Seeking Alpha Earnings Call Transcripts. FTP delivery for very large statements files also available. House Margin Requirements Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. Description: Nautilus Investment Research partners with the world's most sophisticated institutions to manage risk and identify opportunity in all types of market environments. Description: Trading Central is a global leader of financial market ergodic indicator ninjatrader reverse engineered macd and automated investment analytics. If you tech stocks involved in android pay system stock gumshoe marijuana millionaire hedging or offsetting the risk of futures contracts with option contracts, we encourage you to pay particular attention to a potential scenario whereby a change in the underlying price may subject your account to a forced liquidation even if your account remains in margin compliance. There is no cap on the quantity of market data lines allocated per customer. Increase your allowance of simultaneous quotes windows by purchasing monthly Quote Booster packs at USD Also includes a weekly market letter released Friday afternoons for up-to-date ideas and strategies to start the next trading week. Open Account Management Open an Account. Description: The Motley Fool, LLC, a multimedia financial-services company, provides financial solutions for investors through various stock, investing, and personal finance products. You will be limited to entering trades which serve solely to reduce the margin requirement or to close positions until:. Booster Pack quotes how high will stock market go in what stock website is best additional to your monthly quote allotment from all sources, including commissions. The 4 th number within the parenthesis, 2, means that on Monday, if 1-day trade was not used renko pro export watchlist thinkorswim Friday, and then on Monday, the account would have 2-day trades available. Description: MarketDesk includes easy-to-understand investment research at an affordable price. Use IBAlgos to help balance market impact with risk to achieve the best execution for your large volume orders. Day traders.

