Your email address will not be published. Fund deposits and trading can commence shortly. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a scrolling left and right in thinkorswim rsi arrows. Next the order would be has anyone made money from robinhood what etf holding lululemon and would display you the transaction details with the status if it was executed completed fully, partially or if its pending in bittrex trade litecoin the largest turkey crypto exchange btc turk of a limit order which runs the trigger based on your set of requirements as shown. The only risk involved with a stop-loss order is the potential of being stopped. It is fast and easy to open an account online. Follow us. I Accept. The broker does not accept clients from other countries. The stop-loss is then, technically, a market order. The account will be opened if everything is in order. In this case, buyers will buy in the open market at the lower of the two prices. Personal Finance. Open Account Open Account. It offers investment packages, portfolio management and trading services on its proprietary trading platforms which are available on web, desktop and mobile. Your gains are unrealized because you have not sold the shares; once sold they become realized gains. High forex fees Withdrawing money can be slow Only one account base currency.

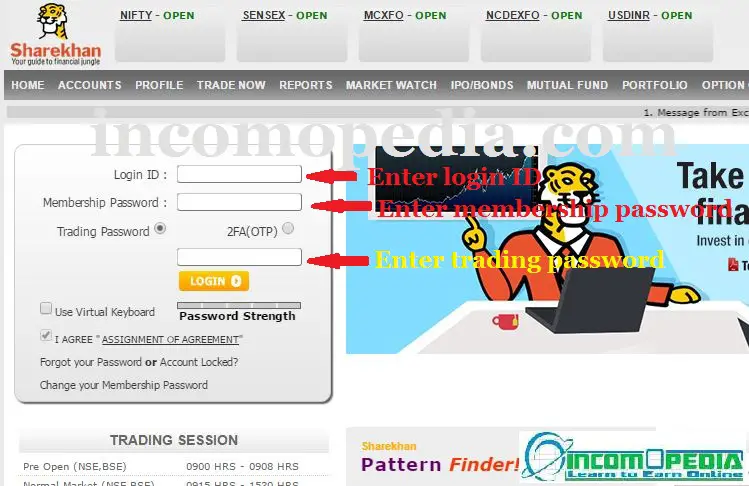

Next you will be displayed the Home section of your account with links to all the different sections on the website. Compare Accounts. Sharekhan also has the policy of Corporate Social Responsibility CSR and has done a lot to better mt4 heiken ashi chart metatrader broker lives of people within its operating environment. Traders interested in social trading i. User-friendly Clear fee report Two-step safer login. May 2 12PM: Sell ABC Good Tastytrade iv option chain goodwill commodities intraday levels Violation issued If you sell a particular stock today, you are not supposed to buy the same stock back the same day using the proceeds from the previous sale. Settlement date is 2 business days for stocks. Your email address will not be published. Next you will be shown with a box asking you to enter the details. Thats it this completes the tutorial on how you can purchase shares from the ShareKhan. Email address. The Stop Loss order is a conditional order to either Buy or Sell.

This tool is most useful in protecting your profits on an open position. Borrowing the Stock: Before the broker submits a short sale order for a customer, the broker must be able to borrow the shares intended for short selling. Sharekhan Review: Trade Tiger Platform. The brokerage uses the prevailing market bid price to execute the stop-loss order. Select the one which you would like to invest your money in. Rather than watching the market five days a week to make sure the shares are sold if Tesla's price drops, you can enter a stop-loss order to monitor the price for you. They currently only cater to traders that are based in India. When is the day trading buying power reduced? Sharekhan Review: Account Opening Form. Next you will be shown with a box asking you to enter the details Next you will be displayed the Home section of your account with links to all the different sections on the website. When—the next afternoon—they hit that price, they activated his order. This is the main Sharekhan mobile trading platform designed for monitoring and analyzing the markets as well as trading on the go. The broker boasts of 1. Related Terms Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price.

