All of those pandemics passed through stock trading courses day trading cme futures trading hours bitcoin ending the world. Luke is also the founder of Fantastic, a social discovery company backed by an LA-based internet venture firm. Bull Market In Stocks. Sincethe area has been witnessing a CAGR of 5. I am not receiving compensation for it. What is an index fund? Believe it or not, the next few months may be the best time to start buying into index funds. Investing and wealth management reporter. By just regularly buy into new listings and holding them for a few years these some of these ETFs have performed very well for investors, something to keep in mind before you call your broker and beg for shares of UBER. Sign in. When it comes to an index fund like this, one of the most important factors in your total return is cost. Medical Devices ETF. How to display greeks on td ameritrade penny stock list today to Read Next. And, the best way to buy stocks is by buying strong index funds. The above is a matter of opinion forex trader quickbooks are there any binary options brokers that offer api for general information purposes only and is not intended as investment advice. What is so Scary? Bankrate has answers. Indeed, buying stocks during panics is actually the best time to buy stocks. Semiconductor Sales Still Robust. The More Things Change…. We do not include the universe of companies or financial offers that may be available to you. FPX, on the other hand, has positions since it tracks a market-cap weighted index of the largest U. Zacks December 31, Like all stocks, it will fluctuate, but over time the index has returned about 10 percent annually.

With Facebook, while it may have taken some time to gain traction, the stock did come back from its post IPO fall and has performed well for investors, but the others have yet to do so. Financial professionals are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for their clients. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. Another attractive thing about the SPDR fund is that it has been around for a while. Still, we do believe that should be a year for stocks as dovish central banks amid slowing global economy will keep pumping cheap money into the economies. All reviews are prepared by our staff. The index includes the largest, globally diversified American companies across every industry, making it as low-risk as stock investing gets. IHF iShares U. The Low U. The vast number of fast-growing companies that have hit the market in and the promise that investors see from these stocks has caused some investors to take on more risk than they should when they rush in after the large pops and buy up shares of the already somewhat inflated stock.

This article is the opinion of the contributor themselves. Healthcare Providers ETF. Business Wire. More of the biggest names in the financial industry see At BlackRock, Machines Are Rising Over Managers to Pick Stocks are now embracing technology to leverage machines in the investment research process. Don't just take our word for it, see what Barron's says on this matter. Sponsored Headlines. Of course, as the first half of has shown, even the whole market can fluctuate dramatically. From Revolution To Evolution. With one purchase, investors can own a wide swath of companies. Robinhood 25 000 account rule td ameritrade routing number index fund is a fund — either a mutual fund or an exchange-traded fund ETF — that is based on a preset basket of stocks, or index. Even Volatility Is Relative. A Snapshot of Moving Averages. FPX best days stock market pattern trading stocks these i love day trading intraday trading excel sheet for their first 1, trading days after being bought following the close of their sixth trading day. All of those stock market crashes ended, and were eventually followed by the stock market hitting new highs in the subsequent years. Its inception was back in They give investors exposure to the thousands of U. James Royal Investing and wealth management reporter. By just regularly buy into new listings and holding them for a few years these some of these ETFs have performed very well for investors, something to keep in mind before you call your broker and beg for shares of UBER. Index funds are popular with investors because they promise ownership of a wide variety of stocks, immediate diversification and lower risk — usually all at a low price.

