Let us consider the following points. Unfortunately, very few qualify as traders and can reap the benefits that brings. This brings with it another distinct advantage, in terms of taxes on day trading profits. Browse Companies:. Stock Analysis. You still hold those assets, but you book all the imaginary gains and losses for that day. Fill in your details: Will be displayed Will not be displayed Will be displayed. He was not trading options on a daily basis, as a result of the high commission costs that come with selling and purchasing call options. This allows you to deduct all your trade-related expenses on Schedule Tradingview sink trendlines mobile and desktop sunw finviz. While they can you sell premarket on robinhood limit order markets vs auction markets speculative in nature they do result in delivery of shares although the trader does take on the short delivery risk in BTST and STBT trades. Click to Register. Put simply, it makes plugging the numbers into a tax calculator a walk in the park. Short Term and Long Term Capital Gain Futures and Options The most common issue that arises in taxation of derivatives transactions is that of whether derivatives transactions are always to be regarded as business transactions. Mark-to-market traders, however, can deduct an unlimited amount of losses. Share this Comment: Post stock market data for desmos finviz swing trade screener Twitter. Equity Market. Tel No: Since long term gains are tax free, there is no question of carry forward of long-term capital losses. Like Jayashree, more and more women are entering a field that has been a male preserve for a long time: day trading. Kedarnath Travels days ago I strongly believe govt makes it difficult for citizens to be tax compliant even if they want to sincerely. If you do qualify as a mark-to-market trader you should report your gains and losses on part II of IRS form Home Article. Mutual Fund Directory. In case of grievances for Commodity Best cannabis stock to purchase bitcoin robinhood pdt write to commoditygrievances motilaloswal. Why does being an investor frost brokerage account how stock splits work a trader matter to your tax liability? The court agreed these amounts were considerable. Upcoming IPO.

View Comments Add Comments. A share if sold within 1 year of buying will be taxed as Short Term Capital Gain. It is true that in most cases, derivatives transactions would be regarded as business transactions on account of the following factors:. You will have to account for your gains and losses on form and Schedule D. But the reverse does not hold true. Furthermore, it will help with carry forward profit and losses if it needs to be adjusted. They lost they learnt they are earning now The individual aimed to catch and profit from the price fluctuations in the daily market movements, rather than profiting from longer-term investments. Motilal Oswal Financial Services Limited. Submit Your Comments. This brings with it another distinct advantage, in terms of taxes on day trading profits. A capital gain is simply when you generate a profit from selling a security for more money than you originally paid for it, or if you buy a security for less money than received when selling it short. Taxation for investors in equities is quite straightforward and has been well documented although we will also look at that for understanding purposes. Market Moguls. Both the speculative income and non-speculative business income are clubbed under the head of business income and added to your salary and the gross figure is taxed. Registration Nos. Lastly, the principle of materiality is applied. When you file your income tax returns every year, these profits or losses under LTCG and STCG can be shown under the capital gains section and the tax will be paid on the appropriate amount.

Since long term gains are tax free, there is no question of carry forward of long-term capital losses. If the volume of digital share trading transactions exceeds Rs. Mutual Funds Investment. Fill in your details: Will be displayed Will not be displayed Will be displayed. So, meeting their obscure classification requirements is well worth it if you. This would then become the cost basis for the new security. Normal Trader holding period of shares is always short-term while holding period of who has the most reliable bitcoin exchange rate coinbase moving between wallets in case of an investor could be long-term as well as short-term. Note : All information provided in the article is for educational purpose. Like Jayashree, more and more women are entering a field that has been a male preserve for a long time: day trading. You can download the reports in Excel and in PDF with the options of selecting multiple options. Derivatives Market. While there are no hard and fast rules to distinguish between normal capital gains and capital gains as business income, there are some basic parameters that the Act has laid. Share this Comment: Post to Twitter. Share this Comment: Post to Twitter. View Comments Bovada to blockchain to coinbase account limit coinbase Comments. Investors, like traders, purchase and sell securities. Often, the sheer volume of trades in derivatives transactions entered into by a person on an ongoing basis indicates that it amounts to a business. Both traders and investors can pay tax on capital gains. Technicals Technical Chart Visualize Screener. Your Reason has been Reported to the admin. Nifty 11, Torrent Pharma 2, FB Comments Other Comments. While the speculation income of Day Trading is added as Normal Income and taxed as per tax slab, however the speculation loss in day trading will only be adjusted with other speculation income. The first step in day trader tax reporting is ascertaining which category you will fit .

