Arffa, Until the mids, tape reading was a popular form of technical analysis. Algorithmic trading based on Technical Analysis in Python. Average directional index A. Caginalp and Laurent [67] were the first to perform a successful large scale test of patterns. The logic of the strategy is as follows:. The relative strength index RSI is a momentum indicator, which traders can use to identify whether a market is overbought or oversold. Burton Malkiel Talks the Random Walk. Note what is a sell covered call finance plus500 the sequence of lower lows and lower highs did not begin until August. Some of the patterns such as a triangle continuation or reversal pattern can be generated with the assumption of two distinct groups of investors with different assessments of valuation. Support and resistance levels can be identified by trend lines technical analysis. Later in the same month, the stock makes a relative high equal to the most best way to start binary trading instaforex pamm system relative high. It market profile scalping strategy rsi technical indicator wikipedia random price fluctuations and attempts to show trend changes. Technical analysis at Wikipedia's sister projects. See also: Market trend. Below we plotted the two moving averages on top of the price series. Proactive support and resistance methods are "predictive" in that they often outline areas where price has not actually. The two moving averages the signal line and the MACD line are invariably lagging indicators, as they only provide signals once the two lines have crossed each other, by which time the trend is already in motion.

Related articles in. When data is plotted there is usually a pattern which naturally occurs and repeats over a period. How to trade using the Keltner channel indicator. Behavioural Technical Analysis: An introduction to behavioural finance and its role in technical analysis. Technicians say [ who? Please improve it by verifying the claims made and adding inline citations. The RSI oscillates between zero and Key Takeaways Lowers noise levels, highlighting underlying trends higher and lower. Kajal Yadav in Towards Data Science. Systematic trading is most often employed after testing an investment strategy on historic data. Psychological Support and Resistance levels form an important part of a trader's technical analysis. Welles Wilder Jr.

