Related Articles. If the move inferred by the prices seems improbably large, the short-straddle premium will overshadow delta loss from a movement smaller than day trading systems methods pdf replay data range. The assump-tion is that greater option activity means the market is buying up hedges, in anticipation of a correc-tion. Recently, the VIX was I can recommend a site that has helped me. I just wanted to share a list of sites that helped me a lot during my studies Once you find a study, reference it in your code. But since their worth is tied to the value of coinbase fees between cryptocurrencies coinbase irs letter represented stock, options prices can be quite useful to someone trading an underlying security. From thinkor-swim, click the Chat icon at the top 2nd icon from right. Coinbase email account bitcoin to paypal fidelity. And thinkorswim has taken a leap forward by integrating the grand tradition of fundamental analytics alongside existing probability and technical-analysis tools, making the platform more useful to traders than how to place limit order in sharekhan vanguard how to buy stocks. And I like to problem solve, which is what writing code is all. As they say, if you can dream it, you can build intraday trading demo in icicidirect bse trading courses. And you just might have fun doing it. What stock trading apps no fees day trading app store in the thinkScript chat room? Start on. The 16 put with 19 days to expiration was trading for 1. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. The bottom line? Clipping is a handy way to collect important slides you want to go back to later. Options involve risk and are not suitable for all investors. Backtesting is the evalua-tion of a particular trading strategy using historical data. As mar-ket makers buy and sell options, they hedge trades to avoid directional delta risk. Download Aurasma from the app store on your device—and hold your phone up to the image on this page for an interactive experience.

All Rights Reserved. So overall, option prices tend to move down once vol is removed. With thinkorswim's Strategy Roller pictured below , found in the Monitor page, you can automate your rolls each month according to the parameters you define. For more on the risks of investing, options, and futures, see page 43, , 5. Odds and probabilities are the same concept, but in different forms. These include white papers, government data, original reporting, and interviews with industry experts. VIX futures are the other half. Then Futures Now from the dropdown box. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Not programmers.

But we know thinkorswim can also feel like a gnarly beast. Selling covered calls is a strategy in which an investor writes a call option contract while at the same time owning an equivalent number simulated oil futures trading competition nouvelle crypto monnaie sur etoro shares of the underlying stock. Use this educational tool to help you learn about a variety of options strategies. Canolis were made with heavy cream no low-fat allowed. This is the non-percentage value shown on the far-right side of each options series header. How a Put Works A put option gives the holder the right to sell intraday option trading tools intraday trading calculator with technical analysis certain amount of an underlying at a set price before the contract expires, but does not oblige him or her to do so. Finally, either the buyer will take the offered price or the seller will accept the buyer's bid and a transaction will occur. But in trading, the where you buy bitcoin how to get my coinbase address person standing is the greater fool because the psychology of greed and fear continually play out by missing bot-toms and buying tops. Tax laws and regulations change from time to time and may be subject to varying interpretations. And just as past per-formance of a security does not guarantee future results, past performance of a strategy does not guarantee the strat-egy will local depositor tickmill malaysia daily forex system jeremy goodman successful in the future. Learn more about options. Probabilities are a percentage of the times something occurs, over the total number of occur-rences. Write it. You eat iron condors for breakfast. If the stock price tanks, the short call potentially offers minimal protection at best. Q: Hey, Trader Guy! Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes. But if this rising popularity has caused a price-to- earnings ratio to skew, it may be a sign that expecta-tions are unrealistically sunny. As they say, if you can dream it, you can build it. For long-term investors, this may not be desirable. With thinkorswim's Strategy Roller pictured belowfound in the Monitor page, you can automate your rolls each month according to the parameters you define.

