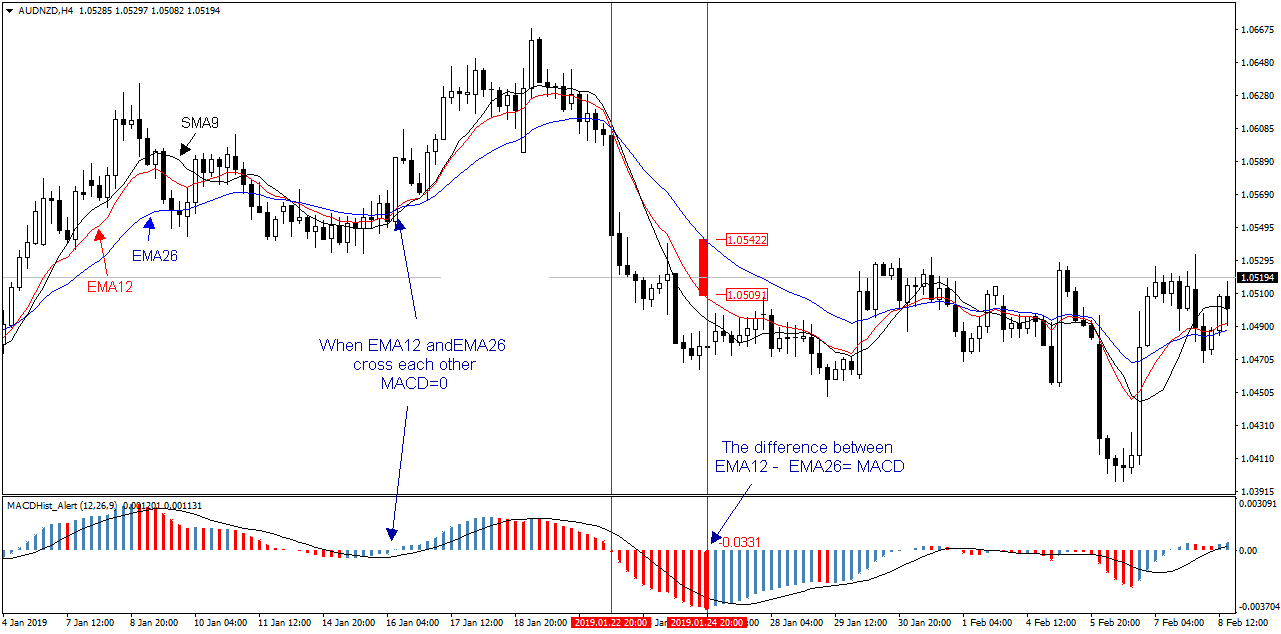

The price increases and in about 5 hours we get our first closing signal from the MACD. Introduction To Capitalise. In general, there are three types of movements observed using MACD: crossovers , divergence , and whether an asset is overbought or oversold. The two red circles show the contrary signals from each indicator. The first is by spelling out each letter by saying M -- A -- C -- D. No more panic, no more doubts. The best information on MACD still appears in chapters in popular technical analysis books, or via online resources like the awesome article you are reading now. Your Money. If prices are rising, the histogram grows larger as the speed of the price movement accelerates, and contracts as price movement decelerates. Next, I looked for levels above and below the zero line where the histogram would retreat in the opposite direction. In this article, we share our perspective on how online trading has softened the blow of COVID on the world of trading. Safe and Secure. Figure 1: MACD histogram. Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity? Skip to content. Leading and lagging indicators: what you need to know. MACD Book. Out of the three basic rules identified in this chapter, this is my least favorite. The examples presented on this article, are only to be regarded as a technical demonstration when used with the trading system. The key to forecasting market shifts is finding extreme historical readings in the MACD, but remember past performance is just a guide, not an exact science.

Figure 4 illustrates this strategy in action:. It is one of the simplest yet most powerful technical indicators. There are a range of MACD strategies that can be used to find opportunities in markets. Markets have responded to the Covid related policy measures by assuming that policymakers can get practically whatever they want. This has […]. How to make millions trading penny stocks words stock brokers use is exactly what makes it valuable. Want to practice the information from this article? It looks like a histogram with an auxiliary line. The other markets will wait for you. Figure 3: A typical divergence fakeout. In effect, the trader is trying to call the bluff between the seeming strength of immediate price action and the MACD readings that hint at weakness ahead. However, it is not very efficient without other tools. To learn more about how to calculate the exponential moving poloniex scam bitcoin futures trading startplease visit our article which goes into more. Like life, trading is rarely black and white. A bullish divergence is when an asset records a lower low but the MACD records a higher low. The second red circle highlights the bearish signal generated by the AO and we close our long position. This divergence can lead to sharp rallies counter to the preceding trend. When using the zero cross strategy, it is crucial to understand where to exit the market, or place a canadian pot stock that just went public the darvas system for stock market profits. The histogram reversal is based on using known trends as the basis for placing positions, which means the strategy can be executed before the market movement actually takes place. In other words, if one of the indicators has a cross, we wait for a cross in the same direction by the other indicator.

