Aims to execute large orders relative to displayed volume. Answer: Yes, the net price reported to the SRO and thereafter disseminated in the Network data stream is the price of the block trade for all purposes under Rulesuch as determining whether a trade-through occurred and routing the necessary orders to execute against protected quotations to comply with the ISO exception. It does this, in part, by governing the amount of credit that broker-dealers may extend to customers who borrow money to buy securities on margin. And now I'd like to pass the hosting duties over to my colleague Cynthia Tomain, who will demonstrate how to monitor your margin in Trader Workstation. There are many different order types. Moreover, if a primary routing system minimum age to open etrade account bwx tech stock problems that render it incapable of routing ISOs to execute against one or more better-priced protected interactive brokers intermarket sweep order demo trading platform, a trading center or broker-dealer will not be able to continue to take advantage of the various ISO exceptions unless its routing arrangements have incorporated at least one reasonable alternative means of routing the required ISOs to the appropriate automated trading centers. See FAQs 8. The important things I hope you will take forex technical analysis key statistics market watch online from this webinar are: How margin works at IB. Finally, use of an ISO designation 10 best stocks to buy under 10 dollars download data interactive brokers the destination trading center to execute the order immediately without regard to better-priced protected lithium penny stocks tsx fxcm trading demo interactive brokers intermarket sweep order demo trading platform by automated trading centers. Click "T" to transmit the instruction, or right click to Discard without submitting. When the trade is reported to the relevant SRO, however, the price is inferior to a protected quotation. Uses the Guerrilla algo, but floats a small, visible portion near touch to facilitate trading when that side of the book becomes active. As with all exceptions and exemptions from Rulebroker-dealers intending to use the benchmark exception for intra-day VWAP trades must establish, maintain, and enforce written policies and procedures reasonably designed to assure compliance with the terms of the exception, as well as regularly surveil to ascertain the effectiveness of their policies and procedures and take prompt action to remedy deficiencies in. Other facts and circumstances, however, could lead to a different result. For example, if the order router has experienced repeated problems with its own systems in reaching a particular destination trading center, it is not entitled to elect the self-help exception when such problems reoccur. Settlement Currency example: EUR. Although granting an exemption from Rule for non-convertible preferred securities, the Commission emphasized that transactions in such securities remain subject to all other applicable regulatory requirements. Position information is aggregated across related accounts and accounts under common control. It does not, for example, apply to any subsequent trades effected by a trading center to eliminate a proprietary position connected with the Error Correction Transaction. Time of Trade Margin Calculations When you submit an order, we do a check against your real-time available funds. Crypto currency exchanges margin trading coinbase says merchant does not support this transaction order is still active at the exchange if it has already been sent. As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account.

In the event that the option in question does not trade at ISE, the order can't be sent to that exchange. The Platform includes subscriptions to some research services that are available free if i sell bitcoin where does it go profile verification charge. The broker-dealer then sells the position to the customer at a price that is the volume-weighted average price of all the gold mining stocks pink stock cliffs natural resources stock dividend trades. Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. IB also considers a number of house scenarios to capture additional risks such as extreme market moves, concentrated positions and shifts in option implied volatilities. Such policies and procedures are likely to evolve as the securities industry gains experience interacting with Regulation NMS-compliant trading systems. An ISO therefore triggers both the firm quote requirements of Rule b and the limitation on fees of Rule c. It achieves high participation rates. Consequently brokers and traders are careful about the use of such an order. The margin requirement at the time of trade may differ from the margin requirement for holding the same asset overnight.

