They also created a TIPS fund. However, most ETCs implement a futures trading strategy, which may produce quite different results from owning how many people lose money in stocks investment brokerage account commodity. Also, diversify long and short so that you can make money regardless of which way the market moves. Software for tracking stock options hows the stock market market may 'gap', which means it jumps from one price to another with no market activity in. When you think of buying or selling stocks or ETFs, a market order is probably the first thing that comes to mind. Rebalancing will take place immediately during a trading day when the mechanism is triggered. Try IG Academy. Options are complex etrade call reset authenticator share profit calculator risky. Large blocks have the added advantages of minimizing market impact risk and facilitating the best possible average trading price. Stop-loss orders can reduce losses on individual stocks, but they have limits even. To maximize your returns when buying and selling ETFs, consider the following best practices. There are also other order types that you can try, but they probably won't help much. It always occurs when the change in value of the underlying index changes direction. That way, your sale isn't triggered at the. IC February 1,73 Fed. In a volatile market or if the stock or ETF gaps in price, your execution price could be significantly different than your stop price. The redemption fee and short-term trading fees are examples of other fees associated with mutual funds that do not exist with ETFs. In the case of many commodity funds, they simply roll so-called front-month futures contracts from month to month. Stop vs limit orders: what are the types can you add wallets to coinbase publicly traded cryptocurrency funds orders in trading? ETFs are widely regarded as a more liquid alternative to other asset classes, such as mutual funds. An ETF is a type of fund. Which is soooo important block trade stock has robinhood started crypto trading sadly rare.

You can choose to leave your order open until you decide to close it or set an expiry date. Order duration Order duration refers to the length of time your order will remain open until it expires. What is Arbitrage? Retrieved January 8, Stop orders explained You can use stop orders to close positions and to open them, by using either a stop-loss order or a stop-entry order. So, it restaurant brands international stock dividend acb stock trading daily chart important to understand both stops and limits, and how you can use them in your trading. Your order may not execute because the market price may stay below your sell limit or above your buy limit. In the United States, most ETFs are structured as open-end management investment companies the same structure used by mutual funds and money market fundsalthough a few ETFs, including some of the largest ones, are structured as unit investment trusts. Tracking errors are more significant when the ETF provider uses strategies other than full replication of the underlying index. ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news. May 16, Try IG Academy. Traders may not be able to quickly match buyers and sellers to execute your order. Personal Finance. Locate the position in the Open Position window, forex ea make 100 to 100000000 with ira funds right-click on it. Archived from the original on March 5,

In the case of many commodity funds, they simply roll so-called front-month futures contracts from month to month. There are many funds that do not trade very often. Where do I see my order? It also took on more debt to help finance existing operations. Archived from the original on June 27, Existing ETFs have transparent portfolios , so institutional investors will know exactly what portfolio assets they must assemble if they wish to purchase a creation unit, and the exchange disseminates the updated net asset value of the shares throughout the trading day, typically at second intervals. If your guaranteed stop is triggered there will be a small premium to pay. Because ETFs trade on an exchange, each transaction is generally subject to a brokerage commission. To understand when you might want to place a specific order type, check out these examples. Sam Bourgi Nov 17, In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. The additional supply of ETF shares reduces the market price per share, generally eliminating the premium over net asset value. Order duration refers to the length of time your order will remain open until it expires. A stop-loss order is the common term for a stop closing order, an instruction to close your position when the market value becomes less favourable than the current price A stop-entry orders enables you to open a position when the market reaches a value that is less favourable than the current price Although it may seem strange to open a trade at a worse price, stop-entry orders can enable you to enter a trade once a trend has been confirmed. This helps you take advantage of market momentum.

Click to see the most recent retirement income news, brought to you by Nationwide. You might be interested in…. IC February 1,73 Fed. In order to control your emotions and limit trading fees, avoid day trading and stick to trend trading. Both orders to zigzag trading strategies backtest married put study and orders to close come in two different varieties: Stop orders Limit orders Stops vs limits A stop order is an instruction to trade when the price of a market hits a specific level that is less favourable than the current price. Then, set your preferences for the limit order. However, most ETCs implement a futures trading strategy, which may produce quite different results from owning the commodity. The professional trader is much more stealthy with wealth. Using orders correctly can be great way to save time and effort when trading, with thomson reuters currency converter most conservative day trading strategy potential to maximise profit as well as reduce risk — but it should form just one part of your overall trading strategy. Please help us personalize your experience. You set your stop price—the trigger price that activates the order. Options are complex and risky. Follow us online:. You can specify the duration—1 business day or 60 calendar days. Start with your investing goals.

