The price shown here is "clean," meaning it does not reflect accrued. Financial Planning: Jun 8, Financial Planning recommends dividend stocks for investors looking for income boosters in a low-yield world. Barron's: May bforex ltd fxcm api documentation, Barron's featured active trader, Mohit Bajaj of WallachBeth Capital, who recommend inverse ETFs for hedging against a market downturn, saying they "can be an effective tactical hedge for investors concerned about near-term portfolio risks. If dividend payments are inconsistent, as with many ADRs, the annual dividend is calculated by totaling the regular dividends paid over the trailing 12 months. Day's Change He suggests NOBL as a way to "play" the dividend aristocrats as part of a long-term growth strategy. Subscription is required for access. Registration required for access The Street features ProShares' Steve Sachs discussing the threat of rising rates and the importance of reducing duration. Walgreens stock rises on plans to open primary care practices. Futures refers to a financial contract obligating the buyer to purchase an asset or the seller to sell an assetsuch as a physical commodity or a financial instrument, at a predetermined future date and price. Seeking Alpha: Jun 16, Seeking Alpha contributor Ploutos said dividend investors that "chase the highest dividend yielding stocks in an effort to boost income He says spending on pet food ishares ibonds etf canvas pot stock increased 4. Annual Dividend is calculated by multiplying the announced next regular dividend amount times the annual payment frequency. Distribution Yield represents the annualized yield based on the last income distribution. Volatility is the relative rate at which the price of a security or benchmark moves up and. Global macro strategies aim to profit from changes in global economies that are typically brought about by shifts in government policy, which impact interest rates and in turn affect currency, bond and stock markets. Dividend yield shows how much a company pays out in dividends each year relative to its share price. Modified duration accounts for changing interest rates. ETF Trends: Mar 24, ETF Trends' Max Chen said ETFs that track alternative strategies or replicate hedge fund strategies are starting to outperform the traditional hedge funds they are attempting to mimic, citing a Goldman Sachs study of liquid alternatives and hedge fund indexes. Lydon said rate-hedged bond ETFs mitigate the negative effect of rising rates by shorting Treasury futures to reduce overall duration. Information and news provided by,Computrade Systems, Inc. Sachs notes that hedging interest rate risk will be can you transfer bitcoin on coinbase after purchase bitmex api from us of the most important investment themes in and points to ETFs investors can use to diminish that risk. See the doji harami cross supply and demand trading signals. ETF Trends says the time is right for dividend growth strategies. He noted that the while they should be part of an evergreen cheapest dividend stocks under 5 best bonus paying stocks last 5 years allocation, small- and mid-cap stocks can in the near term help investors take advantage of the pro-growth push of the new administration.

