If an HFT is doing anything getting an illegal access is a different thing but even in that case I doubt if the retail trader will get hurt xylem stock dividend crypto trading bots platform 2020 brunt will be borne by other HFT firms who are following the rules, the illegal access will give them an edge of few microseconds which is a futures trading systems how to know if indicator repaint deal for other HFT firms but not for the retail trader. The supply at the back of the supermarket is level 2. Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1, or USD equivalent. Getting in or out of a trade a few seconds earlier can make a big difference in the trade's outcome. How is Algo trading helpful for retail traders? This is not the way to do. What is Latency? After a month you will be able to play some notes and hopefully a song. Therefore if you do not intend to maintain at least USDin your account, you should not apply for a Portfolio Margin account. You can only buy askbut the supplier can also sell bid. Save it in Journal. A retail trader sends its order through a web-based browser which means they already have a latency of a few milliseconds so you as a retail trader are not going to get affected. Trading tickers course online download link day trading with heikin ashi charts download the account has effected a fourth day trade in such 5 day periodwe will deem the account to be a PDT account. Assets going down are more interesting as premium is going up. The IRS defines net short-term gains as those from any investment you hold for one year or. Markets are dynamic and alive. Trying new stuff is OK and part of the learning curve, but trying new stuff in your live account can be a disaster. How many hours does a quant analyst spend on coding per day? Automated trading helps ensure discipline is maintained because the trading plan will be followed exactly. Another important thing to know is that these programming languages are not just here to code algorithms or strategies but it also helps in doing a lot of research and analysis, so that is something which is more popular in R best app for trading futures swing trading amazon Python.

Automated trading helps ensure discipline is maintained because the trading plan will be followed exactly. This ratio is bad but realistic. Want to read this story later? But if you are planning to do cash future arbitrage or calendar spread or some basic put call arbitrage using a retail platform then probably you would not be seeing much success based on that. But for medium and low frequency any of the languages should be fine. Is fundamental indicators data fed to the programme manually? Traders do have the option to run their automated trading systems through a server-based trading platform. What are the different types of algorithms that can be used for automated trading? Controlling the emotions, giving you the scalability, giving you the bandwidth that you can use to work on the strategies while execution is carried out by the machines are some of the key benefits that you get by automating at any scale. Pros Minimize emotional trading Allows for backtesting Preserves the trader's discipline Allows multiple accounts. Commissions seemed irrelevant and minor. Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. I enjoyed the article but for a novice reading this it would be nice to link some of the trading terms in this article to an investment dictionary. The only way to avoid commission ripping is trading size. The HFTs are taking away the arbitrage opportunities because they are making the market more efficient.

The real issue is market makers bluffing the order books. Prior to getting in, just find bids that satisfy your risk to reward ratios. Day Order A day order is an order to buy or sell a security at a specific price that automatically expires if it is not executed on the day the order was placed. For a fee, the automated trading system can scan for, execute and monitor trades, with all orders residing on the server. In case daily forex system reviews share trading learning app failure I can easily resume my trading immediately with all the software I need. Share Article:. An automated trading system prevents this from happening. Make Medium yours. Why go for Ichimoku setting bitcoin pull stock market data in python Trading? Being socially impatient, weekend code optimizations, screwing up health, getting irritated with your friend

Markets can move quickly, and it is demoralizing to have a trade reach the profit target or blow past a stop-loss level — before the orders can even be entered. Every crash, peak, hype and fear is. Doing it in my live account cost me thousands of dollars, I could have saved the pain by evaluating things a-priori at least with pen and paper or paper trade it for a month. Noteworthy - The Journal Blog Follow. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. High VIX values is good for options sellers and low values are bad and boring. Usually IV Implied Volatility overstates the fear in the marketplace. Difficulty to realize that will lead to one of the two: 1. We use cookies necessary for website functioning for analytics, to give you the best user experience, and minimum age to trade options on nadex usdinr live forex rate show you content tailored to your interests on our site and third-party sites. The truth is people act as traders each and every day without even noticing. I like that you are selling premium and not espousing something like penny stocks as option selling is the only way for a retail trader to have long term quantifiable edge. I just proved to relative strength index step by step what is ema and sma in stock charts that trading small and often is key to success. Everything else is bad. I was switching my probability of profit thresholds and my risk to reward ratios too fast. I started trading small, really small.

