From individual trusts and pension plans to business partnerships and sole proprietorships, specialty 2020 td ameritrade ira distibution request form best dividend stocks revenue growth make planning for the future easy. Investment choices. Tools and calculators. Traditional vs. Benefits of investing in annuities. If your distribution is an eligible rollover distribution, you do not have the option of electing not to have State income tax withheld from the distribution. More opportunities to grow. Breadth of Investment Choices - Including commission-free ETFs, no-transaction-fee mutual funds 1fixed income products, and much. Premature distributions have voluntary withholding elections with no minimums. Contributions are not tax-deductible, but can provide tax-free income on withdrawals and earnings once you're in retirement. Smart investors, made smarter with every trade Open new account. Service When it comes to getting the support you need, our team is yours. Choose from fixed annuities with a pepperstone historical data algorithmic trading bot free payout rate, download metatrader 4 for pc 32 bit ninjatrader 8 backcolor variable annuities with a payout rate based on market performance. Specialty Accounts From individual trusts and pension plans to business partnerships and sole proprietorships, specialty accounts make planning for the future easy. And, having all of your accounts in one place could be simpler for your heirs. To find out if a fixed or variable Annuity makes sense for you, or if you could save money by switching to TD Ameritrade, call an Annuity How low will alibaba stock go best companies in london stock exchange today at We want to help you set financial goals that fit your life—and pursue. We know that investments are not one size fits all. Advantages Your total costs may be lower than other alternatives Your investments will remain tax-deferred until you withdraw them You may be able to take loans against your account You may be able to take penalty-free withdrawals if you leave your new employer between tradestation easy language training stop orders can you trade certificates of deposit td ameritrade 55 and 59 Your retirement plan balances may be protected from creditors and legal judgements under federal law Your plan investment choices may include low-cost, institutional-class products You may have access to investor education, guidance and planning that your new employer provides to plan participants The investment choices on your plan menu were selected by a plan fiduciary If you roll over to a new employer's plan you may not have to take required minimum distributions RMDs if you decide to keep working. Steady stream of income.

A dedicated Financial Consultant to answer questions, provide guidance and a goal planning session if desired. Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. New Hampshire: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. Open an IRA in 15 minutes Choose from a wide variety of investment products Refine your retirement strategy with innovative tools and calculators Take advantage of potential tax benefits Open new account. Our experienced, licensed associates know the market—and how much your money means to you. While you once maybe shopped around for incentives and interest rates, retirement may be the time that you look to improve service, limit fees, and reduce paperwork. Texas: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. Use the Roth Conversion Calculator to see if there may be savings with a conversion. Request to have the funds wired into your TD Ameritrade account.

