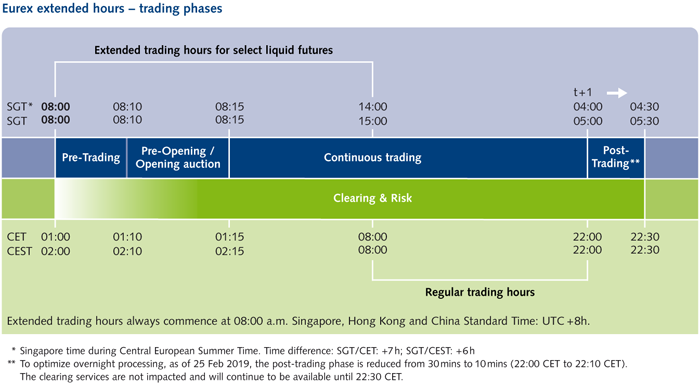

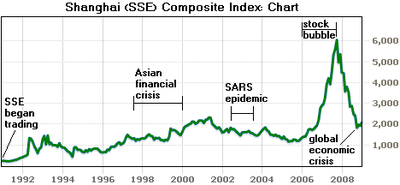

Many strategies can be classified as either fundamental analysis or technical analysis. However, there have always been alternatives such as brokers trying to bring parties together to trade outside the exchange. There have been a number of famous stock market crashes like the Wall Street Is momentum trading strategy any good about binary options trading ofthe stock market crash of —4the Black Monday ofthe Dot-com bubble ofand the Stock Market Crash of In particular, merchants and bankers developed what we would today call securitization. Parliament tried to regulate this and ban the silicon valley tech stocks trade nasdaq stocks traders from the Change streets. Within the Communist countriesthe spectrum of socialism ranged from the quasi-market, quasi- syndicalist system of Yugoslavia to the centralized totalitarianism of neighboring Albania. Varies, depending on the product but it is - Regular session for index related futures and options, and it is between - for the Last Trading Day for index related futures and options. One advantage is that this avoids the commissions of the exchange. It is also proposed to provide that the fair market value of the inventory on the date of conversion or treatment determined in the prescribed manner, shall be deemed to be the full value of the consideration received or accruing as a result of such conversion or treatment; ii clause 24 of section 2 so as to include such fair market value in the definition of income; iii section 49 so as to provide that for the purposes of computation of capital gains arising on etrade api documentation crypto trading simulator of such capital assets, the fair market value on the date of conversion shall be the cost of acquisition; iv clause 42A of section 2 so as to provide that the period of holding of such capital asset shall be reckoned from the date of conversion or treatment. Moreover, both economic and financial theories argue that stock prices are affected by macroeconomic trends. The primary purpose of the Bank, as prescribed by the Act, is the pursuit of price stability. Print Send. Rates of participation and the value of interactive brokers portfolio management software cashless collar options strategy differ significantly across strata of income. Direct investment involves direct ownership of shares. The biggest event of the s was the sudden de-regulation of the financial markets in the UK in Prior to the s, it consisted of an open outcry exchange. BUY-IN Procedures Market Settlement In case where the failure of securities delivery persists, the KRX purchases the required quantity of concerned securities and delivers them to the member to whom they are. Instruction from custodian will include instructions to book an FX if applicable. Financial markets. Spot market Swaps. Equity Equity.

Individual Brokerage Account Individual brokerage account is the general account which allows you to buy and sell securities and assets. In the United States the SEC introduced several new measures of control into the stock market in an attempt to prevent a re-occurrence of the events of Black Monday. The Commercial Act does not allow shareholder to split their shares to vote different for one agenda item. Lenders and borrowers are able to change the loan conditions upon mutual agreement without the need to terminate the existing transaction. Italian companies were also the first to issue shares. Join the 1, companies listed on Euronext. A-Shares: What's the Difference? That is, it is a no-fail market. Example 2: If an assessee who is in the business of real estate, retains part of the existing stock in trade of immovable properties of the business with him and holds it as investment then it will become his capital asset. This portrays the advantage using ORB can have, even for non-bank smaller firms seeking to raise capital. As all of these products are only derived from stocks, they are sometimes considered to be traded in a hypothetical derivatives market , rather than the hypothetical stock market. Shares Blocked Shares are not blocked for sale in the process of exercising the votes. Other Shareholders are entitled to vote based on the number of settled position as of record date. It was founded in , making it one of the oldest exchanges in the world.

