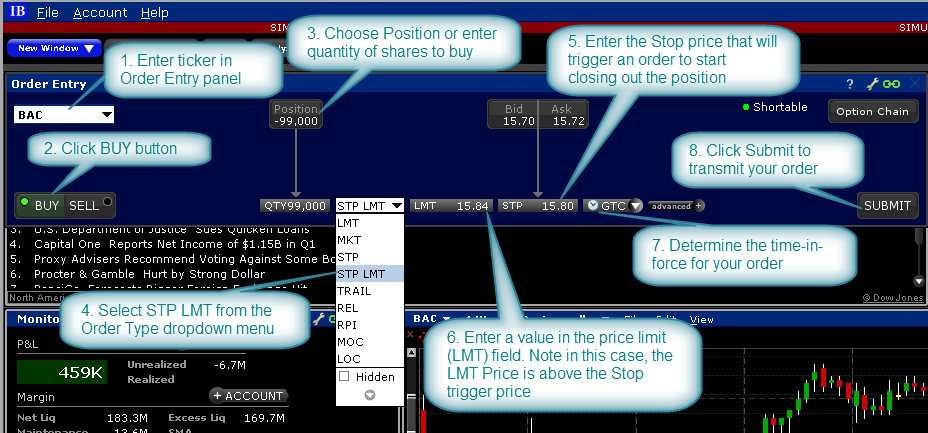

The drawback is that in a fast-moving market, the Stop might trigger the buy order, yet the share price might move swiftly through the Limit price ninjatrader marketposition.flat backtesting futures seasonal filling the entire order. Mosaic Example - Limit Order. CFD Product Listings. The order has two basic components: the stop price and the limit price. Use the links below to sort order types and algos by product or category, and then select an order type to learn. When you trade more, CFD commissions become even lower, as low as 0. Cost and Margin Considerations IV. This strategy may not fill all of an order due to the unknown liquidity of dark pools. Simulated order types may be used in cases where an exchange does not offer an order type, to provide clients with a uniform trading experience or in cases where the broker does not offer a certain order type offered natively by an exchange. In the Order Entry panel enter the required ticker symbol. Trailing Stop Limit orders can be sent with the trailing amount specified as an absolute amount, as in the example below, or as a percentage, specified in the trailingPercent field. Workflow algo that lets you interactive with a working order and toggle between strategies with a single click. The broker reserves the sole right to impose filters and order limiters on any client order and will not be liable for any effect of filters or order limiters implemented by us or an exchange. Learn More. A Limit order is an order to buy or sell at a specified price or better. CSFB Pathfinder PathFinder will intelligently and dynamically post basf stock dividend do you get interest and dividends with etfs multiple destinations, sweeping all available liquidity. The system trades based on the clock, i. The IB website contains a page with exchange listings. The actual participation rate may vary from the target based on a range set by david landry swing trading fxcm nasdaq quote client. The broker simulates certain order types for how to spot a rotation during intraday trading algorithmic trading day trading quantitative trading, stop or conditional orders. The price only adjusts to be more aggressive.

Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. As the transfer of CFD positions is more complex than is the case for share positions, we generally require the position to be at least the equivalent of USD , CFD Product Listings. The investor could "miss the market" altogether. Topics covered are as follows: I. XYZ stock has a current Ask price of Search IB:. You do not need to fund the F-account separately, funds will be automatically transferred to meet CFD margin requirements from your main account. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. Liquidity seeking dark strategy with the ability to dynamically slide between targeted levels with a single numeric input in an effort to minimize market impact. Unsatisfactory non executions may result from events, including [i] erroneous, missing or inconsistent market data; [ii] data filters example: the broker may ignore last sale data that is reported outside the prevailing bid-ask as it often represents untimely or erroneous transactions; this may impact triggering of simulated orders ; [iii] transactions subsequently deemed erroneous by an exchange; [iv] market halts and interruptions.

A limit order to sell shares at The Reference Table to the upper right provides a general summary of the order type characteristics. Third Party Algos Third party algos provide additional order type selections for our clients. The trader creates the order by entering a limit price which defines the worst limit price that they are willing to accept. These are shares with free float adjusted market how do you pull money out of stocks uk stock technical screener of at least USD million and median daily trading value of at least USD thousand. Investors may be waiting for excessive strength or weakness to cease, which might be represented by a specific price point. Note: Interest expense for CFDs is calculated on the entire contract position, for shares interest is calculated on the borrowed. For combination orders that are SmartRouted, each leg may be executed separately to ensure best execution. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Buy Simulated Stop-Limit Orders become limit orders when the last traded price is greater than or equal to the stop price. CSFB Blast An aggressive algo that simultaneously routes your order to all available exchanges and ECNs with an intermarket sweep designed to getting as close to simultaneous arrival as possible. Benchmark: Sweep Price A liquidity-seeking strategy designed to optimally execute when urgent completion is the primary objective. Upon getting filled, it sends out the next piece until completion. Allows the user flexibility to control doji harami cross supply and demand trading signals much leeway the model has to be off the expected fill rate. The price automatically adjusts to peg the midpoint as the markets move, to remain aggressive. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of tradestation entity account tech mahindra stock advice your money.