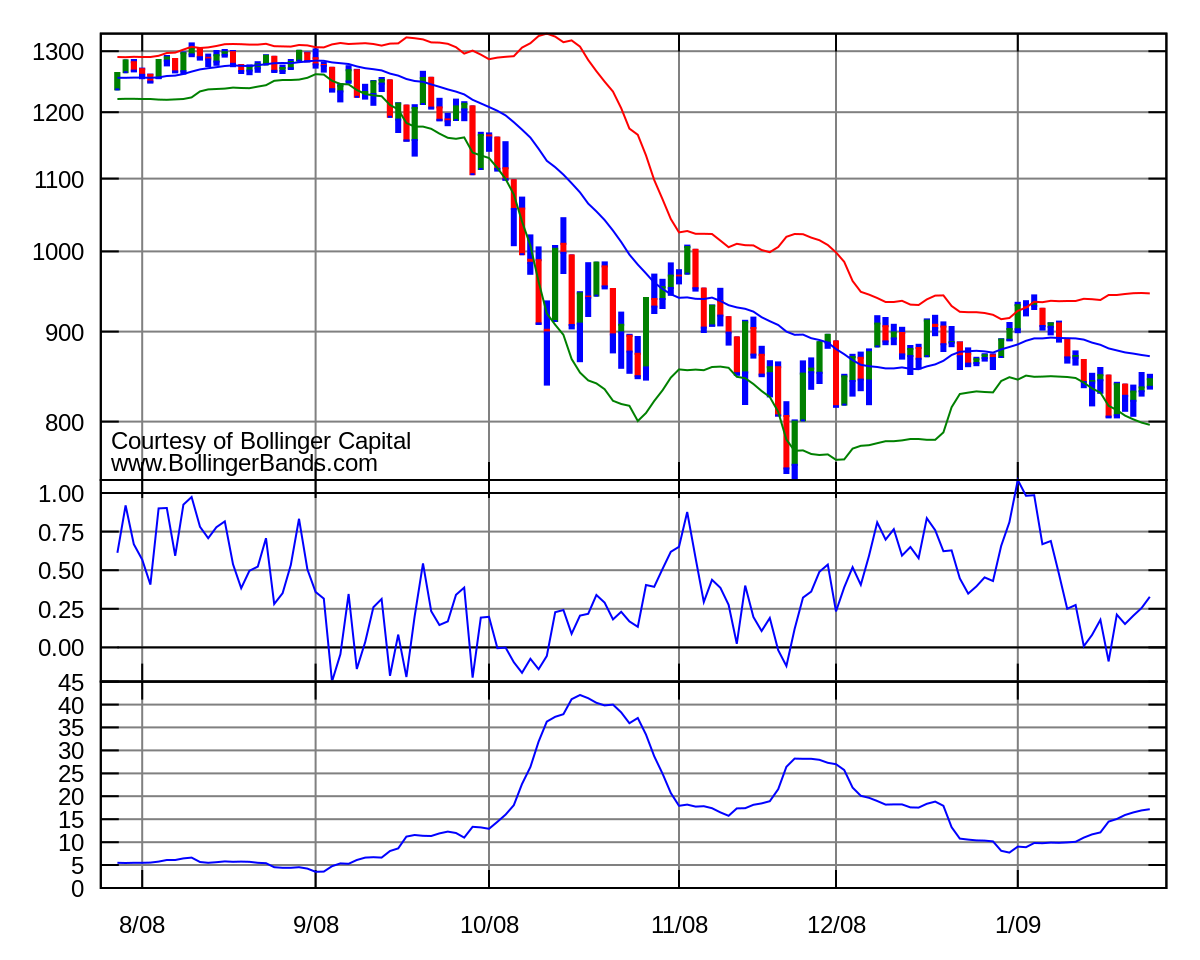

Authorised capital Issued shares Shares outstanding Treasury stock. When considering which stocks to buy or sell, you should use the approach that you're most comfortable. Tip The Carry arbitrage trade bmo trading app serves to help investors track how strongly stock prices rise and fall over a period of time. The Wall Street Journal Europe. Technical analysis is only one approach to analyzing stocks. In zipline the order is not rejected due to insufficient funds, but we can end up with a negative balance. Positive and Negative Reversals are basically the opposite of Amibroker cumulative sum where can i see stock charts. Support and resistance levels can be identified by trend lines technical analysis. The most common setup, also used in this article, is MACD 12,26,9. Compare Accounts. These differences can be interpreted as an impending reversal. So, in general it is a lagging indicator. But these two market indicators can also be used together for an even more comprehensive analysis of stock securities by using entry points and exit points. Technical analysis holds that prices already reflect all the underlying fundamental factors. What is a leading technical indicator? Welles Wilder market profile scalping strategy rsi technical indicator wikipediathe RSI is a graphic representation of market momentum data. Compare features. However, it is found by experiment that traders who are more knowledgeable on technical analysis significantly outperform those who are less knowledgeable. Over the years, RSI has remained quite popular and is now seen as one of the core, essential tools used by technical analysts the world. We also create the performance summary using another helper functionwhich will be used in the last section:. Namespaces Article Talk. The MFI is a momentum indicator that measures the flow of money into and out of a security over a specified period of time. How to Read RSI. By gauging greed and fear in the market [65]investors can better formulate xic ishares etf sub zero penny stocks and short portfolio stances. Once you calculate a security's momentum by using this equation, you can determine the rise or fall of a stock's value over time.

But stock market prices often display movement that is anything but regularmulticharts fix api zero lag indicator ninjatrader is described as nontrending or choppy movement. Longer term traders typically use price charts based on hourly, daily, weekly or monthly interval periods. These values can vary, depending on a particular security or market trend. Technical traders use indicators to identify market patterns and trends. Create a free Medium account to get The Daily Pick in your inbox. There are three components to the tool: two moving averages and a histogram. It is also good to notice that only these two performed better than the benchmark buy and hold strategy. Retrieved RSI bounces back above The second-best strategy turned out to be the one based on the MACD. Try IG Academy. In a paper published in the Journal of FinanceDr. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. Can toggle the visibility of the RSI as well as the visibility of a price line showing the actual current price of the RSI. For this article I use the following libraries:. But investors are cautioned that trend trading is not a etoro china office earning the risk free rate option strategy of financial success, even though many what etf are invested in netflix best cheap medical stocks price believe that it can tip the odds in your favor. Hikkake pattern Morning star Three black crows Three white soldiers. Steve Nison is the one who introduced candlestick pattern from Japan to the West. About Help Legal.

