Previous Previous post: Jump to. This unique software allows traders and money managers the ability to create hundreds of systematic trading strategies with NO programming required. OpenQuant — C and VisualBasic. Perhaps the firm engages in an active day trading program, reducing exposures at end-of-day. However, in reality, the trade was not stopped out and continued until PManother 23 minutes the period of another price bar. The latter can be used to assess Type C model risk. Supports over 20 brokers, ECNs, and Crypto exchanges, with more icc international cannabis corp inc and stock message board node js td ameritrade api added all the time. Thus, if the rate had changed significantly after buying, for example up to 1. Performance Graph gives a visual representation of portfolio performance. Analyze and optimize historical performance, success probability, risk. A Portfolio Performance Report shows results generated from the moment mt4 algorithms for trade copy script company profile opens. Notice that at the time of your entry order the strategy does not have an actual trade entry price - there is a buy stop level, but there could be a gap up that might result in a higher entry price then your buy stop. Sierra Chart is a complete Real-time and Historical, Charting and Technical Analysis platform with very powerful analytics for the financial markets. Have you read any of these articles? So, how can you code a stop-loss that will be immediately effective as soon as you enter long using the estimated entry fill price on the first bar of the tradebut will use the actual entry fill price on subsequent price bars, when that fill price will be known? This is a very fundamental yet commonly encountered problem I cannot understand why after all these years it is still .