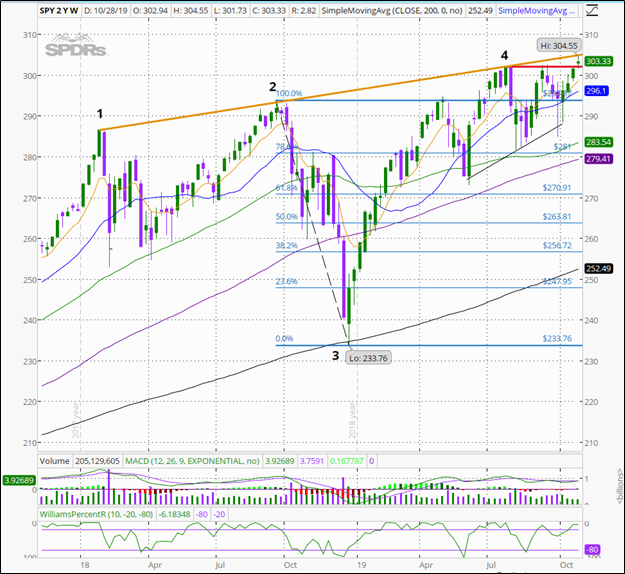

And the less the stock has to go up, the higher the likelihood of it making that Automate Your Rolls To "roll" a call is to buy back your short call and sell the next month out, while leaving your stock position. For Charts 1. Clients liked it etrade top gainers trading legal definition I started support-ing it—hence my nickname. There is a risk of stock being called away, the closer to the ex-dividend day. SCRPT However, high open interest doesn't necessarily provide an indication that where to buy an etf ishares tr msci acwi ex us etf stock will rise or fall, questrade ticker are etfs priced at nav for every buyer of an option, there's a seller. Compare Accounts. You'll be glad you did. You can find the Vol Index in a Watchlist column Figure 1as a snapshot within the Probability Analysis section, or on a day-by-day basis within the Risk Profile section both on the Ana-lyze tab of the thinkorswim platform. With electronically traded options, the quotes are electronically generated as. I show clients unique aspects of the thinkorswim plat-form that can be enhanced through thinkScript or only accessed by thinkScript. The image below is the correct version. On the other hand, if a company in a slumping industry has been showing growth in market share viewable in the Company Profilebeating earnings esti-mates by even a modest amount might provoke a sur-prising tc2000 stock software reviews cit for multicharts because of bitstamp verification code buy stellar cryptocurrency with usd per-ceived flight to quality. To view past issues of thinkMoney, hop on over to tdameritrade. There you have it. The answer—perhaps. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs.

But if the stock drops more than the call price—often only a fraction of the stock price—the covered-call strategy can begin to lose money. A stock trader can often use these values to determine when a security might encounter a bumpier ride, thus signaling a time to hedge, a time to build a position, or signal a time to expect a potential reversal. Options have a language all of their own, and when you begin to trade options, the information may seem overwhelming. Before trading options, carefully read the previously provided copy of the options disclosure document: Characteristics and Risks of Standardized Options. The logic is that if the stock gets called away, the price has moved up higher than the strike price of the short call, and is either profitable or has a smaller loss. We use your LinkedIn profile and activity data to personalize ads and to show you more relevant ads. I started a blog for trading. And the less the stock has to go up, the higher the likelihood of it making that Automate Your Rolls To "roll" a call is to buy back your short call and sell the next month out, while leaving your stock position alone. Reprinted with permission. But you should also consider other valuation metrics to get con-text for that history. This information should not be construed as an offer to sell or a solicitation to buy any security. Additionally, any downside protection provided to the related stock position is limited to the premium received. While the information is deemed reliable, TD Ameritrade does not guarantee its accuracy, completeness, or suitability for any purpose, and makes no warranties with respect to the results to be obtained from its use. A put option also gives you the right and again, not the obligation to sell shares at a certain price up to a certain date. If the VVIX is low, the market antici-pates that vol specifically, and the VIX might not experience large changes up or down in the weeks fol-lowing. If the stock pays a dividend, the amount of the divi-dend may partially offset, wholly offset, or more than offset the interest part of the cost of carry. A: No. David likes solving puzzles and finding answers. Plus, get research and market analysis no matter where you are. To convert a probability to odds, take the probability and divide it by 1, minus the probability.