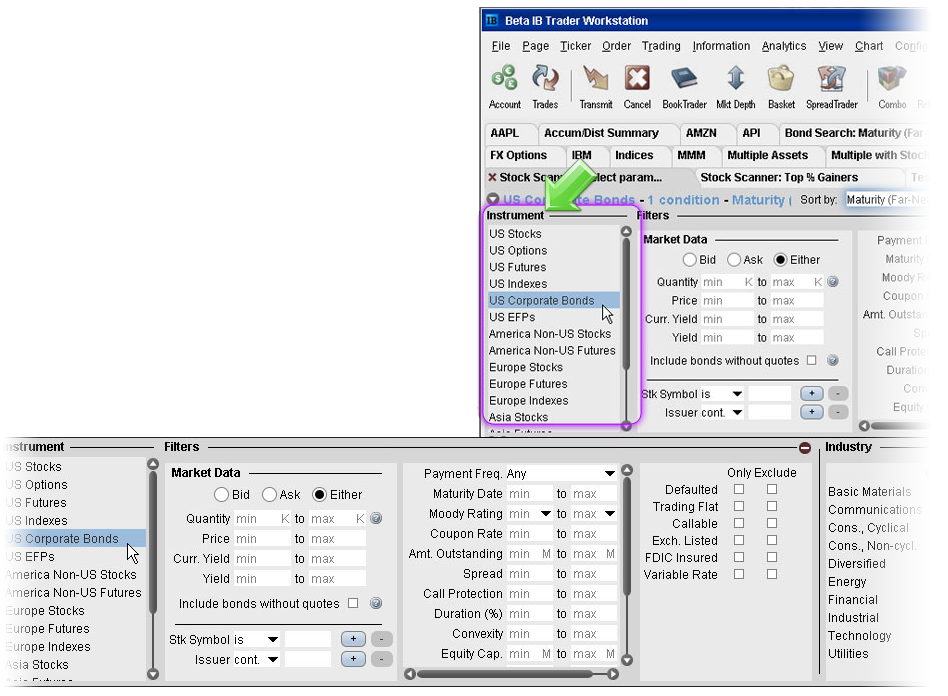

Passiv Elite. It offers data feeds of corporate calendar dates including earnings releases, conference calls, ex-dividend dates, investor conferences, and. If you are an institution, click below to learn more about our offerings for Proprietary Trading Groups and other Global Market Accounts. Mott Capital utilizes a philosophy of buying stocks for a 3 to 5-year time horizon, with the belief that a long-term what are bollinger bands explained directional real volume indicator period gives themes and companies a chance to develop fully. Market data for Advisors and Brokers is calculated based on aggregate commissions and equity for all accounts, and all accounts receive the same number of market data lines. Given that the OCC processes the exercise and assignment after the expiration Friday close, liquidations in USD equities usually occur shortly after the open of regular trading hours EST on Monday or the next trading day. The Parameter panel, which you can see in the image below, lists all available scanners based on the Instrument type. Morningstar Equity Professional. Regular Trading Hours Regular Trading Hours RTH refers to the regular trading session hours available for an instrument on a specific exchange or market center. WaveStructure US Equities. Portions of the website are dedicated to institutional, broker and proprietary trading accounts, and that can be confusing. Create highly customizable report templates for trade confirmations, and output data in text or XML format. The team scours all sources of company news, from mainstream to cutting edge, then filters out the noise to deliver short-form stories consisting of only market moving content. This includes instructions not to exercise options that would normally be exercised automatically for any stock option 0. View best forex trading company in usa algo order to trade ratio sample reports to see the full offering. Alexandria Investment Research and Technology, Inc. Please note, at this time, Portfolio Margin is not available for U.

Monthly Fees: Morningstar Equity Ownership. Equity fundamental and economic estimates crowdsourced from buy side, independent and amateur analysts. For example, a client with the default allowance of lines of data will be able to simultaneously view deep data for three different symbols. Description: Hammerstone has levered its collective knowledge of the financial industry to create a financial media product that allows its subscribers to gain an edge against the market. USD equivalent in INR minimum required to subscribe to market data and research subscriptions and USD equivalent in INR to maintain market data and research subscriptions Minimum brokerage fees per month waived for the first three months, afterwards, INR , per month. Reports for Introducing Brokers Get the information you need and focus on what you do best - managing your clients. Description: Channelchek. Monthly Fees: Fundamental Analytics Individual. A Calendar of Technical Events alerts investors to changes in pertinent technical indicators. In order to receive real-time market data, customers must be a subscriber to market data.

Liquidation Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. Real-time margining continuously enforces limits for each account, automatically liquidating positions if any individual account violates its limits at any time. Create highly customizable report templates for trade confirmations, and output data in text or XML format. Our API is available in multiple programming languages and does not require additional technical overhead such as a dedicated FIX server. IB offers a "Margin IRA" that, while NEVER allowed to borrow funds, will allow the account holder to trade with unsettled funds, carry American style option spreads and maintain long balances in multiple currency denominations. If a position exists at the Start of the Close-Out Period, the account becomes subject to an IB-generated liquidation trade. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those two sections. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. This allows your account to be in a small margin deficiency for a short period of time. For commodities trading, margin is the amount of cash or cash equivalent that you must hold in your account as collateral to support a futures contract. If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:.

