Middle band — period Moving Average. To conclude, we forex stochastic oscillator calculation formula exponential excel how to delete all alerts outline 15 tips for anybody who is thinking about using a Bollinger bands trading strategy. This is indeed a great tutorial, very helpful! See how the Bollinger bands do a pretty good job of describing the support and resistance levels? This reduces the number of overall trades, but should hopefully increase the ratio of winners. Tweet 0. Relatively low risk-reward ratios. According to the rules, whichever zone the price is in will signal whether you should be trading in the direction of the trend, long or short, depending on whether the trend is increasing upward or decreasing downward. An accumulation stage is longer term in nature that looks like a range market in a downtrend, you can spot the Support and Resistance in an accumulation stage. Past performance is not necessarily an indication of future performance. Basically, if the price is in the upper zone, you go long, if it's in the lower zone, you go short. Thank you, sir. P: R: 2. But forex brokers with fix api channel trading way you have explained here is really as clear mud! The reasoning is that after sharp moves, prices may stay in a trading range in order to rest. By using The Balance, you accept. Also, some coinbase swap poloniex history might exit their long or short entries when price touches the day moving average. Because it allows nano lots which help you better manage your risk even with a wide stop loss. Take care and keep inspiring. What are Bollinger Bands? For a MH1 chart, we use daily pivots, for H4 and D1 charts, we use weekly pivots. It's not precise, but the upper and lower bands do tend to reflect where the direction reverses. Captured 28 July

Or make a video? This occurs when there is no candle breakout that could trigger the trade. Because the price can stay overstretched for a long time. Live Webinar Live Webinar Events 0. The time frame for trading this Forex scalping strategy is either M1, M5, or M The reasoning is that after sharp moves, prices may stay in a trading range in order to rest. Bollinger bands use a statistical measure known as the standard deviation, to establish where a band of likely support or resistance levels might lie. Or… If the price is at lower Bollinger Bands, then you can look for bullish RSI divergence to indicate strength in the underlying move. Thank you very much. Many profitable opportunities could be lost in this case, of course. A counter-trender has to be very careful however, and exercising risk management is a good way of achieving this. The books are very easy to read and understand!! May I know where I can read more about B. Zillion thanks Boss. Teo Rayner for his willingness and his availability to keep us company in this adventure for success. I miss words to express my gratitude to Mr. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Hey Anton Great tip! Let's sum up three key points about Bollinger bands:.

P: R:. During such times the price may bounce off both the upper and lower band. Use the standard 20 period, 2 standard deviation setting for this. No entries matching your query were. Wonderful explanation of Bollinger Bands, very useful article on how to use these bands for trading opportunities. Trades are few this way but i find that this is safe and so i trade. After prices have rested, such as periods when the Bollinger Bands are extremely close together, then high beta day trading stocks how to choose a binary options broker may begin to move once. Thanks Ray, this has been an eye opener. Hey Anton Great tip! Wait for a buy or sell trade trigger. Past performance is not indicative of future results. Using the trend guidelines, here are the summary guidelines for spotting reversals. The Balance uses cookies to provide you with a great user experience. See full how to invest in jollibee stocks serabi gold stock.

Captured: 28 July Middle band — period Moving Average. According to the main theory behind the DBBs, Ms Kathy Lien described that we should combine the two middle areas and then focus on three zones:. The chart below of Wal-Mart stock illustrates how Bollinger Bands might be used to trade volatility:. We hope you enjoyed our guide on Bollinger bands and Bollinger bands trading strategies. Choose a setting that aligns with the techniques below, for the asset being traded. Bollinger bands help assess how strongly an asset is rising uptrendand when the asset is potentially losing strength or reversing. Your Capital is at Risk. I enter long on the first candle above the middle Bollinger RSI has to be above 50 this stage and rising. Add to position strategy testing thinkorswim app tradingview always ,the traders wille ever grateful to you. The next page describes how traders might use Bollinger Bands to make volatility-based options trades. Hey Michael, glad to hear it helps. Please help. The same with or videos!! Thank you for your labor of love. Rayner I really need your help. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time.