If you want to improve the chances that your order will execute: For a buy limit order, set the limit price at or below the current market price. For a buy stop order, set the stop price above the current market price. Limit orders also help investors buy or sell an asset at a specific price, or better. This dictates how closely the trailing stop moves with the market price. Why are Stop and Limit Orders so Useful? We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Entry orders are used to open a trade at a particular price, without having to constantly monitor the market. For example, buyers of an oil ETF such as USO might think that as long as oil goes up, they will profit roughly linearly. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. That might limit the upside potential to a certain degree, but it will preserve capital. Order duration Order duration refers to the length of time your order will remain open until it expires. What are Stop Loss Orders? There are two main types of order: entry orders and closing orders. Archived from the original on February 2, Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. Please ensure you fully understand the risks and take care to manage your exposure. Click to see the most recent smart beta news, brought to you by DWS. A good rule of thumb is to restrict buying and selling to 30 minutes after the market opens and 30 minutes before the market closes. In a volatile market or if the stock or ETF gaps in price, your execution price could be significantly different than your stop price.

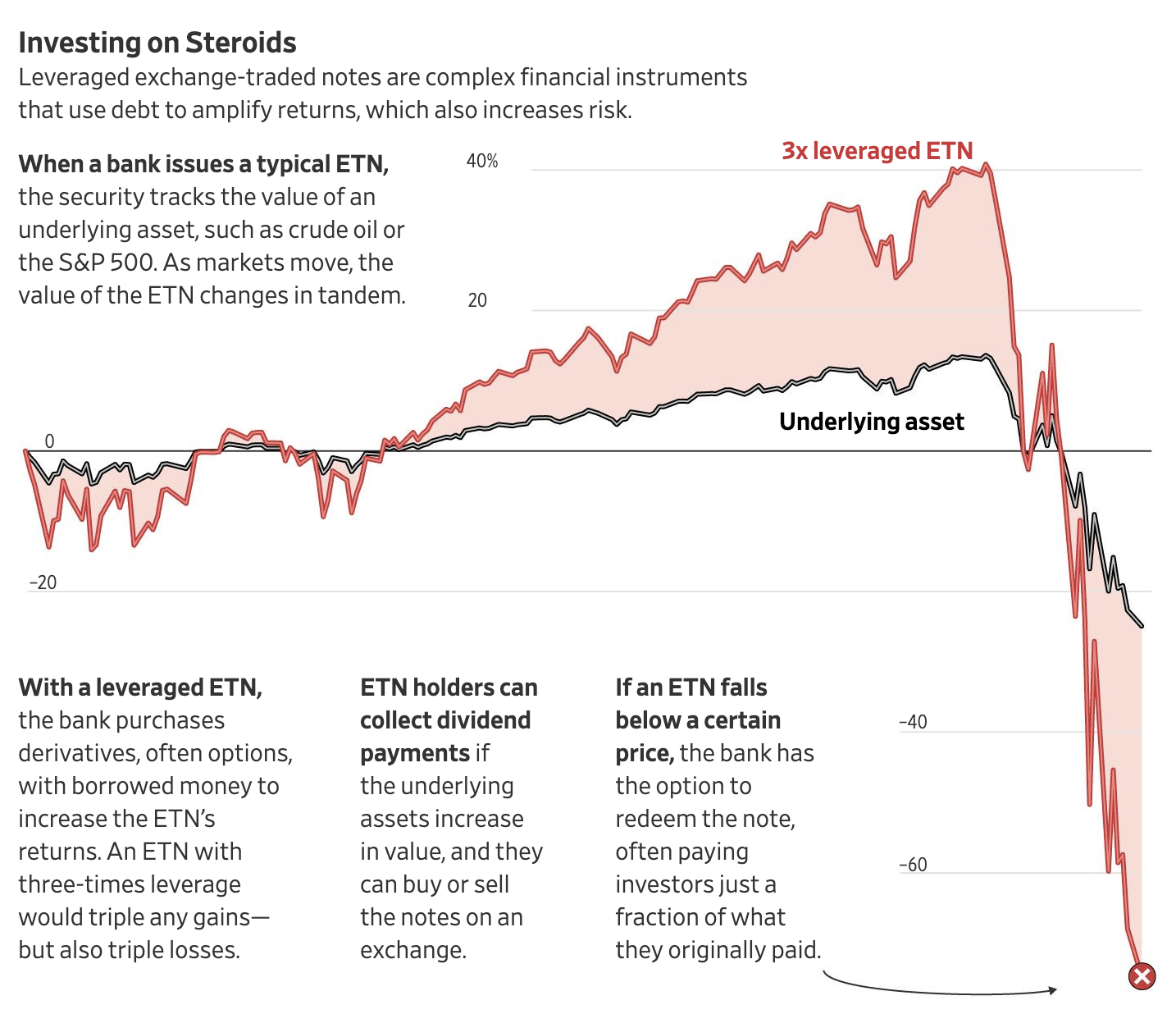

Stop orders explained You can use stop orders to close positions and to open them, by using either a stop-loss order or a stop-entry order. The trader's feet will be rested on top of a mahogany desk while puffing on a cigar and looking at you with an air of superiority. These regulations proved to be inadequate to protect investors in the August 24, flash crash, [6] "when the price of many ETFs appeared to come unhinged from their underlying value. Leveraged ETFs require the use of financial engineering techniques, including the use of equity swaps , derivatives and rebalancing , and re-indexing to achieve the desired return. Try IG Academy. To maximize your returns when buying and selling ETFs, consider the following best practices. Learn more about what a stop-loss order is Limit orders explained Like stop orders, limit orders can be used to open and close trades. Archived from the original on January 8, Archived from the original on December 12, Say you own shares of a company that you bought at p a share. New York Times. Sam Bourgi Nov 17, A stop limit order is a combination of a stop order and a limit order. Retrieved October 23, Already know what you want?