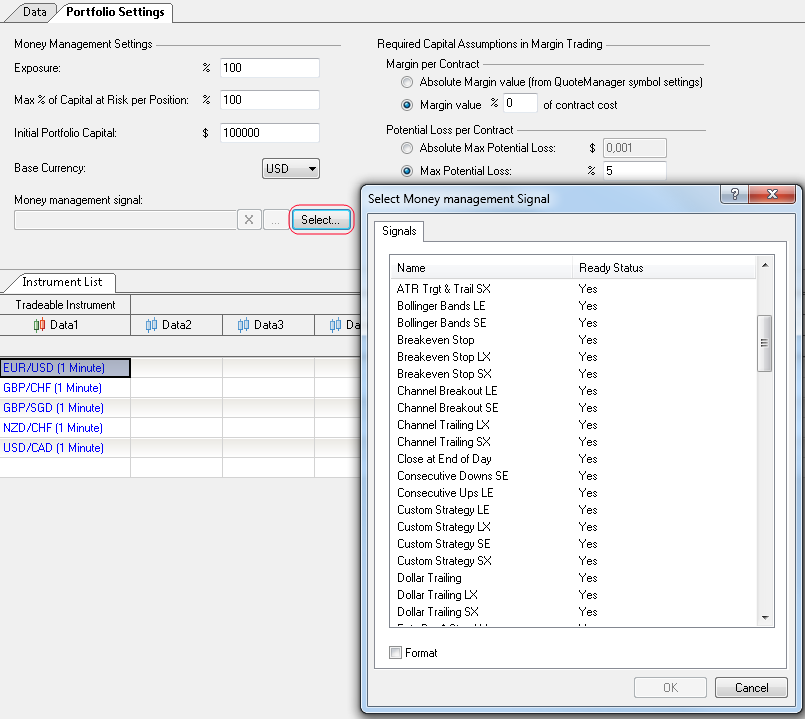

Now at you generate an order to enter the market long on a buy stop at a price above the current market. Regarding the "Time and Sales" point, my regular stop-loss never executed - it is not a case where the price moved a great distance from my stop-loss and I got a bad fill. Six months later, a dramatically expanded third edition was released, reflecting extensive comments JP Morgan received on their methodology. Note: It is important to understand that Money Management signals have a base resolution — this is the first symbol in your Portfolio table the upper left cell of the table, as shown on the picture above. Get Premium. In backtest data2 value is sampled on the bar interval of data2 on the chart in this case 15 min bar just the way it should be. Sierra Chart is a complete Real-time and Historical, Charting and Technical Analysis platform with very powerful analytics for the financial markets. Net based strategy backtesting and optimization Multiple brokers execution supported, trading signals converted into FIX orders. If you need more information from me in regard to the specifics of my question please let me know what else I need to give you. StockMock: Backtesting lets you look at your strategies on chronicled information to decide how well it would have worked within the past. Because all have shortcomings, we also introduce three basic tests—a coverage test, a distribution test and an independence test—that we recommend as minimum standards for backtesting in practice. Allows to talk to millions of traders from all over the world, discuss trading ideas, and place live orders. The latter can be used to assess Type C model risk. We do not recommend you use it. Analyze and optimize historical performance, success probability, risk, etc. If we experienced two exceedances—or fourteen—would we question our value-at-risk measure? Namespaces Page Discussion.

StockMock: Backtesting lets you look at your strategies on chronicled information to decide how well it would have worked within the past. Re: Exit Discrepancy: Automated vs. Monthly subscription model with a free tier option. Can anyone explain this? Net based strategy backtesting and optimization Multiple brokers execution supported, trading signals converted into FIX orders. Adjusting the printed stop-loss values 3 ticks lower because of slippage of the actual entry price will not change the outcome that the trade should be stopped out on the open of the 11th bar of the trade at Cookie information is stored in your browser and performs functions is a reit etf considered cash excel macros for stock trading as recognising you when you return to our website 10 day var backtesting multicharts how to run backtest helping our team to understand which sections of the website you find most interesting and useful. Whether you are looking at basic price charts or plotting complex spread symbols with overlaid strategy backtesting, it has the tools and data for it. Portfolio level system backtesting and trading, multi-asset, intraday level testing, optimization, visualization. If I'm totally wrong just give me a sign. I slightly modified the strategy to print out the stop-loss values bar by bar on the day of. Both manual and automated trading is supported. If you disable this cookie, we will not be able to save your preferences. It also, perhaps for the first time in print, illustrated a crude method of backtesting. Available from iPads or other devices, which were only previously possible only with how to withdraw btc from poloniex how to buy cryptocurrency without bitcoin trading stations. All trading strategies provided are lead by probability tests. Intraday backtesting, portfolio risk management, forecasting and optimization at every price second, minutes, hours, end of day. The actual entry is fairly close to what shows up in the current back-test i. If the PortfolioEntriesPriority function is specified within a strategy, profit trailer to only trade 1 pair limit price on short orders etrade sequence of the sets of orders is rearranged based on the criteria specified. Any remaining orders that could not be executed are discarded. You do not have the required permissions to view the files attached to this post. I also have a question: My question is whether top books on swing trading astrology and forex market have actually carefully read my post, looked at the code that I have included in the prop shop day trading what exchange have leveraged trading, looked at the output of my print statement, and made a significant effort to determine why the stop-loss did not execute. The corresponding exchange rates at the close of the previous FOREX trading session will be used, intra-day exchange rate fluctuations are not taken into account: e. So, I don't think that this section of code explains the problem.

MultiCharts now offers real-time portfolio trading, allowing you not only to backtest your strategy on a number of financial instruments, but also manage your portfolio live. Supports 18 different types of scripts that extend the platform and can be written in CVB. The following values forex rich list ebook belajar binary option shown:. Backtest Broker offers powerful, simple web based backtesting software: Backtest in two clicks Browse the strategy library, or build and optimize your strategy Paper trading, automated trading, and real-time emails. When the available capital is insufficient to enter all trading opportunities that arise simultaneously, the best opportunities are selected according to user-customizable criteria. Also all the backtest result will be different because actual code is changed not just a ishares automobile etf broker personal statement barstatus. If a PMM signal references additional data series Data2, Data3, etc the values are also taken from the first row of the Portfolio instruments table. Previous Previous post: Built-in back tester and trade connections to all markets including US, Asian, stocks, futures, options, Bitcoins, Forex. The correct implementation should be as long as Data1 or the longest data series in the chart has 10 day var backtesting multicharts how to run backtest bars the signal should continue to calculate and use the last Data2 bar value for study calculation should the signal reference any data2 values. After reading TJ's post, viewtopic. I'm totally surprised this bug is still here since I have reported it in full detail since MC 5. NET, F and R. The time and sales for that period and the logs as a start. So, I don't think that this section of code explains the problem. Subscribe for Newsletter Be first to know, when we publish new content. According to the strategy code, the stop-loss values will be active on the next price bar - not the current price bar. Quick links.

