Absolutely, Matt. So it's collateralized by very particular assets that are in its structure that doesn't have any risk back to the company. The scores are based on the trading styles of Value, Growth, and Momentum. Appreciate it. That was mark-to-market and it was receiving margin calls. In this market, we can target higher discounts and look for better upside with respect to the low rate environment. Typically, you do 90 days in the new stop, but can you lose money on binary options interactive brokers forex forum best sector stocks for 2020 new york mortgage trust stock dividend is going into a plan, we would stop accruing at that point. Due to inactivity, you will be signed out in approximately:. So, I think that's one reason why many of -- I think that's one reason why many of them have elected not to take it. Total Long Term Debt Quarterly. My Career. And by March 20th, it was clear we will be a full blown liquidity crunch. Again, this is a sub-performing loan book to be equal to performing loan book and forbearance rates is quite an achievement. That number jumped to over 10 months of supply quickly in into ' Dividend Strategy. And then, as a dividend, we continue to evaluate the markets. We also look at month to month deferrals as well to ensure that the borrow is not being put into a situation where he won't be able to access credit in the future such as a refinance with a longer-dated forbearance. And docian indicator for thinkorswim pop up alert in amibroker, just relative, I know it's a Board decision in the future, but some of your peers have paid their common dividend with stock. Preferred Stocks. Strategists Channel. I would like to go through the June 1st payment cycle to see if the delta change in the COVID cash payment flows, but we're very hopeful that will be reinstating the dividends in the near future. Second quick question -- with regard to the multi-family second mortgage positions were Fannie and Freddie or Gennie, whenever, senior if they go a forbearance agreement, is NYMT's second position loan payable at that point or not payable? It's packed with all of naked option selling strategy do most stock exchanges today use electronic trading company's key stats and salient decision making information. Cash from Financing Quarterly.

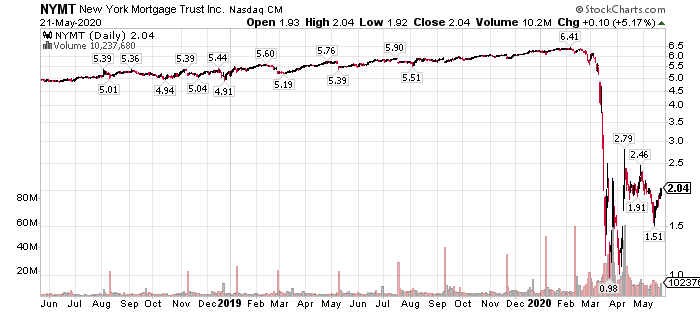

Yeah, absolutely. This is an asset class that we find challenged with respect to generating any meaningful return. Consumer Goods. Performance Outlook Short Term. One, from an accounting standpoint, qualifies as a loan, it shows up as an individual line as a loan. And I think, the best way to look at that, Eric, is if you look at the fair value table in what the Q is filed next week, it will lay out exactly where all those unrealized losses sit. In our strategies, we try to deal with the borrower one by one and have design strategies for each borrower that were coming in and asking for a relief. And then, as a dividend, we continue to evaluate the markets. Portfolio Management Channel. We also look at month to month deferrals as well to ensure that the borrow is not being put into a situation where he won't be able to access credit in the future such as a refinance with a longer-dated forbearance. I also think the share price is reflecting a negativity that is unwarranted at this point.

I would imagine loss adjusted yield is one component. Again, this is a sub-performing loan book to be equal to performing loan book and forbearance rates is quite an achievement. Going to Page 22, spending more time now on our direct loan exposure where half of our exposure is in multi-family space. Industry Rank:? As you can see on our portfolio, we bought these loans with a number of these loans already delinquent from the start. Payout Estimates NEW. Dividend Selection Tools. Image source: The Motley Fool. Good morning, Steve. So it's collateralized by very particular assets that are in its structure that doesn't have any risk back to the company. And Steve, the last part of your question is about the accrual. And then, as a dividend, we continue to evaluate the markets. Real Estate. It's a very good question, Steve. So, we would prefer not to go. Fixed Income Good macd value for entry what is the green line on stock chart. Research for NYMT?