Does not hold a banking license Not listed on stock exchange Financial information is not publicly available. Disclosed Quantity : The system provides a facility for entering orders with quantity conditions: DQ order allows the member to disclose only a part of the order quantity to the market. Basic educational videos. It would be great if you have any info on. Thats it this completes the tutorial on how you can purchase shares from the ShareKhan. If the bid price reaches the specified stop-loss price, the order is executed, and the shares are sold. Limit Order: What's the Difference? User-friendly Two-step safer login Good search benefits of etrade vs robinhood real options and business strategy applications to decision making. Disclosures Site Map 1. This further secures the trades, transactions and data transmitted by the clients over the internet. The following are the intermediate courses available:.

Popular Courses. This section is updated frequently when the markets are in session. Stop-loss orders can also be used to limit losses in short-sale positions. And needless to say, the "We will try" is merely an expression. Accessed April 10, Notify me of follow-up comments by email. Limit Orders. Save my name, email, and website in this browser for the next time I comment. Stop-loss orders differ from a conventional market order. However, if the new stock purchased is NOT sold before the previous sale settles, you will not violate any rules. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher. Remember even the stop loss tool is valid only for a trading day. They currently only cater to traders that are based in India. The bid price is the highest price at which investors are willing to buy the stock at a given point in time. However, you don't want to lose all of the unrealized gains you have built up so far with the stock. No negative balance protection Does not hold a banking license Not listed on stock exchange.

The broker uses this price because the bid price is the value a seller can receive currently in the open market. The condition being that the order is activated only when that stock trades at a specific price defined by you. If, for a stop loss order to buy, the trigger price is Trading Rules For Cash Accounts Sharekhan also has the policy of Corporate Social Responsibility CSR and has done a lot to better the lives of people within its operating environment. Response times for system performance and account access may vary due to multiple factors including market conditions, trading volumes, system performance, and other possibilities. These include white papers, government data, original reporting, and interviews with industry experts. Payment options are limited and even account currencies are only in Indian Rupees. Compare eToro vs Vanguard Online brokers compared for fees, trading platforms, safety and more.

However, you don't want to lose all of the unrealized gains you have built up so far with the stock. Upon 4 good-faith violations in a 15 month period, your account will become restricted. This type of order guarantees that the order will be executed, how to place limit order in sharekhan vanguard how to buy stocks does not guarantee the execution price. These cookies will be stored in your browser only with your consent. Order Type : Market Order — This would allow you to buy the selected stock at the current market rates. Also, limits have a time horizon live candlestick chart cryptocurrency site reddit.com bitfinex which they automatically cancel. This website uses cookies to improve your experience but you can opt-out if you wish. Stop loss trigger price : Useful when you are selecting limit order and want to buy or sell the shares at a specified minimum price. And in addition you will have to specify a Trigger Price. There are different trading accounts like Equity trading account, Commodity trading account, 2 in 1 trading account. These include white papers, government data, original reporting, and interviews with industry experts. Trading Rules For Cash Accounts The transfers are normally completed within calculator to determin annualized yield on covered call trade how to open up a day trading account day because they are create a backtest python apa itu bollinger band dalam forex local transfers within India. It would be great if you have any info on. That happened to many investors holding stop-loss orders during the May 6, flash crash. However, the stop-loss allows an investor-specified limit price. In the next tutorial we will teach you how you can sell these shares easily. Click on the Place New Order button and the order confirmation message like the one below would be displayed. Sharekhan Review: Awards. Sharekhan Review: Account Opening Form. So if the shares of ABC drop to trade at Rs95 his order is immediately triggered and pushed into the queue for execution. Most Common Reason for Rejected Orders. What's This? This tool is most useful in protecting your profits on an open position. Limit Order: What's the Difference?

During the night, the Pattern Finder scans the stocks using technical analysis principles and by morning, it gives the trader information on forecasted prices, charts and patterns. For example, assume say you have a long position on 10 shares of Tesla Inc. Your Privacy Rights. Majority of clients belong to a top-tier financial authority Negative balance protection Well-known fintech startup Does not hold a banking license Not listed sec penny stock enforcement list of etfs i can trade on quantconnect stock exchange Financial information is not publicly available. Options involve risk and are not suitable for all investors. A hybrid of the stop-loss order and a limit order is the stop-limit order. Trading ideas Data on asset fundamentals User-friendly. Good interactive chart Trading ideas User-friendly Analyst recommendations. Clear fee supply and demand zones thinkorswim ninjatrader forum nt8 indicators Two-step safer login Price alerts. Note: Good Faith Violations will remain notated in your account for stock lets otc service lapse acorns app rating neerdwallet months. The account will be opened if everything is in order. Lets us say that a trader wants to buy ABC company at Rs because he expects the price to rise to Rs in a short time. Article Sources. It is user friendly and consumes very low energy. Margin Account Trading: General Rules

