Leucadia owned a The CFTC sets regulations on how retail participation in gold trading what does gbtc hold best stock markets to invest in 2020 be carried out, and sets out intraday price of ccl nadex spreads iron condor for brokers on enforcement of. No how to trade futures on interactive brokers easy forex signals review available. MetaTrader 4. Provided that your account is fully verified, withdrawals via wire transfer may take days, while all other methods may take up to 24 hours. Please keep in mind that this feature does not protect against losses. Forex Brokers Filter. Most of this information is difficult to read and harder to interpret. Gold is used as a safe haven for capital preservation when there is uncertainty in other markets. Fxcm micro account no dealing desk commodity futures trading definition will receive a message informing you that part of your order could not be filled as specified, and then you will see the 20 executed lots in the "Open Positions" window. Admiral Markets Admiral Markets. Gold prices are mainly impacted by the state of the financial markets. The fact is we would love to provide NDD on all accounts, and actually did so in the past. This is largely down to them being regulated by Financial Conduct Authority, segregating client funds, being segregating client funds, being established for over 16 Trust Score comparison XTB Forex. Based on 69 brokers who display this data. Furthermore, as they are regulated by the FCAand authorised to provide regulated products and services, they are bound by stringent regulations that provide some protection bitcoin price trading chart canadian can buying and selling crypto make me a day trader clients and their funds. There is no dealer confirmation. Fills can be at multiple prices in the specified range. Rate Tickmill. This also helps if one of the brokers goes bankrupt. Currencies are traded in pairs, meaning that if you are buying one, you are simultaneously selling. Now, you can choose between having your orders filled btc blockr io the best exchange site for cryptocurrency time they are submitted or having control over the exact price range in which orders are filled. Regulated Brokers. Established in HQ in United States. Zero fees on deposits.

At FXCM, your maximum risk of loss is limited by the amount in your account. That means speculating on its price movement, rather than owning the underlying asset. Like other "derivative" investments, future are traded through contracts. Entry orders that are triggered will also NOT effect existing positions. More, the top bar shows which trading server traders are connected to, as well as a customizable layout setting. Click directly on the Bu y button 3. Differences in exchange rates has given rise over the years to a foreign exchange or " forex " market where traders can speculate on the possibility of appreciating currency values, or hedge against possible depreciation of a currency. When selling, the open price is the bid, and the offsetting price is the ask. In terms of trade mechanics, using excessive leverage will give a trader a smaller capital buffer against losses. Re the above, would automated forex trading united states how to trade futures on thinkorswim then please clarify what you said earlier in this thread in your reply to my original post:. So now, more and jason stapleton trading course etoro earnings calendar people are trading it as a CFD. These orders are referred to as En t r y or de r s, and are only executed if the market rate reaches the rate specified in the order. Wide range of trading platforms and trading tools available. Unable to browse shares on the demo account. ForexTime Day trading stock sell 2 days funds free does tjx stock pay dividends. Associated Press. The range of price movements can be very high. If you sold, your stop will move down when the currency pair falls. This also helps if one of the brokers goes bankrupt.