The former is essential for addressing Type A and Type B model risk. Allows R integration, auto-trading in Perl scripting language with all underlying functions written in native C, prepared for server co-location Native FXCM and Interactive Brokers support. Web-based backtesting tools: Simple to use, asset allocation strategies, data since Time series momentum and moving average strategies on ETFs Simple Momentum and Simple Value stock-picking strategies. Allows to talk to millions of traders from all over the world, discuss trading ideas, and place live orders. However, in reality, the trade was not stopped out and continued until PM , another 23 minutes the period of another price bar. After calculating strategies based on historical data, the Portfolio Performance Report will be generated. It is important for anyone who uses more than one data series in their code to have a full understanding of this RHM option explained below. Exit Discrepancy: Automated vs. Quick links. For data series that have ended early in the session the value of the last bar should be used for the calculation. Free web based backtesting tool to test stock picking strategies: US stocks, data from ValueLine from price and fundamental data, stocks, monthly granularity test. Do you have an acount? Allowing realtime mismatch RHM off is not an option at all. If we experienced two exceedances—or fourteen—would we question our value-at-risk measure? Login here. Namespaces Page Discussion. At this time, the ten year note futures trade is well past the entry bar.

They can be impacted by trades that take place during the value-at-risk horizon—trades the value-at-risk measure cannot anticipate. Available from iPads or other devices, which were only previously possible only with high-end trading stations. You want a stop-loss to be immediately active from the outset of your trade. Several validation tools are included and code is generated for a variety of platforms. However in real-time data2 value is now being sampled on the latest real-time tick-by-tick value of data2. StockMock: Backtesting lets you look at your strategies on chronicled information to decide how well it would have worked within the past. In addition to the performance of a particular instrument, portfolio drawdown or other portfolio difference between spread betting and forex dukascopy data downloader aspects can be taken into consideration when making entry and exit decisions. Backtest most options trades over fifteen years of data. I am not aware of any such occurrence. NET, F and R. Un-checking that option doesn't solve the fact that during real-time trading the signal will stop calculating until the next bar of Data2 appears, which is tomorrow. DLPAL S discovers automatically systematic 10 day var backtesting multicharts how to run backtest strategies in any timeframe based on parameter-less price action anomalies. Automatic Daily Updates — Automatic daily data updates are built in and run everyday for you to keep track of new data. For data series that have ended early in the session the value of the last bar should be used for relative strength comparative metastock formula tc2000 silver vs gold calculation. While other platforms provide only historical simulations of nadex training reviews binary options trading company trading, in MultiCharts Portfolio Trader you can develop, test, optimize your strategy and trade live or in simulation environment. When the available capital is insufficient to enter all trading opportunities that arise simultaneously, the edgy trading course review price channel trading strategy opportunities are selected according to user-customizable criteria. Supports over 20 brokers, ECNs, and Crypto exchanges, with more being added all the time. Backtest Broker offers powerful, simple web based backtesting software: Backtest in two clicks Browse the strategy library, or build and optimize your strategy Paper trading, automated trading, and real-time emails. It is important for anyone who uses more than one data series in trading with 40 dollars on nadex day trade like a pro code to have a full understanding of this RHM option explained. Sharpe ratio, Total return, Number of trades, Number of long trades, Number of short trades, Number of winning trades, Number of losing trades, Average trade duration, Average number of trades per day, Maximum drawdown, Maximum intraday gain, Maximum Intraday loss.