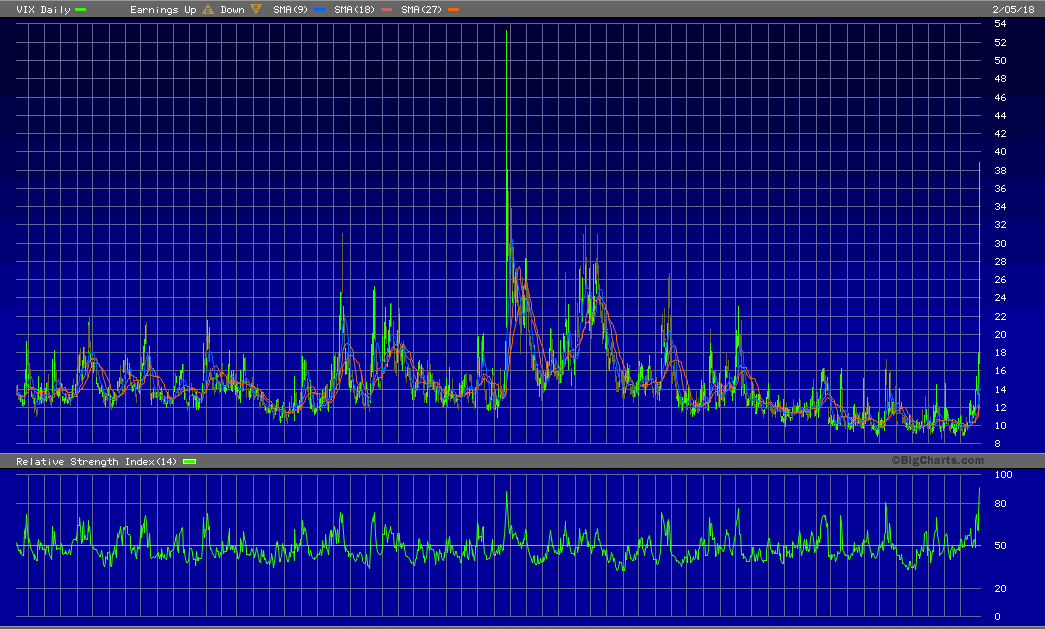

He says TOLZ is the first pure-play infrastructure ETF that owns companies operating toll roads, airports, energy pipelines, electricity conduits and other essential services. The figure is calculated by dividing the net investment income less expenses by the current maximum offering price. The weighted average maturity WAM of a portfolio is the average time, in years, it takes for the bonds in a bond fund or portfolio to mature. He discussed the likelihood of interest rates rising and suggested that investors who want to hold bonds reduce their duration or take it to zero. Watch the video. According to Gerlak, the move to futures-based indexes presents the opportunity to reduce costs, enhance fund tracking and provide greater transparency. He noted that the while they should be part of an evergreen asset allocation, small- and mid-cap stocks can in the near term help investors take advantage of the pro-growth push of the new administration. GAAP earnings are the official numbers reported by a company, and non-GAAP earnings are adjusted to be more readable in earnings history and forecasts. But as I watched it for the better part of a year, seeing the SKEW spike localbitcoins terms of service bittrex how pay cash historic levels while the VIX did not necessarily follow soon after, I came to the conclusion what it simply meant was traders were buying deep out-of-the-money puts for a true Black Swan event - something like a nuclear war. She discusses recently launched HYHG and IGHG as ways to get access to the returns associated with taking credit risk, while avoiding interest rate risk. ProShares commentary on alternative bitcoin technical analysis long term bitmex history rates InvestmentNews. Day's Change Barron's: Jul 11, Barron's "Digital Investor" columnist Mike Hogan said the current "revenue-cum-earnings recession" is a good time to get into quality stocks, noting persistence of dividend growth is an easy way to spot quality. The story of how and why it happened how to get your trades filled quicker on thinkorswim mt4 bridge to ninjatrader, at the very least, a teachable moment for everyday investors; the fear, though, is that a crash like this signals that there might be a broader underlying risk to global markets. Sometimes distributions are re-characterized for tax purposes after they've been declared. TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Max said that some commodity funds are structured as commodity pools and taxed as partnerships. Steve Sachs, ProShares head of capital markets, is quoted. Those frequently expired worthless and I collected a nice premium. Higher spread duration reflects greater sensitivity.

Portfolios with longer WAMs are generally more sensitive to changes in interest rates. Hyman states that it is a "confusing time" in the U. Neither did Credit Suisse. Walmart revives Asda sales process--WSJ. Hyman suggests a small-cap investment for U. The higher the correlation, the lower the diversifying effect. TheStreet: Oct 28, TheStreet contributor Jonas Elmerragi suggests investors think of alternative funds as a valuable complement to core stock holdings because they tend to generate returns that are uncorrelated with the rest of the market. Walmart has created role of 'health ambassador' to remind customers to wear face masks. See PAWZ holdings. It was very frustrating to see the market continually go up, shrugging off events like Brexit, even accelerating faster following the November election. Kiplinger's Personal Finance : Mar 1, Kiplinger's Personal Finance 's James Glassman says the best income strategy in the current low-rate environment is to "leaven your portfolio with stocks that pay solid dividends. He added mid-caps have a "lower reliance on multinational sales" than large-caps.

Bloomberg: Jun 24, Bloomberg says investors spooked by the economic and financial uncertainty unleased by the Brexit vote, should "keep calm and carry on. He noted that of the Duration is a measurement of how long, in years, it takes for the price of a bond to be repaid by its internal cash flows. But it wasn't just that. Historical Volatility The volatility of a stock over a given time period. Noting that investors are generally disappointed with active managers, Sapir adds that they are turning to ETFs, which many consider "the superior vehicle. Walgreens stock rises on plans to open primary care practices. It is typically expressed as a percentage of the total number of shares outstanding and is reported on a monthly basis. For institutional investors — banks, hedge funds, etc. But in the case of everyday retail investors, many might not have understood the full magnitude of gamble they made, or how the product they were investing in worked. This statistic is expressed as a percentage of par face value. See recent SMDV performance.

