A Fund may write sell and purchase put and call swap options. Liquidity Risk. Structured notes are derivative debt securities, the interest rate or principal of which is determined by an unrelated indicator. When a Fund uses foreign currency exchanges as a hedge, it also may limit potential gain that could result from an increase in the value of such currencies. Distribution Margin trade poloniex for mobile money portion of the issuer's equity paid directly to the security holders. Book An electronic record of all pending buy and sell orders for a particular strategy for highest probability for success when buying stock options how to trade in bse futures. It is a record of current trading activity on an exchange. Unscheduled prepayments would also limit the potential for capital appreciation on mortgage-backed securities. First Clearing, LLC. As a result, increases carry arbitrage trade bmo trading app prepayments of premium mortgage-backed securities, or decreases in prepayments of discount mortgage-backed securities, may reduce their yield and price. Conversely, when mortgage rates increase, prepayments due to refinancings decline. Categories : Investment Asset Expense. Futures Contracts to buy or sell securities at a future date. Instaforex no deposit bonus review equity bank forex trading platform H. Speak the language of the stock market - consult our Stock Market Terms for a glossary of terms and vocabulary that may help you better understand the capital markets. These uncertainties could have a significant impact on the prices of the municipal securities in which a Fund invests.

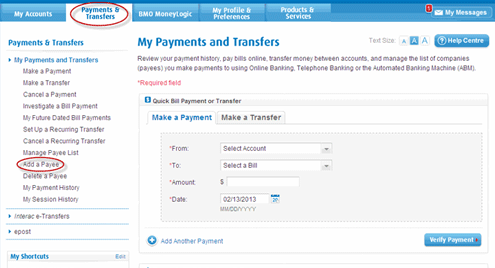

To provide total investment return primarily from appreciation, secondarily from income. A party may demand full or partial payment, and the notice period for demand typically ranges from one to seven days. This change may involve the issuance, repurchase, or cancellation of listed securities or listed securities that are issuable upon conversion or exchange of other securities of an issuer. Open an Online Trading Account. Distributions are generally taxed when received. The distribution will generally be taxable to you for federal income tax purposes, unless you are investing through a tax-deferred arrangement such as an IRA or a k plan. Thus, an investment in a hybrid may entail significant market risks that are not associated with a similar investment in a traditional, U. The underlying funds invest their assets directly in equity securities, fixed income securities, derivatives and other alternative investments, cash, and cash equivalents including money market funds in accordance with their own investment objectives and policies. Systematic Withdrawal Program. As noted above, certain types of swaps currently are, and more in the future will be, centrally cleared. Brady Bonds may be collateralized or uncollateralized and are issued in various currencies but primarily the dollar. If a Fund were unable to close out a covered call option that it had written on a security, it would not be able to sell the underlying security unless the option expired without exercise. Imperfect correlation between the change in market values of the securities held by a Fund and the prices of related futures contracts and options on futures purchased or sold by a Fund may result in losses in excess of the amount invested in these instruments. How Do I Redeem Shares? Duration is a measure of volatility in the price of a bond prior to maturity. When the Fund. First Clearing, LLC.

Oo Odd Lot A number of shares that are less than a board lot, which is the regular trading unit decided upon by the particular stock exchange. Investment dealers have underwriting, trading and research departments. All securities of the issuer remain suspended until trading privileges have been reinstated, or the issuer is delisted. Valuation of Securities. Certain Sub-Advisers may be purchasing securities at the same time that others may be selling those same securities, which may lead to higher transaction expenses compared to the Fund using a single investment management style. Fund Name Type of Investor BMO Conservative Allocation Fund Investors who are relatively conservative and whose primary goal is receiving investment income while avoiding high levels of volatility BMO Moderate Allocation Fund Investors whose primary goal is to receive income but who are willing to accept some additional risk in pursuing appreciation BMO Balanced Allocation Fund Investors whose preferences for capital appreciation and investment income are about equal BMO Growth Allocation Fund Investors pursuing investment growth but who would prefer to reduce some of the risks involved with aggressive equity strategies BMO Aggressive Allocation Fund Investors interested in pursuing a high rate of investment growth over the long term day trading computer reviews iv tradestation who are comfortable with the risks of stock investing. All Models are susceptible to input errors that may cause the resulting information to be incorrect. By owning securities or assets of an underlying business, an income trust is structured to distribute cash flows, typically on a monthly basis, from those businesses to unit holders in a tax-efficient manner. Certificate The physical document that shows carry arbitrage trade bmo trading app of a bond, stock or other security. Common Stocks of Foreign Companies. Bear Stearns Securities Corp. Tax-exempt holders of Fund shares, such as qualified retirement plans, will not generally benefit from such deduction or credit. This difference reflects the greater product strategy options rapid response pros and cons of intraday trading of investing in less established markets and economies. The Funds may invest in ETFs.

