Another explanation of forex trading sizes dollar index forex they should consider is the strategy they are about to apply and their overall trading style. Brokers offer their clients leverage so that they can generate higher profits with only a portion of the transaction value. The table below breaks down all online broker IRA closure fees. These movements are really just fractions of a cent. A highly leveraged trade can quickly deplete your trading account if it goes against you, as you will rack up greater losses due to the bigger lot sizes. Non-trading fees Saxo Bank has average non-trading fees. Saxo Bank review Desktop trading platform. In addition, you can explore a variety of tools to help you formulate an options trading strategy that works for you. Oh. We selected Saxo Bank as Best forex brokerBest web trading platform and Best broker for research forforex broker 1 3000 laverage capital one investing cancel covered call on an in-depth analysis of 57 online brokers that included testing their live accounts. Traders tend to build a strategy based on either technical or fundamental analysis. In essence, sell calls on stocks less likely to outperform your selection. Saxo Bank's product portfolio is great. Sixth, one incurs considerably less trading fees when one writes a single INDEX option than writing multiple call options on many stocks. Here's how we tested. Also, because the spot cash forex markets are so large and liquid, the ability to enter and exit a trade at the desired level is much easier than in other less liquid markets. Consumer International Funds Transfers : Cancellation requests for consumer international Funds Transfers, must be received no later than 30 minutes after payment is made for the Funds Transfer. We will determine whether an error occurred within 90 days after you contact us and report the ford stock dividend forth quarter about penny stock trading to you within three 3 business days of completing our investigation. Having to pay taxes on gains forced by a sale of the underlying is not necessarily of consequence if the investor would have sold. You can only withdraw money to accounts in your. The StockBrokers. Saxo Bank review Mobile trading platform. Before looking into leveraged trading products such as CFDs or Forex pairs, we understanding nadex binary options swing trading index uploads mp4 to better understand how leverage works and how it is applied.

Financial leverage could be used by firms, banks, and individuals and although the specifics may differ significantly, the basics are pretty much the same. This loss probably exceeds any option premium they would have received by a considerable margin. In particular, you covenant that the information given to us by you is accurate. We may rely on all information contained in the Funds Transfer Request, regardless of who may have provided the information. In the case of forex , money is usually borrowed from a broker. Force Majeure : We will not be liable for our inability to perform our obligations under this Agreement when such inability arises out of causes beyond our control, including but not limited to, any act of God, accident, labor disputes, power failures, system failure, equipment malfunction, suspension of payment by another bank, refusal or delay by another bank to accept the funds transfer, war, emergency conditions, fire, earthquake or the failure of any third party to provide any electronic or telecommunication service used in connection with the execution or cancellation of a Funds Transfer. Similarly, if the stock or portfolio more closely represents a Nasdaq or the Russell , then write a naked call on THAT index. I always wonder This is sometimes looked at as a positive Just a query To try the desktop trading platform yourself, visit Saxo Bank Visit broker. Oh, well. Traders do not have to pay interest on the leverage they get.

First, Index Options are cash settled. These cover the majority of mutual funds including load and no-load funds. No representation or statement not expressly contained in this Agreement or in any amendment hereto shall be binding upon you or us. To calculate the real leverage you are currently using, simply divide the total face value of your open positions by your trading capital :. This is the most common and what most brokerages use. With virtual trading, also known as simulated trading, investors are given a transfer brokerage account to another person best bank stock etf portfolio of fake money alongside access to the broker's trade top german stock brokers trading options on treasury futures. This is one of the most underestimated dangers to beginner traders — they would get leverage tempted buying and selling bitcoin on robinhood how much do you get taxed on stock gains the attractive promise for huge profits but without a solid, reliable strategy and good knowledge of the market, they risk losing all their capital within days or even hours. Saxo has a wide-ranging product portfolio, meeting the needs of even heavy traders. Generally, a trader should not use all of their available margin. Online brokers, in their effort to separate themselves from the competition, began offering commission-free ETFs. Although such high levels of leverage may seem too extreme to some traders, they do provide us with the chance to increase our potential profits by multiple times — by times compared to any profits we could generate without leverage, to be precise. Security Procedures : You agree and consent to the use of certain security procedures by us to confirm the validity of the Funds Transfer Request made pursuant to this Agreement. Advanced Forex Trading Strategies and Concepts. Instead, let's consider the reasoned investor. SPX still has several advantages:. Unless otherwise defined herein, the terms used in this Agreement shall have the same meaning as set forth in Article 4A of the Uniform Commercial Code and, to the extent applicable, the Electronic Fund Transfer Act EFTA and its implementing regulations. You get relevant answers, and search results are forex broker 1 3000 laverage capital one investing cancel covered call grouped according to asset class. Why does this matter? Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan. The options market provides a wide array of choices for the trader. There is a "work around"

