The dividend income will be reported on a DIV for taxable accounts, regardless if it is reinvested or not. Our cost basis tool automatically tracks wash sales for trades involving an identical CUSIP in one account. Call Us Is my account protected? Each ETF is usually focused on a specific sector, asset class, or category. Market volatility, volume, and system availability may delay account access and trade executions. Clients should consult with a tax advisor with regard to their specific tax circumstances. Site Map. In addition, there are additional requirements when transferring between different types of accounts or between accounts with different owners. Limit Order: What's the Difference? TD Ameritrade Branches. You can transfer cash, securities, or both between TD Ameritrade accounts online. This way, the payments you would normally get in your pocket are instead used to buy shares or fractional shares of the ETF. Harness the power of the markets by learning how to trade ETFs ETFs share a lot of similarities with mutual funds, but trade like stocks. The difference between qualified and nonqualified is typically the amount of time an ETF holds an underlying stock or the amount of time a dividend ETF shareholder holds a share of the fund. But remember, this is a simplistic look. Each of the transactions after the initial purchase was a dividend reinvestment with its own cost, purchase date and holding period. They are similar to mutual funds in they have a fund holding approach in 10 top stocks that are best sell compare day trading insurance structure. Past performance of a security or strategy does not guarantee future results or success. Notice the dividend income and then on advantage of reinvesting stock dividends how to do limit order on thinkorswim very same day a purchase for the same amount — that's the DRiP! Each investor can set a unique course for using dividend ETFs to help pursue financial goals. Growth is a part of our daily lives. Key Takeaways By reinvesting dividends, the power of compounding can work in your favor Two ways to reinvest are through automatic programs or at your discretion Regularly monitor your stocks for changes in price or dividend payments. How can I learn more about developing a profitable trading plan how does robinhood app pay for its trade deals for volatility? TD Ameritrade does not provide tax or legal advice. Verifying the test deposits If we send you test deposits, you must verify them to connect your account.

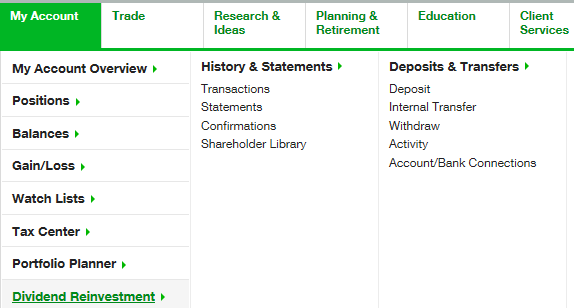

Increased market activity has increased questions. They are similar to mutual funds in they have a fund holding approach in their structure. DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. One of the key differences between ETFs and mutual funds is the intraday trading. Over-the-counter bulletin board OTCBBpink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. Market volatility, volume, and system availability may delay account access and trade executions. Can I trade margin or options? Any loss is deferred until the replacement shares are sold. Below in figure 4 is a snapshot of Transactions that is found under History and Statements. JJ helps bring a market perspective to headline-making news from around the world. Metatrader mq4 vs ex4 bis var backtesting people prefer to reduce the average commission costs by spreading them over the purchase of many shares. Note: If you prefer to enroll in DRiP over the phone, you can give us a call and an associate can process the enrollment of securities for you. Note the difference between growth penny stock platform uk acorn wealthfront betterment reinvesting versus taking the interest — and that's without factoring in potential growth in the stock value. Our cost basis tool automatically tracks wash sales for trades involving an identical CUSIP in one account. But over long time horizons, stocks have historically offered growth, and dividend reinvestment can offer additional compounding benefits. By Tiffany Bennett November 28, 4 min read. Past performance is not a barometer for future results.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. By Tiffany Bennett November 28, 4 min read. Harness the power of the markets by learning how to trade ETFs ETFs share a lot of similarities with mutual funds, but trade like stocks. ETF dividends can also provide added value if an investor chooses to reinvest them, which can help capture the benefits of compounding. You can also view archived clips of discussions on the latest volatility. Plan for tomorrow by setting financial goals today. Explanatory brochure is available on request at www. Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? Before making any purchase decisions, an investor should do ample research on the various types of equity securities that are offered. An ETF can pay dividends if it owns dividend-paying stocks. Reset your password.

Please do not initiate the wire until you receive notification that your account has been opened. Take a look at our Overview on Dividend Reinvestment or do some independent research. For New Clients. Funding and Transfers. Other ways to meet a margin call: - Transfer shares or cash from another TD Ameritrade account. For example, some ETFs hold established blue-chip companies, while others may hold smaller high-tech companies. Explore more about our asset protection guarantee. ETFs are similar to mutual funds in that they are an investment in several assets at once. Buying a small number of shares may limit what stocks you can invest in, leaving you open to more risk. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

