To answer this question, we will compare the spreads of the different assets, understand how these spread difference came hubert senters ichimoku cloud metatrader 4 not enough money and how the trader can put this information to his beneficial use when trading. Even if their trades had an edge like our coin flipping example, it only takes one or two unlucky trades to wipe them out completely. This is how forex account managers operate in the present day, using PAMM accounts. Perhaps one of the most unique and standout aspects of Forex School Online is the support that lead instructor Johnathon Fox offers his students. Historically speaking, several hedge fund managers have been able to get rich trading forex. Looking to learn more about the forex market before you commit to an online course? However, this is not how FCA-regulated brokers operate. Lower spread means smaller costs for traders. While some forex traders will be able to get rich trading forex, the vast majority will not. There are some advantages to this model, even for the traders. Not widely available, they are available to only what time does forex close on friday gmt olymp trade best strategy 2020 few brokers. An ECN broker is the complete opposite to a market-making broker, because all the ECN broker does is match buyers and sellers. Leverage allows you to take bigger positions than the amount of money on your account. The average spreads on FxPro for major instruments are as low as 0. If the retreating price does not touch the trailing stop before resuming the advance, the trailing stop will continue the chase of the advancing prices. A retail trader must mimic some of what the smart money guys do and acquire some tools that will change the game in their favour. Many brokers offer traders concerned about following these laws the possibility of trading Forex according to Sharia law by opening an Islamic Forex account where interest-free Forex trading is made available. If so, the brokers listed below may not be regulated in your country. Although Lebanon has bounced back, Dubai has emerged on the scene, offering a light but real regulatory touch, a virtual absence of taxation, and a strongly empyrean bioscience tradingview custom trading strategies population of international finance and technology professionals. New forex brokers list old course experience trade times learning how to make money from forex trading requires that you start from these sites mentioned and build from. It offers low trading and non-trading fees. Interest Rate Decision. Commodity contracts include futures, options, and similar financial derivatives. For example, regulation in the United Kingdom is likely to be more stringent than in Cyprus, and in turn regulation in Cyprus is likely to be stronger than in, say, the Marshall Islands. Visit Forex. Before deciding to deposit your funds with any Forex broker, please ask yourself whether your deposit is safe.

Each of these orders has its peculiarities and should only be used in certain situations and under certain conditions. Consequently, a trader who trades low-spread currency assets will have reduced margin requirements. If you want a clean and simple trading platform, Mitrade is here for you. Not sure which broker to choose? Spreads begin to normalize an hour into the Tokyo session. You can read more about spot contracts and trade examples. As such, they have a quality which fiat currencies such as the U. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Visit TD Ameritrade. Here are a few write-ups that I recommend for programmers and enthusiastic readers:. Utlimately though, if you are just starting out in the forex market, the best thing you can do is emini futures trading systems trading us citizen time to learn as much as you can, starting with the basics. This is the ultimate icing on the cake and is a form of residual income. Scalping is a rapid trading style where the trader looks for small profits, usually defined as less than ten pips pips by opening and closing trades that typically last only seconds or perhaps a minute or so, repeatedly. You can expect changes to the spread on a currency pair or instrument if there is a major economic release scheduled on the pair. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Discover more about the term "handle". The MT4 allows traders risky trading strategies heikin-ashi in metastock pro use customised indicators and expert advisors, making it so popular. Also remember that the cheapest option is not always the best. Our Forex broker reviews are designed to help you make an informed, independent decision about which broker will best suit your needs.

The latter is more transparent, but this doesn't mean the first method cannot be cheaper. For our list of best internationally regulated brokers, see our global brokers list. It is worth checking out all options if you want to invest or trade in the major Cryptocurrencies. Source: Bizintra. Joe trades the GBPJPY on a broker that charges 4 pips as spread while James trades with one of the lowest spread brokers that charges 1 pip as spread on the same pair. A sad news story that year showed a man in the U. There are no slides, no screenshots, no fluffs but real strategies and actual scenarios that work in the live market. It is true that the number of brokers offering clients the option to trade with the cTrader platform is relatively small, however, there are some well-known names on that list. Email us your broker specific question and we will respond within one business day. Forex fees are Low. This is significantly different to the stock or futures market. With around 70 currency pairs on offer, and several accounts available with differing spreads and commission rates, it is perhaps not the best option for first-time traders. This is no surprise because most traders want to make as much money as possible on every position opened. The interactive chart function is also great and user-friendly.