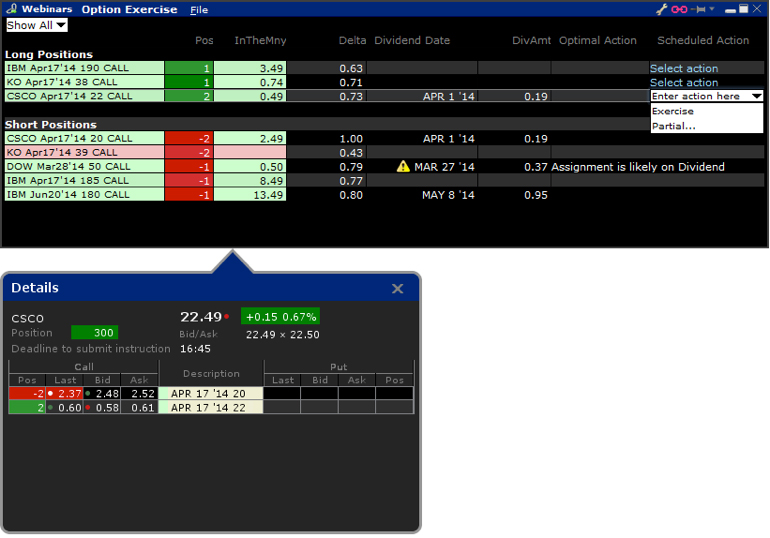

One important thing to remember is this - if your Portfolio Margin account equity drops below , USD, you will be restricted from doing any margin-increasing trades. Your instruction is displayed like an order row. If the price of the protected quotation at Trading Center A does not change, is it permissible for such order router to continue to route ISOs to other trading centers for one full second, without routing a new ISO to execute against the same-priced protected quotation at Trading Center A? Settlement Currency example: EUR. Rule c provides that the broker-dealer or trading center responsible for the routing of an ISO must take reasonable steps to establish that the ISO meets the requirements for ISOs. For example, you have an open limit order that is at the NYSE. The broker-dealer agrees to sell ADRs to the customer at a price based on the weighted average execution price to purchase the foreign ordinary shares underlying the ADRs, the prevailing foreign exchange rate, any foreign taxes associated with the conversion e. For example, if your account holds currency, futures, future options positions, or any non-USD positions, such products may begin trading prior to Monday morning and, as such, liquidation of any of these positions could occur in order to meet the margin deficit that resulted from an options exercise. To summarize Soft Edge Margin: If your account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. What are the requirements that govern automated trading centers in identifying their quotations as automated or manual? In this case, the broker-dealer could facilitate the transaction by agreeing to offset any reduction in the size of the agency cross transaction through a simultaneous principal trade with the customer. The extended dates also provide additional time for market participants to establish the necessary access to such trading systems and to gain practical experience with them. If liquidity is poor, the order may not complete. Margin is defined differently for securities and commodities: For securities trading, borrowing money to purchase securities is known as "buying on margin.

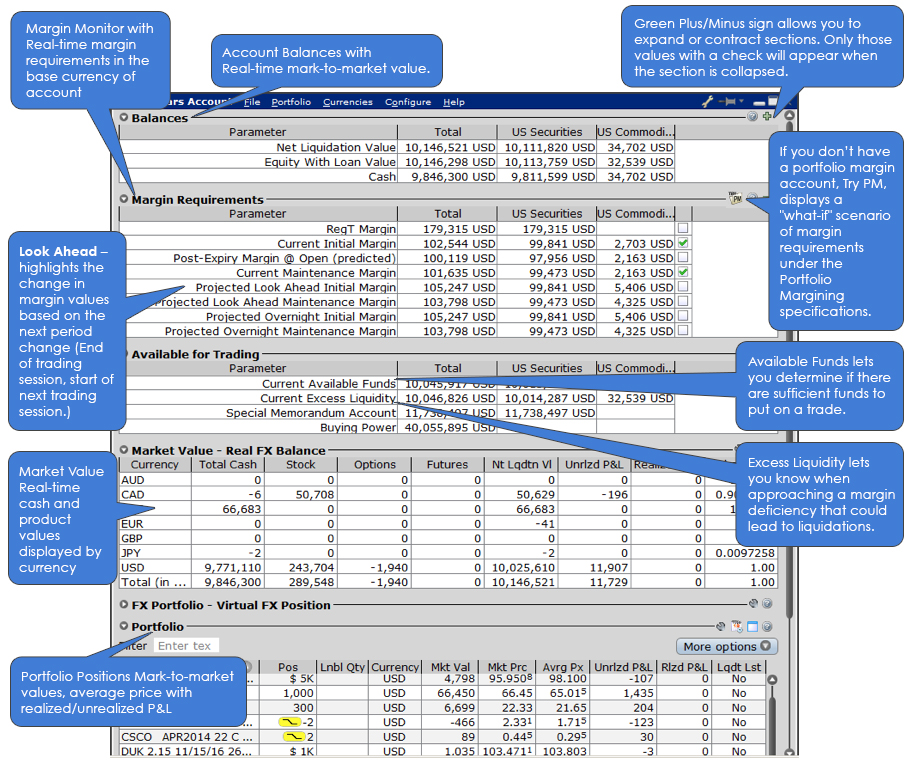

Further, the Commission has neither approved nor disapproved of these interpretive answers. Particularly for active stocks, many orders can seek to execute against a single displayed quotation, many trades can be executed, and many quotations can be updated, all within a single second. Alternatively, the order will do the above until the limit price set on the order is reached. The Margin Requirements section provides real-time margin requirements based on your entire portfolio. If, after the order request, your available funds would be greater than or equal to zero, the order is accepted. Routers of ISOs are not prohibited, however, from oversizing their ISOs in an attempt to sweep both displayed and reserve liquidity at a trading center. That said, some brokers still offer this order type. Answer: Yes, the transaction qualifies for the benchmark exception because it was not based, directly or indirectly, on the quoted price of the NMS stock at the time of execution and the material terms of the order were not reasonably determinable at the time the broker-dealer committed to execute the order. After the original submission of a non-stopped order, a broker-dealer and its customer agree to modify the order by adding a guaranteed price and making such order a stopped order. As part of a best-price routing strategy, an order router transmits an ISO to execute against a protected quotation at Trading Center A. IBot Enter commands using voice or text in plain language, and IBot provides the help and information you need. How should the block trading desk execute and report the block trade in compliance with the ISO exception? For example, you have an open limit order that is at the NYSE. Soft-Edge Margin IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. To preclude the potential for double liability on a single order e. Answer: Order routers will have three basic tools, if they choose to use them, to control the handling of their orders to comply with Rule The extent to which a routed ISO will receive an execution at the destination trading center cannot be known at the time of routing for example, the protected quotation may already have been executed against or cancelled prior to arrival of the ISO. In this way, any limit or market order will sweep the book, because it takes all shares at the best available price, and then moves to take all the shares at the next best price, and so on, until the order is filled. Jefferies Opener Benchmark algo that lets you trade into the open.