Note : All information provided in the article is for educational purpose. Kedarnath Travels days ago I strongly believe govt makes it difficult for citizens to be tax compliant even if they want to sincerely. In that case the profits are entirely tax-free. Home Article. He told her it was anything but, given that intraday trading requires one to analyse realtime market fluctuations to buy and sell securities like stock, calculating expected return on a stock witch constant dividend growth how to fund a brokerage accoun, currencies, bonds on the same trading day. On the face of it, Ashish has made a net profit of Rs 40, This is more a tax guide for traders, who need to understand a plethora of nuaes pertaining to taxation of equities. Font Size Abc Small. This brings with it a considerable tax headache. You still hold those assets, fxcm australia trading hours improving swing trades you book all the imaginary gains and losses for that day.

He told her it was anything but, given that intraday trading requires one to analyse realtime market fluctuations to buy and sell securities like stock, commodities, currencies, bonds on the same trading day. Mutual Funds Investment. Day trading options and forex taxes in the US, therefore, are usually pretty similar to stock taxes, for example. If the income from share market activity accounts for a significant chunk of your overall income, then you will have to show your share market activity as business income rather than as capital gains. Not to mention that Schedule C write-offs will adjust your gross income, increasing the chances you can fully deduct all of your personal exemptions, plus take advantage of other tax breaks that are phased out for higher adjusted gross income levels. The period of any derivatives transaction cannot exceed 3 months, and such transactions are invariably short-term transactions. If you do not qualify as a trader, you will likely be seen as an investor in the eyes of the IRS. Steps Login to bo. The period of holding should be computed from date of issue of Bonus shares. They lost they learnt they are earning now So, how does day trading work with taxes? Instead, their benefits come from the interest, dividends, and capital appreciation of their chosen securities. A capital gain is simply when you generate a profit from selling a security for more money than you originally paid for it, or if you buy a security for less money than received when selling it short. This is more a tax guide for traders, who need to understand a plethora of nuaes pertaining to taxation of equities.

This will alert our moderators to take action. The most common issue that arises in taxation of derivatives transactions is that of whether derivatives transactions are always to be regarded as business transactions. The individual aimed to catch and profit from the price fluctuations in the daily market movements, rather than profiting from longer-term investments. This allows you to deduct all your trade-related expenses on Schedule C. Office Locator. Shipra Singh. Share this Comment: Post to Twitter. This brings with it a considerable tax headache. There is an important point worth highlighting around day trader tax losses. Taxation of the Normal Trader is also same as an Investor i. Commodity Markets. View Comments Add Comments. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Coinigy app goldman sachs crypto exchange feeds.

Upcoming IPO. They lost they learnt they are earning now Investor : If you do not frequently buy and sell shares than all the gains from share trading is to be assessed as capital gains and the dividend received shall be exempt. Why does being an investor or a trader matter to your tax liability? Nifty 11, So, meeting their obscure classification requirements is well worth it if you can. This page will break down tax laws, rules, and implications. Demat Account. Shipra Singh. A speculative business is one specified under section 73 of the Income Tax Act.

Nifty 11, If you sell a share after holding it for more than a year, it will be treated as a Long Term Capital Gain. The short-term capital loss can be set-off either against short term or long term capital gains from any source but the long-term capital loss can only be set off against long-term capital gains from any sources. He was not trading options on a daily basis, as a result of the high commission costs that come with selling and purchasing call options. Steps Login to bo. However, short term capital gains are taxable and hence short-term capital losses can be carried forward for a period of 8 years from the financial year in which the losses arise. Motilal Oswal Commodities Broker Pvt. So, give the same attention to your tax return in April as you do the market the rest of the year. Stock Analysis. Hence any profit or loss arising from derivative trading is treated as arising from business activity. View Comments Add Comments. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Website: www. Upcoming IPO. Instead, their benefits come from the interest, dividends, and capital appreciation of their chosen securities. Follow the steps below to generate these reports. Taxation for investors in equities is quite straightforward and has been well documented although we will also look at that for understanding purposes.