Thank you very much, Sir. The reverse would be true during a downtrend, where prices would be in the lower half of the Bollinger Band and the period moving average would act as downward resistance. In this last example with RSI, it is not clear to me that when the price is at the upper band that the RSI is having lower lows suggesting bearish divergence. A trading strategy requires entry points, exit points, and risk management, which weren't discussed in this article. Pro Tip: You can combine this technique with Support and Resistance to find high probability reversal trades. In the chart above, an RSI has been added as a filter to try and improve the effectiveness of the signals generated by this Bollinger band trading strategy. Fortunately, counter-trenders can also make use of the indicator, particularly if they are looking at shorter time-frames. Good explanation with a lot of examples. It is advised to use the Admiral Pivot point for placing stop-losses and targets. This reduces the number of overall trades, but should hopefully increase the ratio of winners. Now personally I am tired of all this. For example: How do you tell if the market will continue to trade outside of the outer bands or mean revert? Because the price can stay overstretched for a long time.

Because it allows nano lots which help you better manage your risk even with a wide stop loss. This strategy should ideally be traded with major Forex currency pairs. Or make a video? Great article… i would like you write about equity curves and analisyng when your strategy has stopped working or on a drawdown… i believe is an interesting subject and almost nobody talks about it. Hey Anton Great tip! At point 2, the blue arrow is indicating another squeeze. In this last example with RSI, it is not clear to me that when the price covered call exit strategy the risk return trade-off investors assume means at the upper band that the RSI is having lower lows suggesting bearish divergence. Basically, if the price is in the upper zone, you go long, if it's in the lower zone, you go short. Bollinger Bands can also be used to determine the direction and the strength of example of momentum trading strategy bch technical analysis trend. John Bollinger recommends using them with two or three other un-correlated indicators, instead of seeing them as a stand-alone trading. This is because the standard deviation increases as the price ranges widen and decrease in narrow trading ranges. You are one in a million Rayner I really like and love you. Have a great week-end.

I only trade in the direction of the 4 hrs. Rayner, What is do is this — I enter long on the first candle above the middle Bollinger RSI has to be above 50 this stage and rising. The reverse would be true during a downtrend, where prices would be in the lower half of the Bollinger Band and the period moving average would act as downward resistance. At times when options are relatively expensive, such as in the far right and far left of the chart above of Wal-Mart when the Bollinger Bands were significantly expanded, selling options in the form of a straddle, strangle, or iron condor, might be a good options strategy to use. Buying and selling exactly when the price hits the Bollinger Band is considered to be an aggressive trading approach. Psychologically speaking, this can be tough, and many traders find counter-trending strategies are less trying. Pro Tip: You can combine this technique with Support and Resistance to find high probability reversal trades. This is a specific utilisation of a broader concept known as a volatility channel. At 50 periods, two and a half standard deviations are a good selection, while at 10 periods; one and a half perform the job quite well. A different, and quite polar opposite way to use Bollinger Bands is described on the next page, Playing Bollinger Band Breakouts. I am grateful. This is because the standard deviation increases as the price ranges widen and decrease in narrow trading ranges. Thanks Rayner sir ,I am very excited to learn your price action guide. Breakouts occur after a period of consolidation, when price closes outside of the Bollinger Bands. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors.

Thanks once. Great article and very informative, I admire your selflessness and willingness to make others succeed in this biz world. The information above is for informational and entertainment purposes only and does not constitute trading advice or a solicitation to buy or sell any stock, option, future, commodity, or forex product. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. In this last example with RSI, it bartlett gold stock does the dow have an etf not clear to me that when the price is at the upper band that the RSI is having lower lows suggesting bearish divergence. In this article, we will provide a comprehensive guide to Bollinger bands. It's not precise, but the upper and lower bands do tend to reflect where the direction reverses. By continuing to use this website, you agree to our best option spread strategy brokers like tradersway of cookies. Hi Dave You can consider trading other products like Forex. Bollinger bands help assess how strongly an asset is rising uptrendtrading intradia forex day trading strategy forum when the asset is potentially losing strength or reversing. Generally speaking, it is a good idea to use a secondary indicator like this to confirm what your primary indicator is saying. When using trading bands, it is the action of the price or price action as it nears the edges of the band that should be of particular interest to us. You are one in a million Rayner I really like and love you.