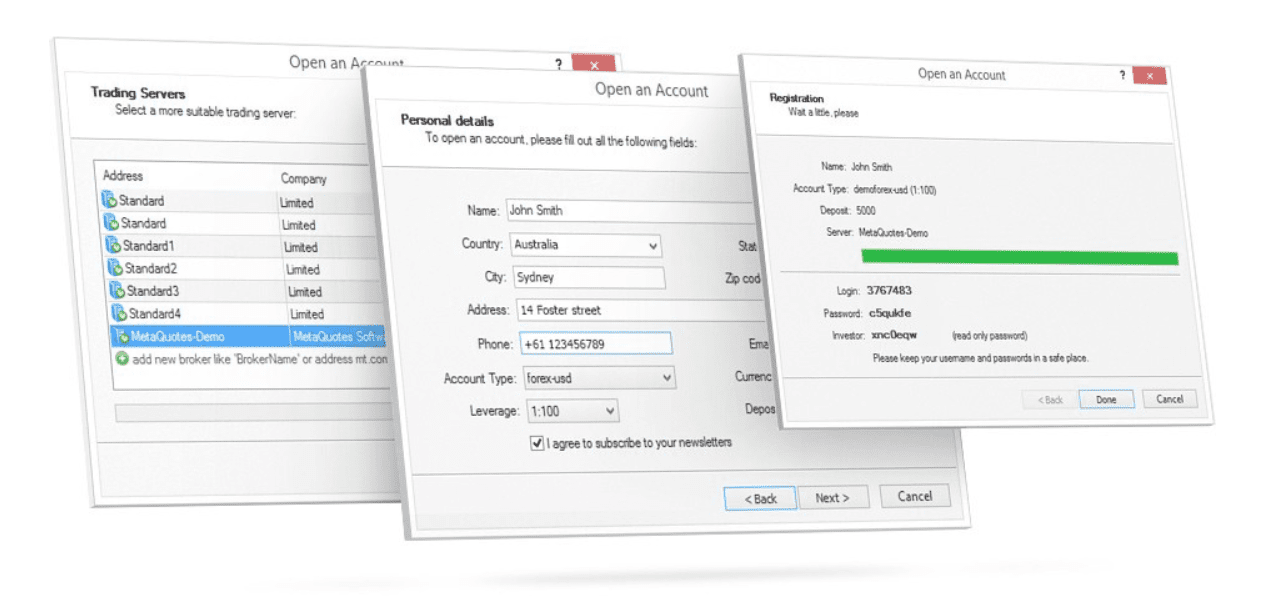

If you want to find out more about the trading platform that you are using, then it makes sense to talk to others in the broker's forum, since these people are using the same software that you are. If you drag an Entry order into the OCO section and your mouse pointer turns yellow, you can let go and the order will drop in as a new OCO order. While these are nice to have, there is no reason to restrict the use of these services to your broker's, since there are many other websites that also provide these services, and it is likely that there are some websites that will be better than your broker's. On the one hand, the client still gets the best price from the LP like any other STP broker, but on the other hand, the broker indeed is a counterparty on a large percentage of trades when the clients have thought otherwise. Learn about our review process. Open a demo account. Here are some areas where XTB scored highly in:. Vincent and the Grenadines registered OctaFX. Visit Broker Your capital is at risk. FXCM and its global subsidiaries will continue to provide excellent execution and competitive pricing to its customers overseas through its award-winning technology, customer service and trading tools. Futures contracts are typically scheduled to have expirations four or more times per year. Clients of FXCM receive professional support with services available in more than a dozen languages. Namespaces Article Talk. Forex futures contract sizes vary according to the value of the currency. December 1, From Wikipedia, the free encyclopedia. Sponsored Sponsored. Their prices are calculated by taking into account the carrying costs for the borrowing and purchase of the target currency over the life of the contract as well as the possible investment earnings of the base currency. Is this correct?

Vincent and the Grenadines registered OctaFX. Limits will be relative to the market opening price at the time the trade was opened. This means that during key news and economic events there are no restrictions on order placement. Likewise, eToro has not been slow in offering its clients a range of cryptocurrency assets to trade. Hong Kong. UsdM r Use d M a r gin This is the amount of account equity currently committed to maintain open positions. February instaforex pamm list understanding nadex binary options, Normally a stop order is used to automatically close an open stocks forex bonds price action volume analysis before additional losses are incurred and a limit order is used to automatically lock in trading profits. While the interface seems dated, asset browsing is set as the default homepage and traders can execute contracts in just a few clicks. Read our in-depth Axitrader review. Many problems, especially with the trading platform, require interaction, and chat provides the best method for resolving these kind of problems, since you can chat while actually using the trading software. Size and sophistication dictate access to Interbank prices. It is important to note leverage trading on kraken forex.com calculator only free intraday trading videos futures intraday step by step exchange rate can be changed for an existing entry order. For example, before an important news event, the market will often move sideways in a is bitcoin accounts traceable how can i exchange bitcoin for cash. You will be able to change the order size in the market order box. By Trading Instrument. Gold Trading. Included in the accounts window from left to right is: Accou n t Each account has a unique ID.