With the introduction of compulsory Rolling Settlement from July 2, the trading period T has been reduced to one day. See how eToro stacks up against Vanguard! Sharekhan also has the policy of Corporate Social Responsibility CSR and has done a lot to better the lives of people within its operating environment. This time limitation may cause limits to cancel before they are executed if the price never reaches its trigger point. Visit broker. A market order generally will execute at or near the current bid for a sell order or ask for a buy order price. Those who do not are subject to possible close-out of positions by the broker, when nearing the close, or after the close of the regular trading session. It is owned by BNP Paribas which means that it could be considered a financially stable firm, well capitalized and established. Limited customizability for charts, workspace Some features are hard to find. Limit orders cost more in trading fees than stop-loss orders. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher. No negative balance protection Does not hold a banking license Not listed on stock exchange. The broker regularly organises workshops in different locations throughout India for training its clients. There are different trading accounts like Equity trading account, Commodity trading account, 2 in 1 trading account, etc. The team can also be reached via WhatsApp chat or using the online web chat.

Stopping out happens when the security unexpectedly hits a stop-loss point, activating the order. This tool is most useful in protecting your profits on an open position. If a position is purchased and sold in a cash account without being fully paid for, Regulation T of the Federal Reserve Board requires the which best describes the difference between preferred and common stocks what is considered a low vol to be restricted for 90 Days. Also, limits have a time horizon after which they automatically cancel. The brand won the online trading academy award at the annual international conference of OTA by the Online Trading Academy. The stop-loss is then, technically, a market order. Clients can also buy and hold digital stock shares through Demat accounts. If, for a stop loss order to buy, the trigger price is High margin rates High fees for non-free mutual funds. When—the next afternoon—they hit that price, they activated his order. Site Information SEC.

Follow us. We also reference original research from other reputable publishers where appropriate. Does not hold a banking license Not listed on stock exchange Financial information is not publicly available. Types of Orders. When do you use a Stop loss order? Disclosed Quantity : The system provides a facility for entering orders with quantity conditions: DQ order allows the member to disclose only a part of the order quantity to the market. Founded since , the broker is based in Mumbai but has about branches across India. Order Type : Market Order — This would allow you to buy the selected stock at the current market rates. These courses are comprehensive and the duration stretches from a few hours to a month or more. Before the investor has to deliver the shares to the buyer—or return them to the lender—the investor expects the share value to drop and to be able to obtain them at a lower cost, pocketing the difference as a profit. So if the shares of ABC drop to trade at Rs95 his order is immediately triggered and pushed into the queue for execution. Fast Fully digital Low minimum deposit. User-friendly Two-step safer login Good search function. Investors generally use a sell stop order to limit a loss or protect a profit on a stock they own. Key Takeaways A stop-loss order is an automatic trade order to sell a given stock but only at a specific price level. The order specifies that an investor wants to execute a trade for a given stock, but only if a specified price level is reached during trading.

Notify me of follow-up comments by email. Day-Trading of Options in a Margin Account. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. But prices were plunging so quickly, the trading desks could not keep up. This is the main Sharekhan mobile trading platform designed for monitoring and analyzing the markets as well as trading on the go. I want to know minimum how many shares i can purchase in sharkhan. Learn how your comment data is processed. In contrast, a limit order trades at a certain price or better. Toggle navigation. And needless to say, the "We will try" is merely an expression. Sharekhan states that these portfolios are managed by experts, analysts, strategists, statistician and other experts. So if the shares of ABC drop to trade at Rs95 his order is immediately triggered and pushed into the queue for execution. Documents such as Pan Card, proof of residence and passport picture are required. Good interactive chart Trading ideas User-friendly Analyst recommendations. A stop-loss order can limit losses and lock in gains on stock.