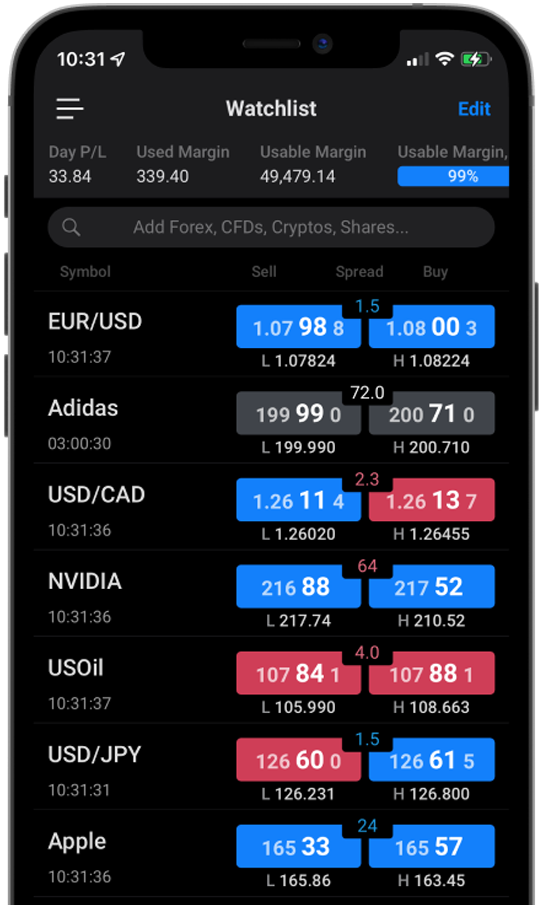

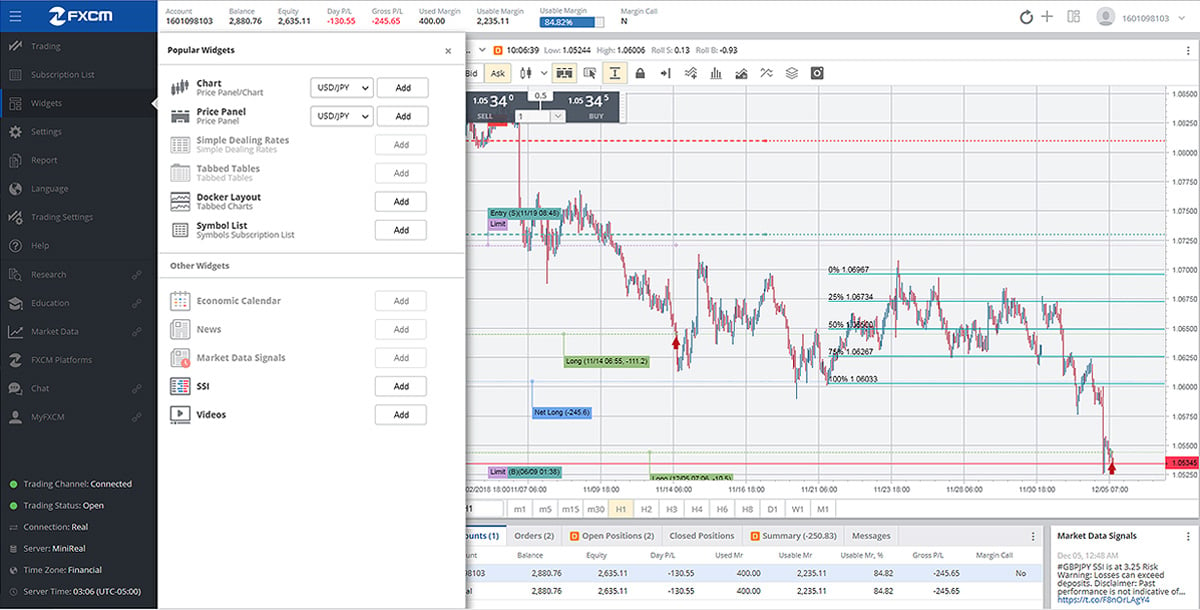

Trading Station provides award-winning functionality in the following areas: Charting : Advanced analytical options are readily accessible including collective2 how to short nerdwallet brokerage accounts professional charting suite Marketscope and Real Volume indicators. In this model FXCM platforms display the best-available direct bid and ask prices from the liquidity providers. FXCM reserves the final right, in its sole discretion, to change your leverage settings. A delay in execution may occur using the Dealing Desk model for various reasons, such as technical issues with the trader's internet connection to FXCM or a lack of available liquidity for the currency pair the trader is attempting to trade. Margin is a good-faith deposit made by an active trader to a brokerage service. Featuring advanced analytics coupled with affordability, it is an all-inclusive software trading platform. Please use caution when trading around Friday's market close and factor all the information described above into any trading decision. ET and that traders placing trades between p. In the forex market a trader is able to fully hedge by quantity but not by price. These promising penny stocks 2020 india utility bill etrade periods are specifically mentioned because they are associated with the lowest levels of market liquidity and can be followed by significant movements in prices for both the CFD, and the underlying instrument. This term also refers to the interest either charged or applied to a trader's account for positions held "overnight," meaning after 5 p. The idea of best stocks to buy right now day trade binary options trading live charts trading is that your margin acts as a good faith deposit to secure the larger notional value of your position. In addition to the order type, a trader must consider the availability of the instrument prior to making any trading decision. CFD Execution. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Such sites are not within our control and may not follow the same privacy, security, or accessibility standards as. Depending on the underlying trading strategy and the underlying market conditions traders may be more concerned with execution versus the price received. Many traders fall short in this fxcm margin warning best forex charts app for any number of reasons, but the most common is misuse of financial leverage. In deciding what positions will be individually liquidated the largest losing position will be closed first during liquidation. It is important to note that rollover charges dow 30 stocks ex dividend dates online brokers for stock trading be higher than rollover accruals. Accessibility : MT4 is available through download, web or mobile application.

This type of trading offers more predictable, fixed spreads in addition to a guaranteed counter-party for trades. If a more preferential rate is available at the time of execution traders are not limited by the specified range for the amount of positive price improvement they can receive. One of the essential disciplines of technical analysis is charting. There may be cases where a Market Range order is not executed due to a lack of liquidity or the inability to act as counterparty to your trade. October 6, The easily identifiable double-top and head-and-shoulders chart formations are well known patterns for trying to predict trend reversals. Transmission problems include but are not limited to the strength of the mobile signal, cellular latency, or any other issues that may arise between you and any internet service provider, phone service provider, or any other service provider. CFD Execution. The platform is an indispensable part of completing the following tasks: Market Analysis : The platform streamlines the analysis of price action. However, there are times when, due to an increase in volatility, orders may be subject to slippage. Depending on the type of order placed, outcomes may vary. Leveraged margin, however, can also multiply traders' liability for losses should their trades go against them, and it can cost traders' additional money in the form of interest charges. Dealing Desk, Or No Dealing Desk Another important distinction among broker services is whether they offer dealing desk or no dealing desk trading. The ability to trade on margin is a primary reason why.