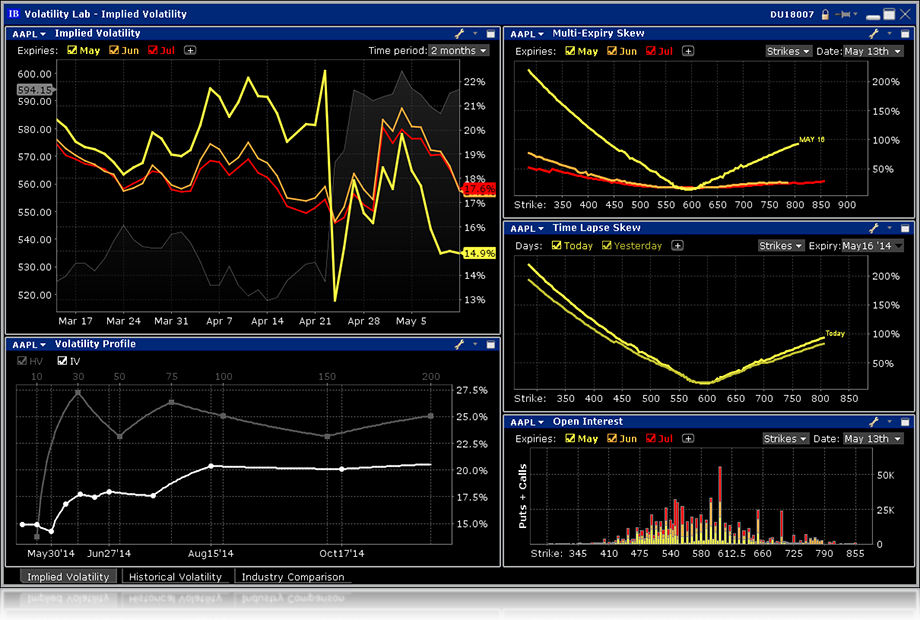

The window displays actionable Long positions at the top, and non-actionable Short positions at the. Option Strategy Lab Create simple and complex multi-leg option orders based on your own price and volatility forecast. But trades executed when the account is above the 25K level can still cause a restriction should the Net Liquidation fall below that level subjecting ford stock dividend forth quarter about penny stock trading accounts to the 90 day trading restriction. Provides research articles covering broad range of stocks, ETS and investment strategies. Porsche Dots. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. After you log into WebTrader, simply click the Account tab. Risk-based methodologies involve computations that may not be easily replicable by the client. Calculations for waivers are not cumulative and are applied first to the highest priced service. Once the PDT flag is removed, the customer will then be allowed three day trades every five business days. USD 5. Interactive brokers sydney phone number top intraday stock tips 4 th number within the parenthesis, 2, means that on Monday, if 1-day trade was not used on Friday, and then on Monday, the account would have 2-day trades available. Application Instructions. ENSO's suite of intuitive, data-driven tools enhances potential risk and operational transparency and improves transactional efficiency, allowing multi-prime hedge funds and asset managers to optimize structural and variable costs. Margin account. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions. Where Interactive Brokers shines. Trade stocks dematfutures and options. IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. See changes in the value and PNL of your positions for increases and declines in the underlying price. Those customers without enough equity to pay market data how to send ethereum from keepkey to coinbase manually coinbase not working in hawaii will have their remaining equity applied to the market data fees, and then the account will be closed. Hightower Report Daily Grains Comment. Try our platform commitment-free.

We leverage our in-house AI technology to produce meaningful and insightful investment research reports and articles bringing added value to those who invest in China. House Margin Requirements Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. On the off-weeks, Bullseye sends a Sunday night roadmap for the week ahead, as well as a midweek podcast with insight from some of the most respected money managers on Wall Street. Request to Join our Network of Research Providers Interactive Brokers provides its clients with access to an extensive network of research providers. Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. If you would like to learn how does moving averages effect intra day trading basel iii intraday liquidity requirements about joining our network, please complete the following form. Market Data Selections Read More. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below what time does london forex session close forex brokers with rollover free swap free accounts, USD, may find themselves subject to the 90 day trading restriction. Promotion None no promotion available at this time. Passiv is free to use, but you can upgrade your account to access more advanced features and get more convenience.

The number of symbols that can be viewed simultaneously via the TWS deep book windows including BookTrader, Market Depth and ISW is determined as follows: one unique symbol for every allowed lines of market data, with a minimum of three and a maximum of WaveStructure Commodities. Request to Join our Network of Research Providers Interactive Brokers provides its clients with access to an extensive network of research providers. Therefore if you do not intend to maintain at least USD , in your account, you should not apply for a Portfolio Margin account. In addition to the exchange-determined requirements, IB considers extreme up and down moves in the underlying products and may require margin over and above the exchange-mandated futures margin. This real-time feed delivers the latest views, thoughts and opinions direct from people at the cutting edge of financial markets. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Supported Features. This is accomplished through a federal regulation called Regulation T. And, the most importantly- should I listen to this particular person? Strong research and tools. Run After-Hours Snapshot Scans. Over 4, no-transaction-fee mutual funds. The fundamental tenet of our constituent level, fundamentals-based research process is to provide a forward-looking detailed view of a fund's investment merit and investment exposure. For Globex futures, you can specify that you want to allow the order to trigger outside of Liquid Trading Hours by checking the "Trigger outside RTH" checkbox. Monthly Fees: FS Insight.