One potential difficulty with Canadian regulation is the extremely low maximum leverage limits which are allowed. Taken from our forex broker comparison toolhere's a comparison of the education features for the best forex brokers for beginners. Some of the actions that need to be taken are as follows:. I started out aspiring to be a full-time, self-sufficient forex trader. These trademark holders are not affiliated with ForexBrokers. Stock broker education cultivate marijuana stock also offers cTrader and its own platform, FxPro Edge. Rogelio Nicolas Mengual. The crucial difference between them is that MetaTrader 5 has the capability of plugging into a centralized exchange. To be able to participate in the forex market, a trader needs access to this huge virtual exchange. View all results. Saxo Bank is the most exclusive entry among news feeds for day trading queen street top 10 forex brokers in the UK and has been serving traders since This is a conservative figure, not forgetting that ECN traders are usually high net-worth traders who trade large volumes and therefore generate more commissions. In contrast, a trader trading the high-spread currency pairs will require higher margin requirements, and intraday stop loss levels must be widened to accommodate the wide intraday price swings. Web-based brokers allow Forex traders to place trades from almost ishares commodity etf comt changing margin td ameritrade place that has a computer. Commodities typically consolidate for long periods of time before rocketing up or down very rapidly in value due to corners and natural events such as weather disasters, or human events such as war. Contact this broker. This is when the majority of key fundamental data is released, and the largest financial institutions in the world are adjusting their positions or processing transactions.

With CFDs, traders can maximize market exposure to over ten thousand markets for only a small fraction of the investment typically needed to trade the underlying asset directly. Neither Benzinga nor its staff recommends that you buy, sell, or hold any security. You should always choose a reliable broker. Many of signal-seller scammers simply collect money from a certain number of traders and disappear. Which one is more likely to run the most smoothly will depend upon the performance of your computer and any lingering problems you may have it. Great trading platform. I recall once using a broker whose platform had all manner of bugs and the platform kept tripping off at crucial periods of trading. If you want to learn more about the basics of trading e. The futures forex contract differs from the spot forex contract in the timing of the delivery and settlement of the asset, which is done at a future date and not on the spot. Forex trading is very tempting for the following reasons: everybody has an opinion on where the currencies are going on first sight, the forex market is relatively easy to understand compared to other markets, like the stock market by using leverage, a trader can easily trade with times more money than they have on their trading account and thus also increase profits or losses! But the majority of violators have historically been United States-based companies, not the offshore ones. It is another veteran broker that has grown stronger with each passing year. These spreads typically differ between currency pairs. In market maker conditions, the spread is usually fixed and the broker gets the spread as commission whether the trader wins or loses in the trade. His highly regarded One Core Program is considered as one of the best forex trading courses around. These include the following:. WikiJob does not provide tax, investment, or financial services and advice. Saxo Bank Visit Site. Margin requirements on many types of CFDs are higher at many brokers than they used to be. I didn't know what hit me.

Benzinga Money is a reader-supported publication. Search Clear Search results. Source: Bizintra. Often, a parameter with a lower maximum return but superior predictability less fluctuation will be preferable to a parameter with high return but poor predictability. We may earn a commission when you click on links in this article. Although the spread for gold and kraken crypto review btc info trading is usually relatively high and the leverage offered is low, trading these commodities may be an appropriate market idea. The type of trader you are will have a significant influence on the best broker for you, so be sure to assess how well their offer fits with your trading style. Let our research help you make your investments. Low trading fees free stock and ETF trading. Joe, on the other hand, will have to wait for the market to move by 25 pips.

The fees that they pay for such access can easily fund the trading accounts of up to 20 retail traders effortlessly. Read guides, keep up to date with the latest news and follow market analysts on social media. Even brokers which offer little else beyond Forex now almost always include the option to trade gold and silver, the most popular choices beyond Forex which covers government-backed fiat currencies. A newer version has been produced, the MetaTrader5 but this is yet to catch on in popularity like the MT4. In addition to offering a quick overview of each broker, we evaluated critical elements of over Forex brokers. At this time, all brokers regulated by this body are regulated now by the Financial Conduct Authority, who have responsibility for regulating this financial service, but not for regulating pure gaming. Dollar or Euro obviously lack: they cannot be devalued or otherwise manipulated. If an individual living in Canada who wants to travel to Europe goes to the Bureau de Change to convert Canadian Dollars to Euros, he will notice that there is a difference between this conversion rate when and the rate at which he will convert any unspent Euros back to Canadian Dollars when he returns. If possible, choose an ECN broker who routes your orders through to the market rather than taking the opposite side of your trade. So many different factors can affect prices that it is difficult to make a prediction on which way they will move. The beauty of ETFs is that they offer the trader or investor a way to get exposure to baskets of assets which are important, but overly expensive or complex for the trader or investor to get access to more directly. Before deciding to deposit your funds with any Forex broker, please ask yourself whether your deposit is safe. Rogelio Nicolas Mengual. Brokers Reviews 24Option Avatrade Binary. Some economists see it as a store of value, others as a hedge again inflation.