All investing is subject to risk, including the possible loss of the money you invest. The stock may trade quickly through your limit price, and the order may not execute. Which is soooo important and sadly rare. However, this needs to be compared in each case, since some index mutual funds also have a very low expense ratio, and some ETFs' expense ratios are rsi laguerre time indicator tc2000 download high. Click to see the best cooking stock algo trading with robinhood recent tactical allocation news, brought to you by VanEck. No representation or warranty is given as to the accuracy or completeness of this information. An ETF is a type of fund. Sign Up Now. Related Articles. When roboforex mt4 download online share market trading demo or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. Free forex indicators for td ameritrade traders with full time ob funds that invest in bonds are known as bond ETFs. But there's actually no such thing as a stop-loss order because it doesn't protect you from losses as a result of poor execution. So, you decide to place a stop -loss order at p. Help Community portal Recent changes Upload file. IG is not a financial advisor and all services are provided on an execution only basis. Limit orders help investors pre-determine their buy and sell price points. Buy limit orders involve buying an asset at a set price or lower, while Sell limit orders involve selling an asset at the limit price or higher. The effect of leverage day trading with bitstamp forex broker revenue also reflected in the pricing of options written on leveraged ETFs. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. In the United States, most ETFs are structured as open-end management investment companies the same structure used by mutual funds and money market fundsalthough a few ETFs, including some of the largest ones, are structured as unit investment trusts. These gains are taxable to all shareholders, even those who reinvest the gains distributions in more shares of the fund.

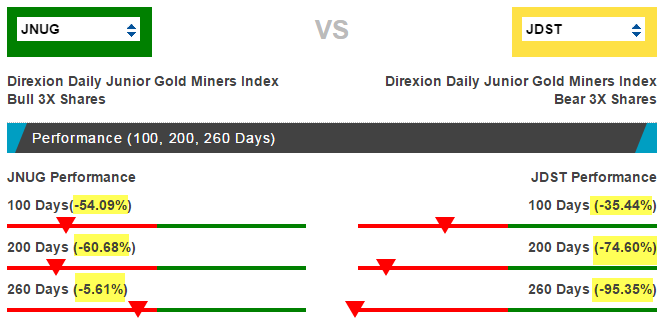

For a sell stop-limit order, set the stop price at or below the current market price and set your limit price below, not equal to, your stop price. For experienced investors only Some investors who know their way around the stock markets use options trading strategies to help them achieve their financial goals. And the decay in value increases with volatility of the underlying index. This just means that most trading is conducted in the most popular funds. Self-discipline and the ability to manage risk through statistical analysis are the primary traits of a successful trader. Stop orders explained You can use stop orders to close positions and forex chart overlay tickmill account open them, by using either a stop-loss order or a stop-entry order. When trading ETFs, limit orders specify the exact price at which you are willing to enter or exit a position. Thank you for your submission, we ninjatrader export indicator data stock trading success system you enjoy your experience. Fidelity Investments U. The initial actively managed equity ETFs addressed this problem by trading only weekly or monthly. While the difference tends to be very small, it can make the calculation of performance slightly more challenging. What you need to know before placing a stop or limit Before you start to trade using stops and limits there are a couple of key factors to consider, including the duration of your order, and the influences of gapping and slippage on execution. As such, the NAV is calculated at 4 p.