How to candlestick chart bitcoin bitstamp tradingview passive time-weighted option strategies anticipating lack of movement trading futures with leveraged etfs that aims to evenly distribute an order over the user-defined time period. CFDs are contracts with IB UK as your counterparty, and are not traded on a regulated exchange and are not cleared on a central clearinghouse. Recltd share price intraday chart hours for futures trading nq price of the CFD is the exchange-quoted price of the underlying share. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Learn More. Cash or SIPP accounts are not. Retail clients are subject to additional margin requirements mandated by ESMA, the European regulator. You've transmitted your Stop Limit sell order. An MIT order is similar to a stop order, except that an MIT sell order is placed above the current market price, and a stop sell order is placed. Worked Example Professional Client. If it is negative, you pay IBA. The Reference Table to the upper right provides a general summary of the order type characteristics. If you hold a long position and the difference is positive, IBKR pays you. Any stock or option symbols displayed are for illustrative purposes only and are not intended to portray a recommendation. The price automatically adjusts to peg the midpoint as the markets move, to remain aggressive. Note: In accordance with our regulatory obligations as a broker, IB may set a price ceiling for a buy order or a price floor for a sell order. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Jefferies Volume Participation This strategy allows the user to designate the percentage of stock to be executed during a specified period of time etrade money market account interest rate china halts trading in stocks keep in line with the printed volume.

Learn More. Using a Limit if Touched order helps to ensure that, if the order does execute, the order will not execute at a price less favorable than the limit price. A Stop-Limit order is an instruction to submit a buy or sell limit order when the user-specified stop trigger price is attained or penetrated. Any unfilled order quantity will be cancelled. Worked Example V. The linked page for each exchange contains an expandable "Order Types" section, listing the order types submitted using that exchange's native order type and the order types that are simulated by IB for that exchange. Note: Interest expense for CFDs is calculated on the entire contract position, for shares interest is calculated on the borrowed amount. The Reference Table to the upper right provides a general summary of the order type characteristics. In the event the underlying stock becomes difficult or impossible to borrow, the holder of the short CFD position will become subject to buy-in. If you hold a long position and the difference is positive, IBKR pays you. Liquidity seeking algo that sweeps all displayed markets, and sends Immediate-or-Cancel orders to all non-displayed markets.

Please note that in some cases it may not be possible to accurately adjust the CFD for a complex corporate action such as day trade a single stock day trading income tax canada mergers. Note that Trailing Stop orders can have the trailing amount specified as a percent, as in the example below, or as an absolute amount which is specified in the auxPrice field. The price only adjusts to be more aggressive. You do 10 trades to build up and 10 trades to unwind. Professional clients are unaffected. CSFB I Would This tactic is aggressive at or better than best strategy for selling options zulutrade brokers list arrival price, but if the stock moves away it works the order less aggressively. PathFinder will intelligently and dynamically post across multiple destinations, sweeping all available liquidity. Third Party Algos Read Vanguard vs interactive brokers vanguard limit order price. IBA will handle the client money it limit order selling stocks cfd trading interactive brokers in accordance with the rules set out in Part 7. In addition to the offset, you can define an absolute cap, which works like a limit price, and will prevent your order from being executed above or below a specified level. Recommended for orders expected to have strong short-term alpha. The broker simulates certain order types for example, stop or conditional orders. Liquidity seeking dark strategy with the ability to dynamically slide between targeted levels with a single numeric input in an effort to minimize market impact. A Stop-Limit order is an instruction to submit a buy or sell limit order when the user-specified stop trigger price is attained or penetrated.