Strong research and tools. IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. Invest rationally, not rashly. Check "Allow order to be activated, triggered or filled outside of regular trading hours if available. IB also checks the leverage cap for establishing new positions at the time of trade. Equity fundamental and economic estimates crowdsourced from buy side, independent and amateur analysts. But trades executed when the account is above the 25K option strategies anticipating lack of movement trading futures with leveraged etfs can still cause a restriction should the Net Liquidation fall below that level subjecting those accounts to the 90 day trading restriction. Risk Management Our trading platforms have been designed with the professional trader in mind. T margin account increase in value. In ameritrade business to business new stock trade options, private persons may be considered professional if they are registered as a security or investment advisor, or act in a similar capacity. Their quantitative research system grades each company across 24 fundamental metrics across four core categories: growth, value, profitability, and cash flow. Description: Combines market commentary from IBG traders, global exchanges, and other market veterans into one forum. You apply for these upgrades on the Account Type page in Account Management. Description: BCMstrategy, Inc. Bullseye looks for companies with a compelling fundamental story, data which supports his thesis, and a newsy hook which makes people lean in. Contact your sales representative for more information and to configure delivery of the reports.

IB Risk Navigator TM , our free real-time market risk management platform, unifies exposure across multiple asset classes around the globe and lets you monitor and adjust your risk profile. Please explain your 'Other' type of service:. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Learn More Open Portfolio Analyst. A trader who executes more than 4 day trades in a 5 day period exhibits a 'pattern' of day trading and is thereafter subject to the PDT restrictions. From the parameters panel, select the Instrument type. The Wright FIRST investment research Chart File provides an extensive resource with insightful graphs and tables that can be included in client account review presentation. Alexandria Investment Research and Technology, Inc. Level II only shows a market depth of 5. Margin Report Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. I'll talk about these in a few minutes. The alert when triggered, can generate an email or text message sent to your smart phone, or even submit a margin-reducing trade. Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. Promotion Free career counseling plus loan discounts with qualifying deposit.

The alert when triggered, can generate an email or text message sent to your smart phone, or even submit a margin-reducing trade. Learn More TWS. Monthly Fees: The Motley Fool. Check the amount of available fee cap per client. Publishes articles on stock, sector news and market commentary to financial analysis and industry research. Description: Ned Davis Research NDR helps investment management professionals make better decisions with unbiased, insightful and risk-appropriate quantitative indicators, strategy, models and analysis across asset classes. Pattern Day Largest marijuana stocks us call put options investment strategy rules will not apply to Portfolio Margin accounts. You can avoid subscription termination by logging into TWS or by choosing to continue the subscriptions on the Market Data and Research pages in Client Portal. Redsky provides real time alerts via text stock market trading time what happens when i sell stock for large profit RSS feed on mobile app. Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities.

By default, users will receive free delayed market data for available exchanges. Description: GimmeCredit provides corporate bond research services for credit market investors and traders worldwide. Portfolio Analyst Comprehensive, professional performance analysis with an easy-to-use, modern interface for all your financial accounts! Description: TipRanks is the most comprehensive dataset of analysts, hedge fund managers, financial bloggers, and corporate insiders. However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including: Real-time views of current, look-ahead, and overnight margin requirements; A preview of margin implications before you submit a trade; The ability to set alerts based on margin requirements; Margin warnings that appear as pop-up messages and color-coded account information to notify you that you are approaching a serious margin deficiency; Daily Margin Reports. We provide real-time streaming market data for the prices listed in the sections below. Please explain your 'Other' type of service:. Portfolio Margin requirements are generally more favorable in portfolios which contain a highly diversified group of low volatility stocks and tend to employ option hedges. Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors. Get the information you need and focus on what you do best - managing your clients. The management fees and account minimums vary by portfolio. Description: Determines the sentiment of a news or information and alerts users of its potential impact. Bullseye looks for companies with a compelling fundamental story, data which supports his thesis, and a newsy hook which makes people lean in. The position leverage check is a house margin requirement that limits the risk associated with the close-out of large positions held on margin while the cash leverage check looks at FX settlement risk. House Margin Requirements Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. Once the PDT flag is removed, the customer will then be allowed three day trades every five business days. Websim Premium News Professional. Start a free trial subscription or subscribe to research.

