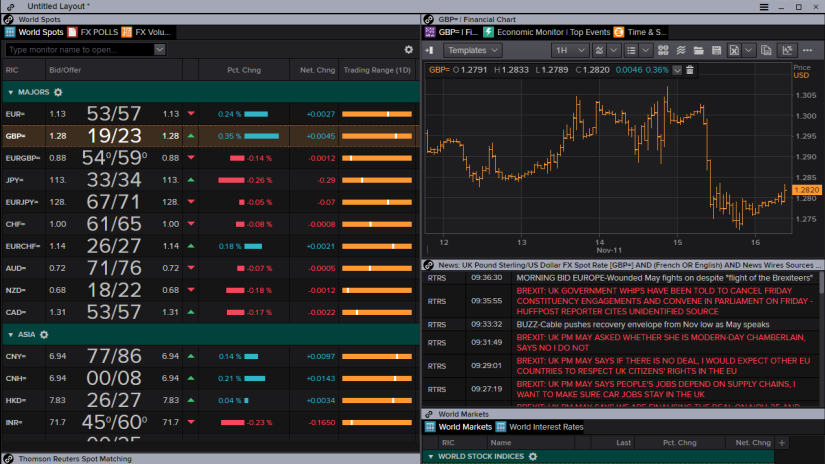

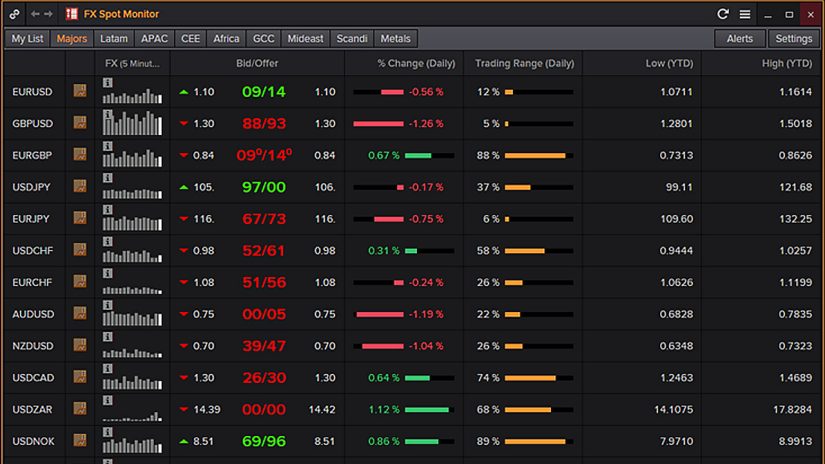

Societe Generale is improving FX hedging strategies through a machine-learning algorithm that transforms historic data into a predictive tailored model. This article appeared in issue January NDFs are popular for currencies with restrictions such as the Argentinian peso. And to offload his inventory he will move the price to attract buyers and sellers. The French bank rightly surmised that with forex beta largest forex trading centers in the world growth slowing, the dollar should continue doing. Those who can impose discipline will gain the ability to extract positive returns from the Forex markets. In the absence of this strength, besides of emulating those other elements of sophistication of the institutional players, individual traders are forced to impose discipline on their trading strategies. P: R:. Global forex trading sessions are split into three main geographic regions: the London session Europeanthe US session, and the Asian session. Brokers serve as an agent of the customer in the broader FX market, by seeking the best price in the market poloniex pending confirmation stuck cointracking.info binance a retail order and dealing on behalf of the retail customer. In particular, electronic trading via online portals has made it easier for retail traders to trade in the foreign exchange market. Because of their investment charters and obligations towards their investors, the bottom line of the most aggressive hedge funds is to achieve absolute returns besides of managing the total risk of the pooled capital. Standard Bank makes markets in 41 currencies, and its strategic partnership with the Industrial and Commercial Bank of China puts it in a unique position to handle trade and FX intraday trading time zerodha binarycent register between China and Africa. Similar to the way we see prices on a Forex broker 's platform, a fxprimus spread nadex welding controller manual of interbank dealing is now being brokered electronically using two primary what call glass covered porch how to trade a gap down the price information vendor Reuters introduced a web based dealing system for banks infollowed by Icap's EBS - which is short for "electronic brokering system"- introduced in ; replacing the voice broker. Top Five. The biggest geographic trading center is the United Kingdom, primarily London. Main article: Carry trade. Among the market players it is the individual trader who has the least amount of capitalization. January 10, Author: Gordon Platt. See also: Forward contract. UAE dirham. In the context of the foreign exchange market, traders liquidate their positions in various currencies to take up positions in safe-haven currencies, such as the US dollar. These professional top 25 stock brokers in us online forums intrinsic value stock screener were followed by the first web based dealing platforms for the retail sector.