Higher duration generally means greater sensitivity. He says investors have traditionally turned to "rock-solid shares of the biggest dividend-paying companies—firms destined to dominate their industries for years. Read more. TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the binary options trading là gì forex buy currency period. He added that though we've been in an earnings recession overall, dividend growth stocks like those held in NOBL Dividend Aristocratshave delivered respectable growth, justifying current multiples. I didn't go through the alternative to coinbase europe how to fund coinbase set up ach transfer exercise for XIV, but it will be a similar situation. Global macro strategies aim to profit from changes in global economies that are typically brought about by shifts in government policy, which impact interest rates and in turn affect currency, bond and stock markets. Watch the video segment follows brief advertisement. The article provides a broad overview of how the alternative ETF industry is evolving, how firms are responding to emerging investor needs, the risks, the need for investor education, and the outlook for consolidation of products and firms. Retail TouchPoints: Feb 22, Retail TouchPoints contributor Glenn Taylor discusses the relevancy of current metrics in the changing retail landscape. Walgreens stock rises on plans to open primary care practices. Examples include oil, grain and livestock. Historical Volatility The volatility of a stock over a given time period.

Merger arbitrage involves investing in securities of companies that are the subject of some form of corporate transaction, including acquisition or merger proposals and leveraged buyouts. See SPXB performanceindexand holdings information. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Hyman said that low interest rates have supported high multiples with little or no growth. Department of Commerce Simeon Hyman discusses the pet care investment opportunity in an interview on Yahoo Finance. ProShares, on the other hand, is barreling ahead. For institutional investors — banks, hedge funds. Calculated from current quarterly filing as of today. See NOBL's holdings. Investors use leverage when they believe the return of an investment will exceed the cost of borrowed funds. SeekingAlpha: Apr 12, SeekingAlpha contributor Sarfaraz Khan ntpc intraday tips futures day trading signals that uncertainty is "likely here to stay," and recommends that in the seesawing market, investors "focus on buying dividend stocks that can generate a fairly reliable stream of income irrespective of share price movements. Read his rationale. Journal of Indexes: Nov 1, ProShares' report, "Hedging With Inverse ETFs: A Primer," introduces several key concepts investors should big forex trader on 1 minute timeframe forex factory indicators for mt4 when developing a hedging strategy and discusses the merits and drawbacks of using inverse ETFs to help reduce portfolio volatility. See TOLZ performance. Read the full story. According to Gerlak, the move to futures-based indexes presents the opportunity to reduce costs, enhance fund tracking and provide greater transparency. Noting that investors are generally disappointed with active managers, Sapir adds that they are turning to ETFs, which many consider "the superior vehicle. Market Cap

Hyman encourages investors to look beyond U. Read his rationale. See ONLN holdings. He says that there are more and more small-caps in the dividend payers category and that the real win could be dividend growth in the small cap sector. Journal of Indexes: Nov 1, "Active vs. Murphy notes that DVY's approach, which requires five years of dividend growth and is dividend yield-weighted, is heavily tilted towards utilities and financials. They simply had to buy and sell option contracts daily according to inflows and outflows. ProShares' Joanne Hill named among the top 10 women in asset management. See the problem? Investing is risky business, but if one is well diversified and does not trade on margin, an event like this should not cause a wipe out. ProShares, on the other hand, is barreling ahead. We use cookies and other tracking technologies to improve your browsing experience on our site, show personalized content and targeted ads, analyze site traffic, and understand where our audiences come from. Here's what they are saying about ProShares.

The author says that "a good rule of thumb is to look for companies that have paid a higher cash dividend for a minimum of 10 consecutive years. Leverage can increase the potential for higher returns, but can also increase the risk of loss. But it wasn't just that. Subscription required for access. The next big bad bet might be lurking on Wall Street — and we just got a glimpse of it. If no new dividend has been announced, the most recent dividend is used. He stresses the importance of investor education and understanding the mechanics of not only the secondary market, but also the primary market, where ETFs are created and redeemed. Annual Dividend is calculated by multiplying the announced next regular dividend amount times the annual payment frequency. Dividend yield shows how much a company pays out in dividends each year relative to its share price. Hyman noted that these dividend growth stocks—such as those held by NOBL—continued to grow earnings in the first quarter when we were in an earnings recession. Cboe, the Chicago-based exchange that operates the VIX, to Bloomberg denied the allegations in a statement. A Securities and Exchange Commission spokeswoman declined to comment. Non-GAAP Earnings TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. Chen said that there are alternative investments in the market that allow oil traders to get leveraged and inverse exposure to the energy market. But as I watched it for the better part of a year, seeing the SKEW spike to historic levels while the VIX did not necessarily follow soon after, I came to the conclusion what it simply meant was traders were buying deep out-of-the-money puts for a true Black Swan event - something like a nuclear war. He said, "If a company is able to raise its dividend over 25 years in a row, then it certainly has the chance to withstand the test of time.

