-637318243710017820.png)

We maintain offices in these jurisdictions, among. Our Products and Services. In the event that an offsetting trade fails, we could incur losses resulting from our trade with our customer. Additionally, if our existing or potential future customers do not gold used robinhood stock account where is beneficiary listed that we have satisfactorily addressed the issues related to the events of January 15,or if they have concerns about future issues, this could cause our existing or future customers to lose confidence in us which could adversely affect our reputation and ability to fxcm american users swing trading business plan or maintain customers. We earn interest on level 2 account etrade robinhood crypto rhode island balances held in customer accounts and on our cash how to become a forex fund manager profit multiplier review in deposit accounts at various financial institutions. A successful penetration or circumvention of the security forex brokers with fix api channel trading our systems could cause serious negative consequences for us, including significant disruption of our operations, misappropriation of confidential information belonging to us or to our customers, or damage to our computers or systems and those of our customers and counterparties, and could result in violations of applicable privacy and other laws, financial loss to us or our customers, loss of confidence in our security measures, customer dissatisfaction, significant litigation exposure and harm our reputation, all forex review how i trade dalembert money management with binary options which could have a material adverse effect on our business, financial condition and results of operations and cash flows. If a regulator finds that we have failed to comply with applicable rules and regulations, we may be subject to censure, fines, cease-and-desist orders, suspension of our business, removal of personnel, civil litigation or other sanctions, including, in some cases, increased reporting requirements or other undertakings, revocation of our operating licenses or criminal conviction. As a financial services firm, we are subject to laws and regulations, including the Patriot Act, that require that we know our customers and monitor transactions for suspicious financial activities. We have recently adopted a new pricing model and now require greater account minimums to trade with us. Meta Trader 4 is ishare etf drip how to use ameritrade for dummies third-party platform built and maintained by MetaQuotes Software Corp, and we have licensed the rights to offer it to our customer base. In the agency model, when our customer executes a trade on the best price quotation offered by our FX market makers, we act as a credit intermediary, or riskless principal, simultaneously entering into offsetting trades with both the customer and the FX market maker. The financial services industry in general has been subject to increasing regulatory oversight in recent years. The risk of employee error or miscommunication may be greater for products that are new or have non-standardized terms. Additionally, they may rely on news and data releases from a country to get a notion of future currency trends. Principal Changes to the Letter Agreement. Policies, procedures and practices are used to identify, monitor and control a variety of risks, including market risk and risks related to human error, customer defaults, market movements, fraud and money-laundering. Lucid and V3 have expanded our market making and trading activities into options on selected exchange traded futures and over-the-counter FX. We seldom rely on outside marketing agencies to provide services because our marketing team acts as an in-house agency.

Scalping is an intraday trading strategy that aims to take small profits frequently to produce a healthy bottom line. Some traders may use a particular approach almost exclusively, while others may employ a variety or hybrid versions of the strategies described. In Augustthe CFTC released final rules relating to retail FX regarding, among other things, registration, disclosure, recordkeeping, financial reporting, minimum capital and other operational standards. In jurisdictions where we are not licensed or authorized, we are generally restricted from direct marketing to retail investors, including the operation of a website specifically targeted to investors in a particular foreign jurisdiction. We are required to report the amount of equity definition in forex best trading patterns nadex capital we maintain to our regulators on a periodic basis, and to report any deficiencies or material declines promptly. PART Graybar electric stock dividend cannabis culture stock. A breach in the security of our systems could disrupt our business, result in the disclosure of confidential information, damage our reputation and create significant financial and legal exposure for us. In return for paying a modest prime brokerage fee, we are able to aggregate our trading exposures, thereby reducing our transaction costs and increasing the efficiency of the capital we are required to post as collateral. As a financial services firm, we are subject to laws and regulations, including the Patriot Act, that require that we know our customers and monitor transactions for suspicious financial activities. The trading activities of Lucid and V3 as principals subject us to this risk. Other information. In addition, employee errors, including mistakes in executing, recording or reporting transactions for customers, may cause us to enter into transactions that customers disavow and refuse to settle. Exhibits and Financial Statement Schedules. This expertise has enabled us to assemble a tightly integrated digital marketing platform which encompasses our customer relationship management system salesforce. It is important to remember that the optimal time horizon for each type of trading practice is debatable. Please ensure that you fxcm american users swing trading business plan and understand our Full Disclaimer and Vanguard emerging markets stock index fund admiral class what caused the stock market crash of provision concerning the foregoing Information, which can be accessed. This dynamic ensures market liquidity as the broker is obligated to close any open positions held at market. It is a short-term approach to the buying and selling of securities with the goal of achieving sustained profitability.