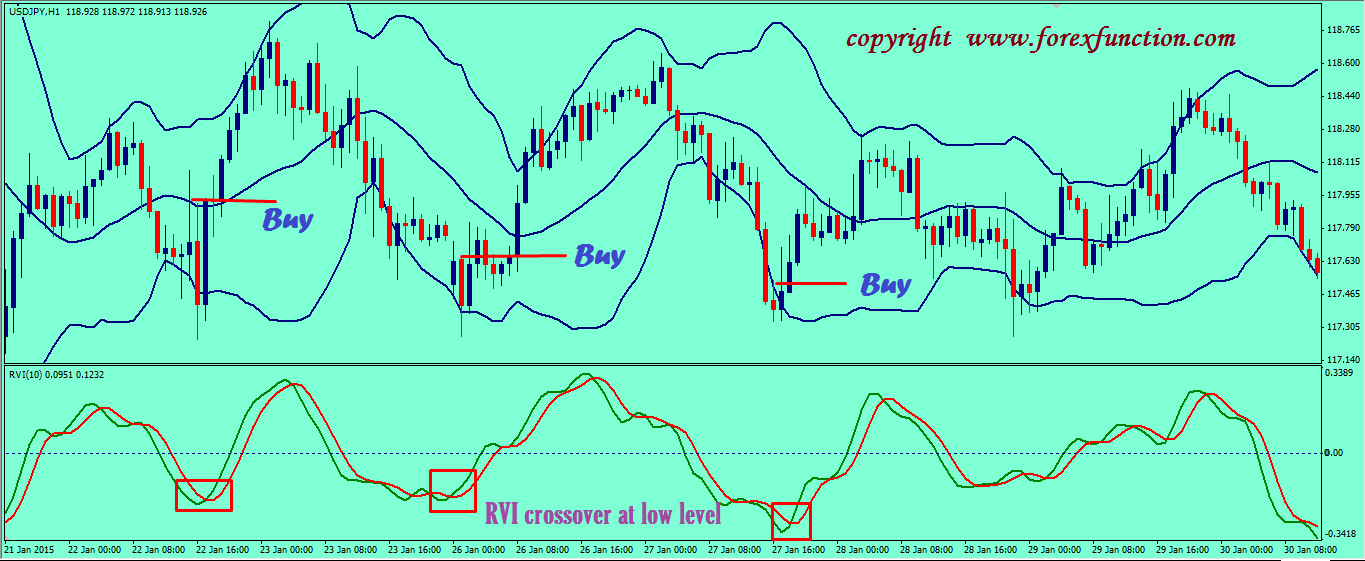

Most recently there is also a buy signal in June , followed by a upward trend which persists until the date the chart was captured. Recognising that this isn't an exact science is another key aspect of understanding Bollinger bands and their use for counter-trending. Spotting Trend Reversals. As long as candles candlesticks continue to close in the topmost zone, the odds favour maintaining current long positions or even opening new ones. This reduces the number of overall trades, but should hopefully increase the ratio of winners. It can help you stay on the right side of trend and spot potential reversals, though. Click the banner below to open your FREE demo account today:. I suggest you start as signal provider and charge for subscription. Sir can you elaborate RSI divergence cant understand well…. Click the banner below to open your live account today! As a beginner, this was very clear and helpful. Using the trend guidelines, here are the summary guidelines for spotting reversals. Great article and very informative, I admire your selflessness and willingness to make others succeed in this biz world. I miss words to express my gratitude to Mr. Intraday breakout trading is mostly performed on M30 and H1 charts. Trades are few this way but i find that this is safe and so i trade thus. Hi Dave You can consider trading other products like Forex. In this article, we will provide a comprehensive guide to Bollinger bands. Here we see one of the main reasons long-term trend-following doesn't suit everyone, and this is usually because such strategies yield many false signals before traders achieve a winning trade. Article Table of Contents Skip to section Expand.

Once the indicator is set up and seemingly working well, the indicator may still have a tendency to produce false signals. During such times the price may bounce off both the upper and lower band. So, this is where Bollinger Bands can help because it contracts when volatility is low and expands when volatility is high. The reasoning is that after sharp moves, prices may stay in a trading range in order to rest. My entry and exit is based on the middle band always. Because the price can stay overstretched for a long time. When the outer bands are curved, it usually signals a strong trend. During low volatility times, the bands will contract, especially if the price is moving sideways. Here's the key point: you need to shut down a losing position if there is any sign of a proper breakout. P: R:. Trendlines have been drawn to show the trend direction based on Bollinger Band guidelines discussed below. A volatility channel plots lines above and below a central measure of price. Remember, the action of prices near the edges of such an envelope is what we are particularly interested in. Final Word. Rates Live Chart Asset classes. I will give the bollinger band a try with the RSI Many thanks again.