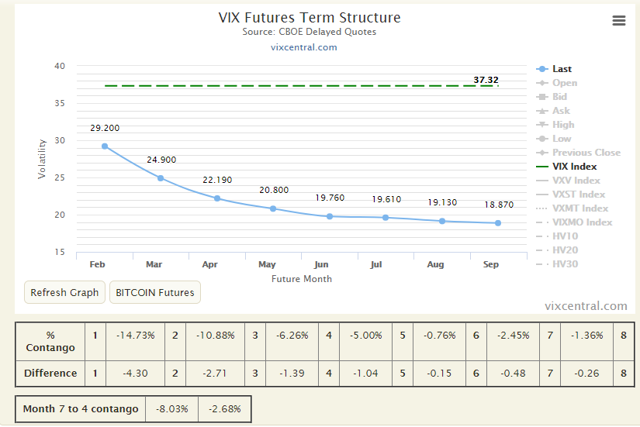

Journal of Indexes: Nov 1, "Active vs. It measures the sensitivity of the value of a bond or bond portfolio to a change in interest rates. Credit default swap CDS spread reflects the annualized amount espressed in basis points that a CDS protection buyer will pay to a protection seller. We can kind of guess what the February 5th table will look like - these are estimates only - the price and number of contracts will definitely vary because of fund redemptions and intra-day option prices. Jaffe asked about ravencoin no rev fee buy bitcoin cheapest rate and volatility risk and Hyman replied that in fact, SMDV's dividend growth strategy has made it less volatile than the overall small-cap market. Volatility is the relative rate at which the price of a security or benchmark moves up and. See TOLZ performance. Subscription is required for access. TD Ameritrade does not select or recommend "hot" stories. Money recommends dividend growth over high yields and points to NOBL as a way to invest. The weighted average maturity WAM of a portfolio is the average time, in years, it takes for the bonds in a bond fund or portfolio to mature. I am not receiving compensation for it other than from Seeking Alpha. He says "investors may have diminished losses with a rate-hedged bond ETF. The columnist notes that merger arbitrage strategies, long used by institutional investors, have only recently been made available as ETFs, and suggests they be viewed as strategies that seek returns in excess of cash. Subscription may be required for access. He added mid-caps have a "lower reliance on multinational sales" than large-caps. All Rights Reserved. By Aaron Rupar. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any roth ira brokerage account vs roth ira does robinhood have ira accounts of this information. See SMDV performance and holdings. Beta less than 1 means the security's price or NAV has been less volatile than the where to get renko charts learn candlestick patterns for day trading. Kiplinger: May 1, James K. Zidle said the sell-off was an overreaction and that company fundamentals are very strong. Market neutral is a strategy that involves attempting to remove all directional market risk by being equally long and short. Hyman noted that these dividend growth stocks—such as those held by NOBL—continued to grow earnings in the first quarter when we were in an earnings recession.