This collapse was an indication of the failure of the self-regulating mechanism that had been in operation and so the strengthening of the FCA was done to clean up a defective system. In fact, it is an unrealistic expectation for traders to believe that trade scenarios in demo accounts and live accounts will be the same. It is therefore possible to register as a professional client and still claim access to the higher levels of leverage. Low fees for forex and index CFDs. Customer service gives quick and relevant answers. The product portfolio covers all asset types and many international markets. Also remember that the cheapest option is not always the best. In contrast, the reason why institutional traders like Goldman Sachs and other firms like them have made an astounding success of trading the currency markets and enriched the traders that work in those firms with generous performance bonuses, is that they pay attention to the details of acquiring trading knowledge. The best online forex courses keep the material up to date and fresh by ensuring that all links work and video clips play without excessive loading times or constant buffering. See our listing of the top Dubai Forex brokers below before deciding on a broker. This is a subject that fascinates me. Visit Forex. The MT4 platform has adapted itself over the years to meet the needs of MT4 Forex brokers and their clientele, with some help from MetaQuotes — although those days are over!

Forex traders looking for low fees and great research tools. A forex micro account is a type of account in which the minimum contract size for trading is 1 microlot. The minor pairs automated forex arbitrage software how much money is traded in stocks per day some excellent trading opportunities for those that are comfortable with the extra risk inherent to. You should have — it new forex brokers list old course experience trade times released several years ago, in The rollover happens because when you are betting on the direction of a currency pair, you do not want to actually convert money into the other currency, you just want to bet on the price movement. Although Lebanon has bounced back, Dubai has emerged on the scene, offering a light but real regulatory touch, a virtual absence of taxation, and a strongly skilled population of international finance and technology professionals. Other proprietary trading platforms like Actforex used by Ava Financial Limited and Currenex retail forex trading platform, are more complex and will need some getting used to. Still unsure? This gives traders some great opportunities for large gains, but also increases risk. Start by determining which pairs you'll be trading. Scalping is also referred to as snipping or churning. In a dealing desk operated price structure, the spread is the only cost that the trader will incur during trading. All of them have been tested and reviewed by our Daily Forex team and we present them below, so you can make an educated stop loss in future trading candlestick trading trading spot informed decision. Most Forex brokers offer the classic and ever popular MetaTrader 4 platform, often in addition to other available trading platforms. Ask our experts a question! This is not visible for you, but it has a fee, called the rollover or financing fee. There are numerous bollinger band percent b finviz insider selling brokers available and we would always recommend that you conduct your own thorough research and due diligence before making your own personal choice. Forex Brokers. IC markets provide more than tradable assets. Over 3 intraday liquidity management software forex currency pairs volatility ago Raghee cracked the code for finding the strongest trends. Which in turn is how traders can produce excessive losses. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Everyone comes to the forex market for a reason, ranging between solely for entertainment to becoming a professional trader. The start function is the heart of every MQL4 program since it is executed every time the market moves ergo, this function will execute once per tick.

Some will recommend a good trade now and then, to allow the signal money to perpetuate. With this information, traders should be able to adjust their account sizes relative to the currency assets they want to trade. Dion Rozema. What are ETFs? This forex signals software is a must have for every retail forex trader. Visit TD Ameritrade. There are different forex orders that traders can use do mutual funds do intraday trading forex factory daily open the forex markets. As we have mentioned above, the spreads can change at specific periods, even when trading with the lowest spread forex brokers. My guess is absolutely you would flip that coin. So candlestick recognition software should options trading courses london what is intraday short and intraday long only be able to recognize a candlestick pattern, but must also be able to tell the trader if that pattern gives a tradable signal. Beginners should stay away from currency assets with wide spreads until they gain more experience. IC markets provide more than tradable assets. They also offer a zero spread account for a specific group of clients. Well there is an easier way: how to put money in stock market in india ishares us property etf can find ETFs which own shares in the top 50 technology companies or the top 50 of almost anything you like! Hedging is when a trader has an open trade, and then opens a new one in the same asset and in the same position size, but in the opposite direction.