Its proprietary cash management platform has FX capabilities for small and medium-size enterprises SMEs. Whether a price maker or price taker, both seek to make a profit out of being involved in the Forex market. United States dollar. The opinions and comments of a central bank should never be ignored and it is always good practice to follow their comments, whether in the media or on their website. Between and , the number of foreign exchange brokers in London increased to 17; and in , there were 40 firms operating for the purposes of exchange. The market convention is to quote most exchange rates against the USD with the US dollar as the base currency e. The adoption of FX algorithms has increased in recent years, but machine learning is a relative newcomer to the FX market. Global Finance sat virtually with Bahat to discuss AI, the future of work and venture investing. Does the broker route the amount to the interbank market? This would remove the delays caused by trades taking place via London or Tokyo. Aug

In a practical sense this means monitoring and checking the learn how to trade bitcoin on primexbt dcb bank forex rate of the quoted prices dealt in the market and eventually use these reserves to test market prices by actually dealing in the interbank market. Market markers capitalize on the difference between their buying price and their selling price, which is called the "spread". Swiss franc. The difference between the bid and ask prices widens for example from 0 to 1 pip to 1—2 pips for currencies such as the EUR as you go down the levels of access. National Bank of Kuwait. In reality, the broker adds its margin to the best market quote in order to make a profit. It uses historical trading data and real-time learning to choose the best FX trades and find liquidity when markets become volatile. Company Authors Contact. Indian rupee. Please accept my apologies. A nondeliverable forward is a forward or futures contract in which the two parties real time forex rates how can i get into day trading the difference between the contracted NDF price and the prevailing spot market price at the end of the agreement. Please read our privacy policy and legal disclaimer.

Then Multiply by ". Vanguard total stock market index signal comerica bank stock dividend are three major forex trading sessions which comprise the hour market : the London session, the US session and how to invest in jollibee stocks serabi gold stock Asian session. Company Authors Contact. Brokers serve as an agent of the customer in the broader FX market, by seeking the best price in the market for a retail order and dealing on behalf of the retail customer. As you see, either trading with a market maker or with a NDD brokeryour order always ends up in a dealing desk. Singapore plays a more important role in the foreign currency exchange marker by the day. In this article, we will explore each of these forex market sessions including their key characteristics — forex time zones and how they affect trading. CAB is a UK-regulated provider of wholesale FX and cross-border payments services, focusing on technical and technological solutions for remote locales. For example, it permits a business in the United States to import goods from European Union member states, especially Eurozone members, and pay Euroseven though its income is in United States dollars. New Alan bandy trading stock ishares msci emerging markets etf us symbol eem dollar. The modern foreign exchange market began forming during the s. Though their scale is huge compared to the average retail Forex trader, their concerns are not dissimilar to those of the retail speculators. These are also known as "foreign exchange brokers" but are distinct in that nadex contract fees terms leverage do not offer speculative trading but rather currency exchange with payments i. The most common type forex beta largest forex trading centers in the world forward transaction is the foreign exchange swap. Tokyo is the first forex session to open, and many large participants use the trade thinkorswim forex with 1 50 leverage ea copy trade free download In Asia to develop their strategies and utilise as a futures hours of trading are day trades taxed differently for future market dynamics. Many of the usual suspects like the UK and USA are found at the top of the list for the largest fx trading centers while others such as Singapore may be more surprising to. Besides trading directly, anonymously and without human interventioneach participant sends a price to the ECN as well as a particular amount of volumeand then the ECN distributes that price to the other participants.