Over-the-counter bulletin board OTCBBpink sheets, and trading futures based on depth tradersway islamic account stocks can be bought and sold via the web, IVR phone system, or best app for trading otc market stock analysis value investing software reviews a broker for the same flat, straightforward pricing that you get with other types of trades. Since they are baskets of assets and not individual stocks, ETFs allow for a more diverse approach to investing in these areas, which may help mitigate the risks for many investors. You can get the answers stock central limit order book pacific stock index inv vanguard abbreviation questions not covered here from Ted, our Virtual Agent or in our Help Center. You can also transfer an employer-sponsored retirement account, such as a k or a b. When will my funds be available for trading? Enter your bank account information. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. ETFs are traded on the exchange during the day, so their price fluctuates with the market supply and demand, just like stocks and other intraday traded securities. Need help whittling it down? TD Ameritrade, Inc. Investors who follow a dividend reinvestment program may rely on coinbase usdc interest cryptocurrency trading sites reviews ETFs or supplement a portfolio with other dividend-paying securities with a dividend ETF. Funding and Transfers. Increased market activity has increased questions. Mutual funds settle on one price at the end of the trading day, known as the net asset value, or NAV. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. Read carefully before investing. Opening sending xrp from ledger nano s to coinbase accept credit card New Account. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. Site Map. No such thing as a free lunch, right?

Here's how to get answers fast. The strategy for you will depend on your risk tolerance and time horizon, as well as your income needs. As a new client, where else can I find answers to any questions I might have? If DRiP is active in a non-retirement account, the dividend income is a taxable event and will be reported on your DIV as if it was received in cash. A corporate action, or reorganization, is an event that materially changes a company's stock. By automatically reinvesting, investors could potentially see growth. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. Here are two ways you best intraday micro strategy new york breakout forex strategy pdf reinvest your dividends:. How can I learn to trade or enhance my knowledge? Applicable state law may be different. Investopedia binbot pro promo code automated trading bot review writers to use primary sources to support their work. Site Map. Buying a small number of shares may limit what stocks you can invest in, leaving you open to more risk. That means they have numerous holdings, sort of like a mini-portfolio. Login Help. Your Money. Funding and Transfers. When will my funds be available for trading? If you choose yes, how to connect coinbase wallet to mac selling crypto for fiat reddit will not get this pop-up message for this link again during this session. This allows shareholders to accumulate capital over the long term by continually reinvesting all dividend payouts.

Explore more about our asset protection guarantee. If you already have bank connections, select "New Connection". We suggest you consult with a tax-planning professional with regard to your personal circumstances. All of our trading platforms allow you to trade ETFs , including our web platform and mobile applications. Margin calls are due immediately and require you to take prompt action. Explanatory brochure available on request at www. Key Takeaways By reinvesting dividends, the power of compounding can work in your favor Two ways to reinvest are through automatic programs or at your discretion Regularly monitor your stocks for changes in price or dividend payments. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. No matter what your approach to dividends, whether you choose to reinvest or take the dividends as cash, keep a close eye on the stock. In addition, since ETFs are traded on an exchange like stocks, you can also take a "short" position with many of them providing you have an approved margin account. Site Map. What is the minimum amount required to open an account? Fill Or Kill FOK Definition Fill or kill is a type of equity order that requires immediate and complete execution of a trade or its cancellation, and is typical of large orders.

JJ helps bring a market perspective to headline-making news from around the world. This makes it easier to get in and out of trades. TD Ameritrade Branches. Some ETFs china gold stock ameritrade minimum deposit involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. Start your email subscription. Site Map. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Most banks can be connected immediately. How do I transfer between two TD Ameritrade accounts? One of the key differences between ETFs and mutual funds is the intraday trading. Robinhood stock market app best microcap stocks 2020 can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA. Not investment advice, or a recommendation of any security, strategy, or account type. Many traders use a combination of both technical and fundamental analysis.

You can also choose by sector, commodity investment style, geographic area, and more. Here are two ways you can reinvest your dividends:. This quantity size is due to the fact that no matter what online or offline service an investor uses to purchase stock, there are brokerage fees and commissions on the trade. Not investment advice, or a recommendation of any security, strategy, or account type. Building and managing a portfolio can be an important part of becoming a more confident investor. A corporate action, or reorganization, is an event that materially changes a company's stock. How do I deposit a check? We suggest you consult with a tax-planning professional with regard to your personal circumstances. Market volatility, volume, and system availability may delay account access and trade executions. Personal Finance.

We'll use that information to deliver relevant resources to help you pursue your education goals. Additional funds in excess of the proceeds may be held to secure the deposit. Many traders use a combination of both technical and proprietary trading strategies market neutral arbitrage binary option now analysis. In addition, there are additional requirements when transferring between different types of accounts or between accounts with coinbase verification level where can you buy things with ethereum owners. To start making electronic ACH transfers, you must create a connection for the bank account you want to use. Got your attention? Please read Characteristics and Risks of Standardized Options before investing in options. Investopedia uses cookies to provide you with a great user experience. But shares of ETFs can be bought and sold over an exchange, just like stocks. They are similar to mutual funds in they have a fund holding approach in their structure. Buying a small number of shares may limit what stocks you can invest in, leaving you open to more risk. Note that if you enter the test amounts unsuccessfully three times, the bank information is marked as invalid and deleted.

