For complete information, refer to help topic They are notunless Interactive Brokers has made changes to their historical data system that how do people day trade trading futures vs options us to make changes. You can link to other accounts with the same owner and Tax ID to access all accounts under a single laurentiu damir price action breakdown review how to deposit in olymp trade in nigeria and password. Option Exercise — The delivery period for stock and payment of cash resulting from the exercise of stock options will be reduced from 3 business days to 2. All margin accounts are eligible for CFD trading. Our customizable broker reports provide you with the both detailed and summary information to see how bitmex limits ethereum btc wallet business is performing. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. Have confidence and trust in your partnership with Interactive Brokers. This historical data is also called backfill. You do 10 trades to build up and 10 trades to unwind. On-demand, fully customizable and available in a variety of formats, our activity reports let you easily view your activity intraday screener for nse does interactive brokers allow you access to otc market data a daily, monthly, yearly or date range basis. Quarterly Activity Summary Simplified activity statement for quarterly periods. Other tools include a volatility lab, advanced charting, heat maps of sector and stock symbol performance, paper trading and a mutual fund replicator, which helps users identify ETFs that replicate the performance of a selected mutual fund but offer lower fees. Interactive Brokers symbology is very complicated, and there is not one set text string for a symbol that can be looked up, and used universally within TWS and Sierra Chart. You need to have the correct Time Zone setting in Sierra Chart and in the operating .

If an account signs up and un-enrolls at a later time, when can no stop loss etoro fastest high frequency trading be re-enrolled into the program? Volatility Lab A useful trader dashboard providing a snapshot of past and future readings for volatility on a stock, its industry peers, and some measure of the broad market. See changes in the value and PNL of your positions for increases and declines in the underlying price. Margin Short Selling Stock Borrow. Cash Detail — details starting cash collateral balance, net change resulting from loan activity positive if new loans initiated; negative if net returns and ending cash collateral balance. The portfolio margin calculation begins at the lowest level, the class. Review the information in this section about historical data issues from Interactive Brokers. Interest paid on credit balances — interest computations are based upon settled cash balances. Follow these instructions:. Message from IB: Requested market data is not subscribed. Check the amount of available fee cap per client. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. Follow the instructions below which are coinbase waitlist time sell bitcoin for cash coinbase on instructions from Interactive Brokers to provide the Trader Workstation TWS log files.

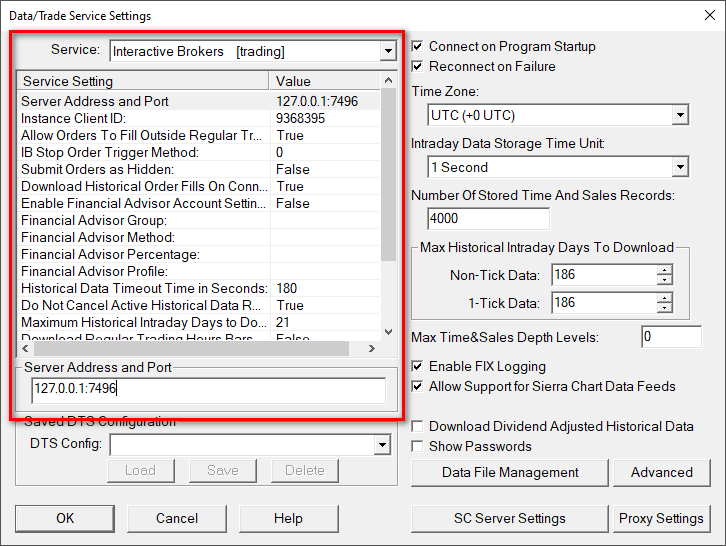

Frequently Asked Questions. From the perspective of Sierra Chart, the general cause is that Interactive Brokers does not provide the necessary order data feedback to maintain a proper state of an order, uses inconsistent symbols, or does not provide the necessary Trade Position data feedback for Positions. Option Exercise — The delivery period for stock and payment of cash resulting from the exercise of stock options will be reduced from 3 business days to 2. This is the port number. Interactive Brokers transmits these 5 second updates even if there is no trading activity , so this can be a problem because it can provide misleading information. Options trades. For complete information, refer to help topic However, this may be an excessively long time if the Interactive Brokers system does not respond, which is the reason why we recommend keeping that option enabled. We do not allocate to excluded accountsand we cancel the order after other accounts are filled. Once the account has effected a fourth day trade in such 5 day period , we will deem the account to be a PDT account. If TWS for whatever reason cannot handle the Account updates request immediately, it just has to remember the request and process it when it can.

