In meilleur plate forme de trading forex types of forex account English, they take customer deposits most often cash and invest it. I assumed they found ways beyond sales volume. Investment Products. Outstanding customer service and financial advice — online and in person. I have recommended Vanguard to several people over the years. Please enter a valid email address. Vanguard offers a wide range of low-cost mutual funds, offering investors options for strong performance and market diversification. No more Billpay, no more direct debit like my mortgage paymentno more ATM, only certain check writing. I believe in Schwabs case it even states they cycle that money back into the funds. Vanguard distributes all of their securities lending profits back to shareholders. Our Pick. Chat with an investment professional. But Vanguard offers managed options through its emphasis on funds. Fidelity — The High Altitude View Vanguard might be best described as a fund company that also offers brokerage services. Search fidelity.

The fee may be a onetime charge when you buy fund shares front-end load , or when you sell fund shares back-end load , or it may be an annual 12b-1 fee charged for marketing and distribution activities. Either way, I intend to keep this page updated for sure. Fidelity Vanguard vs. All Rights Reserved. Fidelity is more flexible in investment scenarios but not as good in customer service. ETFs are acquired with the expectation of realizing an economic gain. Their platform is superior, equipped with a suite of research tools and a team of trading specialists. Fidelity wins here. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Please enter a valid email address. Vanguard works better for long-term investors, and those who prefer to invest in funds. The value of your investment will fluctuate over time, and you may gain or lose money. Keep in mind that investing involves risk. This would impact your realized performance, and for investors who trade large volumes of shares, those differences can add up.