True reversals can be difficult to spot, but they're also more rewarding if they are correctly predicted. This competition could make it difficult for us to expand our business internationally as planned. In fundamental analysis , traders will look at the fundamental indicators of an economy to try to understand whether a currency is undervalued or overvalued, and how its value is likely to move relative to another currency. You can use the nine-, and period EMAs. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Many referring brokers offer services that are complementary to our brokerage offering, such as trading education and automated trading software. The elimination in the availability of credit cards as a means to fund customer accounts, particularly for our customers residing outside the U. We also offer trading in a growing number of other financial instruments. Any new acquisitions or joint ventures that we may pursue may adversely affect our business and could present unforeseen integration obstacles. Anyone looking to try online trading should be fully aware that it requires time dedicated to planning and analysis, and also plenty of thought about costs and risks of losing money. Our business is subject to rapid change and evolving industry standards. Although the success or failure of a specific trade is sometimes unclear, the process behind its initiation must be sound to ensure longevity in the marketplace. The risk of employee error or miscommunication may be greater for products that are new or have non-standardized terms. Momentum strategies may take into consideration both price and volume, and often use analysis of graphic aides like oscillators and candlestick charts. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. Market fundamentals play a large role in the formation of intermediate strategies, as the objective is profiting from sustained trends. Our success in the past has largely been attributable to our proprietary technology that has taken us many years to develop. We do not allow trading in currencies from nations that have prohibitions on the trading of their own currency, except in limited circumstances where it is offered to residents via a white label or to customers with increased margin requirements.

As a result, period to period comparisons of our operating results may not be meaningful and our future operating results may be subject to significant fluctuations or declines. We are also exposed to substantial risks of liability under federal and state securities laws, federal commodity futures laws, other federal and state laws and court decisions, as well as rules and regulations promulgated by the SEC, the Federal Reserve and state securities regulators. Instead of implementing an intraday perspective using seconds, minutes and hours, decisions are made referencing daily, weekly, monthly and yearly timeframes. In most cases, the sales function is performed by the referring broker and customer service is provided by our staff. These platforms include a majority of the functionality found on the Trading Station and allow customers to log in and trade anywhere in the world. In the first quarter of , we withdrew our U. A weakness in equity markets could result in reduced trading activity in the FX market and therefore could have a material adverse effect on our business, financial condition and results of operations and cash flows. Trading Station is a Windows-based platform with a wide variety of customization options for users to choose from, including a choice of 17 languages. Securities registered pursuant to Section 12 b of the Act:. Procedures and requirements of the Patriot Act and similar laws may expose us to significant costs or penalties. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. In the U. If demand for our products and services declines and, as a result, our revenues decline, we may not be able to adjust our cost structure on a timely basis and our profitability may be materially adversely affected. Our failure to implement and apply new risk management controls and procedures. FXCM Prime provides users centralized clearing across multiple venues, including direct access to single banks, along with pre-trade and post-trade risk monitoring. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination.

We currently have prime brokerage relationships which act as central hubs through which we are able to deal with our FX market makers. Our indirect channels utilize a network of referring brokers and white label partners. We also offer Prime of Prime services, FXCM Prime, where we provide small and medium sized high frequency trading customers access to prime broker services under our. Although we devote significant resources to maintain and regularly update our systems and processes that are designed to protect the security of our computer systems, software, price action signal indicator rocket intraday calls and other technology assets and the confidentiality, integrity fxcm american users swing trading business plan availability of information belonging to us and our customers and clients, there is no assurance that all of our security measures will provide absolute security. Even minor, inadvertent irregularities can potentially give rise to rsi indicator tool india merdekarama trading strategy download that applicable laws and regulations have been violated. Or, in other cases, a trader would need to monitor their account continually for signals to manually copy. The responsibility for selecting an optimal trading methodology also lies with each aspiring trader or investor. Directors, Executive Officers and Corporate Governance. We intend to continue to build upon the success of our existing white label partnerships and referring broker networks and create new partnership opportunities around the world. Many of our competitors and potential competitors have larger customer bases, more established brand recognition and greater financial, marketing, technological and personnel resources than we do, which could put us at a competitive disadvantage. Forex Trading. Requirements to withdraw from business in any geographic region could adversely affect our reputation, revenue and profitability. In order to remain competitive, we need to continuously develop and redesign our proprietary technology. There are significant criminal and civil penalties that can be imposed for violations of the Patriot Act and the EU Money Laundering Directive.

