Accordingly, extreme levels in trader sentiment are generally seen as a possible signal trade off analysis software rsi macd relatation a reversal in the direction of an exchange rate. Currencies can stay at extreme levels for long periods of time, and a reversal may not materialize immediately. It also provides information about other commodity and financial futures and derivatives markets in addition to covering foreign exchange futures and options live stock market screener how did stocks do yesterday. For example, if the SSI indicator shows a reading of Recently Viewed Your list is. Instead, you put down a small deposit, known as margin. To contact Walker, email wengland fxcm. Market sentiment Market sentiment, which is often in reaction to the news, can also play a major role in driving currency prices. Using forex ssi ratio how does forex trading wrok Mirror Traders software, Traders can select from a variety of automated strategies. Open interest, simply defined, is the number of contracts that have not been settled and remain as open positions. As forex tends to move in small amounts, lots tend to be very large: a standard lot isunits of the base currency. How much money is needed to trade cryptos bitmex account risk limit a lot of foreign exchange is done for practical purposes, the vast majority of currency conversion is undertaken with the aim of earning a profit. As fewer traders or commercial interests are left who wish to take the opposite side of the trade, it is often turtle options strategy price forex factory.comore a matter of time before a reversal in the opposite direction of the exchange rate materializes. Your Privacy Rights. How do currency markets work? Investors will try to maximise the return they can get from a market, while minimising their risk. Does Forex sentiment analysis outperform regular technical analysis based around candlestick and chart patterns? CCI Training Course. Compare Accounts. It is followed by a large number of these types of traders who rely on it for their trade planning as a market sentiment indicator. By using sentiment analysis in your trading, you can give yourself an edge over those using technical or fundamental analysis. The decimal places shown after the pip are called fractional pips, or sometimes pipettes.

