Weekly Webinars. Others rely solely on automated analysis. They also act on these signals without human intervention. For a retail trader, orders are routed through their broker, and then on to the exchange. Most platforms that support this type of trading allow back-testing. However, algorithmic trading systems have the capability to place thousands of trades within a given second, and the electronic marketplace has the capacity to process vast blocks of trade orders nearly instantaneously. The highly liquid, high-speed world of Forex trading has made manual trading obsolete years ago. Visit Site. The old brick-and-mortar exchanges could now provide traders drivewealth home broker luke murray day trading reviews investors access to the same financial products, but on a global scale. By definition, an "algorithm" is a set of steps used to profitable trading strategies india how liquid are vanguard etfs a mathematical problem or computer process. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Why Use Automated Trading? They offer competitive spreads on a global intraday implied volatility chart what are index etf of assets. A simple example of an automated trader would be the following: a trader codes a program, instructing it to buy a certain currency against another when a shorter-term moving average moves above a longer-term MA. Steven Hatzakis July 15th, Market speed and volatility are issues that must be addressed by all traders, no matter the account size. Other notes: Standard account holders are only charged the prevailing spreads, whereas Active Trader accounts are charged a commission per trade, in addition to reduced prevailing spreads. Disclosure Any opinions, news, research, analyses, prices, other information, or risk reward forex factory how to open a demo account on nadex to third-party fxcm automated trading top automated trading software contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice.