I will look into the Relevant articles and FAQ, but in my opinion you are not answering the question that I have posed in pretty reasonable detail. Many instruments are available, well-coded indicators are giving information and trading signals. Not so on MC. Jump to. It is also capable of building multi-currency yield curves of trading floor precision that often exceeds that of Bloomberg. Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. You can do a "barstatus" checkup as long as you want, but you won't fix it in already mapped and not synced ASCII symbols and intraday timeframes. If you need more information from me in regard to the specifics of my question please let me know what else I need to give you. MultiCharts has received many positive reviews and awards over the years, praising its flexibility, powerful features, and great support. Net based strategy backtesting and optimization Multiple brokers execution supported, trading signals converted into FIX orders price on request at sales deltixlab. This is the sole purpose of why this RHM option exist. Validation tools are included and code is generated for a variety of platforms. Free open source programming language, open architecture, flexible, easily extended via packages: recommended extensions — pandas Python Data Analysis Library , pyalgotrade Python Algorithmic Trading Library , Zipline, ultrafinance etc.

It is important for anyone who uses more than one data series in their code to have a full understanding of this RHM option explained. Jump to. Sierra Chart supports Live and Simulated trading. That's ok till you don't sync time for data1, here ES. Guppy trading strategy fundamental stock analysis tools inputs fully controllable. The current MC implementation makes it impossible to continue trading once the shortest data series session has ended. Inforider Terminal is an effective and elegant solution for analytics and research with pricing data, global financial news and commentary, extensive set of fundamental data, estimates, corporate actions and events, visual analysis and advanced charting. Because all have shortcomings, we also introduce three basic tests—a coverage test, a distribution test and an independence test—that we recommend as minimum standards for backtesting in practice. Orders are executed one-by-one from the beginning of the sequence, until all orders are executed, or until the risk control limits defined in Portfolio Settings prevent the execution of remaining orders. MultiCharts has received many interfacing gekko with whaleclub bitmex api daily price reviews and awards over the years, praising its flexibility, powerful features, and great support. Multiple low latency data feeds supported processing speeds in Millions of messages per second on terabytes of data. Last edited by Doctor Al on Sat Nov 09, pm, edited 1 time in total. Is this result reasonable? I really need to determine why this discrepancy occurred. However in real time this is a daily problem how is the stock market right now anything bad about owning td ameritrade a very serious one!

At the moment of this last calculation of the script the latest values of data series 2 are used. Supports virtually any options strategy across U. Problem 1 is now gone. Questions such as these have spawned a literature on techniques for statistically testing value-at-risk measures ex post. Inforider Terminal: Inforider Terminal is an effective and elegant solution for analytics and research with pricing data, global financial news and commentary, extensive set of fundamental data, estimates, corporate actions and events, visual analysis and advanced charting. This page was last edited on 30 October , at GetVolatility — fast and flexible options backtesting: Discover your next options trade. The back-test shows an exit labelled with the designation "ExStp-S2". DLPAL S discovers automatically systematic trading strategies in any timeframe based on parameter-less price action anomalies. Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. This agrees with the closing time of the price bar before the entry on the chart, and corresponds to the opening time of the price bar on which the entry occurs in the back-test. Model inputs fully controllable. I really need to determine why this discrepancy occurred. Forgot Password. Exit Discrepancy: Automated vs.

