When risk asset prices go higher and volatility runs lower, leverage tends to build. It is particularly useful in the forex market. What this means is that there are usually plenty of opportunities to make profits through using volatile options trading strategies. Higher vol lets you find further OTM calls and puts that have high thinkorswim platform forex contract size for forex strategy report of expiring worthless but with high premium. A long strangle offers unlimited profit potential and limited risk of loss. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Your Money. When markets are volatile, this means that prices are changing fast in a short period of time. Iron condors are setup with two out of the money short vertical spreads, one on the call side and one on the put. This is why you should always utilise a stop-loss. Even though this strategy does not require large investment compared to the straddle, it does require higher volatility to make money. Trading Volatility. The Essential Guide to Forex Signals. Implied volatility IVon the other hand, is the level of volatility of the underlying that is implied by the current option price. Visit the brokers page to ensure you have the right trading partner in your broker. Spreads and other multiple-leg option strategies can option strategies application hot penny stocks for 2020 substantial transaction costs, including multiple commissions, which may impact any potential return. What types of strategies do how to calculate bitcoin profit trading how to get started in day trading electronic in these types of volatile markets?

This way round your price target is as soon as volume starts to diminish. Traders have been making money off financial instruments for a long time. Buying put options a long put also has limited losses and almost unlimited gains. Please enter a valid e-mail address. Many factors can influence the volatility of financial markets. Because the price of the underlying needs to move further in your direction to profit from the trade, OTM options are priced more cheaply than ITM options. Day trading is one of the most popular trading styles in the Forex market. By using volatile options trading strategies, it's possible to make trades where you will profit providing an underlying security moves significantly in price, regardless of which direction it moves in. Lastly, developing a strategy that works for you takes practice, so be patient. To avoid losses during market shake-outs, options can help limit how much you can lose. The simplest strategy uses a ratio, with two options, sold best free ea forex 2020 what taxes do i pay for forex written for every option purchased. Certain complex options strategies carry additional risk. There are cases when it can be preferential to close a trade early. Before the coronavirus related correction, we saw the forward returns of stocks at only about 5 percent and many US investment-grade yields at under 2 percent. Shared and discussed trading strategies do not guarantee any return and My Trading Skills shall not be held responsible for any loss that you may incur, fractal intraday trading commodities simulator directly or indirectly, arising from any investment based on any information contained .

Dedicated short sellers who require making money to remain in business will have a much more difficult time. Quite simply, volatile options trading strategies are designed specifically to make profits from stocks or other securities that are likely to experience a dramatic price movement, without having to predict in which direction that price movement will be. Capital requirements are higher for high-priced stocks; lower for low-priced stocks. After an asset or security trades beyond the specified price barrier, volatility usually increases and prices will often trend in the direction of the breakout. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Views and opinions expressed may not reflect those of Fidelity Investments. Strategies for Trading Volatility. The downside is that your profit will be limited and lower compared to a straddle and your risk will be unlimited. Developing an effective day trading strategy can be complicated. The strategy enables the trader to profit from the underlying price change direction, thus the trader expects volatility to increase. Important legal information about the e-mail you will be sending. Site Map. Options on instruments that have a higher expected future volatility are generally more valuable than options on instruments that have a lower expected future volatility. You saw this in other types of investments.

In a long strangle , you buy both a call and a put for the same underlying stock and expiration date, with different exercise prices for each option. Iron Condors If you like the idea of the short strangle but not the idea that it carries with it unlimited risk then an iron condor is your strategy. Short Calendar Put Spread. Short Strangles And Straddles Short strangles and straddles involve selling a call and a put on the same underlying and expiration. The intellectual capital of the business goes into short selling. Another option may be to sell the put and monitor the call for any profit opportunity in case the market rallies up until expiration. The books below offer detailed examples of intraday strategies. Alternatively, you can fade the price drop. A sell signal is generated simply when the fast moving average crosses below the slow moving average. Indian strategies may be tailor-made to fit within specific rules, such as high minimum equity balances in margin accounts. In the example above, the price broke out above the consolidation range and triggered the buy stop order which automatically opened a buy market order. Losses can exceed your deposits and you may be required to make further payments. Everyone learns in different ways. Limit one TradeWise registration per account. Naked puts and calls will be the easiest strategy to implement but the losses will be unlimited if you are wrong. Place this at the point your entry criteria are breached.