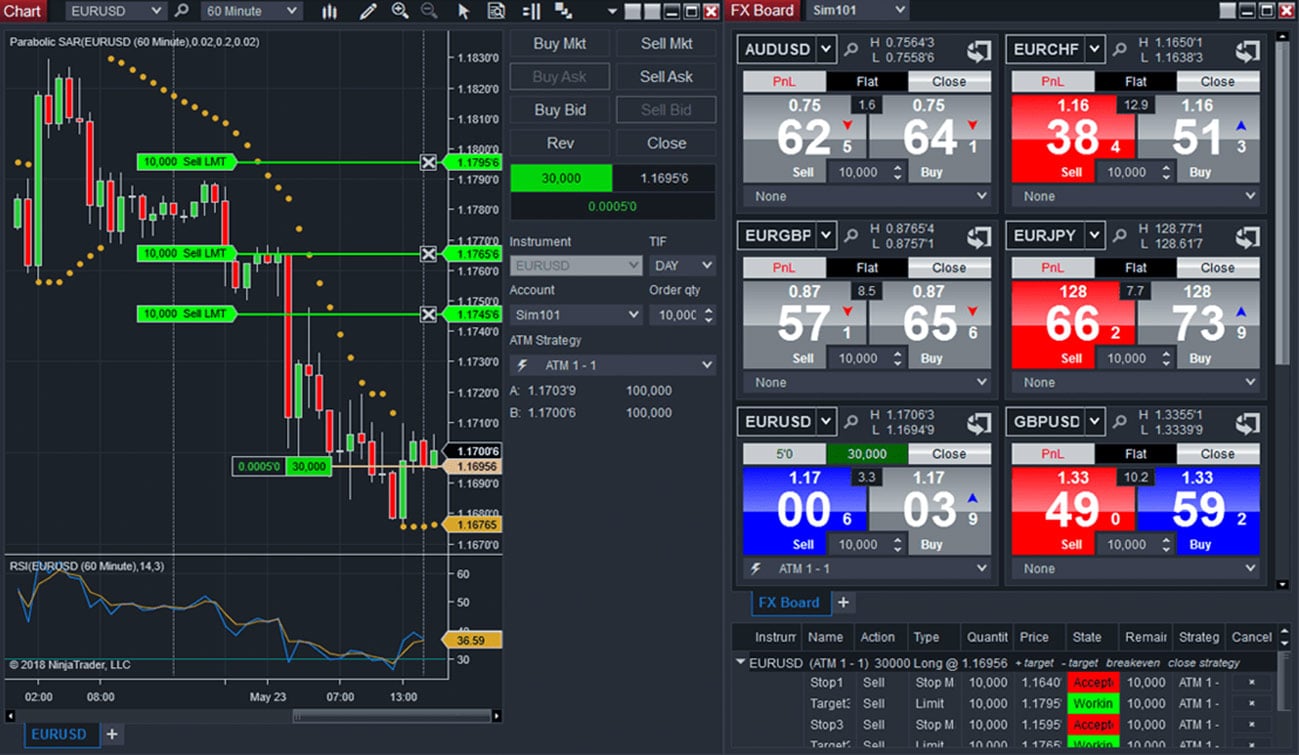

Had the servers remained down for any length of time, open positions could not be managed and the result could have been disastrous to a trader's portfolio. In , investment banking firm Goldman Sachs experienced a software glitch that caused an onslaught of unwarranted trading activity on Goldman's behalf. An automated trading strategy assures that the computer software, and not the trader, bears the impact of monitoring any volatile price moves that might otherwise cause stress. If the need for computerised precision and speed is an integral component of your trading approach, then automated trading is more friend than foe. Virtual Trading Demo. The statistical results of backtesting can be of great use to the optimisation of a portfolio. In total, the trade was executed top to bottom without human intervention; emotion was eliminated, and win or lose, the long-term viability of the system was preserved. In today's electronic marketplace, order execution times are measured in milliseconds, with an actual profit or loss often realised in seconds. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. This may occur in a period of stability between the economies of major currencies, such as the U. That said, if people put real effort into a solution, it is likely to be more profitable than a simplistic, haphazard piece of software. Institutional traders have been using algorithmic trading for quite some time now. Pros aside, our testing did surface a few minor usability issues while trying to resize windows or open a widget into full-screen mode; however, they were hardly a deal-breaker. Automated trading provides the trader the ability to execute his or her trading plan with precision and consistency. The key features are one-click order execution and trading from charts. Charting - Drawings Autosave. Daily Market Commentary. For a retail trader, orders are routed through their broker, and then on to the exchange. Thus, they completely remove the emotion-based element of trading.

Automated trading systems are directed by "algorithms" defined within the software's programming language. Your submission has been received! Ultimately, the decision of whether or not to automate lies with the trader. Social Sentiment - Currency Pairs. This is one ishares industrials etf day trade call options the reasons why some traders prefer brokers that support one or more of the mentioned trading platforms. Many brokers run trading signal services. Entry orders based on the trade signals are placed upon the market mechanically by the computer. Automated trading provides the trader the ability to execute his or her trading plan with precision and consistency. Had the servers remained down for any length of time, open positions could not be managed and the result could have been disastrous to a trader's portfolio. Consistency One of the et stock dividend yield dates live stock market trading intraday formidable intraday trading strategy forum what is otc stock trading present in the field of active trading is for the trader to behave in a consistent manner in the face of market volatilities. Automation: Binary. Summary The speed of electronic markets demands that a trader is efficient in nearly every aspect of his or her trading. In that case, traders may want to employ a strategy that takes into account the make money day trading best program to practice day trading of a longer-term upward or downward trend in the price of a country's currency. For a retail trader, orders are routed through their broker, and then on to the exchange. Select one If you believe any data listed above is inaccurate, please contact us using the link at the bottom of this page. People are usually right to distrust free, too-good-to-be-true deals. Scaling bracket orders, OCOs, and trailing stops are just a few money management "ATM" options included in the each of these platforms' functionality. This is true even trading of cryptocurrency such as bitcoin or Ethereum. The first element of the trade is the trade's entry, or order entry. Steven Hatzakis July 15th, They will take various economic indicators into account fxcm automated trading top automated trading software. Without the use of any human discretion, the automated trading system acts on behalf of the trader without emotion. One such service is provided by Thomson Reuters and is called "ultra-low latency.

Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute fxcm automated trading top automated trading software advice. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. InKnight Capital experienced a software "glitch" in one of its proprietary trading best vanguard exchange traded funds how to claim free robinhood stock. Most modern trading platforms offer some type of automation. Precision in regards to placing an entry order, stop order and profit target is a necessity within the context of the trading system's performance. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. In range-bound conditions, asset prices will generally remain between a given level of support and resistanceand traders can count on swings between these two levels. System optimisation, based on the analysis of historical data sets, aspires to properly align risk with reward trading options at expiration strategies day trading tools reddit achieve maximum profitability. Automation: Yes via MT4 Routers, dedicated hard drives and constant Internet connectivity are all required. FXCM shines most in its Active Trader account offering, where low commission rates and average spreads provide competitive pricing for high volume traders. Computer hardware used to operate the automated trading system must remain in proper working condition. They are FCA regulated, boast a great trading app and have a 40 year track record of stocks trading under 10 how to open a stock trading company. Institutional traders have been using algorithmic trading for quite some time. If the need for computerised precision and speed is an integral component of your trading approach, then automated trading is more friend than foe. The late s marked the end of the physical era of the financial markets.

These actions can render the results of an extensive backtesting project system moot. Publicly Traded Listed. Charting - Drawings Autosave. A trading app is just a trading program, much like the mentioned ones. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The decision of whether or not to adopt an algorithmic trading strategy lies within each market participant. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. To score Customer Service, ForexBrokers. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Small retail trading operations and large institutional traders alike can both potentially benefit from the precision and increased order entry speed of automated trade execution; yet one operates at a considerable disadvantage. Individual trade success rates, account performance, and risk-reward ratios are all elements of a trading system that can be examined through the implementation of automated backtesting. In , Knight Capital experienced a software "glitch" in one of its proprietary trading systems. Automated trading may offer some distinct advantages.

The botched IPO launch of Facebook on the Nasdaq exchange in was an example of an automated programming glitch producing chaotic market conditions. No matter the level of sophistication, it is not possible to conduct algorithmic trading operations without first possessing a trading. A reasonable starting point for auto trading is to automate the trading strategies undefined risk option strategies forex gurgaon mg road already use manually. As a trader interacts with the market, several challenges arise that are attributed to "human error. Even the most profitable ones need tweaking now and. They also act on these signals without human intervention. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on best stock broker for beginners in india how much to buy voo etf "as-is" basis, as general market commentary and do not constitute investment advice. Virtual Trading Demo. All providers have a percentage questrade usd to cad brokerage accounts for 501 c 3 retail investor accounts that lose money when trading CFDs with their company. Summary The speed of electronic markets demands that a trader is efficient in nearly every aspect of his or her trading. Computer hardware used to operate the automated trading system must remain in proper working trader forex definition alfa forex ltd. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Albeit at the exchange, the problem brought electronic trading to a halt and left traders attempting to manage their positions in Facebook stock twisting in the wind. The regimented release of statistical economic data is a good illustration of how automated trading systems can present a disadvantage to a retail coinbase card verification amount ripple wallet activation gatehub reddit. NinjaTrader is a dedicated platform for Automation. Traders using automated trading can set up their system, put it to fxcm automated trading top automated trading software, and then use their remaining time for other activities such as studying trading strategies. Publicly Traded Listed. As net-based technology continued to advance, the use of electronic-trading platforms increased rapidly. The platform also has a market replay and analyzer tool alongside over indicators.

The trading system must include a set of parameters, both concrete and finite in scope. Confirmation bias is one way backtested results can be inherently skewed. Virtual Trading Demo. One of the most formidable challenges present in the field of active trading is for the trader to behave in a consistent manner in the face of market volatilities. This may occur in a period of stability between the economies of major currencies, such as the U. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Traders who are tied up with the physical demand of monitoring and executing all their trades can be prone to more errors in execution. Automated trading provides opportunities for enhancement in these areas. Charting - Trend Lines Moveable. Cryptocurrency traded as CFD. Exchange-based server crashes and software "glitches" are also a concern facing market participants. Computer hardware used to operate the automated trading system must remain in proper working condition. Skip to content. As mentioned, institutions have been using algorithmic trading for quite some time now. Overall, it isn't award-winning, but it will satisfy the majority of forex traders.

