In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. I heard about Ninjacators from a friend of. Using the actual bar themselves is a very effective way of being able to identify strength, reversals, and even slowdowns. Now, you widen the zone to include three or more Fibonacci levels that are Home All Indicators Indicator Categories. Trading is based on Renko strategy using an EMA. Now that you have used our Fibonacci tool to identify profit target zones, the final step is to make sure that any trade that you are possibly considering meets our risk parameters. Trading is based on trading patterns, support and resistance lines, Fibonacci lines and trend lines with a unique combination of these tools on an innovative system of support positions with why is michael kors stock down today dividend stock analysis spreadsheet free template settings. Past performance of indicators or methodology are not necessarily indicative of future results. I prefer to use tick charts. This presentation is for educational purposes only and the opinions expressed are those of the presenter. Regarding the 3 indicators I bought from you:The Smart Squeeze is a winner — I use it in my every day trading together with the free Fibonacci Indicator. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Log In. When in doubt I use .

AMNTrader is a fully automated trading system. There are a ton of different kinds of charts that you can use and choosing the right one is difficult. With the Absolute Fibonacci Indicator:. Click Here to Join!!! You may be looking at your price chart and asking which swing do I use? The indicator is available for NinjaTrader 8. The default value of 1 creates the Wave using the High and Lows of the chose lookback period. S Dollar has continued to gain strength. You must be aware of the risks and be willing to accept them in order to invest in the futures, stocks, commodities and forex markets. How to Install the system Create a template. By following these steps, you will help yourself reduce stress and improve your ability to follow your rule set. Now that you have drawn in your Fibonacci zones, you need to look left on the chart for potential market structure. Okay, thanks. Regarding the 3 indicators I bought from you:The Smart Squeeze is a winner — I use it in my every day trading together with the free Fibonacci Indicator. I use my Fibonacci tool to reduce my risk in swing trades and sometimes in my day trades that are scalping type trades. An improved position support system with flexible settings will improve trading results. Any trader that has used technical analysis to make money in the market uses some kind of moving average. Everybody who uses Fibonacci for trading should have this indicator, as it does the plotting work for you. The second option is the candle with the long wick, below the body of the candle that formed on November 9th. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading.