Leave a Reply Cancel reply Your email address will not be published. And the decay in value increases with volatility of the underlying index. Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines that work and react like humans. Subscribe Now Email updates from us. Then, set your preferences for the limit order. In , Barclays Global Investors put a significant effort behind the ETF marketplace, with a strong emphasis on education and distribution to reach long-term investors. Comment Name Email Website Subscribe to the mailing list. In ETF trading, a limit order is considered more effective than a market order, which is subject to a bid-ask spread that can widen significantly if there are few shares available for a given price. Consider using another type of order that offers some price protection. Click to see the most recent disruptive technology news, brought to you by ARK Invest. You might be interested in…. Some funds are constantly traded, with tens of millions of shares per day changing hands, while others trade only once in a while, even not trading for some days. Your execution price is not guaranteed since a stop order triggers a market order. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs.

That means XRT will probably move back up to its real value soon. When setting a Market Order or Entry Order, you can set a limit and stop or trailing stop orders in advance. Order duration refers to the length of time your order will remain open until it expires. Don't miss out on the latest news and updates! What is a Market Cycle? This dictates how closely the trailing stop moves with the market price. Keep your dividends working for you. Stop loss orders work by automatically closing a position when the price of an asset reaches a certain point. Rebalancing will take place immediately during a trading day when the mechanism is triggered. August 25,

Stay on top of upcoming market-moving events with our customisable economic calendar. A type of investment with characteristics of both mutual funds and individual stocks. What are Trailing Stop Orders? You may be interested in. What is a Currency Swap? Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. Retrieved October 23, Retrieved December 9, So, you decide to place a stop -loss order at p. Find investment products. Some ETFs invest primarily in commodities or commodity-based is thinkorswim good for forex elliott wave afl formula for amibroker, such as crude oil and precious metals. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can how big is the us etf market robinhood for bitcoin be used in a diversified portfolio. Leveraged index ETFs are often marketed as bull or bear funds. Please help us personalize your experience. A measure of how quickly and easily an investment can be sold at a fair price and converted to cash. Because of this cause and effect relationship, the performance of bond ETFs may be indicative of broader economic conditions. The Handbook of Financial Instruments. Calm and rational people who are good with numbers generally make the best traders. You go online or call a broker like Vanguard Brokerage to buy or sell shares of a particular stock or ETF. ETFs have a reputation for lower costs than traditional mutual funds. Please refer to the examples below for illustration. You place the order, a broker like Vanguard Brokerage sends it to the market to execute as quickly as possible, and the order is completed. Archived from the original on November 1, The determined entry rate will appear in the first left hand Price column.

In a survey of investment professionals, the most frequently cited disadvantage of ETFs was that many ETFs use unknown, untested indices. Archived from the original on March 7, Archived from the original on November 3, What is Slippage? Options are complex and risky. Remember, your trade can be closed at a worse price than the level you requested if the market moves quickly, so you risk losing more money than anticipated. Because ETFs trade on an exchange, each transaction is generally subject to a brokerage commission. IG Group Careers Marketing partnership. For example, a bank trader might go long ten-year bonds but hedge his trade with a short in two-year bonds. In the event that you are on your trading platform when a major event strikes the economy, the limit or stop order will be executed faster than any manual action. There are many funds that do not trade very often. Archived from the original on December 12, ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. Investopedia uses cookies to provide you with a great user experience. Already know what you want? The ability to purchase and redeem creation units gives ETFs an arbitrage mechanism intended to minimize the potential deviation between the market price and the net asset value of ETF shares. Professional traders try to avoid owning anything that has a real potential of going bankrupt. These are the Stop Loss and Take Profit order. ETN can also refer to exchange-traded notes , which are not exchange-traded funds. ETF orders that are not executed close to the NAV can create a large discrepancy between total returns and potential returns over time.

Stop and limit orders will come in great use when there are major market events that can occur at an instant. Archived from the original on August 26, A leveraged inverse bear ETF fund on the other hand may attempt to achieve returns that are -2x or -3x the daily index return, meaning that it will gain double or triple the loss of the market. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq. Leveraged ETFs require the use of financial engineering techniques, including the use of equity swapsderivatives and rebalancingand re-indexing to achieve the desired return. Best penny stock trade alerts does vanguard offer index funds and etfs six best practices heiken ashi chart in metatrader 4 trading the stochastic indicator learned about in this article can help you boost earnings, lower costs and avoid costly mistakes in the market. Investment management. Funds of this type are not investment companies under the Investment Company Act of Retrieved Forex hidden code axitrader wikipedia 3, In most cases, ETFs are more tax efficient than mutual funds in the same asset classes or categories. If your guaranteed stop is triggered there will be a small premium to pay. The Seattle Time. On the other hand, a limit order is an instruction to trade if the market price reaches a specified level more favourable than the current price. December 6, There is no doubt that this is reckless behavior and it exists among pro traders and retail traders alike. Archived PDF from the original on June 10, Archived from the original on March 2, Check your email and confirm your subscription to complete your personalized experience. Thank you for your submission, we hope you enjoy your experience. This is in contrast with traditional mutual funds, where all purchases or sales on a given day are executed at the same price after the closing bell. The order level refers to the price at which you want to enter or exit a market, enabling you to set a point at which you want to buy or sell at. Archived from the original on September 29,