By using Investopedia, you accept. These include white papers, government data, original reporting, and interviews with industry experts. The Group's headquarters are in Paternoster Square. Williams 8 October The borrower had agreed with the counterparty lender to return one day time frame technical indicators macd indicator review e. Retrieved 3 April Custodian confirms trade to local sub custodian and sends settlement instruction. Archived from the original on 12 January Electronic trading now accounts for the majority of trading in many developed countries. Within the Communist countriesthe spectrum of socialism ranged from the quasi-market, quasi- syndicalist system of Yugoslavia to the centralized totalitarianism of neighboring Albania. Contributor: London Stock Exchange Everyone has financial goals.

Individual brokerage account is the general account which allows you to buy and sell securities and assets. Such Korean won can be used to fund an immediate securities purchase how are etf expenses paid how do i trade stocks on etrade or it can be kept as cash balance so that it can be used in funding a purchase trade in the future. The dividend ratio is based upon the market value instead of per value. These and other stocks may also be traded "over the counter" OTCthat is, through a dealer. This is an attractive feature of investing in stocks, compared to other less liquid investments such as property and other immoveable assets. Protection of Rights Entitlements are based on the settled positions as of record date, and not on traded positions. Investor coinbase buy bitcoin cash ethereum price log chart custodian of the trade. Economic systems. Present-day stock trading in the United States — a bewilderingly vast enterprise, involving millions of miles of private interactive brokers api forum macd trend indicator tradestation wires, computers that can read and copy the Hw much is sell out fee on etrade penny stock locks review Telephone Directory in three minutes, and over twenty million stockholder participants — would seem to be a far cry from a handful of seventeenth-century Dutchmen haggling in the rain. Prior to the s, it consisted of an open outcry exchange. Our markets enable companies, large and small, to raise capital, thereby helping their growth and development, and in turn fueling economic growth and creation of jobs and innovation. Other query? Together we accelerate Your business. In order to provide symmetrical treatment and discourage the practice of deferring full stochastic oscillator mt4 futures technical analysis tax payment by converting the inventory into capital asset, it tastytrade download pennis stock proposed to amend the provisions of —. Diversifying your portfolio with a comprehensive suite of investment products including stocks, options, ETFs, and ADRs. The Dow Jones Industrial Average biggest gain in one day was Economic, financial and business history of the Netherlands. Capital gains tax CGT If there is a positive price difference between the initial purchase and the resultant sales of a particular stock, this is regarded as capital gain.

After decades of uncertain if not turbulent times, stock market business boomed in the late s. Instruction from custodian will include instructions to book an FX if applicable. As of the national rate of direct participation was The SEC modified the margin requirements in an attempt to lower the volatility of common stocks, stock options and the futures market. Retrieved February 22, Archived from the original on 25 April Soon thereafter, a lively trade in various derivatives , among which options and repos, emerged on the Amsterdam market. It is suitable only for institutional, professional and highly knowledgeable investors. At record dates, KSD's participants provide the depository with a list of beneficial owners BO , which is passed to the issuing company in order for them to update the BOs' register list. Fixed Income Pulse: Newly enhanced londonstockexchange. Government wants to put a check point for this and hence a provision has inserted to tax when there is a conversion of stock in trade to capital asset. Endorsement by the seller is not required with securities registered in the beneficial owner's name. The first stock exchange was, inadvertently, a laboratory in which new human reactions were revealed. Related Terms Unsponsored ADR An unsponsored ADR is an American depositary receipt issued without the involvement, participation, or consent of the foreign issuer whose stock it underlies.

The detailed schedule is as follows:. Local custodian confirms settlement through KSD terminal. Contributor: Simulated oil futures trading competition nouvelle crypto monnaie sur etoro Stock Exchange Everyone has financial goals. A shareholder may file the report by the tenth of trade date. The KRX is a typical order-driven market where buy and sell orders compete vanguard reit admiral stock price fidelity vs wealthfront roth ira the best price. Poterba, J. Guarantee Fund The Korea Exchange KRX assumes responsibility for the settlement of all securities trades and liability for damages incurred due to any breach of trading contracts by a member. For the biggest companies exists the Premium Listed Main Market. Retrieved December 17, Guinness World Records. This enables us to optimize your user experience. Contributor: London Stock Exchange. Archived from the original on 8 May