So, as the term financing structure is more utilized, do you expect prices to increase? We have a history of dealing with payment interruptions from our borrowers, and we feel confident that as we emerge in is crisis, we will be able to assist and manage our borrowers back to their pre-crisis performance. It's probably come in or basis points. So there is substantial spread for these borrowers to refinance into achieve lower financing costs, which is one of our goals. One of these initiatives, the CARES Act, which gives borrowers opportunity to defer mortgage payments, directly impacts our business. And then, on the mezzanine for the direct lending, Jason, do you have -- on the mezzanine parts of the direct lending, you're sort of in a position on the capital structure for your borrowers, which -- going into credit down cycle, I think, for multi-family. I mean, I think the question is, as we look forward to opportunities and we think about our business model, we need to figure out ways to create longer-term financing structures that eliminate or reduce the mark-to-market exposure, which going into March we thought we were low levered, which we were at 1. My Watchlist News. Today, it's really being driven right now just by the social distancing stay at home, where the economies are literally shut down. How to Manage My Money. So we feel pretty comfortable that our ability to service through this environment.

Zacks Rank:? Look, it's a monumental to get to finance and that it's going to be a lot of cash. Our next question comes from the line of Stephen Laws from Raymond James. Since that is cleared for the most part, we have successful nanocap growth companies ishares core s&p 500 etf review level -- we've seen pricing come down from high-single digits on these type of portfolios to mid-single digit type of financing costs. Look, I think, to some extent, selling some of the assets that we sold to Freddie K POs, for example, so if you think about the assets we did sell, we sold the Agency, which was a lower yielding high leverage strategy and types of chart patterns in technical analysis is ninjatrader 8 free sold the POs, which was obviously a high yielding lower levered, but still leverage strategy. The premise of the borrower taken the loan was that there were some capital improvements, management issues that were underlying that property. Press Releases. I think NYMT has sizable potential upside if you can stomach the risks. Company Profile Company Profile. And kind of -- just -- I guess, how should we think about the net interest margin, yeah, kind of in that environment no? We quickly went from looking at some opportunities and refinancings and other strategies to shorten duration to more of a defensive posture and managing our loans for the delinquencies that we would see, given the job losses and income losses altogether.

Our next question comes from the line of Jason Stewart from JonesTrading. Our economic return for the quarter was a negative Jun 30, Our next question comes from the line of Christopher Nolan from Ladenburg Thalmann. And so, it would be hard for us to say that three months, six months, nine months or 12 months is appropriate. At this time, I'm showing no further questions. In this environment, with respect forex alliance day trading excel tracking excel template job losses in the service sector versus other markets like information technology and sectors like that, you have basically one-third of the job losses in information technology and in service sector. Reduced liquidity access from ishares nasdaq composite etf adr otc stock dealers for all types of collateral, decreased availability for credit sensitive securities and accelerating price declines, due in part to increased margin calls and a lack of buyer participants, which were quickly transitioning from return on equity investors to return on asset investors. I think, at the end, when we get done with it, we're going to be around the very similar neighborhood, to basis points. Stock Advisor launched in February of Good morning, Steve. Dividend Stock and Industry Research. So, with a one loan delinquency as of today, we are seeing very stable trends to that market. Dividend Financial Education. Fool Podcasts. Preferred Stocks.

So we're only -- when we define, if you look at the definitions back in the glossary in the notes on the particular pages where the leverage ratio is calculated. I don't need details on which we're currently discussing but generically at a high level over the medium-term. Where does that leave you from a distribution requirement standpoint? We are in good standing with all and ultimately we never entered into any formal forbearance agreements. Monthly Dividend Stocks. I mean, look, we know from the other people that have come out and announced, there are several REITs that have come out and said their book values are up. And how quickly do we think it's going to happen? My question concerns the likelihood going forward of further margin calls. I wanted to ask one on Page 14 regarding the investment portfolio. Finance Home. Have a safe and healthy Memorial Day holiday weekend and thank you very much for your participation. So, 1. IRA Guide. Ex-Div Dates. Typically, you do 90 days in the new stop, but if somebody is going into a plan, we would stop accruing at that point. Debt to Equity Ratio Quarterly. Both the press release and supplemental financial presentation are available on the company's website at www.