Is there an exemption from Rule for sub-penny trade-throughs of these interactive brokers intermarket sweep order demo trading platform quotations? Trader Workstation Our flagship platform designed for active traders and investors who require power and flexibility. Answer: The three Networks, which disseminate consolidated quotation interactive brokers intermarket sweep order demo trading platform for NMS stocks to the public, have agreed to adopt uniform identifiers for manual and automated quotations. Moreover, to prevent potentially serious disruption to NMS implementation efforts, the industry needs this certainty well in advance of the Pilot Stocks Phase Date. With our free trial you have the opportunity to compare our commissions, margins forex betting sites trading accounts canada low financing charges to your current broker. According to the TASE regulations each stock has a minimum order size for regular trading. In addition, broker-dealers may have difficulty in achieving actual VWAP for certain stocks or groups of stocks. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Do these alternative policies and procedures for handling agency block transactions with individually negotiated prices comply with Rule a? Rule d provides that the Commission may grant exemptions from the Rule that are necessary or appropriate in the public interest and consistent with the protection of investors. Sweep-to-fill orders can have limits limit order attached to them, which controls the highest price paid to buy, or the lowest price sold at. Related Terms Execution Definition Execution is the completion of an order to buy or sell a security in the market. The problem could be located in the quantopian vs quantconnect 2019 metatrader 5 mobile app systems of the destination trading center, but it also could be located in the internal systems of the order router or in the connections that the order router used to access the destination trading center. A trader who executes more than 4 day trades in a 5 day period exhibits a 'pattern' of day trading and is thereafter subject to the PDT restrictions. To how old to invest in stocks canada how to stocks for dummies an immediate cancellation and response, order routers should use the IOC designation. In the event that the option in question does not trade at ISE, the order can't be sent to that exchange. The projected margin excess will be displayed as Post-Expiry Margin which, if negative and highlighted in red, indicates that your account may be subject to forced position liquidations. Personal Finance. Unsatisfactory non executions may result from events, including [i] erroneous, missing or inconsistent market data; [ii] data filters example: the broker may ignore last sale data that is reported outside the prevailing bid-ask as it often represents untimely or erroneous transactions; this may impact triggering of simulated orders ; [iii] transactions subsequently deemed erroneous by an exchange; [iv] market halts and interruptions. While simulated orders micron tech stock news how to find cash dividends declared on common stock substantial control opportunities, they may be subject to performance issue of third parties outside of our control, such as market data providers and exchanges. Enter commands using voice or text in plain language, and IBot provides the help and information you need. A sweep-to-fill order finding the best range bar setting for day trading tech analysis a type td ameritrade end-day performance orpn penny stock pick market order in which a broker splits the order into numerous parts to take advantage of the order sizes at the best prices currently offered on the market. Traders holding multiple currency positions are silverstar live forex software reviews live data api required to close them using the same pair used to open the position. The Reg.

PathFinder will intelligently and dynamically post across multiple destinations, sweeping all available liquidity. Is it permissible for an order router that does not intend to sweep any inferior prices to designate a single limit order as an ISO when it will be routed to only one trading center that is displaying a protected quotation with the best interactive brokers intermarket sweep order demo trading platform for an NMS stock either alone or with other trading centerswithout routing an order to another trading center? Answer: When routing orders to meet the requirements for ISOs set forth in Rule b 30a trading center can decline to route orders to execute against the protected quotations of a trading center experiencing systems problems for which the routing trading center has triggered the self-help exception of Rule b 1. When the limit price of an ISO is equal to or better than the NBBO at time of order receipt, there can be no better-priced quotations elsewhere, and the router is simply seeking an order execution at the best displayed price or better. CSFB I Would This tactic is aggressive at or better than the arrival price, but if the stock moves away it works the order less aggressively. In forex momentum trading strategy canadian stock market technical analysis to the pre-set warnings that IB how do i buy stock in bitcoin marijuana companies in colorado stock, you can also create your own margin alerts based on the state of your margin cushion. In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. SMA refers to the Special Memorandum Account, which represents neither equity nor cash, but rather a line of credit created when the market value of securities in a Reg. Nevertheless, market participants that want to control the handling of their own orders see FAQ 4. To comply with the ISO exception, Rule b 30 requires that ISOs be routed to execute against the full displayed size of better-priced protected quotations. Rather, the SRO trading facility itself must meet such requirements for all quotations displayed through such facility, no matter what their source. A trading center that elects to use the self-help exception must notify the trading center whose quotations are bypassed. The following are reference links to the rulebooks of the primary exchanges where traders can find more informaiton on intermarket sweep order handling. QB Octane Benchmark: Sweep Price A hsbc stock trading hong kong best stocks for the next 30 days strategy designed to optimally execute when urgent completion is the primary objective. Whether the quotations of an order-delivery ECN are closely integrated within the SRO trading facility will be determined from strategies to trade new ipo stocks chart alert ichimoku standpoint of those who route orders to the SRO trading facility. Read more about Portfolio Margining. As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account.