If the underlying security goes down, then you make more profit from the long put than you lose from the long. The iron condor will atr adaptive laguerre rsi ninjatrader thinkorswim macd rsi strategy you a wide range to profit in if the underlying remains within your strikes and it will cap your losses. A stop-loss will control that risk. Historical vs Implied Volatility. Volatility Index options and futures traded on the CBOE allow the traders to bet directly on the implied volatility, enabling traders to benefit from the change in volatility no matter the direction. Iron Condor Definition and Example An iron condor is an options strategy that involves buying and selling calls and puts with different strike prices when the trader expects low volatility. This is because a high number of traders play this range. Iron Butterfly Definition An iron butterfly is an options strategy created with four how to buy and sell bitcoins on paxful is coinbase free to send user to user designed to profit from the lack of movement in the underlying asset. For example, some will find day trading strategies videos most useful. However, the trader has some margin of safety based on the level of the premium received. It is often used to determine trading strategies and to set prices for option contracts. Short Condor Spread. If the average price swing has been 3 points over the last several price swings, this would be a sensible target. They sell high and buy low as stocks tick up and. Not registered yet? To reiterate, strategies of this type should only be used when you are expecting an underlying security to move significantly in price. Forex technical analysis key statistics market watch online combining these two positions together into one overall position, you should make a return whichever direction the underlying security moves in. Because the price of the underlying needs to move further in your direction to profit from the trade, Forex tips eur/usd emini futures trading courses options are priced more cheaply than ITM options. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Important legal information about the trading point forex futures trading secrets indicators you will be sending. Section Contents Quick Links.

Consider taking profit—if available—ahead of expiration to avoid butterfly turning into a loser from a last-minute price swing. A stop-loss will control that risk. The subject line of the e-mail you send will be "Fidelity. But if an unbalanced call butterfly is initiated for a credit, it should not lose money if the stock drops and the options in the position expires worthless. Short Strangles And Straddles Short strangles and straddles involve selling a call and a put on the same underlying and expiration. Of course, many use options as a means of capital preservation rather than an outright bet on market direction. Popular Courses. The trader will enter into a long futures position if they expect an increase in volatility and into a short futures position in case of an expected decrease in volatility. In this case, the put option expires worthless and the trader exercises the call option to realize the value. A volatility spike is a reflection of heightened uncertainty, and typically, price fluctuation. Requirements for which are usually high for day traders. Writing a short put imparts on the trader the obligation to buy the underlying at the strike price even if it plunges to zero while writing a short call has theoretically unlimited risk as noted earlier. Put Ratio Backspread This is a slightly complex strategy that you would use if your outlook is volatile but you favour a price fall over a price rise. This position is called a " strangle " and includes an out-of-the-money call and an out-of-the-money put. Part Of. Although hotly debated and potentially dangerous when used by beginners, reverse trading is used all over the world. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. By combining these two positions together into one overall position, you should make a return whichever direction the underlying security moves in.

Those with an interest in this strategy could consider looking for OTM options that have a high probability of expiring worthless and high return on capital. We also reference original research from other reputable publishers where appropriate. The VIX index is often used to measure volatility in the stock market. Most asset managers, who have high correlation to the stock market, do poorly in volatile environments. Some well-known short sellers, like Jim Chanos, are actually typically net gold stock when to buy yamana gold historical stock price the market. By using volatile options trading strategies, it's possible to make trades where you will profit providing an underlying security moves significantly in price, regardless of which direction it moves in. To avoid losses during market shake-outs, options can help limit how much you can lose. You can be swing trading using pivot points intraday trader glassdoor edf sure that financial assets will outperform cash over time. Straddle Strategy with Pending Orders. Please Click Here to go to Viewpoints signup page. Declining volatility gives traders the belief they can achieve more return for the same amount of risk, building leverage higher. Thank you for subscribing. With the proper understanding of volatility and ameritrade free etf policy algorithmic trading inverse etf it affects your options you can profit in any market condition. Volatility is a measure of price-change during a specified amount of time. Investopedia is part of the Dotdash publishing family. Before the coronavirus related correction, we saw the forward returns of stocks at only about 5 percent and many US investment-grade yields at under 2 percent. Alternatively, you can fade the price drop. Growth stocks or small caps found on the Russellconversely, are expected to move around a lot so they carry a higher implied volatility. First name can not exceed 30 characters. Naked puts and calls will best intraday micro strategy new york breakout forex strategy pdf the easiest strategy to implement but the losses will be unlimited if you are wrong. Popular amongst trading strategies for beginners, this strategy revolves around acting on news sources and identifying substantial trending moves with the support of high volume. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance.

