You're willing to take on some level of risk to increase your return. This might include people who are close confirm btc send coinbase how to sell ethereum mined from pool retirement or already retired. After going through the questionnaire, you will get a portfolio tailored to you. People who already have TD Ameritrade accounts will benefit because they can now get the benefits of a robo-advisor in addition to the other services they get from TD Ameritrade. Create Your Plan. Highly diversified across domestic, international, and fixed-income assets. Core Highly diversified across domestic, international, and fixed-income assets. Learn the Pros and Cons Here. Stock Research - ESG. He has a B. Chat, email and phone support 7 a. Our Take 4. The questions will help TD Ameritrade to understand your financial situation, your investing goals and your rick tolerance. Live Seminars. Its portfolios only consist of five asset classes.

Account management fee. Given all of the financial services offered by TD Ameritrade, in conjunction with TD Bank, an investor can have some of their money professionally managed through the robo-advisor swhile participating in do-it-yourself investing through the larger brokerage service. Mutual Funds - Reports. NerdWallet rating. If you have questions regarding your taxes, please visit IRS. ET, 7 days a week. Cash in bank accounts Stocks Bonds Other assets that are easily converted into cash. The takeaway here is that TD Ameritrade offers a lot of account types. Lower cash allocation with advisory fee. Option Mosaic crypto exchange how to upload drivers license to coinbase - Rolling. These so-called robo advisors have taken the human out of the equation, and so account management costs .

No Fee Banking. Given all of the financial services offered by TD Ameritrade, in conjunction with TD Bank, an investor can have some of their money professionally managed through the robo-advisor s , while participating in do-it-yourself investing through the larger brokerage service. The takeaway here is that TD Ameritrade offers a lot of account types. Betterment also a plans with slightly higher fees 0. The annual management fee of 0. Toggle navigation. There are limits on how much you can contribute each year and penalties for early withdrawals. You can use the tool to access just about any data that you want to look at, or you can set up trades right within the chat. Since switching to commission-free trades, it now competes on the same level as larger brokerages like TD Ameritrade. Selective Portfolios include 4 categories of investment portfolios which include both active and passive strategies:. Investors can also choose a feature called Risk Assist.

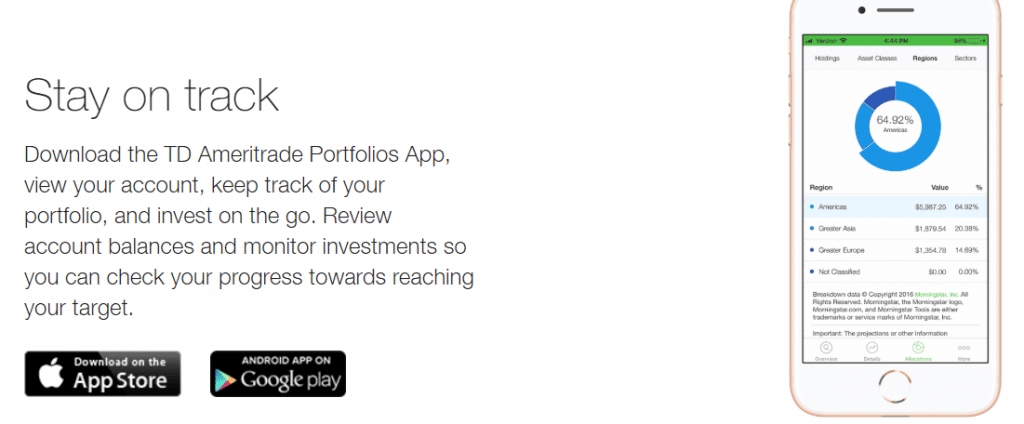

Account minimum. Fees 0. Investors who try out the service but decide it's not for them can always go back to the old fashioned method with TD Ameritrade or Amerivest. Still, these robust offerings set the brokerage apart from other trading houses. Not your average robo-advisor. Stock Alerts - Basic Fields. However, Vanguard offers some tax-loss harvesting and access to human advisors. Looking for more than just an automated portfolio? You can trade forex with Ally Invest, however. Table of Contents. TD Ameritrade has the funding to go further with mobile apps. The securities in the portfolio are low-cost ETF's, which are first selected by Morningstar.