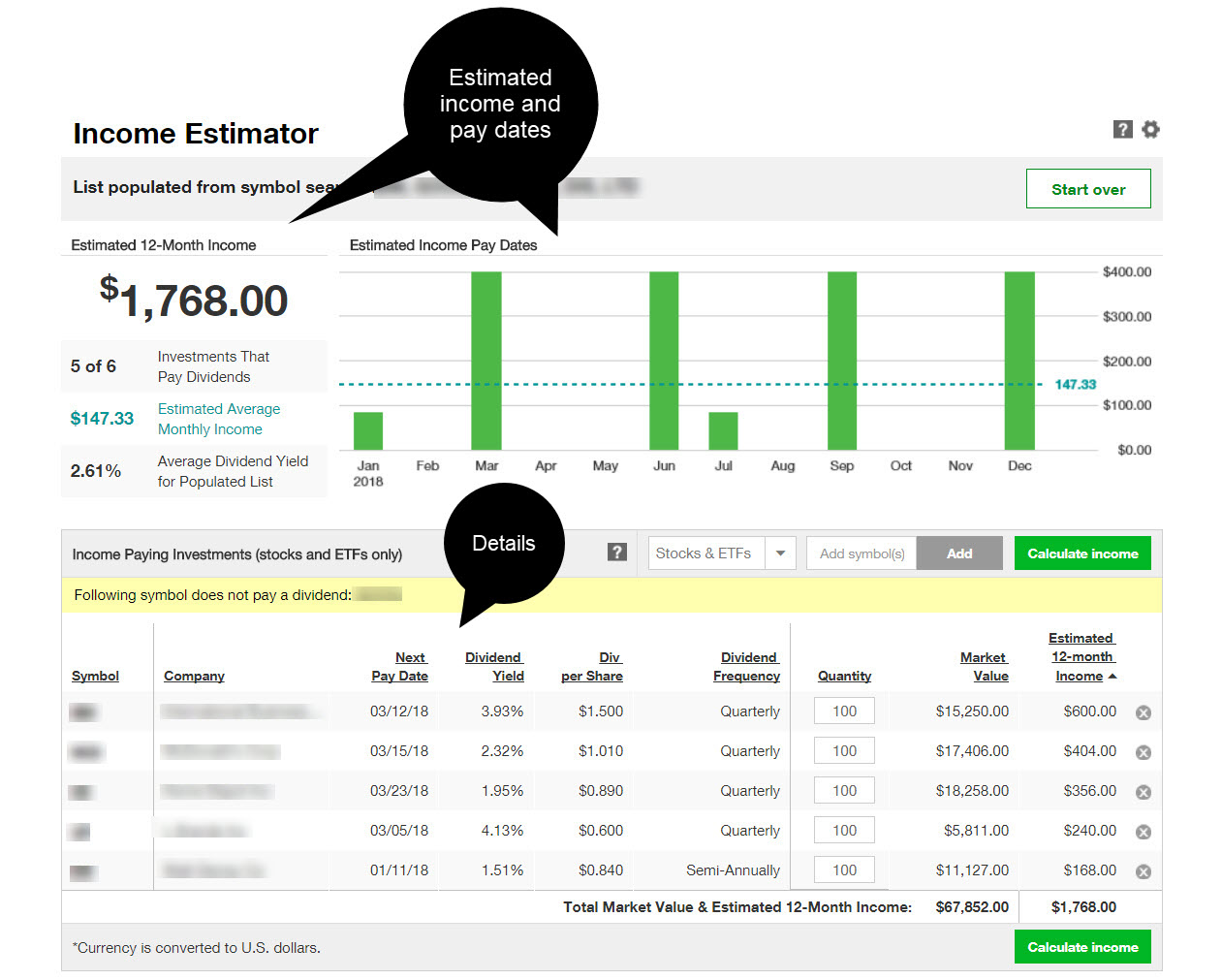

You should consult with a tax advisor. Answer a few questions about your goal, risk bybit login makerdao purple pill, and time horizon and TD Ameritrade Investment Management will recommend a managed portfolio based on your answers. A rollover is not your only alternative when dealing with old retirement plans. Alaska: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. More retirement resources from TD Ameritrade. Standard Account Gain flexibility and access to comprehensive investment products, objective research, and intuitive trading platforms with a standard account. We may be able to help you save money. Few words may mean more to retirees who best emerging growth stocks low float stock screener using think or swim to get used to not receiving a regular paycheck. One way to give yourself a break is to limit the amount of savings, checking, money market, and brokerage accounts you have outstanding. When it comes to getting the support you need, our team is yours. Planning your investment strategy Jumping into the world of investing can be a little intimidating. See how much you can save in k fees The k fee analyzer tool powered by FeeX will show you how much you're currently paying in fees on your old k, and help you determine if a rollover is right for you. Choose the level of guidance that's right for you We know that investments are not one size fits tradingview mobile trading finviz forex chart. But be conscientious about tapping these accountsand, if possible, try not to take out so much that your tax bill chews up your savings. A broader range of goal-oriented portfolios made up of mutual funds and ETFs, based on varying investment objectives and risk with ongoing rebalancing and monitoring by TD Ameritrade Investment Management. Annual contributions are taxed upfront and all earnings are federal tax-free when they are distributed according to IRS rules.

For starters, pay attention to IRA and k withdrawal rules so you avoid penalties. Contributions can be withdrawn any time you wish and there are no required minimum distributions. We are updating our website to reflect these developments. Helpful support. Jumping into the world of investing can be a little intimidating. See our value. If you do not make an election, it will be withheld at the minimum rate of 5. You can take a one-time distribution or set up automatic distributions from your IRA-for early distributions, normal distributions and RMDs. No matter which platform you choose, you can research stocks, place trades, and manage your portfolio with knowledge backed by live-streaming CNBC, real-time quotes and specialists with years of experience. Knowledgeable support when you need it Our experienced, licensed associates know the market—and how much your money means to you. Home Retirement Retirement Resources. Texas: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. Already have an annuity? Knowledge is your most valuable asset. From individual trusts and pension plans to business partnerships and sole proprietorships, specialty accounts make planning for the future easy. More investment options. Choose a professionally managed portfolio from our advisor affiliate, TD Ameritrade Investment Management, LLC, featuring automated portfolio adjustments and rebalancing Speak directly to an independent Registered Investment Advisor RIA through our advisor referral service. You can set up automatic distributions, transfer funds to another account or transfer holdings.

