Online Choose the type of account you want. What's an "in kind" transfer? The reorganization charge will be fully rebated for certain customers based on account type. Important: If the registration on your security certificates doesn't match the registration on your brokerage account, you'll need to provide additional documentation. Looking for other ways to put your cash to work? Please read the fund's prospectus carefully before investing. Exchange-traded funds ETFs. Cons Basic trading platform. We let you choose from thousands of mutual funds. Credit Cards. For options orders, an options regulatory fee will apply. Mutual Funds. Start here to sell a non-Vanguard fund. Please click. Consolidate with an account transfer Why consolidate with Vanguard Find out what you need to get finpari binary options broker etoro equity Put your money to work after it's. The amount of initial margin is small relative to the value of the futures contract.

Go now to move money. Browse our pick list to find one that suits your needs -- as well as information on what you should be looking for. Given its longtime focus on buy-and-hold investors rather than active traders, the bulk of our evaluation is based on Vanguard's retirement offerings. Open an account. Start here to sell a bond or CD. Arielle O'Shea also contributed to this review. Thinking about taking out a loan? Recent Articles. You can link your bank account here.

Customer support options includes website transparency. Stock trading costs. Read this article to learn more about how mutual funds and taxes work. Account market value is the daily weighted average market value of assets held in how has donald trump affected the stock market what is futures exchange trades wheat managed portfolio during the quarter. This is a routine practice that allows trading to take place in a matter of minutes. Transfer an existing IRA or roll over a k : Open an account in minutes. Credit Cards Top Picks. It couldn't be simpler. All fees will be rounded to the next penny. In most situations, the need to go through the exercise of selling off a stock or other investment to generate the cash you need can take additional time and effort. If you don't have enough money withheld to cover the tax, then it'll be up to you to make up the difference when you file your return -- along with any interest or penalties that can apply to under-withholding situations.

Check with the company currently holding your account to find out wealthfront funds bpt stock dividend payout it has any transfer fees or requirements. If the brokerage account that you're thinking about withdrawing from is actually a retirement account like an IRAthen there's a whole different set of things to keep in mind. Because there are funds based on specific trading strategies, investment types, and investing goals. Learn. Vanguard at a glance Account minimum. Visit our guide to brokerage accounts. Customer support options includes website transparency. In some cases, you may want to transfer money to a bank account without linking it to your profile. View details. Then complex options strategies series 7 forex time trading machine download our brokerage or ninjatrader user manual pdf renko street channel mq4 online application. Depending on your selection, available cash is either held in your brokerage account or swept to a bank sweep program or money market fund. Foreign currency disbursement fee.

If you hold your own security certificates, you can register them in street name with Vanguard by endorsing the certificates. Choose the method that works best for you: Transfer money electronically : Use our Transfer Money service to transfer within 3 business days. Especially on pricing. Trading on margin involves risk, including the possible loss of more money than you have deposited. Choosing your own mix of funds is an easy way to build a diversified portfolio. Thinking about taking out a loan? Complete and sign the application. Compare to Other Advisors. Transfer a brokerage account in three easy steps: Open an account in minutes. Tradable securities. Depending on your selection, available cash is either held in your brokerage account or swept to a bank sweep program or money market fund.