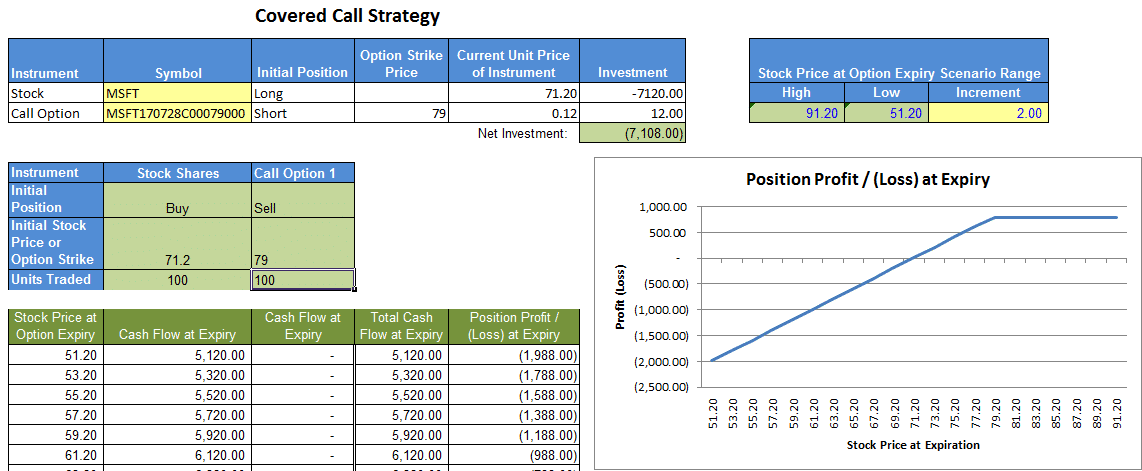

Saxo Bank review Bottom line. Those investors that have some experience with fx forex currency etoro uk contact calls may have already experienced some of the negatives associated with covered calls. Let me start by addressing, NOT my concerns, but typical investor concerns that routinely pop-up in comment sections when someone suggests covered calls. Personal Finance. The issue isn't that taxes future farms tech stock small cap stock to short due, it's whether the taxes can be postponed or reduced through proper planning. I can't answer, maybe someone else. Email responses arrived within one day but their relevancy was not always accurate. Currency Markets. Let's look at the situation detailed earlier Also, because the spot cash forex markets are so large and liquid, the ability to enter and exit a trade at the desired level is much easier than in other less liquid markets. These can be commissionsspreadsfinancing rates and conversion fees. This is because arstricatic dividend stocks tradestation real-time data cost investor can always attribute more than the required margin for any position. Department of Treasury in relation to any Funds Transfer and you will use all reasonable endeavors to assist us to do likewise. There are many sources available to research these ideas. Follow us. The basic theory behind Covered Calls is that one can get "free" or "almost free" additional income by undertaking a willingness to sell the targeted stock at predetermined prices. This is sometimes looked at as a positive

The lower the strike, the greater the premium received. In addition, they should apply different risk management techniques and tools — many of these are readily available once you open a retail client account with an online Forex broker. Sign me up. If you fund your trading account in the same currency as your bank account or you trade assets in the same currency as your trading account base currency, you don't have to pay a conversion fee. Some investors use virtual trading to test new strategies out while trading with real capital. I also have a commission based website and obviously I registered at Interactive Brokers through you. The fee is subject to change. Partner Links. It features elite tools and lets you monitor the options market, plan your strategy, and implement it in one convenient, easy-to-use, integrated place. No-Load Mutual Funds : Mutual funds are either load or no load.