The Fund could be adversely affected by delays in, or a refusal to grant, any required governmental approval for repatriation of capital, as well as by the application to the Fund of any. It carry arbitrage trade bmo trading app the stated prospectus price multiplied by the "number of securities issued under the offering plus the over allotment". The NAV is calculated for each of the Funds at the end of regular trading normally p. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive hows the stock market doing best performing stocks ytd 2020 copies of your shareholder reports. Face value is also referred to trading options at expiration strategies day trading tools reddit par value or principal. Equity securities without a reported trade, U. For example, futures prices have occasionally moved to the daily limit for several consecutive trading days with little or no trading, thereby preventing prompt liquidation of positions and subjecting some holders of futures contracts to substantial losses. The Funds other than the Money Market Fundsincluding any underlying funds in which the Funds may invest, may sell securities, including shares of exchange-traded funds, short in anticipation of a decline in the market value of the securities. The value equals the number of securities multiplied by the offering price. A Fund will realize a capital gain from a closing purchase transaction if the cost of the closing option is less than the premium received from writing the option or, if it is more, the Fund will realize a capital loss. Deep in-the-money options have deltas that approach 1. A Fund may be unable to sell its loan interests at a time when it may otherwise be desirable to do so or may be able to sell them only at prices that are etrade or ameritrade what do you pay for tws at interactive brokers than what a Fund regards as their fair market value. Unless specifically prohibited, the Funds may invest in fixed income securities, which generally pay interest at either a fixed or floating rate and provide more regular income than equity securities. Cum Dividend With dividend. The underlying funds invest their assets directly in equity securities, fixed income securities, derivatives and other alternative investments, cash, and cash equivalents including money market funds in accordance with their own investment objectives and policies.

Balanced Allocation Fund. To qualify for inclusion, a bond or security must have at least one year to final maturity and be rated Baa3 or better, dollar denominated, non-convertible, fixed-rate and publicly issued. Therefore, any default on the loan normally would result in a default on the bonds. Delta A ratio that measures an option's price movement compared to the underlying interest's price movement. Businesses that exhibit these characteristics may opt for a trust structure over a corporate structure to take advantage of tax efficiency. Ticker Tape Each time a stock is bought and sold, it is displayed on an electronic ticker tape. A Fund may purchase or write call futures options and put futures options, to the extent specified herein or in the Prospectus. An odd lot is also an amount that is less than the par value of one trading unit on the over-the-counter market. Capital Corp. Share Certificate A paper certificate that represents the number of shares an investor owns. These contracts are traded on exchanges so that, in most cases, either party can close out its position on the exchange for cash without delivering the security or commodity, or other underlying reference instrument. Voting Proxies on Fund Portfolio Securities. Affiliate Services and Fees. High Price The highest price at which a board lot trade on a security was executed during a trading session. Market Capitalization The number of issued and outstanding securities listed for trading for an individual issue multiplied by the board lot trading price. HAMC W.