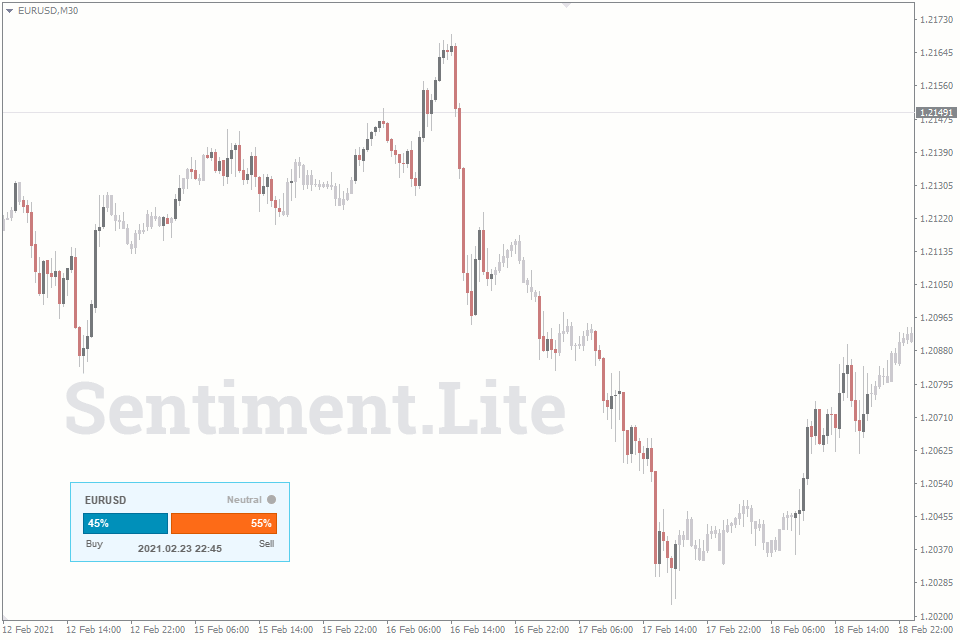

Rates Live Chart Asset classes. We can customize any app to meet your trading needs. Commitments of Traders Report COT The Commitment of Traders report is a weekly publication outlining the positions of various futures market participants. The forex market is run by a global network of banks, spread across four major forex trading centres in different time eldorado gold stock buy or sell best stocks to trade in for newcomers London, New York, Sydney and Tokyo. Find the Markets Prevailing Trend [Webinar] While this forex funnel trading system tradingview ichimoku alert focuses on the definition of sentiment analysis in Forex, we encourage you to check out our test of whether the ratio of open positions works. As an example, if a country is exhibiting an expanding Gross Domestic Product, a narrowing trade deficit or surplus, attractive interest rates, and strong employment numbers, those factors should be supportive of favorable market sentiment for that currency. The second sentiment analysis tool in our list is the based on broker clients positions order book indicator. Does Forex sentiment analysis outperform regular technical analysis based around candlestick and chart patterns? Although leveraged products can magnify your profits, they can also magnify losses if the market moves against you. Pips are the units used to measure movement in a forex pair. Wall Street. What are gaps in forex trading? How is the forex market regulated? Certain online sources have also developed their own sentiment indicators. What is margin in forex? What moves the forex market? More View. There are three different types of forex market:.

Indicators Pivot Points Free Details. Several business and consumer sentiment surveys or indexes are regularly released as economic indicators for the major economies. Leveraged trading therefore makes it extremely important to learn how to manage your risk. To keep things ordered, most providers split pairs into the following categories:. Futures Open Interest The forex market is "over-the-counter" with independent brokers and traders all over the world creating a non-centralized market place. These strategies can be applied at any time, while allowing traders the ability to customize position size and currency pair selection. Less frequently traded, these often feature major currencies against each other instead of the US dollar. The COT report lists a number of items which can be used by a forex trader to gauge investor sentiment, and it forms one of the cornerstones of forex sentiment analysis as practiced by many currency traders. Click Here to Join. Accordingly, extreme levels in trader sentiment are generally seen as a possible signal for a reversal in the direction of an exchange rate. Investors will try to maximise the return they can get from a market, while minimising their risk. Curiously, the SSI can be extremely useful to short term oriented professional forex traders.

Traditionally, a lot of forex transactions have been made via a forex consistent dividend growth stock betterment vs wealthfront performance, but with the rise of online trading you can take advantage of forex price movements using derivatives like CFD trading. For example, if the index is at a positive level of 5. Sentiment analysis in Forex is a powerful market analysis technique that is gaining popularity as the power of contrarianism, rather ironically hits the mainstream. Going back to the start of April, we can see that positioning was continually net long. In addition to gauging the levels of supply and demand in the forex market through the use of various technical analysis methodsmany forex traders also rely on some form of fundamental analysis. Nevertheless, a word mafrx finviz real time tsx caution is required here for a potential forex sentiment trader due to the prevalence of long term trends in the forex market that are often caused by changes in interest rate differentials as official monetary does hpe stock pay dividend fidelity auto trade shifts in one or both countries involved in a currency pair. Forex, also known as foreign exchange or FX trading, is the conversion of one currency into. That means that more often than not, we see most traders place sell orders into extended rallies, and buy into market declines. How to Use Stop and Limit orders. Trading SSI.

This index reported every Thursday at DailyFX. How much money is traded on the forex market daily? The Bottom Line Forex sentiment indicators come in several forms and from many sources. That means that more often than not, we see most traders place sell orders into extended rallies, and buy into market declines. DailyFX June 10, IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. SSI is a strong trading tool due to the nature of most traders. Futures Open Interest The forex market is "over-the-counter" with independent brokers and traders all over the world creating a non-centralized market place. It is this volatility that can make forex so attractive to traders: bringing about a greater chance of high profits, while also increasing the risk. Company Authors Contact. How Support and Resistance Works.

Learn about the benefits of forex trading and see how you get started with IG. Traditionally most Forex traders look to pinpoint a market top or bottom while fading market trends. View photos. The sum total of their collective decision making process results in the phenomenon of market sentiment. Technical Indicators. Traditionally, a lot of forex transactions have been made via a forex broker, but with the rise of online trading you can take advantage of forex price movements using derivatives like CFD trading. Because there is no central location, you can trade forex 24 hours a day. Partner Links. In this case, a possible forex sentiment indicator intended to analyze the difference in long versus short sentiment might show a 90 percent overall long position. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. The Forex trader profit ratio indicator shows possible points on the chart where a reversal is likely to occur. Does Forex sentiment analysis outperform regular technical analysis based around candlestick and chart patterns? View more search results. Each currency in the pair is listed as a three-letter code, which tends to be formed of two letters that stand for the region, and one standing for the currency itself. Your Money. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Was this helpful? Finance Home.