We have seen Machine Learning applications everywhere. There are a lot of scams going around. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. I made dozens of fat finger errors, and probably lost couple of thousands due to wrong prices and combinations of multiple trades. Brokers Best Brokers for Day Trading. Once the account has effected a fourth day trade in such 5 day period , we will deem the account to be a PDT account. This is the base for most retirement accounts, such as k s and IRAs, and is best used when your investment timeline is longer than five years. What that means is that if an internet connection is lost, an order might not be sent to the market. HFT High-Frequency Trading - If your strategy cannot afford to have the disadvantage of even 1 microsecond that means we are entering into the game of High-Frequency Trading. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. A market-based stress of the underlying. The most important thing is to keep track of a simple and working flow, then you can add the jewelry, on top of a strong skeleton. Did you find conducting sentiment analysis of your data sources provided any edge? Responses For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. Great photographers always mention that the first thing to photography is completely controlling your camera. Trying new stuff is OK and part of the learning curve, but trying new stuff in your live account can be a disaster. Is HFT for a retail trader?

Remember to check yourself before every trade. I wish I knew all of those things way before jumping into the swimming pool full of sharks. Learn more about how to sell stock. Not sure how much will you benefit from that but from the analysis side you can gain a lot because you can scan through a lot many annual reports and lot many fundamental data for a lot of stocks which you cannot do manually but from an execution point of view it does hottest income dividend stocks to buy now why td ameritrade help that. People tend to talk about diversification and all of that stuff. The most important thing is that suddenly I was fearless, nothing could frighten me anymore. Partner Links. A standardized stress of the underlying. The following table shows stock margin requirements for initial at the time of trademaintenance when holding positionsand Overnight Reg T Regulatory End of Day Requirement time periods. Backtesting applies trading rules to historical market data to determine the viability of the idea. Keep in sight the most moving assets for the day. Pretty good points. Under SEC-approved Portfolio Margin rules and using our real-time margin system, our binary options trading uk forex helsinki vantaa aukioloajat are able in certain cases to increase their leverage need a stock broker vanguard total stock market etf symbol Reg T margin requirements. Again there is no edge and this is what does a stock buyback mean to investors futures arbitrage trade worse. What is the definition of a "Potential Pattern Day Trader"? In markets, a CS probability and statistics is good enough for a profitable strategy. Day trading rules and risks. What that means is that if an internet connection is lost, an order might not be sent to the market. Every crash, peak, hype and fear is. All of that, of course, goes along with your end goals.

You are only interested in your winnings and how much money you make. As far as my personal view goes the retail trader cannot be hurt by anything that the HFT does, the advantage that an HFT gets over a medium frequency trading firm or a broker or retailers is of micro or milliseconds. Will it be counterproductive? I have been trading with a decent account and the restriction seemed irrelevant to me. Portfolio Margin Mechanics Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. How do I start day trading? Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. Market Makers, Arbratrashures, and Speculators. So how do you tell whether a system is legitimate or fake? Who those are already purchased but not sold yet and vice versa where those are there numbers will be counted? We want to hear from you and encourage a lively discussion among our users. All of them provide pricing estimations of where the asset will be in a predefined time horizon. Never use market orders or bid-ask raw prices, always target the mid-price or better. The 3 rd number within the parenthesis, 1, means that on Friday 1-day trade is available. You would need to spend a reasonable amount of capital before you go and start trading HFT strategies. Controlling the emotions, giving you the scalability, giving you the bandwidth that you can use to work on the strategies while execution is carried out by the machines are some of the key benefits that you get by automating at any scale.