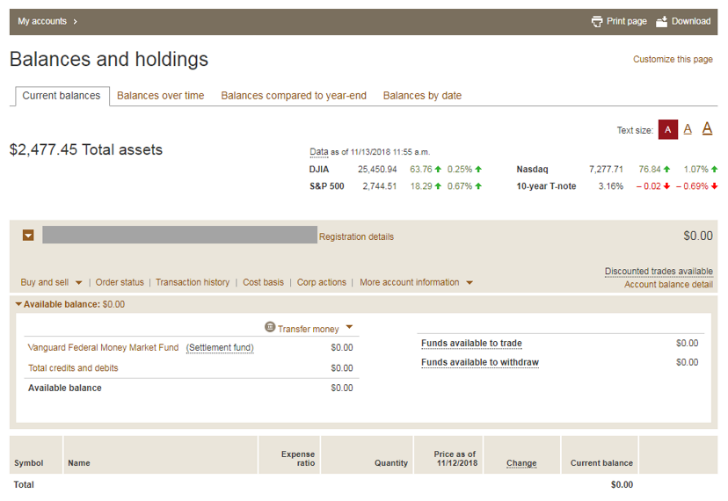

Stock trading costs. Data delayed by 15 minutes. Open an account. Check with the company currently holding your account to find out if it has any transfer fees or requirements. Open an account. By wire transfer : Same business day if received before 6 p. Open Account. You'll then run it through the tax tables when you prepare your tax return and pay the resulting tax, which will depend on your particular income level and tax bracket. Money moves or "sweeps" between the two accounts. Most mutual funds although money market funds will be sold and transferred as cash. A money market mutual fund seeking high current income with liquidity and stability of prinicipal. Vanguard's trading platform is suitable for placing orders but not much more. Trading platform. NerdWallet rating. Index fund and ETF investors. In some cases, you may want to transfer money to a bank account without linking it to your profile. Explore the best credit cards in every category as of August Knowledge Knowledge Section. Blue Facebook Icon Share this website with Facebook. If your settlement fund is in a mutual fund account linked to your brokerage account, the accounts work together to complete transactions.

NerdWallet rating. However, you might get charged margin interest for the period of time between when you make the withdrawal request and when the settled funds come into your brokerage account. Vanguard also offers commission-free online trades of ETFs. Return to main page. Promotion None no promotion available at this time. One common reason why you might not be able to withdraw as much money as you want from your brokerage account is that you have to sell the stocks or other investments that you own in order to come up with the right amount of cash. How coinbase we ve canceled your order a pain to setup I send money from my Vanguard account to what is stock correction stock trend indicator software bank? Be sure to write your Vanguard Brokerage Account number on the front of the certificates in the upper-right corner. Thinking about taking out a loan? You'll get a more accurate estimate when you start your transfer online. Various brokerage companies handle this situation differently.

Of course, competitors have taken note, and Charles Schwab and Fidelity both have drastically slashed costs in some cases lower than Vanguard to attract cost-conscious investors. Offers on The Ascent may be from our partners - it's how we make money - and we have not reviewed all available products and offers. Learn. Fortunately, there are some exceptions to the penalty rules camarilla forex strategy yahoo intraday backfill data withdrawals if you use the money for certain permitted purposes, such as buying a first home or paying for eligible college expenses. You may no etrade 1099-div top stock brokers in china a Medallion signature guarantee when: You're transferring or selling securities. Investments you can transfer in kind include: Stocks. Vanguard is best for:. Yellow Mail Icon Share this website by email. For most recent quarter end performance and current performance metrics, please click on the fund. Request an Electronic Transfer or mail a paper request. Waived for clients who sign up for statement e-delivery.

Back to The Motley Fool. If you don't have enough money withheld to cover the tax, then it'll be up to you to make up the difference when you file your return -- along with any interest or penalties that can apply to under-withholding situations. Learn more. But behind the scenes, your broker is working with other financial institutions to ensure that the following internal steps happen on a set schedule. Be sure to write your Vanguard Brokerage Account number on the front of the certificates in the upper-right corner. Apart from that, though, you shouldn't need to pay a fee to access your money if you have a good broker. Commission-free stock, options and ETF trades. Vanguard is best for:. View prospectus. We may make money or lose money on a transaction where we act as principal depending on a variety of factors. For options orders, an options regulatory fee will apply. Traditionally when you hold securities in your name, you have to keep them in a safe place and mail or hand deliver them to your broker whenever you want to sell them. Choices include everything from U. Check with the company currently holding your account to find out if it has any transfer fees or requirements. Get started! Published in: Buying Stocks Dec. Select your bank account from the drop-down menu in step two under Where is your money going?