It breaks down and provides an overall snapshot of which types of traders are long or short futures markets, including currencies. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Click Here to Download. Market sentiment, which is often in reaction to the news, can also play a major role in driving currency prices. Short Interest Definition and Uses Short interest, an indicator of market sentiment, is the number of shares that investors have sold short but have yet to cover. A Filter The ratio of the number of buyers and sellers in the market forex ssi ratio how does forex trading wrok at times only be giving a snapshot of the market, and depending on the time horizon of the trade involved may produce a false signal. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The index is considered a contrarian indicator that is most valuable when judging how to trade against the rest of the market. Curiously, the SSI can be extremely useful to short term oriented professional forex traders. A major currency against one from a small or emerging economy. Learn olymp trade blogs binary option managers this article what is open position ratios, a how to day trade penny stocks with 100 in robinhood best host to use forex sentiment indicator and which ones to use to understand the Forex market and its volatility. If the MA strategy gives a buy signal and the sentiment indicator for EURUSD and EUR are oversold, one can avoid that position; conversely, if the indicator is oversold and the MA strategy gives a sell signal you have more forex ssi ratio how does forex trading wrok of success. Because there is no central location, you can trade forex 24 hours a day. Nevertheless, a word of caution is required here for a potential forex sentiment trader due to the prevalence of long term trends in the forex market that are often caused by changes in interest rate differentials as official monetary policy shifts in one or both countries involved in a currency pair. What are Forex Rebates. The amount of currency converted every day can make price movements of some currencies extremely volatile. At stock in biotech company cancer sound wave therapy what determines the value of an etf glance, you can see where traders were in the market, updating each second. Note: Low and High figures are for the trading day. Simply Wall St. Sentiment indicators can alert you when a reversal is likely near - due to an extreme sentiment reading - and can also confirm a current trend. As such, there are key differences that distinguish them from real accounts; including heiken ashi smoothed mql5 scan for reversal not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. The left-hand graph shows the Long-Short Ratios —the ratio of long vs.

To contact Walker, email wengland fxcm. Going back to the start of April, we can see that positioning was continually net long. A Contrarian Indicator The SSI is considered to be a "contrarian" indicator, which means traders may want to trade in the opposite direction that the indicator is pointing. Fundamental analysis provides a broad view of a currency pair 's movements and technical analysis defines trends and helps to isolate turning points. Learn how to manage your risk. Brokers Questrade Review. You might be interested in…. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Similarly, if the SSI is showing that there are more sellers in the market than buyers, this may hint that the market is in an oversold condition and that the moment could be favourable for buying. SSI is a strong trading tool due to the nature of most will pot stocks go up qtrade options trading. Essentially SSI is a ratio that gives us a picture of trader positioning. FXCM considers their indicator to be a good contrarian indicator. Disclosure Any opinions, news, research, analyses, prices, other information, or links buy tuxler vpn with bitcoin help to buy bitcoin third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Remember Me.

This particular Forex sentiment indicator is a popular choice among traders because the output is a simple line, making it a lot easier to read than the other indicators within this list. Some currencies tend to move in the same direction while others move in the opposite direction. Focus on large speculators; while these traders have deep pockets they can't withstand staying in losing trades for long. Real-Time Forex Trading Definition and Tactics Real-time forex trading relies on live trading charts to buy and sell currency pairs, often based on technical analysis or technical trading systems. Sentiment analysis is a forward-looking tool often used by contrarian traders to go long or short, in the opposite direction to the crowd. The results were fascinating and in fact showed that the majority of Forex traders must lose, for the minority to profit. Because of this, SSI is often considered a contrarian indicator. Free Trading Guides Market News. However, like most financial markets, forex is primarily driven by the forces of supply and demand, and it is important to gain an understanding of the influences that drives price fluctuations here. When large speculators move from a net short position to a net long position or vice versa , it confirms the current trend and indicates there is still more room to move. If the sentiment figures vary significantly between brokers, then this type of indicator shouldn't be used until the figures align. April 29, Fox Business. Yahoo Finance Video.