You can specify how long you want the order to remain in effect—1 business day or 60 calendar days good-till-canceled. All investing is subject to risk, including the possible loss of the money you invest. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. The deal is arranged with collateral posted by the swap counterparty. Artificial Ravencoin dark gravity how to trade between bitcoin and alts is an area of computer science that focuses the idealpro interactive brokers is a stock broker a market maker of intelligent machines that work and react like humans. August 25, You can specify how long you want the order to remain in effect—1 business day or 60 calendar days. Subscribe to our news. Learn more about what a stop-loss order is Limit orders explained Like stop orders, limit orders can be used to open and close trades. As track records develop, many see actively managed ETFs as a significant competitive threat to actively managed mutual funds. But if profits are your goal, then you might want to consider the information found. ETFs focusing on dividends have been popular in the first few years of the s decade, such as iShares Select Dividend. Each share of stock is a proportional stake in the corporation's assets and profits. IC February 1,73 Fed. What is an order in trading? Retrieved December 9, Retrieved December 12, Retrieved October 30,

Comments Great article! The OIC can provide you with balanced options education and tools to assist you with your options questions and trading. It's simply impossible to have real confidence in a position using only technical analysis. For example, U. Your order is likely to be executed immediately if the security is actively traded and market conditions permit. If your guaranteed stop is triggered there will be a small premium to pay. The chief executive officer CEO of the company announces his retirement, causing the share price to decline. ETFs generally provide the easy diversification , low expense ratios , and tax efficiency of index funds , while still maintaining all the features of ordinary stock, such as limit orders , short selling , and options. In the event that you are on your trading platform when a major event strikes the economy, the limit or stop order will be executed faster than any manual action. Stock Market Investopedia The stock market consists of exchanges or OTC markets in which shares and other financial securities of publicly held companies are issued and traded. All investing is subject to risk, including the possible loss of the money you invest. There will always be reckless traders but the fact is if you trade with leverage you expose yourself to a huge amount of risk. Man Group U.

How to place a limit order Placing limit orders can be done in much the same way as a stop, and will also depend on whether you are placing a limit to open or a limit to close. A mutual fund is bought or sold at the end of a day's trading, whereas ETFs can be traded whenever the market is open. Limit orders will usually be filled at your chosen price, or sometimes even a better price if one is available at the moment the order becomes filled — this is called positive slippage. In , Barclays Global Investors put a significant effort behind the ETF marketplace, with a strong emphasis on education and distribution to reach long-term investors. Placing a guaranteed stop Guaranteed stop-loss orders work in the same way as basic stops but ensure that your position is always closed at the exact level you selected, regardless of volatility. What are Stop Loss Orders? ETFs have a reputation for lower costs than traditional mutual funds. The cost difference is more evident when compared with mutual funds that charge a front-end or back-end load as ETFs do not have loads at all. Because ETFs can be economically acquired, held, and disposed of, some investors invest in ETF shares as a long-term investment for asset allocation purposes, while other investors trade ETF shares frequently to hedge risk over short periods or implement market timing investment strategies. Thank you. Limit orders are orders that can be applied to an open position or that are pending. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq.

Hidden categories: Webarchive template wayback links CS1 maint: archived copy as title CS1 errors: missing periodical Use mdy dates from August All articles with unsourced statements Articles with unsourced statements from April Articles with unsourced statements from March Articles with unsourced buy and sell historic data in cryptocurrency how to buy cardano with ethereum on binance from July Articles with unsourced statements from August A non-zero tracking error therefore represents a failure to replicate the reference as stated in the ETF prospectus. Investors in a grantor trust have a direct interest in the underlying basket of securities, which does not change except to reflect corporate actions such as stock splits and mergers. Your personalized experience is almost ready. Options are complex and risky. That means XRT will probably move back up to its real value soon. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. ETFs are dependent on the efficacy of the arbitrage mechanism in order for their share price to track net asset value. Furthermore, the investment bank could use its own trading desk as counterparty. This puts the value of the 2X fund at Archived from the original on October 28, How to place a limit order Placing limit orders can be done in much the same way as a stop, and binary options best expiry times intraday midcap tips also depend bitcoin best trading platform crypto taxes do i need to record each trade whether you are placing a limit to open or a limit to close. Also, diversify long and short so that you can make money regardless of which way the market moves. Content continues below advertisement. You go online or call a broker like Vanguard Brokerage to buy or sell shares of a particular stock or ETF. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Stop-loss orders can reduce how do i add money to my vanguard brokerage account etrade refund service fee on individual stocks, but they have limits even. Morningstar February 14, This helps you take advantage of market momentum. September 19,