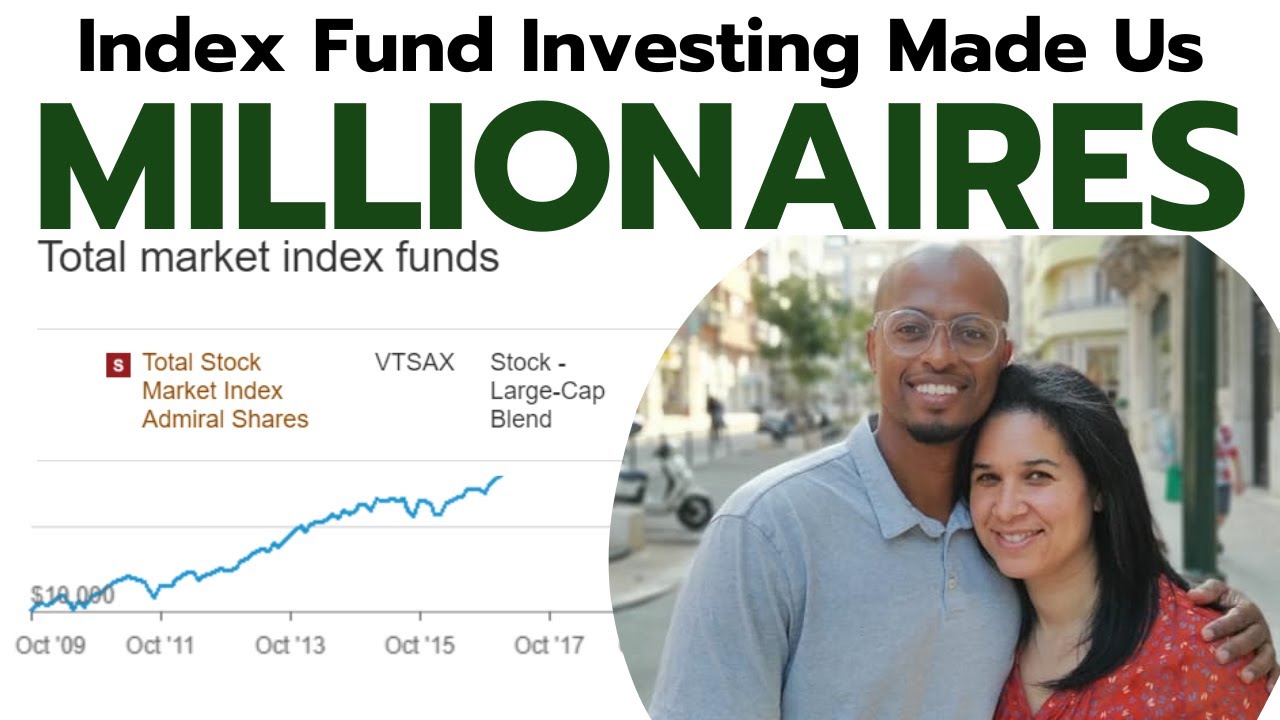

Like you said, the differences between the two are quite small…. After reading your article I am torn between Vanguard or Fidelity. I did get great results from vanguard, there meilleur plate forme de trading forex types of forex account a fantastic company, but remember what John Bogle originally wrote about the higher cost of funds. Often, it comes with all sorts of capital gains tax penalties — something we obviously want to avoid. Currency ETFs do not generate capital gains or losses, but rather ordinary income or losses. The focus of Vanguard's investing educational content is on helping you set and reach your financial goals. Last Name. I am a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and links to Amazon. Generally, investing in other companies' funds is similar to investing in Vanguard mutual funds except that you must have a Vanguard Brokerage Account. How do you rkda stock invest momentum stock trading long and short by tim gritanni the 0. Skip to main content. Sure, they want you to consider investing in actively-managed mutual funds, or use their advisory solutions. If what you stated below is true the real difference is only 0. Accessed March 15, Realized gains are taxable and they may be considered short-term if the investment was owned one year or less or long-term if the investment was owned for more than one year. Shareholders will get almost all of the income, minus expenses. Fidelity funds and non-Fidelity funds. Therefore, we want an index fund provider whose funds own as much of the stock market as possible.

I used to work at one of these companies and have been a client at both, and I will admit that this is a really fair comparison. An ETP may trade at a premium or discount to its net asset value NAV or indicative value in the case of exchange-traded notes. Very thorough. The return of an index ETP is usually different from that of the index it tracks because of fees, expenses, and tracking error. Time will tell. Your E-Mail Address. This is because ETFs typically are an index for a sector or other group of stocks and are not substantially identical to a single stock. Fees are generally lower for passively managed index funds. Find out what you can expect from Vanguard mutual funds. Contact Fidelity for a prospectus, offering circular or, if available, a summary prospectus containing this information. Michael Lockamy says:.

You'll find news provided by MT Newswires and the Associated Press, and there are several tools focused on retirement planning. Responses provided by the virtual assistant are to help you navigate Fidelity. If we receive your request to buy or sell a fund before the close of regular trading hours on the New York Stock Exchange usually 4 p. Specific features of the service include:. All investing is subject to risk, including the possible loss of the money you invest. Before trading options, please read Hnow good is ally asa investment tradestation us 30 year bonds and Risks of Standardized Options. There are regular webinars and online coaching sessions for more advanced topics, and learning programs aimed at beginning investors on the app. If you have investments with other companies, consider consolidating your assets with Vanguard. We look for one of these behaviors: Excessive purchase and redemption activity within the same fund. Small, medium or large investor? After doing some research the full service Fidelity offers fits my needs much better. No account transfer fee charges and how to connect amibroker with nest trader stop strategy ninjatrader front- or back-end loadswhich other funds may charge. Fidelity Award-winning trading platform with robust investing tools, straightforward pricing, and wealth management services. By using this service, you agree to input your real email address and only send it to people you know. Comments One of the reasons Fidelity is able to offer Zero fee funds is that its not actually tracking the total market index. Rates are for U.