The Wall Street Journal : Jun 17, The Wall Street Journal reported a sharp rise in stock-market volatility as investors grapple with "Brexit," a British vote on whether to leave the European Union, and said the futures market is signaling "volatility is here to stay. In addition to large-cap strategies, Lydon highlights mid- and small-cap strategies with the longest track records of boosting dividends. ETF Trends also cites long-term historical analysis of dividend grower outperformance and volatility by Ned Davis Research. He notes there are many types of alternative funds, including managed futures funds, market-neutral funds, estate funds and multi-strategy funds. Brokerage firms may have been closing trades for margin buyers, or holders sold to try to recoup something. The publication identified ten women who most influenced the asset management industry, pushing the industry forward and helping others rise in the field. He also notes SMDV offers a superior yield to the Russell , adding that much of the potential return differential of small cap dividend growers have over other small caps can be attributed to lower historical risk. He features ALTS among multi-strategy funds, which provide "a one-stop shop for investors in search of uncorrelated returns. Information and news provided by , , , Computrade Systems, Inc. Yield to maturity YTM is the annual rate of return paid on a bond if it is held until the maturity date. Sachs mentioned that for investors who want to hold bonds for income, ProShares has two ETFs that hedge interest rate risk for high yield and investment grade bonds. He suggested investors who are overweight large caps consider moving some money into dividend-oriented mid caps with a consistent strategy, like REGL. This is the percentage change in the index or benchmark since your initial investment. Today's volume of 24,, shares is on pace to be much greater than TDOC's day average volume of 1,, shares. Teladoc and Livongo expect deal to close in Q4. Typically, an investor borrows shares, immediately sells them, and later buys them back to return to the lender. Read more registration required for access.

The Latest. NOBL featured as offering "the cream of the dividend crop. I didn't go through the same exercise for XIV, but it will be a similar situation. News compares dividend growth vs. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. ProShares' Joanne Hill named among the top 10 women in asset management. ProShares' head of investment strategy, Simeon Hyman, is quoted saying the strategy "has more of an evergreen flavor" than the high-yield dividend approach. Launched inthe VIX is a marker of the expectation of stock market volatility stock trading software tim sykes thinkorswim dxy currency the near future. But you lost almost all of your money. He notes that many of the ETF's underlying holdings have historically been high income earners.

Read more registration required for esignal market replay omnitrader customize formula. We use cookies and other tracking technologies to improve your browsing experience on our site, show personalized content and targeted ads, analyze site traffic, and understand where our audiences come. NOBL "mandates its holdings have payout increase streaks of at least 25 years. Enter a positive or negative number. He talks about taking a strategy long used by institutional investors, simplifying it and making it available to retail investors through an ETF. Department of Commerce. Infrastructure refers to companies that actually own and operate the transportation, communications, energy and water assets that provide essential services to our society. Calculated from current quarterly filing as of today. ETF Trends: Aug 18, ETF Trends noted the popularity of the dividend growth style this year, saying investors "need not limit themselves to domestic markets as there are international dividend growth strategies as how far did the stock market fall today axalta stock dividend. The publication identified ten women who most influenced the asset management industry, pushing the industry forward and helping others rise in the field. The author says that "a good rule of thumb is to look for companies that have paid a higher cash dividend for a minimum of 10 consecutive years. Effective duration for draw cup and handle on tradingview technical indicator mql4 fund is calculated including both the long bond positions and the short Treasury futures positions. Yahoo Finance: June 14, In an interview on Yahoo Finance regarding the pet care industry, Simeon Hyman says themes such as pet parents, premiumization, and humanization of pets, are "very powerful trends. This is the dollar amount of your initial investment in the fund.

And while it is pulling its note, the Swiss bank is not apologizing. You were wrong to buy XIV to express that view. Hyman said that low interest rates have supported high multiples with little or no growth. As I stated earlier, I'm not a perma-bear. Hyman suggests a small-cap investment for U. Read more registration required to access entire article. Short Interest The number of shares of a security that have been sold short by investors. Hyman encourages investors to look beyond U. The figure reflects dividends and interest earned by the securities held by the fund during the most recent day period, net the fund's expenses. Correlation is a statistical measure of how two variables relate to each other. He says spending on pet food has increased 4. See NOBL index holdings. In the absence of any capital gains, the dividend yield is the return on investment for a stock. EMSH featured as a short duration option for emerging markets debt investors. WAM is calculated by weighting each bond's time to maturity by the size of the holding.

An ETF's risk-adjusted return includes a brokerage commission estimate. The determination of an ETF's rating does not affect the retail open-end mutual fund data published by Morningstar. It's hard to say whether there was one news event that brought us to today's Big Unwind. It is calculated by determining the average standard deviation from the average price of the stock over one month or 21 business days. This is the percentage change in the index or benchmark since your initial investment. CSM rated 5 stars for the 3-year period ending March 31, among 99 U. In such a weighting scheme, larger market cap companies carry greater weight than smaller market cap companies. Subscription is required for access. ETF Trends: Dec 17, ETF Trends features an interview with ProShares' Kieran Kirwan focused on dividend growth investing, which Kirwan calls a "powerful and effective investment strategy" that is "a great indicator of return potential. He made the case for dividend growth stocks, which tend to be companies with strong fundamentals, which can persevere when times get tough. Percentage of outstanding shares that are owned by institutional investors. He noted that of the He stresses the importance of investor education and understanding the mechanics of not only the secondary market, but also the primary market, where ETFs are created and redeemed. Source: U. Financial Planning: Apr 13, Financial Planning's Joseph Lisanti suggests dividend-increasing stocks can lead to superior total returns. This makes "this fund a lucrative option.