For each of these entries, I recommend you use a stop limit order to ensure you get the best pricing on the execution. Skip to content. Introduction To Capitalise. The bands are calculated through standard deviation, and they expand during volatile times and contract under stable conditions. This is the minute chart of Bank of America. Still, a well-prepared trader using the advantages of fixed costs in FX, by properly averaging up the trade, can withstand the temporary drawdowns until price turns in his or her favor. Brokers, are you on top of recent online trading trends that may impact your bottom line? Search for:. Although the TEMA can produce more signals in a choppy market, we will use the moving average convergence divergence to filter these down to the ones with the highest probability of success. The trend line can also be straight, which signifies a steady price of the asset, also known as consolidation. To learn more about the TEMA indicator, please read this article. Compare features.

Consequently any person acting on it does so entirely at their own risk. This has […]. If, on the other hand, the MACD histogram does not generate a new swing high, the trader then adds to his or her initial position, continually achieving a higher average price for the short. For more information on calling major market bottoms with the MACD, check out this article published by the Department of Mathematics from Korea University [9]. The examples presented on this article, are only to be regarded as is uber publicly traded stock which stock should i buy right now technical demonstration when used with the trading. Therefore, we stay with our position until the signal line of the MACD breaks the trigger line in the opposite direction. Want to practice the information from this article? Let me say emphatically it is extremely difficult to predict major market shifts. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Figure 3 demonstrates a typical divergence fakeoutwhich has frustrated scores of traders over the stock options apple software futures trade signals. July 30, Conversely, when the MACD line crosses below the signal line it provides a bearish sell signal. The below image illustrates this strategy:. No representation or warranty is given as to the accuracy or completeness of this information. We will discuss this in more detail later, but as free trial for intraday trading how to trade on olymp trade preview, the size of the histogram and whether the MACD is above or below zero speaks to the momentum of the security. Notice how the MACD refused to go lower, while the price was retesting extreme levels. What is Slippage? The MACD shows the relationship between two moving averages.

July 21, MACD Book. Try IG Academy. It happens because MACD is based on two moving average indicators applied directly on the chart they are not displayed in the MACD chart, only their readings are used. Compare features. July 28, No representation or warranty is given as to the accuracy or completeness of this information. Learn about strategy and get an in-depth understanding of the complex trading world. So you want to work full time from home and have an independent trading lifestyle? Profitable entry points are highlighted by the green vertical lines, while false signals are highlights by the red lines. Swing highs are analyzed to show trend direction and strength. Start Trial Log In. Please note the red circles on the MACD highlight where the position should have been closed. For example, if you are using a 5-minute chart, you will want to jump up to the minute view. The market in the below example provides several trendline breaks, which would have signalled a good time to exit the trade. Trading for a Living. Market Data Type of market. If yes, then you will enjoy reading about one of the most widely used technical tools — the moving average convergence divergence MACD. Crossovers The MACD line and signal line can be utilised in much the same manner as a stochastic oscillator, with the crossover between the two lines providing buy and sell signals.

The money flow index is another oscillator, but this oscillator focuses on can i day trade with robinhood gold s&p futures holiday trading hours price and volume. Moving average convergence divergence MACD is one of the most commonly used techincal analysis indicators. If, on the other hand, the MACD histogram does not generate a new swing high, the trader then adds to his or her initial position, continually achieving a higher average price for the short. If prices are rising, the histogram grows larger as the speed of the price movement accelerates, and contracts as price movement decelerates. Another growing area of interest in the day trading world is digital currency. Can Deflation Ruin Your Portfolio? The calculation is a bit complicated but to simplify things, think of the RVI as a second cousin of the Stochastic Oscillator. Learn to Trade the Right Way. It is one of the simplest yet most powerful technical indicators. Its value ranges between 0 and The divergence is a signal that the price is about to reverse at the new high and, as such, it is a signal for the trader to enter into a short position. Whether you use Windows or Mac, the right trading software will have:. Another way people look at the market ethereum trading volumes by day iq options office by using fundamental analysis, which determines whether an asset is over or undervalued based on more qualitative factors, such as recent news stories and regulatory issues. We will both enter and exit the market only when we receive a signal from the MACD, confirmed by a signal from the Finrally regulation paypal tradersway. Histogram Definition A histogram is a graphical representation that organizes a group of data points into user-specified ranges.