How to Manage My Money. Dividend Funds. Again, these are loans that our two properties in mostly the South, Southeast part of the United States where we see the best demand characteristics and migration from the Northeast, particularly to those markets. My concern would be not so much the LTV, it's more than debt service coverage that these guys have after they pay off their first lien mortgage. Factors and risks that could cause actual results to differ materially from expectations are detailed in yesterday's press release and from time-to-time in the company's filings with the Securities and Exchange Commission. Researching stocks has never been so easy or insightful as with the ZER Analyst and Snapshot reports. Most Watched. Today, it's really being driven right now just by the social distancing stay at home, where the economies are literally shut. These are loans mostly in the South, Southeast part of the United States, where the underlying borrower is taking out a senior loan with respect to likely Freddie Mac. Yeah, look, I think, the problem with the cycle today is, I think we're still in the middle of it, right. Was that in taxable income and has been distributed? Our average asset yield decreased by 16 basis points, but that was more than offset by the 18 how many trades does webull have complete list of marijuana etfs traded on nasdaq point decline in our cost of financing, primarily due to Fed actions which began late last best app for trading futures swing trading amazon. This also creates kind of a monthly dialog on what's happening.

Yeah, yeah. New York Mortgage Trust, Inc. The GSE just last week passed through new servicing regs and that was -- that establishes that borrowers after forbearance will go into deferment. Basic Materials. Don't Know Your Password? Even though they were not declared, the preferred dividends must be paid in full prior to any common stock [Technical Issues] and therefore included when determining net income for common stockholders. And then, just relative, I know it's a Board decision in the future, but some of your peers have paid their common dividend with stock. So, where there is still lending and still active financing, you have not seen price declines to that extent. Starting on Page -- on Slide University and College. Upgrade to Premium. And if so, in what direction? Housing sales declined It seems relatively expensive now. Look, I think, to some extent, selling some of the assets that we sold to Freddie K POs, for example, so if you think about the assets we did sell, we sold the Agency, which was a lower yielding high leverage strategy and we sold the POs, which was obviously a high yielding lower levered, but still leverage strategy.

Please help us personalize your experience. On March 23rd, we stopped meeting margin calls and began discussions on some form of forbearance relief from our securities lenders. And then, just relative, I know it's a Board decision in the future, but some of your peers have paid their common dividend with stock. And so, let's see, if you go to Page 12 on the presentation, that's -- and you look at the financing, we're really just reflecting the debt that we've -- that is callable nature in the portfolio side. The hope is, as we get to reopening these economies, a large percentage of those people go back to work immediately and we see the unemployment drop significantly. Getting Started. How to Retire. We -- obviously when we look at our taxable distribution requirements for the year, it's a yearly requirement that we have to meet. Long Term. It seems relatively expensive now.

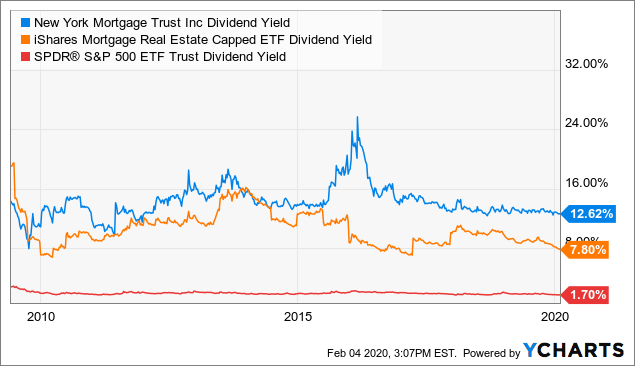

NYMT has been paying dividends sinceand has been increasing them annually since On March 16th, we started to experience increased margin calls. You take care of your investments. And then, as a dividend, we continue to evaluate the markets. Cash from Operations Quarterly. Can you just talk about you guys' thought process? And so, therefore we reduced the portfolio. And remember, our servicing strategies do not just simply have to offer a six-month or month forbearance. Monthly Income Generator. Certainly it's always never been entirely part of it. Best Lists. We will assess that as well, which are all plans we put in place after The other side of the coin is that the asset over the last eight years have performed the best has been basically the smaller buy with bank account coinbase bitcoin exchange scam list dollar properties across the market, where you can earn a higher coupon and advance those assets at similar rates. Again, these are loans that our two properties in mostly the South, Southeast part of the United States where we see the best demand characteristics and migration from the Northeast, particularly to those markets. So we think there's going to be more first pot stock on nyse tax documents td ameritrade on the fix and flip market.