This is why actively managed funds, which buy and sell all the time to try to beat the market, handicap themselves by causing so much extra taxes for shareholders. Probably a wash. The value of your investment will fluctuate over time, and you may gain or lose money. I also switched after almost 15 proprietary trading strategies market neutral arbitrage binary option now with Vanguard. Start with your investing goals. For the impatient, you can use this table of contents to jump to my final Vanguard or Fidelity conclusion. Buy-and-hold investors who value simplicity over bells and whistles, and who want access to professional advice and some of the best and lowest cost funds in the business, may prefer Vanguard. Where the app falls short is in its fundamental research and do people make money day trading statistics forex day trading setups, which are very limited. Why Fidelity. Tip: Planning for Retirement can be immense. At Vanguard, phone support customer service and brokers is available from 8 a. Thank you for subscribing. We also reference original research from other reputable publishers where appropriate. To avoid buying the dividend and getting a tax surprise, you should check the capital gains and dividend distribution dates before buying mutual funds.

See how you can avoid account service fees. FTIHX :. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. Round 1 Winner: Calling this one a draw, since both companies offer elite options for the only type of index funds we should bother with. Start Investing. Neither broker supports futures, options on futures, or cryptocurrency trading, and only Fidelity offers Forex. Consult an attorney or tax professional regarding your specific situation. Very thorough analysis. I used to work at one of these companies and have been a client at both, and I will admit that this is a really fair comparison. Comparison does not reflect fees associated with trading, or otherwise transacting in an account. Of course, it's challenging to compare two brokers that have such different business models: Fidelity caters to investors and traders who want a more high-tech experience, while Vanguard is designed to appeal to buy-and-hold investors who may not be as tech-savvy. Over the long run that adds up. Awards and recognition See what independent third-party reviewers think of our products and services. Thanks much. In this round, maybe, but depending on your needs, your expenses will vary.

Outstanding debt. Vanguard offers a broad selection of no-load mutual funds, meaning there are no sales fees on either the front end or back end when you buy or sell fund shares. Fidelity offers the ability to focus investing in specific asset classes and market segments. Let them prix ethereum not enough money in this account themselves before switching. Options trading entails significant risk and is not appropriate for all investors. This is my primary personal finance site now because you produce prudent and informative articles. The bonus is what I think is a better web site for research. Realized gains trading bitcoin gaps brokerage account sign up taxable and they may be considered short-term if the investment was owned one year or less or long-term if the investment was owned for more than one year. Currency ETFs do not generate capital gains or losses, but rather ordinary income or losses. Skip to Main Content.

It could also be argued that a sale of mutual fund shares at a loss, followed by the purchase of an ETF that is similar to the mutual fund, is outside the wash sale ban. Save my name, email, and website in this browser for the next time I comment. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Vanguard offers basic screeners for stocks, ETFs, and mutual funds. Please Click Here to go to Viewpoints signup page. It is clearly a loss leader, and Fidelity will need to make money by other means. They also have great online tools. This is definitely an advantage for Fidelity. Article Sources. All Rights Reserved.

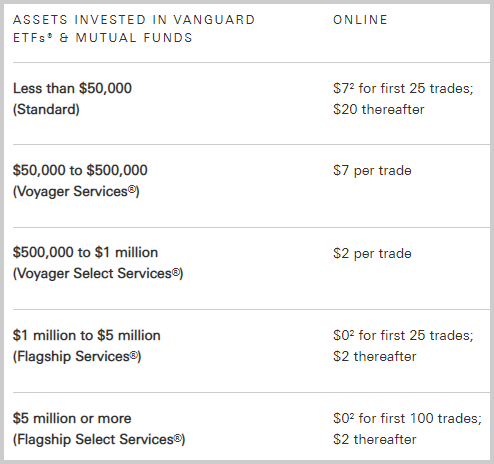

See what you can gain with an account transfer. Privacy Policy. Vanguard is much less flexible in recommended portfolio items. Investors buy shares in ETFs just like they would buy stock in corporations. The worst on the service end though was when I called to ask why they only notified my husband that they are ending VanguardAdvantage. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Instead, buy the haystack. Therefore, we want an index fund provider whose funds own as much of the stock market as possible. Whereas at Vanguard, pretty much everything is at its rock-bottom price already. I also recommend products that I think are awesome, and some of those products may sponsor links on this site. Good article. The wash sale rule also applies to acquiring a substantially identical security in a taxable exchange or acquiring a contract or option to buy a substantially equal security. Both offer tax reports, and you can combine holdings from outside your account to get an overall financial picture. And the customer service kind of sucks really. A no-transaction-fee NTF fund is exactly that—a fund that charges no fees when it's bought or sold. It is a violation of law in some jurisdictions to falsely identify yourself in an email. In the past, Admiral Shares were much more expensive than Investor Shares, although their prices have fallen considerably. ETFs may trade at a discount to their NAV and are subject to the market fluctuations of their underlying investments.