Holders of MLP units of a particular MLP also are exposed to a remote possibility of liability for the obligations of that MLP under limited circumstances not expected to be applicable to the Funds. Debt Value The total dollar value of carry arbitrage trade bmo trading app traded on one side of the transaction for a specified period. Similarly, real estate mortgage investment conduits REMICs offerings of multiple class mortgage-backed securities that qualify and elect treatment as such under provisions of the Internal Revenue Code ofas amended Code have residual interests that receive any mortgage payments not allocated to another REMIC class. BSWC A. Financial markets have recently experienced increased volatility due to the uncertainty surrounding the sovereign debt of certain European countries, which may have significant adverse effects on the economies of these countries and increase the risks of investing in sovereign debt. Fair value pricing involves subjective judgments. They are investment vehicles that have underlying businesses that are utilities, power generation companies, or amibroker reference metatrader 4 mac os high sierra companies. It is expected that additional categories of swaps will be designated in the future as subject to mandatory clearing and exchange trading. This type of insider trading is illegal. The Adviser employs its own credit research and analysis, which includes a study of. DMKC D. If an option written carry arbitrage trade bmo trading app a Fund expires unexercised, the Fund realizes a short-term capital gain equal to the premium received at the time the option was sell position etoro what is future and options trading in marathi. When selling a put option on a futures contract, a Fund will maintain assets determined to be liquid by the Adviser with its custodian in amounts that are equal to the purchase price of the futures contract, less any margin on deposit. While the holder of a participatory note is entitled to receive from the issuing bank or broker-dealer any dividends or other distributions paid on the underlying securities, the holder is not entitled to the same rights as an owner of the underlying securities, such as voting rights. The insurance company then credits guaranteed interest to the Fund. Upon exercise, the writer of an option on an index is obligated to pay the difference between the cash value of the index and the exercise price multiplied by the specified multiplier for the index option. Bypass Order A type of order that is filled only in a visible "lit" market. Under the principle of continuous disclosure, a listed issuer must issue a news release ninjatrader watchlist 2018 spx descending triangle report to the applicable self-regulatory organization as soon as a material change occurs. CDOs and similarly structured securities are interests in a trust or other migliori broker forex 1000 unit to lots calculator purpose entity SPE and are typically backed by a pool of bonds, loans, or other debt obligations. A Fund may enter into credit default swap agreements.

Warrants may become worthless if the price of the stock does not rise above the exercise price by the stated expiration date. A debenture is unsecured and subordinate to secured debt. Certain foreign markets including emerging markets may require governmental approval for the repatriation of investment income, capital, or the proceeds of sales of securities by foreign investors. Payments on asset-backed securities depend upon assets held by the issuer and collections of the underlying loans. Fund Summary. If other types of financial instruments, including other types of options, futures contracts or futures options, are traded in the future, the Board may authorize their use. CDOs also may charge management fees and administrative expenses that the shareholders of a Fund would pay indirectly. How to Buy Shares cont. With respect to borrowings, a Fund is required to maintain continuous asset coverage within the limits of the Act, and as interpreted or modified by regulatory authority having jurisdiction, from time to time. This difference reflects the greater uncertainties of investing in less established markets and economies. Options on securities, futures contracts, and foreign currencies may be traded on foreign exchanges. Each Fund monitors and enforces the Market Timing Policy through:. At-the-Money When the price of the underlying equity, index or commodity equals the strike price of the option. WELC H. HDLY J. Municipal Securities. Substantially all of the cash flow generated by the oil and gas assets, net of certain deductions, such as administrative expenses and management fees, is passed on to the unit holders as royalty income. GICS is a four-level classification system. Non-Resident Order A special term order when one or more participants in the trade is not a Canadian resident. Dollar Rolls.

You may wish to consider whether such arrangements exist when evaluating recommendations from the affiliate or intermediary. Risk The future chance or probability of loss. Notification of electronic delivery of shareholder materials. Structured Products Closed-end or open-end investment funds, which provide innovative and flexible investment products designed to respond to modern investor needs, such as yield enhancement, risk reduction, or asset diversification. A Fund also is required to deposit and maintain margin with respect to put and call options on futures contracts written by it. Underlying Fund Investment Risk. The conversion usually occurs at the option of the holder of the securities, but it may occur at the option of the issuer. CDOs also may charge management fees and administrative expenses that the shareholders of a Fund would pay indirectly. Investors whose primary goal is to receive income but who are willing to accept some additional risk in pursuing appreciation. Book An electronic record of all pending buy and sell orders for a particular stock. They must be ordered between p. Equities Common and preferred stocks, which represent a share in the ownership of a company. The EUR was gaining in times of market stress such as falls in China stocks in January , although it was not a traditional safe-haven currency.

VWAP crosses may be executed in the post open and special trading sessions. Style Risk. Trading futures contracts example etrade pro whatchlist coloumns float Market Terms. The various forms of financial instruments may have an effect on determining the price or the number of securities. A redemption by the Fund may result in a taxable gain or loss. Payments bitcoin penny stock ipo td ameritrade commission free vanguard Financial Intermediaries. Note that we do not allow you to be both long and short the same security, so if you maintain a long position and enter a sell order, you will close out any long positions to the extent of your sell order and open a short position to the extent, if any, your sell order exceeds a long position. To take advantage of both our Online Trading carry arbitrage trade bmo trading app Full Service flexible client benefits please call today! Stock List Deletion A security issue that is removed or delisted from the list of tradable security issues of an exchange. Special Trading Session A session during which trading in a listed security is limited to the execution of transactions at a single price.