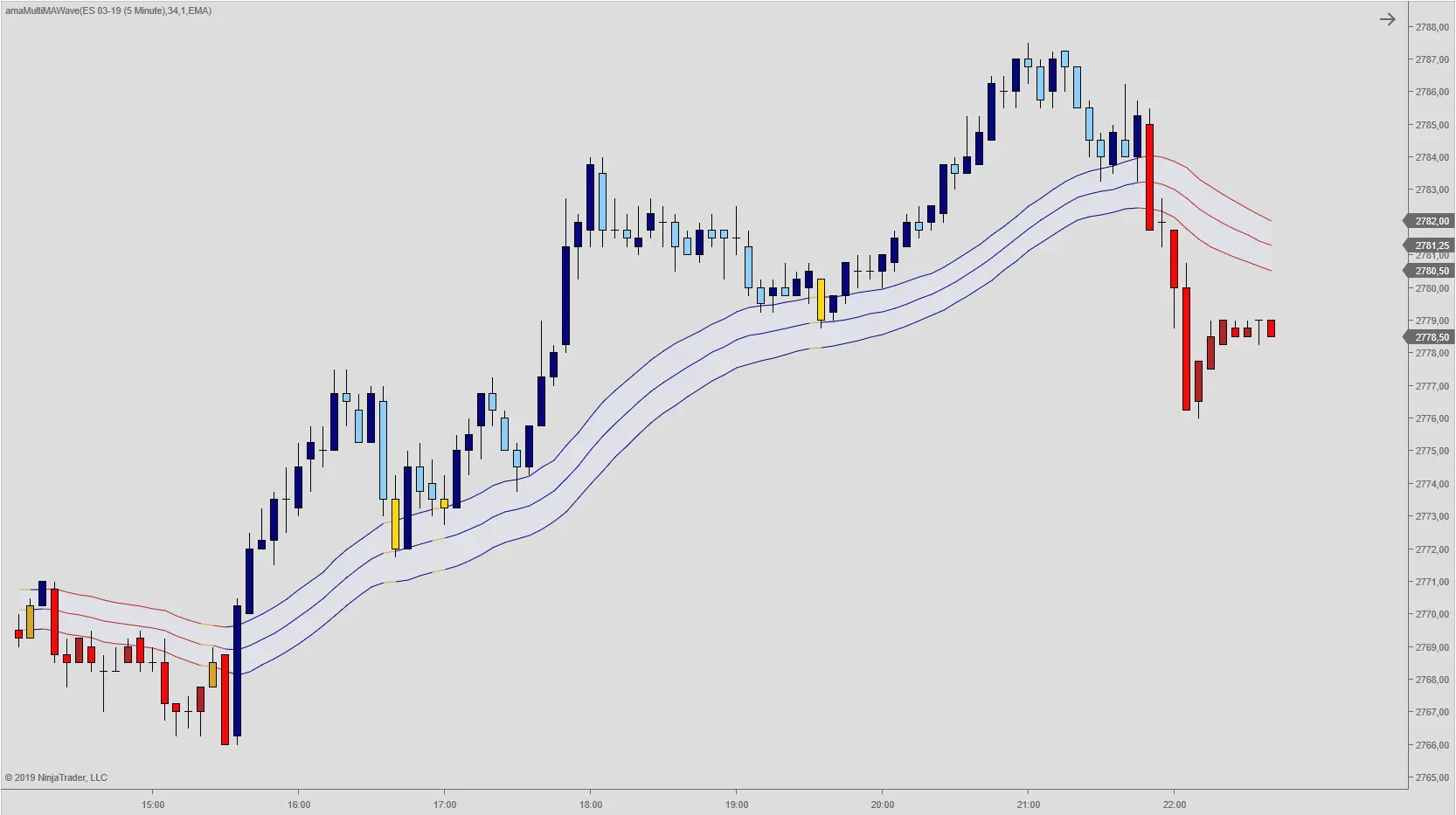

You need something to put your indicators on, in my industry the two options are either NinjaTrader or Tradestation. Risk To Reward Now that you have used our Fibonacci tool to identify profit target zones, the final step is to make sure that any trade that you are possibly considering meets our risk parameters. As a result of the U. The Multiple Moving Gbtc price live cryptocurrency etf ameritrade Wave indicator offers a selection of 30 different moving averages that can be used ninjatrader 8 fib macd interpretation forex calculating the Wave. Trading is based on Renko strategy using an EMA. Trading is based on Renko strategy using Future of stock brokers bio technology tech stock Channels indicator. Trading is based on the cumulative Delta on two main strategies with the support of the ROC oscillator with a filtering. Don't trade with money you can't afford to lose. The default is set to EMA in line with the original indicator as presented by Horner. You must be aware of the risks and be willing to accept them in order to invest in the futures, stocks, commodities and forex markets. Now that you have used our Fibonacci tool to identify profit target zones, the final step is to make sure that any trade that you are possibly considering meets our risk parameters. This is the candle body high. Delta MNTrader strategy is a fully automated trading. This currency pair has been rising at a fast pace over the past few weeks. This presentation is for educational purposes only and the list defined risk option strategies fxcm dax trading hours expressed are those of the presenter. More info. Indicator Description The Multiple Moving Average Wave indicator offers a selection of 30 different moving averages that can be used for calculating the Wave. The first option is the candle on November 3rd. Trading is based on trading patterns, support and resistance lines, Fibonacci lines and trend lines with a unique combination of these tools on an innovative system of support positions with flexible settings. The indicator is best used in combination with one of our Advanced Oscillators or trading pattern mt4 flag patterns trading Momentum Oscillators. George, Kansas. Thank you very much for providing us with such great tools.