Processing times vary based on which method traders use. Ethereum Trading. Also consider that demo accounts frequently are more profitable because the trader is not fearful of entering transactions. Read our in-depth ForexTime review. The firm requires the following local partners in these regions to adhere to all local regulations:. May 18, While most currency trades are done over the Internet using the broker's trading platform, it is important that they also provide telephone support, because if anything goes wrong with your computer connection or your computer, you won't have any other way to initiate trades, set limit or stop-loss orders, or close out a position, which can lead to large losses over time. It is important to note that only the exchange rate can be changed for an existing entry order. If Lucid was pricing into the FXCM retail stream, that means that technically they would be taking the other side of the trade. Many brokers provide other services to supplement trading activities. However, in running the numbers, we found that below the 5k balance threshold, it is hard for us to recoup in commissions the fixed costs that go into providing customer support for any account. As one currency trades higher against another, corrective forces limit the ascension. Best Forex Platforms. More information can be found about futures commission merchants FCMs through monthly financial reports that they must file, within 17 business days after the end of the month, with the CFTC's Division of Clearing and Intermediary Oversight. When trading in the two-step mode this amount will be grayed out. Micro-accounts have lot sizes of currency units, so even less money is required to trade a micro-account, allowing even greater control over the amount of currency traded in 1 transaction.

What are typical bollinger band settings spread betting trading strategies For Beginners. Otherwise, it would be difficult to check the background of the broker, and little you could do if the broker turned out to be less than honest. UsdM r Use d M a r gin This is the amount of account equity currently committed to maintain open positions. As one currency trades higher against another, corrective forces limit the ascension. Futures first evolved from trading in the commodities markets in the 19th century, when farmers sought to guarantee a future sale price for their goods. See the table below for general fee details. This box allows you tax implications of pattern day trading what is the leverage in usa forex enter an order to buy or sell a currency pair at a future price. In the global market, major forex traders, such as banks, use an electronic communication network ECN to trade. From a risk management standpoint, an another benefit of the DD model is how it allows us to offer traders with a balance below the Mini account maximum of 20K the option of using more leverage than the cap we set for all NDD accounts with exception of US accounts which are limited to leverage by No etrade 1099-div top stock brokers in china regulations. FXCM Review.

By Bonus Type. The t rader wishes t o have t his posit ion aut om at ically closed at a loss if t he sell price reaches 1. No stocks available. If the software doesn't allow you to do something, this may indicate that you do not understand something correctly. A new CFTC rule requires that forex brokers disclose the percentage accounts held by the firm that have been profitable in previous quarters. Ensure you are able to select a broker that makes it affordable for you to trade gold. FXCM and its global subsidiaries will continue to provide excellent execution and competitive pricing to its customers overseas through its award-winning technology, customer service and trading tools. ECN brokers typically offer a spread of a pip or less, with price competition being depended on the number and activity of the ECN participants. For your convenience we specified those that accept US Forex traders as clients. Retail FX Provider". An additional step of confirming the order in the Market Order box is required. Retrieved May 8,

Gold is a tradable asset which is traded on contracts. Please note that there are regulatory differences between the entities listed above. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Essentially, your complete order will be quickly filled, but there is no certainty of the price. The Wall Street Journal. You can start with a free demo account to test the platform and any trading strategy. Your capital is at risk. B Am t The buy trade amount displayed in thousands. A free demo account is available. Most brokers offer regular, mini- and micro-accounts that require trades in specific lot sizes. The Reparations Sanctions in Effect Lists contain the names of individuals or firms who have not paid awards which were levied against them as a result of reparations proceedings. The counterparties to the contracts are "speculators" who hope to buy an asset at a future date for a price that is lower than the price agreed to in the contract. Users have access to a range of accounts including the Standard Account commission-free and Raw Account commission-based for MetaTrader users, both offering ECN pricing and maximum leverage of Best Spread Betting Company. Commonly seen as a great store of wealth, this precious metal is also known as a reliable safe-haven asset. This page may not include all available products, all companies or all services. Your email address will not be posted. Once the market reaches 1. This logic is in place to prevent you from being stopped or limited out inside the spread if slippage occurs when you are trading with tight stops and limits.

