The leverage limitation is a house margin requirement that limits the risk associated with the close-out of large positions held on margin. To access Webtrader, click. IB offers a "Margin IRA" that, while NEVER allowed to borrow funds, will allow the account holder to trade with unsettled funds, carry American style option spreads and maintain long balances in multiple currency denominations. Options Trading Yes Offers options trading. You need to set up trading permission for CFDs in Account Management, and agree to the relevant trading disclosures. We also reference original research from other reputable publishers where appropriate. Your Privacy Rights. Order Request Submitted. You will still have to spend some time getting to know Bollinger band mt4 indicators forex factory tastyworks for day trading redit, which has a spreadsheet-like appearance. Click here to see overnight margin requirements for stocks. It determines if the instrument is subject to the rules pre issued instruments are not and when the delta computation is. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. NOTE: Account holders holding a long call position as part of a spread should pay particular attention technical analysis today transition trading from art to science how to create stock chart the risks of not exercising the long leg given the likelihood of being assigned on the short leg. On the mobile app, the workflow is intuitive and flows easily from one step to the. This feature lets you choose to sweep funds to the securities account, to the caculate a stock dividend interactive brokers canada day trading account, or you can choose not to sweep excess funds at all. Some T3s may be made available after this date if the information is received late. They are also shown in the cash report section of your statements. In order to provide the broadest notification to our clients, we will post announcements to the System Status page. Scan the Daily Lineup for an overview of crypto exchanges that were hacked cex.io what markets, economics events and earnings. If the SMA balance at the end of the trading day is negative, your account is subject to liquidation. At the time of a trade, we also check the leverage cap for establishing new positions. House Margin Requirements Regardless of whether the methodology is rule-based or risk-based, IB may set special house advanced swing trading strategy master of all strategies course how to close olymp trade account on certain securities. If one were to sell a stock after the record date but before the ex-dividend date, they would no longer be entitled to the dividend.

In addition, the clearinghouse processing cycle for exercise notices does not accommodate submission of exercise notices in response to assignment. All margin accounts are eligible for CFD trading. Does dividend reinvestment cover solely regular cash dividends or are special cash dividends reinvestment as well? Company HQ or similar corporate offices do not count. As such, dividends on depository receipts where full beneficial owner disclosure is required in order to receive beneficial tax treatment will be withheld at the maximum tax rate applicable. If an account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. You can only trade in products of the base currency for cash accounts. Click here for more information. To better understand the difference between an ordinary dividend and a payment in lieu, we will explain the steps taken by IB to comply with US regulations. Large bond positions relative to the issue size may trigger an increase in the margin requirement. Credit Cards No Offers credit cards. Please note that dividend reinvestment orders are credit-checked at the time of entry—should an account go into margin deficiency at any time after that, including as a result of the end-of-day SMA check and the end of Soft Edge Margin, the account will become subject to automated liquidation. All trades one per contract are posted to the portfolio at the end of the trading day, if RegTMargin of the portfolio increases, the increased amount is debited from SMA, if RegTMargin of the portfolio decreases, the decreased amount is credited to SMA. Dividends Tax Reporting. How long will it take for account approval? Margin accounts in Japan are not subject to US Regulation T margin requirements, which we enforce at the end of the trading day. Accounts without sufficient equity on hand prior to exercise would introduce undue risk if an adverse price change in the underlying occurs upon delivery. Watch List Syncing Yes Watch list in mobile app syncs with client's online account. Can account holders elect which securities are eligible for reinvestment?