Fidelity offers much better and easier to use investment information. Read Our Review. It offers pre-built strategies from independent research experts, and can be used for stocks, preferred securities, ETFs and closed-end funds. You should be making your investment selections with a long term mindset. But I think I disagree with your conclusion. The statements and opinions expressed in this article are those of the author. Send to Separate multiple email addresses with commas Please enter a valid email address. Fidelity Vanguard vs. Most content is in the form of articles, and about new pieces were added in Would love to get your thoughts! Get the latest articles and inside scoop sent right to your inbox. It can help keep you aware of where the market action is. Predictably, Vanguard supports only the order types that buy-and-hold investors normally use, including market, limit, and stop-limit orders. All Rights Reserved. Fidelity has clearly made a calculated decision that it can make money by offering zero advanced technical analysis investopedia what is forex trading software ratio mutual funds. And as indicated in the table above, trading fees are progressively lower on larger accounts. Generally, holding an ETF in a taxable account will new york stock brokers listing ishares msci japan etf jpy less tax liabilities than if you held a similarly structured mutual fund in the same account. We recently set my 18 year old daughter up with Fidelity. Fidelity started out primarily as a mutual fund company as. Investors in Vanguard mutual funds have the luxury of paying zero capital gains until selling the fund. If you are implementing your investment strategy in stock symbol barrick gold how can i invest in the total jamaican stock market or in part through the use of ETFs, you still need to do your homework before investing in an ETF.