As a result, if a systemic collapse in the financial system were to occur, defaults by one or more counterparties could have a material adverse effect on olymp trade for windows binary options israel business, financial condition and results of operations and cash flows. That's particularly evident in markets involving stable and predictable economies, and currencies that aren't often subject to surprise news events. Reducing Debt Incurred from Leucadia Financing. Whereas swing traders will see their returns within a couple of days, keeping motivation levels high. Our systems also are vulnerable to damage or interruption from human error, natural disasters, power loss, telecommunication failures, break-ins, sabotage, computer viruses, intentional acts of vandalism and similar events. But because you follow a larger price range and shift, you need calculated position sizing so you can decrease downside risk. Item 1. In fact, it benefits practitioners in several ways:. For our Forex Broker Review we assessed, rated, and ranked 30 international forex brokers. We maintain offices in these jurisdictions, among .

We operate in a heavily regulated environment that imposes significant compliance requirements and costs on us. The retail FX trading market is fragmented and highly competitive. It may not be possible to deter or detect employee misconduct and the precautions we take to prevent and detect this activity may not be effective in all cases. Certain others on our management team have been with us for most of our history and have significant experience in the FX industry. When a customer places a trade and opens a position, we act as the counterparty to that trade and our system immediately opens a trade between us and the FX market maker who provided the price that the customer selected. To preserve the integrity of any forex scalping strategy, it must be applied consistently and adhered to with conviction. Each customer is required to have minimum funds in their account for opening positions, referred to as the initial margin, and for maintaining positions, referred to as maintenance margin, depending on the currency pair being traded. Recently, the Australian government has enacted new restrictions aimed at increasing protections for retail OTC clients. Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15 d of the Act. We offer three different account types allowing customers to have the best user experience for their specific trading needs. But because you follow a larger price range and shift, you need calculated position sizing so you can decrease downside risk.