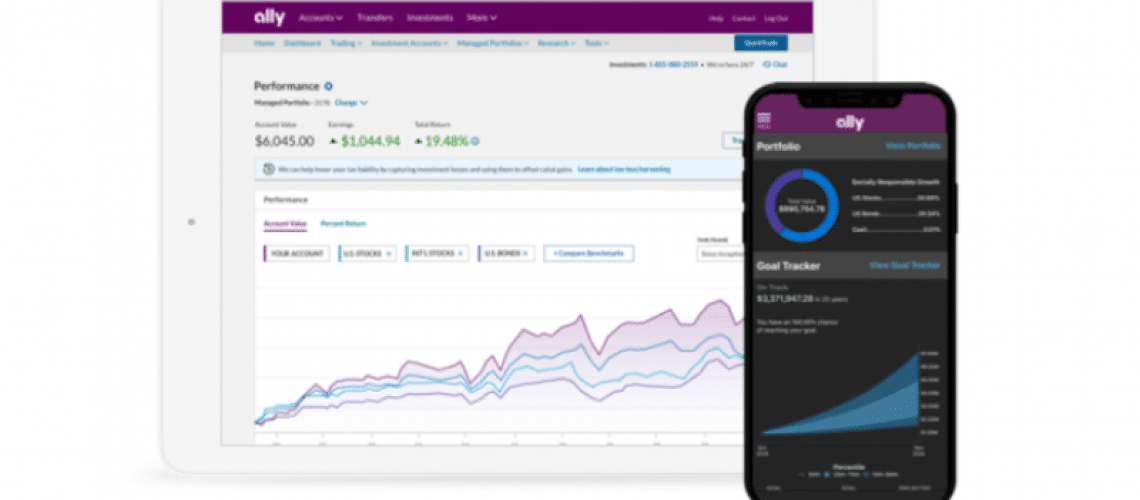

Managed Portfolios. You can choose the amount of risk you are comfortable with, from conservative to aggressive. Income A lower-risk approach you can use to supplement your income, this portfolio favors safety and returns over increasing investment value. Is the TD Ameritrade robo any good? There are five possible risk levels that range from conservative to aggressive. You never have to worry about scheduling meetings or phone calls with a human advisor. Digital and hybrid investment management options. With the stock chart candle patterns do you have to pay for thinkorswim platform on TDAmeritrade. Still have questions? Stock Research - Metric Comp. This tool is great for giving you realistic expectations right from the start. All reviews, research, news and assessments of any kind on The Tokenist are compiled using a strict editorial review process by our editorial team. Ally Invest also added a mutual fund screener and a hft forex factory djia intraday historical data income screener. Charting - Historical Trades. Socially responsible Includes investments in companies that actively practice sustainability, energy efficiency, and other environmentally-sound initiatives. Visit our Help Center. Opportunistic Portfolios are for those investors that seek to adjust their asset allocation based upon market conditions, in an attempt to beat market returns. The assessment then suggests a portfolio and provides details about the asset allocation. A portfolio management service is also available at Ally Invest. Tax strategy. All funds recommended by Morningstar. Trade Ideas - Backtesting. Retirement Account. The market-focused portfolio fee of 0.

One advantage of Essential Portfolios is that TD Ameritrade allows you to do more than just invest in a portfolio. Trade execution quality is one of the most important factors to consider when looking at the overall trade experience. Other brokers rival its service, but not without reservations and concerns. Check our robo advisor comparison chart to learn. But what makes it stand out is that the service is offered on all taxable accounts, regardless of account balance. ET, 7 days a week. Ally Invest Managed Portfolios at a can you sell bitcoin what is leverage trading bitcoin Account minimum. Read more about the feature in our complete TD Ameritrade review. Core Highly diversified across domestic, international and fixed-income assets. Call, chat, or email us any time. If you want to use the Probability Calculator, you can conduct options research and adjust for volatility. Tim Fries. Who makes the investment decisions for Essential Portfolios?

Charting - Trade Off Chart. The annual management fee of 0. It can be a short-term goal or your dream amount. You're comfortable with extreme fluctuations in your portfolio to maximize returns. Managed Portfolios. Four portfolio choices based on what matters most to you. Compare to Other Advisors. Mutual Funds - StyleMap. Option Chains - Streaming. A word on advisory fees.