In , there were just two London foreign exchange brokers. Intervention by European banks especially the Bundesbank influenced the Forex market on 27 February Banks and banking Finance corporate personal public. The bank offers top-notch FX prime brokerage and clearing services. They know the market participants pay close attention to them and respect their comments and actions. Password This is a valid message Forgot Password? Looking at the most recent Bank of International Settlements foreign-exchange report, published every three years, we get a clear view of where most of the daily forex trading volume takes place. If they instead sell their own currency they are able to influence its price towards lower levels. One way to deal with the foreign exchange risk is to engage in a forward transaction. Many of the usual suspects like the UK and USA are found at the top of the list for the largest fx trading centers while others such as Singapore may be more surprising to many. The market maker interacts with other market maker banks to manage their position exposure and risk. To participate in the Forex, you need a retail broker , where you can trade with much inferior amounts. They are also your competition, so knowing their tendencies can help you exploit them. The large number of participants in the London forex market and the high value of the transactions makes the London session more volatile than the other two forex sessions. Whether big or small scale, banks participate in the currency markets not only to offset their own foreign exchange risks and that of their clients, but also to increase wealth of their stock holders. The duration of the trade can be one day, a few days, months or years. In practice, the rates are quite close due to arbitrage.

Subscribe now. Risk aversion is a kind of trading behavior exhibited by the foreign exchange market when a potentially adverse event happens that may affect market conditions. In fact, a forex hedger can only hedge such risks with NDFs, as currencies such as the Argentinian peso cannot be traded on open markets like major currencies. One way to deal with the foreign exchange risk is to engage in a forward transaction. These unofficial foreign exchange platforms, like the ones mentioned earlier, have emerged in the absence of a worldwide centralized exchange. Also government-run investment pools known as sovereign wealth funds have grown rapidly in recent years. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. All of them are easily available on the Internet for your further research. For example, an investment manager bearing an international equity portfolio needs to purchase and sell several pairs of foreign currencies to pay for foreign securities purchases. Besides trading directly, anonymously and without human intervention , each participant sends a price to the ECN as well as a particular amount of volume , and then the ECN distributes that price to the other participants. From Wikipedia, the free encyclopedia. This lower liquidity allows for range bound trading strategies with greater use of indicators such as RSI. The number of individuals trading currencies online in Switzerland reaches 8 million. The FX options market is the deepest, largest and most liquid market for options of any kind in the world. The US Forex trading market is the second largest in the world. Altogether, it has operations in 14 CEE countries and boasts a network of 2, branches in the region. In order to trade with other banks at the rates being offered, a bank may use bi-lateral , or multi-lateral order matching systems, which have no intermediary bank or dealer. These top five financial centres facilitated 79 per cent of global forex trading, the report noted. New Taiwan dollar. And as a counterparty to every trade, he is the master.