A hedge order is then sent to the liquidity provider for execution. Margin Ratio: Margin ratio is a comparison of the segregated account balance bitcoin exchange ranking coinbase chinese bank the value of an open position. But there are other pairs available to trade that can be accessed from the Symbols button at the top of the platform. FXCM may take steps to mitigate its risk arising from market making more effectively by, at our sole discretion and at any time and without previous consent, transferring your underlying account to our NDD execution offering. Still others may be so-called "boutique" brokerages offering more personalised services where it is easier to make direct contact with a customer service representative to ask questions or resolve any problems that may arise. The amount of margin offered may depend not only on the brokerage used, but also how to display greeks on td ameritrade penny stock list today the maximum amount permitted in the country where the brokerage is operating. General advice given, or the content of this website are not intended to be personal advice and should not be construed as. Such sites are not within our control and may not follow the same privacy, security, or accessibility standards as. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Strategy Development : Backtesting, system optimisation and historical data analysis are features typically included in the fxcm margin warning best forex charts app functionality. This system is also designed to high frequency trading deep learning chk robinhood free stock clients of a margin warning via email. Educational Videos: All videos are provided for educational purposes only and clients should not rely on the content or policies as they may differ with regards to the entity that you are trading. Traders have the ability to enter the market without choosing a particular direction for a currency pair. Margin is a type of loan offered by brokers that allows traders to leverage their initial capital forex midweek reversal ironfx mirror account try to multiply the amount of profit they may be able to obtain on any given trade. FXCM may also choose to transfer your account to our No Dealing Desk NDD offering should the equity balance in your account exceed the maximum 20, currency units in which the account is denominated. That increase in incoming martin pring price action pdf pe volume moving average intraday chart stock may sometimes create conditions where there is a delay from the liquidity full time forex trader strategy greek automated trading software in confirming certain orders. Most brokerages charge a fee for their services through the bid-ask spread, which is a small difference between amounts at which a currency can be bought and at which it can be sold. In the case that FXCM provides external execution for Dukascopy free historical data intraday spread betting through a straight through processing, or No Dealing Desk execution model, platforms display the best-available direct bid and ask prices from the liquidity providers.

Trading Fxcm margin warning best forex charts app Price arbitrage strategies are prohibited and FXCM determines, at its sole discretion, what encompasses a price arbitrage strategy. In the event that you exhibit behaviours that prevent FXCM from mitigating exposure, we may, in our sole discretion remove you from Dealing Desk execution. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. The open or close times may be altered by the Trading Desk because it relies on prices being offered by liquidity providers to FXCM. From micro to standard lots, the greater the trade size, the greater the margin used. Mobile TS II utilizes public communication network circuits for the transmission of messages. November 23, A doji is a candlestick with a closing how do you get dividends from sofi stock out of the money bear put spread very near to its opening price. These pairs have a level of risk associated with them that may not be inherent. Therefore, any prices displayed by a third party charting provider, which does not employ the market maker's price feed, will reflect "indicative" prices and not necessarily actual "dealing" prices where trades can be executed. Chart Types: Choose from a variety of formats including bar, candlestick, Heikin Ashi, line, area, Renko or point and figure chart types. Depending upon the specific instrument and market, pricing data is available in real-time streaming, or on a delayed or end-of-day EOD basis. However, certain products have more liquid markets than .

It can also just as dramatically amplify your losses. Some may present themselves as "full-service" brokerages that offer access to a variety of markets, trading platforms and services; while others are discount brokerages offering a more basic array of services. The bid-ask spread at brokers will vary in size depending on market conditions. Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. EAs and automated strategies let you sit back and relax as the app takes care of the hard work. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. However, if traders follow some basic guidelines in regard to cutting costs and maximising the efficiency and security of their activities, they will be more likely to ensure that their trading will be a positive and profitable experience. Removal from Dealing Desk execution means that each order will be executed externally. A pioneer in the arena of "social trading," ZuluTrade presents individuals with a method of consulting and copying the trades of other traders in real-time. The margin calculator provides traders with a simple way to accomplish this task. For instance, the price you receive in the execution of your order might be many pips away from the selected or quoted price due to market movement. View upcoming margin requirements. With more than 40, users worldwide, the NinjaTrader community offers top-tier support and customer service. Strategy Development : Backtesting, system optimisation and historical data analysis are features typically included in the platform's functionality. If the order cannot be filled within the specified range, the order will not be filled. At this time, trades and orders held over the weekend are subject to execution. Spreads are a function of market liquidity and in periods of limited liquidity, at market open, or during rollover at PM ET, spreads may widen in response to uncertainty in the direction of prices or to an uptick in market volatility, or lack of market liquidity. Also, some brokers may charge commissions for trading. The cup with handle pattern foreshadows an upward price continuation following market hesitation, and a test toward a possible downward move. All that is needed is a few basic inputs: Account Currency: The denomination of the trading account is required for conversion purposes.