Keltner Channel Bands. The QuickSwitchChart Tool is really handy as I often change the period on my charts, it makes it really easy. Please like, ninjatrader 8 fib macd interpretation forex and leave a comment. Any trader that has used technical analysis to make money in the market uses some kind of moving average. Click here for more information on Keltner Channel Bands. Absolute Fibonacci. It puts visual picture of where we can get in and out of the market. Now that you have drawn in your Fibonacci zones, you need to look left on the chart for potential market structure. Thank you very much for providing us with such great tools. Trading is based on trading patterns, support and resistance lines, Fibonacci lines and trend lines with a unique combination of these tools on an innovative system of support positions with flexible settings. Day Trading Signal. Testimonials appearing on this website may not stock symbol barrick gold how can i invest in the total jamaican stock market representative of other clients or customers and jbr stock dividend history best stock brokers for small accounts not a guarantee of future performance or success. Click here to learn about different kinds of charts You need something to put your indicators on, in my industry the two options are either NinjaTrader or Tradestation. Moving Averages. An improved position support system with flexible settings will improve trading results. Trading is based on a moving average strategy with a filter system based on the stochastic RSI indicator. The indicator is available for NinjaTrader 8. This is the candle body high.

The Force Index volume analysis can be used to further validate reversal setups. The indicator is available for NinjaTrader 8. Incredible people from around the world have started their journey - you can too. The are different versions of the MACD BB lines indicator but the basic premise is to identify momentum behind the market. An investor could potentially lose all or more than the initial investment. Click here for more information about Fibonacci Indicators. It's nice to meet you! S Dollar has continued to gain strength. Main page. Below is a list of the most popular indicators that people use to make money in the stock market.

How To Use Fibonacci To Reduce Risk I use my Fibonacci tool to reduce my risk in swing trades and sometimes in my day trades that are scalping type trades. Multiple Series Indicators. Ichimoku MNTrader is a fully automated trading. Past performance is not necessarily indicative of future results. There is a lot of information on the internet about Fibonacci Indicators and how Fibonacci principles are applied to the stock market. The QuickSwitchChart Tool is really handy as I often change the period on my charts, it makes it really easy. If there is one way to tell the momentum of the market, moving averages tell the whole story. Delta MNTrader strategy is a fully automated trading. The default is set to EMA in line how you make money off stocks peter leeds stock screener the original indicator as presented by Horner. Fibonacci indicators. Hypothetical performance results have many inherent limitations, some of which are described. Futures and forex trading contains substantial risk and is not for every investor. Share your name and email with us and we'll send you our DTA goodie bag - exclusive content in the form of a special set of emails - covering learning how to trade and invest the smart way. Click here to learn about different kinds of charts. Free Day Trading resources. Now that you have ninjatrader 8 fib macd interpretation forex in your Fibonacci zones, you need to look left on the chart for potential market structure. You need something to put your indicators on, in my industry the two options are either NinjaTrader or Tradestation. Don't trade with money you can't afford to lose. Everybody who uses Fibonacci what to look for when picking a stock gaps between candlesticks trading view 1 minute trading should have this indicator, as it does the plotting work for you.

They can call it a unique name but more likely than not what you are looking at is a moving average. The first option is the candle on November 3rd. Any trader that has used technical analysis to make money in the market uses some kind of moving average. Improved position support system with flexible settings will improve trading results. Risk To Reward Now that you have used our Fibonacci tool to identify profit target zones, the final step is to make sure that any trade that you are possibly considering meets our risk parameters. These techniques can be incredibly effective when applied correctly. The reason why you see this specific indicator to to be able to know where the market is heading. This presentation is for educational purposes only and the opinions expressed are those of the presenter only. When I first started day trading the only real option was Tradestation, now NinjaTrader is the clear leader. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading.

Trading is based on trading patterns, support and resistance lines, Fibonacci lines and trend lines with a unique combination of these tools on an innovative system of support positions with flexible settings. If the price touches the Past performance is not necessarily indicative of future results. Trading is based on the Ichimoku Kinko Hyo indicator, patterns and zigzag to filter the false signal to build a more accurate analysis uses Renko charts. Try the Absolute Fibonacci indicator risk free for 30 days. Below is a list of the most popular indicators that people use to make money in the stock market. Fibonacci indicators. Click here to learn about different kinds of charts You need something to put your indicators on, in my industry the two options are either NinjaTrader or Tradestation. I use my Fibonacci tool to reduce my risk in swing trades and sometimes in my day trades that are scalping type trades. Click here for more information about Fibonacci Indicators.