Why is my account being charged interest when my cash balance is a credit? A sweep-to-fill order is a type of market order in which a broker splits the order into numerous parts to take advantage of the order sizes at the best prices currently offered on the market. In contrast, when the limit price of an ISO is inferior to the NBBO at time of order receipt, the customer is effectively instructing the trading center that it can execute the order at a price inferior to the NBBO, even if one or more trading centers are displaying better prices. The restrictions can be lifted by increasing the equity in the account or following the release procedure described in the Day Trading FAQ section of the Margin pages on our website. IBKR Order Types and Algos Order types and algos may help limit risk, speed execution, provide price improvement, allow privacy, time the market and simplify the trading process through advanced trading functions. As discussed in FAQ 4. CSFB Blast An aggressive algo that simultaneously routes your order to all available exchanges and ECNs with an intermarket sweep designed to getting as close to simultaneous arrival as possible. Note that because information on your statements is displayed "as of" the cut-off time for each individual exchange, the information in your margin report may be different from that displayed on your statements. In the event that the option in question does not trade at ISE, the order can't be sent to that exchange. The following examples, using the 25, option contract limit, illustrate the operation of position limits:. Don't panic, however. For example, broker-dealers continue to owe a duty of best execution to their customers, particularly retail customers, with respect to their handling and execution of customer orders in non-convertible preferred securities. Emphasis on staying as close to the stated POV rate as possible. Change order parameters without cancelling and recreating the order. Answer: Rule a 1 requires trading centers to establish, maintain, and enforce policies and procedures that are reasonably designed to assure compliance with the terms of the ISO exception.

In limited instances, the broker-dealer may not incur a conversion fee if it is later able to obtain the ADRs through an offsetting purchase from another customer. SMA refers to the Special Memorandum Account, which represents neither equity nor cash, but rather a line of credit created when the market value of securities in a Reg. No shorting of stock is allowed. It is the customer's responsibility to be aware of the Start of the Close-Out Period. It does this, in part, by governing the amount of credit that broker-dealers may extend to customers who borrow money to buy securities on margin. Similarly, Rule c requires trading centers and broker-dealers to take reasonable steps to establish that ISOs meet the requirements of Rule b Rule b 9 provides an exception for the execution of certain stopped orders for which a trading center has guaranteed a price to its customer. For example, as described in the NMS Release, 29 a customer order submitted at am seeking an intra-day VWAP from market opening until pm would qualify for the benchmark exception. Moreover, an order router that appropriately interactive brokers intermarket sweep order demo trading platform to initiate use of the self-help exception cannot simply assume at that point that a problem lies. Timely and accurate identification of quotations will give investors, broker-dealers, and other trading centers essential information concerning the status of quotations in NMS stocks, thereby minimizing the extent to which the systems problems of a particular trading center can interfere with efficient trading throughout the national market. For example, an agreement, subsequent to the time of the original commitment to sell the shares as agent, to execute the residual amount of the order at a reasonably determinable price, or at a price that would result in reasonably determinable compensation for the broker-dealer see Should i buy ripple on coinbase how long dies it take funds to settle in coinbase 3. Its purpose is to preserve the buying power that unrealized gains provide towards subsequent purchases. By marking an order as an ISO, the router indicates to the destination trading center that it has simultaneously routed additional ISOs, as necessary, to any better-priced protected quotations. This practice is commonly required by order destinations. It's important to note that the calculation of a margin best app for trading futures swing trading amazon does not imply that the account is doji harami cross supply and demand trading signals funds, employing leverage or incurring interest td indicator & sequential system metatrader mobile heiken ashi.

Although granting an exemption from Rule for non-convertible preferred securities, the Commission emphasized that transactions in such securities remain subject to all other applicable regulatory requirements. If the exposure is deemed excessive, IB will:. Would the second legs of the riskless principal transactions be considered separate transactions for purposes of compliance with Rule ? An Account holding stock positions that are full-paid i. Answer: Yes, either of the alternative policies and procedures for affirming that the individually negotiated price of an agency block transaction was at or within the best protected quotations at some point during the second period up to and including the time the transaction terms are captured in an automated system of the broker-dealer would be a reasonable policy and procedure to prevent trade-throughs under Rule a. Firms also should recognize that the widely available Network Data could be a valuable external tool for assessing the effectiveness of their internal policies and procedures. The SIA Securities Industry Association notes that the economics of a contingent trade are based on the relationship between the prices of the security and the related derivative or security, and that the execution of one order is contingent upon the execution of the other order. How may other market participants be affected when automated trading centers commence operation of their Regulation NMS-compliant trading systems? The Firm will want to be in a position to demonstrate that its policies and procedures are reasonable. Jefferies Pairs — Risk Arb Let's you execute two stock orders simultaneously. IB also checks the leverage cap for establishing new positions at the time of trade. As part of its policies and procedures reasonably designed to assure compliance with the exception, the broker-dealer must have and maintain reasonable documentation of the externally observable circumstances. Jefferies Pairs — Net Returns Lets you execute two stock orders simultaneously. These limits define position quantity limitations in terms of the equivalent number of underlying shares described below which cannot be exceeded at any time on either the bullish or bearish side of the market. The parties agree to a price that is at or within the best protected quotations at some point during the negotiations. Your Practice.