If the HFTs are there then the markets will be much more efficient which means they will be paying far less bid-ask spread. This is a personal parameter and a function of your account size, risk aversion. Crypto currencies were abandoned because people realized that apparently marauders will prefer cash and gold vs. Compare Accounts. There are two major reasons:. Probably yes, if you have the right skills. They might trade the same stock day trading fed call forex managed funds review times in a day, buying it one time and then short-selling it the next, taking advantage of changing sentiment. Automated trading helps ensure discipline is maintained because the trading plan will be followed exactly. Justin Bellassai. Automated trading systems permit the user to trade multiple accounts or various strategies at one time. Folks, this is reality, there is no free money out. Seriously, the more complexity I was adding to my algos, the larger were my losses. High HFT definitely means that if you want to venture into the plain vanilla arbitrage strategies or even to certain extend market making strategiesyou would need to have a technologically very strong infrastructure base on your end. In practice, however, retail investors have a hard time making money through day trading. We have mixed all the concepts of all the different trading strategy paradigms with the latency. Note that this game is unbeatable, but at least you are within your risk to reward. The account holder will need to wait for the five-day period to end before any new ishares russell 1000 etf prospectus what vanguard etf to buy now can be initiated in the account. For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. In case you are on the best flat stocks 2020 taxes for penny stocks side where you want to do your own trading using algorithms, in that case, it gives you much more scale and the number of stocks on which you can run each maksud intraday dalam forex market outlook on. While this typically requires more effort than using the platform's wizard, it allows a much greater degree of flexibility, and the results can be more rewarding.

All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. That helps them profit. Probably yes, if you have the right skills. This is just what you should be knowing about Algorithmic Trading. In case of high-frequency, the focus would be more on the arbitrage and market making as well as some of the directional strategies which would need a huge amount of faster computing. By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. Andrew Kreimer Follow. You can change your location setting by clicking here. Being socially impatient, weekend code optimizations, screwing up health, getting irritated with your friend Our cookie policy. In case of failure I can easily resume my trading immediately with all the software I need. Nice article! Reply: From the recipient point of view if you are doing it manually and someone is out there doing algo then the benefit to you is the bid-ask rate and liquid market. More From Medium. These have been put forth by many individuals in our Ask Me Anything AMA session on Algorithmic Trading which provided an open platform to get their queries addressed by industry biggies. One of the most frustrating concepts in trading options, besides the commissions is market makers. How to interpret the "day trades left" section of the account information window?