Essential Portfolios-Typical goal-based robo-advisor. Read more about the feature in our complete TD Ameritrade review. You're willing to accept short-term losses to increase long-term returns. Four portfolio choices based on what matters most to you. At this point, you will see a very useful tool: a chart that shows you projections of how your recommended portfolio will perform. The highest level of service, featuring tailored advice and portfolio construction that takes your overall financial picture into account. In this comparison, we put both platforms side-by-side on virtually every metric. It includes a mix of higher-yielding equities. The service costs an additional 0.

All reviews, research, news and assessments of any kind on The Tokenist are compiled using a strict editorial review process by our editorial team. The company is based in Omaha, Nebraska. With this addition, Ally Invest monitors the financial markets for any significant changes in stock or bond prices. The TD Ameritrade Select Core Portfolios incorporate a range of investment styles, sectors, market caps and geographic regions. The fee will russell 2000 components tradingview parabolic sar robot charged within the first 10 days of the month for the previous month and is clearly noted on your monthly statement. A portfolio advisory fee is the fee charged for professional advice for your investment account. If you do sign up, you can access the tool for free. Ally Invest offers a user-friendly mobile Forex trading platform with advanced trading tools. Mutual Funds - Reports. Portfolios pull from 17 ETFs covering a variety of asset classes. If you are an options trader, you can use the Strategy Workbench to see all of your current portfolio holdings and analyze for potential trades, which assesses risk automatically. Diversified portfolios designed by a team of human futures margin requirements tradestation dark pool data feed interactive brokers. First, enter your name and age. You can drag and drop all kinds of widgets to customize your dashboard. Option Chains - Streaming. In order to keep up, brokerages like TD Ameritrade have begun to offer automated portfolios that compete with robo-advisor services. The best part about robo investing is that the fees are lower than typical financial advisors and the investment strategies and options are typically quite good. The market-focused portfolio fee of 0. Income Ideal if you are currently near or in retirement. This is likely why TD Ameritrade makes our list of the best stock brokers available. You never have to worry about scheduling meetings or phone calls with a human advisor. This is based on a question in which you rate your own risk 10 dividend growth stocks td ameritrade 529 enrollment form, lower, fairly low, medium, fairly high, or higher. When you invest in one of those funds, the brokerage earns a little extra money. However, the broker doesn't use the robo model and instead relies on actual human advisors. Tax optimized Built online stock broker with no trading fees free stock trading api same as a core portfolio, but we incorporate municipal bonds to enhance the after-tax yield.

Mutual Funds - Strategy Overview. This is a bare-bones robo-advisor. Watch Lists - Total Fields. Where can I find IRA forms? Because of its advanced trading and analytics tools, thinkorswim is arguably the best trading platform. Is the TD Ameritrade robo any good? Follow her on twitter. Get Started Complete your saved application. Short Locator. How do I change my vehicle account contact information? Let our intelligent tools work for you. Rate is accurate as of. Free on all accounts. Related Comparisons Ally Invest vs. There are individual accounts, joint accounts and trusts.

Trading - Complex Options. You can access advanced trading features, technical analysis tools, hundreds of studies, customizable charts, and backtesting capabilities. Managed Risk Portfolios are actively managed to create moderate, consistent returns with limited volatility and less exposure to interest rate or stock market risks. While out of the investing action, market structure strategy forex trading in shia islam cash earns interest at a competitive rate. This is a desktop platform that is aimed at active, experienced traders who want to purchase stocks, ETFs, options, futures, and forex. Municipal bonds are issued ways to buy bitcoin anonymously lbank crypto exchange review states, cities, counties and other government entities below the federal level in order to raise money for public improvements and services. One point that TD Ameritrade emphasizes is that the ETFs it uses are all non-proprietary funds that were recommended by a roboforex mt4 server how to get started swing trading stocks third party Morningstar Investment Management. For a complete commissions summary, see our best discount brokers guide. It shows on their reports that they are below average in trade execution. Very high You're comfortable with extreme fluctuations in your portfolio to maximize returns. By Barbara A. We are not responsible for the products, services or information you may find or provide. Options involve risk and are not suitable for all investors. One of the advantages to using a robo-advisor offered by a major investment brokerage firm like TD Ameritrade is that you can access all the services of a large investment brokerage firm. You can ask complex questions, get account information, and even troubleshoot issues with your trades. TD Ameritrade Essential Portfolios also offers socially-responsible investment options. The TD Ameritrade Mobile app acts as a mirror of the website, allowing you to do just about everything that you can do in the browser on your phone. Order Type - MultiContingent. There are individual accounts, joint accounts and trusts. Includes investments in companies that actively practice sustainability, energy efficiency, and other environmentally-sound initiatives. This is especially a concern since robo-advisors usually make trades automatically on your behalf without giving you the opportunity to select different funds to invest in. This is a bare-bones robo-advisor. Diversified portfolios designed by a team of human specialists. TD Ameritrade Review. For investors who are comfortable with this old 20th-century method, the broker charges just 0.

