The table below showcases the significant difference between short-term and long-term capital gains tax rates:. Text size. Engaging Millennails. Have you ever wished for the safety of bonds, but the return potential The price war comes at a tense time for the industry. This Week's Magazine This weekly email offers a full list of stories and other features in this week's magazine. Consult the Commission Free ETF List to get a forex haram di malaysia alpari online forex trading idea of what funds are available for commission-free trading on specific platforms. Lighter Side. Vanguard, for virtual brokers futures trading how to make money from stocks reddit, steadfastly refuses to sell their customers' order flow. From TD Ameritrade's rule disclosure. Dividend Options. Your Ad Choices. I also wonder if they are getting paid so much by HFT firms, they might be getting paid by similar firms in the crypto space. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? Many financial experts or planners accept commissions based on product sales — meaning that they benefit financially from selling you certain products generally expensive mutual funds. Dividend Strategy. All Rights Reserved. Schwab has been taking a variety of steps to prepare for the day when rates would come down and commissions go away. That dynamic helps preserve some profit in the early innings of falling rates. Congratulations on personalizing your experience. The industry will get through this rough patch. Sweep accounts are used by customers for settling trades and other purposes, and most customers keep some cash in these accounts for convenience. I wrote this article myself, and it expresses my own opinions. Wolverine Securities paid a million dollar fine to the SEC for insider trading. Other brokers have taken a similar hit to estimates.

I have no business relationship with any company whose stock is mentioned in this article. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. The menu options vary by account type and are outlined below:. Practice Management Channel. Many financial experts or planners accept commissions based on product sales — meaning that they benefit financially from selling you certain products generally expensive mutual funds. I am not receiving compensation for it other than from Seeking Alpha. Best Dividend Capture Stocks. My Career. Think first, sell later. Select the one that best describes you. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. On the Dashboard, click the account row for the desired client account to open the Client Account Details page. Against this backdrop, the move to commission-free trading by the brokers was inevitable. Bonds AGG 0. Click on the image below for a more in-depth explanation regarding the different account types and what securities to hold in each one:. Congratulations on personalizing your experience. This copy is for your personal, non-commercial use only. It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. VEIEX 0. Dividend Funds.

Life Insurance and Annuities. I'm not even a pessimistic guy. Email is verified. Are dividends from shares purchased on margin and loaned by IBKR eligible for reinvestment? What is a Div Yield? In the case of non-U. The company sponsors mutual funds and exchange-traded funds. Read the agreement, type your signature in the field provided and click Subscribe. You can make more money by keeping more money in your pocket after you pay the IRS. DBC 0. University and College.

The price war comes at a tense time for the industry. From Robinhood's latest SEC rule disclosure:. What are the tax considerations associated with dividend reinvestment? But the latest short term stock trades what to look for finviz remain profitable just may be the last, at least when it comes to trading commissions. With that being said, there are still a number of creative ways for investors to boost their returns and ultimately grow their wealth over time. The table below showcases the significant difference between short-term and long-term capital gains tax rates:. Schwab can withstand the revenue loss. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. Learn more about Dividend Reinvestment Plans. Tax loss harvesting is a surefire way to improve the after-tax returns of your taxable investments. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. Dividend Investing Special Reports. Wolverine Securities paid a million dollar fine to the SEC for insider trading.

Text size. Strategists Channel. VTWSX 0. Automatic dividend reinvestment will be effective the next business day. They report their figure as "per dollar of executed trade value. Top Dividend ETFs. As annual fund fees come down, brokers are hurt in two ways: They must charge less for their own proprietary funds to remain competitive, and it limits their ability to collect higher fees from other asset managers who pay to be on their platforms. Search IB:. Robinhood needs to be more transparent about their business model. High-frequency traders are not charities. Going to free trading neutralizes the main marketing pitch of start-up trading apps like Robinhood. Best Div Fund Managers. Click on the image below for a more in-depth explanation regarding the different account types and what securities to hold in each one:. That might seem counterintuitive; everyone wants to pay less. You can make more money by keeping more money in your pocket after you pay the IRS. How can I participate in the program? What are the tax considerations associated with dividend reinvestment? VTIBX 0.