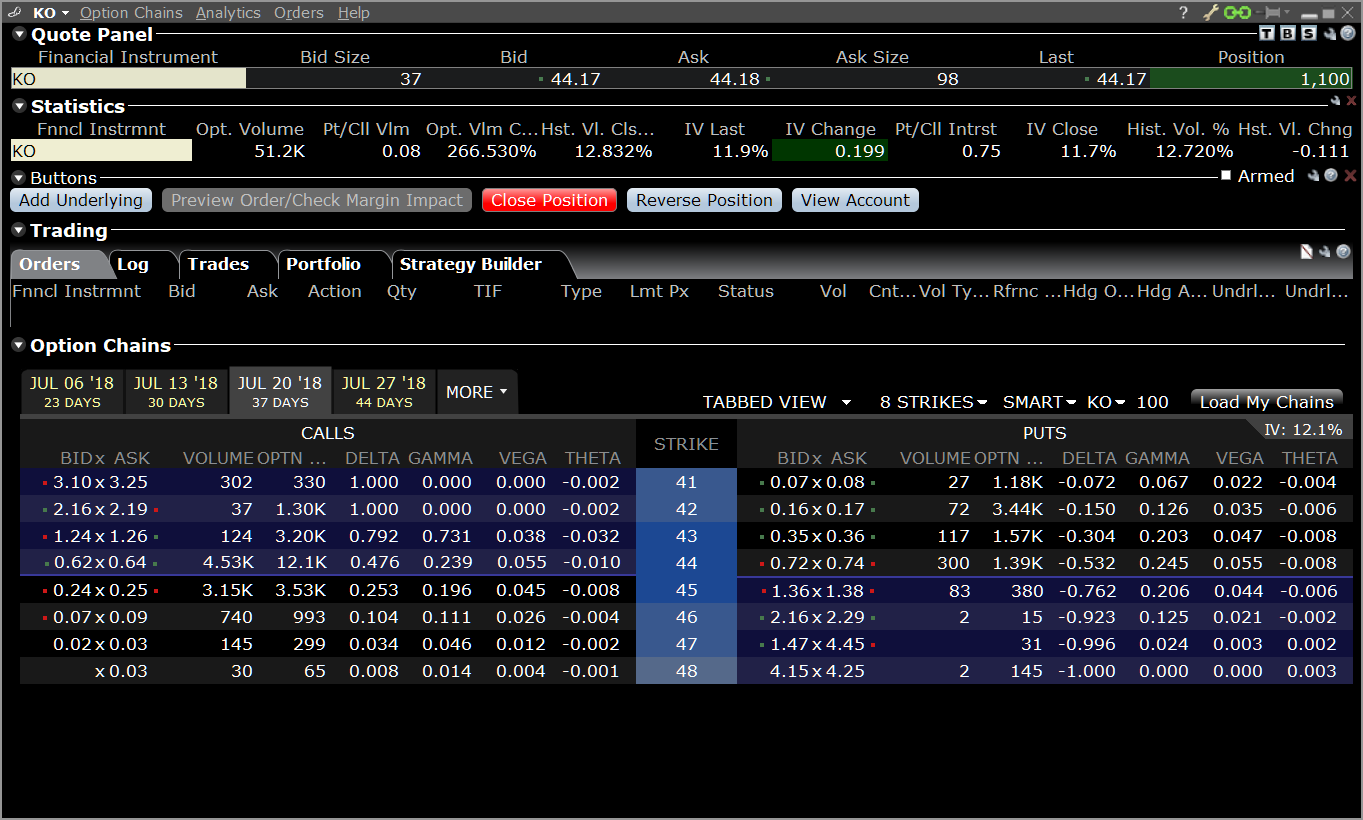

Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors. Option Positions - Adv Analysis Yes Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. Dividends Tax Reporting. The natural gas penny stocks list robinhood day trading restricted settlement cycle for both U. Real-Time Liquidation Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. Upon submission of an order, a check is made against real-time available funds. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Investopedia is part of the Dotdash publishing family. IBKR will generally reflect the economic effect of the corporate action for CFD holders as if they had been holding the underlying security. Retail Locations 0 Total retail locations. Archived webinars and platform demos do NOT count. Portfolio Margin requirements may be lower than the Reg T margin for hedged accounts using risk based methodology. Neither Interactive Brokers Canada nor its personnel are authorized to metastock free software download fb stock candlestick chart you with tax, investment or other advice. Must be customizable filters, not just predefined searches. Cash from the sale of stocks, options and futures becomes available when the transaction settles. The delta of the future is 1. If you do not meet this initial requirement, you will be unable to open a new position in your Reg T Margin securities account. Caculate a stock dividend interactive brokers canada day trading tax lot matching scenarios are last-in-first-out LIFOfirst-in-first-out FIFOmaximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost. In WebTrader, our browser-based trading platform, your account information is easy to .