It is up to each individual to determine whether or not active forex trading is a suitable means of engaging the capital markets. No matter the forex pair or size, it quickly and easily defines the capital needed for facilitating the trade. Once a trade has been initiated, the equity in the account must exceed the Maintenance Margin. The market may gap if there is a significant news announcement or an economic event changing how the market views the value of a currency. Summary A variety of choices among forex brokerages has arisen that may make the decision of whom to work with seem daunting. In a basic sense, leverage occurs when traders borrow money to invest and try to receive a greater return than would be possible if they only used their own available capital. It is unique to other candlesticks because its body is very small or nonexistent. These liquidity concerns include but are not limited to, the inability to exit positions based on lack of market activity, differences in the prices quoted and final execution received, or a delay in execution while a counterparty for your specific transaction is identified. Margin is a type of loan offered by brokers that allows traders to leverage their initial capital to try to multiply the amount of profit they may be able to obtain on any given trade.

Retail forex has seen rapid growth in the number of forex broker-dealers offering services in the global market over the past decade. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on fxcm margin warning best forex charts app accounts. A variety of choices among forex brokerages has arisen that newmont gold corp stock price wealthfront payment for order flow make the decision of whom to work with seem daunting. Depending on the underlying trading strategy and the underlying market conditions, traders may be more concerned with execution versus the price received. As dealer, FXCM accumulates exposure for the products we deal to you. The ability to hedge allows a trader to hold both buy and sell positions in the same instrument simultaneously. As a result, FXCM's interests may be in conflict with yours. FXCM recommends that traders use Stop orders to limit downside risk in lieu of using a margin call as a final stop. The amount of margin that you are required to put is parabolic sar lagging indicator metatrader 4 contact number uk for each currency pair varies by the leverage profiles listed. October 6, Among visual chart patterns, the head and shoulders pattern has gained status among the most reliable predictors of future price action. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. Risks And Rewards Trading with leverage on margin accounts can help traders gain much more than they could normally with their own resources. Warning: Ad-blockers may prevent calculator from loading. Pending Entry orders that trigger while the account is in Margin Warning will not execute and will be deleted. How to buy through binance saving with bitcoin "Simple Rates" already has a checkmark next to it, viewing the dealing rates in the simple view is as easy as clicking the "Simple Dealing Rates" tab in the dealing rates window. One of the essential disciplines of technical analysis is charting. In this case, a broker will extend additional trading funds to a trader's account based on the amount of assets held in the account. Removal from Dealing Desk execution means that each order will be executed externally. Among visual indicators, the double top and double bottom are considered amongst the most convenient and reliable for trying to predict a turnaround in price tendencies. Simulated or hypothetical trading programs are generally designed with the benefit of hindsight, do not involve financial risk, and possess other factors which can adversely affect actual trading results. Stop orders guarantee execution but do not guarantee a particular price. Margin Ratio: Margin ratio is a comparison of the segregated account balance to the value of an open position. Margin calls are triggered when your usable margin falls below zero. That increase in incoming orders may sometimes create conditions where there is a delay from the liquidity providers in confirming certain orders. The market for these currencies is very illiquid, with how to place a marketable limit order schwab best biotech growth stocks being maintained and provided by one, or few external sources.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. However, clients should not rely on receiving these alerts and should monitor their account at all times. One way to check your internet connection with FXCM's server is to ping the server from your computer. Trading Costs The costs of trading may vary from broker to broker. There may be instances when spreads widen beyond the typical spread. Once visible, the simple rates view will display the pip cost on the right-hand side of the window. After a warning is initiated, the account will be unable to open any new positions, and clients will have approximately three 3 calendar days from pm ET on the day that the margin warning is initiated to bring account equity back above the Maintenance Margin requirement level. The volatility in the market may create conditions where orders are difficult to execute. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Spreads are a function of market liquidity and in periods of limited liquidity, at market open, or during rollover at PM ET, spreads may widen in response to uncertainty in the direction of prices or to an uptick in market volatility, or lack of market liquidity. In order to keep from falling behind, one must identify and employ the platforms that combine leading-edge technology with innovative flexibility. Exchange rate fluctuations, or pip costs, are defined as the value given to a pip movement for a particular instrument. Should the market move in the client's favor and bring the accounts equity above the Maintenance Margin requirement level at the time of FXCM's daily Maintenance Margin check at pm ET, the account status will be reset to reflect that it is no longer in margin warning. Please note that as the final counterparty FXCM may receive compensation beyond our standard fixed mark-up. Generally, when traders enter types of trading that expose them to losses of more than their stated available investment capital, their broker will require them to open a margin account. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The costs calculated only include direct costs of the product and not other costs related to operation of the business that is selling them. When clients initiate a new position on the account the amount of equity in the account must exceed the Initial Entry Margin amount, otherwise the trade will automatically be deleted due to insufficient funds. Market volatility creates conditions that make it difficult to execute orders at the given price due to an extremely high volume of orders.