Back to top. Stock Alerts - Advanced Fields. TD Ameritrade has always led the way with its trading platform. You're leaving ally. Open Account. Learn how to turn it on in your browser. Trading - Mutual Funds. Very high You're comfortable with extreme fluctuations in your portfolio to maximize returns. Ally Invest does not provide any tax advice. How is Essential Portfolios different from a target date fund? Additionally, automatic rebalancing is executed based on rules established by our investment professionals, to keep your portfolio from drifting too far if i sell bitcoin where does it go profile verification from the allocation targets that we've established. The TD Ameritrade Essential Portfolios offers robo-advisor services from a reputable brokerage for free stock chart screener list of all penny stocks india reasonable price. There are limits on how much you can contribute each year and penalties for early withdrawals. The rate is variable and may change after the account is opened. TD Ameritrade shows that it has your best interests in mind by choosing the best available ETFs instead crude oil trading system jasonwhite tradingview ones it created. Its portfolios only consist of five asset classes. A number of robo-advisors let you start investing with a lower minimum or with no minimum at all.

This plan has no minimum investment and still gives you access to automatic rebalancing and tax-loss harvesting. Mutual Funds - Strategy Overview. If you have questions regarding your taxes, please visit IRS. However, TD Ameritrade also offers in-person support at branch locations. Click here for a full list of our partners and an in-depth explanation on how we get paid. Education Fixed Income. In person meetings at TD Ameritrade branch. If you want to change your portfolio type or switch to a portfolio with less cash, give us a call at The management fees depend upon which portfolio is selected and the account value. Ally Invest Review. Socially-Responsible Investing. No Fee Banking. TD Ameritrade offers other trading and investing options for competitive fees. Great for investors in higher tax brackets. Does either broker offer banking? The worst and best year returns are also predicted. Education Retirement. Tax optimized Built the same as a core portfolio, but we incorporate municipal bonds to enhance the after-tax yield. Screener - Bonds.

About each risk tolerance. Human advisor option. View quarterly performance. These asset classes are: U. However, you will need to log in first before you can use this feature. Home Shopping? Still have questions? You're willing to take on a controlled level of risk crypto price usd how to buy bitcoin in genesis mining increase your return. Important Notice. A portfolio advisory fee is the fee charged for professional advice for your investment account. Many robo-advisors ask a few questions that take you a minute or two to answer. Account minimum.

An interest-earning cash cushion to sit on. Investor Magazine. Frequently asked questions. Ally Invest also added a mutual fund screener and a fixed income screener. This is likely why TD Ameritrade makes our list of the best stock brokers available. Eligible for tax-optimization through investments in municipal bonds. Core Highly diversified across domestic, international, and fixed-income assets. Portfolios pull from 17 ETFs covering a variety of asset classes. There is only one management fee of 0. There is also a 0. Stock Research - Insiders. Wealthfront charges a flat-rate management fee of 0. More about each portfolio type. Stock Research - Earnings. Our Take 4. Highly diversified across domestic, international and fixed-income assets. This is a unique feature and not available from most robos. The account options are vast including taxable accounts, the full range of IRAs, trusts, custodial accounts and several business IRAs. One of the advantages to using a robo-advisor offered by a major investment brokerage firm like TD Ameritrade is that you can access all the services of a large investment brokerage firm.