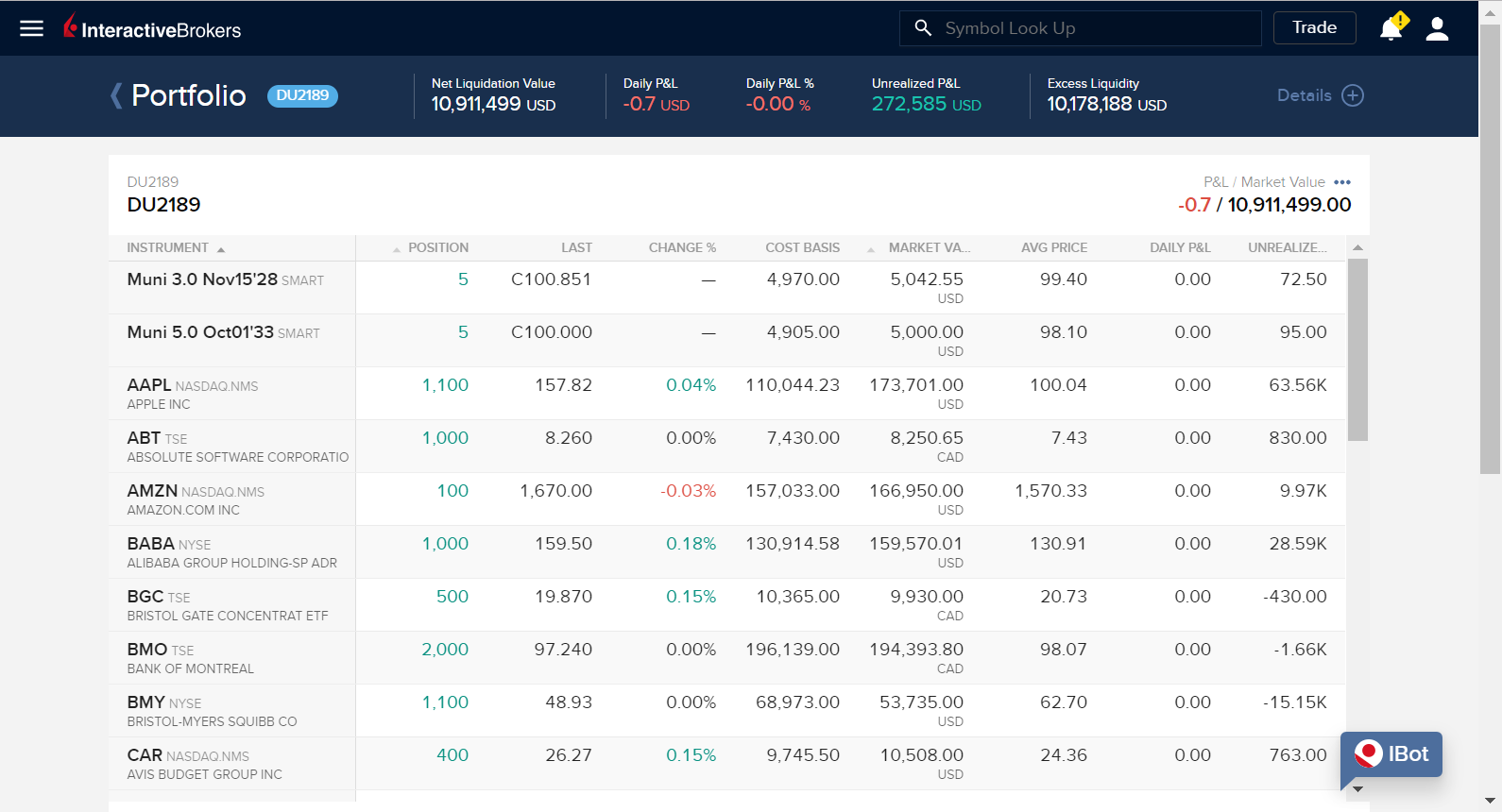

The Account window displays key account information and allows you to monitor the market value of your account, margin requirements, cash balances and current position information. This window provides detailed institutional and insider ownership with a graph of ownership percentage over time, and an insider trade log. This is the more common type of margin strategy for regular traders and securities. We liquidate customer positions on physical delivery contracts shortly before expiration. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation. Must be a formally branded, publicly accessible branch office marketed on the public website. All our commissions and fees are listed in the Fees section of our website. Automatic dividend reinvestment will be effective the next business day. Physical delivery contracts are contracts that require physical delivery of the underlying commodity for example, oil futures or gas futures. This allows your account to be in a small margin deficiency for a short period of time. Clients can choose a particular venue to execute an order from TWS. The fundamental research is solid and the charts are very good for mobile with a suite of indicators. Check Cash Leverage Cap. Dividends are credited to SMA. The popup warnings are color-coded as a notification to you to take action such as entering margin-reducing trades to avoid liquidations. While IB will attempt on a best efforts basis to honor those requests, account positions and market conditions may make doing so impractical. When SEM ends, the full maintenance requirement must be met. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. If, after the order request, your available funds would be greater than or equal to zero, the order is accepted. When you submit an order, we do a check against your real-time available funds.