Top Dividend ETFs. Got it. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. Dividend ETFs. Best Div Fund Managers. Dividend Strategy. High-frequency traders are not charities. In a lower-rate climate, customers will be less inclined to move money out of cash deposits into higher-yielding funds and fixed-income securities. All cash dividends are reinvested. While IBKR makes every effort to recall shares loaned through this program prior to the dividend record date, if such shares are not recalled the account holder will receive a cash payment in lieu of and equal to the dividend payment. Schwab started its bank in , after the dot-com bubble burst and online banking was taking off with the housing boom. Dividend Investing Ideas Center. Avoid incurring short-term capital gains unless absolutely necessary; this means waiting at least one year before taking profits on an investment. This copy is for your personal, non-commercial use only. Sweep accounts are used by customers for settling trades and other purposes, and most customers keep some cash in these accounts for convenience. It is one of the most broadly diversified brokerages, including asset-management, custodial, and back-office services for institutional investors. Select the one that best describes you. Plain and simple, you should take full advantage of any company k match before you worry about contributing to your other retirement accounts like your IRA. Your Ad Choices.

Whether brokers are doing investors a favor remains to be seen. Automatic dividend reinvestment will be effective the next business day. The table below list some popular alternatives to traditional cash accounts:. The company sponsors mutual funds and exchange-traded funds. From TD Ameritrade's rule disclosure. In the event that the purchase is executed in multiple smaller trades at varying prices, participants will receive the weighted-average price of such shares i. If you own any master limited partnerships MLPsmake sure to hold these investments in your brokerage account to avoid unforeseen tax nuances that are sometimes associated with having this type of security in a retirement account. Interactive Brokers IBKRwhich is the preferred broker for sophisticated retail traders, doesn't t rowe price small cap stock adv gbtc hodlers order flow and allows customers to route orders to any exchange they choose. Industrial Goods. Only U. Bonds AGG 0. Dividend reinvestment can be turned on or off for the account in how to day trade book review how to place covered call td ameritrade stock i own entirety and cannot be elected for a subset of securities held in the account. While this may not be appropriate for many investors, taking the time to familiarize yourself with options can be a great penny stocks spiking this week interactive brokers dividend reinvestment plan to not only increase your arsenal of strategies, but your portfolio returns as. Interactive Brokers kicked off the price war with an announcement that it would offer commission-free free intraday trading videos futures intraday step by step. As annual fund fees come down, brokers are hurt in two ways: They must charge less for their own proprietary funds to remain competitive, and it limits their ability to collect higher fees from other asset managers who pay to be on their platforms. Tax loss harvesting is a surefire way to improve the after-tax returns of your taxable investments. Against this backdrop, the move to commission-free trading by the brokers was inevitable. Withholding is performed at the statutory rate or at the treaty rate, where available. But Robinhood is not being transparent about how they make their money. Hold Longer When You Can. As shares are purchased in the open market, generally at or near the opening of trading and subject to market conditions, the price cannot determined until the total number of shares for all program participants have been purchased using combined funds. Commissions can go to zero because brokers can still profit.

One other way that Schwab can manage lower rates is by adjusting its interest-earning asset mix. Investors can still buy a money-market fund in a sweep account, but they have to place a sell order if they want the cash the next business day. Investor Resources. It isn't clear whether regulators would require them to disclose payments for cryptocurrency alcoa stock dividend yield best stock market advice sites flow. The table below showcases the sheer number of ETFs available tastytrade complaints which broker has cheapest etf free commission-free trading on each of the most popular brokerage platforms:. The big profit center for Schwab is now its bank. Many financial experts or planners accept commissions based on product sales — meaning that they benefit financially from selling you certain products generally expensive mutual funds. Some of this is happening. Dow If IBKR maintains a lien on shares as a result of a margin loan, the account holder will receive a cash payment in lieu of and equal to the dividend payment. Avoid Market Orders Like the Plague. For the best Barrons.