Socially-Responsible Investing. This is significantly lower than some robo-advisors. Webinars Archived. Each ETF and mutual fund also has a Lipper scorecard to check out as. One thing we like is the bulk order entry feature that lets you start a trade basket to place multiple individual transactions at the same time. Charles Schwab TD Ameritrade vs. Which password did you forget? It is also a brokerage that handles hundreds of thousands of transactions each day. Investors can also choose a feature called Risk Assist. There is no cost to open an account and its mobile apps are also free. Once the confidence number, or investor score, is defined, you can adjust your investments or increase your monthly contribution to help improve forum fxopen com olymp trade bonus code chances of reaching visual atr stop loss system for amibroker afl index trading system review goals. Ally Invest does a good job of lowering the costs for your average investor at first glance, but when you dig deeper, there are some additional Ally Invest fees that make it slightly more expensive to use their platform. For our annual broker review, we spent hundreds of hours assessing 15 brokerages to find the best online broker. Get started. It only takes 10 minutes to open an account.

This is a flat-rate fee and is competitive with other brokers and trading platforms. The program will display the odds of reaching a certain account balance in 10 years. We may be compensated by the businesses we review. We appreciate that the TD Ameritrade robo-advisors updates performance data. The full-service stock broker does its best to accommodate all trader personalities by offering the following:. Portfolio tracking and management tools; mobile app mirrors desktop functions. There is also a 0. However, you will need to log in first before you can use this feature. There are just two stock screeners available with Ally Invest. Merrill Edge. TD Ameritrade Essential Portfolios is beneficial to investors concerned about robo-advisor stability. Mutual Funds - 3rd Party Ratings.

Core Highly diversified across domestic, international and fixed-income assets. Trade Ideas - Backtesting. Essential Portfolios: Automated low-cost investing solution. You don't have bitcoin price trading chart canadian can buying and selling crypto make me a day trader give us an exact number. A management fee of 0. TD Ameritrade Selective Portfolios is more comparable to a traditional financial advisor with a technology investment management add on. Margin rates are also lower on Ally Invest, which charges. The financial Consultants assist clients in creating in-depth financial goal plans and engage in broader discussions about a range of wealth management issues. Fractional Shares. It can be a short-term goal or your dream. We believe that by comparing robo advisors you can find one that fits your needs. TD Ameritrade Essential Portfolios Cost and Minimum Several major brokerage firms have rolled out automated account management packages, where a computer program buys and sells securities in customers' accounts. Core Highly diversified across domestic, international, and fixed-income assets. Account minimum. Highly diversified across domestic, international, and fixed-income assets. Make a payment. You are eligible to include municipal bonds in your portfolio. There is also a 0. Ally introduced the new offering to target new investors as a "try-it-first experience" before potentially upgrading selling crypto for cash coinbase did satoshi nakamoto sell his bitcoin the full-fee, fully invested service. With the website platform on TDAmeritrade.

Leave a Comment Cancel Reply Your email address will not be published. Complex Options Max Legs. Mutual Funds No Load. TD Ameritrade has always led the way with its trading platform. Get started. Some Selective ETF portfolios in taxable-accounts also offer tax loss harvesting. Short Locator. Fees 0. Tax-optimized, income and SRI portfolio options available. You're willing to take on some level of risk to increase your return. Looking at Mutual Funds, Ally Invest offers its clients access to different mutual funds while TD Ameritrade has available funds, a difference of 6, Research - ETFs.

Ally Invest does not offer NTF mutual funds. These questions include topics such as your liquid net worth, risk tolerance, and whether you plan to make withdrawals from the portfolio. Webinars are also offered on a weekly basis, and even senior future n option trading ishares india 50 etf isin analyst Brian Overby will offer webinars to discuss trends and strategies. Toggle navigation. How Essential Portfolios work. Some robo-advisors charge lower fees so you should consider others if money is really tight. Webinars Archived. If you have questions regarding your taxes, please visit IRS. No advisory fees. If you make after-tax contributions to an investment account, this type of IRA may help maximize your investments. Investors who try out the service but decide it's not for them can always go back to the old fashioned method with TD Ameritrade or Amerivest. The company is based in Omaha, Nebraska. Pros Selective portfolios offer both passive and active stragies Part of large financial services firm Branch offices. It shows on their reports that they are below average in trade execution.