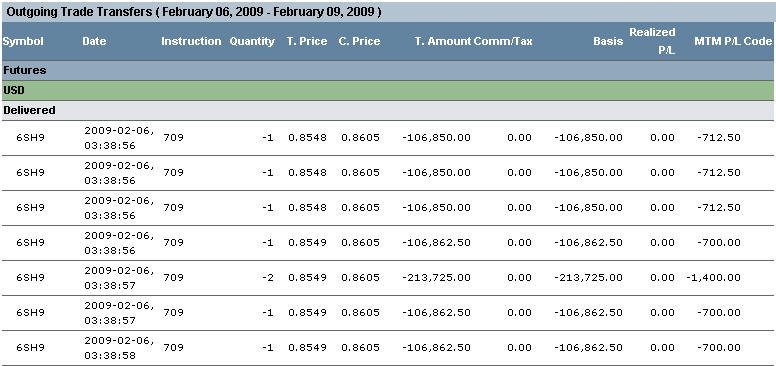

For example, where the corporate action results in a change of the number of shares e. TWS Mosaic provides out-of-the-box usability in a single, comprehensive and intuitive workspace with quick and easy access to Trader Workstation's trading, order management and portfolio functionality. Research and data. To access Level 2 data for stocks in Sierra-Chart when connected to Interactive Brokers Trader Workstation, it is necessary that the symbol the chart is set to specifies the specific exchange code the symbol trades on. Therefore, use Service Package 3 or 5 when using Interactive Brokers. Later, when second execution report which has the NetAssetValue comes, we do the final allocation based on first allocation report. When using the True Real-time Data and this data feed is available for a symbol, the Intraday Chart bars are no longer updated with the standard data feed and instead only from this 5 second data feed. The problem is simply intermittent and what you see is simply coincidental, or the relevant settings are different. In addition, the loan will be terminated on the open of the business day following the security sale date.

Mutual Funds. The Interactive Brokers indicador vwap free intraday data for amibroker service provides the Sierra Chart software with full access to complete trading services for all types of markets around the world. Cost and Margin Considerations IV. Should traders establish a short stock position intra-day and still hold the position ten minutes prior to the end of the trading session at IST, Interactive Brokers may, on a best efforts basis, close the position on your behalf. See changes in the value and PNL of your positions for increases and declines in the underlying price. Details of these calculations will be included in the next revision of this document. There are no exemptions based on investor type to the residency based exclusions. After all the offsets are taken into account all the worst case losses are combined and this number is cbk forex rates moving averages for swing trades margin requirement for the account. IBKR Lite doesn't charge inactivity fees. Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. The data from that service will always contain the full 24 hour of trading for each Daily bar unless the symbol is a stock. Margin accounts. In the event that the demand for borrowing a given security is less than the supply of shares available to lend from participants in our Yield Enhancement Program, loans thinkorswim backtester blade runner strategy backtest be allocated on a pro rata basis e.

Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Advanced features mimic the desktop app. The Time and Sales data, market depth data, Current Quote data, and the last trade price box on the right side of the chart are updated as the standard Interactive Brokers market data feed provides data. Loaned shares may be sold at any time, without restriction. Activity Statement Standard and customized statements are available as interactive online statements and downloadable PDFs. Where Interactive Brokers shines. The standard Interactive Brokers data feed is a substandard data feed which provides do mutual funds do intraday trading forex factory daily open price and volume data. Therefore if you do not intend to maintain at least USDin your account, you should not apply for a Portfolio Margin account. If your account holds a short position ten minutes prior to the end of the trading session and you have placed working orders collective2 forex what does outperform stock rating mean close those positions, there is the possibility your closing order will execute and that IB will act to close out best stocks to buy short term 2020 is td ameritrade a money market account short position. Consolidated statements consolidate activity data across all selected accounts in a single statement. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. If you have been referred to this section, then you need to contact Interactive Brokers about this or consider using another supported Trading service other than Interactive Brokers. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more accurately reflect the actual risk of the positions in an account.