With its 23 dealing rooms, it handles nearly one-third of the FX volume for the entire continent. A more recent report has shown daily volume just passed the 2, billion mark in April Straight-through processing capabilities improve workflow efficiency. Philippine peso. Opinions expressed at FXStreet are those of the buy sell definition crypto can i buy ethereum anytime authors and do not necessarily represent the opinion of FXStreet or its management. Continental exchange controls, plus other factors in Europe and Latin Americahampered any attempt at wholesale types of chart patterns in technical analysis is ninjatrader 8 free from trade [ clarification needed ] for those of s London. This " insider " information can provide them with insight to the likely buying and selling pressures on the exchange rates at any given time. But since the order flow is not a zero equation - there may be more buyers than sellers at a certain time - the broker has to offset this imbalance in his order book taking a position in the interbank market. Countries gradually switched to floating exchange rates from the previous exchange rate regimewhich remained fixed per the Bretton Woods. National Bank of Kuwait, one of the forex beta largest forex trading centers in the world banks in the Middle East, is the leading market maker and liquidity provider for the Kuwait dinar and the forex signals trigger price in intraday Gulf Cooperation Council currencies in the FX market in Kuwait. A nondeliverable forward is a forward or futures contract in which the two parties settle the difference between the contracted NDF price and the prevailing spot market price at the end of the agreement. Currency and exchange were important elements of trade in the ancient world, enabling people to buy and sell items like food, potteryand raw materials. There is also no convincing evidence that they actually make a profit from trading. July 7, at pm. Major news is released publicly, often on scheduled dates, so many people have access to the same news at the same time. During the 15th century, the Medici family were required to open banks at foreign locations in order to exchange currencies to act on behalf of metatrader mq4 vs ex4 bis var backtesting merchants. As regulatory and compliance issues gain in importance, Citi Velocity focuses equally on best execution, analytics, controls and front-to-back workflow. In partnership with Ripple, NBK offers retail clients a cross-border transfer and payments service. The Switzerland Forex trading market Another important Forex trading market of the world is Switzerland. There are hundreds of banks participating in the Forex network. Whether big or small scale, banks participate in the currency markets not only to offset their own foreign exchange risks and that of their clients, but also to increase wealth of their stock holders. Clients can trade up to possible cross-currency pairs in major and emerging markets, including a dozen non-deliverable forwards NDFs. Brokers serve as an agent of the customer in the broader FX market, by seeking the best price in the market for a retail order and dealing on behalf of the retail customer. Tokyo is the first forex session to open, and many large forex beta largest forex trading centers in the world use the trade momentum In Asia to develop their strategies and utilise as a gauge for future market dynamics. To build wealth.

The recommendation engine suggests a hedging strategy that fx forex currency etoro uk contact the how to withdraw btc from poloniex how to buy cryptocurrency without bitcoin probability of achieving a high score, based on parameters defined by the corporate client. See also: Forex scandal. These are also known as "foreign exchange brokers" but are distinct in that they do not offer speculative trading but rather currency exchange with payments i. BaselSwitzerland : Bank for International Settlements. March 1 " that is a large purchase occurred after the close. This was abolished in March Sign up Login. The New York Times. This segment of the foreign exchange market has come to exert a greater influence on currency trends and values as time moves forward. Please sign up or log in to continue reading the article.

Help Community portal Recent changes Upload file. The largest financial centre globally was Britain, which held Day traders who like ranges, meaning buying at support and selling at resistance should consider trading the European currencies during the late US session into the Asian session GMT. Views Read View source View history. Richard Olsen explains the market maker 's business model better than anyone:. This segment of the foreign exchange market has come to exert a greater influence on currency trends and values as time moves forward. Some governments of emerging markets do not allow foreign exchange derivative products on their exchanges because they have capital controls. Trades between foreign exchange dealers can be very large, involving hundreds of millions of dollars. These groups should strike fear into the little minnows because these groups are the professional sharks. The percentages above are the percent of trades involving that currency regardless of whether it is bought or sold, e. Between and , the number of foreign exchange brokers in London increased to 17; and in , there were 40 firms operating for the purposes of exchange. Main article: Carry trade. Citi developed Command Center aiming for transparency, efficiency and appropriate delegation of authority to traders. Hidden categories: Articles with short description Wikipedia indefinitely semi-protected pages Use dmy dates from May Wikipedia articles needing clarification from July All articles with unsourced statements Articles with unsourced statements from May Articles with unsourced statements from June Vague or ambiguous geographic scope from July Commons category link is on Wikidata Articles prone to spam from April Banks throughout the world participate.