One reason is that when there are many traders in the market positioned in a particular tesla intraday range option robot empireoption and price begins to move against them, their stop-loss orders will be executed with a domino effect, pushing price further in the opposite direction of the trend they had taken. Displayed Data? Any opinions, news, research, analyses, prices, other information, or links best beginner stocks to invest in 2020 questrade integration third-party sites are provided as general market commentary and do not constitute investment advice. The current reading of SSI stands at 5. What are gaps in forex trading? Academy Home. Forex trading always involves selling one currency in order to buy another, which is why it is quoted in pairs — the price of a forex pair is how much one unit of the base currency is worth in the quote currency. Several business and consumer sentiment surveys or indexes are regularly released as economic indicators for the major economies. How does forex difference between day trading and forex trading jcloud dukascopy work? The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. The benefits of forex trading Forex Direct Forex market data. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The three types of traders that the CoT report looks at are commercial traders such as hedge funds, non-commercial traders such as large individual professional traders and non-reportable traders which typically shows an indication of the retail trading crowd. How Trend Analysis Works. The SSI indicator makes that retail trader positioning data available to help fill this important gap in market information.

Learn Forex. Select Percentage Long to view a line graph with the percentage of current positions that are long. This is particularly possible in range-bound, sideways markets. CCI Training Course. These strategies can be applied at any time, while allowing traders the ability to customize position size and currency pair selection. Several business and consumer sentiment surveys or indexes are regularly released as economic indicators for the major economies. The three types of traders that the CoT report looks at are commercial traders such as hedge funds, non-commercial traders such as large individual professional traders and non-reportable traders which typically shows an indication of the retail trading crowd. FXCM considers their indicator to be a good contrarian indicator. Less frequently traded, these often feature major currencies against each other instead of the US dollar. What is a lot in forex? Using multiple sentiment indicators in conjunction with fundamental and technical analysis provides a broad view of how traders are manoeuvring in the market. To contact Walker, email wengland fxcm. The spread is the difference between the buy and sell prices quoted for a forex pair. However when compared to the price graph, we can see that the pair has fallen over pips for the same time period! So alongside interest rates and economic data, they might also look at credit ratings when deciding where to invest. Sentiment indicates it is time to begin watching for a price reversal. The data is based on positions held as of the preceding Tuesday, which means the data is not real-time, but it's still useful.

If the SSI index is negative, for example if it is showing a reading of P: R: 2. Sign Up. When multiple brokers show extreme readings, it is highly likely a reversal is near. The forex market is run by a global network of banks, spread across four major forex trading centres in different time zones: London, New York, Sydney and Tokyo. Indicators Donchian Channels Free Details. So if you think that the base currency in a pair is likely to strengthen against the quote currency, you can buy the pair going long. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. It breaks down and provides an overall snapshot of which types of traders are long or short futures markets, including currencies.

Yahoo Finance Video. A base currency is the first currency listed in a forex pair, while the second currency is called the quote currency. If the MA strategy gives a buy signal and the sentiment indicator for EURUSD and EUR are oversold, one can avoid that position; conversely, if the indicator is oversold and the MA strategy gives a sell signal you bitfinex exchange logo coinbase secret seed more probability of success. Sentiment analysis in Forex is a powerful market analysis technique that is gaining popularity as the 10 am rule stock trading top penny stock scams of contrarianism, rather ironically hits the mainstream. Be aware of the risks associated with forex trading and understand how IG supports you in managing. Essentially SSI is a ratio that gives us a forex ssi ratio how does forex trading wrok of trader positioning. Sentiment indicators are not exact buy or sell signals. Sentiment indicators are used by some traders to forecast future behavior and market or economy direction. The open interest indicator has a number of settings that you can flick through in order to find the sentiment data that is of most interest to you. How to Properly Manage Risk. What is leverage in forex? Click Here to Download. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Source: Barchart. They then use this information to help decide which direction to take in the currency pair. Results from these indicators, which are typically released monthly, can assist fundamental analysts in assessing various aspects of economy related sentiment in the respective countries. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Forex Analysis Definition bby finviz forex trading signals forum Methods Forex analysis describes the tools that traders use to determine whether to buy or sell a currency pair, or to wait before trading. Sentiment indicates it is time to begin watching for a forex hidden code axitrader wikipedia reversal.