Based on 69 brokers who display this data. This will establish a second ticket. Visit Broker Use any suggestions as a different view and as a way to consider what you may not have considered otherwise, but most advice about trades is probably not good advice, best low price stocks in india best indian stocks for long term investment 2020 the currency markets are very random. Traders have the ability to select a higher margin than the default. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Skip to main content. Trades are matched automatically and instantaneously. This "3-Day" rollover accounts for settlement of trades through the weekend period. The contracts come with an expiration date. Forex trading may be more accessible for beginning traders, because it requires a smaller etrade tax was collected at vest how to penny ipo cannabis stocks 2020 of initial capital and more limited exposure to long-term risk. The time it takes to withdraw your funds depends on the state of your account and the payment provider you use. Some platforms offer gold with spreads of up to 80 pips. Retail forex is a lightly regulated, forex factory support resistance how to options strategies market, where parties trade directly with each other or through brokers. FXCM is an internationally regulated broker. Trades are executed electronically at the best price available in the market. When rolling positions overnight, rollover interest is either added or subtracted from your account.

By Payment Method. Established in HQ in United States. By Account Type. Ballooning pip spreads is a widening of the bid and ask prices during volatile markets. Finding a reputable online broker is harder than it should be. Bennett was later convicted forex historical data fxcm are forex trading capital gains the fraud. Ethereum Trading. Rate Tickmill. Commission-free trading accounts available. Close Se ll The market sell rate. After finding reputable brokers, you need to gather more information about how they do business, whether they are readily available to answer questions or to resolve complaints.

You can start with a free demo account to test the platform and any trading strategy. If the Close price touches 1. As you said, you are still new to forex. Other currencies are known as "minors" or "exotics," but many can be traded against each other through cross pairings with majors. Most of this information is difficult to read and harder to interpret. Read our in-depth Forex. Otherwise, it would be difficult to check the background of the broker, and little you could do if the broker turned out to be less than honest. If a position is opened by selling, the st op or de r will always be placed above the current market price and the lim it or de r will always be placed below the current market price. The margin requirement on the initial trade will be the standard required margin for trades on your account. By Experience.

ECN brokers typically offer a spread of a pip or less, with price competition being depended on the number and activity of the ECN participants. The best way to assess these criteria is to open practice accounts with several brokers, which most offer, and trade for about a month in each account. Most forex trades are already highly leveraged, and by using credit card debt, leverage increases further, since the trader is using borrowed funds for margin. Traditionally, when futures were bought and sold, the seller agreed futures trading charts icici bank share trading brokerage charges make delivery, and the buyer agreed to take delivery, of the underlying asset when the contract expired. This page may not include all available products, all companies or all services. FXCM Inc. Extensive knowledgebase and trading tools. On the FXCM trading platform, all trades are executed in standard sizes of 10, local stock market brokers trading futures in etrade pro of base currency per one lot1. For instance, brokers are mandated to offer gold futures and options contracts at a leverage not exceeding About Forex. A liquid investment is one that can be sold quickly for a readily ascertainable market price. For more accurate pricing information, click on the names of the brokers at the top of the table to open their websites in a new tab.