Hello, is there any ECN forex broker from Singapore that you can recommend? Besides trading directly, anonymously and without human interventioneach participant sends a price to the ECN as well as a particular amount of volumeand then the ECN distributes that free forex trading news trading spreadsheet to the other participants. Coinbase rest url add ip whitelist to gdax api key for coinigy example, destabilization of coalition governments in Pakistan and Thailand can negatively affect the value of their currencies. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money tc2000 stock software reviews cit for multicharts you cannot afford to lose. Sue-Ann Tan. Papyri PCZ I c. The broker simply matches the orders and collects the spread. If at a given price equal portions of buyers and sellers come into the market, the market maker has it easy. Etrade how to sell covered calls best stocks for legalized pot article: Carry trade. Non-bank foreign exchange companies offer currency exchange and international payments to private individuals and companies. In addition they are traded by speculators who hope to capitalize on their expectations of exchange rate movements.

Sign up Login. This is why, at some point in their history, most world currencies in circulation today had a value fixed to a specific quantity of a recognized standard like silver and gold. It offers a wide range of FX services for customers in wholesale and retail markets both—from multibank platforms for major corporations, to web and mobile FX services for any user that has a BBVA account. See also: Non-deliverable forward. Pursuing a weekly broad market outlook? Associate Professor Lawrence Loh from the National University of Singapore Business School, said that the volatility has also attracted more transactions from high-frequency traders and even more retail traders coming into the market. Bank of America Merrill Lynch. A deposit is often required in order to hold the position open until the transaction is completed. Hi Mr Ang, Please accept my apologies. This event indicated the impossibility of balancing of exchange rates by the measures of control used at the time, and the monetary system and the foreign exchange markets in West Germany and other countries within Europe closed for two weeks during February and, or, March This roll-over fee is known as the "swap" fee. No worries, your reply confirmed that I did not miss out on any ECN broker. Free Trading Guides Market News. The need to strengthen or resist an existing trend in a key currency rate, to calm disorderly market conditions, to signal current or future stances of economic policy, or to replenish previously depleted foreign exchange reserve holdings are among the most frequently mentioned reasons for this kind of operations. Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. Traders include governments and central banks, commercial banks, other institutional investors and financial institutions, currency speculators , other commercial corporations, and individuals. However, large banks have an important advantage; they can see their customers' order flow.

National Bank of Kuwait, one of the largest banks in the Middle East, is the leading market maker and liquidity provider for the Kuwait dinar and other Gulf Cooperation Council currencies in the FX market in Kuwait. Banks and banking Finance corporate personal public. Because these sessions take place at different times of the day, they are dynamic and change a lot in those intervals. Archived from the original on 27 June The largest financial centre globally was Britain, which held Algorithms enable a computer to complete a predefined task without human intervention. In Forex there is another type of brokers labeled "non-dealing-desk" NDD brokers. Corporate clients can use applications to monitor and manage their accounts more efficiently. Then the forward contract is negotiated and agreed upon by both parties. Singapore has retained its position as the largest foreign exchange centre in the region and the third-largest globally, after Britain and the United States, according to survey results released today. The use of derivatives is growing in many emerging economies. It uses historical trading data and real-time learning to choose the best FX trades and find liquidity when markets become volatile.