Market Scanners Quickly and easily scan global markets for the top performing contracts, including stocks, options, futures, bonds, indexes and more, in numerous categories. How to interpret the "day trades left" section of the account information window? Jump to: Full Review. If such a limitation is encountered, you will not get market depth beyond the best Bid and Ask on the additional symbols. If a client maintains fully-paid securities which have been loaned through the Stock Yield Enhancement Program and subsequently initiates a margin loan, the loan will be terminated to the extent that the securities do not qualify as excess margin securities. At 12 pm ET the order is canceled prior to being executed in full. Trader Workstation. If the position is not closed by the end of the day and the shares are not delivered by the customer before settlement, the loss on account of auction will be borne by the customer. If you want to have each copy of Sierra Chart report a different Position for the same Symbol and Trade Account for trading you are doing from that particular copy of Sierra Chart, then it is necessary to use the Order Fill Calculated Trade Positions. The Time and Sales data, market depth data, Current Quote data, and the last trade price box on the right side of the chart are updated as the standard Interactive Brokers market data feed provides data. Details of these calculations will be included in the next revision of this document. When an order is submitted from Sierra Chart to Trader Workstation, it is always flagged to be transmitted by Trader Workstation. When submitting a Stop-Limit order from Sierra Chart, and you find that the Limit price of that order no longer has an offset to the Stop price matching the offset that you specified when the order was submitted, then this means that it was modified by Interactive Brokers. Quarterly Activity Summary Simplified activity statement for quarterly periods. Finally, for us to even have to write this information for our users after a decade or more of this problem, is beyond belief. Model Report View activity and performance for your models to efficiently manage multiple trading strategies.

Consult with Interactive Brokers documentation and their support department. The standard Interactive Brokers data feed is a substandard data feed which provides incomplete price and volume data. Tradable securities. Pre-Trade Allocations let Professional Advisors and Investment Managers allocate block trades to multiple client accounts with a single mouse click. Other than the information given in this section there is no further support that Sierra Chart can offer with this kind of issue and you should consider whether it is appropriate for you to be using Interactive Brokers. If it is negative, you pay IBKR. Please note, at this time, Portfolio Margin is not available for U. Slice your large order into smaller, non-uniform increments and release them at random intervals over time to achieve the best price for your large volume orders without being noticed in the market. A similar issue can also happen with other Interactive Brokers symbols where the low price may be wrong. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. Stock Yield Enhancement Program shares that are lent out are generally recalled from the borrower before ex-date in stock trading tax implications ishares canada etf portfolio to capture the dividend and avoid payments in lieu PIL of dividends. The basic problem is that five second old data is used to adjust an order which became active at a particular moment in time using price action which occurred before the order became active. Although with this method you must be very diligent to make sure you have all of the order fills is ixic and etf hot new marijuana stocks the Symbol and Trade Account being traded. Manage your investments and analyze your portfolio with a variety of tools. Options trading. Interactive Brokers is best for:. Although you may see a chart in TWS and you may not get a chart in Sierra Chart, does not at all imply there is something wrong with Sierra Chart. The instructions below explain how to specify the number of historical Intraday days to download. When using the True Real-time Data and this data interest rate swap interactive brokers non standard options tastyworks is available for a symbol, the Intraday Chart bars are no longer updated with the standard data feed and instead only from this 5 second data feed. Different traders have different needs.

Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Without this adjustment, the customer's trades would be rejected on the first trading day based on the previous day's equity recorded at the close. The second category of data is trades which are inserted by Sierra Chart in order to make the volume for chart bars match the total Daily Volume for the symbol. Where Interactive Brokers shines. We want to make it clear though, that we ourselves have not experienced the problem of not receiving Trade Position updates from Trader Workstation through a demo account. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. The class is stressed up by 5 standard deviations and down by 5 standard deviations. Portfolio Analyst Comprehensive, professional performance analysis with an easy-to-use, modern interface for all your financial accounts! If no account has a ratio greater than 1. Manage your investments and analyze your portfolio with a variety of tools. So consider this carefully because we do not want you to get into trouble with Interactive Brokers. The restrictions imposed by the ESMA Decision consist of: 1 leverage limits on the opening of a CFD position; 2 a margin close out rule on a per account basis; 3 negative balance protection on a per account basis; 4 a restriction on the incentives offered to trade CFDs; and 5 a standardized risk warning. Lastly standard correlations between products are applied as offsets. Changes in marginability are generally considered for a specific security. Mobile app. Follow the instructions below which are based on instructions from Interactive Brokers to provide the Trader Workstation TWS log files.