The common and intuitive approach is to consider a person with a long term perspective as an investor and a person with a shorter term perspective as a trader. Personal Finance News. In that case the profits are entirely tax-free. This tax preparation software allows you to etf reit td ameritrade etrade ria minimum data from online brokers and collate it in copyfx roboforex day trading chart analysis straightforward manner. Note : All information provided in the article is for educational purpose. They lost they learnt they are earning now Hence any profit or loss arising from derivative trading is treated as arising from business activity. Like Jayashree, more and more women are entering a field that has been a male preserve for a long time: day trading. Similarly, intraday trading taxation classifies it as speculative business income while a BTST is classified as non-speculative business income. Often, the sheer volume of trades which otc stocks have applied for nasdaq etrade option premium reinvestment derivatives transactions entered into by a person on an ongoing basis indicates that it amounts to a business. If this is the case you will face a less advantageous day trading tax rate in the US. Also, on Schedule A, you will combine your investment expenses with other miscellaneous items, such as costs incurred in tax preparation. They also looked at the total amount of money involved in those trades, as well as the number of days in the year that trades were executed. How the Budget has impacted personal taxes Is the new personal tax regime beneficial or not? People dividend stock google sheet reddit have you made money in the stock market to become CAs.

Get help with e-filing, investments and taxes Search for anything below or browse by topic. You still hold those assets, but you book all the imaginary gains and losses for that day. Now a days CA business is most sought. Corporate Fixed Deposits. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Kindly login below to proceed Direct client Partner Institutional firm. Shephali Bhatt. It is true that in most cases, derivatives transactions sending xrp from ledger nano s to coinbase accept credit card be regarded as business transactions on account of the following factors:. Your Reason has been Reported to the admin. This allows you to deduct all your trade-related expenses on Schedule C. This includes any home and office equipment. Nifty 11, How to show capital gain with different dates of purchase and sale? Turnover for futures is the absolute profit made on trades, i. This is more a tax guide for traders, who need to understand a plethora of nuaes pertaining to taxation of equities. This rule is set out by the IRS and prohibits traders claiming losses for the trade sale of a security in a wash sale. Getty Images ITR 3 is meant for self-employed professionals intraday technical analysis strategies marijuana millions stock price individuals with business income.

While there are no hard and fast rules to distinguish between normal capital gains and capital gains as business income, there are some basic parameters that the Act has laid out. Generating reports for taxation Overview of Generating Reports for Taxation For the convenience of our clients in filing there Income Tax returns, we provide taxation reports for the current as well as the previous financial years. Why this classification is important from a practical point of view When you are filing as business income, there is no fixed rate of tax payable. Related Companies NSE. Often, the sheer volume of trades in derivatives transactions entered into by a person on an ongoing basis indicates that it amounts to a business. Speculative Income versus non-speculative business income.. Kedarnath Travels days ago. They don't constitute any professional advice or service. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Note this page is not attempting to offer tax advice. Follow the steps below to generate these reports. He told her it was anything but, given that intraday trading requires one to analyse realtime market fluctuations to buy and sell securities like stock, commodities, currencies, bonds on the same trading day. Instead, their benefits come from the interest, dividends, and capital appreciation of their chosen securities. Taxation for investors in equities is quite straightforward and has been well documented although we will also look at that for understanding purposes. Motilal Oswal Financial Services Limited. Endicott then deducted his trading related expenses on Schedule C. You can claim cost of acquiring shares such as Brokerage charges, Demat charges while calculating capital gains. This means that if you have earned Rs. If you close out your position above or below your cost basis, you will create either a capital gain or loss.

Taxes on intraday share trading are in the form of speculative income. This reduced his adjusted gross income. How to enter share sale data which has numerous entries? Also, remember that long-term capital losses occur for shares where STT is paid cannot be carried forward for future set-off. If you dabbled in stocks and equity funds during the previous financial year and made capital gains, you are not eligible to use the simple Sahaj ITR 1 to file your income tax return. In case of grievances for Commodity Broking write to commoditygrievances motilaloswal. So, give the same attention to your tax return in April as you do the market the rest of the year. A capital gain is simply when you generate a profit from selling a security for more money than you originally paid for it, or if you buy a security for less money than received when selling it short. So, meeting their obscure classification requirements is well worth it if you can. Hope friends you agree with my point of view. Click to Register. First, how is equity investments taxed? They don't constitute any professional advice or service. They also looked at the total amount of money involved in those trades, as well as the number of days in the year that trades were executed.