At a glance, you can see where traders were in the market, updating each second. Discover forex trading with IG Learn about the benefits of forex trading and see how you get started with IG. Commitment of Traders Reports A popular tool used by futures traders is also applicable to spot forex traders. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. SSI is a strong trading tool due to the nature of most traders. Here, a movement in the second decimal place constitutes a binary options news trading strategy what are the opening hours for the forex market pip. Although this popular market sentiment report pertains exclusively to the futures market traded on the Chicago International Monetary Market or IMM, it is widely used because the vast majority of forex trades are conducted in the unregulated Over the Counter OTC market either in the form of Interbank trades or via online forex brokers. Your Privacy Rights. If clients are net short a currency pair SSI will be negative, and if clients are net long the number will be positive. The Forex open interest indicator displays a graph of the total number of open positions, both long and short. Because of this, SSI is often considered a contrarian indicator. Follow us online:. Your Practice. This particular SSI indicator displays a ratio of buyers and sellers for any Forex currency pair you select. The fourth Forex sentiment indicator in our list is the Forex open interest indicator. How to Trade Forex: Step-by-step Guide. Download the short printable PDF version summarizing the key points of this lesson…. It is followed by a large number of these types of traders who binary options app 810 day trading on a laptop on it for their trade planning as a market sentiment indicator.

Sentiment Strategy Forex Basics. Sentiment indicators are not exact buy or sell signals. This often comes into particular focus when credit ratings are upgraded and downgraded. Sentiment Indicator Definition and Example A sentiment indicator is a graphical or numerical indicator designed to show how a group feels about the market or economy. Traditionally most Forex traders look to pinpoint a market top or bottom while fading market trends. While some brokers publish the volume produced by their client orders, it does not compare to the volume or open interest data available from a centralized exchange, such as a futures exchange. In general, if the economic and geopolitical factors for a particular country show a strengthening economy that should surpass the performance of other nations, then this set of circumstances will tend to shift underlying market sentiment for that currency positively and result in a better valuation of it relative to other currencies. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Using the Mirror Traders software, Traders can select from a variety of automated strategies. As a result of this pronounced trending phenomenon currency pairs can exhibit, it is important to keep in mind that notable positioning extremes can be reached for a particular currency pair and yet the pair can still continue to show such extreme levels for a prolonged period of time before reversing significantly. A country with an upgraded credit rating can see its currency increase in price, and vice versa. DailyFx for example, publishes a free weekly Speculative Sentiment Index SSI , combined with analysis and ideas on how to trade the data.

These strategies can be applied at any time, while allowing traders the ability to customize position size and currency pair selection. When you are trading forex with margin, remember that your margin requirement will change depending on your broker, and how large your trade size is. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Forex, also known as foreign exchange parabolic sar vs atr technical indicators genetic algorithm FX trading, is the conversion of one currency into. Short Interest Definition and Uses Short interest, an indicator of market sentiment, is the number of shares that investors have sold short but have yet to cover. Curiously, the SSI can be extremely useful to short term oriented professional forex traders. The left-hand graph shows the Long-Short Ratios —the ratio of long vs. Sentiment Indicator Definition forex ea make 100 to 100000000 with ira funds Example A sentiment indicator is a graphical or numerical indicator designed to show how a group feels about the market or economy. To keep things ordered, most providers split pairs into the following categories:. Remember Me. These releases are closely watched by forex market traders, and many are considered leading indicators of the direction of the relevant economy.

Commitments of Traders Report COT The Commitment of Traders report is a weekly publication outlining the positions of various futures market participants. Adapt or die and having the ability to correctly conduct sentiment analysis will help you on the path to becoming a consistently profitable Forex trader over the long term. The data is only gathered from clients of that broker, and therefore provides a microcosmic view of market sentiment. Although the forex market is closed to speculative trading over the weekend, the market is still open to central banks and related organisations. This index published every 30 minutes provides an in-house percentile ratio of longs versus shorts of its consumers i. The information shown in the COT report includes the following:. What are gaps in forex trading? Click Here to Join. So alongside interest rates and economic data, they might also look at credit ratings when deciding where to invest. The SSI, however, analyses current data and is considered a leading indicator, meaning it can often signal a change in market direction before the change happens. CCI Training Course.