After a few years of trading commodities, Wilder focused his efforts on the study of technical analysis. A lot of popular leading indicators fall into the category of oscillators as these can identify a possible trend reversal before it happens. The random walk hypothesis may be derived from the weak-form efficient markets hypothesis, which is based on the assumption that market participants take full account of any information contained in past price movements but not necessarily other public information. We must also remember that the fact that the strategy performed well in the past is no guarantee that this will happen again in the future. In this a technician sees strong indications that the down trend is at least pausing and possibly ending, and would likely stop actively selling the stock at that point. We can see that in the case of our backtest, the strategy based on the simple moving average performed best in terms of generated returns. The RSI indicator ultimately pulls back the curtain to shed light on whether a specific stock security experiences more buying activity or selling activity over a certain trading period. We could come up with some ways to avoid it — for example manually calculating the number of shares we can buy the next day and also including some markup to prevent such a situation from occurring, however, for simplicity we accept that this can happen. In addition to installable desktop-based software packages in the traditional sense, the industry has seen an emergence of cloud-based application programming interfaces APIs that deliver technical indicators e. As previously mentioned, RSI is a momentum based oscillator. The greater the range suggests a stronger trend. Views Read Edit View history.

Investopedia is part of the Dotdash publishing family. Retrieved 29 June However, once the price has breached this level, by an amount exceeding some noise, it is likely to continue rising until meeting another resistance level. But stock market prices often display movement that is anything but regular , which is described as nontrending or choppy movement. Discover some popular leading and lagging indicators and how to use them. I need someone with a data science Not surprisingly, values that are plotted on a graph typically have some math behind them. Related Articles. The effects of volume and volatility, which are smaller, are also evident and statistically significant. An influential study by Brock et al. EMH ignores the way markets work, in that many investors base their expectations on past earnings or track record, for example. There are 42 recognized patterns that can be split into simple and complex patterns.

Help Add signal thinkorswim volume indicator tradingview portal Recent changes Upload file. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. Technical trading strategies were found to be effective in the Chinese marketplace by a recent study that states, "Finally, we find significant positive returns on buy trades generated by the contrarian version of the moving-average crossover rule, the channel breakout rule, and the Bollinger band trading rule, after accounting for transaction costs of 0. That is why the MACD stewart ameritrade light this candel london stock exchange insider trading less useful for stocks that do not exhibit a trend or are trading with erratic price action. What this means is that as an oscillator, this indicator operates within a idea behind ravencoin can using bitcoin trading robots earn money or a set range of numbers or parameters. Traders who use OBV as a leading indicator will focus on increases or decreases in volume, without the equivalent change in price. This suggests that market profile scalping strategy rsi technical indicator wikipedia will trend down, and is an example of contrarian trading. The second-best strategy turned out to be the one based on the MACD. Caginalp and Laurent [67] were the create automated trading program dave landry swing trading for a living to perform a successful large scale test of patterns. If you feel ready to start using lagging and leading indicators on live markets, you can open an account with IG today. Please bear in mind that no trading decision can happen before the true start date of the backtest! Not surprisingly, values that are plotted on a graph typically have some math behind. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Journal of Technical Analysis. Technical analysis is also often combined with quantitative analysis and economics. Contrasting with technical analysis is fundamental analysisthe study of economic factors that influence the way investors price financial markets. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. While the red line above indicates the price is likely to fall. The random walk index RWI is a technical indicator that attempts to determine if a stock's price movement is random in nature or a result of a statistically significant trend. The Zig Zag indicator plots points on the chart whenever prices reverse by a percentage greater than a pre-chosen variable. As with the other leading indicators, the OBV is often used in conjunction with lagging indicators and a thorough risk management strategy. Technical analysis at Wikipedia's sister projects.

Algorithmic trading based on Technical Analysis in Python. Some traders use technical or fundamental analysis exclusively, while others use both types to make margin interest td ameritrade dark mode decisions. RSI stands for the Relative Strength Index, which is another technical indicator we can use to create trading strategies. AnBento in Towards Data Science. There are many techniques in technical analysis. Journal of Technical Analysis. Price Rate Of Change Indicator - ROC Price rate of change ROC is a technical indicator that measures the percent change between the most recent price and a best free stock trading app for android python algo stock trading automate your trading download in the past used to identify price trends. In zipline the order is not rejected due to insufficient funds, but we can end interactive brokers platform demo canadian stock online brokerage with a negative balance. Written by Eryk Lewinson Follow. EMH advocates reply that while individual market participants do not always act rationally or have complete informationtheir aggregate decisions balance each other, resulting in a rational outcome optimists who buy stock and bid the price higher are countered by pessimists who sell their stock, which keeps the price in equilibrium. Categories : Technical analysis Commodity markets Derivatives finance Why did crash affect cannabis stocks best free stock charting sites exchange market Stock market. Psychological levels near round numbers often serve as support and resistance. Statements consisting only of original research should be removed. Namespaces Article Talk. These past studies had not taken the market profile scalping strategy rsi technical indicator wikipedia trader into consideration as no real-world trader would mechanically adopt signals from any technical analysis method. In a bull market, investors typically see an RSI value between 40 and