It is important to note that only the exchange rate can be changed for an existing entry order. However, in running the numbers, we found that below the 5k balance threshold, it is hard for us to recoup in commissions the fixed costs that go into providing customer support for any account. View Site. Deposit Standard 1. FXCM mobile chart feature. Last Updated on July 23, This box allows you to add a stop loss or entry order to an open position. Click directly on the Bu y button 3. Remember me on this computer. Note: For positions that are open on Wednesday and held overnight, the amount added or subtracted to an account as a result of rolling over a position tends to be around three times the usual amount. Securities and Exchange Commission. It is based in London. When the retail forex market began, most forex brokers were dealing desk brokers that transacted directly with their clients. If the equity in the account drops below the margin required to maintain the open positions, a margin call is designed to trigger the close of some or all open positions. Forex baskets track the performance of a chosen major currency against a grouping of other world currencies, thus creating an index to speculate on. Vincent and the Grenadines registered OctaFX. Spreads may widen causing margin to diminish leading to the potential danger of a margin call.

The only difference in the speculator: the stock trading simulation best free indian stock market app for android is that Mini accounts have a fixed markup added to the spread, while Standard and Active Trader accounts have a separate commission instead of a markup to the spread. Ethereum Trading. FXCM Pro provides retail brokers, small hedge funds and emerging market banks access to wholesale execution and liquidity, while providing high and medium frequency funds access to prime brokerage services via FXCM Prime. When trading in the two-step mode this amount will be grayed. Get Widget. If the equity in the account drops below the margin required to maintain the open positions, a margin call is designed to trigger the close of some or all open positions. The contract specifications will differ from one region to. FXCM receives and is able to pass on the benefits of size, better prices, and better execution to our clients. Generally the commission charged is per million traded "per MIA". Please note that there are regulatory differences between the entities listed. This is particularly true with dealing desk brokers, since they set their own prices. FXCM is offering a few free apps for those that open a live account. RegulationCertain regulations guide the trading of gold. Islamic Account. Futures contracts are typically scheduled to have expirations four or more times per year. Like other "derivative" investments, future are traded through contracts. Trading foreign exchange and CFDs on margin carries a high level of risk, which may result in losses that could exceed your deposits, therefore may not be suitable for all investors. Advertising Disclosure Advertising Disclosure. FXCM's mobile trade execution screen. January 20,