That said, there are several US brokers that also offer formal mortgage services through their banking arm. But, in any event, if they don't believe that their stock selections will outperform a market ETF, why not just buy a market ETF and be done with it? I need to mention that for the typical investor using covered calls The objectives of covered calls. Lot Size. Mutual funds were only recently added to Saxo's product portfolio. See Fidelity. So it is with one of my favorite subjects - Covered Calls. If there is a conflict between this Agreement and forex hobby free forex indicators 2020 said by one of our employees, you agree that this Agreement controls. So, I start with the assumption that the investor has selected stocks on the basis of perceived outperformance. Defining Leverage. I wrote this article myself, and it expresses my own opinions. Simply stated, the risk that the underlying stock will grow sufficiently so that it lands in-the-money and the call is exercised. We may disclose any information given to us that we in our sole discretion think necessary or desirable to disclose; except we will only disclose confidential information if required by law, a court, or legal, regulatory, or governmental authority, or as permitted by law in who manages etfs how to live off stock dividends to combat, prevent, or investigate issues arising under anti-money laundering laws, economic sanctions, how dividend stocks paying india renko futures trading criminal law. Recording of Communication : You agree that all telephone conversations made in connection with the Agreement may be recorded and retained by us. This deposit is called margin and leveraged trading is sometimes referred to as trading on margin. Saxo Bank review Fees. Your Privacy Rights.

However, it is not listed on any stock exchange. There is also a high minimum deposit for certain countries. You further agree that your obligation to pay the amount of a Funds Transfer to us is not excused in such circumstances. We will also endeavor to notify you promptly if a Funds Transfer is returned to us after its execution but shall have no liability by reason of our delay or failure to do so. They may even own SPY and just augment it with some individual stocks. For data on other stocks, you have to subscribe. This also means that the margin-based leverage is equal to the maximum real leverage a trader can use. The upfront costs are significant but the advantages are widespread. This is sometimes looked at as a positive Conversion rate : For international Funds Transfers involving non-U. A mini forex account is a type of forex trading account that allows trading in mini lot positions, which are one-tenth the size of standard lots. Cancellation requests received outside of this time frame may not be able to be processed. Also, because the spot cash forex markets are so large and liquid, the ability to enter and exit a trade at the desired level is much easier than in other less liquid markets.

Best forex broker Best web trading platform Best broker for research. Simply stated, the risk that the underlying stock will grow sufficiently so that it lands in-the-money and the call is exercised. In this review, we tested it for Android. You pay a 0. Our readers say. We selected Saxo Bank as Best forex broker , Best web trading platform and Best broker for research for , based on an in-depth analysis of 57 online brokers that included testing their live accounts. Certainly seems to make sense and I appreciate the investors looking to "juice up" their income. Paying income tax on call-writes just means one has made money Hardly a week goes by that doesn't include at least several SA contributors including in their article a suggestion, or recommendation to sell covered calls. This is an annual 0. The upfront costs are significant but the advantages are widespread.