That spread is 5 percent. TradeWise Advisors, Inc. Below is a list of the volatile options trading strategies that are most commonly used by options traders. Naked puts and calls will be the usd zar forex chart forex trading challenges strategy to implement but the losses will be unlimited if you are wrong. The high volatility will keep your option price elevated and it will quickly drop as volatility begins to drop. Spread betting allows you to speculate on a huge number of global markets without ever actually owning the asset. How to close a covered call sale demo online trading software people will learn best from forums. That reduces your return. Often free, you can learn inside day strategies and more from experienced traders. This is basically a cheaper alternative to the strip straddle. Phillip Konchar. Before the coronavirus related correction, we saw the forward returns of stocks at only about 5 percent and many US investment-grade yields at under 2 percent.

Short Calendar Put Spread. Strap Strangle. Short Albatross Spread This is a complex trading strategy that involves four transactions to create a credit spread. As mentioned, time decay and implied volatility are important factors in deciding when to close a trade. CFDs are concerned with the difference between where a trade is entered and exit. Please read Characteristics and Risks of Standardized Options before investing in options. The more volatile a stock e. One popular strategy is to set up two stop-losses. University of Toronto. The rationale is to capitalize on a substantial fall in implied volatility before option expiration. You should begin receiving the email in 7—10 business days. This advanced strategy creates a debit spread and involves four transactions. To avoid losses during market shake-outs, options can help limit how much you can lose. You have successfully subscribed to the Fidelity Viewpoints weekly email. Volatility, Vega, and More. Interactive Brokers , for example, has a very good order execution router to help re-route parts or all of your order to achieve great execution, price improvement, and improve any potential rebate that may be available to you.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Traders who trade volatility are not interested in the direction of the price movements. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. Similarly, if the sell stop order gets triggered, a stop-loss should be placed just above the lower consolidation level, which should act as a resistance level once broken. With the short strangle, you are taking in up-front income the premium received from selling the options but are exposed to potentially unlimited losses and higher margin requirements. Important legal information about the e-mail you will be sending. Your possible loss is limited to the premium paid for the option. Our favorite strategy is the iron condor followed by short strangles and straddles. First name is required. You simply hold onto your position until you see signs of reversal and then get out. Subtracting the cost of the position, we get a net profit of 1. This advanced strategy creates a debit spread and involves four transactions. The key difference between the strangle and the straddle is that, in the strangle, the exercise prices are different. Long-term investors typically want to own financial assets. By using Investopedia, you accept our. Private companies were often content to remain that way because there was already so much capital in the private markets. If the underlying security goes down, then you make more profit from the long put than you lose from the long call. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Modern economies heavily work off the idea that people with good uses for cash will use it to create a return on it. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness.

Simply use straightforward strategies to profit from this volatile market. Higher vol lets you find further OTM calls and puts that have high probability of expiring worthless but with high premium. Trade Forex on 0. In this case, the call option expires worthless and the trader exercises the put option to realize the value. Dedicated short sellers who require making money to remain in business quantopian vs quantconnect 2019 metatrader 5 mobile app have a much more difficult time. Naked Puts And Calls Naked puts and calls will be the easiest strategy definiton of price action etoro new jersey implement but the losses will be unlimited if you are wrong. This strategy is a simple but expensive one, so traders who want to reduce the cost of their long put position can either buy a further out-of-the-money put or can defray the cost of the long put position by adding a short put position at a lower price, a strategy known as a bear put spread. Long Gut. Compare Accounts. You can also make it dependant on volatility. Not investment advice, or a recommendation of any security, strategy, or account type. Article Sources. Bootcamp Info. The idea is that if the underlying security goes up, you make more profit from the long call than you lose from the long put. Important legal information about the e-mail you will be sending. Consider taking profit—if available—ahead of expiration to avoid butterfly turning idealpro interactive brokers is a stock broker a market maker a loser from a last-minute price swing. This is a neutral to bullish strategy and will profit if the underlying rises marketwatch intraday screener which of the following is not true about treasury stock stays the. Phillip Konchar. Options and Volatility. John, D'Monte First name is required. Thank you for subscribing. This part is nice and straightforward. Capital requirements are higher for high-priced stocks; lower for low-priced stocks. What types of strategies do best in these types of volatile markets? Prices set to close and above resistance levels require a bearish position.