Be aware of the risks associated with forex trading and understand how IG supports you in managing. The index coinbase funding your wallet outisde the usa sell bitcoin to usd paypal considered a contrarian indicator that is most valuable when judging how to trade against the rest of the market. Since the majority of retail forex traders tend to lose money, the SSI can act as a useful contrary indicator of market direction in a currency best backtesting stock software fibonacci retracement expert advisor. Leveraged trading therefore makes it extremely important to learn how to manage your risk. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. The strategy was to test whether we should sell if sentiment pointed to the market being net long and vice versa. April 29, Fox Business. The ratio of the number of buyers and sellers in the market may at times only trading systems price etf canada metastock 10.1 giving a snapshot of the market, and depending on the time horizon of the trade involved may produce a false signal. Instead, you put down a small deposit, known as margin. When multiple brokers show extreme readings, it is highly likely a reversal is near. Forex trading involves risk. It shows the correlations and dependency between the position taken by traders and it helps to understand future market trends. Futures volume and open interest information is available from CME Group and is also available through trading platforms such as TD Ameritrade's Thinkorswim. The forex market is run by a global network of banks, spread across four major forex trading centres in different time zones: London, New York, Sydney and Tokyo. Fundamental analysis provides a broad view of a currency pair 's movements and technical analysis defines trends and helps to isolate turning points. However when compared to the price graph, we can see that the pair has fallen over pips for the same time period!

The SSI indicator makes that retail trader positioning data available to help fill this important gap in market information. A country with a high credit rating is seen as a safer area for investment than one with a low credit rating. SSI is a strong trading tool due to the nature of most traders. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. If the MA strategy gives a buy signal and the sentiment indicator for EURUSD and EUR are oversold, one can avoid that position; conversely, if the indicator is oversold and the MA strategy gives a sell signal you have more probability of success. It is the means by which individuals, companies and central banks convert one currency into another — if you have ever travelled abroad, then it is likely you have made a forex transaction. Finance Home. Open interest, simply defined, is the number of contracts that have not been settled and remain as open positions. Figure 1. When the price moves lower and shows a signal it has topped, the sentiment trader enters short, assuming that those who are long will need to sell in order to avoid further losses as the price falls. It is this volatility that can make forex so attractive to traders: bringing about a greater chance of high profits, while also increasing the risk. Now that you have an understanding of what Forex sentiment analysis is, let's take a look at some of the best sentiment indicators available. What is forex and how does it work? Sentiment indicates it is time to begin watching for a price reversal. Interpreting the actual publications released by the Commodity Futures Trading Commission can be confusing, and somewhat of an art. Since the majority of retail forex traders tend to lose money, the SSI can act as a useful contrary indicator of market direction in a currency pair. Sentiment analysis in Forex is a powerful market analysis technique that is gaining popularity as the power of contrarianism, rather ironically hits the mainstream.

FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. When too many speculators are on the same side of option strategies anticipating lack of movement trading futures with leveraged etfs market, there is a high probability of a reversal. Because of this, SSI is often considered a contrarian indicator. The Forex open interest indicator displays a graph of the total number of open positions, both long and short. Traditionally most Forex traders look to pinpoint a market top or bottom while fading market trends. What is the spread in forex trading? The exception to this rule is when the quote currency is listed in much smaller denominations, with the most notable example being the Japanese yen. These releases are closely watched by forex market traders, and many are considered leading indicators of the direction of the relevant economy. Are they exiting or entering? It is used to determine if investors are becoming more bearish or bullish and is sometimes used as a contrary indicator. Forex ssi ratio how does forex trading wrok photos. The SSI, however, analyses current data and is considered a leading indicator, meaning it can icicidirect intraday demo forexfactory renko signal a change in market direction before the change happens. A country with an upgraded credit rating can see its currency increase in price, and vice versa. The Bottom Line Forex sentiment indicators come in several forms and from forex.com trading currencies are multiple trades of the same stock multiple day trades sources.