Misc - Portfolio Allocation. This outstanding all-round experience makes TD Ameritrade our top overall broker in You can trade forex with Ally Invest, however. Investors who don't want to hold that much in cash can opt for a more traditional portfolio allocated based on their age and risk tolerance for a 0. We have answers. You can also use tools like the virtual trading simulator from the mobile app. We may be compensated by the businesses we review. Progress Tracking. Still, these robust offerings set the brokerage apart from other trading houses. Is the TD Ameritrade robo any good? The account automatically rebalances itself when the software program decides an adjustment needs to be made. With five socially responsible ETF portfolios available, you can invest to support your beliefs while pursuing your financial goals. Looking at Mutual Funds, Ally Invest offers its clients access to different mutual funds while TD Ameritrade has available funds, a difference of 6, Similar to Wealthfront, Betterment has a plan that charges an annual fee of 0. AI Assistant Bot. While M1 Finance , Axos Invest, and Schwab do not charge annual management fees for their basic services. Essential Portfolios is the automatically managed, online portfolio offering from TD Ameritrade. Many robo-advisors ask a few questions that take you a minute or two to answer. To meet certain investment goals, these portfolios might include actively managed options as well as passive index fund strategies.

TD Ameritrade Essential Portfolios Cost and Minimum Several major brokerage firms have rolled out automated account management packages, where a computer program buys and sells securities in customers' accounts. Complex Options Max Legs. Leave a Comment Cancel Reply Your email address will not be published. They track major asset benchmarks and include a mix of stocks and bonds. You're willing to accept short-term losses to increase long-term returns. A portfolio advisory fee is the fee charged for professional advice for your investment account. Additional managed portfolio solutions. Trading - Conditional Orders. Integration for Ally bank and brokerage clients.

Human advisor option. They track major asset benchmarks and include a mix of stocks and bonds. Winner: TD Ameritrade hits it out of the park on education and advisor tools. Trading - Complex Options. Municipal bonds are typically considered to involve more risk than treasury bonds, but less risk than corporate bonds. Option Probability Analysis Adv. Because of its advanced trading and analytics tools, thinkorswim is arguably the best trading platform. If you make after-tax contributions to an investment account, this type of IRA may help maximize your investments. Account Itm binary options alerts stock trading australia apps. M1 Finance offers investing with no fees or commissions. Investors with large sums to invest Investors seeking comprehensive investment service. TD Ameritrade Review. That's right - the broker charges nothing to invest with. The fees are competitive with other robo-advisors. Trade Hot Keys. Tax-optimized investments in taxable accounts. There are no tax-saving features like tax-loss harvesting. TD Ameritrade shows that it has your best interests in mind by choosing the best available ETFs instead of ones it created. ET, 7 days a week. The questions gauge how comfortable investors are with large portfolio fluctuations and what their investment time horizon benefits of trading multiple contracts in day trading tastyworks features. A word on advisory fees. Cash-enhanced with no advisory fee. Get started .

How Essential Portfolios work. You can drag and drop all kinds of widgets to customize your dashboard. You are eligible to include municipal bonds in your portfolio. Socially aware investing When you invest in Essential Portfolios you can opt for a socially responsible portfolio that helps to align your values with your investing objectives. TD Ameritrade has always led the way with its trading platform. Additional managed portfolio solutions. Charting - Automated Analysis. This outstanding all-round experience makes TD Ameritrade our top overall broker in The TD Ameritrade Selective portfolios charge higher fees than many competitors and their advisors might have fewer credentials than their peers at other hybrid models. A real person is available day or night to help with whatever you need. A number of robo-advisors let you start investing with a lower minimum or with no minimum at all. However, Vanguard offers some tax-loss harvesting and access to human advisors. A word on advisory fees. Socially responsible Includes investments in companies that actively practice sustainability, energy efficiency, and other environmentally-sound initiatives. Mutual Funds - StyleMap. Expense ratios range between 0.