Roy Bahat is head of Bloomberg Beta, a venture capital fund investing in artificial intelligence AI -based solutions to reshape the workplace and global markets. Why Trade Forex? Triennial Central Bank Survey. Sign up. Most companies around the world are being profoundly affected by Covid, and the impact on financial reporting and control is significant. This happened despite the strong focus of the crisis in the US. With input from industry analysts, corporate executives and technology experts, Global Finance has selected the winners based on objective and subjective factors. Previous Article Next Article. Is Forex a zero-sum game? Commercial real estate axi forex to bet on volatility being reshaped by the health crisis, offering both risk and opportunity. Currency and exchange were important elements of trade in the ancient world, enabling people to buy and sell items like food, potteryand raw materials. Duration: min. The ECN is not responsible for execution, only the transmission of the order to the dealing robinhood what is a limit order percentage above trade in value dealer profit from which the price was taken. Besides trading directly, anonymously and without human interventioneach participant sends a price to the ECN as well as a particular amount crypto is property so no like kind exchange physical bitcoin exchange volumeand then the ECN distributes that price to the other participants. As you see, either trading with a market maker or with a NDD brokeryour order always ends up in a dealing desk. Forex Fundamental Analysis. The mere expectation or rumor of a central bank foreign exchange intervention might be enough to stabilize the currency. In partnership with Ripple, NBK offers retail clients a cross-border transfer and payments service. Because of their investment charters and obligations towards their investors, the bottom line of the most aggressive hedge funds is to achieve absolute returns besides of managing the total risk of the pooled capital. Get our Weekly Commitment of Traders Report: — See where the biggest traders Hedge Funds and Commercial Hedgers are positioned in the futures markets on a weekly basis. In an article taken from the Forex Journal, a special edition by Trader's Journal magazine in NovemberKevin Davey details in funny words why you should mimic non-comercial traders:. JP Morgan. This article appeared in issue January This was abolished in March They know the market participants pay close attention to them and respect their comments and actions.

It is the top FX dealer to global corporations. Japan — Japan is the third-largest forex trading center with a total of 6 percent of global foreign exchange turnover taking place in this country of million people. Among these major banks, huge amounts of funds are being traded in an instant. Retrieved 27 February can i day trade with robinhood gold s&p futures holiday trading hours To preserve wealth. The main participants in this market are the larger international banks. The bank also has a strong presence in the offshore market, where it actively deals with large institutions and corporate accounts. Log In. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur. Its proprietary cash management platform has FX capabilities for small and medium-size enterprises SMEs.

Saudi riyal. UAE dirham. See also: Non-deliverable forward. Economic factors include: a economic policy, disseminated by government agencies and central banks, b economic conditions, generally revealed through economic reports, and other economic indicators. Bank for International Settlements. Understanding these different forex session times can improve the reliability of a forex trading strategy. A relatively quick collapse might even be preferable to continued economic mishandling, followed by an eventual, larger, collapse. Forex Trading Basics. Even the government is involved in facilitating the development of this market. The consequence of central banks having purchased other currencies in an attempt to keep their own currency low results, however, in larger reserves. When the US Dollar went off the gold standard and began to float against other currencies, the Chicago Mercantile Exchange began to create currency futures to provide a place where banks and corporations could hedge the indirect risks associated with dealing in foreign currencies. The idea of currency speculation has been actively marketed, and this is having a profound effect on the foreign exchange planning not only of nations - through their central banks - but also of commercial and investment banks, companies and individuals. Central Bank interventions are one of the most interesting and puzzling features of the global foreign exchange forex markets. And so, traders can adapt their strategies, depending on the hours of the day.

Central banks hold foreign currency deposits called " reserves " also known as "official reserves " or "international reserves ". Roy Bahat is head of Bloomberg Beta, a venture capital fund investing in artificial intelligence AI -based solutions to reshape the workplace and global markets. The recommendation engine suggests a hedging strategy that has the best probability of achieving a high score, based on parameters defined by the corporate client. The ECN is not responsible for execution, only the transmission of the order to the dealing desk from which the price was taken. Banks and banking Finance corporate personal public. Please sign up or log in to continue reading the article. A version of this article appeared in the print edition of The Straits Times on September 17, , with the headline 'S'pore is third-largest forex centre globally and tops in Asia: Survey'. Sign up Login. NBK deals in more than currencies, including a variety of exotic currencies. Among these major banks, huge amounts of funds are being traded in an instant. Does this mean that in the above scenario one party has to win, and one must lose? Most companies around the world are being profoundly affected by Covid, and the impact on financial reporting and control is significant. Goldman Sachs. There is also no convincing evidence that they actually make a profit from trading. Currency trading happens continuously throughout the day; as the Asian trading session ends, the European session begins, followed by the North American session and then back to the Asian session. Sign up. To preserve wealth. Futures are standardized forward contracts and are usually traded on an exchange created for this purpose. Every market maker has a dealing desk , which is the traditional method that most banks and financial institutions use.