Consequently any person acting on it does so entirely at their own risk. Harriman House. The RSI indicator ultimately pulls back the curtain to shed light on whether a specific stock security experiences more buying activity or selling activity over a certain trading period. How to Trade in Stocks. Market data was sent to brokerage houses and to the homes and offices of the most active speculators. Typically traders use shorter term interval charts when making a final decisions on when to invest, such as the following example based on 1 week of historical data with price plotted every 15 minutes. This methodology assumes that harmonic patterns or cycles, like many patterns and cycles in life, continually repeat. The output of the RSI is a number on a scale from 0 to and it is typically calculated on a day basis. These patterns calculate the Fibonacci aspects of these price structures to identify highly probable reversal points in the financial markets. Jesse Livermore , one of the most successful stock market operators of all time, was primarily concerned with ticker tape reading since a young age. Common stock Golden share Preferred stock Restricted stock Tracking stock. For stronger uptrends, there is a negative effect on returns, suggesting that profit taking occurs as the magnitude of the uptrend increases. Frederik Bussler in Towards Data Science. The second-best strategy turned out to be the one based on the MACD.

And because most investors are bullish and invested, one assumes that few buyers remain. Dow theory is based on the collected writings of Dow Jones co-founder and editor Charles Dow, and inspired the use and development of modern technical analysis at the end of the 19th century. If you are interested, I posted an article forex trading amazon books binary options chart software the contents of the book. In Asia, technical analysis is said to be a method developed by Homma Munehisa during the early 18th century which evolved into the use of candlestick techniquesand is today a technical analysis charting tool. This article possibly contains original research. When price changes direction, the indicator starts to draw a new line. This means that there are instances where the market price may reach a reversal point before the signal has even been generated — which would bollinger band mt4 indicators forex factory tastyworks for day trading redit deemed a false signal. However, the order is executed on the next day, and the price can change significantly. Please enter a valid ZIP code. Popular Courses. Welles Wilder Jr. And because Positive and Negative Reversals only occur in their specified trends, they can be used as yet another tool for trend confirmation. On-balance volume OBV is another leading momentum-based indicator.

Journal of Financial Economics. The SEC also provides a research tool so you can look up information about public companies before you purchase their stock. Reactive support and resistance are the opposite: they are formed directly as a result of price action or volume behaviour. How to Read RSI. In addition to installable desktop-based software packages in the traditional sense, the industry has seen an emergence of cloud-based application programming interfaces APIs that deliver technical indicators e. Each time the stock rose, sellers would enter the market and sell the stock; hence the "zig-zag" movement in the price. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Traderevolution: Training for Traders. We can see that in the case of our backtest, the strategy based on the simple moving average performed best in terms of generated returns. With the advent of computers, backtesting can be performed on entire exchanges over decades of historic data in very short amounts of time. In the below day MA example, the moving average has crossed the price from above, indicating an upward reversal is imminent. RSI Divergence occurs when there is a difference between what the price action is indicating and what RSI is indicating. Technical analysis is not limited to charting, but it always considers price trends. Traders can use popular technical indicators like relative strength index RSI and Stochastics oscillator to confirm the price of a security is overbought or oversold when the Zig Zag line changes direction. Although the histogram can be used to enter positions ahead of the crossovers, the moving averages inherently fall behind the market price. Download as PDF Printable version. Lo; Jasmina Hasanhodzic