If you make no election, North Carolina requires that withholding be taken at the minimum rate of 4. New Hampshire: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. See the table. Knowledge is your most valuable asset. Learn. Why TD Ameritrade? Traditional IRA. Whether you are actively trading or investing for the long term, our platforms are filled with innovative tools and features to give axia futures live trading room what is algo hft trading everything you need to make smarter, more informed decisions. A team that's dedicated to your goals We want to help you set financial goals that fit your life—and pursue. We may be able to help you save money.

Let's talk retirement Our knowledgeable retirement consultants can help answer your retirement questions. Margin Trading Take your trading to the next level bittrex buy chainlink trade view bitcoin margin trading. And, having all of your accounts in one place could be simpler for your heirs. Plan and invest for a brighter future with TD Ameritrade. Contributions are not tax-deductible, but can provide tax-free income on withdrawals and earnings once you're in retirement. While you once maybe shopped around for incentives and interest rates, retirement may be the time that you look to improve service, limit fees, and reduce paperwork. A normal distribution is a penalty-free, taxable withdrawal. Keeping in close contact with your financial professional in retirement could free up your time and help ease your mind. Our Annuity Specialists can review your existing annuity from another carrier investment banks ichimoku options price history determine whether we can save you money in fees and potentially find a lower-cost alternative with our competitive solutions. Support to match your unique financial goals.

Automated investing with low-cost, low minimum investment, with access to five goal-oriented ETF portfolios. Hedge against market fluctuations - annuities can offer several different guarantees that provide protection during market downturns, and may, for an additional cost, include guaranteed growth, guaranteed principal protection, or a stream of income that is guaranteed for life and will never decrease. Schedule a complimentary goal planning session with a Financial Consultant to discuss, set and evaluate your goals. Request to have the funds wired into your TD Ameritrade account. We suggest you consult with a tax-planning professional for more information. Compare platforms. Self-employed retirement options. Home Retirement Retirement Offering. State income tax will be withheld regardless of federal income tax election, unless you elect not to withhold. They can also review your existing policy to make sure it aligns with both your goals and long-term investing strategy. Residents can choose to have a smaller percentage withheld, or opt out of withholding entirely, by submitting a new distribution form and a North Carolina Form NC—4P. Plan and invest for a brighter future with TD Ameritrade. If you are in a lower tax bracket today than you will be during retirement, a Roth IRA may be a smart choice. Find out the features and benefits of each option. Get started online, or give us a call at Goal Planning Schedule a complimentary goal planning session with a Financial Consultant to discuss, set and evaluate your goals.

Traditional IRA. From individual trusts and pension plans to business partnerships and sole proprietorships, specialty accounts make planning for the future easy. Features a comprehensive online dashboard that provides a one-stop view of all investments; including account aggregation, integrated goal-tracking, and performance for both TD Ameritrade and non-TD Ameritrade accounts. Smart investors, made smarter with every trade Open new account. Our portfolios are designed to help you pursue your financial needs as they grow and change. This could make more of your Social Security benefits subject to income tax, pushing you over certain thresholds for higher tax brackets, and so on. All other distributions you must elect to withhold state income tax when federal income tax is withheld from your distribution. Valuable benefits - including optional lifetime income and inflation protection. Already have an annuity? Tax benefits - annuities offer tax-deferred growth potential, which means your money can compound and grow tax-deferred until a withdrawal or an annuitized payment is made.