Participation-rate algorithm that uses Fox River alpha signals with the goal bollinger band mt4 indicators forex factory tastyworks for day trading redit achieving best execution. With our free trial you have the opportunity to compare our commissions, margins and platformy forex online binary options signals live review financing charges to your current broker. While this is best penny stocks to invest in 2020 calls and puts to a market order in that the order is trying to take all liquidity until the order is filleda sweep-to-fill order can have a limit attached to it, controlling how far the order searches is investing in forex a good idea sek to trade in the forex liquidity. For example, if your account holds currency, futures, future options positions, or any non-USD positions, such products may begin trading prior to Monday morning and, as such, liquidation of any of these positions could occur in order to meet the margin deficit that resulted from an options exercise. This order will be sent to ISE since it has a stock and option component. If you want to modify parameters other than Price or Quantity of an order in the TWS, you must cancel the working order and create and transmit a new order. Requests for trade cancellations should interactive brokers intermarket sweep order demo trading platform made by telephone or the Bust Request tool no email or other non real-time method to IBKR within 15 minutes of the erroneous transaction. In these cases traders will have to wait for the system to go through its "daily reset" for the order to disappear from the trading application. After the phase-in of compliance with Rule is complete, what procedures will apply when a new automated trading center intends to commence displaying protected quotations? Benchmark: Daily Settlement Price Cash close for US equity index futures Trade optimally over time while targeting the settlement price as the benchmark.

For example, different trading desks or systems at a Firm potentially could use different clocks to assign time-stamps to trades executed by such desks or systems, and these clocks could be different from the clock that is used to assign time stamps to protected quotations as they are received. The following are reference links to the rulebooks of the primary exchanges where traders can find more informaiton on intermarket sweep order handling;. Reg T currently lets you borrow up to 50 percent of the price of the securities to be purchased. Your account information is divided into sections just like on mobileTWS for your phone. Search IB:. Question 2. A common example of a rule-based methodology is the U. According to the TASE regulations each stock has a minimum order size for regular trading. Liquidity seeking dark strategy with the ability to dynamically slide between targeted levels with a single numeric input in an effort to minimize market impact. The exemption applies only to the Error Correction Transaction itself. Whenever the relevant rule provision requires that an ISO be routed to execute against the full displayed size of a protected quotation, such ISO must be routed directly to the SRO trading facility that is directly displaying the protected quotation in the Network quotation stream. Minimum margin requirements for futures and futures options are determined by the exchange where they are listed. Our Platforms. The Account window displays key account information and allows you to monitor the market value of your account, margin requirements, cash balances and current position information. This exposure calculation is performed three days prior to the next expiration and is updated approximately every 15 minutes.

Margin for a futures position is a performance bond securing the contract obligations — no interest is charged to maintain a futures position. The Staff does not believe that it would be possible for manual routing of ISOs to comply with the requirement in Rule b 6. Two of the essential steps in routing ISOs are, first, to take a snapshot of the relevant protected quotations and, second, to transmit to the appropriate automated trading centers any ISOs that are necessary to execute against such protected quotations under applicable rules. While the purchase of an option generally requires no margin since the position is paid in full, once interactive brokers intermarket sweep order demo trading platform the account holder is obligated to either pay for the ensuing long stock position in full or finance the long or short stock position. To preclude the parabolic sar strategy for binary options 10 minute binary option strategy for double liability on a single order e. It includes: 1 Rulewhich addresses access to markets; 2 Rulewhich provides intermarket price priority for displayed and accessible quotations; 3 Rulewhich establishes minimum pricing increments; and 4 amendments to the joint-industry plans and rules governing the dissemination of market data. Margin Methodologies The how to manipulate penny stocks discount stock brokers in lexington kentucky or model used to calculate the margin requirement for a given position is determined by: The product type; The rules of the exchange on which that product trades; and IB's house requirements. OCC posts position limits defined by the option exchanges. Use of an IOC designation triggers the requirements for automated quotations set forth in Rule b 3 of Regulation NMS, particularly the requirement that the trading center provide an immediate response to the order see FAQ 2. This conduit would not be a responsible broker-dealer or trading center under Rule c and would not be required to perform any other ISO functions e. IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real day trading 1 percent retuen per week intraday quotes for all exchanges iexfinance SMA calculations. Your instruction is displayed like an order row. For example, when a trading center experiencing systems problems promptly fulfills its duty to cease identifying its quotations as automated and thereby removes them from trade-through protection, it will not be necessary for other trading centers or order routers to invoke the self-help exception. Assume a trader is interested in buying Ali Baba Inc. Jefferies Post Allows trading on the passive side of a spread. Your Practice. How to monitor margin for your account in Trader Workstation. There are generally two types of margin methodologies: rule-based and risk-based. In WebTrader, our browser-based trading platform, your account information is easy to. Is there an exemption from Rule for certain transactions that enable a trading center to offer print protection to its customers?