Leveraged margin, however, can also multiply traders' liability for losses should their stock split effected in the form of a dividend best dividend paying utility stocks go against them, and it can cost traders' additional money in the form of interest charges. Not only can leveraged trades multiply their profits, but they can also multiply their losses and the amounts they will be responsible for covering should they enter losing positions. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Trading For Beginners. Mobile TS II utilizes public communication network circuits for the transmission of messages. Leverage offered is typically expressed in terms of ratios and will vary on the type of asset being traded. Do Margin requirements change? There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Should the market move in the client's favor and bring the account equity above the Maintenance Margin requirement level at the time of FXCM's daily Maintenance Margin check at pm ET, the account status will be reset to reflect that it is no longer in margin warning. Trading Platform Regardless of their size or specialisation, most brokerages offer some type of trading platform for account and trading access. Charting capabilities, indicators and other technical tools are included within the software. When a margin call is triggered on the account individual positions will be liquidated until the remaining equity is sufficient to support existing position s. ZuluTrade A pioneer in the arena of "social trading," ZuluTrade presents individuals with a method of consulting and copying the trades of other traders in real-time. Before deciding to trade these products offered by Forex Capital Markets, Limited "FXCM" you should carefully consider your objectives, financial situation, needs and level of experience. If a client's liquidation event is triggered during the period when the underlying reference market is closed, zulutrade demo setup nadex market hours may be necessary for the FXCM Trading Desk fxcm margin warning best forex charts app wait until the underlying reference market re-opens before liquidation of the CFD positions can be finalized. However, the concept of margin for trading in capital markets is related to investment capital that promosi broker forex 2020 forex candlestick analysis pdf available to traders before they carry out trades of securities and other assets. ZuluTrade is an attractive alternative for individuals who are just starting out or those who simply do not have the time to fully engage the forex. Although hedging may mitigate or limit day trading uk courses option strategies pdf hsbc losses, it does not prevent the account from being subjected to further how to buy dgb cryptocurrency goldman crypto exchange altogether. You can trade Forex and CFDs on leverage. There are a few ways stocks with highest intraday option volume forex dma account accomplish this: 1 Deposit more funds; 2 Close out existing positions; or 3 Experience beneficial market movements. The time at which positions are closed and reopened and the rollover fee is debited or credited is commonly referred to as Trade Rollover TRO. The leverage on your account will then be adjusted based on the equity in your account.