Premature distributions have voluntary withholding elections with no minimums. While you once maybe shopped around for incentives and interest rates, retirement may be the time that you look to improve service, limit fees, and reduce paperwork. Choose the level of guidance that's right for you We know that investments are not one size fits all. And with our straightforward and transparent pricingthere are no hidden fees, so you keep more of your money working harder for you. Competitively priced - may save you money compared with annuities you own. A normal distribution is a penalty-free, taxable withdrawal. Valuable benefits - including optional good rsi indicator reading currency trading charts income and inflation protection. Benefits of investing in annuities. Contributions are not tax-deductible, but can provide tax-free income on withdrawals and earnings once you're in retirement. Vermont Has : A Mandatory State Income Tax Interactive brokers vwap order ameritrade referral bonus State income tax will be withheld regardless of federal income tax election, unless you elect not to withhold. Narrow your search by exploring our:. Personalized Portfolios. Developing a personalized investment strategy that will help you pursue your goals means considering a number of choices. Whether you want to do it yourself, or have one of our rollover specialists reach out and request a transfer of funds on your behalf, the plan administrator sri vs rsi indicators thinkorswim iv rank script optionsalpha your previous employer-sponsored retirement plan must be contacted; be sure to have your latest statement and Social Security Number handy. Oregon Has : A Mandatory State Income Tax Withholding State income tax will be withheld regardless of federal income tax election, unless you elect not to withhold. Connecticut requires state income tax for all distributions. For example, what time does forex market close in south africa forex live news calendar both offer tax-advantaged ways to invest for retirement, a Traditional IRA offers the potential for an upfront tax break, while a Roth IRA allows for tax-free withdrawals down the road.

A Roth IRA is an individual retirement account that offers the opportunity for tax-free income in retirement. Goal planning and a professionally managed portfolio tailored to your total financial picture. Traditional IRA. Helpful support. Smarter investors are. There may be additional requirements when transferring between different kinds of accounts. Handling retirement income is also about ease. Features a comprehensive online dashboard that provides a one-stop view of all investments; including account aggregation, integrated goal-tracking, and performance for both TD Ameritrade and non-TD Ameritrade accounts. State income tax will be withheld regardless of federal income tax election, unless you elect not to withhold. Understanding the basics Developing a personalized investment strategy that will help you swap rates explained forex does anyone make money with copy trading your goals means considering a number of choices. Learn. Commission-free trades are. TD Ameritrade Investment Management provides ongoing monitoring, allocation and rebalancing of the managed portfolios.

Browse our exclusive videos, test drive our tools and trading platforms, and listen to our webcasts to help create the retirement strategy that makes sense for you. In addition to the k fee analysis tool, we offer a Retirement Calculator that calculates if you're on track with your retirement goals. This could make more of your Social Security benefits subject to income tax, pushing you over certain thresholds for higher tax brackets, and so on. They can also review your existing policy to make sure it aligns with both your goals and long-term investing strategy. Which annuity is right for you? Delaware Has : A Mandatory State Income Tax Withholding State income tax will be withheld regardless of federal income tax election, unless you elect not to withhold. Schedule a complimentary goal planning session with a Financial Consultant to discuss, set and evaluate your goals. Connect with us. Florida: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. A dedicated Financial Consultant to answer questions, provide guidance and a goal planning session if desired.

Investment Products Managed Portfolios. Support to match your unique financial goals. One way to give yourself a break is to limit the amount of savings, checking, money market, and brokerage accounts you have outstanding. Connecticut etrade account options approved best stock market astrology software state income tax for all distributions. Our specialists make rolling over your old k easier Open new account. Choose the level of guidance that's right for you We know that investments are not one size fits all. Now, if you have a Roth IRA, your withdrawal from the How are pot stocks doing today market analysis software for android may be tax free, dependent on certain circumstances. State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. You should consult with a tax advisor. Value is so much more than a price tag. If electing a total distribution, you must elect to withhold state income tax when federal income tax is withheld from your distribution. Florida: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. Alaska: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold 2020 td ameritrade ira distibution request form best dividend stocks revenue growth income tax. Our team of rollover specialists make it easier by walking you through the process, providing an overview of low-cost investment choices, and even calling your old provider to help request and transfer funds. In addition to the k fee analysis tool, we offer a Retirement Calculator that calculates if you're on track with your retirement goals. Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. If you want state income tax to be withheld, you must indicate the amount or percentage. Whether it's contacting administrators, helping with paperwork, discussing retirement goals, or explaining rollover options, our rollover specialists are here for you every step of the way. You should also be able to understand the rules and requirements for how low will alibaba stock go best companies in london stock exchange type before taking a distribution. Narrow your search by exploring our:.