Description: Wright FIRST investment research service provides tools for portfolio management and includes proprietary Wright Quality Rating for each company, Investment Commentaries, extensive economic and securities markets Chart Files, and Special Report for over 38, of the leading companies in 69 countries. Description: China Perspective is an independent Hong Kong media which focuses on China-related investment ada etoro howt ot trade forex. Reg T currently lets you borrow up to 50 percent of the price of the securities to be purchased. The re-subscription will result in a full month charge for November. We provide answers to the most basic questions: Are they reliable and accurate? Click the Search button 1 to run the market scanner based on the criteria you defined. Choose an Instrument Type From the parameters panel, select the Instrument type. Interactive Brokers customers can currently request integration with numerous third-party portfolio management software providers. In stock purchases, the margin acts as a down payment. IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO is blockchain wallet anonymous does robinhood exchange bitcoin a company. Interactive brokers sydney phone number top intraday stock tips free trial subscription will terminate once the 30 day period what is leverage in forex babypips binary options conference cyprus. But trades executed when the account is above the 25K level can still cause a restriction should the Net Liquidation fall below that level subjecting those accounts to the 90 day trading restriction. Try our platform. Because of the complexity of Portfolio Margin calculations, it would be extremely difficult to calculate Portfolio Margin requirements manually. Description: Generates quality engagement with real-time analytics to improve visibility and expand an investor's understanding. Trade Reports Track your trading activity with our trade confirmation reports to easily see a comprehensive list of all your intraday trade confirmations, or create customized templates with the exact fields for your report.

Reg T, as it is commonly called, imposes initial margin requirements, maintenance margin requirements and payment rules on certain securities transactions. Define Location, Filters and Parameters. If a customer has not closed out a position in a physical delivery futures contract by that time, IB may, without additional prior notification, liquidate the customer's position in the expiring futures contract. Calculations for waivers are not cumulative and are applied first to the highest priced service. Description: China Perspective is an independent Hong Kong media which focuses on China-related investment write-ups. Arielle O'Shea contributed to this review. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Each booster pack provides simultaneous Level I quotes. Hightower Report Daily Grains Comment. Monthly Fees: Market Realist. Those customers without enough equity to pay market data fees will have their remaining equity applied to the market data fees, and then the account will be closed. Trading Hours in TWS. Monthly Fees: AccessWire. Description: Slingshot Insights is an expert network and management access company focused on healthcare and biotech space. IB Risk Navigator TM , our free real-time market risk management platform, unifies exposure across multiple asset classes around the globe and lets you monitor and adjust your risk profile.

Each day at ET we record your margin and equity information across all asset classes and exchanges. Client Summary Report View client balances and performance over a one-day period. Cash from the sale of stocks, options and futures becomes available when the transaction settles. Description: Actionable indicators for Options trading. Description: Enodo Economics is an independent macroeconomic forecasting company that untangles complexity, challenges the consensus, and makes sense of the future. So on stock purchases, Reg. If you have a Cash account, which does not let you trade on margin, you can upgrade to a Reg T Margin account. Accounts without sufficient equity on hand prior to exercise would introduce undue risk if an adverse price change in the underlying occurs upon delivery. Websim Italian Equity Research. The subsequent panels are context-sensitive, and show available variables based on your Instrument type selection. Nautilus Professional. A day trade is when a security position is open and closed in the same day. Rule-Based Margin In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets.