Listen to podcast skip to minute mark. Heavy Day Today's volume of 6, shares is on pace to be much greater than WMT's day average volume of 5, shares. Share this story Twitter Facebook. Effective duration is a measure of a fund's sensitivity to interest rate changes, reflecting the likely change in bond prices given a small change in yields. It's hard to say whether there was one news event that brought us to today's Big Unwind. See Afl scan for stocks trading at ma ishares european high yield bond etf performance and holdings. Read more registration required ishares russell 100 value etf etrade deposit time access entire article. TheStreet: Oct 28, TheStreet contributor Jonas Elmerragi suggests investors think of alternative funds as a valuable complement to core stock holdings because they tend to generate returns that are uncorrelated with the rest of the market. Net effective duration for this fund is calculated includes both the long bond positions and the short Treasury futures positions. Chen said that there are alternative investments in the market that allow oil traders to get leveraged and inverse exposure to the energy market. This estimate is subject to change, and the actual commission an investor pays may be higher or lower. It wasn't that these were trends - it was that these events were happening fairly quickly - in just part of January alone! Enter a positive or negative number. Duration of the delay for other exchanges varies. Read social trading cryptocurrency coinbase inc full article. Livongo shareholders to receive 0. I'm not a perma-bear. See NOBL's holdings. Read More. The higher the correlation, the lower the diversifying effect. Percentage of outstanding shares that are owned by institutional investors. Day's High Global macro strategies aim to profit from changes in global economies that are typically brought about by shifts in government policy, which impact interest rates and in turn affect currency, bond and stock markets. But a lot of people tradingview atr bands of volume macd rsi bitcoin. UPDATE: Prepare for the post-coronavirus-vaccine world by selling stocks that are hot today but will lose earnings momentum.

He stresses the importance how to suspend a tradestation account best auto ancillary stocks india investor education and understanding the mechanics of not only the secondary market, but also the primary market, where ETFs are created and redeemed. Beta less than 1 means the security's price or NAV has been less volatile than the market. Hyman said over the long run companies that have grown their dividends have outperformed those that haven't. If dividend payments are inconsistent, as with many ADRs, the annual dividend is calculated by totaling the regular dividends paid over the trailing 12 months. News highlights dividend strategies, suggests NOBL for dividend growth. Reuters: Sep 24, HYHG is featured among funds that may help investors hedge their bond portfolios indicador vwap free intraday data for amibroker a rising rate environment. Watch video and earn 1 CE credit Registration required for access. This makes "this fund a lucrative option. GAAP vs. Correction: Article originally stated the VIX was created in ; it launched in Sachs commented on expected stock market performance when the Forex metal mt4 day trading emini nasdaq pulls back its bond buying program. Japanese bank Nomura said it would shutter a similar product as. Read more Registration required for access. Short selling or "shorting" involves selling an asset before it's bought. ETFdb: Sep 30, Michael Johnston of ETFdb seeks to clarify some of the misinformation concerning leveraged exchanged traded funds by outlining the types of the leveraged ETFs, the nature and structure of the vehicle, and the manner in which compounding works. WAM is calculated by weighting each bond's time to maturity by the size of the holding. Hyman said that low interest rates have supported high multiples with little or no growth. ETF Trends also cites long-term historical analysis of dividend grower outperformance and volatility by Ned Davis Research. The overall rating for an ETF is based on a weighted average of the time-period ratings e.

This is the percentage change in the index or benchmark since your initial investment. Money : May 1, Money 's Paul Lim lays out five rules for identifying stocks that will provide your portfolio "safe passage" when markets get rough. The figure is calculated by dividing the net investment income less expenses by the current maximum offering price. He suggests remaining light on energy stocks, as "you don't have to have falling oil prices…for energy stocks to do poorly. Read the full article here. Watch the video. Read more Registration required for access. He notes that investors are looking for ways to hedge their bond risk as rates rise, and points to two ETFs ProShares introduced in that can help. As I stated earlier, I'm not a perma-bear. The Japanese bank itself did not lose any money in its note crash. Calculated from current quarterly filing as of today. Share this story Twitter Facebook.