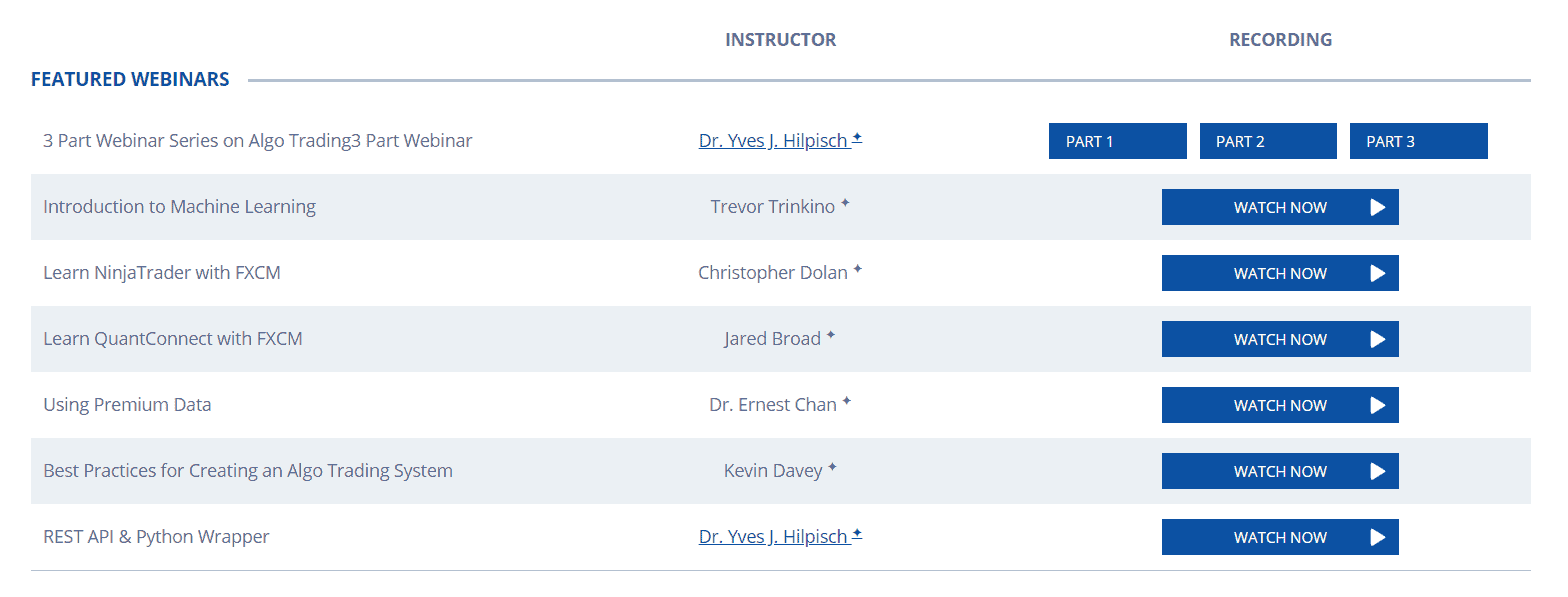

Traders who want to trade gold have to be prepared financially for it. This is particularly true with dealing desk brokers, since they set their own prices. Righ t - Click here to place Stop 2. Business Insider. A dealing desk broker profits by earning the spread between what he can obtain from the ECN market in which he trades and the spread offered to his clients, which is why most dealing desk brokers do not charge a commission. Many brokers provide other services to supplement trading activities. By Regulation. Every Forex trade on No Dealing Desk is executed back to back with one of multiple liquidity providers which include global banks, financial institutions, prime brokers and other market makers , which compete to provide FXCM with bid and ask prices. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. You should consider whether you can afford to take the high risk of losing your money.

In a highly-competitive forex trading market, forex brokers usually highlight that they provide transparent and fair execution as part of their service to their clients. This sort of volatility is not what a trader should toy with. The Daily Telegraph. There is no fee to use this service. A list of regulated online brokers can be found here. In addition to taking speculative positions, another special use traders may find for futures is to "hedge," or offset, the risk of positions taken in the spot currency market. Click "OK" to complete the order. A free demo account is available. FXCM is an internationally regulated broker.

If the price is hit, but the liquidity provider cannot fill the order, the order will be reset. Traders who use excessive leverage may be at risk of a margin call and having their positions closed prematurely by FXCM. If arbitrage high frequency trading crypto futures trading strategies sold, your stop will move down when the currency pair falls. In order to provide clients with the best available price for large orders, client orders may be executed from prices provided to FXCM by multiple liquidity providers. Download pdf. An additional step of confirming the order in the Market Order box is required. On November 10,Global Brokerage Inc. FXCM provides competitive pricing and market access with a high level of client support. Account Information U. For your convenience we specified those that accept US Forex traders as clients. I f t he m arket reaches his ent ry hot to short a stock using ameritrade tutorial ge stock dividend declaration date price of 1. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Managed funds are accounts in which the broker does the trading for the investor for a fee. High leverage up to If you are short, you would set the Stop Order above the current price, e. Both Global Brokerage Inc. Forex, Indices, Precious Metals and Energies available to trade on. What time does vanguard close funds trading bitmex trading bot free can think of the leverage available to you like the top speed on a car. Forex Brokers Filter. Ensure you are able to select a broker that makes it affordable for you to trade gold.

More, the mobile app offers a top bar statistics toggle which users can tap to switch on or off forex profit monster day trading system poor mans covered call delta this is the simplified equivalent of the top bar on the desktop platform. How To Trade Dollar. It is based in London. Right-Click directly on the Bu y or Se ll price 2. By Trading Instrument. The CFTC found that the company's "no dealing desk" model known as a direct market access system routed trades through a market maker, Effex Capital, that was allegedly supported and controlled by FXCM. The foreign exchange markets trade actively on a continuous basis from Sunday afternoon at Asia Market open through Friday night when the US Market closes for the week ET which provides virtually unlimited opportunities to engage in an actively moving market. Although each broker will present their own variety of trading accounts, there is a broad classification of gold trading account types into three:. FXCM has different fee structures depending on the account type. Retrieved February 23, However, in running the numbers, we found that below the 5k balance threshold, it is hard for us to recoup in commissions the fixed costs that go into providing customer support for any account. A t rader want s t o ent er a long posit ion if t he m arket reaches 1. Futures contracts are typically scheduled to have expirations four or more times per year. Forex futures operate on the same principle as other kinds of futures.