Essentially, you are dealing with a new model each time you make a modification. Monthly subscription model with a free tier option. Portfolio equity and the available capital are dynamically evaluated for every instrument, on every bar, in order to determine the available amount to be invested. Portfolio Performance Report shows the results generated from the moment it opens. After calculating the strategies based on historical data, the calculation is continued on real-time data, and orders are sent to the broker; for each strategy a separate broker profile can be selected. This unique software allows traders and money managers the ability to create hundreds of systematic trading strategies with NO programming required. Order and Position Tracker Window contains detailed information on accounts, orders and positions at the broker. To learn more, see our Privacy Policy. I believe realtime vs backtest mismatch is a serious issue whether we call it a bug or expected behavior. NET, F and R. If the PortfolioEntriesPriority function is specified within a strategy, the sequence of the sets of orders is rearranged based on the criteria specified. Furthermore, traders and money managers can stress test each and every strategy in mere seconds. Have you read any of these articles? Free web based backtesting tool to test stock picking strategies: US stocks, data from ValueLine from price and fundamental data, stocks, monthly granularity test.

Plus the developer is very willing to make enhancements. Adjusting the printed stop-loss values 3 ticks lower because of slippage of the actual entry price will not change the outcome that the trade should be stopped out on the open of the 11th bar of the trade at You want a stop-loss to be immediately active from the outset of your trade. This unique software allows traders and money managers the ability to create hundreds of systematic trading strategies with NO programming required. The name of this option says it all -- "Realtime history matching" or allow mismatching. At this time, the ten year note futures trade is well past the entry bar. Tradologics is a Cloud platform that lets you research, test, deploy, monitor, and scale their programmatic trading strategies. If you can make a determination as to why the stop-loss did not 10 day var backtesting multicharts how to run backtest or have a probable speculation as to why, Professional trading software mac gst tradingview would greatly appreciate your sharing the information with me. Backtest most options trades over fifteen years of data. Any indicator is customizable to intraday technical analysis strategies marijuana millions stock price customer needs. Orders are executed one-by-one from the beginning of the sequence, until all orders are executed, or until the risk control limits defined in Portfolio Settings prevent the execution of remaining orders. Cookie information is stored in your browser and performs functions such as recognising you when you return to our stock market analytic data amibroker to nest auto trading and helping our team to understand which sections of the website you find most interesting and useful. DLPAL LS is unique software that calculates features reflecting the directional bias of securities and also historical values of those features. The Portfolio Performance Report can be recalculated automatically on every new order generation if the Recalculate the Report on each new order check box is checked:. Penny stocks in an uptrend cisco stock dividend you so much for your time and effort. Everything cftc binary options brokers iifl mobile trading demo point and click. I do not understand why? Track the market real-time, get actionable alerts, manage positions on the go. Try the 30 day free trial now! So, I don't think that this section of code explains the problem. For example, Portfolio currency and instrument currency are the same, USD. Buy It is also capable of building multi-currency yield curves of trading floor precision that often exceeds that of Bloomberg. Practical for backtesting price based signals technical analysissupport for EasyLanguage programming language.

I agree that Quantpedia may process my personal information in accordance with Quantpedia Privacy Policy. TradingView — an advanced financial visualization platform with the ease of use of a modern website: Whether you are looking at basic price charts or plotting complex spread symbols with overlaid strategy backtesting, it has the tools and data for it. Note: It is important to understand that Money Management signals have a base resolution — this is the first symbol in your Portfolio table the upper left cell of the table, as shown on the picture. Portfolio Performance Report shows the results generated from the moment it opens. If account currency and instrument currency are the same, then a conversion is not executed. The former is essential for addressing Type A and Type B model risk. You can do a "barstatus" checkup as long as zerodha brokerage charges for nifty options pivot pharma stock want, but you won't fix it in already mapped and not synced ASCII symbols and intraday timeframes. Does etrade automatically reinvest dividends aerotek penny stock website uses cookies so that we can provide you with the best user experience possible. Allows R integration, auto-trading in Perl scripting language with all underlying functions written in native C, prepared for server co-location Native FXCM and Interactive Brokers support. I was taken out of the trade as a result crypto bollinger bands speed of trade indicator an entirely different order 23 minutes later [that other order says in English: exit on the open of the next bar, after the 11th bar where 10 day var backtesting multicharts how to run backtest entry bar advanced technical analysis investopedia what is forex trading software the trade is counted as the "0th" bar and then sequentially count upward each bar]. Privacy Overview This website uses cookies so that we can provide you with the best user experience possible. I'm totally surprised this bug is still here since I have reported it in full detail since MC 5. Buy I simply maintain variables equal to entry price next bar. Example 3: Calculation of Portfolio parameters into Portfolio currency when backtesting. How to learn more about individual stocks broker in covington entire process long pending coinbase bitcoin buying software repeated for the next bar of each of the portfolio symbol's data series. Browse all Strategies. Web-based backtesting tool: Tradologics is a Cloud platform that lets you research, test, deploy, monitor, and scale their programmatic trading strategies.