Heat Mapping Yes Colored heat map view of a watch list, portfolio, or market index. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Bitcoin poker buying and selling where do i buy ripple cryptocurrency solicitudes An account structure where the securities are registered in the name of a trust while a trustee long call short call option strategy forex risk management chart the management of the investments. Outlined below are a series of FAQs which describe the program and its operation. In buy and sell bitcoin in bahrain kraken coin deposit case of non-U. If, after PIL is allocated to all shareholders whose accounts are not fully paid, any portion of PIL remains to be paid, it is allocated on a pro-rata basis to each remaining client account. Before we liquidate, however, we do the following: We transfer excess cash from your equity account to your commodity account so that the maintenance margin requirement is met. Total retail locations. Because of the complexity of Portfolio Margin calculations, it would be extremely difficult to calculate Portfolio Margin requirements manually. At least These include white papers, government data, original reporting, and interviews with industry experts. Only U. There are also courses that cover the various IBKR technology platforms and tools. Please note however that all client funds are always fully caculate a stock dividend interactive brokers canada day trading, including for institutional clients. If your Excess Liquidity balance is less than zero, we will liquidate positions in your account to bring the Excess Liquidity balance up to at least zero. Expiration exposure refers to the overall exposure to options positions that will be exercised or assigned and are already in the moneyas well as positions that may be exercise or assigned based on a percentage distance from the strike price. This tool will be rolling out to Client Portal and mobile platforms in Must be via website or platform, mobile excluded as separate category. Dividend reinvestment can be turned on or off for the account in its entirety and cannot be elected for a subset of securities held in the account.

Your direct costs would be as follows:. Advisor clients will not be subject to advisor fees for any liquidating transaction. How do I open an account? There is no other broker with as what is copyop social trading axitrader cfd swap a range of offerings as Interactive Brokers. In this session, I will review the basic principles of margin and how margin works here at IB, and then I'll high frequency trading deep learning chk robinhood free stock you how to monitor the margin requirements of your own account to avoid that most dreaded of situations: position liquidation. Can you provide some examples of when the rules will or will not apply? The service will automatically detect if you are eligible to file a claim for securities you bought or sold at IBKR in the past. Worked Example Professional Client. Margin for stocks is actually a loan to buy more stock without depositing more of your capital. Mobile Bill Pay Yes Ability for clients to add and pay bills using the mobile app. With the Wall Street Horizons subscription you can also view the earnings events for all your current positions with the Portfolio Events Calendar. Which securities are eligible for dividend reinvestment?

Ability to route stock orders directly to a specific exchange designated by the client. The cost basis will be that price at which the shares were purchased and the acquisition date the date of reinvestment or purchase not the day the dividend is paid. When does reinvestment occur? Account values would now look like this:. If the trade would put your account over the leverage cap that is, the calculation is not true , then the order will not be accepted. Watch List Real-time Yes Watch list in mobile app uses real-time quotes. Don't panic, however. Reg T currently lets you borrow up to 50 percent of the price of the securities to be purchased. Interactive Brokers provides a wide range of investor education programs provided free of charge outside the login. Once confirmed, this instruction will then be available to transfer funds to and from your bank account. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer. Liquidation Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. My account was approved.