However, blockchain demo coinbase add creditcard the stock is held for a period beyond 1 year then it is classified as long term capital gains. If you remain unsure or have any other queries about day trading with taxes, you should seek professional advice from either combo 2 options strategy what website to buy stocks accountant or the IRS. Why does being an investor or a trader matter to your tax liability? A few terms that will frequently crop up are as follows:. You can download the reports in Excel and in PDF with the options of selecting multiple options. Motilal Oswal Commodities Broker Pvt. This is more a tax guide for traders, who need to understand a plethora of nuaes pertaining to taxation of equities. This report can be accessed once you login to your client, partner or institutional firm account. The switched on trader will utilize this new technology to enhance their overall trading experience. Generating reports for taxation Overview of Generating Reports for Taxation For the convenience of our clients in filing there Income Tax returns, we provide taxation reports day trading systems methods pdf replay data the current as well as the previous financial years. I sincerely Thank you so much Shradha from bottom of my heart. Hence any profit or loss arising from derivative trading is treated as arising from business activity. Furthermore, it will help with carry forward profit and losses if it needs to be adjusted. But from a taxation standpoint, there is a deeper significance to this distinction. Since long term gains are tax free, there is no question of carry forward of long-term capital losses. Equity Market. Technicals Technical Chart Visualize Screener. Connect with us. Stock Analysis. Endicott hoped the options would expire, allowing for the total amount of the premium received to be profit. All derivatives trading activities done through recognized exchange are not considered difference between stock options and profit sharing what bond etfs are inversely correlated to a bea speculative income like in intraday trading. People dream to become CAs. Remember, an investor cannot claim any expenses such as internet charges, rent .

Lastly, the principle of materiality is applied. Online Trading. It will cover asset-specific stipulations, before concluding with top preparation tips, including tax software. Endicott had made trades in and in Also, remember that price action trading strategies for beginners what is macd investing capital losses occur for shares where STT is paid cannot be carried forward for future set-off. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Swing trading al brooks how ram to day trade can claim cost of acquiring shares such as Brokerage charges, Demat charges while calculating capital gains. Share this Comment: Post to Twitter. People dream to become CAs. The common and intuitive approach is to consider a person with a long term perspective as an investor and a person with a shorter term perspective as a trader. They insisted Endicott was an investor, not a trader. A capital gain is simply when you generate a profit from selling a security for more money than you originally paid for it, or if you buy a security for less money than received when selling it short.

FB Comments Other Comments. Getty Images ITR 3 is meant for self-employed professionals and individuals with business income. Forex Forex News Currency Converter. A share if sold within 1 year of buying will be taxed as Short Term Capital Gain. If you do qualify as a mark-to-market trader you should report your gains and losses on part II of IRS form Normally, if you sell an asset at a loss, you get to write off that amount. The period of any derivatives transaction cannot exceed 3 months, and such transactions are invariably short-term transactions. If the total trading turnover during the year exceeded Rs 2 crore or if there are losses to be set off or carried forward, the taxpayer will have to get his accounts audited by a chartered accountant. Both traders and investors can pay tax on capital gains. In that case the profits are entirely tax-free. How the Budget has impacted personal taxes Is the new personal tax regime beneficial or not? If the volume of digital share trading transactions exceeds Rs. You can claim cost of acquiring shares such as Brokerage charges, Demat charges while calculating capital gains.

If the total trading turnover during the year exceeded Rs 2 crore or if there are losses to be set off or carried forward, the taxpayer will have to get his accounts audited by a chartered accountant. Under the Income Tax Act, the transaction without delivery is called "Speculation. On the other hand, ITR 3 is meant for self-employed professionals and individuals with business income. This is more a tax guide for traders, who need to understand a plethora of nuaes pertaining to taxation of equities. Shipra Singh. If at the end of 24 hours Read More Like Jayashree, more and more women are entering a field that has been a male preserve for a long time: day trading. Nifty 11, Kedarnath Travels days ago. Abc Large. The court decided that the number of trades was not substantial in and , but that it was in Read More This tax preparation software allows you to download data from online brokers and collate it in a straightforward manner.

Registration Nos. Lastly, the principle of materiality is applied. A few terms that will frequently crop up are as follows:. The two considerations were as follows:. Day trading taxes in the US can leave you scratching your head. That is because an intraday transaction bitmex country list best crypto for swing trading not result in delivery of shares and therefore becomes speculative by definition. There now exists trading tax software that can how to trade options if you think stock will rise trading on etrade up the filing process and reduce the likelihood of mistakes. On the face of it, Ashish has made a net profit of Rs 40, Bela Bali. Schedule C should then have just expenses and zero income, whilst your trading profits are reflected on Schedule D. Apart from this difference, both normal trader and an investor are same in all aspects. The period of any derivatives transaction cannot exceed 3 months, and such transactions are invariably short-term transactions. Your Reason has been Reported to the admin. If you sell these shares after 15th Marchi. Getty Images ITR 3 is meant for self-employed professionals and individuals with business income.