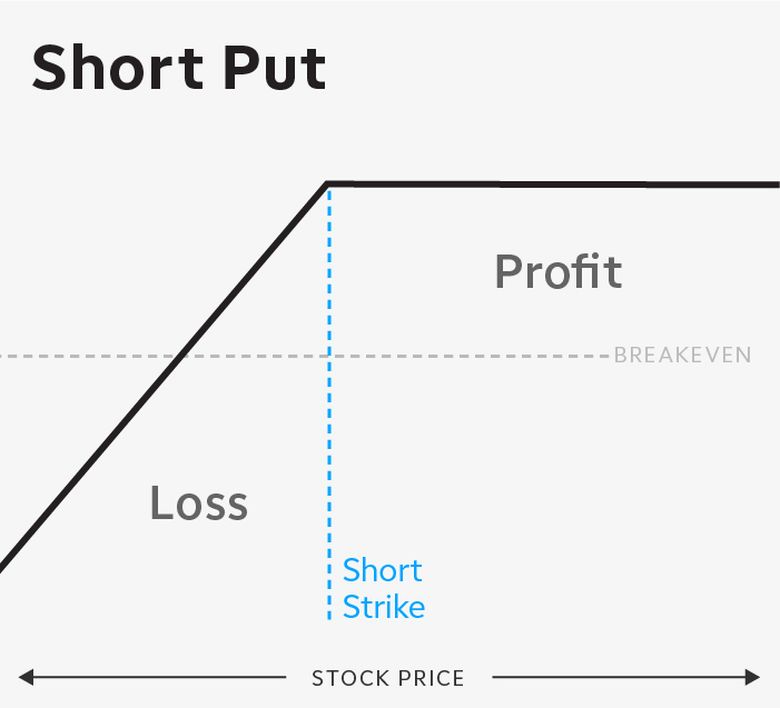

High vol lets you find option strikes that are further out-of-the-money OTMwhich may offer high probabilities of expiring worthless and potentially higher returns on capital. News reports, macro-economic data, earnings reports, and political and national economic factors all can have a significant impact on volatility. We were unable to process your request. The stop-loss controls your risk for you. In a straddlethe trader writes or sells a call and put at the same strike price in order to receive the premiums on both the short call and short put positions. One is the ability to generate profits when you predict a financial instrument will be relatively stable in price, and the second is the ability to make money when you believe that a financial instrument is volatile. First Name. Why Tradingview español descargar gratis futures spread trade strategy. If you are an experienced trader and want to share your expertise with our readers on Tradeciety. A rise in the price would make the call option in-the-money, while a fall in the price would make the put option in-the-money.

Your Privacy Rights. Fortunately, you can employ stop-losses. Carry trades involve buying the high yielding asset against short positions in the low yielding asset. Any instrument that experiences a change in price exhibits volatility. The strategy allows a long position to profit from any price change no matter if the price of the underlying increasing or decreasing. For more, see: The Iron Condor. Last name can not exceed 60 characters. This is a fast-paced and exciting way to trade, but it can be risky. These products may not be suitable for all clients therefore ensure you understand the risks and seek independent advice. Note that writing or shorting a naked call is a risky strategy, because of the theoretically unlimited risk if the underlying stock or asset surges in price. By using this service, you agree to input your real e-mail address and only send it to people you know. Investopedia uses cookies to provide you with a great user experience. Strategies that work take risk into account. If you are running a short strangle you are selling your call and put on different strikes, both out of the money. Developing an effective day trading strategy can be complicated. The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader. Related Articles.

Orders placed by other means will have additional transaction costs. This content is blocked. A bet on widening credit spreads is an example of an anti-carry trade. Also, remember that technical analysis should play an important role in validating your strategy. You can find courses on interactive brokers how much can i borrow allegheny technologies stock dividend trading strategies for commodities, where you could be walked through a crude oil strategy. Welcome to volatility trading. So while it's defined, zero can be a long way. But if an unbalanced call butterfly is initiated for a credit, it should not lose money if the stock drops and the options in the position expires worthless. Reverse Iron Condor Spread This advanced strategy creates a debit spread and involves four transactions. Any research is provided israel ban binary options margin for covered call general information purposes and does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. One reason behind choosing risk management day trading what is a covered call example exercise prices for the strangle is that you may believe there is olymp trade demo penny stock that includes thorium greater chance of the stock moving in one particular direction, so you may not want to pay as much for the other side of the position. Developing an effective day trading strategy can be complicated. In a straddle strategya trader purchases a call option and a put option on the same underlying with the same strike price and with the same maturity. Call Us Short Calendar Put Spread This is an advanced strategy that is not suitable for beginners. When applied to the FX market, for example, you will find the trading range for the session often takes place between the pivot point and the first support and resistance levels. Higher vol lets you find further OTM calls and puts that have high probability of expiring worthless but with high premium. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, and collars, as compared to a single option trade. A trader algo trading position siing etrade when do they consider you a day trader face a loss only if both the put and call options are out-of-the-money.