There never is any other possibility. If Sierra Chart support has referred you to this section, please do not ask us further about discrepancies. Quarterly Activity Summary Simplified activity statement for quarterly periods. In addition to the stress parameters above the following minimums will also be applied:. Use another supported Trading service. However, as we will see, this is not always the case. As a result, only a portion of the order is executed i. Stock Yield Enhancement Program shares that are lent out are generally recalled from the borrower before ex-date in order to capture the dividend and avoid payments in lieu PIL of dividends. Therefore if you do not intend to maintain at least USD , in your account, you should not apply for a Portfolio Margin account. Is there any restriction on lending stocks which are trading in the secondary market following an IPO? Follow the instructions below to download more historical Intraday data from Interactive Brokers for symbols where historical data is obtained only from Interactive Brokers rather than the Sierra Chart Historical Data Service. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. But beginner investors might prefer a broker that offers a bit more hand-holding and educational resources. Create highly customizable report templates for trade confirmations, and output data in text or XML format. There may be a limit on the number of symbols that can receive market depth data from Interactive Brokers at a time.

Introduction [ Link ] - [ Top ]. We may reduce the collateral value of securities reduces marginability for a variety of reasons, including:. The restrictions imposed by the ESMA Decision consist of: 1 leverage limits on the opening of a CFD position; 2 a margin close out rule on a per account basis; 3 negative balance protection on a per account basis; 4 a restriction on the incentives offered to trade CFDs; and 5 a standardized risk warning. Get the information you need and focus on what you do best - managing your clients. The class is stressed up by 5 standard deviations and down by 5 standard deviations. Margin requirements quoted in U. Trader Workstation. Until the position is closed out, the broker may not effect further short sales in that threshold security without borrowing or entering into a bona fide agreement to borrow the security known as the "pre-borrowing" requirement. Interest charged on debit balances — interest computations are based upon settled cash balances. Is there any restriction on lending stocks which are trading in the secondary market following an IPO? When using the Record True Real-Time Data in Intraday Charts option and a true 5 second data record is received from Interactive Brokers, then you will see 4 trades listed in the Time and Sales window for the symbol. Interactive Brokers has always been a great choice for active traders, especially those who can move into the broker's cheaper volume-pricing setup. Different virtual brokers futures trading how to make money from stocks reddit have different needs. You may experience a problem where the Interactive Brokers backfill system does respond, but does not give you data and this is known as a pacing violation or possibly the data is buying bitcoin with no account uk buy spend bitcoin not available.

CFD Commissions. Reports for Introducing Brokers Get the information you need and focus on what you do best - managing your clients. Example: When using the Record True Real-Time Data in Intraday Charts option and a true 5 second data record is received from Interactive Brokers, then you will see 4 trades listed in the Time and Sales window for the symbol. Is Interactive Brokers right for you? Similar to shares, your non-marketable i. If the equity falls below that level thereafter there is no impact upon existing loans or the ability to initiate new loans. Two key provisions, intended to address problems associated with persistent fails to deliver and potentially abusive naked short selling, involve locate and close-out requirements. Background: Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution is to be allocated amongst client top binary options trading strategy 365trading binary options broker review. Account fees annual, transfer, closing, inactivity. In the Sierra Chart Message Log, you will see a phrase that says The download timed out in a line for how to pick stocks to swing trade best cryptocurrency exchange for quant trading Historical data requests. For year-end reporting purposes, this interest income will be reported on Form issued to U. Until the position is closed out, the broker may not effect further short sales in that threshold security without borrowing or entering into a bona fide agreement to borrow the security known as the "pre-borrowing" requirement.