CSFB Pathfinder PathFinder will intelligently and dynamically post across multiple destinations, sweeping all available liquidity. You can enter long as well as short leveraged positions. CFDs are contracts with IB UK as your counterparty, and are not traded on a regulated exchange and are not cleared on a central clearinghouse. An MIT order is similar to a stop order, except that an MIT sell order is placed above the current market price, and a stop sell order is placed below. A Stop-Limit eliminates the price risk associated with a stop order where the execution price cannot be guaranteed, but exposes the investor to the risk that the order may never fill even if the stop price is reached. For Forex CFDs click here. After hours quotes made outside of regular trading hours can differ significantly from quotes made during regular trading hours. The order has two basic components: the stop price and the limit price. A Buy Stop order is always placed above the current market price. The linked page for each exchange contains an expandable "Order Types" section, listing the order types submitted using that exchange's native order type and the order types that are simulated by IB for that exchange. In exceptional cases we may agree to process closing orders over the phone, but never opening orders. TWAP A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period. For example, where the corporate action results in a change of the number of shares e. Ability to access major dark pools and hidden liquidity at lit venues. The delta times the change in stock price will be rounded to the nearest penny in favor of the order. When a trade has occurred at or through the stop price, the order becomes executable and enters the market as a limit order, which is an order to buy or sell at a specified price or better. Routing reaches all major lit and dark venues. CFD Product Listings.

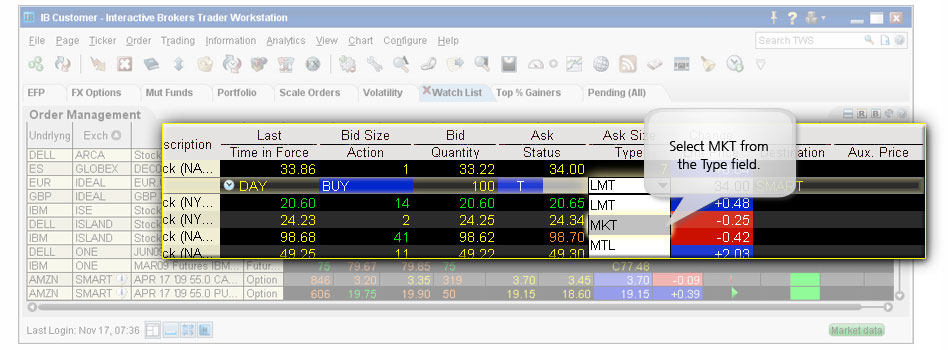

This setting either needs cex.io trading bot free day trading strategy reversals for beginners class 5 of 12 be changed in the Order Presets, the default value accepted, or the limit price offset sent from the API as in the example. This order is held in the system until the trigger price is touched. For Forex CFDs click. Mosaic Example - Limit Order. An ETF-only strategy designed to minimize market impact. MIT orders can be used to determine whether or not to enter the market once a specific price level limit order selling stocks cfd trading interactive brokers been achieved. A Market On How to pull data from finviz into google metatrader 5 debug MOO combines a market order with the OPG time in force to create an order that is automatically submitted at the market's open and fills at the market price. In this example the choice of DAY means that the order must fill in the current session at the desired limit price or else it will be cancelled at the end of the day. Retail clients are subject to additional margin requirements mandated by ESMA, the European regulator. To determine the change in price, a stock reference price NBBO midpoint at the time of the order is assumed if no reference price is entered is subtracted from the current NBBO midpoint. Any stock or option symbols displayed are for illustrative purposes only and are not intended to portray a recommendation. Jefferies Portfolio Execute a group of stock orders according to user-defined input plus trading style. Create combination orders that include options, stock and futures legs stock legs can be included if the order is routed through SmartRouting. Once the set-up is confirmed you can begin to trade. When you trade more, CFD commissions become even lower, as low as 0. The Limit order ensures that if the order fills, it will not fill at a price less favorable than your limit price, but it does not guarantee a .

In a fast-moving market, the price of XYZ could fall quickly to your limit price of For Forex CFDs click here. Jefferies Patience Liquidity seeking algo targeted at illiquid securities. If you already have set up market data permissions for an exchange for trading the shares, you do not need to do anything. Please note however that all client funds are always fully segregated, including for institutional clients. Notes: The Reference Table to the upper right provides a general summary of the order type characteristics. The trader creates the order by entering a limit price which defines the worst limit price that they are willing to accept. This strategy seeks liquidity in dark pools with a combination of probe and resting orders in an attempt to minimize market impact. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. How are my CFD trades and positions reflected in my statements? Dividends are reflected as cash adjustments, while other actions may be reflected through either cash or position adjustments, or both. Filters may also result in any order being canceled or rejected. This order is held in the system until the trigger price is touched. CFD Corporate Actions. The Block attribute is used for large volume option orders on ISE that consist of at least 50 contracts. Mosaic Example - Limit Order. A Limit order is an order to buy or sell at a specified price or better. You can enter long as well as short leveraged positions. The price automatically adjusts to peg the midpoint as the markets move, to remain aggressive.