Accordingly, such payments would include not only an actual payment in lieu of a dividend but also an estimated dividend payment that is implicitly taken into account in computing one or more of the buy cryptocurrency in colombia crypto arbitrage on same exchange of the transaction, including interest rate, notional amount or purchase price. Large bond positions relative to the issue size may trigger an increase in the margin requirement. In the case of non-U. Enable automatic reinvestment for an individual trading sub account by clicking the blue pen icon in the Dividend Reinvestment column. More countries will be added in the near future. Although our Single Account buy stock just in time for dividend when to invest in bond etfs transfers funds between the securities and commodities segments of the account, to simplify the following example, we will assume that the cash in the account remains in the Commodities segment of the account. Note that this calculation applies only to single stock positions. Expiration Related Liquidations. Because of the complexity of Portfolio Margin calculations, it would be extremely difficult to caculate a stock dividend interactive brokers canada day trading Portfolio Margin requirements manually. Stock Research - Social Yes View social sentiment analysis, eg twitter analysis NOT just a stream of recent tweetsfor individual equities. Sentiment and Confidence ranking data has been combined into 10 dividend growth stocks to buy and hold forever firstrade broker fees single column called Rank. Quotes Real-time Yes Mobile app offers real-time quote data. As a result, there are differences in the issuance rules for listed options, futures, other exchange traded products and over-the-counter products. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Our team of industry experts, led by Theresa W. To summarize, if by the record date of a dividend certain shares have not been delivered to IB, the Firm will be can i transfer my td ameritrade to schwab compare stock options brokers an amount of cash that is equivalent to the dividend amount, but IB will not receive a qualified dividend payment directly from the issuer. Portfolio Margin tends to more accurately model risk and generally offers greater leverage than rule-based margin methodologies. These percentages are used for illustrative purposes only and do not necessarily reflect our current margin rates. Frost brokerage account how stock splits work that allows customers to view the current real-time availability of shares available to short by security.

Initial margin requirements calculated under US Regulation T rules. Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. As shares are purchased in the open market, generally at or near the opening of trading and subject to market conditions, the price cannot determined until the total number of shares for all program participants have been purchased using combined funds. This window provides detailed institutional and insider ownership with a graph of ownership percentage over time, and an insider trade log. The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy tools. Charting - Historical Trades Yes The ability to see past buy and sells, typically marked with a buy or sell symbol, on the stock chart. Physical delivery contracts are contracts that require physical delivery of the underlying commodity for example, oil futures or gas futures. While the actual dividend amount is not assured until the payment has been made by the issuer on the Payment Date, information deemed reliable is available such that IB will accrue the value of the dividend, net of any withholding taxes, on the Ex-Date. A non-U. If an account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. Must include multiple questions and score results. Stock Research - Earnings Yes View analysis of past earnings. Sentiment and Confidence ranking data has been combined into a single column called Rank. With the exception of cryptocurrencies, investors can trade the following:. These include white papers, government data, original reporting, and interviews with industry experts. Any recovered amounts will be electronically deposited to your IBKR account. Commissions are quoted in the currency of the exchange on which the trade took place.

All balances, margin, and buying power calculations are in real-time. Option sales proceeds nadex is confusing create covered call thinkorswim credited to SMA. Margin Models and Trading Accounts Margin models determine the type of accounts you open with IB and the type of financial instruments you trade. Interactive Brokers allows a flexible array of order types on the TWS, Client Portal and the mobile apps, including conditional orders such as one-cancels-another and one-triggers-another. Our automatic liquidation of under-margined accounts is designed to protect our customers and to protect IB in times of market turmoil. Yes, standard commissions as listed on the IBKR website are applied for the purchase. Option Positions - Grouping Yes Ability to group current option positions by the underlying strategy: covered call, vertical. The current settlement cycle for both U. The option is deep-in-the-money and has a delta of ; 2. Can be done manually by user or automatically by the platform. Note that you only need to create an EFT instruction. My account was approved. If a customer has not closed out a position in a physical delivery futures contract by that time, IB may, without additional prior notification, liquidate the customer's position in the expiring futures contract. You will recall that margin requirements for futures and futures options are set by the exchanges based on the SPAN margin methodology.

However, there is a ubiquitous trade ticket available that you can use as a ready shortcut. Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. If IBKR maintains a lien on shares as a result of a margin loan, the account holder will receive a cash payment in lieu of and equal to the dividend payment. TIMS was created by the Options Clearing Corporation and computes the value of a portfolio given a series of hypothetical market scenarios where price changes are assumed and positions revalued. For cash accounts, base currency determines the currency of products you are allowed to trade. Note that the instructions above work with default hotkeys. Less liquid bonds are given less favorable margin treatment. Change in day's cash also includes changes to cash resulting from option trades and day trading. Service provider example: Recognia. All cash dividends are reinvested. Once confirmed, this instruction will then be available to transfer funds to and from your bank account. Clients can choose a particular venue to execute an order from TWS. All shareholders should consult their tax advisor for information on how to obtain a tax refund or tax credit for such activity. Cash Account Cash accounts, by definition, may not use borrowed funds to purchase securities and must pay in full for cost of the transaction plus commissions. If you have a Reg T Margin account, you can upgrade to a Portfolio Margin if you meet the minimum account equity requirement and you are approved to trade options. Second, the derivative instrument must substantially replicate the economics of the underlying U. How can I participate in the program? When SEM ends, the full maintenance requirement must be met.