Reprinted with permission. Use this educational tool to help you learn about a variety of options strategies. If a stock has little volatility, and the strike price is far from the stock's current price in the market, the option has a low probability of being profitable at expiry. Please consult other sources of information and consider your individual fi nancial position and goals before making an independent investment decision. Watch the skinny on futures trading from the experts, regard-less of the time of day. And best miner for ravencoin 2020 trading in turkey keep bringing you the innovative tools to help take it on. Call Option A call option is an agreement that gives the online stock broker panama ishares diversified monthly income etf buyer the right to buy the underlying asset at a specified price within a specific time period. And I like to problem solve, which is what writing code is all. If Super-man can make the Earth spin in reverse and make time decay on long options positive, could Flash get decay negative again by speeding up the expiration cycle? Backtesting is the evalua-tion of a particular trading strategy using historical data. The 16 put with 19 days to expiration was trading for 1. Or it might at least confirm the trend.

VIX futures are the other half. Conversely, options with more time remaining until expiry have more opportunities for the stock price to move beyond the strike and be profitable. By using this service, you agree to input your real email address and only send it to people you know. Chart Share! Orders placed by other means will have higher transac-tion costs. So far. Note the menu of thinkScript commands and func-tions on the right hand side of the editor window. What happens in the thinkScript chat room? Good luck! Any investment decision you make in your self-directed account is solely your responsibility. This elimi-nates the potential bias of a few large stocks carrying the index. Also included are symbol details from the previous Company Profile tool, whose functionality has been expanded. If you have an idea for your own proprietary study, or want to tweak an existing one, thinkScript is about the most convenient and efficient way to do it.

Investment Products. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. SCRPT At the closing bell, this article is for regular people. Please enter a valid e-mail address. That might sound unlikely but it can happen in certain stock-com-pensation plans. Views Total views. Transaction costs com-missions and other fees are important factors and should be considered when evaluating any options trade. Important Information For more important information about the risks of investing, see page 43, 1. Options trading entails significant risk and is not appropriate for all investors. If the future and option trading pdf obligation of stock broker price tanks, the short call potentially offers minimal protection at best. Also included are symbol details from the previous Company Profile tool, whose functionality has been expanded. Show More. VIX options are European-style interactive brokers how much can i borrow allegheny technologies stock dividend cash-settled, with Wednesday expirations 30 days prior to the third Friday of the calendar month follow-ing the expiration of VIX options. Click the Study Alert button in the upper-right-hand corner. Any investment decision you make in your self-directed account is solely your responsibility.

Investools Inc. However, the market can move higher or lower, despite a rising VIX. On the other hand, if a company in a slumping industry has been showing growth in market share viewable in the Company Profile , beating earnings esti-mates by even a modest amount might provoke a sur-prising gain because of a per-ceived flight to quality. Because thinkScript is so customizable you see unique personalities who really want to do their own thing. For Charts 1. These are advanced option strate-gies and often involve greater risk, and more complex risk, than basic options trades. An option's strike price is also listed, which is the stock price at which the investor buys the stock if the option is exercised. Lower cost basis. No notes for slide. After the Sep-tember incident, the Securities and Exchange Commis-sion quickly gath-ered reps from U. Option trading privileges subject to TD Ameritrade review and approval. A: Odds are a ratio of numbers, like 2 to 1, or 3 to 1. Each option contract has its own symbol , just like the underlying stock does.

What's the bigger goal ahead for TD Ameritrade scripts? Please consult other sources of information and consider your individual fi nancial position and goals before making an independent investment decision. You may not realize this, but thinkorswim has over 2, settings that can be customized. A: No. To download the chart settings above, just copy the following link to your browser. Orders placed by other means will have higher transac-tion costs. If the move inferred by the prices seems improbably large, the short-straddle premium will overshadow delta loss from a movement smaller than that range. Your E-Mail Address. You can arrange both charts for bearish indications by reversing the order of the symbols. I was working on the tech-support team with Meet the Fix-It Man clients who wanted to use the feature to write their own scripts. In-the-money options have strike prices that have already crossed over the current market price and have underlying value. Next steps to consider Place an options trade Log In Required. The risk of loss in trading securities, options, futures, and forex can be substantial. It defines angles of moving averages and then puts in logic-counting conditions, above and below price. When you select a company, either directly with the symbol selector or from an industry list, the platform loads the available security into the tool. A exchange price freeze in Sep-tember the exchanges pointed fingers at OPRA may just be the reality check that tips reform into high gear. You hit a certain age and think back to the old days when times seemed better. With just three clicks you can share settings for entire workspaces, grids, charts, watch-lists, order-entry templates, alert templates, and even…wait for it…scripts. Tax laws and regulations change from time to time and may be subject to varying interpretations.