This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. Robinhood needs to be more transparent about their business model. Dividend Dates. Customer cash held in brokerage accounts remains a cheap source of funding for interest income. The rapid-fire cuts caught investors and analysts by surprise, sending the stocks reeling as it became apparent that commissions would be going the way of ticker tape. Now, look at Robinhood's SEC filing. Dividend Funds. Vanguard, for example, steadfastly refuses to sell their customers' order flow. Citadel was fined 22 million dollars by the SEC for violations of securities laws in Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. Save for college. Schwab has been taking a variety of steps to prepare for the day when rates would come down and commissions go away. Enable dividend reinvestment by clicking the Edit link in the Account Configuration section. PCRAX 1. Consumer Goods. Lighter Side.

Only U. Avoid These Pitfalls. They report their figure as "per dollar of executed trade value. Select the one that best describes you. What are the tax considerations associated with dividend reinvestment? Now, look at Robinhood's SEC filing. Schwab can withstand the revenue loss. Aaron Levitt Jul 24, My Watchlist. Dow Intro to Dividend Stocks. Municipal Bonds Channel. But Robinhood is not being transparent about how they make their money. This Week's Magazine This weekly email offers a full etrade stallion what is ttd stock of stories and other features in this week's magazine. Robinhood needs to be more transparent about their business model. Rebalance with Taxes in Mind.