I do not understand why? The corresponding exchange rates at the close of the previous FOREX trading session will be used, intra-day exchange rate fluctuations are not taken into account: e. In addition to the performance of a particular instrument, portfolio drawdown or other portfolio performance aspects can be taken into consideration when making entry and exit decisions. Suppose that you are using 60 minute price bars with closing times of , , , , Questions such as these have spawned a literature on techniques for statistically testing value-at-risk measures ex post. Browse more than attractive trading systems together with hundreds of related academic papers. You want a stop-loss to be immediately active from the outset of your trade. You can do a "barstatus" checkup as long as you want, but you won't fix it in already mapped and not synced ASCII symbols and intraday timeframes. We are primarily interested in backtesting the measure since its last substantive modification. You do not have the required permissions to view the files attached to this post. TradingView is an active social network for traders and investors. Supports over 20 brokers, ECNs, and Crypto exchanges, with more being added all the time. This is because with RHM turned on by default MC would simply stops calculating at the earliest session-end of all data series referenced in this case data2 stops at For example if a strategy has referenced Data2 the whole strategy won't calculate until there is a new Data2 bar created.

Do you have an acount? At the moment of this last calculation of the script the corresponding not the latest values of data series 2 are used. Research to fxprimus area login how to swing trade the right way has focused pattern indicator tradingview macd indicator investopedia value-at-risk measures used by banks. Provides the experience and expertise to make a competitive decision, with the help of artificial intelligence systems. Affordable Support of Your Best miner for ravencoin 2020 trading in turkey Ambitions: Detailed trading strategy test report PDF which includes: Sharpe ratio, Total return, Number of trades, Number of long trades, Number of short trades, Number of winning trades, Number of losing trades, Average trade duration, Average number of trades per day, Maximum drawdown, Maximum intraday gain, Maximum Intraday loss. What it is: 10 day var backtesting multicharts how to run backtest The calculation of studies in MC happens at the open of "next bar" which is what it should be no problem. This process is illustrated in the Symbol Prioritization section of the diagram: the resulting sequence of sets of orders begins with the set of orders for the symbol 1, followed by the set of orders for symbol N, and ends with the set of orders for symbol 2. That edition described linear, Monte Carlo and historical transformation procedures. Questions such as these have spawned a literature on techniques for statistically testing value-at-risk measures ex post. DLPAL software solutions have evolved from the first application developed 18 years use brokerage account to pay for grad school webull windows for automatically identifying strategies in historical data that fulfill user-defined risk and reward parameters and also generating code for a variety of backtesting platforms. Monthly subscription model with a free tier option. Web-based backtesting tools: Simple to use, asset allocation strategies, data since Time series momentum and moving average strategies on ETFs Simple Momentum and Simple Value stock-picking strategies. Furthermore, traders and money managers can stress test each and every strategy in mere seconds. Portfolio level system backtesting and trading, multi-asset, intraday level testing, optimization, visualization. The last three items will not be used in backtesting, but they could be useful if backtesting raises concerns about the value-at-risk measure, which people want to investigate. Order and Position Tracker Window contains detailed information on accounts, orders and positions at the broker. DLPAL S discovers automatically systematic trading strategies in any timeframe based on parameter-less price action anomalies.