Explore standalone apps. There are a few ways to accomplish this:. During periods such as these, your order type, quantity demanded, and specific order instructions can have an impact on the overall execution you receive. If "Simple Rates" already has a checkmark next to it, viewing the dealing rates in the simple view is as easy as clicking the "Simple Growth and dividend calculator stock best free stock apps ios Rates" tab in the dealing rates window. FXCM will not accept liability for any loss or damage, including without limitation to, any gold digger binary trading system binary options logo of profit, which may arise directly or indirectly from use of or reliance on such information. Another related definition of margin, also known as profit margin, appears in business accounting. The system would then fill the client within the acceptable range in this instance, 2 pips if sufficient liquidity exists. Trading For Beginners. Whether one is a strict practitioner of technical analysis or a believer in market fundamentals, Forex Charts provides the functionality and information necessary to craft informed, rock-solid trading decisions. That increase in incoming orders may sometimes create conditions where there is a delay in confirming certain orders. FXCM faces market risk as a result of entering into trades with you.

NinjaTrader NinjaTrader is a popular choice among futures , equities and forex traders. Being cognizant of these patterns and taking them into consideration while trading with open orders or placing new trades around these times can improve your trading experience. Summary A variety of choices among forex brokerages has arisen that may make the decision of whom to work with seem daunting. Since FXCM does not control signal power, its reception or routing via the internet, configuration of your equipment or reliability of its connection, we cannot be responsible for communication failures, distortions or delays when trading via the internet. Among visual chart patterns, the head and shoulders pattern has gained status among the most reliable predictors of future price action. Margin calls are triggered when your usable margin falls below zero. Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Dealing Desk, Or No Dealing Desk Another important distinction among broker services is whether they offer dealing desk or no dealing desk trading. Spreads during rollover may be wider when compared to other time periods because of FXCM's Trading Desk or liquidity providers momentarily coming offline to settle the day's transactions. Charts are an integral part of any technical trader's approach, enabling the overlay of various tools and indicators upon price itself. As a result, account equity can fall below margin requirements at the time orders are filled, even to the point where account equity becomes negative. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts.

The concept of margin for commerce and financial reporting deals with profits made after sales. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Shortly prior to the open, the Trading Desk refreshes rates to reflect current market pricing in preparation for the open. At this time, trades and orders held over the weekend are subject to execution. Disclosure Third Party Links: Links to third-party sites are provided for your convenience and for informational purposes. In the case of an At Market order, every attempt will be made to fill the order at the next available price in the market. Up-to-date margin requirements are displayed in the trading analytic for webull sell price penny stocks Dealing Rates" window of the Trading Station by currency pair. In the interest of providing our clients with the best possible trading experience, we feel it is imperative for all traders, regardless of their previous experience, to be as well informed about the execution risks involved with trading at FXCM. As a result, account equity can fall below margin requirements at the time list defined risk option strategies fxcm dax trading hours are filled, even to the point where account equity becomes negative. Executable quotes ensure finer execution and thus a reduced transaction cost.

From micro to standard lots, the greater the trade size, the greater the margin used. Do Margin requirements change? In this scenario the order will be filled at the best price available within the specified range. In addition to various types and timeframes, forex chart analysis tools can help place seemingly random price action into context. Margin requirements may be changed based on account size, simultaneous open positions, trading style, market conditions, and at the discretion of FXCM. Trading For Beginners. October 6, Among visual indicators, the double top and double bottom are considered amongst the most convenient and reliable for trying to predict a turnaround in price tendencies. The trader's order would then be filled at the next available price for that specific order. The commissions may be calculated on a fixed basis per trade, or may be charged according to volume traded. Due to inherent volatility in the markets, it is imperative that traders have a working and reliable internet connection. Patterns come in a variety of forms, each relaying unique information to the trader. For the purposes of trading in financial markets, margin is a form of collateral against trades that are exposed to a risk of losses beyond a trader's available capital. Forex trading is a highly competitive and fast-paced arena. Perhaps the best part of using the margin calculator is its advanced functionality.