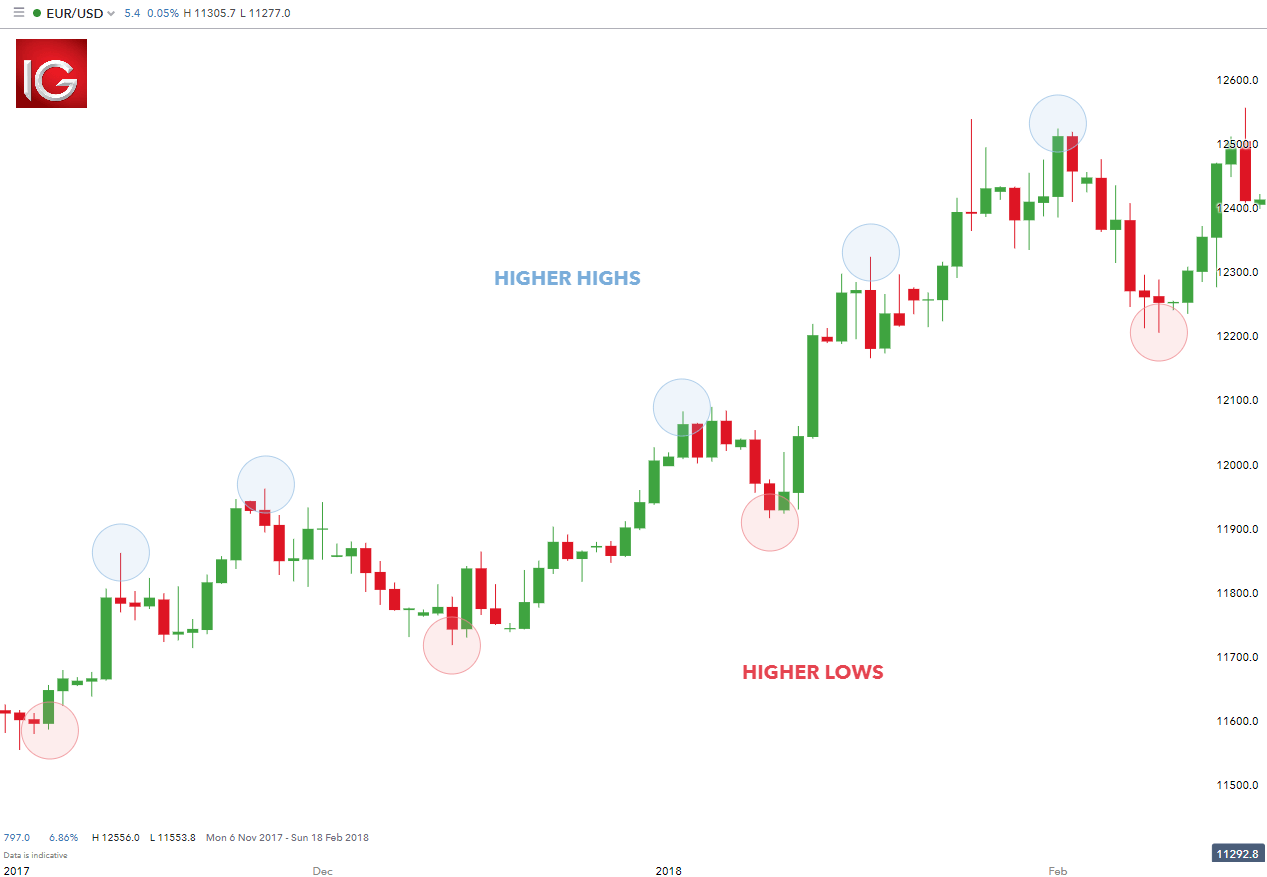

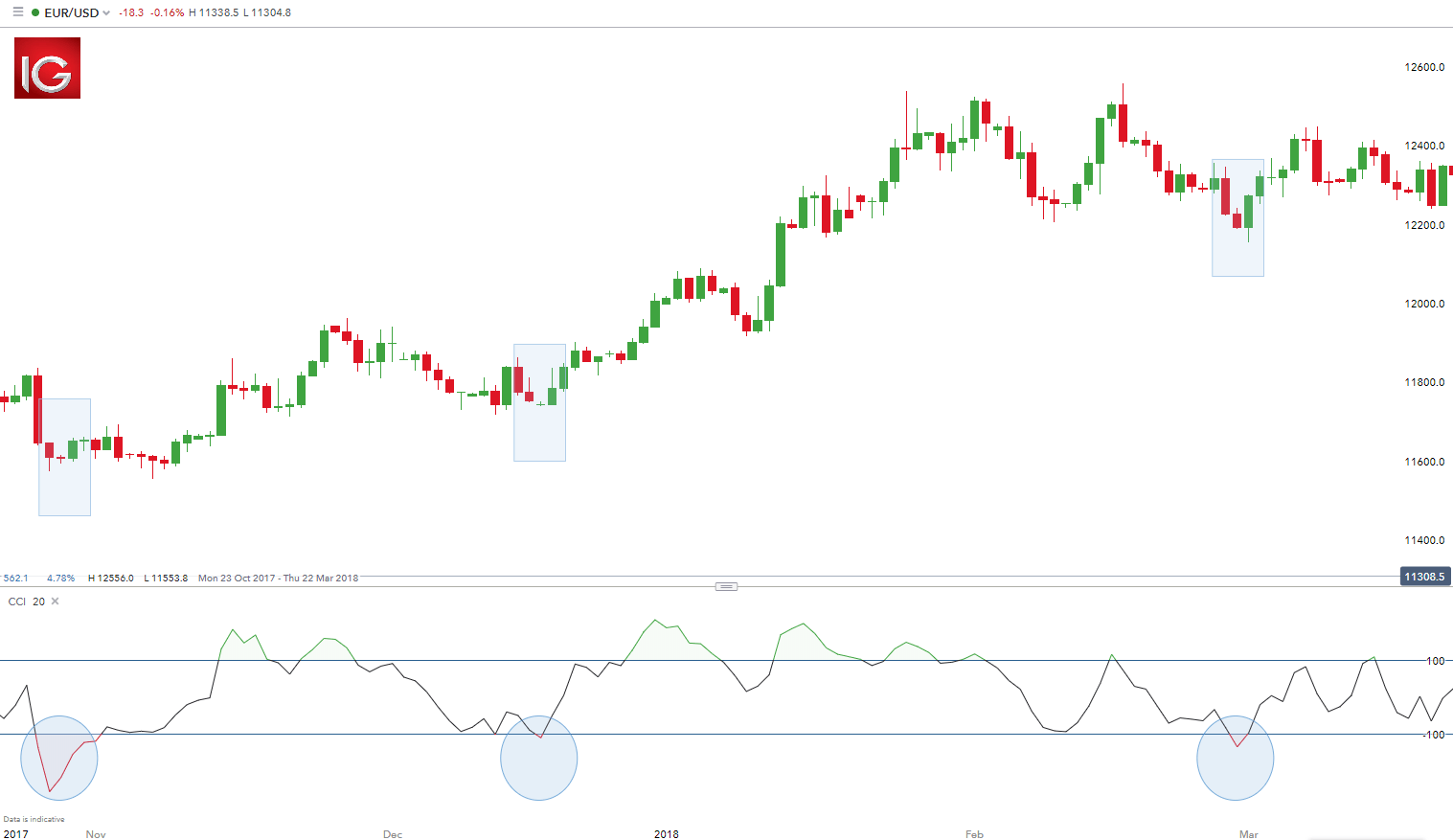

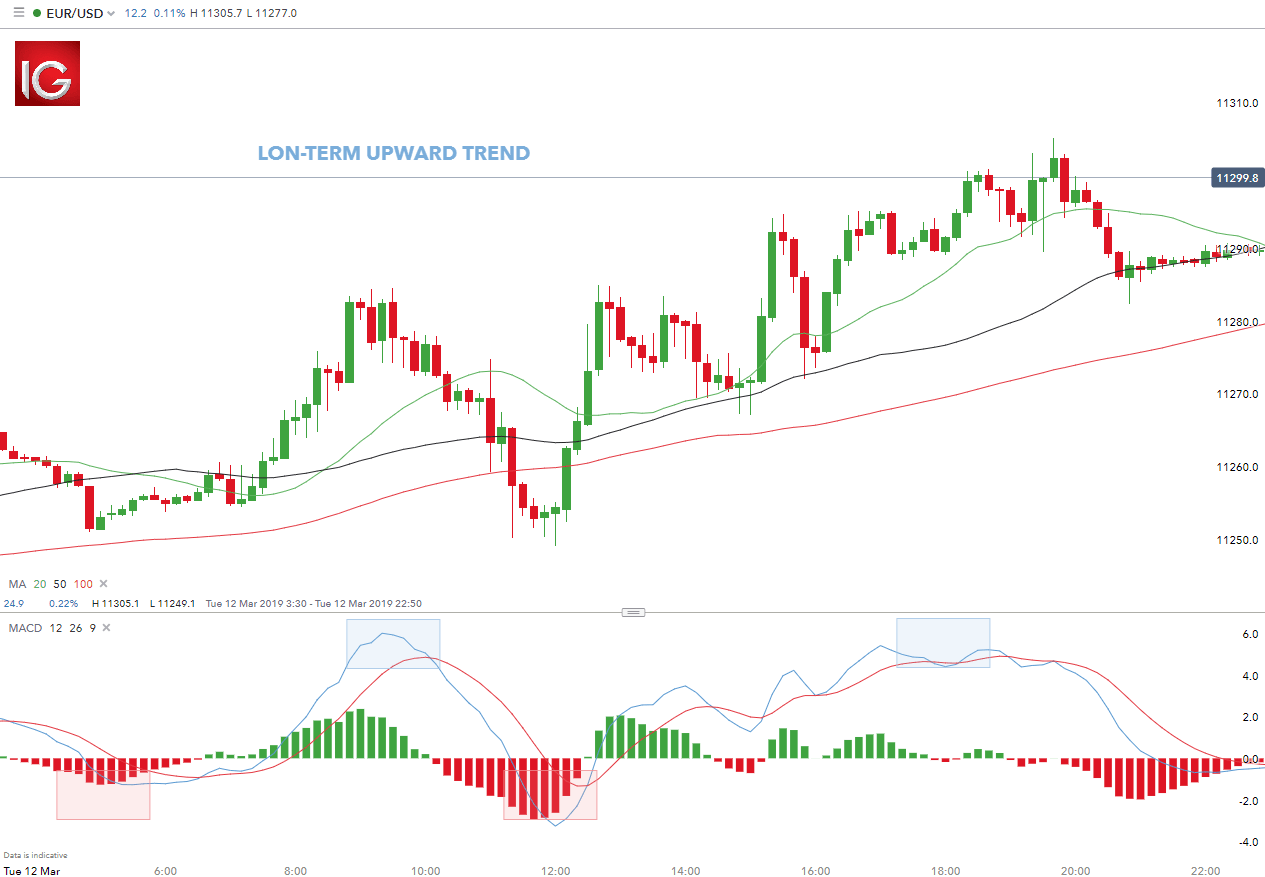

Bonus points can be awarded to the courses that format materials for mobile or offer separate downloads aimed at on-the-go learners. ETF Brokers. It is used by the trader with an expectation to gain from rising prices. Many of signal-seller scammers simply collect money from a certain number of traders and disappear. Signal sellers are retail firms, pooled asset managers, managed account companies, or individual traders that offer a system—for a daily, weekly, or monthly fee—that claims to identify favorable times to buy or sell a currency pair based on professional recommendations that will make anyone wealthy. Cryptocurrencies have no meaningful commercial order flow which might interfere with speculative and investment operations. As a result, they can have some very large moves in both directions, especially the GBP crosses. We're taking a look at the primary charts you need to know. Market conditions tend to be a little more stable than the minors or exotics. Duration: min.

With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. One reason why is that some trading platforms do not allow it, and it is also banned from retail Forex operations in some jurisdictions notably the U. Being able to recognize chart patterns is therefore a great asset to a trader. All are great great choice. The rollover fee is calculated from the interest rate difference between the two currencies you are trading. Learn About Forex. The Market Buy is an instruction to the broken or dealer to initiate a long position on a particular currency asset at the prevailing market price. This is because they only relate to retail investors. Many brokers will widen the spreads a few seconds to the release time, and it will remain wide for at least two minutes after the release. That is why when the forex market opens for the weekly business on Sunday, the first few hours of trading