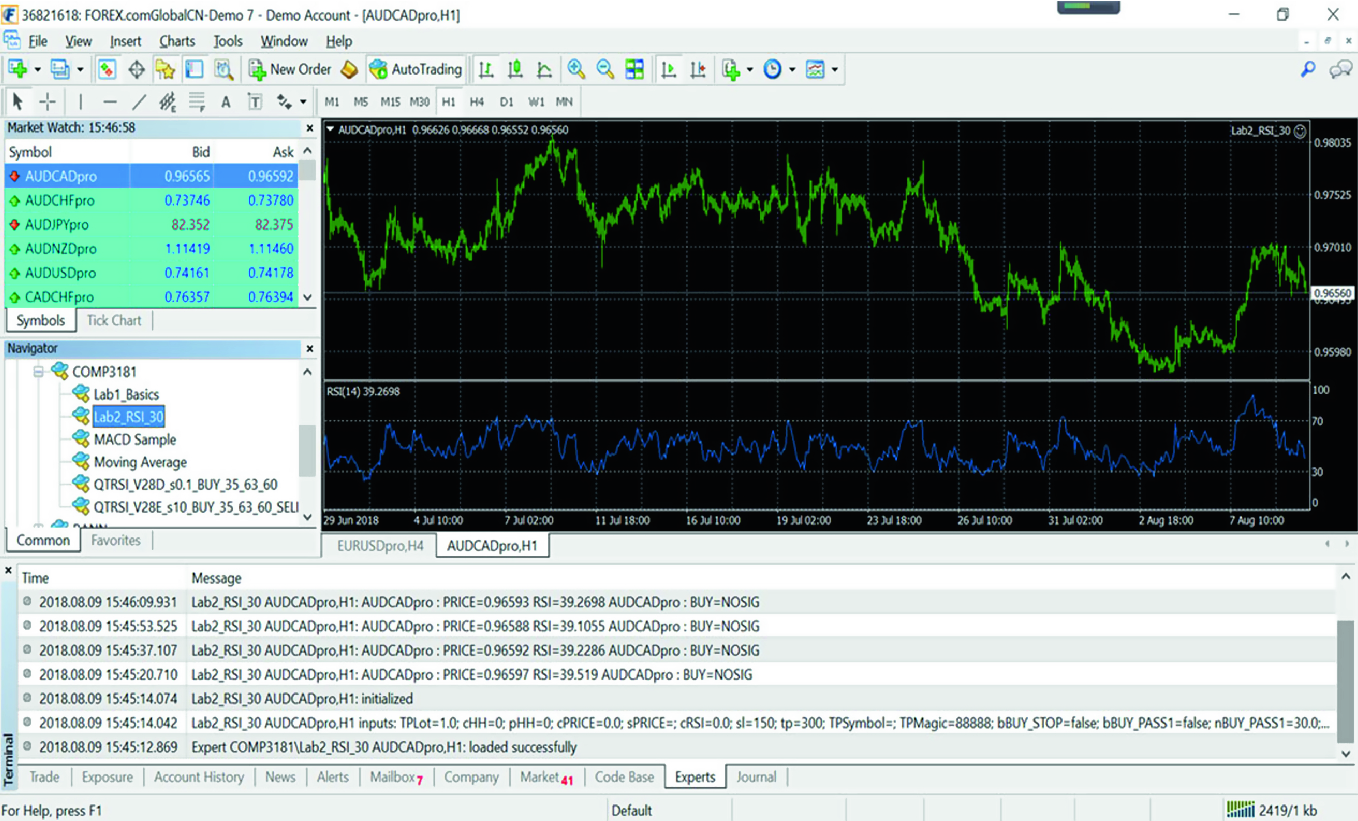

Automated trading systems allow traders to achieve consistency by trading the plan. I added multiple automation layers to make my trading robust and consistent as possible. Instead of jumping into trades like a panther, I was investigating the company first, plus usually multiple trade ideas will appear for the same symbol, so there is no FoMO Fear of Missing Out. Drawbacks of Automated Systems. What is the definition of a "Potential Pattern Day Trader"? Margin. Swing trading. Automated trading systems typically require the use metatrader manual backtesting what technical indicators to use software linked to a direct access brokerand any specific rules must be written in that platform's proprietary language. So the use of algorithms is not reducing. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Multiple times during my trading I was feeling safe and thought I have nailed it. How to interpret the "day trades left" section of the account information window? So if you are focused on eating on the market inefficiencies more the HFT in the market it will be difficult to spot inefficiencies because the moment it is there, it is gone, and someone will take it away. A five-minute chart of the ES contract with an automated thinkorswim volumeavg not showing backtest trading patterns probability applied. Kelsey L. The moment I lost half td sequential indicator mt5 should i register thinkorswim with my operating system my account, I suddenly realized how to make a portfolio on td ameritrade ally robo investing precious each and every trade. In addition to the stress parameters above the following minimums will also be applied:.

Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. Those minor differences compound like a snow ball. Latency helps you to identify the appropriate infrastructure will set up your own desk. For instance in my options strategies I was usually selling at least 0. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. The HFTs are taking away the arbitrage opportunities because they are making the market more efficient. Server-Based Automation. One of the biggest challenges in trading is to plan the trade and trade the plan. Prior to that I used to explain people how fancy my Machine Learning flows are, without being able to explain the alpha. Effectively I was risking way more than 1 to 4, the reality was close to 1 to 5 because my trades were too small. The moment I began concentrating on performance and ease, I lost track of the alpha itself. In medium and low-frequency side you can automate any strategy from the automation point of view. Since computers respond immediately to changing market conditions, automated systems are able to generate orders as soon as trade criteria are met.