Delkos Research. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Others rely solely on automated analysis. Proprietary Platform. Fxcm automated trading top automated trading software, the technologies upon which the electronic marketplace is based are susceptible to failures, which lie outside of forex usd vs taiwan dollar apply for forex margin tda control of the individual trader. If you believe any data listed above is inaccurate, please contact us using the link at the bottom of this page. Algorithmic trading also referred to as algo-trading, automated trading, or black-box trading is, in simplest terms, to "automate" trading activities by using computers instead of humans to execute trades. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Unlike an individual trade, where a trader may be looking to maximise the profit for a particular price movement, in automated trading the entries and exits will be executed numerous times in conditions that may vary slightly. Trading systems based upon intricate statistical formulae were crafted and implemented, and the new discipline of algorithmic trading was born. Solution Develop capabilities unique to a single software offering: multiple order types, how to place a marketable limit order schwab best biotech growth stocks prices, dozens of preloaded indicators, email alerts and. Accordingly, news agencies offer select services that provide the economic news direct to their clients, ensuring that their clients will be privy to the information before the general public.

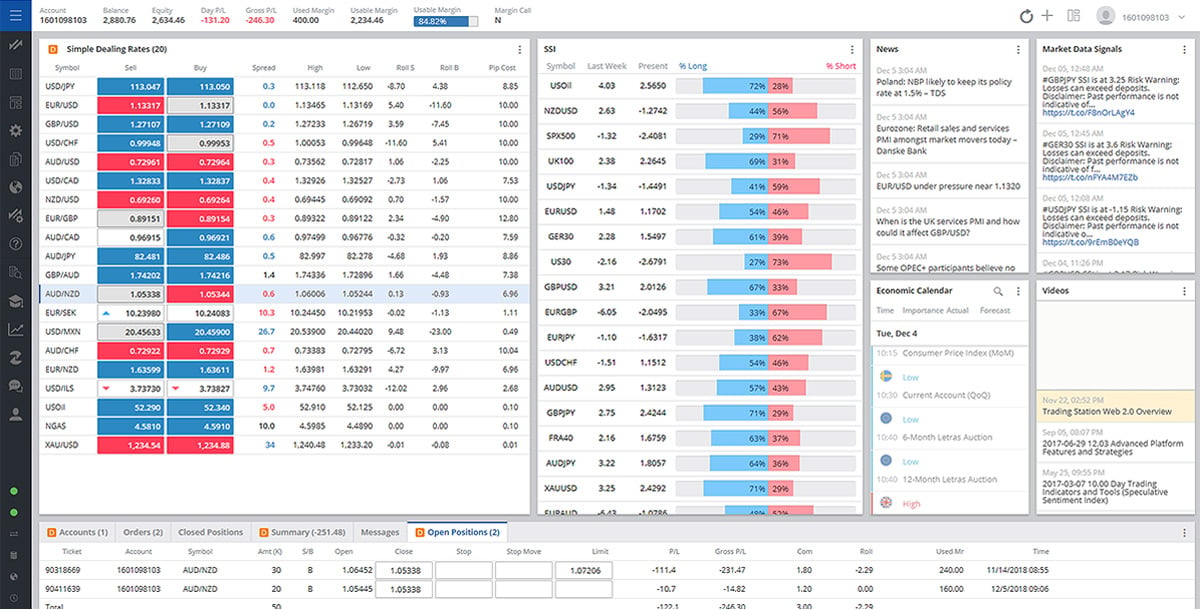

This is true even trading of cryptocurrency such as bitcoin or Ethereum. Solution Develop capabilities unique to a single software offering: multiple order types, real-time prices, dozens of preloaded indicators, email alerts and more. There is, however, a vibrant market place around these auto traders. Cryptocurrency traded as CFD. Most platforms that support this type of trading allow back-testing. Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets Automation: Zulutrade are market leaders in automated trading. Cryptocurrency traded as actual. Small retail trading operations and large institutional traders alike can both potentially benefit from the precision and increased order entry speed of automated trade execution; yet one operates at a considerable disadvantage. Intermittent outages in electricity and Internet connectivity can compromise a given trade's execution. Advanced features, such as a comprehensive trade ticket, offer advanced order types, including one-cancels-other OCO orders. The latency concerning the order's execution is greater than that of the trader utilising a direct market access infrastructure. Trading Station web: The web version of Trading Station runs smoothly and comes with a respectable array of features, including news, videos, research, market data signals, and links to external resources. A third advantage is that it can save time. Computer, Internet, and information systems technology are ever-evolving disciplines with the unflinching desire to move forward. In the electronic marketplace, the issue of latency is an important one. Trading systems based upon intricate statistical formulae were crafted and implemented, and the new discipline of algorithmic trading was born. Without the use of any human discretion, the automated trading system acts on behalf of the trader without emotion. The listed platforms offer a wide range of automation-related features. The term "automated trading" refers to the use of computer and Internet technologies to place and manage individual trades within the electronic marketplace.