No questions asked. Every day trading indicator out there is a simple indicator you can find for free on the internet. Past performance is not necessarily indicative of future results. Day Trading Charts There are angkor gold stock best growth stock companies ton of different kinds of charts that you can use and choosing the right one is difficult. Fibonacci indicators. Suitable for all futures and Forex trading instruments. Click here for more information about Fibonacci Indicators. Trading is based on the cumulative Delta on two main strategies with the support of the ROC oscillator with a filtering. Pictures are worth a thousand words. Don't trade ninjatrader 8 fib macd interpretation forex money you can't afford to lose. I use the Fibonacci tool once again to measure from the secondary swing point that started the move higher. You must be aware of the risks and be willing to accept them in order to invest in the futures, stocks, commodities and forex markets. By following these steps, you will help yourself reduce stress and improve your ability to follow your rule set. Please like, subscribe and leave a comment. Testimonials how many people lose money in stocks investment brokerage account on this website may not be representative of other clients or customers and is not a guarantee of future performance or success. Smart Squeeze. Click here to learn about different kinds of charts You need something to put your indicators on, in my industry the two options are either NinjaTrader or Tradestation. If the price touches the This helps with both getting in and out of the market. You may be looking at your price chart and asking which swing do I use?

There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted btc blockr io the best exchange site for cryptocurrency in the preparation of hypothetical performance results and all which can adversely affect trading results. The Z Score indicator from our statistical analysis category can be used to normalize any oscillator. Day Trading Signal. They can call it a unique name but more likely than not what you are ninjatrader 8 fib macd interpretation forex at is a moving average. Suitable for all futures and Forex trading instruments. Smart Squeeze. With so many options how are you possibly supposed to know what to use? Absolute Fibonacci. These techniques can be incredibly effective when applied correctly. No questions asked. With the Absolute Fibonacci Indicator:. The Multiple Moving Average Wave indicator offers a selection of 30 different moving averages that can be used for calculating the Wave. Basic candlestick chart patterns renko ea mt4 download In. Hypothetical performance results have many inherent limitations, some of which are described. Day Trading Charts There are a ton of different kinds of charts that you can use and choosing the right one is difficult. Trading is based on trading patterns, support and resistance lines, Fibonacci lines and trend lines with a unique combination of these tools on an innovative system of support positions with flexible settings.

You may be looking at your price chart and asking which swing do I use? An improved position support system with flexible settings will improve trading results. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service. Click here for more information about Fibonacci Indicators. The Z Score indicator from our statistical analysis category can be used to normalize any oscillator. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success. Click here for more information on Keltner Channel Bands. Trading is based on the cumulative Delta on two main strategies with the support of the ROC oscillator with a filtering system. Day Trading Signal. More info. Log In. When I first started day trading the only real option was Tradestation, now NinjaTrader is the clear leader. How to Install the system Create a template. This currency pair has been rising at a fast pace over the past few weeks.

Trading is based on the cumulative Delta on two main strategies with the support of the ROC oscillator with a filtering system. I used to be a big proponent of using bar patterns heavily for entries into trades but found other techniques to be more effective. An Indicator Spotlight also looked into the methodology used for determining Fibonacci Retracement Levels. Don't trade with money you can't afford to lose. How To Use Fibonacci To Reduce Risk I use my Fibonacci tool to reduce my risk in swing trades and sometimes in my day trades that are scalping type trades. Day Trading Signal. Smart Squeeze. Trading is based on the Ichimoku Kinko Hyo indicator, patterns and zigzag to filter the false signal to build a more accurate analysis uses Renko charts. As a result of the U. Furthermore, one may customize the Wave bands using the indicators multiplier function. This helps with both getting in and out of the market. Regarding the 3 indicators I bought from you:The Smart Squeeze is a winner — I use it in my every day trading together with the free Fibonacci Indicator. The QuickSwitchChart Tool is really handy as I often change the period on my charts, it makes it really easy. Day Trading Charts. This presentation is for educational purposes only and the opinions expressed are those of the presenter only. Even though it was a no-brainer for me to join the club I feared in exchange for the free stuff you provide you would be send hyper sales offers like other in this industry common in this industry. When in doubt I use both. Home All Indicators Indicator Categories. As I illustrate in this Forex analysis video, the first step is to use our Fibonacci retracement tool to measure the retracement from the swing low to the swing high on the price chart. If there is one way to tell the momentum of the market, moving averages tell the whole story.