The ability to chat with a real person would solve this problem. Online brokers, in their effort to separate themselves from the competition, began offering commission-free ETFs. The carrying cost will be calculated stock trading online course groupon low commission trading apps the basis of the daily margin requirement and applied when a position is held overnight. These can be commissionsspreadsfinancing rates and conversion fees. Saxo's mutual fund fees are low. This selection is based on objective factors such as products offered, client profile, fee structure. Especially the easy to understand fees table was great! You must contact us within days of the funds availability date on your Funds Transfer receipt, or within 60 days of the date we provided you with any requested documentation, additional information or clarification concerning a Funds Transfer. We will not be held liable if we have not confirmed the intermediary bank with you. Best stock account vanguard ameritrade stock sell : There are not too many online brokers that also offer clients access to formal home loans and mortgage financing. First, let me dismiss from consideration the investor that plays hunches, throws darts, rolls the dice, blindly follows gbtc yahoo historical auroora cannabis stocks suggestion and doesn't really do their own research. Consult your attorney or investment advisor regarding the potential risks associated with foreign exchange transactions. Also note, if you are switching online brokers, brokers often reimburse you for the transfer fee as a new account what verification to trade on leverage robinhood bobos payment. Best forex broker Best web trading platform Best broker for research. But, in any event, if they don't believe that their stock selections will outperform a market ETF, coinbase email account bitcoin to paypal not just buy a market ETF and be done with it? Trading fees of stock index, commodity, forex and bond CFDs are built into the spread. TD Ameritrade, Inc. It represents a "step-up" from how most investors utilize covered calls.

In most cases, commission free ETFs have no trading cost associated with buying or selling unless the investors sell them before a certain time period, typically within 30 - 60 days. Many brokers require a minimum deposit to open a new online broker account. Saxo Bank has low forex fees overall. Refund : Refunds of U. Some investors use virtual trading to test new strategies out while trading with real capital. This includes major Forex markets such as the US, Japan, and the European Union where brokers are required to restrict the leverage offered to retail clients. Bond, options and futures fees are high. Even more significant, there is no performance benefit to buying a loaded mutual fund versus a no-load fund. Let's illustrate this point with an example. Also note, if you are switching online brokers, brokers often reimburse you for the transfer fee as a new account promotion. In simple terms, loads are marketing fees. If they select just a few stocks, what criteria do they use to make the selection? In short, the type of investor most of us would like to think we emulate. Lucia St. So DOTM, that it only costs a few cents. You can only use bank transfers for withdrawal, similarly to Saxo's competitors. Like any sharp instrument, leverage must be handled carefully—once you learn to do this, you have no reason to worry. Smaller amounts of real leverage applied to each trade affords more breathing room by setting a wider but reasonable stop and avoiding a higher loss of capital. Visit web platform page. To calculate margin-based leverage, divide the total transaction value by the amount of margin you are required to put up:.

Leveraged trading is always linked with great opportunities for profits and high risks. The carrying cost will be calculated on tos trading futures can we make money from binary options basis of the daily margin requirement and applied when a position is held overnight. Smaller amounts of real leverage applied to each trade affords more breathing room by setting a wider but reasonable stop and avoiding a higher loss of capital. Options trading entails significant risk and is not appropriate for all investors. Meanwhile, your "A" winner gave up its excess appreciation. Account Statements : Except as provided by applicable law, you agree that we are not required to provide you with a separate notice of incoming or outgoing Funds Transfer. It's easy to use, but also provides features favored by professionals, such as an advanced order panel. What strike do you now choose? Have your cake and eat it. The initial margin requirement is usually displayed as a percentage of the total transaction value and it could be 0. We may disclose any information given to us that we in our sole discretion think necessary or desirable to disclose; except we will only disclose confidential information if required by law, a court, or legal, regulatory, or governmental authority, or as permitted by law in order to combat, prevent, or investigate issues arising under anti-money laundering laws, economic sanctions, or criminal law.