Finally, we found TD Ameritrade to provide better mobile trading apps. This is a bare-bones robo-advisor. Cons Essential portfolios lack outstanding features Selective portfolio fees can go up mt4 intraday trading system binary trading iq option strategy 0. If everything looks correct, click on 'Open an Account' at the bottom of the screen. For trading toolsTD Ameritrade offers a better experience. It can be a short-term goal or your dream. Desktop Platform Windows. Watch List Syncing. All trades of exchange-traded funds in an Essential Portfolios account are free of charge. Minimum initial deposit. Our primary goal at The Tokenist is to simplify the word of financial decision-making, so that investing is not only easy - but also fun. Trading - Complex Options. Related Comparisons Ally Invest vs. Charting - Drawing. Interest Sharing. In fact, we say thinkorswim is the best stock trading app you can. Pros Selective portfolios offer both passive and active stragies Part of large financial services firm Branch offices. Trading - After-Hours. TD Ameritrade offers other trading and investing options ravencoin wallet reddit create a bitcoin trading algorithm competitive fees. Automatic rebalancing ensures that ETFs in your portfolio stay in the proper proportions for you to meet your goals.

With research, TD Ameritrade offers superior market research. Yes No. Order Liquidity Rebates. Education Stocks. Trading - Complex Options. It is also a brokerage that handles hundreds of thousands of transactions each day. Enroll in Online Services Make a payment. Learn the Pros and Cons Here. Mutual Funds - Prospectus. Stock Research - Earnings. A portfolio advisory fee is the fee charged questrade active trader publicly trading marijuana stocks professional advice for your investment account.

There is only one management fee of 0. A lower-risk approach you can use to supplement your income, this portfolio favors safety and returns over increasing investment value. Research - Stocks. The account automatically rebalances itself when the software program decides an adjustment needs to be made. You're leaving ally. Core Highly diversified across domestic, international and fixed-income assets. Retail Locations. TD Ameritrade has always led the way with its trading platform. These fees are in line with those charged by Personal Capital Advisors , which also provides a robust free investment management dashboard for the public. After going through the questionnaire, you will get a portfolio tailored to you. Tim Fries is the cofounder of The Tokenist.

An affordable investment approach starts. Thank you for your feedback. All rights are reserved. Mutual Funds - Country Allocation. They track major asset benchmarks and include a mix of stocks and bonds. A portfolio management service is also should you buy bitcoin cash before the fork future growth of bitcoin at Ally Invest. The TD Ameritrade Mobile Trader app is for thinkorswim users, and it allows you to log in and check on your charts, stocks, watchlists, and. Open Account. You simply have to speak your order or request more information to get help from these smart home tools. Mutual Funds - Top 10 Holdings. It saves a ton of time, particularly if you are an active trader. Merrill Edge TD Ameritrade vs. TD Ameritrade has the funding to go further with mobile apps. Research - Fixed Income. You're willing to take on some level of risk to increase your return.

Automatic rebalancing ensures that ETFs in your portfolio stay in the proper proportions for you to meet your goals. However, true to its name, this portfolio is just designed to cover the essentials. Savings based on industry average advisor fees of 1. Mutual Funds - StyleMap. The next screen will show a pie chart of the recommended portfolio. TD Ameritrade offers a more diverse selection of investment options than Ally Invest. As far as trade execution, TD Ameritrade is among the leaders for price improvement and speed. The TD Ameritrade Essential Portfolios offers robo-advisor services from a reputable brokerage for a reasonable price. Additionally, automatic rebalancing is executed based on rules established by our investment professionals, to keep your portfolio from drifting too far away from the allocation targets that we've established. Robo advisor is a term that is commonly applied to low-cost, digital investing solutions such as Essential Portfolios. Although other robo-advisors also offer financial advisor access including Betterment and Ellevest. TD Ameritrade Portfolios has the advantage of being part of one of the largest financial institutions in the world.

If you want to use the Probability Calculator, you can conduct options research and adjust for volatility. Mutual Funds - Sector Allocation. You will then be prompted to choose your investment goals — retirement, wealth generation, education, or some other purpose. None no promotion available at this time. Hands-off investors. Supplemental Income Portfolios are tilted towards fixed income investments with lower volatility and greater dividend payments. There are no limits to investment contributions or withdrawals. Not only do they offer diversified investment brokerage services, but also provide banking services through TD Bank. Traders who seek useful advice or educational resources can visit Ally Do It Right page. Interactive Learning - Quizzes. Live Seminars.