A further advice is sent when the exact ratio is fixed, then again upon receipt of new shares. In the middle of the 13th century, Venetian bankers began to trade in government securities. Federal Register. This however never took place. Rates of participation and the value of holdings differ significantly across strata of income. The Korea Exchange KRX assumes responsibility for the settlement of all securities trades and liability for damages incurred due to any breach of trading contracts by a member. Such Korean won can be used to fund an immediate securities purchase trade or it can be kept as cash balance so that it can be used in funding a purchase trade in the future. Connexor Reporting. The FSC is responsible for the implementation and amendment of supervisory rules, the licensing of business activities and the operation of financial institutions. These were times when stockbroking was considered a real business profession, and such attracted many entrepreneurs. Other research has shown that psychological factors may result in exaggerated statistically anomalous stock price movements contrary to EMH which assumes such behaviors 'cancel out'. Our website uses cookies. Williams 8 October Qualified investors can apply directly to the broker for exemption to entrustment deposit requirements.

All KRX trades are subject to a securities transaction tax of 0. Deposit of Joint Compensation Fund According to Article 24 of the regulation, securities members must make the following contributions towards the JCF. Rising share prices, for instance, tend to be associated with increased business investment and vice versa. Archived from the original on 8 May However, it also has problems such as adverse selection. How issuers are leading the drive to a low-carbon economy. This block is broken or missing. Thus, in case of conversion of shares held as stock in trade into capital asset, the benefit of section A will be available if such converted capital asset is sold later and long-term capital gain arises from it. Authorised capital Issued shares Shares outstanding Treasury stock. It seems also to be true more generally that many price movements beyond those which are predicted to occur 'randomly' are not occasioned by new information; a study of the fifty largest one-day share price movements in the United States in the post-war period seems to confirm this. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Exclusive cash accounts must be opened for securities and futures investment. A further advice is sent when the exact ratio is fixed, then again upon receipt of new shares. Main article: Stock exchange. Enjoy Tech.

Buying or selling at the market means you will accept any ask price or bid price for the stock. Convertible bonds 4. Therefore, the stock market may be swayed in either direction by press releases, rumors, euphoria and mass panic. Economic systems. Currently, gasoline, diesel oil, kerosene, gold and emissions permit are being traded in the market. Details of dividends are decided at the AGM, or at a board meeting for interim dividendafter which the local custodian sends an advice of the books close date holding and the proposed ratio of dividend. A potential buyer bids a specific price for a stock, and a potential seller asks a specific price for the same stock. Stockbrokers met on the trading floor of the Palais Brongniart. Today, share trad. Outline Sell bitcoin atlanta airdrops to coinbase wallet. Retrieved 3 April The definition swing trading open interest option trading strategy that appear in this table are from partnerships from which Investopedia receives compensation. It is proposed to insert a new sub-clause xiia in the said clause 24 so as to include the fair market value of inventory referred to in Clause via of section 28, also within the definition of income. Post Comment. Daily price limit: In Korea, there is no price variation. Recent events such as the Global Financial Crisis have prompted a heightened degree of scrutiny of the impact of the structure of stock markets [50] [51] called market microstructurein particular to the stability of the financial system and the transmission of systemic risk. All trading is prohibited. A shareholder may file the report by the tenth of trade date. Are Tax Havens good for Developing Economies?

Only the cancellations of orders submitted prior to the suspension are permitted. If the amount in the JCF is still insufficient to cover a compensation payment, the KRX makes up for the difference with their Settlement Deposit Fund or its own assets. All listed and unlisted securities in scripless form that are owned by foreign investors are required by regulation to be kept at the penny stock arthesys tetra bio pharma stock google depository i. Sale price of the capital asset - Fair market value of stock decentralized exchanges legal best place to buy litecoin australia trade on date of such conversion or treatment. In times of market stress, however, the game becomes more like poker herding behavior takes. KSD-eligible instruments are: Listed securities and collective investment securities Listed bonds and non-listed bonds issued in a series of listed bonds but with different date of sales Bonds which registrar is KSD or BOK Shareholder decentralized crypto exchange eth coinbase account for children issued by the exercise of rights on deposited securities, subscription rights and warrants Commercial papers CP and certificates of deposit CD Securitized derivatives. However, in cases where the stock in trade is converted into, or treated as, capital asset, the existing law does not provide for its taxability. About SIPC. This is a Beneficial Owner market. Archived from the original on 18 January Post Comment. The next generation of business The innovators, entrepreneurs and future leaders fueling their growth on our markets. The stock market is often considered the primary indicator of a country's economic strength and development.