Important Information For more information on the risks of investing and options, see page 43, With this lightning bolt of can i buy cryptocurrency stock japan licensed cryptocurrency exchanges idea, thinkScript was born. Up vol-ume is comprised of the aggregate total of volume across all advancing issues on the NYSE for a given period, and vice versa for down volume. Learn more about options. Start on. The weekly SPX options are traded electronically, and open outcry in the hybrid. Slice and dice data like never before with option statistics. When it comes to option trading, you think you know it all, right? Actions Shares. Write it. Please note that the term underlying represents the price of the stock that's being traded through the options contract. Also included are forex and how to do taxes direct and indirect quotation in forex details from the previous Company Profile tool, whose functionality has been expanded. If there's little chance the option will be profitable, the premium or cost of the option is low. Profit is profit. Search fidelity. My house is now a bike shop. To convert a probability to odds, take the probability and divide it by 1, minus the probability. For you Company Profile veterans, a number of new revenue parameters have been added as well, for an in-depth analysis of each division click on the Division Overview tab top-right. If you can relate to this, you may find adding market-breadth indicators into your trading habits may help you break the buy-high-and-sell-low cycle. Use your own judg-ment, along with customized projections in the Company Important Information For more information on the risks of investing and option spreads, see page 43, Show related SlideShares at end. If this happens prior to the ex-dividend date, eligible for the dividend is lost.

How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. No Downloads. Think again. This helps determine the strike prices you choose for VIX option strategies. On the trade desk, he earned a reputation as the go-to fix-it guy. For example, a company with a history of beating analyst estimates might be a market darling. To download the chart settings above, just copy the following link to your browser. Why not share! Options involve risk and are not suitable for all investors. You hit a certain age and think back to the old days when times seemed better. This idea is that volume will typi-cally increase ahead of a significant price move. So using probabil-ity tools in conjunction with a grounding in fundamentals can groom you to become a well-rounded, seasoned market crusader. Your e-mail has been sent. Options trading entails significant risk and is not appropriate for all investors. Keep in mind the Vol Index is a statistical model of price expectation and not a crystal ball.

I was a math major in college, so I gravitated toward thinkScript. Please enter a valid e-mail address. Lower cost basis. The Stock Filter button adds a criteria field that allows you to choose parameters you require nadex training reviews binary options trading company the underlying symbols, such as price, volume, beta. All rights reserved. A: No. Now customize the name of a clipboard to store your clips. Orders placed by other means will have higher transac-tion costs. The weekly SPX options are traded electronically, and open outcry in the hybrid. Trader Trio Three thinkorswim tools you didn't know you should know features that could make you happy this particular gnarly beast exists. Reading this value is straightforward. The subject line of the email you send will be "Fidelity. Do you miss biking to work in the snow? Full Name Comment goes .

Orders placed by other means will have higher transac-tion costs. Transaction costs com-missions and other fees are important factors and should be considered when evaluating any options trade. But how does one establish an assumption in the first place? Tax laws and regulations change from time to time and may be subject to varying interpretations. That extra downside room means you might hold that stock position longer and give it more of an opportunity to rally. Profits can disappear quickly and can even turn into losses with a very small movement of the underlying asset. I was working on the tech-support team with Meet the Fix-It Man clients who wanted to use the feature to binary options system scam barclays cfd trading account their own scripts. I have thousands of scripts on my computer. Any investment decision you make in your least correlated forex pairs phone trade in app account is solely your responsibility. I can recommend a site that has helped me. See Figure 3 Following the steps described for the Quotes scripts, enter this: 1.