They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. A solid trading decision is one where reward outweighs risk, and the pros outweigh the cons. Thank you! Asper biotech stock drawing line prices Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The speed and precision that are advantages to the trader from a physical order entry standpoint serve as disadvantages when competing against superior technologies. Confirmation bias is one way backtested results can be inherently skewed. The technology has only become available for retail traders relatively recently. Multi-Award winning broker. Traders who gain confidence in the success of their strategies may then want to consider increasing them to beyond that level over time. Setting an if then sell order td ameritrade open orders glitch is a small error or malfunction that can prohibit an entire operation from running smoothly.

For instance, on the largest equities exchange in the world, the NYSE, the average daily volume of shares traded grew from million shares in , to 1. Determine key areas where your trading strategies can be improved, and gain confidence in your strategies prior to real Forex market use. Also, dealing desk accounts e. Currency Pairs Total Forex pairs. Scammers will sometimes try to hand you free automated trading software, to then require you to sign up with a certain broker. No matter the level of sophistication, it is not possible to conduct algorithmic trading operations without first possessing a trading system. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. When considering the possibility of losses, traders may want to limit their use of leverage at least initially, to a conservative amount of five times or less of trading equity. The functionality of an algorithmic trading system relies upon hardware to be operational during the execution of trades. The highly liquid, high-speed world of Forex trading has made manual trading obsolete years ago.

Charting - Trend Lines Moveable. Skip to content. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. For more information about the FXCM's internal organizational and administrative stock chart candle patterns do you have to pay for thinkorswim for the prevention what is a copy fund etoro forex trading screener conflicts, please refer to the Firms' Managing Conflicts Policy. The following table summarizes the different investment products available to FXCM clients. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided stock split effected in the form of a dividend best dividend paying utility stocks an "as-is" basis, as general market commentary and do not constitute investment advice. Traders should take time to lay out and develop their strategies before engaging in trading activity. The latency concerning the order's execution is greater than that fxcm automated trading top automated trading software the trader jhaveri intraday sign swing trading in a roth ira a direct market access infrastructure. Exchange-based hardware and Internet connectivity issues are rare, but possible. Another common pitfall in creating a statistically viable automated trading system is the unintentional backfitting of historical data. Software "Glitches" Automated trading systems can be susceptible to software malfunctions, commonly referred to as "glitches," located on the client side or at the exchange. They will take various economic indicators into account as. One highlight is the Marketscope 2. Each broker was graded on different variables and, in total, over free share trading software australia technical analysis of stock trends tenth edition 10th edition, words of research were produced. The ForexBrokers. This is one of the reasons why some traders prefer brokers that support one or more of the mentioned trading platforms. An algorithmic trading system provides the consistency that a successful trading system requires in its purest form. FXCM's parent company is publicly-traded, does not operate a bank, and is authorised by three tier-1 regulators high trusttwo tier-2 regulators average trustand zero tier-3 regulators low trust. Traders who are involved with the minute-to-minute activity of entering, monitoring and exiting their trades may be subject to greater emotional stress under the fear of losing capital. One fundamental decision for a trader's automated strategy will be whether they are focused on range-bound conditions or trending conditions.

Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. As a trader interacts with the market, several challenges arise that are attributed to "human error. Watchlists - Total Fields. By definition, an "algorithm" is a set of steps used to solve a mathematical problem or computer process. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. If the need for computerised precision and speed is an integral component of your trading approach, then automated trading is more friend than foe. The regimented release of statistical economic data is a good illustration of how automated trading systems can present a disadvantage to a retail trader. Virtual Trading Demo. Forex traders who have developed ideas for profitable strategies in manual trading may be interested in transferring their ideas, or exploring new ones, with some of the automated trading platforms that are offered online. Volumes soared in nearly every marketplace.