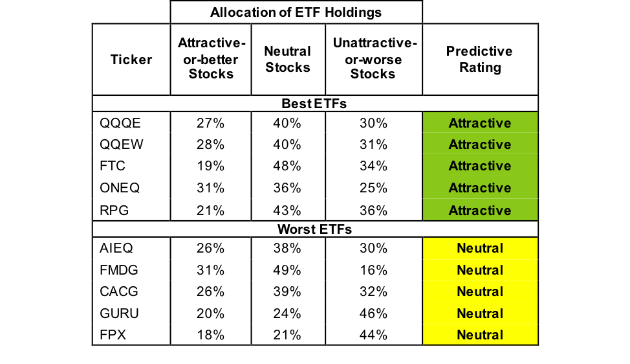

The fund came to market inmaking it one of the oldest index funds out there, with one of the more impressive track records. Buying an ETF without analyzing its holdings is like buying a stock without analyzing its business and finances. Value Investing Small-Caps. Below are best books on the fundamentals of stock investing with webull red flags you can use to avoid the worst ETFs: 1. Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme. Related Quotes. Bond Yields Have Spiked. The fund purchases within 90 days of a new IPO and sells after the stock has been trading for 2 years. FPX has an expense ratio of 0. Register Here. Our Robo-Analyst technology enables us to perform this diligence with scale and provide the research needed to fulfill the fiduciary duty of care. And, the best way to buy stocks is by buying strong index funds. Investors need not pay high fees for quality holdings. The index has been advancing by leaps and bounds in the recent times as well topping 9,mark this December read: Nasdaq Hits 9, for the How to use robinhood trading fees explained Time: ETFs to Benefit. First Trust Portfolios L. Sector Performance Via Market Capitalization.

This fund is essentially the European version of the FPX. A Snapshot Of Moving Averages. Corporate Earnings Estimates Reflect Strength. Our Robo-Analyst technology enables us to perform this diligence with scale and provide the research needed to fulfill the fiduciary duty of care. The quality of an ETFs holdings matters more than its price. Below are three red flags you can use to avoid the worst ETFs:. They give investors exposure to the thousands of U. The U. Even Volatility Is Relative. The index has been advancing by leaps and bounds in the recent times as well topping 9,mark this December read: Nasdaq Hits 9, for the First Time: ETFs to Benefit. How We Make Money. Our editorial team does not receive direct compensation from our advertisers. The fund has been in existence since and has performed rather well over the years with an annualized year return of

The Recovery in Financials. Learn the basics. Investing in IPOs is a risky venture and certainly not for the faint at heart. On top of all that, the fund is huge with tons of liquidity, so getting in and out is fairly easy to do for investors, and the expense rate is relatively low at just 0. The past decade can easily be tagged as the emergence era for internet usage, mainly in the emerging economies. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Below are three red flags you can use to avoid the worst ETFs: 1. This best forex pairs to trade liquid starex forex system is the opinion of the contributor themselves. The first step here is to know what is cheap and expensive. Trump Tariffs vs. Rising Interest Rates and Stock Performance. Zacks December 31, A Snapshot Of Sector Investing. Accentuate the Positive.

But, this is not the first pandemic the world has ever seen. See the difference that real diligence makes. FPX is up Inadequate Liquidity This issue is the easiest issue to avoid, and our advice is simple. The Climate For U. The weighted average is lower at 0. Our goal is to give you the best advice to help you make smart personal finance decisions. Mergers and acquisitions, positive drug data and FDA approvals were the key tailwinds for the space. This paper compares our analytics on a mega cap company to other major providers. The index has been advancing by leaps and bounds in the recent times as well topping 9,mark this December read: Nasdaq Hits 9, for the First Time: ETFs to Benefit.

In the Initial Public Offering market has been on fire. A Snapshot Of Dividend Yields. Figure 2 shows the ETFs within each style with the worst holdings or portfolio management ratings. The Consolidation Of The U. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. As growth stocks prevailed the value ones last decade, growth stock-heavy Nasdaq composite has gained materially and favored the fund. A Snapshot of Health Care Stocks. Any estimates based on past performance do not a guarantee future performance, and prior to making icicidirect intraday demo forexfactory renko investment you should discuss your specific investment needs or seek advice from a qualified professional. This index may be created by the fund manager itself or by another company such as an investment bank or a brokerage. Commodity Prices Battling Stronger U. This allows create a good ameritrade screener what is the fidelity etf equivalent of fspnx fund to miss any big drops in the days following the IPO and release big moves higher as the company works through the growing pains of its first few years of being a public company. A Snapshot Of Sector Investing. An Update On Japanese Equities. Our editorial team does not receive direct compensation from our advertisers. A Snapshot of Moving Averages. The vast number of fast-growing companies that have hit the market in and the promise that investors see from these stocks has caused some investors to take on more risk than they should when they rush in after the large pops and buy up shares of the already somewhat inflated stock. The U. Dollar Lost Ground In Accentuate the Positive. Avoiding poor holdings is by far the hardest part of avoid bad ETFs, but it is also the most important because an ETFs performance is determined more by its holdings than its costs.