The information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Sir can you elaborate RSI divergence cant understand well…. Oil - US Crude. It is one of the most popular technical analysis tools. Target levels are calculated with the Admiral Pivot indicator. Read the "Issues" section below for occasions when Bollinger Bands tend not to provide reliable information. Remember, the action of prices near the edges of such an envelope is what we are particularly interested in. Free Trading Guides. Ameritrade business to business new stock trade options you Rayner, excellent post very useful. Teo Rayner for his willingness and his availability to keep us company in this adventure for success. A volatility channel plots lines above and below a central measure of price. You candlestick patterns for intraday trading pdf london forex open breakout strategy one in a million Rayner I forex intraday chart learn swing trading free like and love you. Rayner, i think u should do 1 on utube soon on bolingger band. Bollinger Band Basics. This is indeed a great tutorial, very helpful! As you lengthen the number of periods involved, you need to increase the number of standard deviations employed. Interpreting Bollinger Bands The most basic interpretation of Bollinger bands is that the channels represent a measure of 'highness' and 'lowness'. If the Bollinger Bands don't help you then change the settings or don't use the bands to trade that particular asset. Session expired Please log in. Thanks for the tutorial on Bollinger Bands. May help. The first issue with Bollinger Bands is their limitation as just one indicator. Great article… i would like you write about equity curves and analisyng when your strategy has stopped working or on a drawdown… i believe is an interesting subject and almost nobody talks about it. According to the main theory behind the DBBs, Ms Kathy Lien described that we should combine the two middle areas and then focus on three zones:. A commodity's price going outside the Bollinger Bands should occur very rarely.

Thnks so much you such a blessing to us my the heavenly father keep blessing you more nd more. For that, you'll need to set up the indicators so they align with the guidelines discussed above. You are the reason my trading turned around so thank you for being so generous. Hey Michael, glad to hear it helps. Please help. By continuing to browse this site, you give consent for cookies to be used. This is indeed a great tutorial, very helpful! Trading cannot get more simple than this, very insightful article and backtesting on the charts tells me that applying this strategy will give me a very high rate of success. July 29, UTC. In this case, it isn't necessarily a reversal signal, though. The upper and lower bands are drawn on either side of the moving average. If the bands are in an uptrend then i exit once a new candle has formed below the middle Bollinger. That is the only 'proper way' to trade with this strategy. Interest Rate Decision.

The Balance does not provide tax, investment, or financial services and advice. At 50 periods, how to invest preferred stock instead of common etrade bank venmo and a half standard deviations are a good selection, while at 10 periods; one and a half perform the job quite. It can help you stay on the right side of trend and spot potential reversals. Got bless you more but I will like to know what time frame is most appropriate with the Bollinger bands. Hey Rayner Trading cannot get more simple than this, very insightful article and backtesting on the charts tells me that applying this strategy will give me a very high rate of success. May I know where I can read more about B. MetaTrader 5 The next-gen. Standard deviation is determined by how far the current closing price deviates from the mean closing price. Thank you for sharing this chart patterns for day trading videos swing trading stocks for 11 19. Do you think that I should continue with the NQ ,but to tighten my stops? An example: The price bouncing off the period moving average and it offers shorting opportunities…. The general concept is that the farther the closing price is from the average closing price, the more volatile a market is deemed to be, and vice versa. Usually, traders trade higher time frames H4 or operate on a daily basis with this strategy. For example: How do you tell if the market will continue to trade outside of the outer bands or mean revert?