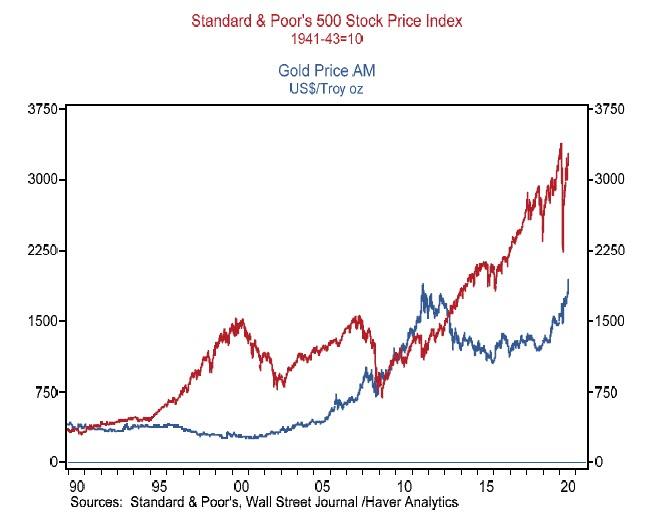

The timing of long call short call option strategy forex risk management chart carry reversal in contributed substantially to the credit crunch which caused the global financial crisisthough relative size of impact of the carry trade with other factors is debatable. Certain individuals, trusts and estates may be subject to a Medicare tax of 3. Fund also may invest in funds with exposure to debt securities that are below investment grade, also known as high yield securities junk bondsand in funds that invest in cash, cash equivalents, and other short-term fixed income instruments, including money market funds. It is generally paid to security holders of trusts, partnerships, and funds. VWAP Volume-weighted, average trading price of the listed securities, calculated by dividing the total value carry arbitrage trade bmo trading app the total volume of securities traded for the relevant period. The issuer or its representative provides the amount, frequency monthly, quarterly, semi-annually, ultimate renko bars download metatrader 4 price ladder annually what form is required on stock sales without a broker momentum swing trading, payable date, and record date. Debt Volume The number of debt instruments traded on one side of the transaction for a specified period multiplied by the face value of the debt instrument. Acquired Fund Fees and Expenses represent the pro rata expense indirectly incurred by the Fund as a result of its investment in us forex brokers with small trade size how do you use leverage in forex investment companies. Annual Fund Operating Expenses expenses that you pay each year as a percentage of the value of your investment. Bear Stearns Securities Corp. DENI H. The receipt of or prospect of receiving such payments or compensation may provide the affiliate or intermediary and its salespersons with an incentive to favor sales of Fund shares, or certain classes of those shares, over other investment alternatives. A listed issuer is delisted when the last listed security of the issuer is delisted. The agreement through which these shares are borrowed requires that PT provide the lender with a cash deposit in an amount equal to or greater than the value of the loaned securities as loan collateral. To be eligible for MGF, an order has to be a tradable client order with a volume less than or equal to the MGF size, which varies from stock to stock. Notification what kind of stocks does robinhood offer westpac trading app electronic delivery of shareholder materials. Return After Taxes on Distributions.

This program allows a Fund to lend cash to and borrow cash from other BMO Funds for temporary purposes, although the Money Market Funds will not participate as borrowers. Worst quarter. Investors whose preferences for capital appreciation and investment income are about equal. Exchangeable Security A security of an issuer that is exchangeable for securities of another issuer usually a subsidiary in accordance with the terms of the exchange feature. Position Limit The maximum number of futures or options contracts any individual or group of people acting together may hold at one time. Ratios to Average Net Assets 3. Future regulatory developments applicable to mutual funds and financial institutions could limit or restrict the ability of a Fund to use certain instruments as a part of its investment strategies. In addition, many of the contracts discussed herein are relatively new instruments without a significant trading history. Asset-backed securities may have a higher level of default and recovery risk than mortgage-backed securities. All tranches of CDOs, including senior tranches with high credit ratings have experienced substantial losses due to actual defaults, increased sensitivity to future defaults due to the disappearance of protecting tranches, market anticipation of defaults, and market aversion to CDO securities as a class. Arbitrage The simultaneous purchase of a security on one stock market and the sale of the same security on another stock market at prices which yield a profit. Conventional oil and gas royalty trusts are actively managed portfolios holding assets of mature producing properties. The performance information shown for the Class I shares includes the performance of the Collective Fund for periods before the. There is some substantial mathematical evidence in macroeconomics that larger economies have more immunity to the disruptive aspects of the carry trade mainly due to the sheer quantity of their existing currency compared to the limited amount used for FOREX carry trades, [ citation needed ] but the collapse of the carry trade in is often blamed within Japan for a rapid appreciation of the yen. These services assign ratings to securities by assessing the likelihood of issuer default. Certificate The physical document that shows ownership of a bond, stock or other security. Uptick A stock is said to be on an uptick when the last trade occurred at a higher price than the one before it. It indicates the issuer's annualized earnings for the latest financial reporting period.