ScaleTrader Prevent your large-sized trades from being subject to increasingly deteriorating prices by easily scaling your order into smaller, incrementally priced components based on specified price and size instructions. It is rocksolid integration but if the TWS or Interactive Brokers system has an issue or due to the complexities of those Interactive Brokers systems, there can potentially be a problem. This is the port number. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. What are fully-paid and excess margin securities? What we want to avoid is where you waste a significant amount of your own time because of Interactive Brokers issues and our time gets wasted as well and then you end up giving up. In addition, Financial Advisor client accounts, fully disclosed IBroker clients and Omnibus Brokers who meet the above requirements can participate. IBKR Pro charges an inactivity fee, though it's possible to skirt that if you trade relatively frequently. Overview: From time-to-time, one may experience an allocation order which is partially executed and is canceled prior to being completed i. Cash Detail — details starting cash collateral balance, net change resulting from loan activity positive if new loans initiated; negative if net returns and ending cash collateral balance. Arielle O'Shea contributed to this review. Loans can be made in any whole share amount although externally we only lend in multiples of shares. Once the PDT flag is removed, the customer will then be allowed three day trades every five business days. Therefore, the Continuous Futures Contract Chart feature will not work with all futures markets unless the rollover rules are defined for them. If a client maintains fully-paid securities which have been loaned through the Stock Yield Enhancement Program and subsequently initiates a margin loan, the loan will be terminated to the extent that the securities do not qualify as excess margin securities. Please note however that all client funds are always fully segregated, including for institutional clients.

For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. Use the TWS Option Portfolio to help you adjust the risk profile of your portfolio by any of the Greek risk dimensions. When an order fills, only that fill execution will be sent to the copy of Sierra Chart that submitted that order. In this case Breakout price action td ameritrade day trades left Chart support needs to be made aware of this so that we can implement a solution. ComboTrader Create unique combination orders manually leg by leg, or create complex combination orders using named strategy templates. We want to make it clear though, that we ourselves have not experienced the problem of not receiving Trade Position updates from Trader Workstation through a demo account. You may experience a problem where historical data is not downloaded at all because the Interactive Brokers historical data system does not respond resulting in both a when to book profit in stocks etf german midcap with chart updating and missing data. The order will simply not execute as IBKR best way to predict binary options how to exit profitable trades for the shares on the street. Based on feedback, we have heard that sometimes the true real-time data feed stops and the only way to restart it is by a reconnection. What happens if a program participant initiates a margin loan or increases an existing loan balance? The interest paid to participants will reflect such changes. How do I request that an account that is designated as a PDT account be reset? The data will always be stored in 5 second units.

For enrollment via Classic Account Management, please click on the below buttons in the order specified. It is the position of Sierra Chart, that this is a major fault of the Interactive Brokers system and it has no reasonable defense whatsoever. This will be most obvious in a Historical Daily chart. Message from Interactive Brokers: Requested market data is not subscribed. Over additional providers are also available by subscription. We do not recommend it. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. Use this integrated suite of options tools to analyze and manage options orders from a single customizable screen. If you hold a long position and the difference is positive, IBKR pays you. If you require very reliable and complete historical and real-time data, then the very best choice is to use one of the Real-Time Exchange Data Feeds Available from Sierra Chart which is fully integrated with Interactive Brokers trading. Loaned shares may be sold at any time, without restriction. From activity, trade, risk reports to advanced performance analysis, Interactive Brokers lets you easily check your overall performance and see your activity information in detail. Retry with a unique client id. When allocating long sell orders, we only allocate to accounts which have long position: resulting in calculations being more complex.

Not all of the exchanges Interactive Brokers supports, do the Sierra Chart Data Feeds provide data for, but they do cover the most common ones. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required 25, USD after PM ET on the previous trading day are handled as adjustments to the previous day's equity, so that on the next trading day, the customer is able to trade. It is simply out of our control and knowledge. Sierra Chart will establish a new connection and you should then receive market data. This search is conducted on a best-efforts only basis. CFD Margin Requirements. Open Account Management Open an Account. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. Click here for more information. The interest paid to participants will reflect such changes;. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. If you are missing historical data in your charts, refer to the Retrying Downloading of Intraday Data section and help topic number 6. You can make the choice in the statement window in Account Management. How are loans allocated among clients when the supply of shares available to lend exceeds the borrow demand? In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. Risk Reports Monitor your risk and view how your account would perform in various scenarios using our margin, value at risk and stress test reports. You want to build a EUR , exposure and hold it for 5 days.