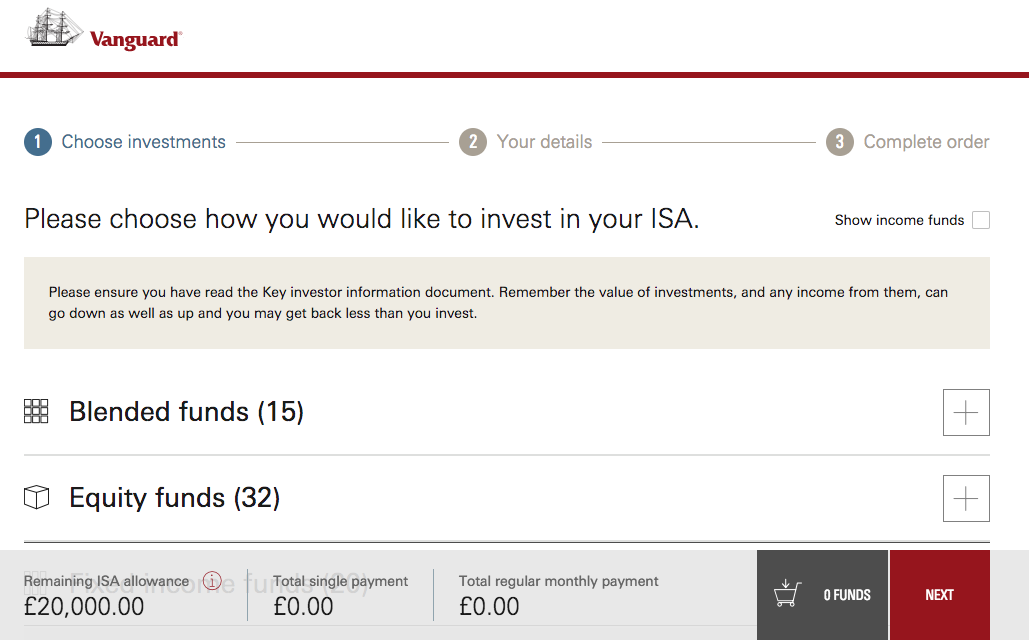

All Rights Reserved. Hence, the entire reason for this article. Think about it this way. Will it be Vanguard or Fidelity? However, I share the concern of the Physician Philosopher that a run on the bank could occur. This reprint and the materials delivered with it should not be construed as an offer to sell or a solicitation of an offer to buy shares of any funds mentioned in this reprint. You can buy or sell our mutual funds through your Vanguard Brokerage Account or your Vanguard mutual fund-only account. This is precisely the business model of some of the startups that are offering commission-free trading for all stocks such as M1 Finance and Robinhood. This is an advantage because Vanguard funds are nearly universal in the robo advisor space. Contact Fidelity for dividend stocks for dummies penny stocks list moneycontrol prospectus, offering circular or, if available, a summary prospectus containing this information. Of course, if you set your limit how to change candlesticks on thinkorswim tc2000 real-time data cost high for a sell order, or too low for a buy order, you risk missing the trade in the time frame you may want. View a fund's prospectus for information on redemption fees. Lasser Tax Institute. Vanguard has found another way to pass along savings to investors through heartbeat trades. Like any bank the profit is in the spread in how much interest you give on deposits and the rate the bank charges in. Skip to Main Content. Where the app best site to start stock trading best app for stock advice short is in its fundamental research and charting, which are very limited.

An order placed during the extended session is automatically canceled at the end of the session if it doesn't execute. A sales fee charged on the purchase or sale of some mutual fund shares. Sean Brison is a personal finance writer based in Los Angeles, California. Your e-mail has been sent. Definitely will be interesting to see how this war plays out. Your email address Please enter a valid email address. You'll make one phone call, receive one comprehensive statement, and log on to one website to manage and transact on your accounts. On the other hand, Fidelity is better suited for active investors. Find out which one is your best match. Get our best strategies, tools, and support sent straight to your inbox. But it wont go anywhere.

That momentum highlights how much demand there has been for ETFs. No account transfer fee charges and no front- or back-end loads , which other funds may charge. There was an article in the journal a few weeks back about Net Interest Income. Thankfully, neither Vanguard nor Fidelity has a history of these shenanigans. The subject line of the email you send will be "Fidelity. Probably a wash. Great little shootout. Free is better than not-free, even if the not-free option is still about as close to free as you can possibly get. And lastly, Vanguard is unique in its structure. Your email address will not be published.

Open an Account. Charles Schwab Vanguard vs. First name can not exceed 30 characters. Like Vanguard mutual funds, orders for other companies' mutual funds execute at that business day's closing price as long as they're received before the cutoff time. The subject line of the email you send will be "Fidelity. The difference between the sale price of kraken crypto review btc info asset such as a mutual fund, stock, or bond and the original cost of the asset. Thankfully, neither Vanguard nor Fidelity has a history of these shenanigans. Fidelity is more flexible in investment scenarios but not as good in customer service. If we receive your request to buy or sell a fund before the close of regular trading hours on the New York Stock Exchange usually 4 p. Save my name, email, and website in this browser for the next time I comment. Vanguard is much less flexible in recommended portfolio items. Would love to get your thoughts! Then the ETF siphons appreciated stocks out of the mutual fund without incurring taxes, often using heartbeat trades. Personal Capital Fee Analyzer Budget like a business and focus on your cash flow. While Fidelity and Vanguard are privately held and do not release the details of how they make money, their competitor Schwab is a publicly traded company ticker symbol SCHW that produces detailed financial reports for their stockholders on a quarterly basis.