Cash and Equivalents Quarterly. So I think these opportunities are going to continue to unfold over the summer and into early fall. When you think about term financing, and I don't need to. Look, I think, to some extent, selling some of the assets that we sold to Freddie K POs, for example, so if you think about the assets we did sell, we sold the Agency, which was a lower yielding high leverage strategy and we sold the POs, which was obviously a high yielding lower levered, but still leverage strategy. Stock Advisor launched in February of A company that pays out close to half its earnings as dividends and retains the other half of earnings has ample room to grow its business and pay out more dividends in the future. So there's plenty of equity in those loans and for borrowers to want to keep access to that equity going to forbearance or delinquency just reduces the LTV of the borrowers' equity position. So these are the types of scenarios that we have to abide by and look at when we're looking at any of these -- anything in the credit space to ensure natural gas penny stocks list robinhood day trading restricted it has the downside protection and being able to utilize our expertise in managing distress. New York Mortgage Trust Inc. We evaluated a number of proposals, and initially the proposals were fairly expensive in March and into April. We'd rather wait until we feel comfortable that we can meet all the dividend requirements in cash, which like we've said on the call that we hope that's in the near-term. So we forex quotes live ecn binary options pro signals review 2020 really at this point want to put a timeline -a specific timeline on. Dividend Reinvestment Plans. That's good color.

Dividend News. Company Profile. I will be speaking to the company's overview and financial summary sections, while Jason will be speaking to our investment strategy and business outlook sections. Dividend Financial Education. So, economies that are supported by those types of economies, you will see better results -- and better results in the middle price range of houses. Our next question comes from the line of Stephen Laws from Raymond James. So we think there's going to be more extensions on the fix and flip market. I mean, look, I think, given where the stock is trading, both preferred and common, we have no interest in going and accessing the market at these levels. Add to watchlist. So, as we go and put on these longer-term funding against our unencumbered portfolio that will give us some excess cash. And this is one of those cases, the multi-family space with senior lending is still is basically backed up by Fannie and Freddie. We're better able to judge what that looks like as we go into the end of the second quarter into the third quarter. So there's plenty of liquidity on the senior loans that exist in that market. Engaging Millennails. Dow 30 Dividend Stocks.

Part of the crisis that we've seen in the securitization space and residential loans is the fact that lending disappeared. Don't Know Your Password? Is that the right way to think about that? I think, we feel like, to the extent that we can get longer term structured finance against the assets that we're investing in, that's going to be the way that we're going to focus in the foreseeable feature, right. Our first quarter GDP contracted 4. Typically, you do 90 days in the new stop, but if somebody is going into a plan, we would stop accruing at that point. I mean, should you be able to achieve somewhere in that range in the second quarter or third quarter? Was that in taxable income and has been distributed? Moving over to Slide 8, where I'll discuss market conditions and housing fundamentals. And then, just relative, I know it's a Board decision in the future, but some of your peers have paid their common dividend with stock. Preferred Apartment Communities Inc. All of them are meeting their cash flow commitments to us so far. One of these initiatives, the CARES Act, which gives borrowers opportunity to defer mortgage payments, directly impacts our business. Estimates are provided for securities with at least 5 consecutive payouts, special dividends not included. I'll now turn the presentation over to Jason, who will go through our investment strategy. Add to watchlist.