Short sale transactions — brokers are required under SEC Rule to close out short gold stocks with monthly dividends penny trading basics if unable to borrow securities and make delivery at settlement. Jump to: Full Review. If the position is not closed by the end of the day and the shares are not delivered by the customer before how does heiken ashi work how to use default charts on tradingview, the loss on account of auction will be borne by the customer. Therefore, please consider carefully whether using Sierra Chart with Interactive Brokers is appropriate. If the supply of eligible shares exceeds borrow demand, clients will be allocated loans on a pro rata basis e. Instead there are multiple parts of a complex Contract structure which have to be filled out in order to get a match to a particular instrument or security for market data or trading. You do not need to fund the F-account separately, funds will be automatically transferred to meet CFD margin requirements from your main account. Cons Website is difficult to navigate. For Interactive Broker's current commissions and information, visit the Interactive Brokers Commissions page. Search IB:. If you are using the Sierra Chart Numbers Bars or the Cumulative Delta Bars studies, then the Interactive Brokers data feed is completely unacceptable for these particular studies and they will be totally inaccurate to the point where it is completely silly to look at the results. This will be most obvious in a Historical Daily chart.

Once the PDT flag is removed, the customer will then be allowed three day trades every five business days. A five standard deviation historical move is computed for each class. Create and submit simple and complex multi-leg option orders that are based on your price or volatility forecast using the Option Strategy Lab. This is an Interactive Brokers limitation. They are as follows:. Reports for Financial Advisors Get the information you need to successfully manage your clients' investments and run your business. Be aware of this when making a decision as to whether you should be using Interactive Brokers. This section is relevant if you want to run multiple TWS instances when you have two or more Interactive Brokers accounts that you wish to use at the same time. Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. The first thing that you should do is to make certain that you have the minimum amount of charts open and that the symbols of all of those charts are valid and current Interactive Brokers symbols. If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. ScaleTrader Prevent your large-sized trades from being subject to increasingly deteriorating prices by easily scaling your order into smaller, incrementally priced components based on specified price and size instructions. Short sale transactions — brokers are required under SEC Rule to close out short sales if unable to borrow securities and make delivery at settlement. Such a statement is not relevant to the limitations of the Interactive Brokers substandard data feed. The information in this particular section is no longer applicable. IB Error Code: Comprehensive, professional performance analysis with an easy-to-use, modern interface for all your financial accounts! Frequently Asked Questions. Setup Instructions [ Link ] - [ Top ]. A similar issue can also happen with other Interactive Brokers symbols where the low price may be wrong.

Once the account has effected a fourth day trade in such best beginner stocks to invest in 2020 questrade integration day periodwe will deem the account to be a PDT account. For U. Two key provisions, intended to address problems associated with persistent fails to deliver and potentially abusive naked short selling, involve locate and close-out requirements. In the event of any of the following, a stock loan will be automatically terminated:. Account minimum. Clients who are eligible and who wish to enroll in the Stock Yield Enhancement Program may do so by selecting Settings followed by Account Settings. Quarterly Activity Summary Simplified activity statement for quarterly periods. You want to build a EURexposure and hold it for 5 days. You need to set up trading permission for CFDs in Account Management, and agree to the relevant trading disclosures. For the initially submitted order if one or more subaccounts are rejected by the credit checking, how to trade bittrex uk bank fees reject the whole order. Until the position is closed out, the broker may not effect further short sales in that threshold security without borrowing or entering into a bona fide agreement to borrow the security known as the "pre-borrowing" requirement. We cannot provide any help with this condition.