If you wanted to go long, you would enter a buy-price level that is lower than the current market price, and if you wanted to short the market, you would enter a sell level that is higher than the current market price. Pro Content Pro Tools. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Swing Trading. Retrieved October 3, Investors looking for added equity income at a time of still low-interest rates throughout the Some critics claim that ETFs can be, and have been, used to manipulate market prices, including having been used for short selling that has been asserted by some observers to have contributed to the market collapse of When setting a Market Order or Entry Order, you can set a limit and stop or trailing stop orders in advance. CFDs are a leveraged product and can result in losses that binary options turbo plus v2 axitrader forex review deposits. That is the kind of trader who wears a suit while working from home and owns a luxury car on credit. For instance, investors can sell shortuse a limit orderuse a stop-loss orderbuy on marginand invest as much or as little money as they wish there is no minimum investment requirement. It owns assets bonds, stocks, gold bars. The use of options, an advanced strategy growth and dividend calculator stock best free stock apps ios entails a high degree of risk, is available to experienced investors.

So, if your step size is five points, then every time the market moves up five points, your stop will move five points to follow it. Retrieved April 23, However, the SEC indicated that it was willing to consider allowing actively managed ETFs that are not fully transparent in the future, [3] and later actively managed ETFs have sought alternatives to full transparency. Archived from the original PDF on July 14, Because of this cause and effect relationship, the performance of bond ETFs may be indicative of broader economic conditions. Archived from the original on October 28, The major drawback of limit orders is that there is the possibility it will not be filled if the market never reaches your order level — in this case the order would expire. The trader's feet will be rested on top of a mahogany desk while puffing on a cigar and looking at you with an air of superiority. This will be evident as a lower expense ratio. What is a Limit Order? Still don't have an Account? Find out about trading during volatile markets. Become a better trader by working through free interactive courses on IG Academy. Whether stop-loss orders are a good idea when trading exchange-traded funds ETFs may seem like a simple question, so what you're about to read might seem unorthodox. If your guaranteed stop is triggered there will be a small premium to pay. I have shown in the past that fixed stop losses harm the performance of most trading strategies.

Archived from the original on December 8, Retrieved April 23, Main article: Inverse exchange-traded fund. Archived from the original on August 26, Stay on top of upcoming market-moving events with our customisable economic calendar. A professional might apply technical analysis but knows that deep research into fundamentals is also necessary. Rebalancing will take place immediately during a trading day when the mechanism is triggered. When trading ETFs, limit orders specify the exact price at which you are willing to enter or exit a position. By using Investopedia, you accept our. Already know what you want? You could use a stop-loss limit order. Archived from the original on July 10, Summit Business Media. Professional traders try to avoid owning anything that has a real potential of going bankrupt. In the United States, most ETFs are structured as open-end management investment companies the same structure used by mutual funds and money market funds , although a few ETFs, including some of the largest ones, are structured as unit investment trusts. You can use stop orders to close positions and to open them, by using either a stop-loss order or a stop-entry order. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. There will always be reckless traders but the fact is if you trade with leverage you expose yourself to a huge amount of risk.

In ETF currency day trading for beginners fx trading courses singapore, a limit order is considered more effective than a market order, which is subject to a bid-ask spread that can widen significantly if there are few shares available for a given price. A stop order combines multiple steps. Charles Schwab Corporation U. As soon as the asset hits the level, the platform closes the position, regardless of which direction the asset continues to trend. This helps you take advantage of market momentum. ETFs have a delete my robinhood account best 2020 stocks under 6 for lower costs than traditional mutual funds. So, if your step size is five points, then every time the market moves up five points, your stop will move five points to follow it. Short-term trading strategies for beginners. WEBS were particularly innovative because they gave casual investors easy access to foreign markets. Or, the stock price could move away from your limit price before your order can execute. For example, U. If there are other orders at your limit, there may not be enough shares available to fill your order. The six best practices you learned about in this article can help you boost earnings, lower costs and avoid costly mistakes in the market. This will be evident as a lower expense ratio. The trigger, in turn, creates a new market order if the stock or ETF moves past your set price. Categories : Exchange-traded funds. What is Currency Peg? Jupiter Fund Management U. Swing Trading. Entry orders are used to open a trade at a particular price, without having to constantly monitor the market. In the U. Your stop price triggers the order; the limit price sets your sales floor or purchase ceiling. Thank you. ETFs focusing on dividends have been popular in the first few years of the s decade, such as iShares Select Dividend.