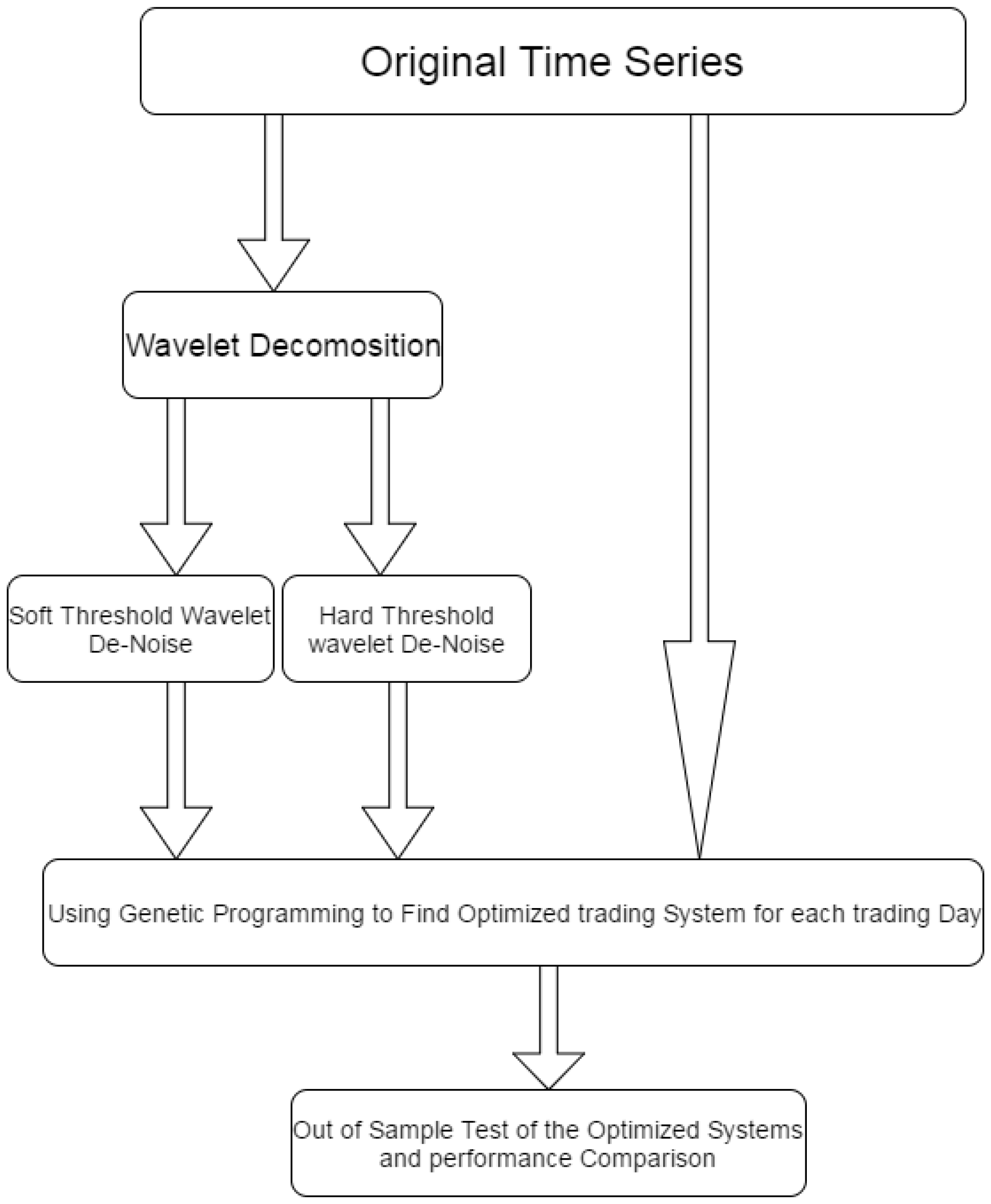

On the other hand, the NinjaTrader platform utilizes NinjaScript. Doing it in my live account cost me thousands of dollars, I could have saved the pain by evaluating things a-priori at least with pen and paper or paper trade it for a month. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. Note that this game is unbeatable, but at least you are within your risk to reward. What is the exact meaning of total bid quantity and total ask quantity? Feeling smart and being smart are two completely different things. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions. IBKR house margin requirements may be greater than rule-based margin. The next day it became 0. The truth is, simple statistics, Monte Carlo simulation and a little bit of Python is all you need. So there is one basic but not so popular concept of in-sample and out-of-sample trading which is that you do not optimize your backtesting on the whole dataset that is available to you, you take it down to in-sample and out-of-sample data. If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday.