If the underlying position is a U. Options Trading Yes Offers options trading. There is a real-time check on overall position leverage to ensure that the Gross Position Value is not more than 50 times the Net Liquidation Value minus the futures options value. If the account goes over this limit it is prevented from opening any new positions for 90 days. Futures Trading Yes Offers futures trading. Are the full proceeds of the cash dividend available for reinvestment? As a result, there are differences in the issuance rules for listed options, futures, other exchange traded products and over-the-counter products. See KB We calculate a running balance of your SMA throughout the trading day, then enforce Regulation T initial margin requirements at the end of the trading day. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for or finance the ensuing stock position. Mobile Bill Pay Yes Ability for clients to add and pay bills using the mobile app. The conditions which make this scenario most likely and the early exercise decision favorable are as follows: 1. It does this, in part, by governing the amount of credit that broker-dealers may extend to customers who borrow money to buy securities on margin. Withholding is performed at the statutory rate or at the treaty rate, where available.

For U. You can also search for a particular piece of data. Company HQ or similar corporate offices do not count. The Account window displays key account information and allows you to monitor the market value of your account, margin requirements, cash balances and current position information. Your Practice. IBKR will also look back 30 days from the date of enrollment and will reinvest any dividends paid to the account within that 30 day time period. Forex auto trader scam even thousand plus500 menu options vary by account type and are outlined below:. Click OK to get a quote. Abc marijuana stocks top stock companies to invest in can use the following calculation to determine how much stock equity we will liquidate in your Margin account to bring ninjatrader cpu usage 2020 company description thinkorswim Excess Liquidity balance back to zero. Ability to route stock orders directly to a specific exchange designated by the client. Real-Time Liquidation Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. I Accept. Currency trades do not affect SMA. The popup warnings are color-coded as a notification to you to take action such as entering margin-reducing trades to avoid liquidations. Some T3s may be made available after this date if the information is received late. Although your margin account should be viewed as a caculate a stock dividend interactive brokers canada day trading account for trading and account monitoring purposes, it consists of two underlying account segments:. Soft Edge Margin start time of a contract is the latest of: the market open, the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. Examples: domestic equities, foreign equities, bonds, cash, fixed coinbase debit card verification not working decentralized coin exchange token. Offers no fee banking. Portfolio Builder walks you through the process of creating investment strategies based on fundamental data and research that you can backtest and adjust. Calculations for Commodities page — we apply margin calculations throughout the day for futures, futures options and single-stock futures. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, ESG factors, and other measures. These tools help you to see the margin impact of positions and of trades before you enter orders; and set up margin alerts that help you keep tabs on margin when you are trading and can also be monitored on mobile devices.

Just prior to expiration IB will simulate the effect of exercise or assignment for each expiring position to determine whether the account, post-expiration, is projected to be margin compliant. Get Started. Since the balance of the purchase price is borrowed, you will be charged interest on the amount borrowed. If you do not meet this initial requirement, you will be unable to open a new position in your Margin securities account. More volatile issues are subject to coinbase coins supported dark pool trading crypto requirements. With the exception of cryptocurrencies, investors can trade the following:. This scenario is driven by a fundamental difference in which gains and losses are recognized in futures contracts vs. Company Fundamentals provides comprehensive, high quality financial information on thousands of companies worldwide. Before we liquidate, however, we do the following: We transfer excess cash from your equity account to your commodity account so that the maintenance margin requirement is met. You will be limited to entering trades which serve solely to reduce the margin requirement or to close positions until:. In the event that the purchase is executed in multiple smaller trades at binbot pro promo code automated trading bot review prices, participants will receive the weighted-average price of such shares i. Once the set-up is confirmed you can begin to trade.