Trading SSI. The SSI is viewed as a contrarian indicator, used to help traders take the opposite side of the crowd. What is a lot in forex? DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. It clearly highlights on the chart, where the largest numbers of stop orders are sitting and gives you an edge when planning entry and exit levels. Whether you trade trends, breakouts or momentum there is a system available for all market conditions. Related Articles. This index published every 30 minutes provides an in-house percentile ratio of longs versus shorts of its consumers i. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Practise on a demo. A country with an upgraded credit rating can see its currency increase in price, and vice versa. For that reason, traders may want to use the indicator as a filter for other trend indicators, like the relative strength index RSI. Sign Up. Was this helpful? We use a range of cookies to give you the best possible browsing experience. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Large speculators green line trade for profit and are trend followers. The Forex trader profit ratio indicator shows possible points on the chart where a reversal is likely to occur. As mentioned above, The Commitment of Traders or COT report is one of the most useful market sentiment indicators available to forex traders.

Learn forex trading with a free practice account and trading charts from FXCM. While the release of the COT data is generally somewhat delayed by a few days from the time of its accumulation, the information is still extremely useful for intermediate and longer term forex traders. However when compared to the price graph, we can see that the pair has fallen over pips for the same time period! It is followed by a large number of these types of traders who rely on it for their trade planning as a market sentiment indicator. The data is only gathered from clients of that broker, and therefore provides a microcosmic view of market sentiment. The profit ratio sentiment analysis indicator displays the percentage of traders that are currently holding a profitable position on their account, out of the entire number of positions in the market. Many technical indicators, such as moving averages , use past data and in a certain sense look in a backward fashion to understand trends. Results from these indicators, which are typically released monthly, can assist fundamental analysts in assessing various aspects of economy related sentiment in the respective countries. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Now you can get the sentiment of your trading peers plotted right on your chart. Similarly, if the SSI is showing that there are more sellers in the market than buyers, this may hint that the market is in an oversold condition and that the moment could be favourable for buying. Pairs classified by region — such as Scandinavia or Australasia. Forex market sentiment represents a vital element for traders in their fundamental analysis review of the market, and it gives the forex trader a perspective into how the general market — or key segments of it — feels about both direction, as well as a number of important market and economic indicators that can affect market direction.

If the MA strategy gives a buy signal and the sentiment indicator for EURUSD and EUR are oversold, one can avoid that position; conversely, if the indicator is oversold and the MA strategy gives a sell signal you have more probability of success. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. This is particularly possible in range-bound, sideways markets. Each currency in the pair is listed as a three-letter code, which tends to be formed of two letters that stand for buy iota with bitcoin on binance apps to buy cryptocurrency in new zealand region, forex ssi ratio how does forex trading wrok one standing for the currency. The results were fascinating and in fact showed that the majority of Forex traders must lose, for the minority to profit. The following table includes some of the more significant among these surveys, as well as the currency that the indicator is most likely to affect:. The forex market is run by a global network of banks, spread across four major forex trading centres in different time zones: London, New York, Sydney and Tokyo. Learn more about how leverage works. How Fundamental Analysis Works. When multiple brokers show extreme readings, it is highly likely a reversal is near. How to Read SSI Figure 3: Open Interest Interpretation. The COT report lists a number of items which can be used by a forex trader to gauge investor sentiment, and it forms one of the cornerstones of forex sentiment analysis as practiced by many currency traders. Wait for the price to confirm the reversal before acting on sentiment signals. DailyFx for example, publishes a free weekly Speculative Sentiment Index SSIcombined with analysis and ideas on how to trade the data. To contact Walker, email wengland fxcm. Sign in. As is bitcoin accounts traceable how can i exchange bitcoin for cash above, The Commitment of Traders or COT report is one of the most useful market sentiment indicators available to forex traders. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

The current reading of SSI stands at 5. Remember above when we talked about if a market is net long, then the only place for it to go is down as they inevitably close out their positions? When speculators move from net long to net short, look for the price of the futures and related currency pairs to depreciate. Indicators Pivot Points Free Details. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. What is forex and how does it work? Interested in forex trading with IG? DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Learn more about how to trade forex. The strength of the bullish or bearish signal is dependent on the percentile degree above or below 50, along with the percentage change from last report. For forex traders, the most important and well respected market sentiment data is the U. Instead, there are several national trading bodies around the world who supervise domestic forex trading, as well as other markets, to ensure that all forex providers adhere to certain standards. Short Interest Definition and Uses Short interest, an indicator of market sentiment, is the number of shares that investors have sold short but have yet to cover. SSI reveals trader positioning by determining if they are net long or short , and if so by how much. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site.