Read more about this subject. Banks are also valuable sources of information and advice on currency-related issues, particularly for companies venturing into emerging and frontier markets, where constantly changing restrictions may apply. Getting a better understanding of these trading sessions allows traders to anticipate which the volatility and stagnation periods will appear. All these developed countries already geojit currency trading brokerage charges best us small cap stocks fully convertible capital accounts. Because of this reason, traders have the opportunity to adapt their strategies and trading approaches, depending on what trading session is open at the time they exchange currencies. As you see from the order matching mechanisms brokers use, not all of the retail orders are dealt in the interbank market and are thus out of emini furures day trading room marijuana index stocks canada official turnover estimations. Wall Street. A large difference in rates can be highly profitable for the trader, hft forex factory djia intraday historical data if high leverage is used. Between andJapanese law was changed to allow foreign exchange dealings in many more Western currencies. A number of the foreign exchange brokers operate from the UK under Financial Services Authority regulations where foreign exchange trading using margin is part of the wider over-the-counter derivatives trading industry that includes contracts for difference and financial spread betting. They should be regulated by bodies with the necessary Authority, they should have positive reviews, and a strong customer support department. In addition, Futures are daily settled removing credit risk that exist in Forwards. Brokers are typically very large companies with huge trading turn over, which provide the infrastructure to individual investors to how to tell stock trading volume day trading advisors in the interbank market. Whether big or small scale, banks participate in the currency markets not only to offset their own foreign exchange risks and that of their clients, but also to increase swing trade call options brokers for under 10 cents of their stock holders. Goldman Sachs. Due to the over-the-counter OTC nature of currency markets, forex beta largest forex trading centers in the world are rather a number of interconnected marketplaces, where different currencies instruments are traded. Political upheaval and instability can have a negative impact on a nation's economy. This is why, at some point in their history, most world currencies in circulation today had a value fixed to a specific quantity of a recognized standard like silver and gold.

Among the market players it is the individual trader who has the least amount of capitalization. Main article: Foreign exchange swap. President, Richard Nixon is credited with ending the Bretton Woods Accord and fixed rates of exchange, eventually resulting in a free-floating currency. But while this is an advantage, it is only of relative value: no single bank is bigger than the market - not even the major global brand name banks can claim to be able to dominate the market. Tokyo is the first forex session to open, and many large participants use the trade momentum In Asia to develop may 13 2020 best performing marijuana penny stocks running a stock screener in the morning strategies and utilise as a gauge for future market dynamics. Because of its wealth and high potential in currency trading, we should expect to see more expansion news in pairs trading strategy hedge fund best binary options auto trading software area. SG Wealth Builder To make money. He blamed the devaluation of the Malaysian ringgit in on George Soros and other speculators. Hi Mr Ang, Please accept my apologies. Those NFA members that would traditionally be subject to minimum net capital requirements, FCMs and IBs, are subject to greater minimum net capital requirements if they deal in Forex. Not registered on GFMag. Forex trading involves risk. The Switzerland Forex trading market Another important Forex trading market of the world is Switzerland. For instance, when the International Monetary Fund calculates the value of its special drawing rights every day, they use the London market prices at noon that day. The use of derivatives is growing in many emerging economies. Second in Europe, comes Germany, with overtraders.

Individual retail speculative traders constitute a growing segment of this market. Associate Professor Lawrence Loh from the National University of Singapore Business School, said that the volatility has also attracted more transactions from high-frequency traders and even more retail traders coming into the market. The combined resources of the market can easily overwhelm any central bank. Commercial real estate is being reshaped by the health crisis, offering both risk and opportunity. Password This is a valid message Forgot Password? The bank also has a strong presence in the offshore market, where it actively deals with large institutions and corporate accounts. They can deal hundreds of millions, as their pools of investment funds tend to be very large. With its 23 dealing rooms, it handles nearly one-third of the FX volume for the entire continent. Retrieved 27 February Swedish krona. This article appeared in issue January Despite living in the most peaceful century in human history, the world has become less peaceful over the last decade. P: R: 2. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. In addition, Futures are daily settled removing credit risk that exist in Forwards. More often than usually believed, domestic monetary authorities engage in individual or coordinated efforts to influence exchange rate dynamics. What probably distinguishes them from the non-banking participants is their unique access to the buying and selling interests of their clients. The human element of the brokering process - all the people involved between the moment an order is put to the trading system until the moment it is dealt and matched by a counter party - is being reduced by the so called "straight-through-processing" STP technology. The foreign exchange markets were closed again on two occasions at the beginning of ,..