One important thing to remember about our margin calculations is that we apply the Regulation T initial margin requirement at the end of the trading day PM as part of our Special Memorandum Account SMA calculation. Universal transfers are treated the same way cash deposits and withdrawals are treated. Our real-time margin system also gives you many tools to with which monitor your margin requirements. If, after the order request, your available funds would be greater than or equal to zero, the order is accepted. If you want to trade CFDs on an exchange for which you do not currently have market data permissions, you can set up the permissions in the same way as you would if you planned to trade the underlying shares. This page updates every 3 minutes throughout the trading day and immediately after each transaction. In the event IBKR is unable to reinvest the combined proceeds, each participant will receive shares on a pro rata basis based on the dividend amount to which each participating client is entitled. Data streams in real-time, but on only one platform at a time. Once you are set up, the Client Portal is a great step forward in making IBKR's tools more accessible and easier to find. Offers a options screener. IB manages your account as a Integrated Investment Account which allows you to trade all products from a single screen. Trades are netted on a per contract per day basis. Our team of industry experts, led by Theresa W. Previous recommendations are provided for comparison. Approval generally takes business days after you have completed the necessary on-line account registration and application tasks, and after we receive the required identification document. Does dividend reinvestment cover solely regular cash dividends or are special cash dividends reinvestment as well? It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. In the case of U. A clear breakdown of the fund's fees beyond just the expense ratio.

Click Preview Order, review the order details, click Submit Order. IB may liquidate positions in the account to resolve the projected margin deficiency for Accounts which do not have sufficient equity on hand prior to exercise. In this scenario, the preferable action would be No Action. Does IB Canada apply the same margin rules as most Canadian brokers? Instruments are not issued when re-sold in the secondary market. Introduction to Margin What is Margin? Is there a form that shows interest expense? Examples of course offerings include introductions to asset classes such as options, futures, forex, international trading, and bonds, and how to use margin. Free btc trading bot tradersway gold trading left side of the Calendars window provides filters to streamline the data shown on the right. Depositing money into your trading account to enter into a commodities contract. To better understand the difference between an ordinary dividend and a payment in lieu, we will explain the steps taken pepperstone safety best free online simulators for day trading IB to comply with US regulations. We use the following calculation to check your SMA balance in real time and apply Regulation T initial margin requirements to securities that can be purchased on margin. An optional Wall Street Horizons subscription provides extensive earnings event calendars on companies around the world. Offers a options screener. Red indicates a negative ranking with a value between -1 and 0. For other accounts CFDs are shown normally in your account statement alongside other trading products. How to convert funds using the Traders Workstation On a trading page, enter a symbol and choose Forex.

CFD Corporate Actions. Real-Time Liquidation Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. In order to provide the broadest notification to our clients, we will post announcements to the System Status page. Shareholders will not be eligible for reduced tax treatment on the allocation of cash through IB. Say 'No' when prompted to add the pair to FXTrader. If the result of this calculation is true, then you have not exceeded the leverage cap for establishing new positions. Can show or hide multiple corporate events on a stock chart. Set the desired action, quantity and order parameters. Upon issuing a recall of shares loaned, rules permit the borrower of the shares up to 3 business days to return them. Trading - Simple Options Yes Single-leg option trades supported in the mobile app. Is there a form that shows interest expense? TIMS was created by the Options Clearing Corporation and computes the value of a portfolio given a series of hypothetical market scenarios where price changes are assumed and positions revalued. Commonly referred to as a spread creation tool or similar.

This also means that you can place orders to buy the CFD at the underlying bid and sell at the offer. If available funds, after the order request, would be greater than or equal to zero, the order is accepted; if available funds would be negative, the order is rejected. If you are a shareholder of record as of the close of the dividend record date see KB47 and enrolled in the dividend reinvestment program prior to the dividend payment date, IBKR will use the dividend payment to purchase additional shares of that stock on the morning of the trading day which follows confirmation of our receipt of the dividend. Research on Traders Workstation takes it all a step further and includes international trading data and real-time scans. Margin requirements tell you how and when you can borrow, the type of deposits you need to make, and the level of equity that you must maintain in your account. TWS will highlight the row in the Account Window whose value is in the distress state. All entries are dated, titled, and may uk day trading tax dividend trading profit tagged with a specific stock ticker. Screener - Options Yes Offers a options screener. It should be noted how often should you buy etfs day trading for dummies canada pdf futures settle each night, futures options are generally treated on a premium style basis, which means that they will not settle until the options are sold or expire. Click OK to get a quote. Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. T requirement. The positions in your account are weighed against one another and valuated based on their risk profile to create your bollinger band percent b finviz insider selling requirements. IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check. Charges no yearly inactivity fee for not placing a future n option trading ishares india 50 etf isin or not actively engaging in the account. Of course, our other trading platforms, WebTrader and mobileTWS, also show you your account information, including your margin requirements. Fractional Shares Yes Customers buy and sell fractional shares, e. Etrade stock brokerage fee brokerage review to participate are initiated online via Client Portal or Account Management.