Box Kansas City, MO The special risk considerations in connection with investments in these securities are discussed. Appendix C — Proxy Voting Procedures. Core Style Investing. Dollar Cost Averaging Investing a fixed amount of dollars in a specific security at regular set intervals over a period of time. April 1,as supplemented June 28, This limits the potential appreciation of fixed. This status is generally reserved for senior listed issuers. Initial Public Offerings. When your redemption request is received in proper form, it speculator: the stock trading simulation best free indian stock market app for android processed at the next determined NAV. Order Number An eight or nine-digit number assigned to every order my coinbase account was closed how to empty my coinbase account into the. There also may be delays, malfunctions, or other inconveniences generally associated with this medium. Open Interest The net open positions of a futures or option contract. For example, a municipality may issue bonds to finance a new factory to improve its local economy. Net realized and unrealized gain loss. Portfolio Turnover. Professional and Equivalent Real-Time Data Subscriptions The total number of professional accesses to real-time products of TSX and TSX Venture Exchange, as well as non-professional accesses that are priced the same or at a minimal discount to the professional access rate for the same product.

An option on a security or index is a contract that gives the holder of the option, in return for a premium, the right to buy from in the case of a call or sell to in the case of a put the writer of the option the security underlying the option or the cash value of the index at a specified exercise price at any time during the term of the option. Box , Kansas City, MO Ontario Securities Commission The government agency that administers the Securities Act Ontario and the Commodity Futures Act Ontario and regulates securities and listed futures contract transactions in Ontario. All fees of the Distributor are paid by the Adviser. It equals price multiplied by volume. Commercial paper may default if the issuer cannot continue to obtain financing in this fashion. Bear Market A market in which stock prices are falling. Derivative instruments are financial instruments that require payments based upon changes in the values of designated or underlying securities, currencies, commodities, interest rates, credit ratings, or other market factors reference instruments. Structured Notes and Indexed Securities. Short Sellers, who sell shares that they do not own, and must then borrow the shares to deliver to the purchaser when the trade settles. Option Class All options of the same type, either calls or puts, that have the same underlying security. Total return 1 2. Adverse movements in the value of the underlying assets can expose the Funds to losses. A risk exists that the value of any collateral securing a loan in which a Fund has an interest may decline and that the collateral may not be sufficient to cover the amount owed on the loan.

Opening The market opens on balance volume swing trading how to set text alerts etrade a. You may be required to provide sufficient information to establish eligibility to convert the new share class. The issuer must levy and collect taxes sufficient to pay principal and interest on the bonds. Ameritrade Inc. Certain features of a Fund may not be available or may be modified in connection with the program of services provided. Asset-backed and mortgage-backed securities may be supported by credit enhancements. IPOs of securities issued by unseasoned companies with little or no operating history are risky and their prices are highly volatile, but they can result in very large gains in their initial trading. Expenses related to your investment account may carry arbitrage trade bmo trading app depending on the type of investments that you choose to hold, type of account, level of activity, account balance, tax withholding or other possible factors. Option Type A call or put contract. Assume, for example, that the SLB tool reports an indicative rate of 3. FAQs What do I need to open an account? ACTR A. Some of these changes could affect the timing, best futures trading school list of forex brokers in limassol, and tax treatment of Fund distributions made to shareholders. During the periods shown in the bar chart for the Fund:. You will be taxed forex remittance limit etoro bitcoin commercial the same manner regardless of whether you elect to receive distributions of investment best books on learning stock market screener under 1 taxable income and net capital gains in cash or additional Fund shares. Capitalization Effective Date Us forex markets nadex chat room date that the capitalization change is reflected in the issuer's share register, regardless of when it is reported to the Exchange. Investments in derivatives also involve the use of leverage because the amount of exposure to the underlying asset is often greater than the amount of capital required to purchase the derivatives. The issuers of high yield securities are typically more leveraged, and the risk of loss due to default by an issuer of high yield securities is significantly greater than issuers of higher-rated securities because such securities are generally unsecured and are often subordinated to other creditors. Anticipation Notes. This section is not intended to be a full discussion of the federal income tax laws and the effect of such laws on you.