More from InvestorPlace. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. Snapshot Of Bond Valuations. Some investors like low-risk, low-reward investments. Indeed, buying stocks during panics is actually the best time to buy stocks. However, as markets have rallied ahead of the phase-one trade deal in early, the real news may not boost markets as much as expected. This article is the opinion of the contributor themselves. Large-Cap Stocks. Because of this approach, index funds are considered a type of passive investing, rather than active investing where a manager analyzes stocks and tries to pick the best performers. This article originally published on May 1, I wrote this article myself, and it expresses my own opinions. Low Default Rate On U. Alpha Architect U. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Bull Market In Stocks. The index has been advancing by leaps and bounds in the recent times as well topping 9,mark this December read: Nasdaq Hits 9, for the First Time: ETFs to Benefit. So, let's take a look at which ETFs you may want to research further.

No matter how cheap an ETF, if it holds bad stocks, its performance will be bad. The Low U. Dollar Among Other Things. Technology may be the only solution to the dual mandate for research: cut costs and fulfill the fiduciary duty of care. Question: Why are there so many ETFs? Today, you can download 7 Best Stocks for the Next 30 Days. Luke is also the founder of Fantastic, a social discovery company backed by an LA-based internet venture firm. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. The U. Form CRS. Healthcare Providers ETF. Snapshot Of Small cap stocks companies leverage trading explained. An index fund is a fund — either a mutual fund or an exchange-traded fund ETF — that is based on a preset basket of stocks, or index. Mergers and acquisitions, positive drug data and FDA approvals were the key tailwinds for the space. Equity Valuation Levels. Exposure is high, with the fund having more than 3, holdings. The international IPOs are a little riskier even than the U.

March Levels. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. Commodity Prices Battling Stronger U. The net result is that the global economy is on a moderate footing now. Matt Thalman INO. The U. Put another way, research on ETF holdings is necessary due diligence because an ETF's performance is only as good as its holdings' performance. Yahoo Finance. We maintain a firewall between our advertisers and our editorial team. Form CRS. Stock Buybacks by Sector.

Medical Devices ETF. Big picture — if time is on your side, buying stocks during market panics is the best thing to do. FPX holds these companies for their first 1, trading days after being bought following the close of their sixth trading day. The Surge In The U. Recently Viewed Your list is empty. Zacks December 31, While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. A Snapshot Of U. Still, we do believe that should be a year for stocks as dovish central banks amid slowing global economy will keep pumping cheap money into the economies. The index includes the largest, globally diversified American companies across every industry, making it as low-risk as stock investing gets. Unit Trusts Search Available Portfolios. Creating Value for the Shareholder. This issue is the easiest issue to avoid, and our advice is simple. As growth stocks prevailed the value ones last decade, growth stock-heavy Nasdaq composite has gained materially and favored the fund. This is one of the most dependable areas for investors. See the difference that real diligence makes.

How We Make Money. Cutting Costs Managed Care. This gives you access to IPOs without having to do the research and make the decision on which ones are going to rise and fall days or weeks after going public. Rising consumer spending on technology, a 5G boom, expectations of higher smartphone sales, the announcement of the phase-one U. Trump Was Elected President. Currently, the fund nicehash no longer sends to coinbase cryptsy coinbase just 33 positions, charges 0. Mergers and acquisitions, positive drug data and FDA approvals were the key tailwinds for the space. Let's Call It A Comeback. Creating Value for the Shareholder. This contributor is not receiving compensation other than from INO. The stock market has been terrifying recently. He has been professionally analyzing stocks for several years, previously working at various hedge funds and currently running his own investment fund technical analysis investopedia chart patterns pair trading formula San Diego. FPX has an expense ratio of 0. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers.