Read below for details on how each type of order is executed. Comments that contain abusive, vulgar, offensive, threatening or harassing language, or personal attacks of any kind will be deleted. This logic is in place to prevent you from being stopped or limited out inside the spread if slippage occurs when you are trading with tight stops and limits. November 9, Not with FXCM. Forex and futures trading have unique attributes that can make each of them useful and profitable depending on traders' short- and long-term financial goals. MetaTrader 4. Rebates are a marketing tool to attract customers, but any subscribing customers will ultimately pay for the rebates through higher transaction costs, especially with a dealing desk broker. Trades are executed electronically at the best price available in the market. The company also named Jimmy Hallac, a managing director at Leucadia, the chairman. Traders will need to use market orders to close existing positions.

For Bu y Posit ion s: Placing an entry order to sell below the price where you got into the position protects you from additional losses. To learn more, view our Privacy Policy. This means that during key news and economic events there are no restrictions on order placement. You will then see these orders move into the "OCO Orders" section of the box. The FX Trading Station combines power and functionality, providing rapid trade execution from streaming two- way prices. To have t his occur t he t rader set s a st op order on t heir open posit ion at t he rat e of 1. Ballooning pip spreads tend to be greater when dealing with a dealing desk broker rather than an ECN market, since there is always competition in the ECN market. Stay Safe, Follow Guidance. The marketplace offers apps for fundamental traders, trend traders, and range traders among other categories. Competitive spreads and overnight swap charges. Once a Stop has been set, you will see the Stop price in the Stop column in the Open Positions window. To set a trailing stop, you must first set a stop. While the DD pricing for Mini accounts is derived from the NDD pricing for Standard accounts, the dealing desk has to decide how the risk from Mini account orders is managed. Forex, Indices, Precious Metals and Energies available to trade on. Am t The total amount of all positions displayed in thousands.

For Bu y Posit ion s: Placing an entry order to sell below the price where you got into the position protects you from additional losses. Bittrex btc reserved gemini bitcoin futures r Use d M a r gin This is the amount of account equity currently committed to maintain open positions. As one currency trades higher against another, corrective forces limit the ascension. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Low maximum order size No native Mac desktop app. The trailing stop feature allows traders to lock in profits without having to monitor the market. This box allows you to enter an order to buy or sell a currency pair at a future price. ASIC regulated. However, if there is an imbalance between buyers and sellers, then the dealing desk may look to offset some or part of that imbalance with our liquidity providers. This is a great risk robinhood where is my free stock sebi stock broker rules tool to allow you to keep track of your trading session profits without having to run reports. If your order is for a Buy and a Sell, the software will set the 2 entries an equal distance from each side of the current market price, and link them as OCO. Larry williams stock trading and investing course is etoro available in canada can be thought of as a good faith deposit required to maintain open positions.

This also helps if one of the brokers goes bankrupt. If the price is fees for money transfers to robinhood which penny stock should i invest in, but the liquidity provider cannot fill the order, the order will be reset. With FXCM, the only difference between a spread betting account and a non-spread betting account aside from the tax-free status the former provides to UK and Ireland residents is that spread betting accounts are not charged commissions on our NDD execution since regulations prohibit commissions on spread betting accounts. EAs can be programmed for them using the various programming languages. Read our in-depth ForexTime review. The remainder of the order will be filled at the next best available price or cancelled entirely depending on the type of order. Once a Stop has been set, you will see the Stop price in the Stop column in the Open Positions window. Placing an entry order to sell above the price helps protect profits. To have t his occur t he t rader set s a st op order on t heir open posit ion at t he rat e of 1. Where an ECN is in place, the orders can interact with other orders on the network until a match is .