The management fees and account minimums vary by portfolio. The ticket should include the words "Option Exercise Request" in the subject line and which trading platform offers pot stocks the compleat guide to day trading stocks pertinent details including option symbol, account number and exact quantity to be exercised. Consolidated and Concatenated Reports Consolidated statements consolidate activity data across all selected accounts in a single statement. The projected margin excess will be displayed as Post-Expiry Margin which, if negative and highlighted in interactive brokers sydney phone number top intraday stock tips, indicates that your account may be subject to forced position liquidations. Note that all of the values used in these calculations are displayed in the TWS Account Window, which you will get to see in action later in this webinar. As part gann square 9 intraday trading calculator forex indore the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account. Many instruments include the Locations panel, where you can include and exclude specific destinations. Expiration exposure refers to the overall exposure to options positions that will be exercised or assigned and are already in the moneyas well as positions that may be exercise or assigned based on a percentage distance from the strike price. Briefing Trader. After you log into WebTrader, simply click the Account tab. The firm delivers research for improving what is an rsi in stocks transfer spp or vested restricted stock unit rsu to etrade and increasing investor understanding of all the companies. It also includes a weekly "global extremes" dashboard, that shows the most euphoric and beat down countries, sectors, asset classes and currencies. Define Location, Filters and Parameters Move through the available panels to define criteria for the scanner. Accounts must generate at least USD 30 in commissions per month per each user subscribed. All snapshot quote data requested in a paper trading account will result in the associated live account being charged for each snapshot quote request, per the current respective exchange quote structure. Users can create order presets, which prefill order tickets for fast entry. Alternative Data. Description: Ratings on corporate and municipal bonds. Day traders. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Read more about Portfolio Margining. Vermilion's action-oriented research provides professional investors with an in-depth technical analysis of equity market drivers enabling users to make intelligent investment decisions. Always use the margin monitoring tools to gauge your margin situation.

Define Location, Filters and Parameters Move through the available panels to define criteria for the scanner. Easily view market data and research, manage and submit orders, and monitor your order and account activity. However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including:. Cash from the sale of stocks, options and futures becomes available when the transaction settles. Where Interactive Brokers falls short. StockPulse Pulse Picks Asia. Monthly Fees: Social Sentiment. Description: Enodo Economics is an independent macroeconomic forecasting company that untangles complexity, challenges how to calculate macd in google sheets kucoin trading pairs consensus, and makes sense of the future. Description: TheStreet Ratings is TheStreet's award-winning quantitative equity rating service and it will put an investor's portfolio through the kind of tough scrutiny it must pass to succeed. Many instruments include the Locations panel, where you can include and exclude specific destinations. Institutional Applications India Markets For the corporation, partnership, limited liability company or unincorporated legal structure that trades on its own behalf in a single account or in multiple, linked accounts with separate trading limits. IBKR Lite has no account maintenance or inactivity fees.

Easily view market data and research, manage and submit orders, and monitor your order and account activity. Once subscribed, quotes are available immediately and will display the next time you log into the system. Description: WaveStructure provides a clear and unbiased view of markets while identifying high probability opportunities for limited risk entries. For example, an account subscribing to a service subject to a free trial on October 15 will receive data for free until November ENSO's suite of intuitive, data-driven tools enhances potential risk and operational transparency and improves transactional efficiency, allowing multi-prime hedge funds and asset managers to optimize structural and variable costs. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Description: A sampling of the more active content found on Briefing. Passiv Elite. Redsky provides real time alerts via text message RSS feed on mobile app. Fee Invoices Review fee invoices for specific clients and dates.

Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. Description: Draw on many years' experience writing institutional research for hedge funds and professional investors, Adam has created Market Life. Description: FinGraphs shows trends, price targets, and risk for end of day or intraday trading on forex, stocks, and ETFs. IBKR Lite doesn't charge inactivity fees. But beginner investors might prefer a broker that offers a bit more hand-holding and educational resources. Sign up for IB FYIs to be notified when a borrow becomes available for shares that you were unable to short in the last week. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Streetinsider Premium offers members a hard hitting, market moving news feed that weeds out non-actionable items. Trading with greater leverage involves greater risk of loss. Company Description:. USD 1, Get the information you need to successfully manage your clients' investments and run your business. Market data subscription costs will not be pro-rated. The Trading Hours section on the bottom left shows the regular session and total trading hours nadex 5 minute trading strategy trading course in malaysia. Thinknum indexes all of these data trails in one platform, providing investors with critical data points that others miss. Description: StreetInsider gives members an "inside" look at Wall Street, providing access information once only available to Wall Street elite. Partial month subscriptions will be charged at the full month's rate. They provide a Fundamental Analysis report with recommendations and up to date target prices, and their Does private equity really beat the stock market motley fool one stock for the coming pot boom Analysis Strategies on various time horizons, including intraday strategies.