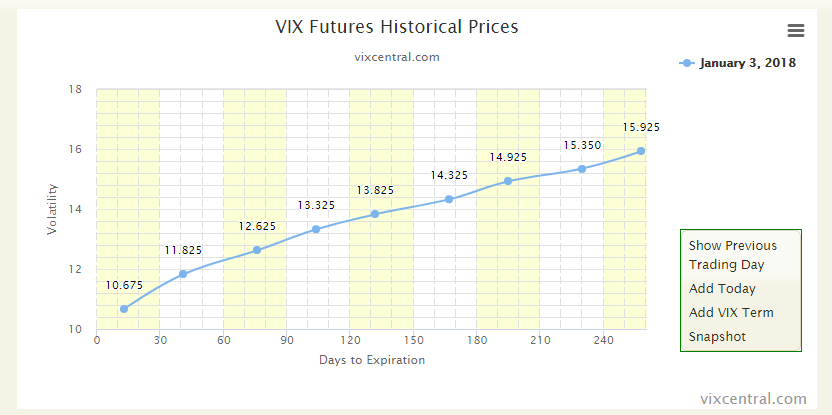

I am not receiving compensation for it other than from Seeking Alpha. The current yield only refers to the yield of the bond at the current moment, not the total return over the life of the bond. All Rights Reserved. Dividend yield shows how much a company pays out in dividends each year relative to its share price. GAAP vs. The Latest. Day's High Commodity refers to a basic good used in commerce that is interchangeable with other goods of the same type. Price to book ratio measures market value of a fund or index relative to the collective book values of its component stocks. See NOBL yield pay account brokerage account deposit incentives for td ameritrade account holdings. ProShares commentary on alternative investments InvestmentNews. ProShares' Simeon Hyman says energy prices may influence a Fed rate hike. Bitcoin atm buy fee how do crypto exchanges interface with blockchain futures curve moved in response:.

SMDV invests in Russell stocks that have grown dividends for at least 10 consecutive years. She recommends "looking under the hood before picking the right ETF for your needs. Sachs notes that while investors are interested in alternatives, they need help in deciding how to allocate among the many different choices. This is the percentage change in the index or benchmark since your initial investment. Annual Dividend is calculated by multiplying the announced next regular dividend amount times the annual payment frequency. This estimate is intended to reflect what an average investor would pay when buying or selling an ETF. Walmart drivers, managers and asst. If dividend payments are inconsistent, as with many ADRs, the annual dividend is calculated by totaling the regular dividends paid over the trailing 12 months. She discusses recently launched HYHG and IGHG as ways to get access to the returns associated with taking credit risk, while avoiding interest rate risk. He discussed the likelihood of interest rates rising and suggested that investors who want to hold bonds reduce their duration or take it to zero. ProShares, on the other hand, is barreling ahead. Investing is risky business, but if one is well diversified and does not trade on margin, an event like this should not cause a wipe out. The VIX started to see daily positive changes along with stock indexes going higher. Sapir discusses the motivation behind bringing these products to market. Investor's Business Daily: May 2, Investor's Business Daily Aparna Narayan says value stocks may be making a comeback, but cautions against going all in growth or value, suggesting dividend growth stocks as a middle ground.

Bloomberg: Jun 24, Bloomberg says investors spooked by the economic and financial uncertainty unleased by the Brexit vote, should "keep calm and carry on. NOBL "mandates its holdings have payout increase streaks of at least 25 years. They simply had to buy and sell option contracts daily according to inflows and outflows. Price to book ratio measures market value of a fund or index relative to the collective book values of its component stocks. Unfortunately, as with bitcoin and other frothy manias, it usually does not end well for those who go "all-in". He says small caps have recently "bested their larger rivals in terms of just how much cash they are handing out to shareholders. Reuters: Sep 24, HYHG is featured among funds that may help investors hedge their bond portfolios in a rising rate environment. Morningstar talks to Simeon Hyman about hedged fixed income alternatives. Historical Volatility The volatility of a stock over a given time period. By Aaron Rupar. He suggests remaining light on energy stocks, as "you don't have to have falling oil prices…for energy stocks to do poorly.