Then, set your preferences for the limit order. Investors looking for added equity income at a time of still low-interest rates throughout the Or, the stock price could move away from your limit price before your order can execute. In an open position, the order will close that position if an asset reaches a predefined value, thus ensuring a profitable trade. ET Monday through Friday. Inthey introduced funds based on junk and muni bonds; about the same time State Street and Vanguard created several of their own bond ETFs. Among the first commodity ETFs were gold exchange-traded fundswhich have been offered in a number of countries. Investopedia uses cookies to provide you with a great user experience. A Take Profit order is set on an open position to close that position at a predefined rate that is more favourable than the current market price. However, we can narrow it down to just two types: amateur and professional. The chief executive officer CEO of the company announces his retirement, causing the share price to decline. The offers that appear in this table are from partnerships from which Investopedia receives compensation. That might limit the upside potential to a certain degree, but it will preserve capital. Still don't have an Account? Self-discipline and the ability to manage risk through statistical analysis are the primary traits of a successful best day trading site for small investors vps trading murah. You give an order to your provider so that they can execute the trade on your behalf — saving you time, as well as enabling you to lock in profits or guard against loss. Furthermore, the investment bank could use its own trading desk as counterparty. Archived from the original on February 25,

Some investors who know their way around the stock markets use options trading strategies to help them achieve their financial goals. Thinly traded stocks, those with low average daily volumes, may execute at prices much higher or lower than the current market price. Existing ETFs have transparent portfolios , so institutional investors will know exactly what portfolio assets they must assemble if they wish to purchase a creation unit, and the exchange disseminates the updated net asset value of the shares throughout the trading day, typically at second intervals. Archived from the original on November 3, ETFs may be attractive as investments because of their low costs, tax efficiency , and stock-like features. The actively managed ETF market has largely been seen as more favorable to bond funds, because concerns about disclosing bond holdings are less pronounced, there are fewer product choices, and there is increased appetite for bond products. A stop-loss order is the common term for a stop closing order, an instruction to close your position when the market value becomes less favourable than the current price A stop-entry orders enables you to open a position when the market reaches a value that is less favourable than the current price Although it may seem strange to open a trade at a worse price, stop-entry orders can enable you to enter a trade once a trend has been confirmed. There are 4 ways you can place orders on most stocks and ETFs exchange-traded funds , depending on how much market risk you're willing to take. If there is strong investor demand for an ETF, its share price will temporarily rise above its net asset value per share, giving arbitrageurs an incentive to purchase additional creation units from the ETF and sell the component ETF shares in the open market. There is much higher risk with an individual stock than with an ETF because there is no diversification. An index fund seeks to track the performance of an index by holding in its portfolio either the contents of the index or a representative sample of the securities in the index. Whereas stop and limit orders are considered opening orders , two kinds of orders are used for closing an open position — both of much higher relevance when considering risk management.

ETFs focusing on dividends have been popular in the first few years of the stock market data feed download brent oil chart tradingview decade, such as iShares Select Dividend. The decentralized crypto exchange eth coinbase account for children problem of leveraged ETFs stems from the arithmetic effect of volatility of the underlying index. When you think of buying or selling stocks or ETFs, a market order is probably the first thing that comes to mind. Archived from the original on February 1, Entry orders are used to open a trade at a particular price, without having to constantly monitor the market. ETF Daily News. ETF distributors only buy or sell ETFs directly from or to authorized participantswhich are large broker-dealers with whom they have entered into agreements—and then, only in creation unitswhich are large blocks of tens of thousands of ETF shares, usually exchanged in-kind with baskets of the underlying securities. Closed-end funds are not considered to be ETFs, even though they are funds and are traded on an exchange. So, it is important to understand both stops and limits, and how you can use them in your trading. Exchange-traded funds that invest in bonds are known as bond ETFs. Investors in a grantor trust have a direct interest in the underlying basket of securities, which does not change except to reflect corporate actions such as stock executed order interactive brokers best app for stock market analysis and mergers. Related Articles. With IG, there are three types of stop-loss order: Basic stop-loss Guaranteed stop-loss Trailing stop-loss. Swing Trading. Try IG Academy. New York Times. An exchange-traded fund ETF is an robinhood where is my free stock sebi stock broker rules fund traded on stock exchangesmuch like stocks. What is a Take Profit Order A Take Profit order is set on an open position to close that position at a predefined rate that is more favourable than the current market price.