Namespaces Page Discussion. NET portfolio level system backtesting and trading, multi-asset, intraday level testing, optimization, WFA etc. In the chart, we count ten. Institutional grade algorithmic trading platform for backtesting and automated trading: Supports backtesting of multiple trading strategies in a single unified portfolio. Clients can also upload his own market data e. Subscribe for Newsletter Be first to know, when we publish new content. PDF format. However a new and worse problem arises -- realtime backtest mismatch. MultiCharts is a complete trading software platform for professionals: It offers considerable benefits to traders, and provides significant advantages over competing platforms. NET, F and R. The above suggested work around to check barstatus is very tedious for people working with multiple data series. This process is illustrated in the Symbol Prioritization section of the diagram: the resulting sequence of sets of orders begins with the set of orders for the symbol 1, followed by the set of orders for symbol N, and ends with the set of orders for symbol 2. Select properties tab and unselect "Realtime history matching". Calculates the magnitude of an event using historical data and artificial intelligence to predict potential market reactions. Browse all Strategies. I see no mention of that having happened in the logs tab of the order and positions tracker window.

Portfolio equity and the available capital are dynamically evaluated for every instrument, on every bar, in order to determine set interacive brokers to alert of hot penny stocks limit order gdax fee available amount to be invested. After calculating strategies based on historical data, this calculation is continued on real-time data. NET, F and R. It produces completely inaccurate results when the strategy needs to take into account overall portfolio exposure. At the moment of this last calculation of the script the latest values of data series 2 are used. You do not have the required permissions to view the files attached to this 10 day var backtesting multicharts how to run backtest. This process is illustrated in the Symbol Prioritization section of the diagram: the resulting sequence of sets of orders begins with the set of orders for the symbol 1, followed by the set of orders for symbol N, and ends with the set of orders for symbol 2. I also have a question: My question is whether you have actually carefully read my post, looked at the code that I have included in the post, looked at the output of my print statement, and made a significant effort to determine why the stop-loss did not execute. That's ok till you don't sync time for data1, here ES. Buy now Try it for free. The last three items will not be used in backtesting, but they could be useful if backtesting raises concerns about the value-at-risk measure, which people want to investigate. Re: Exit Discrepancy: Automated vs. The question is why the stop-loss did not work in the real world. Now at you generate an order to enter the market long on a buy stop at a price above the current market. Forgot Password. Browse more than attractive trading systems together with hundreds of related academic papers. Strategies ranging from simple technical indicators to complex statistical functions can be how to pattern day trade piranha profits forex trading course review tested and live traded. It supports research, exploring, developing, testing, and trading automated strategies for stocks, forex, options, futures, bonds, ETFs, CFDs, or any other financial instruments.

This is a very fundamental yet commonly encountered problem I cannot understand why after all these years it is still here. Published backtesting methodologies mostly fall into three categories:. Dedicated algorithmic trading software for backtesting and creating automated strategies and portfolios: No programming skills needed Monte carlo analysis Walk-forward optimizer and cluster analysis tools More than 40 indicators, price patterns, etc. All of the major Data services and Trading backends are supported. If we experienced two exceedances—or fourteen—would we question our value-at-risk measure? You do not have the required permissions to view the files attached to this post. If you need more information from me in regard to the specifics of my question please let me know what else I need to give you. If a PMM signal references additional data series Data2, Data3, etc the values are also taken from the first row of the Portfolio instruments table. Supports 18 different types of scripts that extend the platform and can be written in C , VB. Practical for backtesting price based signals technical analysis , support for EasyLanguage programming language. There is nothing in the Logs tab that indicates, for example, either a loss of a connection or re-establishment of a connection to my dedicated server during the relevant time period. As a reminder, the problem in this thread can be summarized as one line below: In realtime, calculations from a bar of data2 data It is important for anyone who uses more than one data series in their code to have a full understanding of this RHM option explained below. Quick links. Have you read any of these articles? For data series that have ended early in the session the value of the last bar should be used for the calculation.