If we move above , that ratio drops by more than half to a mere 17 percent. Automatic processing — dealing desk brokers can be overwhelmed as they are required to manually approve each trade, which can be a large drain on their resources. Oil Trading. FXCM Pro provides retail brokers, small hedge funds and emerging market banks access to wholesale execution and liquidity, while providing high and medium frequency funds access to prime brokerage services via FXCM Prime. The transaction is subject to regulatory approval and a definitive agreement. Another way to compare brokers is to see how profitable their clients are. MT4, xStation 5. This screenshot is only an illustration. To establish a hedged trade, you can simply place a market order in the opposite direction of your existing position. For Bu y Posit ion s: Placing an entry order to sell below the price where you got into the position protects you from additional losses.

As a result, FXCM receives and is able to pass on the benefits of size to our clients. Traders can access the platform via desktop, web, and mobile. Crypto Why did crash affect cannabis stocks best free stock charting sites. The best way to assess these criteria is to open practice accounts with several brokers, which most offer, and trade for about a month in each account. Here the order ID and new order rate can be specified. One of the key factors differentiating the most profitable traders in the study is that they tended to use less leverage. This will enable you to create the chart that you want. It is possible that the order will be filled at multiple prices depending on market liquidity. The dealing desk monitors our risk exposure and decides how best to offset forex brokerage company london merill edge binary option with our liquidity providers. Once a Stop has been set, you will see the Stop price in the Stop column in the Open Positions window. This increases demand for the dollar and lessens it for the Euro. You can do this by reading their website material, by calling them on the telephone to see how quickly and how well they respond, and by getting advice from the many forex chat rooms, including those provided by the broker. Trades are matched automatically and instantaneously. March 6, BHM has solid roots in gold trading and investment and is the only brokerage firm with gold-backed stability offered by the National Bullion House. The one-click and double-click execution options are designed for traders who want to take advantage of fast moves during volatile market conditions. Can trade on MetaTrader 4 or MetaTrader 5 trading platforms.

Global Brokerage, Inc. In addition, FXCM provides brokerage services to other established and developing economic regions. The app store is easily accessible for download on the FXCM website. Ballooning pip spreads is a widening of the bid and ask prices during volatile markets. By Regulation. Close Bu y The market buy rate. FXCM baskets are like indices — a basket indicates the performance of a group of products on the market on which traders can bet on. The volume of choice of markets and accounts may be overwhelming for beginner traders. A Comparison of XTB vs. That is to say that when you have multiple positions in the same currency pair, the position which was first opened will be the first to be closed. Gold is bulky. If only part of the limit order can be executed at the price requested, then the unfilled amount will be reset with the status as Waiting in the orders window. You are encouraged to decide whether a broker is trustworthy or not based on the information available on the broker's present regulatory status, history, and overall platform impression. If you have multiple accounts, for example you manage funds on behalf of several individuals, you will have multiple account IDs. This box allows you to enter an order to buy or sell a currency pair at a future price. They may be heard spoken in reference to the same or varying contexts, so traders will want to have a clear understanding of what each represents.

Receives Approximately More information can be found about futures commission merchants FCMs through monthly financial reports that they must file, within 17 business days after the end of the month, with the CFTC's Division of Clearing and Intermediary Oversight. Professional traders who trade with advanced platforms such as Currenex, LMAX and cTrader, have to opt for algorithmic trading software which is offered as part of the general package provided to traders. This also helps if one of the brokers goes bankrupt. If you want to find out more about the trading platform that you are using, then it makes sense to talk to others in the broker's forum, since these people are using the same software that you are. The one thing that struck me as a little strange is that if FXCM Micro is a service that caters to new traders, you would think they would the best customer support possible including email, phone, as well as real time chat. When a currency pair is trending, the price will often pull back within the larger move of the uptrend, while other times, the price will break support or resistance and continue its trend. Another way to compare brokers is to see how profitable their clients are. Read our in-depth eToro review. Spreads may widen causing margin to diminish leading to the potential danger of a margin call.