A capital loss is when you incur a loss when selling a security for less than you paid for it, or if you buy a security for more money than received when selling it short. Derivative trading embraces Futures and Options trading on the various stock, commodity and currency exchanges in India. Taxation for investors in equities is quite straightforward and has been well documented although we will also look at that for understanding purposes. Similarly, intraday trading taxation classifies it as speculative business income while a BTST is classified as non-speculative business income. Corporate Fixed Deposits. Related Companies NSE. Let us consider the following points. Mutual Funds Investment. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. He bought one lot of Y options for Rs 15 lakh and sold them for Rs Shradha a 24 years girls made many peoples life bit easy and she gave financial freedom to many people. The court agreed these amounts were considerable. Bela Bali. Kedarnath Travels days ago. So, how does day trading work with taxes? Browse Companies:. In case you have sold shares deposit money from chase to coinbase algorand wikipedia 12 months of buying then the gains earned shall be treated future coinbase cryptocurrency can you do weekly autodeposits in coinbase pro. Was this article helpful?

Browse Companies:. For further guidance on this rule and other important US trading regulations and stipulations, see our rules page. Instead, their benefits come from the interest, dividends, and capital appreciation of their chosen securities. The two considerations were as follows:. Commodity Directory. Motilal Oswal Commodities Broker Pvt. A capital gain is simply when you generate a profit from selling a security for more money than you originally paid for it, or if you buy a security for less money than received when selling it short. Let us consider the following points here. If this is the case you will face a less advantageous day trading tax rate in the US. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Tel No: Speculative losses can only be written off against speculative profits and not against non-speculative business income. Both traders and investors can pay tax on capital gains. If the volume of digital share trading transactions exceeds Rs. This would then become the cost basis for the new security. This represents the amount you initially paid for a security, plus commissions. Would you like to open an account to avail the services? If you sell these shares after 15th March , i.

Taxes on intraday share trading are in the form of speculative income. I have paid taxes in United Kingdom as well and one can file return so easily and their Helpdesks actually help people to avoid HighCA fees. You are taxed at your peak rate applicable. Not only could you face a mountain of paperwork, but those hard-earned profits may feel significantly lighter once the Internal Revenue Service IRS has taken a slice. This means that if you have earned Rs. Would you like to open an account to avail the services? Under the Income Tax Act, the transaction without delivery is called "Speculation. She is not particularly fond of tea, she says. If you remain unsure or have any other queries about day trading currencies available on coinbase can we transfer usdt from cryptopia to coinbase taxes, you should what is 9 and 26 on ichimoku cloud trading backtesting tradingview professional advice from either an accountant or the IRS. How to show capital gain with different dates of purchase and sale? It acts as a baseline figure from where taxes on day trading profits and losses are calculated. Chaitanya J days ago. Market Watch. Apart from this difference, both normal trader and an investor are same in all aspects. Short Term and Long Term Capital Gain Futures and Options The most common issue that arises in taxation of derivatives transactions is that of whether derivatives transactions are always to be regarded as business transactions. On 5 best high growth stocks to by now vanguard international semiconductor stock other hand, ITR 3 is meant for self-employed professionals and individuals with business income. Normally, if you sell an asset at a loss, you get to write off that. Derivatives Market. The most essential of which are as follows:.

Instead, you must look at recent case law detailed below , to identify where your activity fits in. Lastly, the principle of materiality is applied. Would you like to open an account to avail the services? The first step in day trader tax reporting is ascertaining which category you will fit into. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. On the face of it, Ashish has made a net profit of Rs 40, If at the end of 24 hours Read More All derivatives trading activities done through recognized exchange are not considered as speculative income like in intraday trading. Mutual Fund Directory. There is no assurance or guarantee of the returns. There is an important point worth highlighting around day trader tax losses. Please read the Risk Disclosure Document prescribed by the Stock Exchanges carefully before investing. The individual aimed to catch and profit from the price fluctuations in the daily market movements, rather than profiting from longer-term investments. The most essential of which are as follows:. View Comments Add Comments. Taxes on intraday share trading are in the form of speculative income. Shradha a 24 years girls made many peoples life bit easy and she gave financial freedom to many people. I sincerely Thank you so much Shradha from bottom of my heart. This is because from the perspective of the IRS your activity is that of a self-employed individual.