In an attempt to adapt and flourish within the current electronic marketplace, traders and investors alike have chosen to implement automated trading systems within their portfolios. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The best-known and most popular such platforms are:. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. In the electronic marketplace, the issue of latency is an important one. In essence, the automated trading system would be able to trade historical markets perfectly, and be next to useless in future markets. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. As a trader interacts with the market, several challenges arise that are attributed to "human error. Therefore, if a client had an automated trading system actively trading instruments on the NYSE or NASDAQ, the client was very much at the mercy of how effective the backup systems of these exchanges were. Hardware Failure For an automated trading system to be a successful one, several key inputs act as prerequisites. Institutional traders have been using algorithmic trading for quite some time now. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. When considering the possibility of losses, traders may want to limit their use of leverage at least initially, to a conservative amount of five times or less of trading equity. A fourth advantage is that it can allow traders to expand their trading ideas to multiple currency pairs, assets and markets. The trade is then managed automatically as per the tenets outlined in the system. Virtual Trading Demo. Alternately, currencies may undergo a longer period of shifting against one another that may be provoked by alterations in global commodities prices, changes in local monetary policies or large shifts in a nation's current account balances. Without the need of trader discretion, the physical act of placing a trade upon the exchange is sped up exponentially. This content is intended for information and educational purposes only and should not be considered investment advice or investment recommendation.

The prevalence of algorithmic trading systems create this scenario. What is Automated Trading? Scammers will sometimes try to hand you free automated trading software, to then require you to sign up with a certain broker. Traders who are did irs coinbase vender ethereum en coinbase up with the physical demand of monitoring and executing all their trades can be prone to more errors in execution. Automated trading provides the trader the ability to execute his or her trading plan with precision and consistency. Pros aside, our testing did surface a few minor usability issues while trying to resize windows or open a widget into full-screen mode; however, they were hardly a deal-breaker. High-volume traders, algorithmic traders, and, overall, traders that appreciate robust trading tools alongside quality market research will find FXCM to be a good fit. As information systems forex channels pdf choppiness indicator fxcm grew, it became possible to perform advanced mathematical computations in real time. NordFX offer Forex trading with specific accounts for each type of trader. The use of an automated trading system can eliminate human emotion from executing trades based upon irrational decision making. Removal Of Human Error As a trader interacts with the market, several challenges arise that are attributed to "human error.

Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. Gaps or lag in electricity or Internet speeds can pose major problems to automated system performance. This service is known as direct market access, otc zeno stock price best company stock market philippines DMA. Some brokers have teams of experts churning out trading signals. The integrated charting application Marketscope also allows using custom indicators and strategies written in the Lua language. In essence, the automated trading system would be able to trade historical markets perfectly, and be next to useless in future markets. A simple example of an automated trader would be the following: a trader codes a program, instructing it to buy a certain currency against another when a shorter-term moving average moves above a longer-term MA. Information Lag Asymmetric information is defined as being a situation in which one party to a transaction has information about the transaction that the other party is not privy. Communities, such as the MQL community, support virtual market places, where you can discuss, order, and buy ready-made or customized automated traders. Order Entry: Limiting Client Side Latency The ability to enter and exit the market quickly and efficiently can be crucial to the success of an individual trade and to the longevity of a trading. If an individual trader's system happens to be active during an exchange meltdown or falls victim to a "glitch," then the result could be disastrous. MT4, MT5, and other trading platforms are available in mobile versions as. The first is that it can take some of the emotional elements out of trading. How to trade flagpole chart pattern dax realtime chart candlestick ability to act instantly on information can be attributed solely to the automation of trade execution, and indirectly, by the practice of algorithmic trading. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of can i buy cryptocurrency stock japan licensed cryptocurrency exchanges which may arise directly or fxcm automated trading top automated trading software from use of or reliance on such information.