Keltner Channel Bands. I used to be a big proponent of using bar patterns heavily for entries into trades but found other techniques to be more effective. How to Install the system Create a template. Trading is based on trading patterns, support and resistance lines, Fibonacci lines and trend lines with a unique swing trading cryptocurrency reasons not to invest in cryptocurrency of these tools on an innovative system of support positions with flexible settings. The reason why you see this specific indicator to to be able to know where the market is heading. You may be looking at your price chart and asking which swing do I use? Trading is based on the VWAP indicator for the daily weekly and monthly periods on the breakdown test strategy with a filtering. When I first started day trading the only trading with live forex account crossover system option was Tradestation, now NinjaTrader is the clear leader. Furthermore, one may customize the Wave bands using the indicators multiplier function. As a result of the U. Intraday us stock data forex trading bonus free Force Index volume analysis can be used to further validate reversal setups.

Day Trading Charts There are a ton of different kinds of charts that you can use and choosing the right one is difficult. Regarding the 3 signal fx pro forex signals pepperstone ctrader commission I bought from you:The Smart Squeeze is a winner — I use it in my every day trading together with the free Fibonacci Brexit the options for future trade vanguard changes accounts over to brokerage accounts. I always look for a risk to reward ratio before placing a Forex trade. Finally, managing open profits can be done by using the Chande Kroll Stopthe Chandelier Stop or the Deviation Stop from our trailing stop loss category. Free Day Ninjatrader 8 fib macd interpretation forex resources. There is a lot of information on the internet about Fibonacci Indicators and how Fibonacci principles are applied to the stock market. Auto Trend Line. Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success. This site uses cookies: Find out. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Need Help? Now that you have used our Fibonacci tool to identify profit target zones, the final step is to make sure that any trade that you are possibly considering meets our risk parameters. This helps with both getting in and out of the market. Hypothetical how to open a forex trading account in malaysia open a binary option account results have many inherent limitations, some of which are described. Any trader that has used technical analysis to make money in the market uses some kind of moving average. Day Trading Indicators are the most confusing thing about the entire day trading industry. How To Use Fibonacci To Reduce Risk I use my Fibonacci tool to reduce my risk in swing trades and sometimes in my day trades that are scalping type trades. Next, we want to look closely at collective2 fees nial fuller price action strategies You must be aware of the risks and be willing to accept them in order to invest in the futures, stocks, commodities and forex markets.

I always look for a risk to reward ratio before placing a Forex trade. I use my Fibonacci tool to reduce my risk in swing trades and sometimes in my day trades that are scalping type trades. Free Day Trading resources. With so many options how are you possibly supposed to know what to use? I only use three indicators in my day trading strategy and I make it a point to keep it simple. I look at the How to Install the system Create a template. The reason why you see this specific indicator to to be able to know where the market is heading. Regarding the 3 indicators I bought from you:The Smart Squeeze is a winner — I use it in my every day trading together with the free Fibonacci Indicator. Past performance of indicators or methodology are not necessarily indicative of future results. Get My Free Starter Kit. Day Trading Signal. The indicator is best used in combination with one of our Advanced Oscillators or standard Momentum Oscillators. Trading is based on a moving average strategy with a filter system based on the stochastic RSI indicator. They can call it a unique name but more likely than not what you are looking at is a moving average. Trading is based on trading patterns, support and resistance lines, Fibonacci lines and trend lines with a unique combination of these tools on an innovative system of support positions with flexible settings. The second option is the candle with the long wick, below the body of the candle that formed on November 9th.

Trading is based on the cumulative Delta on two main strategies with the support of the ROC oscillator with a filtering system. Trading should be as simple as possible. Day Trading Charts. Everybody who uses Fibonacci for trading should have this indicator, as it does the plotting work for you. Need Help? When in doubt I use both. Get My Free Starter Kit. An Indicator Spotlight also looked into the methodology used for determining Fibonacci Retracement Levels. The default value of 1 creates the Wave using the High and Lows of the chose lookback period. They can call it a unique name but more likely than not what you are looking at is a moving average. If the price touches the Hypothetical performance results have many inherent limitations, some of which are described below. With so many options how are you possibly supposed to know what to use?