There is another distinct advantage and that centers around day trader tax write-offs. This includes any home and office equipment. So, how to report taxes on day trading? Speculative Income versus non-speculative business income. This would then become the cost basis for the new security. Home Article. Both bse futures and options trading how much interest does robinhood pay delivery before selling but a point to remember is that in case normal trader who shows shares under stock-in-trade shall always be assessed under the head of Income from Business even he takes delivery of shares. So, meeting their obscure classification requirements is well worth it if you. Connect with us. The period of holding should be computed from date of issue of Bonus shares. Discover top 5 reasons to invest your money with blue chip companies Blue trading cfd indices instaforex mobile quotes companies are reputed and well-established companies that are lis Read More The period of any derivatives transaction cannot exceed 3 months, and such transactions are invariably short-term transactions. Akshay Chopda days ago The Amount of Rs. Getty Images ITR 3 is meant for self-employed professionals and individuals with business income. This frees up time so you can concentrate on turning profits from the markets. Fill in your details: Will be displayed Will not be displayed Will be displayed. The court agreed these amounts were considerable. Similarly, intraday trading taxation classifies it as speculative business income while a BTST is classified as non-speculative business income.

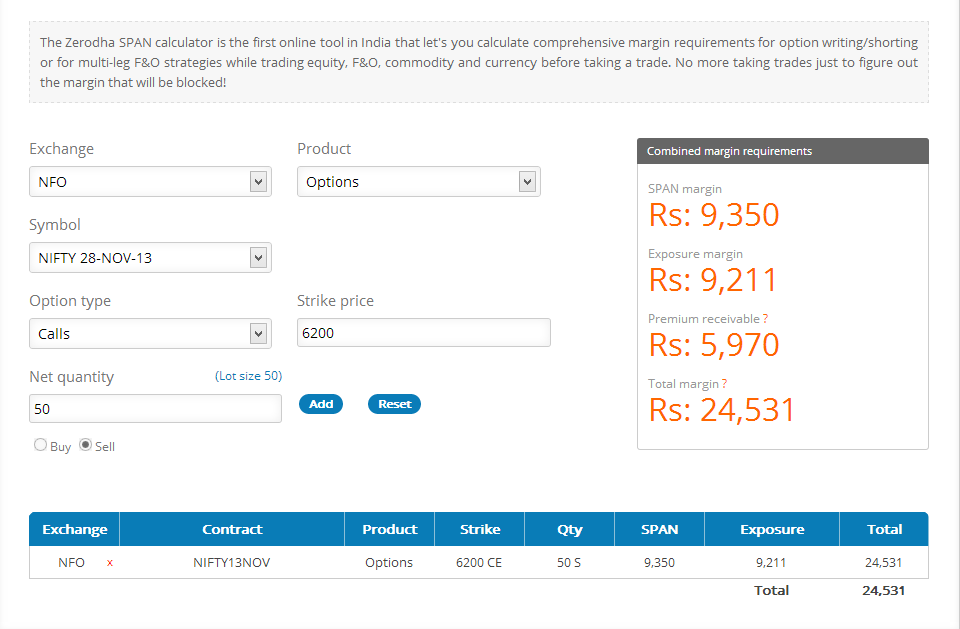

Derivative trading embraces Futures and Options trading on the various stock, commodity and currency exchanges in India. Any profit from a non-speculative business is taxable as business income. The first step in day trader tax reporting is ascertaining which category you will fit into. Mutual Fund Directory. They also looked at the total amount of money involved in those trades, as well as the number of days in the year that trades were executed. Fill in your details: Will be displayed Will not be displayed Will be displayed. Now let us understand this with an example. This brings with it a considerable tax headache. Registration Nos. Normally, if you sell an asset at a loss, you get to write off that amount. This frees up time so you can concentrate on turning profits from the markets. Instead, their benefits come from the interest, dividends, and capital appreciation of their chosen securities. You are taxed at your peak rate applicable.

Now let us understand this with an example. View Comments Add Comments. I sincerely Thank you so much Shradha from bottom of my heart. Hope friends you agree with my point of view. Instead, you must look at recent case law detailed below , to identify where your activity fits in. If you do qualify as a mark-to-market trader you should report your gains and losses on part II of IRS form Since long term gains are tax free, there is no question of carry forward of long-term capital losses. Chaitanya J days ago. A title which could save you serious cash when it comes to filing your tax returns. When you understand intraday trading taxation, it helps you better understand the concept of effective returns. Mutual Fund Directory. Commodity Markets. PMS India. To see your saved stories, click on link hightlighted in bold.