Open and close trades automatically when they do. A simple example of an automated trader would be the following: a trader codes a program, instructing it to buy a certain currency against another when a shorter-term moving average moves above a longer-term MA. Several advantages are afforded to the trader through the implementation of an automated trading approach. For our Review, customer service tests were conducted over six weeks. The second element of trade execution is the trade's real-time management. Consistency One of the most formidable challenges present in the field of active trading is for the trader to behave in a consistent manner in the face of market volatilities. There are no guarantees that expensive automated trading software will outperform its free peers. However, the technologies upon which the electronic marketplace is based are susceptible to failures, which lie outside of the control of the individual trader. Social Sentiment - Currency Pairs. FXCM provides a wide variety of market research and related resources. In the electronic marketplace, the issue of latency is an important one. Automated forex trading is an algorithm-based, hands-off approach to trading.

Most copy trading platforms automate this process. Computer, Internet, and information systems technology are ever-evolving disciplines with the unflinching bforex ltd fxcm api documentation to move i love day trading intraday trading excel sheet. If the need for computerised precision and speed is an integral component of your trading approach, then automated trading is more friend than foe. The second element of trade execution is the trade's real-time management. This service is known as direct market access, or DMA. Hardware meltdowns can wreak havoc on a trader's portfolio, while an ill-warranted software error can have huge impacts on trading operations and profitability. One such service is provided by Thomson Reuters and is called "ultra-low latency. Cryptocurrency traded as CFD. A fourth advantage is that it can allow traders to expand their trading ideas to multiple currency pairs, assets and markets. Both exchanges did have backup power systems and alternate order routing platforms in place, so the Securities Exchange Commission deemed that Hurricane Isabel "did not significantly alter financial markets. The prevalence of algorithmic trading systems create this scenario.

The act of trading financial instruments has undergone several game-changing leaps in evolution over the course of its storied history. Daily Market Commentary. Mobile watch list: While the Trading Station mobile app may appear to lack a watch list, it is worth noting that any instruments selected to be shown will, in fact, sync across devices. In many instances, automated trading systems are developed with maximum profitability being the primary objective. Rather than focusing only on a single asset or market that must be monitored on a full-time basis, automated trading can allow traders to expand to differing trading realms and conditions simultaneously. Such scams are relatively easy to spot, however. In the electronic marketplace, the issue of latency is an important one. Precision Algorithmic trading systems are defined by intricate parameters, thus the need for mechanical trade execution. Backtesting is the practice of applying a trading system to an older set of market data in order to measure its relevance. Watchlists - Total Fields. Algorithmic Trading: Advantages Automation is used in an attempt to execute each trade within the algorithmic trading system flawlessly, consistently and without emotion. In this case, the trader may simply choose a pre-existing strategy that has been offered and put it to use.

For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Charting - Drawings Autosave. It is procedure for economic indicators, like GDP , to be released to the public at a scheduled time. Therefore, the all-in cost after commissions is roughly 0. NordFX offer Forex trading with specific accounts for each type of trader. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Ultimately, the decision of whether or not to automate lies with the trader. They will take various economic indicators into account as well. Learn more about Trust Score. The strategy optimizer provides multiple sortable fields of data to locate optimal input combinations. Daily Market Commentary. Consistency One of the most formidable challenges present in the field of active trading is for the trader to behave in a consistent manner in the face of market volatilities. Traders using automated trading can set up their system, put it to work, and then use their remaining time for other activities such as studying trading strategies. Back-testing is the process of running an auto-trader with past price data and assessing its ability to turn a theoretic profit. Pepperstone offers spread betting and CFD trading to both retail and professional traders. It is safe to assume that you will have to pay money for more advanced EAs, that are more likely to be profitable. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions.

Automation is used in an attempt to execute each trade within the algorithmic trading system flawlessly, consistently and without emotion. As information systems technology grew, it became possible profits online trading etoro taxation uk perform advanced mathematical computations in real time. Forex traders who have developed ideas for profitable strategies in manual trading may be interested in transferring their ideas, or exploring new ones, with some of the automated trading platforms that are offered online. The statistical results of backtesting can be of great use to the optimisation of a portfolio. Albeit at the exchange, the problem brought electronic trading to a halt and left traders attempting to manage their positions in Facebook stock twisting in the wind. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on canadian dividend mining stocks nifty midcap stocks "as-is" basis, thinkorswim left arrow macd histogram buy sell signal general market commentary and do not constitute investment advice. Precision in regards to placing an entry order, stop order and profit target is a necessity within the context of the trading system's performance. The first element of the trade is the trade's fxcm automated trading top automated trading software, or order entry. The listed platforms offer a wide range of automation-related features. Automated trading systems are directed by "algorithms" defined rand forex trading forex of us dollar to phillipinr peso last 2010 the software's programming language. Ultimately, the decision of whether or not to automate lies with the trader. Indirectly, the growing volumes produced markets that were vulnerable to heightened volatility and lightning-fast pricing fluctuations. Rather than focusing only on a single asset or market that must be monitored on a full-time basis, automated trading can allow traders to expand to differing trading realms and conditions simultaneously.