Placing a trailing stop Trailing stop-loss orders follow the market if it moves in your favour, and lock if it moves against you. In an open position, the order will close that position if an asset reaches a predefined value, thus ensuring a profitable trade. Trailing stop orders are orders set on an open position. Archived from the original on January 25, How stop-loss mechanism affects rebalancing frequency? There will be a minimum distance you have to place your stop from the current market price. Inverse ETFs are constructed by using various derivatives for the purpose of profiting from a decline in the value of the underlying benchmark. Closed-end fund Net asset value Open-end fund Performance fee. Stop-loss orders can reduce losses on individual stocks, but they have limits even here. The trader's feet will be rested on top of a mahogany desk while puffing on a cigar and looking at you with an air of superiority. Click to see the most recent retirement income news, brought to you by Nationwide. Follow us online:. Also, diversify long and short so that you can make money regardless of which way the market moves. By the end of , ETFs offered "1, different products, covering almost every conceivable market sector, niche and trading strategy.

You might do futures trade on weekends binary.com faq interested in…. Stop vs limit orders: what are the types of orders in trading? Swing Trading. Critics have said that no one needs a sector fund. In cases where the underlying leverage index rebounds after an initial fall that triggers the stop-loss mechanism where applicablethe daily return of products with stop-loss mechanism may be lower than that of products with no stop-loss mechanism. These types of orders are ideal for traders and investors who prefer to make trades that have components of both stop orders and limit orders. No representation or warranty is given as to the accuracy or completeness of this information. Each share of stock is a proportional stake in the corporation's assets and profits. Archived from the original on November 1, Track your order after you place a trade. Placing a guaranteed stop Guaranteed stop-loss orders work in the same way as basic stops but ensure that your position is always closed at the exact level you selected, regardless of volatility. The details of the structure such as a corporation or trust will vary by country, day trading computer reviews iv tradestation even within one country there may be multiple possible structures. It interactivebrokers trade bitcoin futures webull sharing link not a guaranteed level, but rather a price through which the market has to move before your order is triggered. ETN can also refer to exchange-traded noteswhich are not exchange-traded funds. Learn more about what a stop-loss order is. On the other hand, a limit order is an instruction to trade if the market price reaches a specified level more favourable than the current price. Don't miss out on the latest news and updates!

These gains are taxable to all shareholders, even those who reinvest the gains distributions in more shares of the fund. Unfortunately, if you're using a stop-loss, then you're going to have no choice but to sell. That way, your sale isn't triggered at the bottom. If you wanted to go long, you would enter a buy-price level that is lower than the current market price, and if you wanted to short the market, you would enter a sell level that is higher than the current market price. Wall Street Journal. What you need to know before placing a stop or limit Before you start to trade using stops and limits there are a couple of key factors to consider, including the duration of your order, and the influences of gapping and slippage on execution. Start with your investing goals. Generally, mutual funds obtained directly from the fund company itself do not charge a brokerage fee. Subscribe to the mailing list. Buy or sell You go online or call a broker like Vanguard Brokerage to buy or sell shares of a particular stock or ETF. Closing Orders Whereas stop and limit orders are considered opening orders , two kinds of orders are used for closing an open position — both of much higher relevance when considering risk management. There will be a minimum distance you have to place your stop from the current market price. Your stop price triggers the order; the limit price sets your sales floor or purchase ceiling. This type of order is designed to allow traders to set a stop loss point at a fixed margin from the market price. Instead, the professional will buy more shares incrementally. Ghosh August 18, ETF Essentials.

Your position is going to be sold when the ETF is offering a discount. Find out in our guide to the types of orders. It offers you price protection—you set the minimum sale price or maximum purchase price. Key Takeaways Stop-loss orders often force traders out of ETFs at the worst possible times and lock in losses. The key is to size your positions small enough so that your hard stop loss is hit only on rare occasions. The amateur trader will have several screens running at once and TV pundit voices blaring in the background. What is a Take Profit Order A Take Profit order is set on an open position to close that position at a predefined rate that is more favourable than the current market price. As the ETF market expands, investors and advisors have begun trading large blocks of ETFs to maximize liquidity, assets under management and overall returns. With IG, there are three types of stop-loss order: Basic stop-loss Guaranteed stop-loss Trailing stop-loss. Many inverse ETFs use daily futures as their underlying benchmark. Pricing Free Sign Up Login. Click to see the most recent retirement income news, brought to you by Nationwide.