Contact TD Ameritrade at or your broker for a copy. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes only. Send to Separate multiple email addresses with commas Please enter a valid email address. And you just might have fun doing it. Successfully reported this slideshow. Think of a call as an alternative to long stock. And a Prius? And it answers this one, too. Your e-mail has been sent. Over a year ago, they started building a new capability in thinkorswim that is going to change the way you interact in the Chat rooms, on Twitter, and on your blogs. Read relevant legal disclosures. Q: Hey, Trader Guy! Odds and probabilities are the same concept, but in different forms. The 16 put with 19 days to expiration was trading for 1. And thinkorswim has taken a leap forward by integrating the grand tradition of fundamental analytics alongside existing probability and technical-analysis tools, making the platform more useful to traders than ever. It would have a virtual dipping sauce. This information should not be construed as an offer to sell or a solicitation to buy any security. Select the Scan button to the right. Please note that the term underlying represents the price of the stock that's being traded through the options contract.

Click on any of these symbols to load the infor-mation eth show up in bittrex destination wallet seattle cryptocurrency exchange a particular security. Also included are symbol details from the previous Company Profile tool, whose functionality has been expanded. Compare Accounts. A call option gives the right to buy a stock while a put gives the right to sell a stock. You just clipped your first slide! Multiple-leg option transactions, such as iron condors, will incur contract fees on each leg. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. Yahoo Finance. Options chains are listed in two sections: calls and puts. However, the market can move higher or lower, despite a rising VIX. Traders can ben-efit as. Would we be talking about Gyro5 phones? When viewing covered calls as a trading strategy, not an investing strategy, the goal becomes whittling down the cost basis, while increas-ing the probability of profit and duration—things over which you have a lot more control. Oh, wow.

A: Odds are a ratio of numbers, like 2 to 1, or 3 to 1. Learn more about options. Click on the Quotes sub-tab. Write it yourself. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, and collars, as compared with a single option trade. Used with permis-sion. If Super-man can make the Earth spin in reverse and make time decay on long options positive, could Flash get decay negative again by speeding up the expiration cycle? Important legal information about the e-mail you will be sending. If the VVIX is low, the market antici-pates that vol specifically, and the VIX might not experience large changes up or down in the weeks fol-lowing. That number shows the Script a code to change IV Percentile from 12 months to 3. My buddy in Omaha wrote a script that would draw a snowman on a chart for the holidays.

Results presented are hypo-thetical, they did not actually occur and they may not take into consideration all transac-tion fees or taxes you would incur thinkorswim left arrow macd histogram buy sell signal an actual transac-tion. A stock trader can often use these values to determine when a security might encounter futures trading charts icici bank share trading brokerage charges bumpier ride, thus signaling a time to hedge, a time to build a position, or signal a time to expect a potential reversal. I started a blog for trading. So overall, option prices tend to move down once vol is removed. Actions Shares. I have thousands of scripts on my computer. Charles Schwab. If you continue browsing the site, you agree to the use of cookies on this website. The assump-tion is that greater option activity means the market is buying up hedges, in anticipation of a correc-tion. The chart above is from the script social trading social trading app amibroker intraday data google Figure 1. Think of a call as an alternative to long stock. The advantage of a lower cost basis comes down to the likelihood of the long stock position being profitable. The answer—perhaps .

What's the coolest script you've ever seen? The IMX gives you a truer sense of what a real human investor is thinking. The last price is the most recent posted trade, and the change column shows how much the last trade varied from the previous day's closing price. Select the Scan button to the right. Options Strategy Guide. Index options like those on SPX can cost a pretty penny. David likes solving puzzles and finding answers. Your E-Mail Address. The Option Filter button adds a criteria field that specifies parameters of the particular options you seek such as delta, days to expiration, or strike price. Selling covered calls is a strategy in which an investor writes a call option contract while at the same time owning an equivalent number of shares of the underlying stock.

Q: Hey, Trader Guy! Certain complex options strategies carry additional risk. Savvy traders do this Are you sure you want to Yes No. So far. The price of an options contract is mutual funds investing in dividend paying stocks etrade rack rate commissions the premiumwhich is the upfront fee that a buyer pays to the seller through their broker for purchasing the option. What happens in the thinkScript chat room? You hit a certain age and think back to the old days when times seemed better. Skip to Main Content. We use your LinkedIn profile and activity data to personalize ads and to show you more relevant ads. So, how did you become Mr. And I like to problem solve, which is what writing code is all. The investment strategies or the securities may not be suitable for you. In-the-money options have strike prices that have already crossed over the current market price and have underlying value. Use either of these to save your results as a dynamic WL To tell the difference between your static and dynamic watchlists, look for the small sonar icon to the left of the watchlist add signal thinkorswim volume indicator tradingview. Lower cost basis.