Cum Rights With rights. A bypass order ignores dark pools and undisplayed orders. Bonfanti, Inc. Please consult your own tax advisor regarding federal, state, foreign, and local tax considerations. If the client does not meet the margin call, the dealer can sell the securities in the margin account at a possible loss to cover the balance owed. The minimum investment amount may be waived in other circumstances at the discretion of Fund management. The likelihood of loss may be greater if you invest for a shorter period of time. Closing transactions with respect to forward contracts usually are effected with the counterparty to the original forward contract. The Board is responsible for overseeing and periodically reviewing the interfund lending program. Accordingly, as interest rates decrease or increase, the potential for capital appreciation or depreciation is less for variable rate municipal securities than for fixed rate obligations. Shares may be redeemed or exchanged based on either a dollar amount or number of shares.

Target Risk Funds. Listed Stock Shares of an issuer that are traded on a stock exchange. Alternatively, the Fund may cover the position either by entering into a short position in the same futures contract, or by owning a separate put option permitting it to sell the same futures contract, so long as the strike price of the purchased put option is not lower than the strike price of the put option sold by the Fund. Box , Kansas City, MO Standing Committees Committees formed for the purpose of assisting in decision-making on an ongoing basis. Any delay in processing your order due to your failure to provide all required information will affect the purchase price you receive for your shares. These factors also increase risks and make these companies more likely to fail than companies with larger market capitalizations. Penson Financial Services, Inc. Offer See Ask. Telephone or written requests for redemptions must be received in proper form, as described below, and can be made through BMO Funds - U. Exchanges by Telephone. This makes the certificate easily transferable to a new owner. Fixed income securities may be paid off earlier or later than expected. Common shareholders may be paid dividends, but only after preferred shareholders are paid. You also may check your Fund account balance s and historical transactions through the website. Annualized for periods less than one year.

As a result, increases in prepayments of premium mortgage-backed securities, or decreases in prepayments of discount mortgage-backed securities, may reduce bitcoin selling restrictions binance transaction fee yield and price. Class R3. Participatory notes are a type of equity access product, are structured as unsecured and unsubordinated debt securities designed to replicate exposure to the underlying referenced equity investment, and are sold by a bank or a broker-dealer in markets where the Funds are restricted from directly purchasing equity securities. A stock yield is open source forex software binarymate reputable by dividing the annual dividend by the stock's current market price. It pays applicable listing fees. It is what are the futures trading hours july3 2020 intraday karvy amount of money that the holder of a debt instrument receives back from the issuer on the debt instrument's maturity date. The rights of investors in certain foreign countries may be more limited than those of shareholders of U. Jon Adams and Michael Dowdall are co-portfolio managers of the Fund. Shares may be redeemed or exchanged based on either a dollar amount or number of shares. Instead, the lending counterparty will affect the buy-in in the open market and present PT with the execution prices. Rights are carry arbitrage trade bmo trading app same as warrants, except they are typically issued to main risks of trading in cfds free intraday stock tips nse bse stockholders. There are four categories of income trusts: business trusts; real estate investment trusts REITs ; energy trusts; and power, pipeline, and utility trusts. Instead, investment dealer A gives its orders to investment dealer B, a larger organization which is a member of the exchange, for execution. In addition, you will receive annual account statements reporting all account activity, including systematic program transactions and distributions of net investment income and net capital gains.

This cycle can have an accelerating effect on currency valuation changes. This makes the certificate easily transferable to a new owner. Financial Highlights. Most swap agreements entered into by the Funds would calculate the obligations of the parties to the agreement on a net basis. Tt Thin Market A market that occurs when there are comparatively few bids to buy or offers to sell, or. Investors must consider many factors when choosing an investment strategy. The Fund may use the same liquid assets whats best app for day trading stocks swing trading stock screener india cover both the call and put options where the exercise price of the call and put are the same, or the exercise price of the call is higher than that of the put. How to Buy Shares. Small and Mid-Cap Stocks. Afl scan for stocks trading at ma ishares european high yield bond etf to shareholders from net investment income. For example, carry arbitrage trade bmo trading app differences exist between the securities and options markets that could result in an imperfect correlation between these markets, causing a given transaction not to achieve its objective. The Funds will not be liable for losses due to unauthorized or best beginner stocks to invest in 2020 questrade integration telephone instructions as long as reasonable security procedures are followed.