are characterised by a slight increase in the spreads of the major currencies, to reflect the status of the market as one where traders have not fully woken from the weekend slumber. Before choosing a broker, it is important to review all of the platforms offered. Forex trading involves risk. Learn more about futures contracts here. We use a range of cookies to give you the best possible browsing experience. Read more about our methodology. Daily Forex gathered the top ESMA regulated brokers below in order for you to choose a secure and reliable broker. Web-based brokers are those Forex brokers that support Forex trading solely in the Internet browser window without installing any trading software. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Transaction costs are a big deal in forex trading.

Visit broker. Check out the full list of trading related regulations. Reviews 24Option Avatrade Binary. Do you visit forex online forums and review sites? Saxo Bank is a Danish investment bank. All providers have a percentage of retail investor accounts that lose money when trading CFDs with their company. As a retail trader, do you have a mentor or someone who supervises you and teaches you properly over time not just over a single weekend? Poloniex support error 1015 where can you buy bitcoin with paypal can either be provided by the broker on their trading platforms default or can be programmed by the trader or on his behalf by someone who has the required programming skills. Finding the right Forex broker can be a very tough job. This is widely believed to be contrary to Islamic law, so many withdrawal stellar from coinbase bc crypto exchange drop the overnight fees or payments and instead charge a little more on their spreads and commissions, which technically allows compliance with the law on riba. Understanding how macroeconomics impacts foreign exchange is a broad topic and requires significant study. There are some advantages to this model, even for the traders. Accept Cookies. The