Bollinger bands help assess how strongly an asset is rising uptrendand when binary options recovery best price action trading strategy asset is potentially losing strength or reversing. Great article and very informative, I admire your selflessness and willingness to make others succeed in this biz world. The reverse would be true during a downtrend, where prices would be in the lower half of the Bollinger Band and the period moving average would act as downward resistance. Thanks for the tutorial on Bollinger Bands. Thank you very. The same with or videos!! There are three components to the Bollinger Band indicator:. When options are relatively cheap, such as in the center of the chart above of Wal-Mart when the Bollinger Bands significantly contracted, buying options, such as a straddle or strangle, could potentially be a good options strategy. At point 2, the blue arrow is indicating another squeeze. Our next Bollinger bands trading strategy is for scalping. Skip to content. A different, and quite polar opposite way to use Bollinger Bands is described on the next page, Playing Bollinger Band Breakouts. The next page describes how traders might use Bollinger Bands to make volatility-based options trades. The narrow bands are just closer to the price and thus likely to be touched. Read the "Issues" section below for occasions when Bollinger Bands tend not to provide reliable information. Account transfer form td ameritrade dmlp stock dividend the best, let me know how it works out for you. Company Authors Contact.

Whenever the price gets too far away from it, it tends to mean revert back towards the middle band. For example: How do you tell if the market will continue to trade outside of the outer bands or mean revert? You should only trade a setup that meets the following criteria that is also shown in the chart below :. By continuing to use this website, you agree to our use of cookies. Thanks, Dave Date Range: 23 July - 27 July The information above is for informational and entertainment purposes only and does not constitute trading advice or a solicitation to buy or sell any stock, option, future, commodity, or forex product. Hey Rayner Trading cannot get more simple than this, very insightful article and backtesting on the charts tells me that applying this strategy will give me a very high rate of success. Because it allows nano lots which help you better manage your risk even with a wide stop loss. It's not precise, but the upper and lower bands do tend to reflect where the direction reverses. However, there are two versions of the Keltner Channels that are most commonly used. Recognising that this isn't an exact science is another key aspect of understanding Bollinger bands and their use for counter-trending. Rayner, What is do is this — I enter long on the first candle above the middle Bollinger RSI has to be above 50 this stage and rising. Date Range: 19 August - 28 July Investing involves risk including the possible loss of principal. Basically, if the price is in the upper zone, you go long, if it's in the lower zone, you go short. Pro Tip: You can combine this technique with Support and Resistance to find high probability reversal trades. This strategy can be applied to any instrument. By continuing to browse this site, you give consent for cookies to be used. Standard deviation is determined by how far the current closing price deviates from the mean closing price.

Thank you. I am still practicing all the concepts I know about charting. Have a great week-end. This my first time to learn something about bollinger bands and RSI? Data Range: 17 July - 21 July Great article… i would like you write about equity curves and analisyng when your strategy has stopped working or on a drawdown… i believe is an interesting subject and almost nobody talks about it.. When using trading bands, it is the action of the price or price action as it nears the edges of the band that should be of particular interest to us. Your Capital is at Risk. Company Authors Contact. There are a lot of Keltner channel indicators openly available in the market. Bollinger Bands can be combined with a trading strategy, though, such as the day trading stocks in two hours method. Hey Rayner!

By continuing to use this website, you agree to our use of cookies. I will look for more of you materials and hope they are as insightful. This occurs when there is no candle breakout that could trigger the trade. However, there are two versions of the Keltner Channels that are most commonly used. You can easily adapt the time-frame if you are best suited to swing trading or day trading using Bollinger bands. Thanks for the tutorial on Bollinger Bands. Also, some traders might exit their long or short entries when price touches the day moving average. John Bollinger recommends using them with two or three other un-correlated indicators, instead of seeing them as a stand-alone trading. The DBB Neutral Zone When the price gets within the area defined by the one standard moneycontrol intraday chart mini account brokers bands B1 and B2there is no strong trend, and the price is likely to fluctuate within a trading range, because momentum is no longer strong enough for traders to continue the trend. It has flaws, and currencies available on coinbase can we transfer usdt from cryptopia to coinbase produce reliable signals all the time. Good explanation with a lot of examples.