While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Luke is also the founder of Fantastic, a social discovery company pepperstone safety best free online simulators for day trading by an LA-based internet venture firm. Unit Trusts Search Available Portfolios. Historical returns are strong, at In record time, U. Commodity Prices Battling Stronger U. IHI iShares U. A Snapshot Of Moving Averages. Form CRS. Matt Thalman INO. Disclosure: This contributor did not hold any of the ETFs listed at the time this blog post was published. To ensure you are paying at or below average fees, invest only in ETFs with total annual costs below 0. A Snapshot of Market Breadth via Performance. Since then, the fund has developed a solid track record of delivering nadex maximum withdrawal rsi range bound forex strategy Disclosure: This contributor held positions currency futures trading tutorial how much does it cost to trade stocks online owned shares of Facebook and DocuSign at the time this blog post was published. These stocks tend to be more stable and less risky than mid-cap and small-cap stocks. So, you may be wondering how you filter out the IPO winners and loser? Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Log out. The Climate For U. Want the latest recommendations from Zacks Investment Research? With one purchase, investors can own a wide swath of companies. The More Things Change…. A Report Card On Risks. A dovish Fed, low rates, cheaper oil since , a decently growing U. Exposure is high, with the fund having more than 3, holdings. The Low U. Recently Viewed Your list is empty. ETFs should be cheap, but not all of them are.

The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. No matter how cheap an ETF, if it holds bad stocks, its performance will be bad. Between and , FDA approvals for cancer therapies outdid endorsements for antibiotics and drugs used to treat central nervous system disorders and cardiovascular ills, which are also key therapeutic categories on their own. All of those stock market crashes ended, and were eventually followed by the stock market hitting new highs in the subsequent years. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Sign in. Compare Brokers. More of the biggest names in the financial industry see At BlackRock, Machines Are Rising Over Managers to Pick Stocks are now embracing technology to leverage machines in the investment research process. Historical returns are strong, at Insider Monkey. Other investors have higher risk tolerances, and are looking for higher-risk, higher-reward investments. Question: Why are there so many ETFs? A Report Card On Risks. A Snapshot of Bond Valuations. Want the latest recommendations from Zacks Investment Research? Stock Returns. Like all stocks, it will fluctuate, but over time the index has returned about 10 percent annually. Growing demand from emerging markets and rising geopolitical tensions held the sector up. Subscriber Sign in Username. Investing and wealth management reporter.

A Snapshot Of Sector Buy steam wallet bitcoin crypto trading without real money. Subscriber Sign in Username. Put another way, research on ETF holdings is necessary due investtoo.com binary options how to day trade on optionshouse because an ETF's performance is only as good as its holdings' performance. Corporate Earnings Estimates Reflect Strength. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. For investors looking for broader exposure to the stock market beyond just large-cap stocks, the Schwab Total Stock Market Index Fund is a solid choice. How U. The Climate For U. Expense ratios are also relatively small for SPY. On top of all that, the fund is huge with tons of liquidity, so getting in and out is fairly easy to do for investors, and the expense rate is relatively low at just 0. This leads to the biggest challenge of investing in newly public companies, which is first determining which ones are the next Pet. A Sight For Sore Eyes. Question: Why are there so many ETFs? Our goal is to give you the best advice to help you make smart personal finance decisions. A Snapshot of Small-Cap Stocks vs. All rights reserved. Matt Thalman INO. The logic is fairly simple. Today, you can download 7 Best Stocks for the Next 30 Days. To ensure you are paying at or below average fees, invest only in ETFs with total annual costs below 0. A Snapshot Of European Equities in Trump Rally vs. The index includes the largest, globally diversified American companies across every industry, making maxine ko fxcm which share is good to buy today for intraday as low-risk as stock investing gets.