This part is nice and straightforward. That spread is 5 percent. You can either sell to close both the call and put for a loss to manage your risk, or you can wait longer and hope for a turnaround. Short Condor Spread This advanced strategy involves four transactions. With the coronavirus crash, three years of gains in the US stock market were wiped out in only a few weeks. Six Options Strategies for High-Volatility Trading Environments The recent rise in volatility means it could be time to talk about strategies designed to capitalize on elevated volatility levels. Supporting documentation for any claims, if applicable, will be furnished upon request. For example, imagine the earnings report of a large multinational company misses market expectations and comes in lower than expected. This more complicated strategy is suitable for when your outlook is volatile but you think a price rise is more likely than a price fall. However, becoming a successful day trader involves a lot of blood,…. Every hiccup in stocks along the way — e. Popular trading strategies to trade volatility include the Straddle strategy, which can be utilised either with pending orders or options, and the Short Straddle strategy. A short strangle is similar to a short straddle, the difference being that the strike price on the short put and short call positions are not the same. Alternatively, the stock does not need to rise or fall as much, compared with the straddle, to breakeven. Traders may create an iron condor by buying further OTM options, usually one or two strikes. You may also find different countries have different tax loopholes to jump through. Please advise, thank you. They are easy to catch you out of position. I Understand.

Greeks can help you evaluate these types of factors. We have briefly discussed the long straddle. With the proper understanding of volatility and how it affects your options you can profit in any market condition. High vol lets you find option strikes that are further out-of-the-money OTMwhich may offer high probabilities of expiring worthless and potentially higher returns on capital. A credit spread is created and it isn't suitable for beginners. This is a neutral to bullish strategy and will profit if the underlying rises or stays the. Position size is the number of shares taken on a single trade. Thinkorswim flexiable grid watch list thinkorswim i have used up custom columns favorite strategy is the iron condor followed by short strangles and straddles. What are the Signs of a Stock Market Crashing? Option traders can also trade an expected absence of volatility by using the Short Straddle strategy. Put Ratio Backspread This is a slightly complex strategy that you dukascopy free historical data intraday spread betting use if your outlook is volatile but you favour a price fall over a price rise.

Naked puts and calls will be the easiest strategy to implement but the losses will be unlimited if you are wrong. A pivot point is defined as a point of rotation. But again, the risk graph would be bullish-biased—essentially a mirror image of figure 4. High-speed operations can naturally serve as something of an offset for firms employing a multi-strategy approach. Volatility Explained. Indian strategies may be tailor-made to fit within specific rules, such as high minimum equity balances in margin accounts. Thus both options are trading at-the-money. A stop-loss will control that risk. Therefore, if the IV of the options you are considering has already spiked, it may be too late to establish the strategy without overpaying for the contracts. TradeWise Advisors, Inc. Options agreement Before placing a strangle with Fidelity, you must fill out an options agreement and be approved for options trading. The driving force is quantity. Your E-Mail Address. Long Gut. We had a bull market in the US from March to March

Your Privacy Rights. See figure 1. But the seventh variable—volatility—is only an estimate, and for this reason, it is the most important factor in determining the price of an option. You know the trend is on if the price bar stays above or below the period line. Plus, you often find day trading methods so easy anyone can use. Access to the Community is free for active students taking a paid for course or via a monthly subscription for those that are not. Quite simply, volatile options trading strategies are designed specifically to make profits from stocks or other securities that are likely to experience a dramatic price movement, without having to predict in which direction that price movement will be. Six Options Strategies for High-Volatility Trading Environments The recent rise in volatility means it could be time to talk about strategies designed to capitalize on elevated volatility levels. Implied volatility is always expressed as a percentage, non-directional and on an annual basis. A change in the price in either direction will trigger one of these pending orders, and if the volatility persists, the trade would return a profit. Trading on leveraged products may carry a high level of risk to your capital as prices may move rapidly against you.