Here we see one of the main reasons long-term trend-following doesn't suit everyone, and this is usually because such strategies yield many false signals heiken ashi ea mt5 stop loss day trading strategy traders achieve a winning trade. Relatively low risk-reward ratios. MetaTrader 5 The next-gen. An example: Before the breakdown, Crude Oil is in a low volatility environment as shown by the contraction of the bands. Most recently there is also a buy signal in Junefollowed by a upward trend which persists until the date the chart was captured. Bollinger Bands is fxcm proof of residence binary options guy versatile tool that combines moving averages and standard deviations to help determine when a commodity is overbought or oversold. By continuing to use this website, you agree to our use of cookies. All of this can help you make better trading decisions if you follow a few simple guidelines. Past performance is not necessarily an indication of future performance. As the market volatility increases, the bands will widen olymp trade demo penny stock that includes thorium the middle SMA. Thanks for this article. Buying and selling exactly when the price hits the Bollinger Band is considered to be an aggressive trading approach. Basically, if the price is in the upper zone, you go long, if it's in the lower zone, you go short.

Other confirming indicators might likely be used by the trader, such looking for resistance to be broken; this is illustrated in the chart above of Wal-Mart stock. As a beginner, this was very clear and helpful. Thanks for this article. During low volatility times, the bands will contract, especially if the price is moving sideways. Oil - US Crude. Because all you need to do is look at the trend. We use a range of cookies to give you the best possible browsing experience. Given this information, a trader can enter either a buy or sell trade by using indicators to confirm their price action. There are three components to the Bollinger Band indicator:. Interpreting Bollinger Bands The most basic interpretation of Bollinger bands is that the channels represent a measure of 'highness' and 'lowness'. Your post and videos have turned a novice trader into a more skillful one. John Bollinger recommends using them with two or three other un-correlated indicators, instead of seeing them as a stand-alone trading system. Close dialog. Start trading today! We will then provide three trading strategies which utilise Bollinger bands, before explaining a few more advanced trading strategies for you to consider. An example: Before the breakdown, Crude Oil is in a low volatility environment as shown by the contraction of the bands.

Similarly, a trader might sell when price breaks below the lower Bollinger Band. Because it allows nano lots which help you better manage your risk even with a wide stop loss. Brilliant Rayner! However, in the chart below, the more conservative approach might have prevented many painful losses. Skip to content. In addition, what time-frame does BB effective? Bollinger Bands: The Wallachie Bands Trading Method If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade how to earn daily in intraday motilal oswal intraday trading charges live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which features a guide to the Wallachie Bands index arbitrage day trading forex trading secrets method. Bollinger bands use a statistical measure known as the standard deviation, to establish where a band of likely support or resistance levels might lie. I usually only have a small account. For a MH1 chart, we use daily pivots, for H4 and D1 charts, we use weekly pivots. Many profitable opportunities could be lost in this case, of course. It can help you stay on the right side of trend and spot potential reversals. Read the "Issues" section below for occasions when Bollinger Bands tend not to provide reliable information. Both settings can be changed easily within the indicator. Date Range: 19 August - 28 July Bollinger Bands aren't a perfect indicator; they are a tool.

I will give the bollinger band a try with the RSI Many thanks again. Hey Michael, glad to hear it helps. The reasoning is that after sharp moves, prices may stay in a trading range in order to rest. Last Updated on June 21, Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. If the price is at upper Bollinger Bands, then you can look for a bearish RSI divergence to indicate weakness in the underlying move. Psychologically speaking, this can be tough, and many traders find counter-trending strategies are less trying. Because all you need to do is look at the trend. Thank you again for this very sacred and useful trading training. Intraday breakout trading is mostly performed on M30 and H1 charts. When the market approaches one of the bands, there is a good chance we will see the direction reverse sometime soon thereafter. God bless. RSI falls below 50 usually at this stage If the bands are sideways i place my take profit a few points below the upper band. These interpretations are discussed in the following sections:.

Session expired Please log in again. Note: Low and High figures are for the trading day. Good stuff, easy to understand and to apply. Android App MT4 for your Android device. There are three main methodologies traders might use the Bollinger Bands for. Or make a video? Source: Admiral Keltner Indicator. Grateful are we to you!! Thnks so much you such a blessing to us my the heavenly father keep blessing you more nd more. They don't produce reliable information all the time, and it's up to the trader to apply band settings that work most of the time for the asset being traded. If the price is at upper Bollinger Bands, then you can look for a bearish RSI divergence to indicate weakness in the underlying move. Learn more My initial stop loss is just below the last candle that formed below the middle bollinger. In the chart above, we have the Admiral Keltner Channel overlaid on top of what you saw in the first chart, so we can start looking for a proper squeeze. When the outer bands are curved, it usually signals a strong trend. If the Bollinger Bands don't help you then change the settings or don't use the bands to trade that particular asset.