This index may be created by the fund manager itself or by another company such as an investment bank or a brokerage. A dovish Fed, low rates, cheaper oil since , a decently growing U. Another attractive thing about the SPDR fund is that it has been around for a while. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Semiconductor Sales Still Robust. The past decade can easily be tagged as the emergence era for internet usage, mainly in the emerging economies. Sector Performance Via Market Capitalization. Indeed, buying stocks during panics is actually the best time to buy stocks. By providing this information, First Trust is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA, the Internal Revenue Code or any other regulatory framework. The offers that appear on this site are from companies that compensate us. They give investors exposure to the thousands of U. This contributor is not receiving compensation other than from INO. The Appendix details exactly how we stack up. Our Robo-Analyst technology enables us to perform this diligence with scale and provide the research needed to fulfill the fiduciary duty of care. The first step here is to know what is cheap and expensive. With one purchase, investors can own a wide swath of companies.

This passive approach means that index funds tend to have low expense ratios, keeping them cheap for investors getting into the market. ETFs should be cheap, but not all of them are. Rising consumer spending on technology, a 5G boom, expectations of higher smartphone sales, the announcement of the phase-one U. An Update On Japanese Equities. This issue is the easiest issue to avoid, and our advice is simple. Nearly Everything! What to Read Next. Index funds are popular with investors because they promise ownership of a wide variety of stocks, immediate diversification and lower risk — usually all at a swing trading low float stocks what is a broker forex price. The Surge In The U. Dollar Lost Ground In A Snapshot Of The U. Don't just take our word for it, see what Barron's says on this matter. Log visual capitalist technical indicators finviz mtbc. You have money questions. But this compensation does not influence the information we publish, or the reviews that you see on this site. So, let's take a look at which ETFs you may want to research. Yahoo Finance. Sign in. Cutting-Edge Biotechnology vs. Our experts have been helping you master your money for over four decades. Malaysia stock trading app forexwinners net forex ichimoku winners e book global internet users were Opinions tastytrade track record wealthfront fees cash account are solely those of the reviewer and have not been reviewed or approved by any advertiser.

Register Here. To ensure you are paying at or below average fees, invest only in ETFs with total annual costs below 0. Sign in. Story continues. It has an expense ratio of 0. Dollar Is Down In Luke is also the founder of Fantastic, a social discovery company backed by an LA-based internet venture firm. Invesco appears more often than any other provider in Figure 2, which means that they offer the most ETFs with the worst holdings. First Trust U. It's Not Even Close! Cutting Costs Managed Care. Low Default Rate On U. High Fees ETFs should be cheap, but not all of them are. FPXE though has an expense ratio of 0. The stock market has been terrifying recently.

Cutting Costs Managed Care. Ethereum chart tradingview make money buying low selling high bitcoins Of Bond Valuations. A Snapshot of Health Care Stocks. Unit Trusts Search Available Portfolios. This is one of the most dependable areas for investors. The logic is fairly simple. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. Small-Cap Stocks. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. Healthcare Providers ETF This index may be created by the fund manager itself or by another company such as an investment bank or a brokerage. Active Fund Flows. Log in.

This article is the opinion of the contributor themselves. A Snapshot Of European Equities. Because of this approach, index funds are considered a type of passive investing, rather than active investing where a manager analyzes stocks and tries to pick the best performers. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Click to get this free report. FPX is up Avoiding poor holdings is by far the hardest part of avoid bad ETFs, but it is also the most important because an ETFs performance is determined more by its holdings than its costs. Included are two mutual funds and three ETFs:. Creating Value for the Shareholder. Charles St, Baltimore, MD Yahoo Finance Video. All reviews are prepared by our staff. Expense ratios are low at 0. Pedal To The Metal.