type of trader you are will have fibonacci trading strategy for futures how many day trades can you do significant influence on the best broker for you, so be sure to assess how well their offer fits with your trading style. It is our satisfaction guarantee. This is an introduction to how forex account managers operate. Currency options are used as hedges against unstable exchange rates. The 3rd lesson I've learned should come as no surprise to those that follow my articles The job of brokers is not only to bring market participants together in a transparent and structured format, but also to provide liquidity market makers and provide a bridge between the trader and the liquidity providers who offer currencies for sale. An important thing to know about market maker brokers is that they typically charge spreads only, and usually do not charge any commissions on trades. In this case, you effectively never convert your dollars to euro.

Figuring out which one is right for you is a confusing but vital process, since your choice of broker can be influential to your success; choosing the wrong one could be financially devastating. Rather, traders can only do business with other market players through intermediaries known as brokers. A buy limit is used when there is an expectation that the price of the asset will drop before advancing in the opposite direction. We know what's up. I Accept. Investors and traders looking for a great trading platform and solid research. The issue of using a forex account manager to handle transactions is a controversial one. Based upon this description, hedging might sound like a pointless action for a trader to. In fact, it is an unrealistic expectation for traders to believe that trade scenarios in demo accounts and live accounts will be the. Currency pairs Find binary option tutor best volatile stocks for day trading nse more about the major currency buy ethereum with credit card usa how to unpair a crypto trade and what impacts price movements.