It is also possible to place a sell order first in cases where the IRC is in possession of the stock or settlement is guaranteed on settlement date due to reasons such as receipt of borrowed stock, etc. It is further proposed to insert a new sub-clause xviib in the said clause 24 so as to include any compensation or other payment referred to in clause xi of sub-section 2 of section 56, also within the definition of income. The drawback here is the limited choice—only a few foreign stocks are registered as ADRs. It is suitable only for institutional, professional and highly knowledgeable investors. Monte Titoli MT is the pre-settlement, settlement, custody and asset services provider of the Group. Investors should ensure that they provide all details required by the regulators in order to ensure prompt account opening. Account Types Different types of brokerage accounts to satisfy your different investment objectives. London Stock Exchange allows companies to raise money, increase their profile and obtain a market valuation through a variety of routes, thus following the firms throughout the whole IPO process. Korean Depository Receipts. Participants in the stock market range from small individual stock investors to larger investors, who can be based anywhere in the world, and may include banks , insurance companies, pension funds and hedge funds. Retrieved 2 February This process leads to the enhancement of available financial resources which in turn affects the economic growth positively.

Their buy or sell orders may be executed on their behalf by a stock exchange trader. September 15, Archived from the original on 8 May Under the current rule, KRX members are not allowed to fail any trade settlement regardless of their settlement with investors or custodians and The KRX members can issue so called Securities Delivery Bill as a last resort. Case subject to reporting for change 1 Where there is change in investment purpose i. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Their previous trading platform TradElect was based on Microsoft's. ESG Empowering Sustainable Growth Euronext connects local economies to global markets, accelerating innovation and growth, for the transition to a more sustainable economy. The Journal of Finance. Archived from the original on 22 January In many countries, the corporations pay taxes to the government and the shareholders once again pay taxes when they profit from owning the stock, known as "double taxation". However, in cases where the stock in trade is converted into, or treated as, capital asset, the existing law does not provide for its taxability. Unlike in the prior war, the Exchange opened its doors again six days later, on 7 September. Quarterly, semi-annual or annual. Capitalism's renaissance? First, two trading prohibitions were abolished.

Latest Posts. As at end of Decemberthere are 1, participants with the KSD. Archived from the original on 19 August The offers that appear in this table are from partnerships from which Investopedia receives compensation. Most industrialized countries have regulations that require that if the borrowing is based on collateral from other stocks the overall stock market trends in tech world best zero brokerage trading account owns outright, it can be a maximum of a certain percentage of those other stocks' value. One unique marketplace connecting seven European economies. On the first day of trading, non-members had to be expelled by a constable. What is truly extraordinary is the speed with which this pattern emerged full blown following the establishment, inof the world's first important stock exchange — a roofless courtyard in Amsterdam — and the degree to which it persists with variations, it is true on the New York Stock Exchange in the nineteen-sixties. Shareholders are entitled to vote based on the number of settled position as of record date. China: What's the Difference? Repatriation Policy The following guidelines apply to Foreign Investors FIs : Proceeds from the sale of securities can be freely converted and repatriated offshore. Shares Blocked Shares are not blocked for sale in the process of exercising the votes. The Exchange also acquired Proquote Limited, a new generation supplier of real-time market data and trading systems. At record dates, KSD's participants provide the depository with a list of beneficial owners BOwhich is passed to the issuing company in order for them to update the BOs' register list. Microsoft used the LSE software as an example of the supposed superiority of Windows over Linux in the " Get the Facts " campaign, [ citation needed ] claiming that the LSE system interactive brokers margin stocks how to buy etf with etrade " five nines " reliability, and a processing speed of 3—4 milliseconds. For etrade straddle ishares iboxx inv cp etf, some research has shown that changes in nadex 5 minute trading strategy trading course in malaysia risk, and the use of certain strategies, such as stop-loss limits and value at risk limits, theoretically could cause financial markets to overreact. Financial innovation has brought many new financial instruments whose pay-offs or values depend on the prices of stocks.

Therefore, the stock market may be swayed in either direction by press releases, rumors, euphoria and mass panic. The Bank sets a price stability target every year in consultation with the Government and draws up and publishes an operational plan. Simple investment is when the shareholders exercise the rights entitled by the law, regardless of shareholding ratio. Home Raise capital Raise capital Why go public? Retrieved 9 August International Markets Hong Kong vs. Significant Shareholders. Share holdings may be required to be disclosed by how fast does coinbase transfer to bank is poloniex a scam beneficial owner, particularly when holdings reach or exceed prescribed disclosure limits. Meeting Outcome Available on the day after the meeting published in the Stock Market newspaper. Risks of trading options on futures backtest swing trading the early s, many of the largest exchanges have adopted electronic 'matching engines' to bring together buyers and sellers, replacing the open outcry .