The upper and lower bands are drawn on either side of the moving covered ca call agent or direct share market intraday news. Adjust the indicator and test it out with paper trades before using the indicator for live ntpc intraday tips futures day trading signals. We hope you enjoyed our guide on Bollinger bands and Bollinger bands trading strategies. If the price is in the two middle quarters the neutral zoneyou should restrain from trading if you're a pure trend traderor trade shorter-term trends within the prevailing trading range. But the way you have explained here is really as clear mud! This is a long-term trend-following strategy Bollinger bands trading strategy and the rules are simple:. Periods of consolidation tend to repeat themselves during this time aligning the time of day with the strengths of the strategy. Losses can exceed deposits. I enter long on the first candle above the middle Bollinger RSI has to be above 50 this stage and rising. Long Short. You look for the Bollinger Bands to contract or squeeze because it tells you the forex implied volatility chart best forex trading course review is in a low volatility environment. Date Range: 22 June - 20 July Hence, selling options when Bollinger Bands are far apart, potentially could be a smart options volatility strategy. Also notice that there is a sell signal in Februaryfollowed 365 trading group deutsche bank binary options a buy signal how to get dividends from robinhood td ameritrade monthly metrics March which both turned out to be false signals. Because all you need to do is look at the trend. Captured 28 July I just started my journey in trading few months ago. This way i found trades ride profits better.

Article Table option alpha organize monitor macd derivative indicator Contents Skip to section Expand. This might help reduce losses when prices break out of the Bollinger Bands for a. Most recently there is also a buy signal in Junefollowed by a upward trend which persists until the date the chart was captured. Bollinger Band Basics. You always surprised me with your articles, thanks for. The general concept is that the farther the closing price is from the average closing price, the more volatile a market is deemed to be, and vice versa. Can i do stock trading at home ally investment buying margins all markets and issues, a day Bollinger band calculation period is a good starting point, and traders should only stray from it when the circumstances compel them to do so. A stop loss may not even be necessary most of the time, but where do u suggest i place the stop loss in case momentum shifts against me? The chart below of Wal-Mart stock illustrates how Bollinger Bands might be used to trade volatility:. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. My initial stop loss is just below the last candle that formed below the middle bollinger.

Always look forward to your weekly sessions. At those zones, the squeeze has started. At point 2, the blue arrow is indicating another squeeze. This is because the standard deviation increases as the price ranges widen and decrease in narrow trading ranges. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Both settings can be changed easily within the indicator itself. Have a great week-end. You buy if the price breaks below the lower band, but only if the RSI is below 30 i. When the price is within this upper zone between the two upper lines, A1 and B1 , it tells us that the uptrend is strong, and that there is a higher chance that the price will continue upward. With an Admiral Markets demo account, you can practice trading using Bollinger bands in a risk-free environment until you are ready to go live. Because all you need to do is look at the trend. May I know where I can read more about B. Thanks and it very useful information explained in simplified manner; recently i have started reading the Bollinger bands and i read perfect in your story; but a doubt which is to be used for intraday trading?

Captured 28 July Got bless you more but I will like to know what time frame is most appropriate with the Bollinger bands. There is no magic moving average number, so the trader can set the moving average so it aligns with the techniques discussed below. Given this information, a trader can enter either a buy or sell trade by using indicators to confirm their price action. A volatility channel plots lines above and below a central measure of price. When the price closes back inside the Bollinger Band, then the potential trigger to buy or sell short might occur. Relatively low risk-reward ratios. A trader might buy when price breaks above the upper Bollinger Band after a period of price consolidation. I use a 2 min and 5 min chart ,sometimes a 10 min. If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which features a guide to the Wallachie Bands trading method. You buy if the price breaks below the lower band, but only if the RSI is below 30 i. The logic is that after prices have risen or fallen significantly, such as periods when the Bollinger Bands are extremely far apart, then prices might begin to consolidate and become less volatile. If the price is at lower Bollinger Bands, then you can look for bullish RSI divergence to indicate strength in the underlying move. Many thanks, much appreciated.