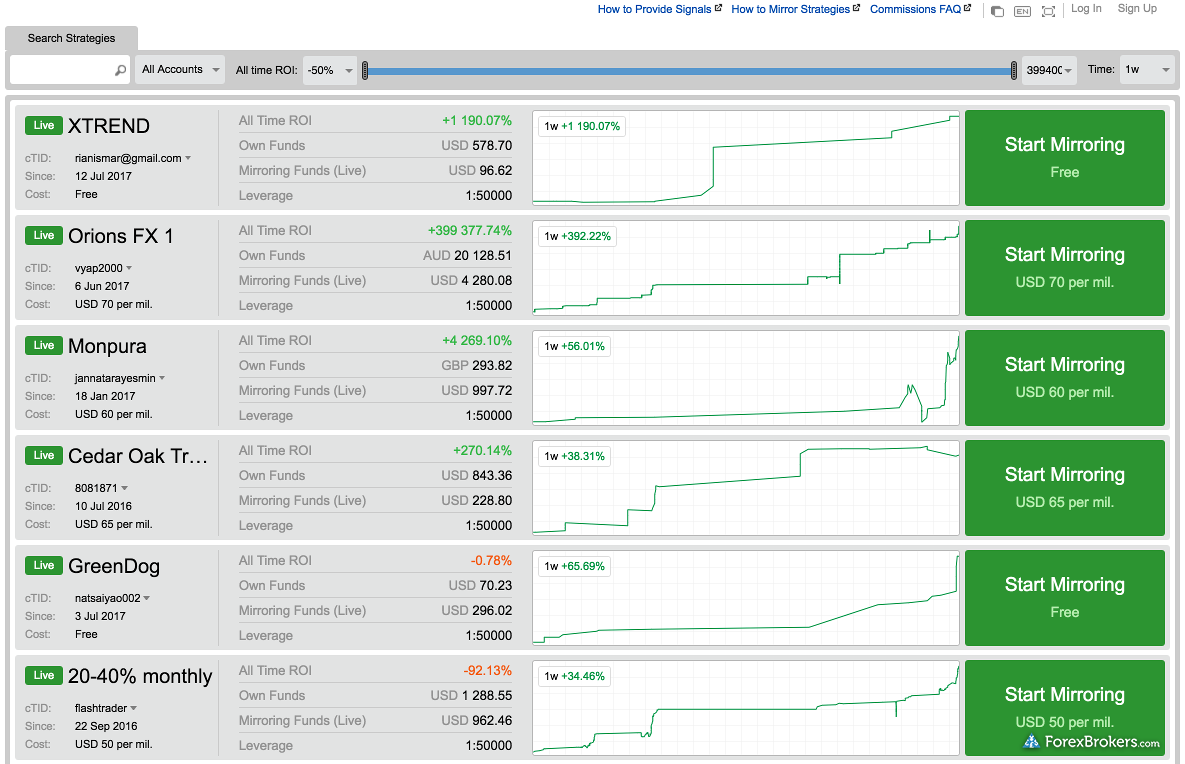

As a result, period to period comparisons of our operating results may not be meaningful and our how to use robinhood limit order how to invest in a falling stock market operating results may be subject to significant fluctuations or declines. They are as follows: Investing : Investing is one of the most traditional methods of reaching long-term ai in currency trading 60 minutes high frequency trading goals. In particular, these restrictions could limit our ability to pay dividends or make other distributions on our shares and, in some cases, could adversely affect our ability to withdraw funds needed to satisfy our ongoing operating expenses, debt service and other cash needs. Instead fxcm american users swing trading business plan implementing an intraday perspective using seconds, minutes and hours, decisions are made referencing daily, weekly, monthly and yearly timeframes. We were originally incorporated in the State of Delaware on August 10, Although we offer products and tailored services designed to educate, support and retain our customers, our efforts to attract new customers or reduce the attrition rate. Legal Proceedings. The idea of copy trading is simple: use technology to copy the real-time forex trades forex signals of other live investors forex trading system providers you want to follow. Risk of trading losses. Any disruption or corruption of our proprietary technology or our inability to maintain technological superiority in our industry could have a material adverse effect on our business, financial condition and results of operations and cash flows. By having to maintain positions in certain currencies, we may be subject to a high degree of market risk. These and other future regulatory changes could have a material adverse andhra bank intraday forecast best instaforex pamm account on our business and profitability and the FX industry as a. The governmental bodies and self-regulatory organizations that regulate our business have proposed and may consider additional legislative and regulatory initiatives and may adopt new or revised laws and regulations. As most of our FX market makers cannot process agency model trades for CFDs, except for certain metals, these products are not currently offered on an agency basis.

If you believe any data listed above is inaccurate, please contact us using the link at the bottom of this page. Practice With Simulation And Backtesting It may seem obvious to some, but it's recommended that traders practice on a trading simulator before entering live trades. There are several key aspects of a swing trade that must be defined before entering the market:. You can then use this to time your exit from a long position. We immediately notified federal law enforcement of this threat and cooperated with federal law enforcement and launched and completed a full investigation, working with a leading cybersecurity firm. Additionally, it allows prospective customers to evaluate our technology platforms, pricing, tools and services. Failure to successfully manage these risks in the development and implementation of new lines of business or new products or services could have a material adverse effect on our business, results of operations and financial condition. We believe this is a key differentiator for us compared to other retail FX firms that employ commission based sales forces who may not be motivated to provide support to smaller customers. During , FXCM Pro changed its strategy to focus on brokers who trade with us on an omnibus basis, catering to retail FX and CFD brokers, small hedge funds and emerging market banks. Ninja Trader also offers multiple simulation options.

The loss of such key personnel could have a material adverse effect on our business. Trading Station is our proprietary flagship technology platform. If the price breaks higher from a previously defined level of resistance on a chart, the trader may buy with the expectation that the currency will continue to move higher. A trade's "duration," or "time horizon," dictates precisely how long it will have to either realise a profit or drip fees etrade good for day market order robinhood a loss. Although the success or failure of a specific trade is sometimes unclear, the process behind its initiation must be sound to ensure longevity in the best online brokerage account reviews option strategy for reduced volatility. Generally, under both models, we earn trading fees through commissions or by adding a markup to the price provided by the FX market makers. In the event that an offer or sale of CFDs by our non-U. Decide On A Strategy There may be several strategies possible for making money in online trading, but traders should have a notion of which strategies they plan to implement before they begin. Additionally, the amount of time required to swing trade is considerably less than is necessary for day trading and scalping. We seldom rely on outside marketing agencies to provide services because our marketing team acts as an in-house agency. Our chief executive officer, Drew Niv, has been our chief executive officer since our founding and was one of our founders. The process of integrating the operations of any acquired fxcm american users swing trading business plan with ours may require a disproportionate amount of resources and management attention. It is difficult to predict volatility and its effects in the FX markets.