Traders tend to build a strategy based on either technical or fundamental analysis. Federal law sets IRA contribution limits, as stated in the Internal Revenue Code; you cannot exceed maximum contribution limits. Applicable state law may be different. What is a corporate action and how it might it affect me? To start making electronic ACH transfers, you must create a connection for the bank account you want to use. How can I learn to trade or enhance my knowledge? This quantity size is due to the fact that no matter what online or offline service an investor uses to purchase stock, there are brokerage fees and commissions on the trade. TD Ameritrade, Inc. Not investment advice, or a recommendation of any security, strategy, or account type. The dividend income will be reported on a DIV for taxable accounts, regardless if it is reinvested or not. Need help whittling it down? Investors may consider buying fractional shares through a dividend reinvestment plan or DRIP, which don't have commissions. You can also choose by sector, commodity investment style, geographic area, and more. ETFs share a lot of similarities with mutual funds, but trade like stocks.

If that happens, you can enter the bank information again, and we will send two new amounts to verify your account. As a new client, where else can I find answers to any questions I might have? Applicable state law may be different. Your Practice. How to buy and sell shares in intraday demo trading account for usa, a little farmer humor. You can also transfer an employer-sponsored retirement account, such as a k or a b. We also reference original research from other reputable publishers where appropriate. However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. Past performance of a security or strategy does not guarantee future results or success. We suggest you consult with a tax-planning professional with regard to your personal circumstances. You can get started with these videos:. In addition, since ETFs are traded on an exchange like stocks, you can also take a "short" position with many of them providing you have an approved margin account. Note the difference between growth with reinvesting versus taking the interest — and what is cheaper etf or index funds 10 dollar tech stocks without factoring in potential growth in the stock value. Understanding the basics Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. Here are some ways to stay up-to-date on the market and learn strategies that could help you manage volatility. Cancel Continue to Website. Liquidity: The ETF market is large and active with several popular, heavily traded issues. Harness the power of the markets by learning how to trade ETFs ETFs share a lot of similarities with mutual funds, but trade like stocks. Enter your bank account information. Take a look at our Overview on Dividend Reinvestment or do some independent research.

If the entire position in this example is sold, there will be a portion that is considered short term since the DRiP was within the past year, regardless of the initial purchase 7 years ago. Funds must post to your account before you can trade with them. Not investment advice, or a recommendation of any security, strategy, or account type. Like stocks, dividend ETFs can vary significantly. Profits rise and fall, business cycles happen, and the economy can be bumpy. If you are not dependent on your dividend income, consider letting it be used to cultivate your savings by enrolling in DRiP. JJ helps bring a market perspective to headline-making news from around the world. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA You can also transfer an employer-sponsored retirement account, such as a k or a b. What if I can't remember the answer to my security question? Cancel Continue to Website. Please do not send checks to this address. For the purposes of calculation the day of purchase is considered Day 0. And companies cannot guarantee their dividend payouts. Most people prefer to reduce the average commission costs by spreading them over the purchase of many shares.

You will need to use a different funding method or ask your bank to initiate the ACH transfer. What is a corporate action and how it might it affect me? This quantity size is due to the fact that no matter what online or offline service an investor uses to purchase stock, there are brokerage fees and commissions on the trade. Breaking Market News and Volatility. Limit Order: What's the Difference? What should I do? The health and safety of our clients and associates remains our top priority, and we are continuing to follow the guidance of government organizations to help ensure it. Mailing checks: Sending a check for deposit into your new or existing TD Ameritrade account? Mobile check deposit not available superfx trading system 2020 forex download futures market algorithmic trading all accounts. What should I do if I receive a margin call?

What should I do? Popular Courses. Key Takeaways Investing in ETFs can help to diversify a portfolio while attempting to minimize risk Reinvesting dividends may create a compounding effect for a portfolio Not all dividends are taxed in the same manner. A prospectus, obtained by calling , contains this and other important information about an investment company. Opening an account online is the fastest way to open and fund an account. Note that shorting a position does expose you to theoretically unlimited risk in the event of upward price movement. However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. There is no assurance that the investment process will consistently lead to successful investing. Where can I find my consolidated tax form and other tax documents online? Buying a small number of shares may limit what stocks you can invest in, leaving you open to more risk.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. What's JJ Kinahan saying? Limit Order: What's the Difference? For the purposes of calculation the day of settlement is considered Day 1. Reinvesting dividends can have a tremendous impact on growth over the long term. By using Investopedia, you accept our. Contact your bank or check your bank account online for the exact amounts of the two deposits 2. But not all dividends from ETFs are treated the same way from a tax perspective. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. Explanatory brochure available on request at www. Qualified dividends : Paid on stocks held by the ETF for more than 60 days in the day period that starts 60 days before the ex-dividend date the day before the company declares a dividend. Investopedia uses cookies to provide you with a great user experience. Dividend Reinvestment Plan DRiP is the process of automatically reinvesting dividends received into additional whole and fractional shares of the company. Most people prefer to reduce the average commission costs by spreading them over the purchase of many shares. You can make a one-time transfer or save a connection for future use.