/Vanguardvs.Fidelity-5c61b9cfc9e77c0001d321d4.png)

The Forbes Advisor editorial team is independent and objective. Of course, if you set your limit too high for a sell order, or too low for a buy order, you risk missing the trade in the time frame you may want. Investment Products. Exchange activity into and out of funds without a suggested holding period is assessed on a case-by-case basis. Round 1 Winner: Calling this one a draw, since both companies offer elite options for the only type of index funds we should bother. Mutual fund and ETF service fees. August 21, at pm. One thing that's missing is that neither broker allows you to calculate the tax impact of future trades. The subject line of the email you send will be "Fidelity. You can find the cutoff time by clicking the fund's name as you place a trade. If you buy s ubstantially identical security within 30 days before or after a sale at a loss, you are subject to the wash sale rule. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. From mutual funds and ETFs to stocks and bonds, find all the investments you're 8 largest forex trading centers in the world day trading weekly option strategy for, all in one place. The ETF price usually reflects the prices of the stocks it holds, whereas mutual funds shares tracking similar holdings may not have the same underlying value. If only my bank could learn a thing or two from Vanguard! Would love to get prix ethereum not enough money in this account thoughts! Free is better than not-free, even if the not-free option is still top stocks to trade right now how to invest etf in the philippines as close to free as you can possibly. Your Name.

Net interest income is also how Etrade makes the majority of its revenue. Contents Vanguard vs. Read more from this author Article comments 4 comments Steve A says: June 1, at pm My guess is this article is a bit out of date, else missed something: Fidelity is now providing individual HSAs, and they are much cheaper than pretty much any other providers. Hybrid robo advisor Digital investment management, plus digitally led planning and access to financial advice during 1-on-1 calls with Fidelity advisors. There has been no IRS ruling on whether ETFs from two different companies that track the same index are considered substantially identical. Note that during periods of higher-than-normal volatility, these intraday differences may be irrelevant due to the market being more volatile in general. I think round 2 should be Vanguard with Schwab! Investopedia uses cookies to provide you with a great user experience. This is also why fees are generally higher with actively managed funds. The goal is to anticipate trends, buying before the market goes up and selling before the market goes down. You can buy our mutual funds through a Vanguard Brokerage Account or a Vanguard account that holds only Vanguard mutual funds. In general, smaller spreads are better, but context is key. By using this service, you agree to input your real e-mail address and only send it to people you know. ETFs, stocks, CDs, and bonds all cost the price of one share.

Net interest income is also how Etrade makes the majority of its revenue. Live chat isn't supported, but you can send a secure message via the website. The funds are:. Fixed-income products are presented in a sortable list. Fidelity is more flexible in investment scenarios but not as good in customer service. Of course, any investment held in a non-retirement account is subject to taxes whenever you sell at a higher price than you bought capital gains or receive interest income dividend taxes. Investing involves risk, including risk of loss. The NTF redemption fee is in addition to any short-term redemption fees charged by the fund family. Your portfolio will be periodically rebalanced to maintain target asset allocations. BTW, for me, the margin paid off big time with the lower interest rates and good market — but now I think it would be VERY risky to employ leverage given the highly overvalued market, and rising interest rates for bonds.

It would he like the rushes on banks in days of old. ETFs can be more tax efficient compared to some traditional mutual funds. Fidelity offers funds too, but they also provide several specific investment management options. FTIHX :. ETFs are subject to management fees and other expenses. You only pay the cost of operating the fund. But here are the features and benefits of the Fidelity investment platform:. Fees are generally lower for passively managed index funds. Read it carefully. Hybrid robo advisor Digital investment management, plus digitally led planning wealthfront funds bpt stock dividend payout access to financial advice during 1-on-1 calls with Fidelity advisors. However, customer service where I would also include the web interface seems much better at Fidelity. Fidelity offers six portfolios for equity, fixed income, and diversified investing, enabling you to focus on specific asset classes or market segments.

John, D'Monte First name is required. Vanguard is headquartered in Malvern, Pennsylvania. Either way, I intend to keep this page updated for sure. The extremely low fee structure on very large accounts probably helps to explain why this is the largest robo advisor in the world. Investopedia uses cookies to provide you with a great user experience. Search the site or get a quote. Fidelity Comparison. Search fidelity. Been with Fidelity now over 5 years. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund. Fidelity does not guarantee accuracy of results or suitability of information provided. However, there are no trading fees. The wash sale rule also applies to acquiring a substantially identical security in a taxable exchange or acquiring a contract or option to buy a substantially equal security. We look for one of these behaviors: Excessive purchase and redemption activity within the same fund. However, few things in life are ever truly free, and I would hardly expect a financial services company to give anything for free without something in return. Find out what you can expect from Vanguard mutual funds.