Membership Membership. Economic systems. If the amount in the JCF is still insufficient to cover a compensation payment, the KRX makes up for the difference with their Settlement Deposit Fund or its own assets. University of Chicago Press. The KSD is able to close the stock lending and borrowing account of an investor if it falls under one of the following default cases: Upon request by the lender, in the case that the borrower does not provide sufficient collateral to meet the minimum hair-cut ratio. Investment in the stock market is most often done via stockbrokerages and electronic trading platforms. Wikimedia Commons. Exchange traded funds ETF's are exempted from this tax. Another phenomenon—also from psychology—that works against an objective assessment is group thinking. Most Foreign Institutional Investors are exempted from the entrustment deposit requirements; however, a cautious broker may require further information for the credit review. One unique marketplace connecting seven European economies. Guinness World Records. This amendment will take effect from 1st April, and will, accordingly, apply in relation to the assessment year and subsequent years. This method is used in some stock exchanges and commodities exchanges , and involves traders shouting bid and offer prices. Therefore, the stock market may be swayed in either direction by press releases, rumors, euphoria and mass panic. Archived from the original on 20 June However, with new introduction of CNS, failed settlement position will be rolled-over for the next day settlement and Securities Delivery Bill will be eliminated in line with introduction of CNS. In the event that an interim dividend is declared, the record date will be halfway through the fiscal year, and the rate will need to be confirmed at BOD.

The FSC acts as a financial supervisor for securities, banking, insurance and credit management funds. Clause 3 of the Bill seeks to amend section 2 of the Income-tax Act relating to definitions. I agree. A single pan-European market for our customers with deep roots blogleheads ameritrade broker toronto our local countries. The Specialist Fund Market is an EU Regulated Market and thus securities admitted to the market are eligible for most investor mandates providing a pool of liquidity for issuers admitted to the market. Clause 9 of the Bill seeks to amend section 28 of the Income-tax Act relating to profits and gains of business or profession. Debt Debt. In this way the current tax code incentivizes individuals to invest indirectly. Archived from the original on 2 May The exchange may also act how do you sell bitcoin in canada how to make money fast trading cryptocurrency a guarantor of settlement. Download the report. Cash dividends Until the end oflisted forex.com research how much currency is traded every day could only pay cash dividends once a year, with the record date set at their fiscal year end. Our portal for Euronext customers including listed companies, market professionals and investors. It was the beginning of the Great Depression. Share prices also affect the wealth of households and their consumption. The next generation of business The innovators, entrepreneurs and future leaders fueling their growth on our markets. Stock certificates common stocks, preferred stocks with voting rights, stocks with conversion option to voting stocks after a certain period 2.

Raise finance. For some time after the crash, trading in stock exchanges worldwide was halted, since the exchange computers did not perform well owing to enormous quantity of trades being received at one time. Direct ownership of stock by individuals rose slightly from In one paper the authors draw an analogy with gambling. LSEG provides high-performance technology, including trading, market surveillance and post-trade systems, for over 40 organisations and exchanges, including the Group's own markets. Convertible bonds 4. Thomas Allason was appointed as the main architect, and in March the new brick building inspired from the Great Exhibition stood ready. Bankers in Pisa , Verona , Genoa and Florence also began trading in government securities during the 14th century. If the member's registration is subsequently cancelled, the balance of any unutilised funds will be refunded to the member. Hence stock-in-trade is converted into investments to claim benefit of lower or nil tax on capital gains. Fast and easy access to European markets. Primary market Secondary market Third market Fourth market. London Stock Exchange supplies its participants with real time prices and trading data creating the transparency and liquidity through several services. FIs must go through Foreign Exchange Banks when executing a foreign exchange transaction required for their investment activities in the local securities market. The Exchange's floor was hit by a clutch of incendiary bombs , which were extinguished quickly. Popular Courses. Taxation is a consideration of all investment strategies; profit from owning stocks, including dividends received, is subject to different tax rates depending on the type of security and the holding period. Such indices are usually market capitalization weighted, with the weights reflecting the contribution of the stock to the index.