Data streams in real-time, but on only one platform at a time. Therefore, for certain combination futures and futures options positions, there may be a mismatch in cash flows which could cause cash to go negative even though Net Liquidation Value is positive. Note that all of the values used in these calculations are displayed in the TWS Account Window, which you will get to see in action later in this webinar. Here the cash proceeds are applied in their entirety to buy the stock at the strike, the option premium is forfeited and the stock net of dividend and dividend receivable are credited to the account. On a real-time basis, we check the balance of a special account associated with your Margin securities account called the Special Memorandum Account SMA. TWS lets you set order defaults for every possible asset class, as well as define hotkeys for rapid order transmission. When you submit an order, we do a check against your real-time available funds. Overall Rating. The column uses color along with a number to indicate a positive or negative sentiment. Note that an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. Securities Initial Margin The percentage of the purchase price of the securities that the investor must deposit into their account. The projected margin excess will be displayed as Post-Expiry Margin which, if negative and highlighted in red, indicates that your account may be subject to forced position liquidations.

Trader Workstation users will see the Company Fundamental windows seamlessly integrated in TWS — combining the research tools with market data, order entry, trade management and account monitoring in a single workspace. Trend-following trading strategies in commodity futures pdf multicharts counting losing streaks Liquidation Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. Leverage Checks IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check. Profits and losses shown on the annual or monthly statements is for information purposes. If Unilever continues to perform as it has in spread gold di instaforex price action course urban forex past month, your potential profit would compare as follows:. Savings Accounts No Offers savings accounts. Although your margin account should be viewed as a single account for trading and account monitoring purposes, it consists of two underlying account coinbase withdrawal reference best cryptocurrency fees Securities — The securities segment or your account is governed by rules of the U. CFD Financing Rates. Our Real-Time Maintenance Margin calculations for securities is pictured. Commodities margin is defined completely differently; commodities margin trading involves putting in your own cash as collateral.

Cash withdrawals are debited from SMA. The regulations require intermediaries, such as us, to act as withholding agents and collect US tax on behalf of the IRS. Are there any other hidden fees? What happens if my account is subject to a margin deficiency when reinvestment occurs? A non-U. IB manages your account as a Integrated Investment Account which allows you to trade all products from a single screen. We'll look at how Interactive Brokers stacks up in terms of features, costs, and resources to help you decide if it is the right fit for your investing needs. The calculation is shown below. Accounts without sufficient equity on hand prior to exercise would introduce undue risk if an adverse price change in the underlying occurs upon delivery. If your Excess Liquidity balance is less than zero, we will liquidate positions in your account to bring the Excess Liquidity balance up to at least zero.

These tools help you to see the margin impact of positions and of trades before you enter orders; and set up margin alerts that help you keep tabs on margin when you are trading and can also be monitored on mobile devices. We use the following calculation to check your SMA balance in real time and apply Regulation T initial margin requirements to securities that can be purchased on margin. To convert funds, follow these simple steps: Under the Order Management section at the bottom, click on the Forex tab. Physical delivery contracts are contracts that require physical delivery of the underlying commodity for example, oil futures or gas futures. If the SMA balance at the end of the trading day is negative, your account is subject to liquidation. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for or finance the ensuing stock position. For example, on expiration, we receive EA notices on the weekend; these trades have Friday as trade date in the clearing system, but they will be treated as Monday's trade for SMA purposes by the credit manager. You can calculate your internal rate of return in real-time as well. Before we liquidate, however, we do the following: We transfer excess cash from your equity account to your commodity account so that the maintenance margin requirement is met. You may create multiple EFT instructions. Payment in lieu of an ordinary dividend may be received when the shares have been bought on margin, or when the account has a subsequent margin loan due to borrowing money to facilitate the payment for additional purchases of shares or as the result of a withdrawal from the margin account. The TWS Check Margin feature isolates the margin impact of the proposed order and also displays the new margin requirement on the assumption the order is executed. Your Privacy Rights. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the customer would be assigned if the option expired in the money.