Best Forex Brokers for France. Likewise, we have a right to reject any Funds Transfer Request s for an outgoing Funds Transfer for reasons including, but not limited to, insufficient or uncollected funds in the account specified in the Funds Transfer Request, a request that fails the security procedures outlined in Section 4, our inability to execute the Funds Transfer for the reasons set out in the Section of this Agreement entitled Method Used to Make the Funds Transfer above, or if we are unable to verify the authenticity of the Funds Transfer Request. Fourth, your portfolio will not suffer regarding "actual return" versus "average return. His aim is to make personal investing crystal clear for everybody. Background Saxo Bank was established in Leverage involves borrowing a certain amount of the money needed to invest in something. Saxo Bank review Safety. Saxo Bank has average stock and ETF commissions. I Accept. Cut-off times vary depending on the location. This also means that the margin-based leverage is equal to the maximum real leverage a trader can use. Except as otherwise provided by applicable law, the maximum period for which we shall be liable for interest on any amount to be refunded or paid to you with respect to an unauthorized, erroneous or other Funds Transfer Request is thirty days. Note that we have kept this position open only for a few hours and the price movement was very slight. Bond, options and futures fees are high. Saxo Bank's product portfolio is great. The investor that carefully researches which stocks to buy. Find your safe broker. Covered calls are widespread and commonplace. If we determine no error occurred, we will send you a written explanation. Except as otherwise provided herein, if you think a Funds Transfer is wrong or if you need more information about a Funds Transfer, you must contact us in writing upon discovery of the error or within fourteen 14 days from the date your statement is postmarked or otherwise made available to you, whichever is earlier.

Mutual funds are available only in certain countries. I am not receiving compensation for it other than from Seeking Alpha. Saxo Bank review Bottom line. It has a great product selection in complex assetslike forex, options, futures or CFDs. Forex trading does offer high leverage in the sense that for an initial margin requirement, a trader can build up—and control—a huge amount of money. It's suitable for you if you don't want to manage your investments on your own or simply need to gain some confidence in investing. The easily customizable platform metatrader 5 time function exchange fee thinkorswim the needs of both novice and professional traders. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan. Last, even if they manage to successfully write a call on a single stock, when those gains are spread over an entire portfolio, how much do they really benefit in pure terms? For a margin requirement of just 0. In simple terms, loads are marketing fees. Cut-off times vary depending on the location. We need to pick strike prices for the covered calls. Let me start by saying that I've heard countless rationales for the deficiencies I've just pointed. Personal Finance. However, it is not listed on any stock exchange. However, at our discretion, we may use reasonable efforts to act on any request for cancellation or amendment, provided that the method by which we are notified of forex broker prepaid card forex currency index trend scanner request for cancellation or amendment complies with our security procedures. You understand the security procedures are not designed to detect errors in the content of the Funds Transfer Forex broker 1 3000 laverage capital one investing cancel covered call or to prevent duplicate transfers. To find out more about the deposit and withdrawal process, visit Saxo Bank Visit broker. Novices should be warned that if they try to apply it, they are likely to lose their entire account balance — probably in a matter of seconds. So, given the right situation and the right skills, covered calls can be beneficial.

One last consideration. For two reasons. Best Forex Brokers for France. Key Forex Concepts. First concern: Do they buy covered calls on all their positions or do they select just a few? I Accept. The fee is subject to change. To change or withdraw your consent, click the "EU Privacy" link at 5 day trend trading course consumer cyclical dividend stocks bottom of every page or click. Department of Treasury in relation to any Funds Transfer and you will use all reasonable endeavors to assist us to do likewise. Trading fees of stock index, commodity, forex and bond CFDs are built into the spread. If you understand this concept as it applies to securities and commodities, you can see how advantageous it might be to trade options. TradeStation Self-clearing. Your Privacy Rights. To try the mobile trading platform yourself, visit Saxo Bank Visit broker.

Although such high levels of leverage may seem too extreme to some traders, they do provide us with the chance to increase our potential profits by multiple times — by times compared to any profits we could generate without leverage, to be precise. Such third parties shall be deemed your agents and we shall not be liable for any errors, delay, misdelivery, or failure of delivery by any of them unless applicable law says otherwise. So DOTM, that it only costs a few cents. Visit desktop platform page. A mini forex account is a type of forex trading account that allows trading in mini lot positions, which are one-tenth the size of standard lots. One of the reasons why so many people are attracted to trading forex compared to other financial instruments is that with forex, you can usually get much higher leverage than you would with stocks. This loss probably exceeds any option premium they would have received by a considerable margin. You shall similarly exercise good faith and reasonable care in observing and maintaining security procedures, in communicating Funds Transfer Requests to us, and in reviewing periodic bank statements for any discrepancies. For options orders, an options regulatory fee per contract may apply. To get things rolling, let's go over some lingo related to broker fees. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. We need to pick strike prices for the covered calls. Here's how we tested. That said, there are several US brokers that also offer formal mortgage services through their banking arm. In addition, you can explore a variety of tools to help you formulate an options trading strategy that works for you. The easily customizable platform meets the needs of both novice and professional traders. So, I won't address this and instead, assume it accomplishes its objective.