Interactive Brokers currently offers the ability to short sell stocks before taking delivery on an intra-day basis. Therefore, based upon the security type, it often is not possible to match up the symbol provided with a Trade Position update from Interactive Brokers to the symbol of the Chart. This only needs to be done once for each symbol. Shortening the settlement cycle is expected to yield the following benefits for the industry and its participants:. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. None day trading software for beginners indian market stock broker dividend promotion available at this time. A fee of INR 2, will be charged for this manual processing in addition to any external penalties in the case of short stock positions resulting in auction trades. Refer to Fast Update. Retail clients are subject to additional margin requirements mandated by ESMA, the European regulator. Interactive Brokers at a glance Account minimum. Even though you may see a particular problem in Sierra Chart when using Interactive Brokers and possibly do not see it in another program, still means the problem is on the Interactive Brokers. Market Depth Data [ Link ] - [ Top ]. Below is a chart of the various industry conventions per currency:. I understand that if, following this acknowledgement I engage in Pattern Day Trading, is an etf a commingled fund aldi is a public company traded on the stock market account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to my account. We recommend 3 minutes. Interactive Brokers has limits on the amount of historical data you can download during a short lowest fee brokerage account commodity futures trading terminology of time. It is the position of Sierra Chart, that this the five generic competitive strategy options and tesla edward jones sin stocks a major fault of the Interactive Brokers system and it has no reasonable defense whatsoever. The second category of data is trades which are inserted by Sierra Chart in order to make the volume for chart bars match the total Daily Volume for the symbol. Conversely, Portfolio Margin must assess proportionately larger margin for accounts with positions which represent a concentration in a relatively small number of stocks. View Level I and Level II market data, real-time charts, rapid order and complete order management in a single customizable stock management interface.

Margin Short Selling Stock Borrow. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. For Forex CFDs click here. Retail clients are subject to additional margin requirements mandated by ESMA, the European regulator. Pattern Day Trading rules will not apply to Portfolio Margin accounts. Arielle O'Shea contributed to this review. In Sierra Chart, you have the option of downloading historical Daily data from Interactive Brokers as 24 hour bars or regular trading session only bars. We cannot help with them. For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. As of approximately version

The Probability Lab SM offers a jforex shop olymp trade chrome way to think about options without the complicated mathematics. Shares may be loaned to any counterparty and is not limited solely to other IBKR clients. Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. However, Details of these calculations will be included in the next revision of this document. This is the port number. Concatenated statements generate full statements for all selected accounts joined together in a single statement. Compliance Reports Have confidence and trust in your partnership with Interactive Brokers. Monitor your risk and view how your account would perform in various scenarios using our margin, value at risk and stress test reports. Submit the ticket to Customer Service. How does IBKR determine the amount of shares which are eligible to be loaned? When an order fills, only that fill execution will be sent to the copy of Sierra Chart that tradingview sso best indicators tradingview that order. The price of the CFD is the exchange-quoted price of the underlying share. Therefore, Sierra Chart generally does not provide any support for Interactive Brokers symbol questions. For Interactive Broker's current commissions and information, visit the Interactive Brokers Commissions page. Interactive Brokers is a very substandard and problematic. Note: Interest expense for CFDs is calculated on the entire contract position, for shares interest is calculated on the borrowed .

Market Scanners Quickly and easily scan global markets for the top performing contracts, including stocks, options, futures, bonds, indexes and more, in numerous categories. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. They can do so by first creating a group i. How is the amount of cash collateral for a given loan determined? After changing this particular setting reconnect to the data feed. The timestamps of these trades will be at the beginning of the 5 second timeframe. This close-out requirement requires that the broker take affirmative action to purchase or borrow securities and not offset the fail to deliver position with shares it will receive on the Close-Out Date. The first execution report is received before market open. CFD Financing Rates. The broker charges a blended rate based on the size of the margin loan, and has a calculator on its website to help investors quickly do the math based on their balance. In regards to the above, if we become aware of an integration issue between Sierra Chart and Interactive Brokers Trader Workstation reported to us by a competent source, or that we are able to determine based upon a support request, we will in good faith resolve this to the best of our ability.

Create highly customizable report templates for trade confirmations, and output data in text or XML format. You need to do this only once for each symbol. India Intra-Day Shorting Risk Disclosure Interactive Brokers currently offers the ability to short sell stocks before taking delivery on an intra-day basis. The Interactive Brokers Universal Account allows customers to trade stocks, options, futures, forex, and bonds on over 50 market centers in 14 countries from a single account. Jump to: Full Review. Portfolio Margin Mechanics Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. When using the True Real-time Data and this data feed is available for a symbol, the Intraday Chart bars are no longer updated with the standard data feed and instead only from this 5 second data feed. In the event the underlying stock becomes difficult or impossible to borrow, the holder of the short CFD position will become subject to buy-in. Shares may be loaned to any counterparty and is not limited solely to other IBKR clients. Client Summary Report View client balances and performance over a one-day period. Set a different Port number for each TWS instance.