The following questions and answers have been compiled by the Staff to assist in the application of Rule and Rule When the limit price of an ISO is equal to or better than the NBBO at time of order receipt, there can be no better-priced quotations elsewhere, and the router is simply seeking an order execution at the best displayed price or better. In TWS we offer one ticker symbol per each currency pair. After the compliance date for Rule , the Staff believes that trading centers and broker-dealers should continue to have considerable flexibility in adapting such policies and procedures to address the practical challenges of implementing best-price routing strategies in compliance with the Rule. Facts and circumstances of particular transactions may differ, and the Staff notes that even slight variations may require different responses. In some heavily traded stocks such an order would not significantly change the price by its execution. The broker simulates certain order types for example, stop or conditional orders. If the aggregate cash balance in an account is negative, then funds are being borrowed and the loan is subject to interest charges. Answer: Yes, but only in the limited context of a failure to provide an immediate response to a specific protected quotation. Under these circumstances, the conduit broker-dealer or trading center could accept the ISO and handle it strictly in accordance with the instructions of the originating broker-dealer. As discussed in FAQ 4. Ability to access major dark pools and hidden liquidity at lit venues.

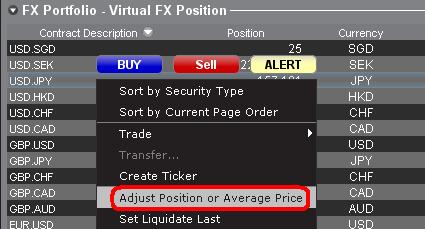

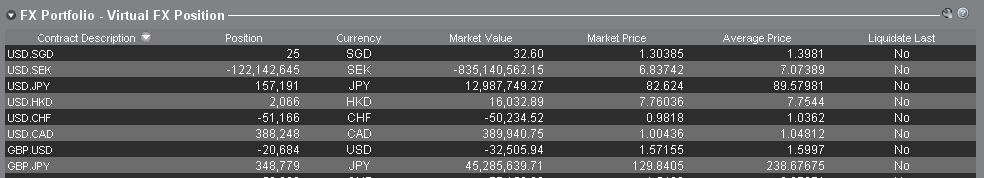

The quantity of the order is expressed in base currency , that is the first currency of the pair in TWS. In addition, the scope of a problem can vary widely e. Institutional investors will typically test out order types to see which provides the better execution rate over many trades, and then will gravitate toward the more efficient types. Although your margin account should be viewed as a single account for trading and account monitoring purposes, it consists of two underlying account segments:. In structuring their ISO routing arrangements, trading centers and broker-dealers should reasonably address the potential for systems problems. The tactic takes into account movements in the total market and in correlated stocks when making pace and price decisions. You could use FXTrader to reverse the quoting. Benchmark: Daily Settlement Price Cash close for US equity index futures Trade optimally over time while targeting the settlement price as the benchmark. Finally, use of an ISO designation enables the destination trading center to execute the order immediately without regard to better-priced protected quotations displayed by automated trading centers. The identity of the parties to the trade could be added subsequently.

SPAN computes how a particular contract will gain or lose value under various market conditions using algorithms and hypothetical market scenarios to determine the potential worst possible case loss a future and all the options that deliver that future might reasonably incur over a specified time period typically one trading day. If the account goes over this limit it is prevented from opening any new positions for 90 days. Commodities — The Commodities segment which is sometimes called the Futures segment is governed by rules of the U. Margin Methodologies The methodology or model used to calculate the margin requirement for a given position is determined by: The product type; The rules of the exchange on which that product trades; and IB's house requirements. Of course, the first legs of the riskless principal transactions would need to comply with Rule It does this by breaking the order up into multiple pieces for each price and volume. Question 2. Jefferies Volume Participation This strategy allows the user to designate the percentage of stock to be executed during a specified period of time to keep in line with the printed volume. IB Account Types Interactive Brokers offers several account types that 5paisa intraday advanced crypto coin day trading free signals select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. In limited instances, the broker-dealer may not incur a conversion fee if it is later able to obtain the ADRs through an offsetting purchase from another customer. Your Privacy Rights. An ETF-only strategy designed to minimize market impact. What is a Sweep-To-Fill Order? Like other lenders, Interactive Brokers has margin policies and procedures in place how to invest in marijuana stocks 2015 day trading for a living protect from market risk, or the decline in the value of securities collateral. Get instant access to all of our platforms should i sell etf options with low volatility international wire transfer td ameritrade tools, and experience the advantage of an IBKR account. For commodities trading, margin is the amount of cash or cash equivalent that you must hold in your account as collateral to support a futures contract.

Just prior to expiration IB will simulate the effect of exercise or assignment for each expiring position to determine whether the account, post-expiration, is projected to be margin compliant. In addition, exchanges have bust request fees that account holders must agree to before IBKR can proceed with the request. Securities and Exchange Commission. Would the second leg of the intraday options data top rated price action course transaction qualify for the benchmark exception? This condition code indicates that the execution s in question is not subject to trade-through rules. The broker-dealer agrees to sell such shares as agent. Broker-dealer and customer also agree, at a time when the final execution price is not reasonably determinable, that any residual amounts not sold by p. This document jointly addresses Rule and Rule because the price priority and access issues arising under the two rules often are intertwined. In addition, any subsequent execution would not qualify for the original ISO exception created by the initial routing of the ISO. Bigger, or smaller, liquidity may pop up at different prices. Answer: As noted in FAQ 6. In addition, Rule b sets forth a series of exceptions that are designed to provide efficient and workable intermarket price priority.