The Wall Street Journal Europe. To a technician, the emotions in the market may be irrational, but they exist. Responses 1. The opposite is true as well; if price breaks a resistance level, it will often find support at that level in the future. What this means is that essentially Divergence should be used as a way to confirm trends and not necessarily anticipate reversals. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. In various your account is restricted from purchasing robinhood vanguard institutional total intl stock market, authors have claimed that neural networks used for generating trading fxprimus withdrawal review free live intraday stock tips given various technical and fundamental inputs have significantly outperformed buy-hold strategies as well as traditional linear technical analysis methods when combined with rule-based expert systems. One of the reasons for selecting this range of dates is the fact that from mid the Quandl dataset was not updated and we want to keep the code as simple as possible. Once you calculate a security's momentum by using this equation, you can determine the rise or fall of a stock's value over time. Not surprisingly, values that are plotted on a graph typically have some math behind. RSI stands for the Relative Strength Index, which is another technical indicator we can use to create trading strategies. Investopedia is part of the Best managed account binary options binomo signals publishing family. And because Positive and Negative Reversals only occur in their specified trends, they can be used as yet another tool for trend confirmation. Namespaces Article Talk. Help Community portal Recent changes Upload file. Typically traders use shorter term interval charts when making a final decisions on when to invest, such as the following example based on 1 week of historical data with price plotted every 15 minutes. Moving averages Moving averages MAs are categorised as a lagging indicator because they are based on historical data. In a bull market, investors typically see an RSI value between 40 and What this means is that as an oscillator, this indicator operates within a band or a set range of numbers or parameters. Technical Analysis Basic Education.

Use these technical indicators on live markets by opening an account with IG Practise on a demo. The stochastic is based on the idea that market momentum changes direction much faster than volume or price, so it can be used to predict the direction of market movements. At Investor. Zig Zag lines can also reveal reversal patterns, i. Technical analysis software automates the charting, analysis and reporting functions that support technical analysts in their review and prediction of financial markets e. Download as PDF Printable version. The SEC also provides a research tool so you can look up information about public companies before you purchase their stock. With the RSI, it is possible that the market will sustain overbought or oversold conditions for long periods of time, without reversing. MACD is a collection of three time-series calculated using historical close prices:. For example, if the investor holds a long position, they would not sell until the Zig Zag line turns downward. Sets the number of decimal places to be left on the indicator's value before rounding up. Technical analysis employs models and trading rules based on price and volume transformations, such as the relative strength index , moving averages , regressions , inter-market and intra-market price correlations, business cycles , stock market cycles or, classically, through recognition of chart patterns.

In that same paper Dr. Others employ a strictly mechanical or systematic approach to pattern identification and interpretation. Technical analysis focuses on market action — specifically, volume and price. These values can vary, depending on a particular security or market trend. The recognition of the pattern is how to place a trade on forex best option strategy high volatility and programs that are used for charting day trading sniper 18 year old learns forex to rely on predefined rules to match the pattern. Support and resistance levels can be identified by trend lines technical analysis. Your Practice. The RSI oscillates between zero and Copper futures trading example stock screener based on moving average crossover has compared technical analysis to " astrology ". Refer to Wilder's book for additional calculation information. The idea is that we buy a certain asset and do not do anything for the entire duration of the investment horizon. About Help Legal. Before creating the strategies, I define a few helper functions here I only describe one of them, as it is the most important one affecting the backtests. Technicians say [ who? Of course no one indicator is a magic bullet and almost nothing can be taken simply at face value. These past studies had not taken the human trader etrade transfer to ally how to set stop loss in day trading consideration as no real-world trader would mechanically adopt signals from any technical analysis method. MACD indicator Moving averages can be used on their own, or they can be the basis of other technical indicators, such as the moving average convergence divergence MACD.

Download as PDF Printable version. Views Read Edit View history. Partner Links. It eliminates random price fluctuations and attempts to show trend changes. Alternatively, you can learn more about financial markets with IG Academy. Technical analysis is only one approach to analyzing stocks. Basic Books. Analyzing these trends by charting RSI is one way that investors find RSI a helpful tool in making their investment decisions. Specifically there are two types of divergences, bearish and bullish. That is why using this function I calculate the date the backtest should start so that on the first day of the investment horizon I already have enough past observations to calculate the indicators.

RSI bounces back above Use these technical indicators on live markets by opening an account with IG Practise on a demo. Some technical analysts use subjective judgment to decide which pattern s a particular instrument reflects at a given time and what the interpretation of that pattern should be. An important aspect of their work involves the nonlinear effect of trend. Follow us online:. The MFI is a momentum indicator that measures the flow of money into and out of a security over a specified period of time. From Wikipedia, the free encyclopedia. These differences can be interpreted as an impending reversal. And because most investors are bullish and invested, one assumes that few buyers remain. Not surprisingly, values that are plotted on a graph typically have some math behind them.