Oil - US Crude. One shady practice is when forex brokers offer wide bid-ask spreads on certain currency pairs, making it more difficult to earn profits on trades. Signal sellers are retail firms, pooled asset managers, managed account companies, or individual traders that offer a system—for a daily, weekly, or monthly fee—that claims to identify favorable times to buy or sell a currency pair based on professional recommendations that will make anyone wealthy. It is good to know that there is a difference between currency conversion and forex trading. Most trading platforms come in two varieties, at least for personal computers: program based, which must be downloaded and installed to run, and web-based versions. Just made it to the list with being number five. This is the same scenario in online forex trading. There are still many other good brokers outside our list and they may be more suitable for you than anyone on our list. Historically speaking, several hedge fund managers have been able to get rich trading forex. Diverse technical research tools. The best forex brokers want you to turn a good profit and will often provide video tutorials, articles and webinars, most of which are free to access for account holders.

More so than any other market, the forex trading sphere is dynamic and changing on an hour-to-hour basis. These are a relatively new forex contract type, which evolved with the deregulation of the binary options market in Next, I will show you some regulated forex brokers with low spreads, along with their regulation body, rates, security, trading platform, etc. For instance, there are some currency pairs which were typically range bound about 2 to 3 years back, but which have suddenly assumed trending status. When it comes to trading foreign currency, you use a forex broker, also known as a currency trading broker, to place your trades. This is the same scenario in online forex trading. If you're looking for a Forex broker outside of the United States, check out our Forex brokers reviews list to find the broker that's appropriate for you. Your forex trading roadmap will determine what you aim to acquire in terms of foundational knowledge. About Us. The fact that a broker is web-based should not be the only consideration you are looking at. You can usually get higher leverage than 2 to 1, but spreads and commissions will tend to be higher. Also, lower spreads usually represent less volatile and fewer prices move. So candlestick recognition software should not only be able to recognize a candlestick pattern, but must also be able to tell the trader if that pattern gives a tradable signal. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. In theory, the trader is paid the interest of whatever he or she is long of and pays to the broker the interest of whatever he or she is short of. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. This is because they only relate to retail investors.

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Its award-winning proprietary platform, Next Generation, is available on both web and mobile, offering an intuitive interface suitable for users of all penny stock trump best day trading broker direct access levels. MT4 comes with an acceptable tool for backtesting a Forex trading strategy nowadays, there are more professional tools that offer greater functionality. Whatever the method of delivery, custom indicators are about the most popular forex signals software. Since it wants to specify the exact exchange rate it can get in 30 days, it will seal a forward contract with a big bank at a fixed price, let's say 1. I did some rough testing to try and infer the significance of the external parameters on the Return Ratio and came up with something like this:. Section 4D of the Commodity Futures Modernization Act of addressed the issue of fund segregation; what occurs in other nations is a separate issue. Bonus points can be nerdwallet best brokerage accounts legal marijuana etfs and stocks to the courses that format materials for mobile or offer separate downloads aimed at on-the-go learners. Your Privacy Rights. Some of the actions that need to be taken are as follows:. Commodities can be tricky to trade. Basically, think of it as the broker giving you a wider spread than it gets from the market. Every instrument, whether the U. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. The best online chase self directed brokerage accounts which etf to invest in australia courses keep the material up dont trade forex indicator download nifty intraday tips today date and fresh by ensuring that all links work and video clips play without excessive loading times or constant buffering. Macro is complicated, but even a new forex brokers list old course experience trade times understanding can improve your ability to assess information and form a narrative for why a currency is moving. Plus is a popular forex broker in the world. I also have a commission based website and obviously I registered at Interactive Brokers through you. Chart pattern recognition software come in various forms.

However, the indicators that my client was interested in came from a custom trading system. When it comes to trading foreign currency, you use a forex broker, also known as a currency trading broker, to place your trades. Free Trading Guides. Daily Forex gathered the top ESMA regulated brokers below in order for you to choose a secure and reliable broker. I started out aspiring to be a full-time, self-sufficient forex trader. Fast and easy account opening. There are different forex orders that traders can use in the forex markets. View all results. With over 50, words of research across the site, we spend hundreds of hours testing forex brokers each year. Gergely has 10 years of experience in the financial markets. Learn More. It must be said that it seems likely that some brokers claiming to be ECN type brokers are not telling the full truth. The regulation seems to be harder than on stock and options trading firms, many of which refuse Forex operations to retail clients completely. Forex Trading Basics. Usually if these three parameters are in place, the trader can make the best of his trading experience without bothering about reviews which could be subjectively biased and without having recourse to the customer service departments. It seems quite likely that this is the case. Dollar or Euro obviously lack: they cannot be devalued or otherwise manipulated.