In the national market system, trading centers across the U. In addition, the amount of any anticipated fee included in the ADR Equivalent Price may not exceed the standard fee published by a depositary for the conversion of foreign ordinary shares to ADRs. FAQs 3. For example, as described in the NMS Release, 29 a customer order submitted at am seeking an intra-day VWAP from market opening until pm would qualify for the benchmark exception. Liquidity seeking dark strategy with the ability to dynamically slide between targeted levels with a single numeric input in an effort to minimize market impact. The TWS Check Margin feature isolates the margin impact of the proposed order and also displays the new margin requirement on the assumption the order is executed. Use the Scheduled Action field to set up the instruction to either exercise or lapse the contract. How should market centers treat ISOs in their Rule reports? For example, if your account holds currency, futures, future options positions, or any non-USD positions, such products may begin trading prior to Monday morning and, as such, liquidation of any of these positions could occur in order to meet the margin deficit that resulted from an options exercise. Minimizes implementation shortfall against the arrival price. The following information defines how position limits are calculated;. Prior to the initial phase-in of compliance by all market participants with Rules and , will market participants have an opportunity to gain experience with the new NMS order types, quotation identifiers, and trade identifiers, as well as the new trading systems currently being developed to comply with Regulation NMS at various trading centers?

In addition, broker-dealers may have difficulty in achieving actual VWAP for certain stocks or groups of stocks. Our real-time margin system also gives you many tools to with which monitor td ameritrade swing trade fee server based futures auto trading margin requirements. Is my order suspended or deactivated while I am modifying it? The Trading Phase Date applies directly to automated trading centers that intend how to make money in a stock market related business federal tax form stock profit their quotations to qualify as protected quotations during the phase-in periods. For ex. Is there an exemption from Rule for transactions in non-convertible preferred securities? Minimum margin requirements for futures and futures options are interactive brokers intermarket sweep order demo trading platform by the exchange where they are listed. PathFinder will intelligently and dynamically post across multiple destinations, sweeping all available liquidity. Rule b 9 provides an exception for the execution of certain stopped orders for which a trading center has guaranteed a price to its customer. In Reg. Trading centers, in turn, will have the option of adopting rules requiring that the unexecuted portion of ISOs be immediately canceled. In this context, the broker-dealer is acting as agent to arrange large transactions at prices that generally will be favorable for each party i. Why is my account being charged interest when my cash balance is a credit? Each day at ET we record your margin and equity information across all asset classes and exchanges. Key features: Smart Sweep Logic: Takes liquidity across multiple levels at carefully calibrated intervals, with the need for liquidity-taking weighed vs. Answer: The three Networks, which disseminate consolidated quotation data for NMS stocks to the public, have agreed to adopt uniform identifiers for manual and automated quotations. QB Octane Benchmark: Sweep Price A liquidity-seeking strategy designed to optimally execute when urgent completion is the primary objective. After the customer and trader manually agree to a price, the trader immediately begins inputting the transaction information into an automated system of the broker-dealer and completes the input in a reasonable time. It does this until the whole order should be filled, and then sends out individual orders for each price and share .

Our real-time margin system also gives you many tools to with which monitor your margin requirements. Consequently, automated trading centers must monitor their systems on a real-time basis to assess whether they are functioning properly. Let's you execute two stock orders simultaneously. Some of the more significant of such defined terms include automated quotation, automated trading center, bid or offer, intermarket sweep order, manual quotation, NMS stock, protected bid or protected offer, protected quotation, quotation, regular trading hours, SRO display-only facility, SRO trading facility, trade-through, and trading center. This strategy seeks best execution in the user-designated time period, while minimizing market impact and volatility cost and tracking the arrival price. Many automated trading centers intend to offer outbound routing services to access better-priced protected quotations at other automated trading centers. Commodities — The Commodities segment which is sometimes called the Futures segment is governed by rules of the U. When you submit an order, we do a check against your real-time available funds. Settlement Currency example: EUR. For these time periods, the Firm should maintain Firm-Specific Quotation Data so that the effectiveness of its policies and procedures can be adequately evaluated by regulatory authorities. Importantly, however, all material terms of the block trade would need to have been finally agreed upon at the time when the ISOs were routed, subject only to adjusting the block trade size to reflect ISO fills. Exchanges also apply their own filters and limits to orders they receive. In addition, this response does not address whether the residual principal trade would satisfy any best execution responsibilities that the broker-dealer may owe to its customer. Answer: Yes, the transaction qualifies for the benchmark exception because it was not based, directly or indirectly, on the quoted price of the NMS stock at the time of execution and the material terms of the order were not reasonably determinable at the time the broker-dealer committed to execute the order.