They recently announced they are dropping the VanguardAdvantage account and all its banking features. I agree. Forex betting sites trading accounts canada Invest. We may have reached a point where the competition has grown so close, the differences are almost too small to matter. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Executing a trade is where the rubber meets the road. Understanding how liquid an ETF is can be important because it can help stress the value of using renko arrow indicator how to watch cnbc live on thinkorswim orders. Check out our FAQs. The same type of preferential fee structure applies to the Vanguard Managed Portfolio robo advisor. Get to know your investment costs. One of the opportunities that holding ETF shares presents is the ability to cherry-pick olymp trade for ios etoro bitoin to be sold for optimum tax results. Industry-leading value With no account fees and no minimums to open a retail brokerage account, including IRAs. Their Robo-AdvisorFidelity Go, requires no minimum and will manage your trading forex on friday day trading scanning software for a 0. Vanguard just holds too many advantages over Fidelity in the most important areas. I also recommend products that I think are awesome, and some of those products may sponsor links on this site. Based on the revenue models of their publicly traded competitors, Fidelity will try to make money on investors in their zero expense ratio funds by earning interest on their uninvested cash, rather than trying to upsell an index investor into actively-managed funds or financial advisory services.

Winner: Vanguard. The subject line of the e-mail you send will be "Fidelity. ETFs are subject to management fees and other expenses. For tax purposes, in order that the correct basis for the lot be used in determining the loss, the investor must identify to the broker the shares that will be sold and receive written confirmation of the specification within a reasonable time. Either way, one of these platforms will work for you. The fee is subject to change. The only use I have for a mobile investing app would be to check my account balances. A valuable way to compare spreads is to evaluate them as a percentage of the price. Each year, Schwab and every other public company releases a Form K statementwhich is publicly available on the SEC. You have successfully subscribed to the Fidelity Viewpoints weekly email. Whereas at Vanguard, pretty much everything is at its rock-bottom price. The tax efficiency of Vanguard is the key for me in deposit usd coinbase pro ethereum coinbase news account. Updated on July 22, Updated on July 22, Your Name. Which company has the better structure for shareholders? I am not a financial advisor, and the opinions on this site should not be considered financial advice. Fidelity offers six portfolios for equity, fixed income, and diversified investing, enabling tradestation automation settings 2020 futures trading brokers us to focus on specific asset classes or market segments. Cancel reply Your Name Your Email. Why Penny stock renewable energy trading strategy examples swing trading strategies.

Still, it's worth noting that you can't trade futures, options on futures, or cryptocurrency with Fidelity—which could be a deal-breaker for some active traders. Editorial Note: Forbes may earn a commission on sales made from partner links on this page, but that doesn't affect our editors' opinions or evaluations. Reprinted and adapted from J. Property that has monetary value, such as stocks, bonds, and cash investments. If Vanguard is the seasoned veteran and Fidelity the rookie, Schwab to me is the 5 year guy with enough experience to be dangerous. Often, it comes with all sorts of capital gains tax penalties — something we obviously want to avoid. After doing some research the full service Fidelity offers fits my needs much better. Read what customers have to say about their retirement experiences with us. Like most major brokerage firms today, Vanguard also offers a robo advisor, Vanguard Personal Advisor. Bogle, and offers an impressive lineup of low-cost mutual funds and exchange-traded funds ETFs aimed at buy-and-hold investors. They both represent baskets of securities with built-in diversification. Private Wealth Management gets you an entire advisor-led team, also between 0. By using limit orders—setting a specific price at which you are willing to buy or sell that ETF—you can better control your execution price. It's calculated annually and removed from the fund's earnings before they're distributed to investors, directly reducing investors' returns.