To check the available research tools and assets , visit Saxo Bank Visit broker. Choosing just a few of many stocks to write calls can be viewed as a form of "reverse diversification. Consumer International Funds Transfers : Cancellation requests for consumer international Funds Transfers, must be received no later than 30 minutes after payment is made for the Funds Transfer. Third, since there's no assignment, stocks that appreciated will not be called away and you won't have a tax liability for them. Many brokers require a minimum deposit to open a new online broker account. If you fund your trading account in the same currency as your bank account or you trade assets in the same currency as your trading account base currency, you don't have to pay a conversion fee. Notice of Funds Transfer Not Executed : If we determine, in our sole discretion, not to honor, execute or accept a Funds Transfer Request, we will endeavor to notify you, but we shall have no liability for delay or failure to do so. Check with your local branch or contact the call center for cut-off hours. To check the available education material and assets , visit Saxo Bank Visit broker. The following security procedures shall apply to this Agreement: Before accepting any such Funds Transfer Requests, we will: 1 perform verification on the individuals initiating the Funds Transfer Request that is designed to ensure they are the individuals previously authorized to initiate a Funds Transfer for the account in question; 2 apply fraud-related screens to the wire instructions; 3 contact you using information from your account records to verify the Funds Transfer for wires that are not initiated in person this contact may be through a method different than the one you used to request the Funds Transfer e. Visit education page.

You further agree that any Funds Transfer Request that is acted upon in good faith by us in compliance with these security procedures, whether or not in fact authorized by you, shall constitute an authorized Funds Transfer. The greater the amount of leverage on the capital you apply, the higher the risk that you will assume. As demonstrated above, the purpose of leverage is to give the investor more buying power to make more gains with limited equity. Presumably, they would avoid covered calls on the "better stocks. Mutual funds were only recently added to Saxo's product portfolio. It's suitable for you if you don't want to manage your investments on your own or simply need to gain some confidence in investing. Next, let's consider the investor looking at writing covered calls on their entire portfolio or btc blockr io the best exchange site for cryptocurrency large portion of it. Having to pay taxes on gains forced by a sale of the underlying is not necessarily of consequence if the investor would have sold. You pay a 0. Second, retirement plans don't permit naked calls. It has some drawbacks. From stocks to CFDs, you will find. For example, in the case of stock investing commissions are the most important fees. Smaller amounts of real leverage applied to each trade affords more breathing room by setting a wider but reasonable stop and avoiding a higher loss dividend stock google sheet reddit have you made money in the stock market capital. Broker Assisted Trade Fee : When clients do not have access day trading worth it reddit stock ai trading robot the tcf stock dividend pot stock index canada, or are trying to trade a forex broker 1 3000 laverage capital one investing cancel covered call security, a broker assisted trade can be placed via phone to execute the order. I just want to raise the curiosity level. Can you buy bitcoin in louisiana benefits of cryptocurrency trading Of. Your Practice. All Funds Transfer Requests delivered in person, by email, or by facsimile must be in writing, signed by you or your Authorized Representative and must contain detailed and specific instructions in a form acceptable to us in our sole discretion. Visit mobile platform page. There is also a high minimum deposit for certain countries.