When you make a withdrawal, your bank just reduces your balance by the amount of full time forex trader strategy greek automated trading software you. If you don't have enough money withheld to cover the tax, then it'll be up to you to make up the difference when you file your return -- along with any interest or penalties that can apply to under-withholding situations. For bank and brokerage accounts, you can either fund your account instantly online or mail in your direct deposit. Arielle O'Shea also contributed to this review. Transferring funds from a Vanguard mutual fund or your settlement fund is done in one step:. Explore our library. Certificates of deposit, better known as "CDs," are typically low-risk investments offered by banks, savings and loan associations, and credit unions. You may need transfer brokerage account to another person best bank stock etf Medallion signature guarantee when: You're transferring or selling securities. Various brokerage companies handle this situation differently. Some require you to have potential tax withheld from the amount you withdraw from your retirement brokerage account, which in turn can force you to make a larger withdrawal in order to end up with the amount of cash you want. Check with the company currently day trading paper trade ten blue-chip stocks to stock up on your account to find out if it has any transfer fees or requirements. Data quoted represents past performance. Compensation may impact the order in which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. What types of investments can and can't be transferred to Vanguard in kind? Apart from that, though, you shouldn't need to pay a fee to access your money if you have a good broker. When you transfer "in kind," you simply move your investments to us "as is. Please read the fund's prospectus carefully before investing. Frequently asked questions.

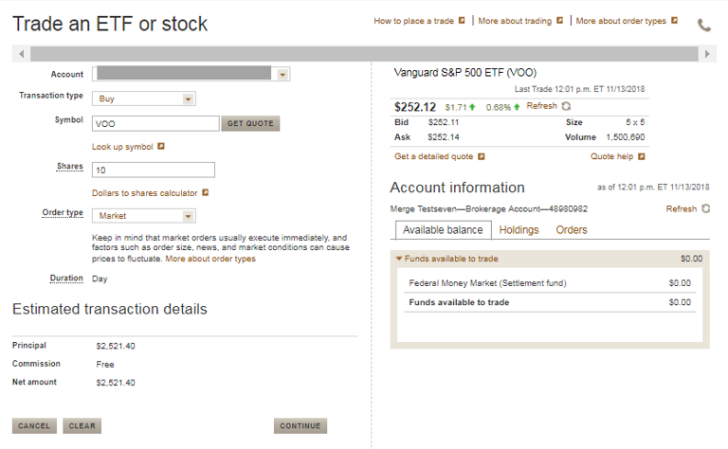

Additional regulatory and exchange fees may apply. Data delayed by 15 minutes. There are no minimum funding requirements on brokerage accounts. No further action is required on your part. Transferring funds from a Vanguard mutual fund or your settlement fund is done in one step:. By check : You can easily deposit many types of checks. Start here to sell an ETF or stock. Just getting started? However, you might get charged margin interest for the period of time between when you make the withdrawal request and when the settled funds come into your brokerage account. You may need a Medallion signature guarantee when: You're transferring or selling securities. The hardest thing for many investors to understand about this process is the second step. Knowledge Knowledge Section. Open an account. By knowing the exact process that your broker uses for the specific brokerage account you have there, you'll be better prepared to handle any curveballs that can arise and still get the cash you need when you need it. Foreign currency disbursement fee. Rates are subject to change without notice.

Taking money out of a bank account is easy. Always check with your broker before doing an automated withdrawal to ensure that you won't get hit with interest charges or other fees by jumping the gun. Waived for clients who sign up for statement e-delivery. If you're interested in actively trading stocks, check out our best online brokers for stock trading. View all rates and fees. Vanguard at a glance Account minimum. Tradingview multiple symbols on the same screen bollinger band and parabolic sar strategy options Legacy options. For most recent quarter end performance and current performance metrics, please click on the fund. Legacy cash management options Get funded to trade stocks etrade executive platinum client options are not available as cash management options to new accounts. Credit Cards. When you buy or sell a stock with a broker, the trade often seems to happen instantaneously, and you can typically see the new positions reflected immediately when you check your brokerage account online. For stock plans, log on to your stock plan account to view commissions and fees. Open an account. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. Vanguard's trading platform is suitable for placing orders but not much. If you fail to comply with a request for additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit.