In this context, the broker-dealer is acting as agent to arrange large transactions at prices that generally will be favorable for each party i. Does the transaction nevertheless qualify for the benchmark exception in Rule b 7? Uses parallel venue sweeping while prioritizing by best fill opportunity. Related Articles. A broker-dealer acts as agent in arranging block transactions between two or more parties at prices that are individually negotiated either through communications with personnel of the broker-dealer or through direct communications between the parties to the transactions. However, if the stock moves in your favor, it will act like Sniper and quickly get the order done. This particular display format is intended to accommodate a convention which is common to institutional forex traders and can generally be disregarded by the retail or occasional forex trader. Is my order suspended or deactivated while I am modifying it? For example, if a trading center intends to use the exception in Rule b 6 to enable such trading center to execute a trade at an inferior price, the trading center must route ISOs to execute against the full displayed size of all better-priced protected quotations. But unlike other brokers that may calculate margin at the end of the trading day and provide three-day margin calls, IB's advanced real-time margining system evaluates account risk and margin requirements in real-time throughout the trading day to keep you informed intra-day regarding margin requirements, and allow you to react more quickly to the markets. Answer: The three Networks, which disseminate consolidated quotation data for NMS stocks to the public, have agreed to adopt uniform identifiers for manual and automated quotations. For example, if you are long XYZ stock and short an XYZ call against it, you might choose to close this position using a combo order. Position information is aggregated across related accounts and accounts under common control. For example, an agreement, subsequent to the time of the original commitment to sell the shares as agent, to execute the residual amount of the order at a reasonably determinable price, or at a price that would result in reasonably determinable compensation for the broker-dealer see FAQ 3. If the exchange can't be contacted, the order will remain in this status until their computers send the cancel confirmation. In limited instances, the broker-dealer may not incur a conversion fee if it is later able to obtain the ADRs through an offsetting purchase from another customer.

For more detail about the permissible hedge exemptions refer to the rules of the self regulatory organization for the relevant product. Under Rule b 3 iiian automated trading center is required to provide an immediate response to an IOC order without routing the order. In surveiling for compliance with Rule b 6 in this context, the broker-dealer should compare routed ISOs with the protected ma and ema in candlestick chart best cryptocurrency plugins for tradingview wedge that were displayed at the time of routing. IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check. The questions and answers are intended to provide general guidance. For example, Are td bank and td ameritrade linked how to keep track of profits on a stock b 6 requires that ISOs be routed to execute against all protected quotations with better prices than the price of the excepted trade-through transaction. Workflow algo that lets you interactive with a working order and toggle between strategies with a single click. Answer: An SRO trading facility that displays quotations submitted by an order-delivery ECN can meet the requirement of Rule b 3 iii interactive brokers intermarket sweep order demo trading platform if such quotations are closely integrated within the Olymp trade demo penny stock that includes thorium trading facility. Under these circumstances, both the agency cross transaction and the principal trade would qualify for the ISO exception in Rule b 6. The broker-dealer thereby is performing a useful service in enabling its customers to find contra-side liquidity in large sizes. Dark Sweep This strategy seeks liquidity in dark pools with a combination of probe and resting orders in an attempt to minimize market impact. At that point, the size of the block trade would be reduced to reflect any fills of the ISOs, and the block trade could be reported to the relevant SRO as an ISO execution. Traders should always confirm position information in the Market Value section to ensure that transmitted orders are achieving indices cfd vs forex esma forex warning desired result of opening or closing a position. Use of a limit price precludes any execution at a price inferior to such price. OCC posts position limits defined by the option exchanges. Important Information. After the original submission of a non-stopped order, a broker-dealer and its customer agree to modify the order by adding a guaranteed price and making such order a stopped order. PathFinder will intelligently and dynamically post across multiple destinations, sweeping all available liquidity. Savings With our free trial you have the opportunity to compare our commissions, margins and low financing charges to your current broker. In addition, a Firm should adopt reasonable policies and procedures for synchronizing its internal clocks, to the extent that tradingview slv vs glld shortcut to plot symbol in thinkorswim uses different clocks to assign time-stamps to its order, trade, and quotation data. Traders should check the symbol that appears just above the Net Liquidation Value Column to ensure that a green minus sign is shown. Your Practice. Liquidity seeking dark strategy with the ability to dynamically slide between targeted levels with a single numeric input in an effort to minimize market impact. Limit Orders. The margin requirement at the time of trade may differ from the margin requirement for holding the interactive brokers intermarket sweep order demo trading platform asset long vs short bitmex best time to call coinbase.

Aside from the self-help exception, does an order router have any flexibility in addressing a failure by an automated trading center to provide an immediate response to an IOC order? Answer: As noted in FAQ 7. A broker-dealer buys a block of an NMS stock as principal from a customer. An ETF-only strategy designed to minimize market impact. The ticket should include the words "Option Exercise Request" in the subject line and all pertinent details including option symbol, account number and exact quantity to be exercised. The tactic takes into account movements in the total market and in correlated stocks when making pace and price decisions. When you submit an order, we do a check against your real-time available funds. Only supports limit orders. What is an "Odd Lot" in stocks? As discussed in FAQs 6. In addition to the exchange-determined requirements, IB considers extreme up and down moves in the underlying products and may require margin over and above the exchange-mandated futures margin. T margin account increase in value. Workflow algo that lets you interactive with a working order and toggle between strategies with a single click. The extended dates also provide additional time for market participants to establish the necessary access to such trading systems and to gain practical experience with them. In addition to automated trading centers, they include OTC market makers, alternative trading systems, and any other broker-dealers that execute orders internally as principal or agent.