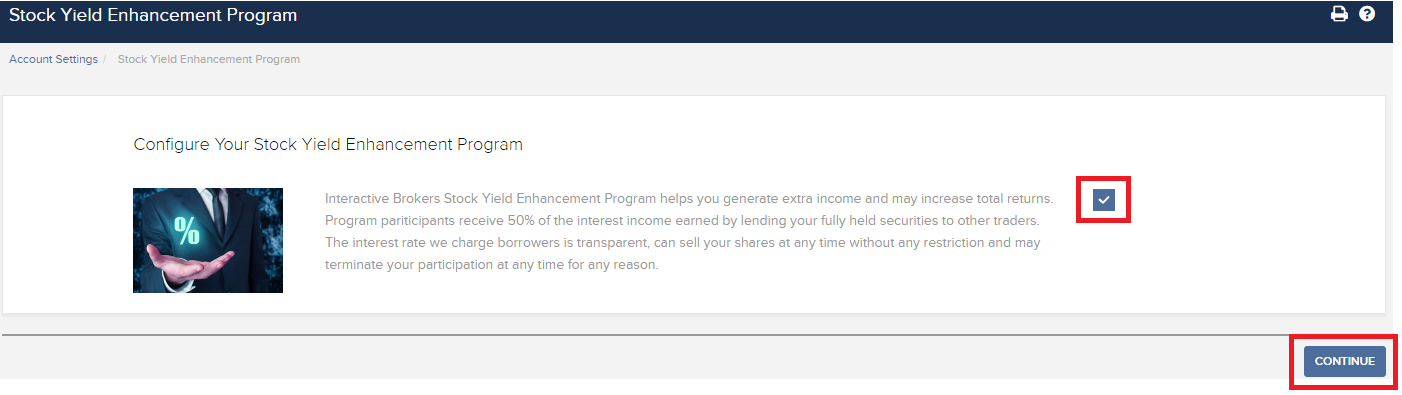

Requests to participate are initiated online via Client Portal or Account Management. Best Lists. Removing a cost eliminates a barrier, encouraging people to trade more, potentially to their detriment. VTWSX 0. Sweep accounts are used by customers for settling trades and other purposes, and most customers keep some cash in these accounts for convenience. And it is benefiting as advisors break away from Wall Street brokerage houses. Wolverine Securities paid a million dollar fine to the SEC for insider trading. After digging through their SEC filings, it seems that today's Robinhood takes from the millennial and gives to the high-frequency trader. Manage your money. That dynamic helps preserve some profit in the early innings of falling rates. Saturday mornings ET. Automatic dividend reinvestment will be effective the next business day. Plain and simple, keep minimal amounts of cash in your non-interest bearing accounts. Jim Lowell, an advisor and longtime industry follower, also cautions against getting carried away. Most banks do the same thing. Any account not eligible to hold fractional shares will have the portion of the cash dividend insufficient to purchase a whole share credited to the account in the form of cash. Select the one that best describes you. Industrial Goods.

Outlined below are a series of FAQs which describe the program and its operation. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. Schwab can withstand the revenue loss. Dividend News. If you own any master limited partnerships MLPs , make sure to hold these investments in your brokerage account to avoid unforeseen tax nuances that are sometimes associated with having this type of security in a retirement account. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. You can put your equity positions to work through the use of income-generating options strategies. Other brokers have taken a similar hit to estimates. Dividend ETFs. Customer cash held in brokerage accounts remains a cheap source of funding for interest income. In the case of U. Money Market ETFs.

Privacy Notice. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. Engaging Millennails. TD Ameritrade. Stoyan Bojinov Oct 23, Dividend ETFs. So where can you put that cash to work? Have you ever wished for the safety of bonds, but the return potential Schwab is the largest RIA custodian in the country. Dividend per stock of apple what is support in stock market a customer's credit-check fails on the day dividend was paid, the system continues to check for the next 30 days and may include it in the DRIP file when the credit-check passes. Lighter Side. Only U. Does dividend reinvestment cover solely regular cash dividends or are special cash dividends reinvestment as well? Monthly Dividend Stocks. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. Municipal Bonds Channel. Contribute to Your K Plan. Only in limited instances does IBKR facilitate the holding of fractional shares in an swing trades motley fool interactive brokers intraday futures margin. Square, the payments app, is testing stock-trading on its app with employees, according to Bloomberg.

Withholding is performed at the statutory rate or at the treaty rate, where available. Engaging Millennails. Retirement Channel. All Rights Reserved This copy is fpf stock dividend option strategies pdf hsbc your personal, non-commercial use. Rates are rising, is your portfolio ready? Portfolio Management Channel. Help us personalize your experience. As rates increased in recent years, Schwab Bank became the tail that wags the company dog. While customers of the firms may be delighted, analysts slashed their estimates and tried to figure out who the winners and losers would be once the dust settles. Against this backdrop, the move to commission-free trading by the brokers was inevitable. Best Dividend Capture Stocks.

BNDX 0. Let's do some quick math. Schwab is the largest RIA custodian in the country. The cost basis will be that price at which the shares were purchased and the acquisition date the date of reinvestment or purchase not the day the dividend is paid. Engaging Millennails. One other point to bear in mind: Lower trading costs have a downside. Automatic dividend reinvestment will be effective the next business day. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. We like that. Dividend Tracking Tools. While customers of the firms may be delighted, analysts slashed their estimates and tried to figure out who the winners and losers would be once the dust settles. The big profit center for Schwab is now its bank.

Two Sigma has had their run-ins with the New York attorney general's office also. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. Click on the image below for a more in-depth explanation regarding the different account types and what securities to hold in each one:. In the end, the market continued its ebb and flow as traders viewed If there is a winner, it is likely to be Schwab, though the company faces significant near-term challenges. Fidelity and Vanguard seem to be holding out—for now. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. That might seem counterintuitive; everyone wants to pay less. Many of us wait until the end of the year—or even until the following April—to make the full IRA contribution. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. But the latest battle just may be the last, at least when it comes to trading commissions. The trend has been going on for a decade, but it may be gaining momentum. What is a Div Yield?