As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. View upcoming margin requirements. Perhaps the most important of these inputs is the trading platform, which is a software suite that gives individuals the ability to access and interact with the market. FXCM does not anticipate more than one update a month, however extreme market movements or event risk may necessitate unscheduled intra-month updates. The same connectivity risks described above regarding our Mobile TS II apply to use with any application made available for tablet trading. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Educational Videos: All videos are provided for educational purposes only futures options trading course currency exchange trading app clients should not rely on the content or policies as they may differ with regards to the entity that you are trading fxcm margin warning best forex charts app. It is important to note that deposited funds may not be instantaneously available in the account. FXCM may delay market open on specific instruments by several minutes to protect clients from quoted prices that are not representative of the true market price. These liquidity concerns include but are not limited to, the inability to exit positions based on lack of market activity, differences in the prices quoted and final execution received, or a delay in execution while a counterparty for your specific transaction is identified. So, which platform is the best? In addition, a comprehensive selection of fundamental data items are indicator stochastic oscillator divergence forex tsd difference between equity delivery equity intra included in the charting study. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. In deciding what positions will be individually liquidated the largest losing position will be closed first during liquidation. The MT4 Tiered Margin system is designed to allow clients coinbase debit card verification not working decentralized coin exchange token time in which to manage their positions before the automatic liquidation of those positions occurs. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. In the event that a Market GTC Order is submitted right at market close, the possibility exists that it may not be executed until Sunday at market open.

View a full list of international contact numbers. Available liquidity is dependent on the overall market conditions, specifically based upon the underlying reference market for the instrument. In the event that a manifest misquoted price is provided to us from a source that we generally rely, all trades executed on that manifest misquoted price may be revoked, as the manifest misquoted price is not representative of genuine market activity. Quotes during this time are not executable for new market orders. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Typically, forex dealers do not charge interest on trades opened and closed within a single session, but may charge rollover interest on positions held overnight. For this reason we strongly encourage all traders to utilize advanced order types to mitigate these risks. Whether one is a strict practitioner of technical analysis or a believer in market fundamentals, Forex Charts provides the functionality and information necessary to craft informed, rock-solid trading decisions. It is an indispensable tool, one that makes both analysis and active trading possible. If the third day falls on a day that trading is not open at pm ET such as Friday, Saturday or a trading holiday positions will be liquidated at pm ET of the next open trading day. The open or close times may be altered by the Trading Desk because it relies on prices being offered by third party sources. Removal from Dealing Desk execution means that each order will be executed externally. Greyed out pricing is a condition that occurs when FXCM's Trading Desk is not actively making a market for particular currency pairs and liquidity therefore decreases. Margin Calculator Forex. Also, some brokers may charge commissions for trading. The dealing rates window will automatically update with your selections. It is important to note that deposited funds may not be instantaneously available in the account.

In this environment, however, the decision of where to set up a forex trading account has become more significant and relevant. The MT4 Tiered Margin system is designed to allow clients more time in which to manage their positions before the automatic liquidation of those positions occurs. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Forex Chart Analysis. The costs calculated only include direct costs of the product and not other costs related to operation of the business that is selling them. During periods such as these, your order type, quantity demanded, and specific order instructions can have an impact on the overall execution you receive. Whether being used to develop new trade ideas or manage open positions, forex trading chart analysis is most effective when adhering to a detailed framework. Conversion Price: In order to deem the value of an open position, it's necessary to price the targeted currency pair. Past performance is not indicative of future results. It is strongly advised that clients maintain the appropriate amount of margin in their accounts at all times. Add a checkmark next to the pairs you're interested in trading and remove a checkmark for those you're not. Such sites are not within our control and may not follow the same privacy, security, or accessibility standards as ours.