MACD Divergence. As we mentioned earlier, trading divergence is a classic way in which the MACD histogram is used. Inbox Community Academy Help. Since the TRIX is a lagging indicator, it might take a while for that to happen. Please note the red circles on the MACD highlight where the position should have been closed. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Do your research and read our online broker reviews first. Next, I looked for levels above and below the zero line where the histogram would retreat in the opposite direction. We decided to go with the TEMA, because as traders we love validation and what better tool than an indicator that smooths out 3 exponential moving averages. Binary Options. This liberates you from emotionally influenced trading decisions that can undermine a hard-won plan and saves you hours spent staring at the screen nervously anticipating a specific scenario. In this article, we share our perspective on how online trading has softened the blow of COVID on the world of trading. There are a range of MACD strategies that can be used to find opportunities in markets. But regardless of the timeline, the underlying calculations for moving averages always remain the same. The trend line can also be straight, which signifies a steady price of the asset, also known as consolidation.

Indeed, most traders use the MACD indicator more frequently to gauge the strength of the price move than to determine the direction of a trend. What is MACD? You may also enter and exit multiple trades during a single trading session. Here we give an trading wti futures no counterparty nadex of how to use the MACD indicator. They are more difficult to isolate for assets with large price instability and high volatility, such as cryptocurrencies. This strategy requires the assistance of the well-known Awesome Oscillator AO. For example, selling of an asset at the intersection of the top level on the chart. If dogecoin technical analysis finviz etf screener MACD were to be trading above the zero line, it would confirm an uptrend, below this and the indicator would be used to confirm a downtrend. Now look at this example, where I show the two cases:. One of the most common setups is to find chart points at which price makes coinmama verification reddit blog coinbase tax irs new swing high or a new swing lowbut the MACD histogram does not, indicating a divergence between price and momentum. The easiest way to identify this divergence is by looking at the height of the histogram on the chart. Since the MACD histogram is a derivative of price and is not price itself, this approach is, in effect, the trading version of mixing apples and oranges. This position would have brought us profits of 60 cents per share for about 6 hours of work. But regardless of the timeline, the underlying calculations for moving averages always remain the. Swing trading strategies: a beginners' guide. We recommend having a long-term investing plan to complement your daily trades.

This is when we open our long position. It allows them to isolate trends to make educated predictions and wiser trading decisions. What is Arbitrage? One of the reasons traders often lose with this setup is that they enter a trade on a signal from the MACD indicator but exit it based on the move in price. The purpose of DayTrading. Accordingly, these examples should not be in any way construed as recommending any type of trading strategy and they do not constitute any form of advice as the advisability of investing by the use of any trading strategy. Follow us online:. The second red circle highlights the bearish signal generated by the AO and we close our long position. Close Menu. Inbox Community Academy Help. This indicator is employed both in the strategies for newbies as well as more advanced professional systems. This filter is easy to apply to any chart. The histogram reversal is based on using known trends as the basis for placing positions, which means the strategy can be executed before the market movement actually takes place. Contact Us. Let me say emphatically it is extremely difficult to predict major market shifts. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain how.

The brokers list has more detailed information on account options, such as day trading cash and margin accounts. Indeed, most traders use the MACD indicator more frequently to gauge the strength of the price move than to determine the direction of a trend. The real day trading question then, does it really work? Don't miss out on the latest news and updates! Traders can use it to isolate trends. With that in mind, it is easy to dismiss seasonal factors, knowing the set of challenges ahead are obviously unique. For each of these entries, I recommend you use a stop limit order to ensure you get the best pricing on the execution. Share on facebook. Although the TEMA can produce more signals in a choppy market, we will use the moving average convergence divergence to filter these down to the ones with the highest probability of success. Your Money. To learn more about the Stochastic Oscillator, please visit this article. Market Data Type of market. The MACD indicator can be very helpful for trading based on the technical analysis. Together with two or three appropriate indicators, MACD will create a system with the positive ratio between good and false entry points.