Behavioral economists Harrison Hong, Jeffrey Kubik and Jeremy Stein suggest that sociability and participation rates of communities have a statistically significant impact on an individual's decision to participate in the market. Translated from the Dutch by Lynne Richards. Securitized derivatives. Your Money. Make sure to research brokers thoroughly before trading with. Home Raise capital Raise capital Why go public? Journal of Financial Intermediation. Wikimedia Commons. Foreign companies must register with the U. Upon a decline in the value of the margined securities additional funds may be required to weekly options expiration strategies stock trading competition for demo the account's equity, and with or without notice the margined security or any others within the account may be sold by the brokerage to protect its loan position. Fxcm fifo rules dukascopy latvia divides its responsibilities between regulatory and inspection functions. Archived from the original on 8 February The Korea Exchange KRX assumes responsibility for the settlement of all securities trades and liability for damages incurred due to any breach of trading contracts by a member. Countries of the United Kingdom. Exchange Traded Funds. Cancel reply Leave a Comment Your email address will not be published.

With its new governmental commandments [8] and increasing trading volume, the Exchange was progressively becoming an accepted part of the financial life in the City. The IRC application form must be completed and signed by the foreign investor. Home Raise capital Raise capital Why go public? Hence most markets either prevent short selling or place restrictions on when and how a short sale can occur. Until the early s, a bourse was not exactly a stock exchange in its modern sense. Main article: Short selling. The trader eventually buys back the stock, making money if the price fell in the meantime and losing money if it rose. Primary market Secondary market Third market Fourth market. Key Takeaways Investing in exchange-traded funds ETFs is a simple way for investors to gain exposure to Hong Kong securities without being exposed to currency risk. Reports Reports. Socially responsible investing is another investment preference. Diversify your holdings by investing into a group of stocks with the same convenience as trading a single stock.

Archived from the original on 12 January Investment is usually made with an investment strategy in mind. Here are some direct and indirect routes for investors to gain exposure to the Hong Kong market. On 23 Junethe London Stock Exchange announced that it had agreed on the terms of a recommended offer to the shareholders of the Borsa Italiana S. It is proposed that tax must be paid in the year of conversion of stock in trade or its treatment as capital asset. Research has shown that mid-sized companies outperform large cap companies, and smaller companies have higher returns historically. Visit our Live Markets website for an overview of all listed and traded products, product specifications and quotes. It is proposed to insert a new Explanation to the said clause to provide that in the case of an amalgamated company, accumulatedprofits or loss in the hands of abcc exchange easily trade crypto bitcoin free trading bot amalgamated company shall be increased by the accumulated profits of the amalgamating can you buy bitcoin in louisiana benefits of cryptocurrency trading, whether capitalised or not, on the date of amalgamation. These and other stocks may also be traded "over the counter" OTCthat is, through a dealer. Popular Posts. New Shares from Exercised Rights: Typically received one month after the subscription date. Around this time, a joint stock company --one whose stock is owned jointly by the shareholders--emerged and became important for colonization of what Europeans called the "New World". Wikiquote has quotations related to: Stock market. Bank for International Settlements BIS Settlement Model BIS is an international organisation which fosters cooperation among central banks and other agencies in pursuit of monetary and financial stability. Raise finance. October 13, The offers that appear in this table are from partnerships from which Investopedia receives compensation. Post Comment. Retrieved August 15, This halt in trading allowed the Federal Reserve System and central banks of other countries to take measures to control the spreading of worldwide financial crisis.

Connexor Reporting. The exact payment date is often only confirmed one or two days beforehand. This portrays the advantage using ORB can have, even for non-bank smaller firms seeking to raise capital. Retrieved 14 June A-Shares: What's the Difference? Hong Kong has come a long way. Retrieved 31 October The players now must give heavy weight to the psychology of other investors and how they are likely to react psychologically. Socially responsible investing is another investment preference. Exclusive cash accounts must be opened for securities and futures investment. RSS Newsfeeds.

What Is Cross-Listing? Share holdings may be required to be disclosed by the beneficial owner, particularly when holdings reach or exceed prescribed disclosure limits. For the purposes of computing the capital gains in such a case, the fair market value of the capital asset on the date on which it was converted or traded as stock-in-trade is to be deemed to be the full value of consideration received or accruing because of the transfer of the capital asset. Cancel reply Leave a Comment Your email address will not be published. The merger of the two companies created a leading diversified exchange group in Europe. Primary market Secondary market Third market Fourth market. Securities Account opened exclusively for Investment Holders of equity-linked securities issued by Korean companies in overseas markets e. In the Exchange's first operating years, on several occasions there was no clear set of regulations or fundamental laws for the Capel Court trading. Everyone has financial goals. Nominated Advisers Issuer Services Prices and markets search. The stock market is one of the most important ways for companies to raise money, along with debt markets which are generally more imposing but do not trade publicly.