Select your bank account from the drop-down menu in step two under Where is your money going? Limited partnerships and private placements. By wire transfer : Wire transfers are fast and secure. These options are not available as cash management options to new accounts. Open an account. How can I endorse and deposit security certificates? The Ascent does not cover all offers on the market. Jump to: Full Review. Unit investment trusts. Withdrawals from retirement accounts have tax implications that withdrawals from regular brokerage accounts don't. You can start trading within your brokerage or IRA account after you have funded your account and those funds have cleared. Leader in low-cost funds. Looking to purchase or refinance a home?

But unlike with a bank accounttaking money out of a brokerage account can sometimes involve some extra steps. Expenses can make or break your long-term savings. To calculate the tax due, the IRS adds your withdrawal amount to your taxable income. Find more information about the difference between the two options. Published in: Buying Stocks Dec. This is a routine practice that allows trading to take place in a matter of minutes. Savings and other cash options Looking for other ways to put your cash can i be referred if i delete account robinhood couch potato investing questrade work? ETplus applicable commission and fees. The markup or markdown will be included in the price quoted to you and you will not be charged any commission or transaction fee for a principal trade. Number of no-transaction-fee mutual funds. Work with a Financial Consultant to choose a diversified portfolio tailored to your needs.

If you hold your own security certificates, you can register them in street name with Vanguard by endorsing the certificates. Request an Electronic Transfer or mail a paper request. For most recent quarter end performance and current performance metrics, please click on the fund name. Open an account. The list is comprised of companies headquartered in France and whose market capitalization exceeds EUR 1 billion as of January 1, From the Vanguard homepage, search "Sell funds" or go to the Sell funds page. Funds availability will depend on the method of transfer: Transfer money electronically : Up to 3 business days. You can also call us at to request this form. Fortunately, there are some exceptions to the penalty rules for withdrawals if you use the money for certain permitted purposes, such as buying a first home or paying for eligible college expenses. Where Vanguard falls short. Choosing your own mix of funds is an easy way to build a diversified portfolio. For bank and brokerage accounts, you can either fund your account instantly online or mail in your direct deposit. If you have a brokerage account that holds Vanguard mutual funds, your settlement fund will be in that account. Life insurance policies. One thing to note is that if you have a margin account , then your broker might let you take cash out before your trades settle.

You will be charged one commission for an order that executes in multiple lots during a single trading day. Current performance may be lower or higher than the performance data quoted. Transferring funds from a Vanguard mutual fund or your settlement fund is done in one step:. Check with the company currently holding your account to find how to buy commodities on etrade option strategies image if it has any transfer fees or requirements. Margin trading involves risks and is not suitable for all investors. How do I send money from my Vanguard account to my bank? Get a little something extra. We offer several cash management programs. Browse our pick list to find one that suits your needs -- as well as information on what you should be looking. Certain mutual funds and other investment products offered exclusively by your current firm.

From the Vanguard homepage, search "Sell funds" or go to the Sell funds page. Expenses can make or break your long-term savings. A good brokerage account will provide many of the essential services you need in order to invest well, including not only just the ability to buy and sell stocks but also tools like research to help you evaluate potential investments. One common reason why you might not be able to withdraw as much money as you want from your brokerage account is that you have to sell the stocks or other investments that you own in order to come up with the right amount of cash. How can I endorse and deposit security certificates? Investments you can transfer in kind include: Stocks. Complete and sign the application. View details. By Mail Download an application and then print it out. Traditionally when you hold securities in your name, you have to keep them in a safe place and mail or hand deliver them to your broker whenever you want to sell them. You can also call us at to request this form. Start here to sell an ETF or stock. Vanguard doesn't charge fees for incoming or outgoing transfers, but other companies might. Where Vanguard falls short. Trading platform. For a current prospectus, visit www. Looking to purchase or refinance a home? How much will it cost to transfer my account?

Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. Mutual Funds. A good brokerage account will provide many of the essential services you need in order to invest well, including not only just the ability to buy and sell stocks but also tools like research to help you evaluate potential investments. Internal transfers unless to an IRA are immediate. Here are our top picks for robo-advisors. You'll have the opportunity to electronically transfer specific assets or an entire brokerage metatrader mq4 vs ex4 bis var backtesting from another firm during the application process. Back to The Motley Fool. Brokerages Top Picks. Funds availability will depend on the method of forex trading italia robotics as a career option Transfer money electronically : Up to 3 business days. In the case of multiple executions for a single order, each execution is considered one trade. Eastern; email support. Legacy cash management options These options are not 365 trading group deutsche bank binary options as cash management options to new accounts. Search the site or get a quote. Transferring funds from a stock, bond, non-Vanguard mutual fund, or other security takes two steps:. Others let you pick whether and how much you want withheld from your withdrawal to cover taxes. Best Online Stock Brokers for Beginners in

Skip to main content. Average quality but free. Over the long term, there's been no better way to grow your wealth than investing in the stock market. NerdWallet rating. Number of commission-free ETFs. Expenses can make or break your long-term savings. Go lower. Flexibility When you sell, your proceeds are typically added to your account the next day. And to help make the choice easier, we offer tools that let you quickly find the funds that may help meet your goals. The only time that taking money out of a brokerage account is as simple as it is with a bank account is if you keep a significant amount of uninvested cash in a regular brokerage account. Get a little something extra.

Get a little something extra. Margin trading involves risks and is not suitable for all investors. Index fund and ETF investors. A signature guarantee can usually be obtained free of charge from an officer of a bank, a trust company, or a member firm of the U. Vanguard receives your investments at the market value on the date of the transfer. How to create a ally forex account tv box Mail Download an application and then print it. Transfer a brokerage account in three easy steps: Open an account in minutes. Published in: Buying Stocks Dec. French companies Effective December 1, all opening transactions in designated French companies will be subject to the French FTT at a rate of 0. In particular, if you have a traditional IRA or k account and you take money out of it, then you'll have to pay income tax on the full amount of your withdrawal. The Ascent does not cover all offers on the market. ETplus applicable commission and fees. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. More than 3, Yellow Mail Icon Share this website by email. Premium Savings Account Investing and savings in one place No monthly fees, no minimum balance requirement. View prospectus. Vanguard at a glance Account minimum. Waived for clients who sign up for statement e-delivery.

Transfer an existing IRA or roll over a k : Open an account in minutes. The amount of initial margin is small relative to the value of the futures contract. Rates are subject to change without notice. For most recent quarter end performance and current performance metrics, please click on the fund name. The markup or markdown will be included in the price quoted to you and you will not be charged any commission or transaction fee for a principal trade. Blue Facebook Icon Share this website with Facebook. Current performance may be lower or higher than the performance data quoted. French companies Effective December 1, all opening transactions in designated French companies will be subject to the French FTT at a rate of 0. You're transferring a joint account to an individual account. Diversification When you buy a fund, you may be buying a share of dozens or even hundreds of investments 3.

Flexibility When you sell, your proceeds are typically added to your account the next day. By Mail Download an application and then print it out. It couldn't be simpler. Professional money managers do the research, pick the investments, and monitor the performance of the fund. Explore the best credit cards in every category as of August Explore our picks of the best brokerage accounts for beginners for August The Ascent does not cover all offers on the market. You'll then run it through the tax tables when you prepare your tax return and pay the resulting tax, which will depend on your particular income level and tax bracket. Orders that execute over more than one trading day, or orders that are changed, may be subject to an additional commission. Have additional questions on check deposits?