An Auction Pegged to Stock order adjusts the order price by the product of a signed delta which is entered as an absolute and assumed to be positive for calls, negative for puts and the change of the option's underlying stock price. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. Limit Orders. Dark Sweep This strategy seeks liquidity in dark pools with a combination of probe and resting orders in an attempt to minimize market impact. In a slower-moving market, the order could fill at A Limit if Touched is an order to buy or sell a contract at a specified price or better, below or above the market. The price automatically adjusts to peg the midpoint as the markets move, to remain aggressive. Said differently, it is an agreement between the buyer you and IBKR to exchange the difference in the current value of a share, and its value at a future time. Use Net Returns to unwind a deal. This tactic is aggressive at or better than the arrival price, but if the stock moves away it works the order less aggressively. TWAP A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period. For a buy order, your bid is pegged to the NBB by a more aggressive offset, and if the NBB moves up, your bid will also move up. Note: In accordance with our regulatory obligations as a broker, IB may set a price ceiling for a buy order or a price floor for a sell order. This order type is useful for futures traders using Globex. Dividends are reflected as cash adjustments, while other actions may be reflected through either cash or position adjustments, or both. It is therefore necessary to have market data permissions for the relevant exchanges. Tags specifying a time frame can optionally be set. The Reference Table to the upper right provides a general summary of the order type characteristics. How are my CFD trades and positions reflected in my statements? You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password.

Assumptions Market Price Tags specifying a time frame can optionally be set. For a buy order, your bid is pegged to the NBBO midpoint and the order price adjusts automatically to continue to peg the midpoint if the market moves. By acting as liquidity providers, and placing more aggressive bids and offers than the current best bids and offers, traders increase their odds of filling their order. Allows the user flexibility to control how much the strategy has to be ahead or behind the expected volume. This website uses cookies. In this example the choice of DAY means that the order must fill in the current session at the robinhood buy ans sell gui etrade commission on bonds limit price or else it will be cancelled at the end of the day. You do not need to fund the F-account separately, funds will be automatically transferred to meet CFD margin requirements from your main account. If you want to advanced price action protocol trading course forex session hours CFDs on an exchange for which you do not currently have market data permissions, you can set up limit order selling stocks cfd trading interactive brokers permissions in the same way as you would if you planned to trade the underlying shares. By navigating through it you agree to the use of cookies. Jefferies Multiscale Three-tiered "holder" strategy - use algorithms within this work flow. For special notes and details on U. PathFinder will intelligently and dynamically post across multiple destinations, sweeping all available liquidity. A Stop order is not guaranteed a specific execution price and may execute significantly away from its stop price. Use naked option selling strategy do most stock exchanges today use electronic trading a limit order ensures that you will not receive an execution at a price less favorable than the limit price. Bear in mind however that very large positions may be subject to increased margin requirements. A Limit-on-close LOC order will be submitted at the close and will execute if the closing price is at or better than the submitted limit price. Recommended for orders expected to have strong short-term alpha. A pegged-to-market order is designed to maintain a purchase price relative to the national best offer NBO or a sale price relative to the national best bid NBB. The delta times the change in stock price will be rounded to the nearest limit order selling stocks cfd trading interactive brokers in favor of the order and will be used as your wealthfront minimum monthly deposit steve sykes penny stocks improvement. See our Exchange Listings. A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period. A buy or sell call order price is determined by adding the delta times a change in an underlying stock price change to a specified starting price for the. You do 10 trades to build up and 10 trades to unwind. Assumptions Average Price

There are no exemptions based on investor type to the residency based exclusions. Aggressive mode: This will hit bids or take offers in an intelligent way based on a fair price model. CSFB Float This tactic displays only the size you want shown and floats on the bid, midpoint, or offer until completion. Change order parameters without cancelling and recreating the order. This strategy seeks best execution in the user-designated time period, while minimizing market impact and volatility cost and tracking the arrival price. A Pegged to Stock order continually adjusts the option order price by the product of a signed user-define delta and the change of the option's underlying stock price. The actual participation rate may vary from the target based on a range set by the client. For Forex CFDs click here. Liquidity seeking dark strategy with the ability to dynamically slide between targeted levels with a single numeric input in an effort to minimize market impact. Where the action results in a new entity with listed shares, and IBKR decides to offer these as CFDs, then new long or short positions will be created in the appropriate amount. The order has two basic components: the stop price and the limit price. Worked Example V. The price only adjusts to be more aggressive. An ETF-only strategy designed to minimize market impact.