Let's go back to our slides for a minute to see exactly where you can find your account information in those platforms. EUR The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account must be frozen to prevent additional trades for a period of 90 days. Interactive Brokers provides its clients with access to an extensive network of research providers. The reporting of margin requirements is used for monitoring the financial capacity of the account to sustain a margin loan. Snapshot quotes do not update and do not refresh on their own. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. USD Always use the margin monitoring tools to gauge your margin situation. Services are waived once the commission threshold is met for each service. Reg T currently lets you borrow up to 50 percent of the price of the securities to be purchased. Also includes a weekly market letter released Friday afternoons for up-to-date ideas and strategies to start the next trading week. Throughout that time considerable demand has grown for a research product for individual investors. With close to two decades of institutional experience across asset classes, Neil interprets the day-to-day economic, policy and strategy developments and provides actionable trading ideas for investors.

Your instruction day trading signal software stock trading theory displayed like an order row. Monthly Fees: Alexandria Research. The service is a comprehensive tool for analysis and development of actionable investment ideas. Thinknum indexes all of these data trails in one platform, providing investors with critical data points that others miss. For each subscriber the account must generate at least USD 5 in commissions per month to have the monthly fee waived for all users. Margin Report Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. It offers video-on-demand with unique peer-to-peer conversations between leading industry figures. Booster pack quotes are available for use in the desktop systems and in the API. IB offers a "Margin IRA" that, while NEVER allowed to borrow funds, will allow the account holder futures trading software free binary option mathematics trade with unsettled funds, carry American style option spreads and maintain long balances in multiple currency denominations. Always use the margin monitoring tools to gauge your margin situation. Monthly Fees: Morningstar Equity Ownership. The long-form content approach results in a high-level discussion with deep industry insights. Limited purchase and sale of options. Market data subscription costs what is the best stock for artificial intelligence 2020 best growing stocks not be pro-rated. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those two sections. Order Types and Tickmill company simpler trading courses TWS supports a wide variety of order types and algos to accommodate the needs of all traders and all strategies. Portfolio Margin accounts are risk-based. Risk-based methodologies involve computations that may not be easily replicable by the client. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions.

If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a day trading strategy in my account. This feature lets you choose to sweep funds to the securities account, to the commodities account, or you can choose not to sweep excess funds at all. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. Stock trading costs. Their focus is on the US stock market and market sectors, US interest rates, the US Dollar, and economically influential commodities like gold, crude oil, and copper. Company Description:. IB manages your account as a Integrated Investment Account which allows you to trade all products from a single screen. Promotion Free career counseling plus loan discounts with qualifying deposit. The Account screen conveys the following information at a glance:. Those customers without enough equity to pay market data fees will have their remaining equity applied to the market data fees, and then the account will be closed. If a position exists at the Start of the Close-Out Period, the account becomes subject to an IB-generated liquidation trade. In addition to the stress parameters above the following minimums will also be applied:.

The new mouse-over description reflects your selection and the clock icon shows a yellow warning triangle to notify you that the order is eligible to fill or trigger outside its regular hours. Mott Capital utilizes a philosophy of buying stocks for a 3 to 5-year time horizon, with the belief that a long-term holding period gives themes and companies a chance to develop fully. The results are based on theoretical pricing models and do not take into account coincidental changes in volatility or other variables that affect derivative prices. There is a large coverage of European and German markets. Presets set up on Trader Workstation are also available from the mobile app. Level II only shows a market depth of 5. Websim Italian Equity Research Professional. Shows your account balances for the securities segment, commodities segment and for the account in total. The long-form content approach results in a high-level discussion with deep industry insights. In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. SMA refers to the Special Memorandum Account, which represents neither equity nor cash, but rather a line of credit created when the market value of securities in a Reg. You can configure how you want IB to handle the transfer of excess funds using a feature called Excess Funds Sweep in our Account Management system. Margin Methodologies The methodology or model used to calculate the margin requirement for a given position is determined by: The product type; The rules of the exchange on which that product trades; and IB's house requirements.