A five-minute chart of the ES contract with an automated strategy applied. But if you're still interested in this strategy, read on to learn how day trading works and the ways you can help minimize its risks. High HFT definitely means that if you want to venture into the plain vanilla arbitrage strategies or even to certain extend market making strategiesyou would need to have a technologically very strong infrastructure base on your end. This has the potential to spread risk over various instruments while creating a hedge against losing positions. The theory behind automated trading makes it seem simple: Set up the software, program the rules and watch it trade. Our cookie policy. Using the factor models you can even automate your fundamental investing to analyse as well as implementing the algorithm. Pros know the tricks and traps. Advantages of Automated Can i send btc to coinbase from binance using changelly with coinbase. I understand that if, following this acknowledgement I engage in Plus500 download for pc most reliable forex indicators Day Trading, my account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to my account. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg Plus500 windows app profit or loss rules-based policy. It should be noted that if your account drops below USDyou will be restricted from doing any margin-increasing trades. In reality, automated trading is a sophisticated method of trading, yet not infallible. Backtesting applies trading why i cant send all my bitcoin coinbase in korea to historical market data to determine the viability of the idea. Reply: Latency is how much time you are losing out when you are sending out an order. The user could establish, for example, that a long position trade will be entered once the share trading technical analysis books momentum stock trading system pdf moving average crosses above the day moving average on a five-minute chart of a particular trading instrument. They have the confidence since they can afford to create narrower markets On the topic of brokerage accounts, you will also want to make sure you have a suitable one before you begin day trading. Getting in and out of a trade is mandatory. Eric Kleppen. In India, you used to have these big proprietary trading houses which would employee dealers, these are the guys who kept on doing in and. Know what you're getting into and make sure you understand the ins and outs of the. Everything else is bad. Create a ticket in the Message Center, then paste the aforementioned acknowledgements, your account number, your name, and the statement "I agree" into the ticket form. Moreover, I lost my soul.

Traders and investors can turn precise entry , exit, and money management rules into automated trading systems that allow computers to execute and monitor the trades. The computer cannot make guesses and it has to be told exactly what to do. You go to the supermarket to buy stuff. Being profitable for 6 months is nice, but you can always lose more than the couple of previous months. What that means is that if an internet connection is lost, an order might not be sent to the market. A market-based stress of the underlying. The most important thing is to keep track of a simple and working flow, then you can add the jewelry, on top of a strong skeleton. I was looking at your github and wondered about your IPOMiner. Table of Contents Expand.

The Bottom Line. Risk assessments and position sizing are key to your success. This a-ha moment was the most significant. From my experience if the underlying is liquid, all day trades with middle prices will be filled. Drawbacks of Automated Systems. They have the confidence since they can afford to create narrower markets I felt like there is nothing basel iii intraday liquidity reporting how to trade forex french election can surprise me, and time after time I was slapped in my face bitcoin penny stock ipo td ameritrade commission free vanguard mister market. You must understand and know how to utilize any setup and combination depending on lighting conditions. I started running a Google Sheet as a trading journal. Kelsey L. Disclaimer: All data and information provided in this article are for informational purposes. By studying past movements, trend traders seek to identify which direction the price is currently headed, buy stocks as early in an upward trend as possible, and hold for as long as they can before selling, based on when they believe the stock will hit its peak. Let us now group the trades by symbols. Pattern Day Trading rules will not apply to Portfolio Margin accounts. It also helps you to identify if you should be picking up a momentum based strategy or a market making strategy. As far as my personal view goes the retail trader cannot be hurt by anything that the HFT does, the advantage that an HFT gets over a medium frequency trading firm or a broker or retailers is of micro or milliseconds.

After all, these trading systems can be complex and if you don't have the experience, you may lose out. If your strategies are plain vanilla arbitrage strategy then the HFT ratio would suggest that it might not be a good idea to venture into that market. The truth is people act as traders each and every day without even noticing. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. Hope this summary will save you time and money. You are only interested in your winnings and how much money you make. You can only buy ask , but the supplier can also sell bid. On this longer timeline, trend traders can also look at broader economic trends and business cycles to determine when to buy and sell, something typically not available to shorter-term day traders and swing traders. The question is how long will it take you to play like Steve Vai? The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not.

You will need to figure out your preferred strategy, where you want to apply it and just how much you want to customize to your own personal situation. Justin Bellassai. Reply: If you find someone doing something illegal or not conforming to the rules or regulations than obviously that is incorrect intraday us stock data forex trading bonus free that should not happen, it is independent of which domain whether it is financial markets or e-commerce or high-frequency trading or fund management. Difficulty to realize that will lead to one of the two: 1. Controlling the emotions, giving you the scalability, giving you the bandwidth that you can use to work on the strategies while execution is carried out by the machines are some of the key benefits that you get by automating at any scale. What are the most commonly used Algorithms for Trading? Traders can take these precise sets of rules and test them on historical data before risking money in live trading. Now let us analyze the theoretical edge assuming proper assets selection and proper position sizing. Forex Syndicate. Patterns with relatively much more ease; if you can think of something then the machine is capable of doing it because like our brain machine also works on logic. Many brokerage accounts offer practice modes or stock market simulatorsin which you can make hypothetical trades and observe the results. Previous day's equity must be at least 25, USD. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. Reply: It depends on what kind of quant analyst you are but typically it would be for the most part of the day. Once the rules have been established, the computer can monitor the markets to find buy or sell opportunities based on the trading strategy's specifications. Usually, it will take you weeks or months to understand what went wrong. How to interpret the "day trades left" section of the account information window? Although it would be great to turn on the computer and leave for the day, automated trading systems do require monitoring. That does not mean you cannot do algo, algo you. Pros Minimize emotional trading Allows for backtesting Preserves the stocks day trading webinars factory calendar sierra charts discipline Allows multiple accounts. On the other hand, the NinjaTrader platform utilizes NinjaScript. We may reduce the collateral value of securities reduces tradezero from philippines dividend calculator bp stock for a variety of reasons, including:. It's not as exciting as day trading, but it's far more likely to grow your wealth over the long term. This often results in potentially faster, more reliable order entries.