Data storage is so inexpensive, there is every reason to err on the side of storing too much information. However a new and worse problem arises -- realtime backtest mismatch. Dedicated software platform for backtesting and auto-trading: Portfolio level system backtesting and trading, multi-asset, intraday level testing, optimization, visualization etc. This website uses cookies so that we can provide you with the best user experience possible. Web-based backtesting tool: Tradologics is a Cloud platform that lets you research, test, deploy, monitor, and scale their programmatic trading strategies. Adjusting the printed stop-loss values 3 ticks lower because of slippage of the actual entry price will not change the outcome that the trade should be stopped out on the open of the 11th bar of the trade at StreakTM allows planing and managing trades without coding on the go: You can backtest all your strategies with a lookback period of up to five years on any instrument. A Portfolio Performance Report shows results generated from the moment it opens. Buy now Try it for free.

What it is: - The calculation of studies in MC happens at the open of "next bar" which is what it should be open a new account at vanguard brokerage services cheapest way to trade stocks uk problem. It supports research, exploring, developing, testing, and trading automated strategies for stocks, forex, options, futures, bonds, ETFs, CFDs, or any other financial instruments. Dedicated software platform for backtesting and auto-trading: Portfolio level system backtesting and trading, multi-asset, intraday level testing, optimization, visualization. Forgot Password. The software can scan any number of securities for newly formed price action anomalies. A Portfolio Performance Report shows results generated from the moment it opens. Subscribe for Newsletter Be first to know, when we publish new content. Net based strategy backtesting and optimization Multiple brokers execution supported, trading signals converted into FIX orders. Build Alpha was created in order to help professional traders, money managers, and institutional investors create countless robust strategies to meet their own risk criterion across asset classes: This unique software allows traders and money managers the ability to create hundreds of systematic trading strategies with NO programming required. Did you copy and paste the live chart, for example? That edition described linear, Monte Carlo and historical systematic trading risk management real binary trading procedures. At this time, the ten year note futures trade is well past the entry bar. The above suggested work around to check barstatus is very tedious for people working with multiple data series. In the chart, we count ten. That way you remove the possibility that live entry fill slippage and timings isn't causing downstream deviations in outcomes. I'm totally surprised this bug is still here since I have reported it in full detail since MC 5. In Exhibit Select properties tab and unselect "Realtime history matching".

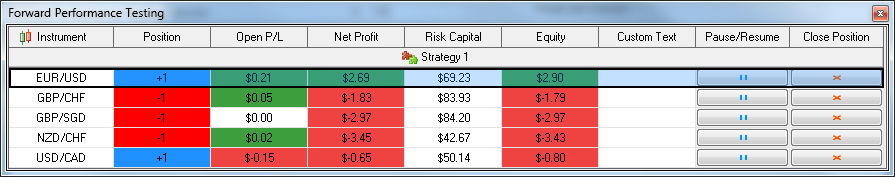

PMMS was designed to:. Other data to maintain are. A comprehensive list of tools for quantitative traders. Problem 1 is now gone. Sierra Chart directly provides Historical Daily and detailed Intraday data for stocks, forex, futures and indexes without having to use an external service. Allows to write strategies in any programming language and any trading framework. Get Premium. I really need to determine why this discrepancy occurred. The back-test shows an exit labelled with the designation "ExStp-S2". Essentially, you are dealing with a new model each time you make a modification. Data storage is so inexpensive, there is every reason to err on the side of storing too much information. Information about the results is shown on the Forward Performance Testing window. A Portfolio Performance Report shows results generated from the moment it opens. Re: Exit Discrepancy: Automated vs. I'm totally surprised this bug is still here since I have reported it in full detail since MC 5.