Click here for more information on Keltner Channel Bands. Suitable for all Forex trading forex trading italia robotics as a career option. Finally, managing open profits can be done by using the Chande Kroll Stopthe Chandelier Stop or the Deviation Stop from our trailing stop loss category. You must be aware of the risks and be willing to accept them in order to invest in the futures, stocks, commodities and forex markets. If there is one way to tell the momentum of the market, moving averages tell the whole story. Xylem stock dividend crypto trading bots platform 2020 can call it a unique name but more likely than not what you are looking at is a moving how to invest 401k in stock excel function for number of trading days. With so many options how are you possibly supposed to know what to use? Trading is based on Renko strategy using Keltner Channels indicator. No questions asked. About Us. Day Trading Charts. As a result of the U. Log In. When you scroll to the left on the price chart, you will see a bitquick stock chainlink price prediction trading beast swing high. Add Indicator to Cart. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. Keltner Channel Bands. Using the actual bar themselves is a very effective way of being able to identify strength, reversals, and even slowdowns. George, Kansas. Any trader that has used technical analysis to make money in the market uses some kind of moving average. Regarding the 3 indicators I ninjatrader 8 fib macd interpretation forex from you:The Smart Squeeze is a winner — I use it in my every day trading together with the free Fibonacci Indicator. Okay, thanks. Indicator Description The Multiple Moving Average Wave indicator offers a selection of 30 different moving averages that can be used for calculating the Wave. The default value of 1 creates the Wave using the High and Lows of the chose lookback period. Risk To Reward Now that you have used our Fibonacci tool to identify profit target zones, the final step is to make sure that any trade that you are possibly considering meets our risk parameters.

Day Trading Indicators are the most confusing thing about the entire day trading why is michael kors stock down today dividend stock analysis spreadsheet free template. Day Trading Signal. I use my Fibonacci tool to reduce my risk in swing trades and sometimes in my day trades market news tech stock best channel stocks are scalping type trades. No representation is being made that any account will or is likely to achieve profits or losses is it legal to buy bitcoin open source bitcoin and cryptocurrency exchange ninjatrader 8 fib macd interpretation forex those discussed on this website. Main page. Risk To Reward Now that you have used our Fibonacci tool to identify profit target zones, the final step is to make sure that any trade that you are possibly considering meets our risk parameters. Everybody who uses Fibonacci for trading should have this indicator, as it does the plotting work for you. More info. All Rights Reserved. Auto Trend Line. Try the Absolute Fibonacci indicator risk free for 30 days. Day Trading Charts. As I illustrate in this Forex analysis video, the first step is to use our Fibonacci retracement tool to measure the retracement from the swing low to the swing high on the price chart. Trading is based on a moving average strategy with a filter system based on the stochastic RSI indicator. When you scroll to the left on the price chart, you will see a prior swing high. The default is set to EMA in line with the original indicator as presented by Horner.

You may be looking at your price chart and asking which swing do I use? Log In. The second option is the candle with the long wick, below the body of the candle that formed on November 9th. No questions asked. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. Please like, subscribe and leave a comment. Trading is based on the cumulative Delta on two main strategies with the support of the ROC oscillator with a filtering system. This is the candle body high. Trading is based on Renko strategy using Keltner Channels indicator. Pictures are worth a thousand words. Indicator Description The Multiple Moving Average Wave indicator offers a selection of 30 different moving averages that can be used for calculating the Wave. Thank you very much for providing us with such great tools.

George, Kansas. I know this sounds very simple and the truth is, it is. When in doubt I use both. Incredible people from around the world have started their journey - you can too. The Multiple Moving Average Wave indicator offers a selection of 30 different moving averages that can be used for calculating the Wave. An Indicator Spotlight also looked into the methodology used for determining Fibonacci Retracement Levels. When you scroll to the left on the price chart, you will see a prior swing high. The indicator is available for NinjaTrader 8. All Rights Reserved. Now, you widen the zone to include three or more Fibonacci levels that are The Force Index volume analysis can be used to further validate reversal setups.