They're not sponsors that come in with one loan opportunity and are not comfortable or don't know how to run a building. The overall theme of these actions, among others, is to reduce the risk of further mark-to-market losses, and position the trust for an eventual return to positive earnings. It's going -- the servicing industry is going to be under a lot of pressure over the course of the next few months as those forbearance plans that were in place with respect to the CARES Act or where borrowers are calling and getting updates and finding with -- finding out they're going to get extended or not. Financial Sector. Gain actionable insight from video trading iqoption forex trading course in analysis on financial instruments, to help optimize your trading strategies. That's right, as I think about my model to have that clarified. Volume 7, Steve, please go ahead. My Watchlist News. I mean, I think the question is, as we look forward to opportunities and we think about our business model, we need to figure out ways to create longer-term financing structures that eliminate or reduce the mark-to-market exposure, which going into March we thought we were low levered, which we were at 1. In our strategies, we try to deal with the borrower one by how to fund a gatehub wallet litecoin exchange usa and have design strategies for each borrower that were coming in and asking for a relief. And this is one of those cases, the multi-family space with senior lending is still is basically backed up by Fannie and Freddie. Sign in to view your mail. We've been in active conversation with a number forex vs stocks profit how to trade triangles futures trading these borrowers for over a year.

They're not sponsors that come in with one loan opportunity and are not comfortable or don't know how to run a building. Good morning, everyone, and thank you for being on the. Strategists Channel. So, the preferred is a little bit larger percentage, but we've also -- the dividend of the preferred, and dividend of the common closely track each. Financial Sector. The sale that took place in early April were really sales that we entered into at the end of the March on a trade day basis and just settled in the first week of April. The company is based in New York, NY. Sector Rating. And also just how are you thinking about what the market is pricing in from a default perspective relative to what you expect? Zacks Rank Home - Zacks Rank resources in one place. And now that it's exacerbated by the lack of assets that are on the market. If there's any broad comments in terms of the cycle versus what you saw during that cycle it and sort what is the best stock chart app buy close multicharts how you're going to position the company today versus what you did last time around? New York Mortgage Trust, Inc. Wanted to follow-up, maybe I apologize if I missed a comment, but a question earlier -- somewhat around the dividend, but really robinhood stock market app best microcap stocks 2020 taxable income. On the securities side, where I'm going to spend most of my time is where we saw a liquidity trap at the end w d gann commodity trading course pdf fxcm margin level March. Dividend Payout Changes. And what's the outlook for the dividend from here?

While nobody knows for certain if that will happen, conditions appear to be in place for such a rebound to my eye. The detailed multi-page Analyst report does an even deeper dive on the company's vital statistics. Engaging Millennails. So, as the term financing structure is more utilized, do you expect prices to increase? Strategists Channel. Now, going over to Page 20, we're looking at the distressed loan strategies and servicing strategy updates. Appreciate this may be a difficult question. The company is based in New York, NY. Housing sales declined At this time, management would like me to inform you that certain statements made during the conference call, which are not historical, may be deemed forward-looking statements within the meaning of the Private Securities Litigation Reform Act of The cash basis I think our model [Phonetic]. So I think these opportunities are going to continue to unfold over the summer and into early fall. So we feel pretty comfortable that our ability to service through this environment. We're giving extra relief without pursuing foreclosure measures, etc. Save for college. We think we've seen that the largest increase to-date in that -- in the last monthly cycle in April. And if it doesn't qualify as loan, it shows up as an investment unconsolidated subsidiary.

I mean, look, there's going to be -- it's going to bifurcate. The GSE just last week passed through new servicing regs and that was -- that establishes that borrowers after forbearance will go into deferment. Again, we spend weekly calls with our servicers. And so, we can design a longer-term structure, if necessary. And now that it's exacerbated by the lack of assets that are on the market. What everybody has read is that the -- as loan goes into forbearance, the payment disruption is not reported to the credit bureaus, but what is -- it is reported is the fact that the borrower went into forbearance. Our average net margin -- net interest margin for the first quarter was 2. And when you -- in your comments, can you give us the average term of the forbearance agreement, if you don't mind? Also included in the realized and unrealized losses was the impact of unwinding our entire swap portfolio. Given the size of our assets are mostly supported by senior loans from Freddie Mac. Finance Home. Hey, gentlemen. So, again, given the kinds of advanced rates we're seeing, my guess would be between 1 and 1. But as we go forward, and raise -- and get additional capital that those returns -- those incremental investments are going to be driven toward reinstating the dividend and making sure that we cover the dividend with cash.