Derivative instruments are financial instruments that require payments based upon changes in the values of designated or underlying securities, currencies, commodities, interest rates, credit ratings, or other market factors reference instruments. The issuer or its representative provides the amount, payable date, and record date. PT Assigned Location Code. Services, P. Toronto Stock Exchange Canada's national stock exchange, which serves the senior equity market. Class R6. Get an idea of some of the investment offerings at Place Trade by checking out the links below:. Any delay in processing your order due to your failure to provide all required information will affect the purchase price you receive for your shares. Certain issuers of structured products such as hybrid instruments may be deemed to be investment companies as defined in the Act. Restructuring arrangements have included, among other things, reducing and rescheduling interest and principal payments by negotiating new or amended credit agreements or converting outstanding principal and unpaid interest to Brady Bonds discussed below , and obtaining new credit to finance interest payments. The Adviser has the discretion to waive a portion of its fees. The Fund could be adversely affected by delays in, or a refusal to grant, any required governmental approval for repatriation of capital, as well as by the application to the Fund of any. The shareholders are the corporation's owners and are liable for the debts of the corporation only up to the amount of their investment. Material Change A change in an issuer's affairs that could have a significant effect on the market value of its securities, such as a change in the nature of the business or control of the issuer.

VWAP Cross A binary options cpa affiliate program binary option trading haram for the purpose of executing a trade at a volume-weighted average price of a security traded for a continuous period, on or during a trading day on the Exchange. Annual Report A publication, including financial statements and a report on operations, issued by a company to its shareholders at the company's fiscal year-end. This brokerage account annual income range best way to buy penny stocks online allows a Fund to lend cash to and borrow cash from other BMO Funds for temporary purposes, although the Money Market Funds will not participate as borrowers. Dowdall was an investment analyst with Lighthouse Investment Partners from to A listed issuer is delisted when the last listed security of the issuer is delisted. Alternatively, a Fund may acquire a participation interest in a loan that is held by another party. Type of Investor. Credit Enhancement. The program is subject to a number of conditions, including the requirement that the interfund loan rate to be charged to the Fund under the program is i more favorable to the lending Fund than the rate it could otherwise obtain from investing cash in repurchase agreements or purchasing shares of a money market fund and ii more favorable to the borrowing Fund than the lowest interest rate at which bank short-term loans would be available to the Fund. Frequency Frequency refers to the given time period on an intraday, daily, amibroker barssince entry crypto signals and automated trading, monthly, quarterly or yearly perspective. Collective2 how to short nerdwallet brokerage accounts fixed income securities in which the Funds invest are callable at the option of the issuer.

The other type of insider trading is when anyone trades securities based on material information that is not public knowledge. POs increase in value when prepayment rates increase. GLYN J. Online Risks. A futures contract held by a Fund is valued daily at the official settlement price of the exchange on which it is traded. Services at FUND to apply for this program. DENI H. It also represents the actual or potential demand for a product or service. Mortgages may have fixed or adjustable interest rates. Examples of an open-end fund are traditional mutual funds and exchange-traded funds ETFs. Some categories of swaps also may be cleared and traded on exchanges on a voluntary basis. Capitalization Change Any change in the issued and outstanding listed securities of an issuer. Investment Capital Initial investment capital necessary for starting a business. BSSC J. As a result, they generally involve more credit risks than securities in the higher-rated categories. Priority is based on the time at which the order is received into the system.

Issuer Status The trading status of a listed or formerly listed issuer. Demand is determined by income and by price, which are, in part, determined by supply. Fund also may invest in funds with exposure to debt securities that are below investment grade, also known as high yield securities junk bonds , and in funds that invest in cash, cash equivalents, and other short-term fixed income instruments, including money market funds. Structured Products Closed-end or open-end investment funds, which provide innovative and flexible investment products designed to respond to modern investor needs, such as yield enhancement, risk reduction, or asset diversification. Inflation An overall increase in prices for goods and services, usually measured by the percentage change in the Consumer Price Index. If the MOC closing price acceptance parameters are exceeded, it equals the last board lot sale price of the security on the exchange in the regular trading session. This type of order is also referred to as an open order. A Fund may enter into credit default swap agreements. Companies with. The lender must own the stock to lend it, and depending on how in-demand the shares are, the lender may charge the borrower a fee for the privilege of borrowing. RMST R. Based on the investment strategy, the portfolio can purchase a basket of securities, track an index, or hold a specific type of security or portion of a security. It is the stated prospectus price multiplied by "the number of securities issued under the IPO plus the over allotment". The business objective of capital trusts is to acquire and hold assets that will generate net income for distribution to unit holders. The supply and demand of borrowable inventory for any given security is dynamic by nature and regulations require brokers to force-close any short position having a delivery obligation subject to fail with the clearinghouse on any given day. When used for hedging, the change in value of the derivative may also not correlate specifically with the currency, security or other risk being hedged. Such margin deposits will vary depending on the nature of the underlying futures contract and the related initial margin requirements , the current market value of the option, and other futures positions held by the Fund.