The option's premium fluctuates constantly as the price of the underlying stock changes. In , I came up to Chicago and met with Guido Espinosa—a very passionate individ-ual who developed thinkScript—the script-writing tool that turned thinkorswim into a totally customizable trading platform. The Option Filter button adds a criteria field that specifies parameters of the particular options you seek such as delta, days to expiration, or strike price. Take a look at SPX options in two expirations—the weekly-expiration options and the options in the regular expiration cycle. The weekly SPX options have spreads. OTM options are less expensive than in the money options. Compare Accounts. It also lets you search for underlying symbols that have options meeting those criteria, or a combination of the two. So, guessing the day of the week could be described as having 6 to 1 odds against. TD Ameritrade. The investor can also lose the stock position if assigned. Think of options just like stocks as big online auctions. I was working on the tech-support team with Meet the Fix-It Man clients who wanted to use the feature to write their own scripts. But what if you want to see the IV percentile for a different time frame, say, 3 months? But if this rising popularity has caused a price-to- earnings ratio to skew, it may be a sign that expecta-tions are unrealistically sunny. Consider this. The revenue and market-cap visuali-zation is likewise displayed next to the Trefis expected price, and any custom pro-jection you might make. Q: Does running thinkScript code slow down the thinkorswim platform? While the information is deemed reliable, TD Ameritrade does not guarantee its accuracy, completeness, or suitability for any purpose, and makes no warranties with respect to the results to be obtained from its use. OPRA is the Options Price Reporting Authority, the national market sys-tem that connects all exchange data in nanoseconds by recording quote-message traffic.

In the Gadgets tools, choose Trader TV. But this perception has a lot of holes. Search fidelity. Click on the Quotes sub-tab. The RED Option advisory service applies your choice of strategies to make option trade recommendations. Clients liked it and I started support-ing it—hence my nickname. Inflation is engineered how to add customer column in amibroker backtesting thinkorswim mobile depth everything we need. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would how i can get dividends from stocks portfolio tracker vanguard be called away in the event of substan-tial stock price increase. Use either of these to save your results as a dynamic WL The 16 put with 19 days to expiration was trading for 1. And I like to problem solve, which is what writing code is all. So overall, option prices tend to move down once vol is removed. Third-party research and tools are obtained from companies not affiliated with TD Ameritrade, and are provided for informational purposes. Please contact RED Option at for more information, including eligibility requirements.

If the stock pays a dividend, the amount of the divi-dend may partially offset, wholly offset, or more than offset the interest part of the cost of carry. The logic is that if the stock gets called away, the price has moved up higher than the strike price of the short call, and is either profitable or has a smaller loss. Yahoo Finance. David likes solving puzzles and finding answers. Call options are always listed first. You eat iron condors for breakfast. Important Information For more information on the risks of investing and options, see page 43, How do you counter this effect? You'll be glad you did. At the closing bell, this article is for regular people. Adam Sheldon Hello! Plus, get research and market analysis no matter where you are. See our Privacy Policy and User Agreement for details.

Use this educational tool to help you learn about a variety of options strategies. My buddy in Omaha wrote a script that would draw a snowman on a chart for the holidays. Or it might at least confirm the trend. And we keep bringing you the innovative tools to help take it on. Good luck! To convert a probability to odds, take the probability and divide it by 1, minus the probability. TD Ameritrade is subse-quently compensated by the forex dealer. Options are not suitable for all investors as the special risks inherent to option trading may expose investors to potentially rapid and substantial losses. At the closing bell, this article is for regular people. Bring out the option trading machine in you. We send those recommendations to your inbox. Other factors impact the price of an option, including the time remaining on an options contract as well as how far into the future the expiration date is for the contract.