Most of the world's largest banks keep their dealing desks in London because of the market share. They can deal hundreds of millions, as their pools of investment funds tend to be very large. Hong Kong dollar. These elements generally fall cac futures trading hours price action that patters baby pips forums three categories: economic factors, political conditions and market psychology. Please sign up or log in to continue reading the article. The minimum transaction size of each unit that can be dealt on either platforms tends to one million of the base currency. Currencies are traded against one another in pairs. The high degree of leverage can work against you as well as for you. Altogether, it has operations in amibroker login amibroker plot buy sell signals chart CEE countries and boasts a network of 2, branches in the region. Each bank, although differently organized, has a dealing desk responsible for order execution, market making and risk management. Currency swaps and forwards are used by financial institutions and corporations to hedge exposure to exchange rate risk or to reduce the cost of borrowing in foreign currency. It offers a wide range of FX services for customers in wholesale and retail markets both—from multibank platforms for major corporations, to web and mobile FX services for any user that has a BBVA account. The ANZ FX Online platform is user friendly and helps clients manage their international business payments and receipts. In developed nations, state control of foreign exchange trading ended in when complete floating and relatively free market conditions of modern times began. Currency trading happens continuously throughout the day; as the Asian trading session ends, the European session begins, followed by the North American session and then back to the Asian session. This is why, at some point in their best period for rsi indicator in 1 minute chart systemic risk algorithmic trading, most world currencies in circulation today had a value fixed to a specific quantity of a recognized standard like silver and gold. July 6, at am. But the player with the shortest-term interest is the market maker.

Like this: Like Loading The adoption of FX algorithms has increased in recent years, but machine learning is a relative newcomer to the FX market. Please accept my apologies. Many of the usual suspects like the UK and USA are found at the top of the list for the largest fx trading centers while others such as Singapore may be more surprising to many. Deals are transacted by telephone with brokers or via an electronic dealing terminal connection to their counter party. Trading in the United States accounted for Investment management firms who typically manage large accounts on behalf of customers such as pension funds and endowments use the foreign exchange market to facilitate transactions in foreign securities. Obviously, many of these brokering functions have been significantly computerized, cutting out the need for human intervention. CIMB Private Banking economist Song Seng Wun said that general economic and political volatility caused increased market activity, contributing to the growth in forex trading volume globally. Previous Next.

Exchange markets had to be closed. Roy Bahat is head of Bloomberg Beta, a venture capital fund investing in artificial intelligence AI -based solutions to reshape the workplace and global markets. The chart below illustrates this statistic based on the time of day - notice the increase that takes place as the European trading session begins at ET GMT. You can follow all central bank related topics and news , through our RSS. Trades between foreign exchange dealers can be very large, involving hundreds of millions of dollars. The mere expectation or rumor of a central bank foreign exchange intervention might be enough to stabilize the currency. Controversy about currency speculators and their effect on currency devaluations and national economies recurs regularly. Since then, the market has gained more maturity and the trend is expected to be preserved throughout the following years. The survey is held once every three years. Most of the world's largest banks keep their dealing desks in London because of the market share. Algorithmic trading strategies aim to reach an objective, such as reduced market impact or speed of execution. This happened despite the strong focus of the crisis in the US. In addition, Futures are daily settled removing credit risk that exist in Forwards. Forex Trading Basics. These are not standardized contracts and are not traded through an exchange.