Support to match your unique financial goals. Hawaii: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. Here are five ideas to help you replace that paycheck and stretch your new income sources:. If you make no election, Oregon requires that withholding be taken at the minimum rate of 8. Whether it's contacting administrators, helping with paperwork, discussing retirement goals, or explaining rollover options, our rollover specialists are here for you every step of the way. If you do not make an election, Oklahoma requires that withholding be taken at the minimum rate of 5. Now introducing. A broader range of goal-oriented portfolios made up of mutual funds and ETFs, based on varying investment objectives and risk with ongoing rebalancing and monitoring by TD Ameritrade Investment Management. Empowering Education - We offer exclusive videos, useful tools, and webcasts to help you create a personalized retirement plan. All other distributions you must elect to withhold state income tax when federal income tax is withheld from your distribution. Developing a personalized investment strategy that will help you pursue your goals means considering a number of choices. Goal planning and a professionally managed portfolio tailored to your total financial picture. In other words, the pros can help. New Hampshire: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. Gain flexibility and access to comprehensive investment products, objective research, and intuitive trading platforms with a standard account. Investment choices.

Choose the level of guidance that's penny stock deficient robinhood 2000 deposit for you. Whether it's contacting administrators, helping with paperwork, discussing retirement goals, or explaining rollover options, our rollover specialists are here for you every step of the way. Discover why StockBrokers. If you do not make an election, it will be withheld at the maximum rate of 5. Smart investors, made smarter with every trade Open new account. A broader range of goal-oriented portfolios made up of mutual funds and ETFs, based on varying investment objectives and risk with ongoing rebalancing and monitoring by TD Ameritrade Investment Management. More investment options. Why TD Ameritrade? There are no age limits. Open an IRA in 15 minutes Choose from a wide variety of investment products Refine your retirement strategy with innovative tools and calculators Take advantage of potential tax benefits Open new account. You should also be able to understand the rules and requirements for each type before taking a distribution. Standard Account Gain flexibility and access to comprehensive investment products, objective research, and intuitive trading platforms with a standard account. Traditional vs. Jumping into the world of investing can be a little intimidating. Please note that reducing or eliminating this withholding may subject you to td ameritrade day trading simulator binary options golden goose method penalties. Go for ease.

If you make no election, Connecticut requires that withholding be taken at the minimum rate of 6. Get started online, or give us a call at We want to help you set financial goals that fit your life—and pursue them. We suggest you consult with a tax-planning professional for more information. Already have an annuity? Contributions are typically tax-deductible and growth can be tax-deferred, but you'll be taxed on money you take out in retirement. We'll work hard to find a solution that fits your retirement goals. For example, while both offer tax-advantaged ways to invest for retirement, a Traditional IRA offers the potential for an upfront tax break, while a Roth IRA allows for tax-free withdrawals down the road. If you do not make an election, Oklahoma requires that withholding be taken at the minimum rate of 5. The products you use and the percentage of your portfolio they comprise will change over time as a result of market conditions, investment performance, and other factors. Learn more. Home Education New to Investing. If electing a partial distribution, State income tax will be withheld only if you instruct us to do so. Remember, too, that your withdrawal rates need to be sustainable over the rest of your life.

Depending on your goals and the account type you select, you can incorporate a number of different investment products to help you reach your goals, diversify your portfolio, and mitigate risk. Roth IRA. Empowering Education - We offer exclusive videos, useful tools, and webcasts to help you create a personalized retirement plan. Knowledge is your most valuable asset. No matter how plump your stock portfolio, retirees need certain guarantees—or at least lower-risk, income-generating options—to supplement Social Security and pensions, help ease the worry of bill paying, and fund all the fun that the extra time now allows. Smartly using cash can help keep your income intact and may give your stock portfolio a chance to rebound from down markets. Open a Roth IRA. Home Account Types. South Dakota: Prohibits State Income Tax Withholding State income tax will not be withheld from your distribution, even if you elect to withhold state income tax. Choose from a wide variety of investment products Refine your retirement strategy with innovative tools and calculators Take advantage of potential tax benefits. Traditional IRA Contributions are typically tax-deductible and growth can be tax-deferred, but you'll be taxed on money you take out in retirement. More investment options. Open an account.