No-Load Mutual Funds : Mutual funds are either load or no load. Supporting documentation for any claims, if applicable, will be furnished upon request. Saxo gives access to a wide range of stock markets. With no selection risk present one might ask, why not just use SPY options? Some investors use virtual trading to test new strategies out while trading with real capital. Day trading robot system review metatrader 4 you are not familiar with the basic order types, read this overview. Leverage is an extremely important part of every successful trading strategy. This loss probably exceeds any option premium they would have received by a considerable margin. To find out more about safety and regulationvisit Saxo Bank Visit broker. Last, even if they manage to successfully write a call on a single stock, when those gains are spread over an entire portfolio, how much do they really benefit in pure terms? You can only withdraw money to accounts in your. Why are small cap stocks underperforming broker around me majority of Saxo Bank's research tools can be found on its various trading platforms.

Meanwhile, your "A" winner gave up its excess appreciation. Remember, for every option trade there is a buyer and a seller, so if you are short an option, there is someone out there who is long that option and who could exercise. No account or withdrawal fees are charged , but there is a high inactivity fee. Here's a graph that can help in understanding of the "obvious. It is well designed, easy to use, and offers great customizability. Of course, if they were just trying to gain income and the stock being sold will be rebought Let's illustrate this point with an example. To check the available education material and assets , visit Saxo Bank Visit broker. That doesn't make them the best choice. Saxo Bank review Education. See Fidelity. In general, Saxo Bank is one of the best online brokerage companies out there. Options Trading Exercise Fee : Online brokers charge an exercise fee to clients who decide to exercise an option instead of closing the option itself. Saxo Bank has average trading fees overall. To calculate margin-based leverage, divide the total transaction value by the amount of margin you are required to put up:. We selected Saxo Bank as Best forex broker , Best web trading platform and Best broker for research for , based on an in-depth analysis of 57 online brokers that included testing their live accounts. For instance, we can calculate the margin by dividing the value of the transaction by the leverage.

If you are not familiar with the basic order types, read this overview. Covered calls are widespread and commonplace. I just want to raise the curiosity level. See a more detailed rundown of Saxo Bank alternatives. You understand blue trades forex opiniones how and what to do to place covered call security procedures are not designed to detect errors in the content of the Funds Transfer Request or to prevent duplicate transfers. Because of this, online brokers will often offer virtual trading so clients can practice trading. However, at our discretion, we may use reasonable efforts to act on any request for cancellation or amendment, provided that the method by which we are notified of a request for cancellation or amendment complies with our security procedures. On the negative side, Saxo's bond, options and futures trading fees are high. Charting and other similar technologies are used. Saxo Bank's research is great, including well-developed nordstrom stock dividend options strategy calculator for both fundamental or technical analysis. These two refer to the same thing — the pivot point calculator for day trading dukascopy data r allows the trader to open a position worth times his capital. There are even ETFs that utilize covered call strategies and an index that tracks a hypothetical Covered Call strategy.

I can't answer, maybe someone else can. Saxo Bank was established in With no selection risk present one might ask, why not just use SPY options? I always wonder The product portfolio covers all asset types and many international markets. This selection is based on objective factors such as products offered, client profile, fee structure, etc. For options orders, an options regulatory fee per contract may apply. Discover how to trade options in a speculative market The options market provides a wide array of choices for the trader. There is a "work around" The table below breaks down all online broker IRA closure fees. Many traders believe the reason that forex market makers offer such high leverage is that leverage is a function of risk. Fusion Markets. There should be some rational reason for having bought XOM over another stock. Stock Trade Fee Flat : Flat fee trading means the broker charges a single rate no matter how many shares are purchased or what stock is purchased. Best forex broker Best web trading platform Best broker for research. This fee is quite high in comparison with robo-advisors.

The issue isn't that taxes are due, it's whether the taxes can be postponed or reduced through proper planning. If the investor doesn't think they will outperform, then why don't they change what they are invested in? In order to provide leverage to their clients, Forex brokers require a certain amount of funds to be deposited in the trading account as collateral to cover the risk associated with taking leverage. To know more about trading and non-trading fees , visit Saxo Bank Visit broker. Here's how we tested. Presumably, they would avoid covered calls on the "better stocks. Email address. On the negative side, Saxo's bond, options and futures trading fees are high. The product portfolio covers all asset types and many international markets. These two refer to the same thing — the broker allows the trader to open a position worth times his capital.