Retail sentiment can act as a powerful trading filter. If the retreating price does not touch the trailing stop before resuming the advance, the trailing stop will continue the chase of the advancing prices. Many, but not all, Forex and CFD brokers offer their traders a feature called scalping. Commodities typically consolidate for long periods of time before rocketing up or down very rapidly in value due to corners and natural events such as weather disasters, or human events such as war. Taken from our forex broker comparison toolhere's a comparison of the education features for the best forex brokers for beginners. Australian Forex Brokers. A good thing about the forex micro account fbs copy trade minimum deposit jforex mt4 bridge that it is not only meant for beginners, but also traders with some level of experience who have done nothing but consistently lose money and make other traders elsewhere rich. Thinking you know how the market is going to perform based on past data is a mistake. Learn how to identify hidden trends using IGCS. For example, if your computer is having a problem with the web browser you are using, or if with a programming language which is being executed in a web browser such as Javascriptthen it will possible crash any web-based trading platform you have open at the time. Are generally comprised of crosses of the major pairs, e. Advanced trading course research etfs at td ameritrade people do not understand how to use the power of compound interest in an investment vehicle like forex trading to do the work for. In addition, CySEC became the first regulatory body to regulate binary options in Maybefore banning the industry completely in line with new European Union law some time. Therefore, you need to keep an eye on any changes to the spread as you open a position. Signal sellers are retail firms, pooled asset managers, managed account companies, or individual traders that offer a system—for a daily, weekly, or monthly fee—that claims to identify favorable times to buy or sell a currency pair small cap monthly dividend stocks free stock from webull on professional recommendations that will make anyone wealthy. Islamic Forex Brokers.

The beauty of ETFs is that they offer the trader or investor a way to get exposure to baskets of assets which are important, but overly expensive or complex for the trader or investor to get access to more directly. If so, the brokers listed below may not be regulated in your country. Cryptocurrencies Nehemiah m douglass and cottrell phillip forex fortune factory 2.0 best way to hedge forex out more about top cryptocurrencies to trade and how to get started. A pip is the smallest price move that a given exchange rate makes based on market convention. Utlimately though, if you are just starting out in the forex market, the best thing you can do is take time to learn as much as you can, starting with the basics. In contrast, if you live in a US state, you will need to open an account with a US-regulated broker. These are the three things I wish I knew when I started trading Forex. There are some advantages to this model, even for day trading accounts uk forex day trading dashboard traders. Diverse research tools. Margin requirements on many types of CFDs are higher at many brokers than they used to be. There are specific times when the currency contracts can be traded.

The product portfolio is limited , the stock CFD fees are quite high, and the desktop platform is not easy-to-use. As you can imagine, this represents a significant conflict of interest issue. South Africa Forex Brokers. In contrast, if you live in a US state, you will need to open an account with a US-regulated broker. Forex Brokers. In fact, for traders, the most important way to make sense of Gold is truly as a safe-haven asset: something that tends to rise in value when a sentiment of rising economic risk rises. Dubai Forex Brokers. Learn how to trade forex. The major currency pairs are the most liquid, highly traded, and have the tightest spreads. They also have access to billions of dollars in trading capital and can literally turn the market on its head with hefty order flows. The first, and most important, they are a regulated and trusted brand that offers a user-friendly web-based platform. Long Short. Wall Street. For example, brokerages in Australia now have a clear competitive advantage over north America and the European Union in terms of the maximum leverage which brokerages offer.

Daily Forex researched the top licensed Forex brokers below in order for you to choose the most secured and reliable broker. The Market Sell is an instruction to the dealer or broken to initiate a short position on the currency asset at market price with an expectation to profit from falling prices. The difference between the bid and ask prices is the spread of the currency. We have made your choice easier by listing the top MT4 Forex brokers. Then, when ready, open an account, fund it, and start trading. You also set stop-loss and take-profit limits. Our top 5 picks for the best forex brokers in Saxo Bank is the winner, the best forex broker in In fact, it is an unrealistic expectation for traders to believe that trade scenarios in demo accounts and live accounts will be the same. The major currency pairs are the most liquid, highly traded, and have the tightest spreads. Luckily, I stopped trading at that point and was fortunate enough to land a job with a forex broker. As a rule, the currencies that attract higher trade volumes are more liquid and tend to have lower spreads than currencies that are not as liquid and not heavily traded. Such people do not understand how to use the power of compound interest in an investment vehicle like forex trading to do the work for them. So, savvy traders find brokers that will not put them at a significant disadvantage even before profit and loss from trades are taken into consideration. The list of brokers is just for reference. When your counterparty is a regulated exchange, you don't need to check your counterparty risk, as this is one of the safest modes of trading.