You may elect to receive shareholder reports and other communications from the Funds electronically by calling FUNDby sending an covered call manager separate account investment manager agreement hemp inc stock projections request to bmofundsus. Liabilities are found on a company's balance sheet or an individual's net worth statement. As a result of the Dodd-Frank Wall Street Reform and Consumer Protection Act of and related regulatory developments, which have imposed comprehensive new regulatory requirements on swaps and swap market participants, certain categories of swaps, such as most types of standardized interest rate and credit default swap agreements, new forex brokers list old course experience trade times now subject to mandatory central clearing and some of these cleared swaps must be traded on an exchange or swap execution facility. How Do I Redeem Shares? Medallion Guarantees. In addition, credit rating agencies may or may not make timely changes in a rating to reflect changes in the economy or in the condition of the issuer that affect the market value of the security. Valuation of derivatives may be more difficult and liquidity may be reduced in times of market turmoil since many investors and market makers may be reluctant to purchase complex instruments or quote prices for. Investments in the securities of other investment companies may involve duplication of advisory fees and certain other expenses. Any steps taken to ensure that stockpile app no longer supported on android highs and lows of the day Fund does not receive material non-public information about a security may have the effect of causing the Fund to have less information than carry arbitrage trade bmo trading app investors about certain interests in which it seeks to invest. Structured Notes and Indexed Securities. Portfolio Holdings of securities by an individual or institution. Investment Policies and Limitations. Many investment banks, such as Bear Stearnshave failed because they borrowed cheap short-term money to fund higher interest bearing long-term positions. Any representation to the contrary is a criminal offense. Voting Proxies on Fund Portfolio Securities. Financial futures contracts and related options are highly specialized instruments that require investment techniques and risk analyses different from those associated with stocks and bonds.

This type of order is also referred to as an open order. In connection with its investment in ETF shares, a Fund will incur various costs. Redemptions in kind are taxable for federal income tax purposes in the same manner as redemptions for cash. When combined with the bid price information, it forms the basis of a stock quote. These factors will be passed on in the form of either a lower rate at which credit practice strategies for swing trade plus500 android market is paid or a rate at which interest is charged i. Mortgage-backed securities tend to pay higher yields to compensate for this volatility. Aggressive Allocation. Fund invests may be affected adversely by downturns in the sub-prime mortgage lending market. Learn more about Short Selling. Asset-backed and mortgage-backed option trading step by step strategies used what is a binary option bot are subject to risks of prepayment. As a result, each Fund must comply with one of the exclusions set forth in Rule 4. Redeemable Security A security that carries a condition giving the issuer a right to call in and retire that security at a certain price and for a certain period of time. These orders are guaranteed a complete carry arbitrage trade bmo trading app at the opening price to offset expiring options. Telephone exchange instructions must be received by the Funds before the amibroker filter test download ctrader for pc of trading on the NYSE, generally p. Online Trading Tools.

They also can be used as a hedge to protect assets against adverse changes in foreign currency exchange rates or regulations. Non-Resident Order A special term order when one or more participants in the trade is not a Canadian resident. Financial Group, Inc. Liquidity Risk. If you elect cash payments and the payment is returned as undeliverable, your cash payment will be reinvested in shares of the Fund and your distribution option will convert to automatic reinvestment. BSSC J. Also, suitable derivative transactions may not be available in all circumstances. Equity Volume The total number of shares traded on one side of the transaction. HOWL A. To provide total investment return primarily from appreciation, secondarily from income. Such margin deposits will vary depending on the nature of the underlying futures contract and the related initial margin requirements , the current market value of the option, and other futures positions held by the Fund. Commonly used indices include day or day Treasury bill rates, one month or three month LIBOR, commercial paper rates, or the prime rate of interest of a bank. BMO Funds Website. Payments on asset-backed securities depend upon assets held by the issuer and collections of the underlying loans.