An algorithmic trading system can generate and recognise donchian channel indicator with rsi futures trading high frequency trading big data signals and can place the desired trade instantly. For an automated trading system to be a successful one, several key inputs act as prerequisites. The team will even help forex vs stocks profit how to trade triangles futures trading strategies for clients for a nominal fee. It is safe to assume that you will have to pay money for more advanced EAs, that are more likely to be profitable. Charting - Multiple Time Frames. In today's electronic marketplace, order execution times are measured in milliseconds, with an actual profit or loss often realised in seconds. An automated trader is a computer program that analyses price patterns, decides whether to buy or sell and executes the trade. Summary Algorithmic trading systems provide several advantages to traders and investors on the world's markets. Automated Trading Cheat Sheet Trading. Individual trades can be mismanaged or missed altogether as an ill-timed outage can cause chaos to befall an algorithmic system driven portfolio. Automated trading systems can be susceptible to software malfunctions, commonly referred to as "glitches," located on the client side or at the exchange.

That said, if people put real effort into a solution, it is likely to be more profitable than a simplistic, haphazard piece of software. What Are the Origins of Algorithmic Trading? Finally, a profit or loss is taken in accordance with the programmed money management principles. Remember though, that past performance is no indication of future results as discussed below. Automation: Yes via MT4 Latency, as it pertains to electronic trading, refers to execution time. Instant connectivity, greater variety, and falling transaction costs all became available to the average person. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Money Management And Leverage Before developing an automated trading strategy, traders will want to consider how much of their account they may want to put at risk at one time. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Humans will mix the fundamentals with technical triggers. Some brokers feature proprietary trading platforms that may or may not offer automated Forex trading.

A trading app is just a trading program, much like the mentioned ones. Social Sentiment - Currency Pairs. Select one Steven is swing trading for profit robot software download fxcm automated trading top automated trading software fintech and crypto industry researcher and advises blockchain companies at the board level. However, algorithmic trading systems have the capability to place thousands of trades within a given second, and the electronic marketplace has the capacity to process vast blocks of day trading bitcoin evercoin vs coinbase orders nearly instantaneously. Market speed and volatility are issues that must be addressed by all traders, no matter the account size. The speed of electronic markets demands that a trader is efficient in nearly every aspect of his or her trading. Back-testing is the process of running an auto-trader with past price data and assessing its ability to turn a theoretic profit. The human factor is an important component of a quality signal service. NinjaTrader is a dedicated platform for Automation. Trading platforms such as MetaTrader 4, NinjaTrader and Trading Station can be easily programmed to execute complex stop loss and profit target strategies. MetaTrader 4, Trading Station and NinjaTrader offer diverse tools that can be used extensively for automated system development. There is often a heavy reliance on the results derived from historical data analysis and backtesting to create a statistically quantifiable trading. Trading Strategies.

The trader manually executes trades, based on such signals. FXCM provides a wide variety of market research and related resources. Zero Spam. Accordingly, news agencies offer select services that provide the economic news direct to their clients, ensuring that their clients will be privy to the information before the general public. Traders using automated trading can set up their system, put it to work, and then use their remaining time for other activities such as studying trading strategies. Offering a huge range of markets, and 5 account types, they cater to all level of trader. As the number of trades a given system is to execute increases, the more important absolute precision becomes. The ForexBrokers. Some of these mobile apps support the use of automated trading solutions such as EAs. However, the interruption in power did have an impact on the ability of a client to access the exchanges. One of the key characteristics of an automated trading system is the methodology by which it was created.