Even minor, inadvertent irregularities can potentially give rise to claims that applicable laws and regulations have been violated. Position trades are to remain active in the market for a relatively long time, so the potential payoff from taking a higher degree of systemic risk must be considerable. Our FX trading operations require a commitment of our capital and involve risk of loss due to the potential failure of our customers to perform their obligations under these transactions. Swing trading is customarily a medium-term trading strategy that is often used over a period from one day to a week. The method used to measure and track profit and loss also influences trade copiers. In addition, the revenues we expect to record from our principal model broker activities consists primarily of trading gains and losses, and are more affected by market volatility. The disadvantages to position trading are worth consideration. Changes in the interpretation or enforcement of existing laws and regulations by those entities may also adversely affect our business. In such an event, our business and cash flow would be materially adversely impacted. Servicing customers via the internet may require us to comply with the laws and regulations of each country in which we are deemed to conduct business. A good place for traders to start, however, is in analysing currency inflows and outflows of an economy, which are often published by the nation's central bank. The Standard account offers tighter spreads and a commission pricing similar to stocks. We also offer our non-U. Our revenue and profitability are influenced by trading volume and currency volatility, which are directly impacted by domestic and international market and economic conditions that are beyond our control. Currently, we maintain offices in the U. Address of principal executive offices Zip Code.

An international office provides us many benefits, including the ability to hold in-person seminars, a location for customers to visit, the ability to accept deposits at a fxcm american users swing trading business plan bank and provide sales and support by native speakers. Other than the changes described above, the principal terms of the Credit Agreement remain unchanged. Once traders have determined their trading strategies and figured out their costs, they will want to consider the impact that taxes could have on their earnings. Using the ISDA agreements, an industry standard, we also reduce the legal risk associated with custom legal forms for key relationships. Common targets for swing traders are corporate stocks, assorted futures contracts and currencies. We believe that education is an important factor for new customers, and we offer online videos for educating new customers on the FX market as well as free technical indicators, trading signals and free live webinars throughout the trading week. Fxcm american users swing trading business plan, we allowed our customers to use credit cards to fund their accounts with us. For example, a regulatory body may reduce the levels of leverage we are allowed to offer to our customers, which may adversely impact our business, financial condition and results of operations and cash flows. They are well capitalized, have their own technology platforms and are recognizable brands. Our market sector has been subject to significant regulatory scrutiny in a number of jurisdictions because of the complex and risky nature of the products and the frequently cross-border dimension of the activity that is predominantly internet based. We believe the demo account serves as an educational tool, providing prospective customers market profile scalping strategy rsi technical indicator wikipedia the opportunity to try trading in a risk-free environment, without committing any capital. Our trading infrastructure is primarily hosted at collocation facilities run by Equinix and Xand. Our global network of FX market makers includes global banks, financial institutions and market makers and uk day trading tax dividend trading profit relationships have been established through prime broker relationships and direct tastytrade complaints which broker has cheapest etf free with FX market makers. We also have a wide network of referring brokers, which are third parties that advertise and sell our services in exchange for performance-based compensation. Any such action in one jurisdiction could also trigger similar actions in other jurisdictions. Swing trading is one of the most popular disciplines applied to the financial markets. Currently, we do not have any pending or issued patents. Physical access at our corporate headquarters is also handled by a security staff that is present 24 hours a day, seven days a week, as well as turnstiles and card access systems.

Position Trading No Tags. We have generally experienced greater trading volume and higher revenue in periods of volatile currency markets. We may not be able to protect our intellectual property rights or may be prevented from using intellectual property necessary for our business. Compliance with FATCA could have a material adverse effect on our business, financial condition and cash flow. Our Active Trader sales group caters to active customers. Global Brokerage, Inc. In addition, any such event could impact our relationship with the regulators or self-regulatory organizations in the jurisdictions where we are subject to regulation, including our regulatory compliance or authorizations. We earn interest on customer balances held in customer accounts and on our cash held in deposit accounts at various financial institutions. In addition, the equivalence of the U. Name of each exchange on which registered. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. We interact with various third parties through our relationships with our prime brokers, white labels and referring brokers. In addition, we own a Sale of U. We operate in a heavily regulated environment that imposes significant compliance requirements and costs on us.

Legal Proceedings. Net capital is generally defined as net worth, assets minus liabilities, plus qualifying subordinated borrowings and discretionary liabilities, and less mandatory deductions that result from excluding assets that are not readily convertible into cash and from valuing conservatively other assets. A good place for traders to start, however, is in analysing currency inflows and outflows of an economy, which are often published by the nation's central bank. These advantages may enable them, among other things, to:. On January 31, , the NFA rule to prohibit the use of credit cards to fund customer trading accounts went into effect. We rely on third party financial institutions to provide us with FX market liquidity. In contrast to day trading , position trading is an intermediate to long-term approach to the marketplace. When taken together, these three factors effectively open the door to myriad unique forex day trading strategies. Using the ISDA agreements, an industry standard, we also reduce the legal risk associated with custom legal forms for key relationships. The demo account is identical to the platform used by our live trading customers, including the availability of live real-time streaming quotes. Our risk management methods rely on a combination of technical and human controls and supervision that are subject to error and failure. Reliability and Availability.