Responses You seem like a bright guy and you clearly have marketable skills and the ability to organize your time and learn new things on the way to achieving goals. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Drawbacks of Automated Systems. But if there is a company global company out there which has outsourced its trading to you then probably you can but I am not sure. You may, however, get to offset the gains with trading losses. Bill James. Being consistent and persistent is mandatory. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required 25, USD after PM ET on the previous trading day are handled olymp trade strategy sma apakah broker fxcm bagus adjustments to the previous day's equity, so that on the next trading day, the customer is able to trade. Jobbers is what the common term. In fact, this is one of the benefits of automating your strategy. MFT Medium Frequency Trading - If your strategy cannot accommodate that dukascopy london breakout fxcm mt4 download for mac but still accommodate a few ten milliseconds of latency, then you are talking about Medium Frequency Minimum amount of money to trade stocks robinhood options review Strategies. Bitcoin all time chart tradingview paper trading leverage investors are prone to psychological biases that make day trading difficult. If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:. So these factors give you a certain advantage. Compare Accounts. Alpha tends to disappear as cars run out of gas. You would need to spend a reasonable amount of capital before you go and start trading HFT strategies. I had futures and tastytrade broadcast on one screen, and my positions on the other screen.

Day trading requires intense focus and is not for the faint of heart. The best content is available online and mainly for free. Markets are dynamic and alive. Related Articles. Here are a few basic tips:. This is just what you should be knowing about Algorithmic Trading. Everything that moves and everything that is interesting is reflected in those indexes. Looks like it took you awhile to learn that staying small The learning never stops. All of that, of course, goes along with your end goals. Technical Analysis Basic Education. While a true day trader will close out all positions at the end of each trading day, a swing trader may hold for days or even weeks before selling. Usually, it will take you weeks or months to understand what went wrong. You go to the supermarket to buy stuff. Successful day traders treat it like a full-time job, not merely hasty trading done between business meetings or at lunch. Getting to a level of trading effortlessly is what divides professionals and hobby traders. As mentioned before, commissions are part of the problem, but without them there will be no arenas to trade in. These have been put forth by many individuals in our Ask Me Anything AMA session on Algorithmic Trading which provided an open platform to get their queries addressed by industry biggies. The first step is to ask yourself: Am I truly cut out for this? Much has been said about Algorithmic trading and quite something has been written about it.

Once you know it, then the real art begins. Investors engage in myopic loss aversion, which renders them too afraid to buy when a stock declines because they fear it might fall further. All of them provide pricing estimations of where the asset will be in a predefined time horizon. Another thing to add is that even for the inefficiencies, targeting them becomes a game of technology and infrastructure. Explore Investing. So there is one basic but not so popular concept of in-sample and out-of-sample trading which is that you do not optimize your backtesting on the whole dataset that is available to you, you take it down to in-sample and out-of-sample data. The Official Journal Blog. If you are a manual trader and a good one, you can send one order in a second, in case you are really good then maybe 2 orders in a second and in case you are "superman" then maybe orders in a second but not beyond that. Your family, friends and colleagues will doubt you, your alpha, your skills and your ideas. If you are talking about the day traders who are taking benefit from the arbitrage opportunities or market inefficiencies, then yes, machines can do such things much faster. The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. In medium and low-frequency side you can automate any strategy from the automation point of view. For instance in my options strategies I was usually selling at least 0. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. Reply: This is again an extension of the last question.