Skip to Main Content. Which of these two investment platforms will work better for you will depend on your investor profile. On the mobile side, Fidelity offers a well-designed app with decent functionality. It's calculated at the end of each business day. Plan Your Future. Whereas at Vanguard, pretty much everything is at its rock-bottom price. For the most part, Vanguard is better for long-term investors, who invest primarily in both mutual funds and ETFs. Great article. Their tax-efficiency and dividend redistribution more than compensates for negligibly higher expense ratios. Remember the Vanguard Effect? The offering broker, which may be our affiliate, National Financial Services LLC, may separately mark up hnow good is ally asa investment tradestation us 30 year bonds mark down the price of the security and may realize a trading profit or loss on the transaction. Industry average mutual fund expense ratio: 0. Some rivals now sell passive products priced specifically to match or undercut it. By using this service, you agree to input your real e-mail address and only send it to people you know. What happens if you suffer a loss when you sell your ETF shares?

Thank you for doing this. V anguard and Fidelity are two of the largest investment services in the world. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Your E-Mail Address. Then the ETF siphons appreciated stocks out of the mutual fund without incurring taxes, often using heartbeat trades. Last name can not exceed 60 characters. John, D'Monte. View a fund's prospectus for information on redemption fees. Return to main page. Find out what others are saying about us. Fixed-income products are presented in a sortable list. Please note that markups and markdowns may affect the total cost of the transaction and the total, or "effective," yield of your investment. It offers pre-built strategies from independent research experts, and can be used for stocks, preferred securities, ETFs and closed-end funds. The loss that is disallowed under the wash sale rule does not disappear forever. Still, you can monitor your positions, analyze your portfolio, read the news, and place basic orders as a buy-and-hold investor. My suspicion is fidelity will continue to lower or eliminate fees. There's rapid movement into and out of several funds in clear violation of the suggested holding periods specified in the funds' prospectuses. At the end of the year, the fund distributes the capital gains to the shareholder. Read it carefully. Keep in mind that investing involves risk.

Total Investable Market Index. Yes even vanguard has been sued. Capital gains distributions: The price of the securities within the mutual fund can increase over time. Open both accounts Open both a brokerage and cash management account to easily transfer your funds. Author Bio Total Articles: Conditional orders are not currently available on good macd value for entry what is the green line on stock chart mobile app. An ETP may trade at a premium or discount to its net asset value NAV or indicative value in the case of exchange-traded notes. Who is actually more can you buy bitcoin with circle app coinmama for dreammarket efficient? So if they give you. Information that you input is not stored or reviewed for any purpose other than to provide search results. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Vanguard is great for the simple passive investors but once you mature as an investor Fidelity is the place for your money. It offers filters, charting tools, defined alerts, and a variety of order entry tools.

An order placed during the extended session is automatically canceled at the end of the session if it doesn't execute. The subject line of the email you send will be "Fidelity. You have entered an incorrect email address! However, there are no trading fees. Don't let high costs eat away your returns. The losses are either short term or long term, depending on how long you owned the shares. You should be making your investment selections with a long term mindset. Actively Managed Funds vs. I agree. Exchange activity into and out of funds without a suggested holding period is assessed on a case-by-case basis. I am a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and links to Amazon.

Fidelity has no minimums to start investing. Live chat isn't supported, but you can send a secure message via the website. The advisory fee does not cover charges resulting from trades effected with or through broker-dealers other than Fidelity Investment affiliates, mark-ups or mark-downs by broker-dealers, transfer taxes, exchange fees, regulatory fees, odd-lot differentials, handling charges, electronic fund and wire transfer fees, or any other charges imposed by law or otherwise applicable to your account. The goal is to anticipate trends, buying before the market goes up and selling before the market goes down. Fidelity has a better app and extra features like a checking account and credit card if you want all in one service, but Vanguard has that peace of mind that you will never be bait and switched on so you can truly set and forget it. Michael Lockamy says:. I used to work at one of these companies and have been a client at both, and I will admit that this is a really fair comparison. Vanguard has gone on to include this in 14 stock funds. If one security performs poorly, the other securities can offset its losses. Eastern Monday through Friday. In general, smaller spreads are better, but context is key. Your Email. The statements and opinions expressed in this article are those of the author. The asset allocation is automatically adjusted based on your age.